| Latest Forum Topics / Straits Times Index |

|

|

News Update!

|

|||

|

tanglinboy

Elite |

11-Nov-2012 06:48

Yells: "hello!" |

||

|

x 0

x 0 Alert Admin |

Thanks for the links. Very useful. | ||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

10-Nov-2012 22:44

|

||

|

x 0

x 0 Alert Admin |

Editors’ PicksGetting The Questions Right by The Federal Reserve Bank of Atlanta Grand Bargain: Are Fiscal Spending Cuts And Revenue Increases Both Needed? Part 1 by James A. Kostohryz Fiscal Grand Bargain: Are Spending Cuts And Revenue Increases Both Needed? Part 2 by James A. Kostohryz Even With A Fiscal Cliff Deal, Stocks And The U.S. Economy Will Unravel In 2013 by Trade In Mexico Daily State Of The Markets: Things Don't Matter Until They Do, But Then... by David Moenning Market OutlookCompromise Seems Futile As Cliff Nears by David Fry Europe's Fault. Really? by Bespoke Investment Group The Slowing South Korean Economy by Hale Stewart Grand Bargain: Are Fiscal Spending Cuts And Revenue Increases Both Needed? Part 1 by James A. Kostohryz Fiscal Grand Bargain: Are Spending Cuts And Revenue Increases Both Needed? Part 2 by James A. Kostohryz The Market Aftermath Of Presidential Elections by Doug Short Even With A Fiscal Cliff Deal, Stocks And The U.S. Economy Will Unravel In 2013 by Trade In Mexico In A Fiscal Restraint Environment, There Is Nowhere To Hide by George Kesarios A Look At The Current Macro Environment by AAII ECRI's WLI Falls Again And SPY Is Down Another 2.2% Since The Release by Kirk Lindstrom S& P 500 Snapshot: The Post-Election Sell-Off Continues by Doug Short Investors Continue To Give The Election Results A Bronx Cheer by Bret Jensen Mark Grant's '3 Cliffs' And Calamity In Greece by Colin Lokey Friday Charts: From One Uncertainty To The Next by Lou Basenese Today's Market News To Trade On: 5 Stocks Moving On News by Matthew Smith 200 DMA Looms! by Roger Nusbaum Daily State Of The Markets: Things Don't Matter Until They Do, But Then... by David Moenning Gold & Precious MetalsChristos Doulis Uses Cash Flow And A Good Story To Find The Next Mid-tier Producer by The Gold Report Gold And The Fiscal Cliff by Evariste Lefeuvre Gold Is Not An 'Investment' by Cullen Roche Is It Time To Buy Gold Again? by MetalMiner CommoditiesWASDE: Corn And Soybean Yields Increase by T. Marc Schober Coal's Brutal Sell-Off by Energy and Capital Continental Resources To Buy Bakken Assets by Energy and Capital Big Oil Could Benefit From Obama Win by Energy and Capital 5 Commodity Stocks Moving On News by Matthew Smith EconomyWhat Obama's Win Means For Your Wallet by StreetAuthority The Election Stimulus And Recession - Analysis And Forecast by One Eyed Guide Recession Watch: November 2012 by Sold At The Top U.S. Consumer Sentiment At 5-Year High by Dean Popplewell Getting The Questions Right by The Federal Reserve Bank of Atlanta Obama Won. Now What for the Fiscal Cliff, Dividends, and Taxes? by CFA Institute Contributors Bianco And Biderman Talk Presidential Election And Economy by TrimTabs The Fearless Fiduciary: 4 More Years And The Travails Of Dodd-Frank by CFA Institute Contributors Michigan Consumer Sentiment: Highest Level Since July 2007 by Doug Short Mining The Australian CPDO Decision by Felix Salmon Evolving Financial Institutions by John M. Mason Dividend Decreases Suggest U.S. Deeper In Recessionary Territory by Ironman at Political Calculations Climate Change Is Back On The Agenda by Pater Tenebrarum ForexHas Tokyo Finally Neutered The BOJ? by Free Cash Flow 50 Forex: The EUR/USD Knocks On Bearish Doors After Printing Third Weekly Loss by FXstreet U.S. Consumers Not Concerned About Fiscal Cliff by Ralph Shell Euro Dips Below 1.2700, Risks Skewed To The Downside by FXstreet EUR Black Hole Threatens to Deepen by Dean Popplewell BOE Eases (Slightly) by Marc Chandler |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

krisluke

Supreme |

09-Nov-2012 22:06

|

||

|

x 0

x 0 Alert Admin |

US import prices rise but gains in oil slow

WASHINGTON, Nov 9 (Reuters) - U.S. import prices rose more than expected in October but price hikes for imported oil slowed, pointing to only modest inflation pressures.

Import prices climbed 0.5 percent last month, the Labor Department said on Friday. Driving the overall gain, the cost of petroleum imports increased 1.3 percent during the month. America imports much of the fuel it consumes, and higher prices at the pump threaten to hurt consumers' pocket books. But the increase in the cost of imported oil was well below the 4.7 percent gain in September and the 6.2 percent increase in August. Analysts had expected overall import prices would be flat. U.S. stock index futures dipped and were on track to post their worst week in five months as the euro zone crisis was seen hitting France and Germany and investors fretted over the possibility the United States could raise taxes and cut government spending in 2013. Prices for U.S. Treasuries rose. Still, there were signs that foreign suppliers of goods and services had a little more leverage to raise prices last month. Non-petroleum import prices rose 0.3 percent in October, the biggest gain since March. Prices for imported consumer goods other than cars rose 0.2 percent. The U.S. economy has shown some signs of perking up in recent months, with consumers spending more readily and housing construction picking up. Prices for imports from Canada rose 0.5 percent, while those from Mexico gained 0.4 percent. Prices from China, however, dropped 0.3 percent. The three countries are America's biggest trading partners. Despite stronger consumer spending, factory output in the United States has looked relatively weak, with businesses investing less and exporters troubled by the European debt crisis and the cooling global economy. In October, export prices were unchanged, the Labor Department said. |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 22:04

|

||

|

x 0

x 0 Alert Admin |

|||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 17:33

|

||

|

x 0

x 0 Alert Admin |

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

krisluke

Supreme |

09-Nov-2012 17:23

|

||

|

x 0

x 0 Alert Admin |

Wall Street’s Ground Game Continues

I read somewhere that 70% of financial advisors were backing Romney this fall. That makes sense given his stance on investment taxes and high income earners' tax rates. But he lost and now The Street has to deal with that. Or do they? I have a few quotes in this story for CBS News... Indeed Wall Street may not be interested in reconciliation.

Head over for more, including what the win for Elizabeth Warren may mean. Source: Can Wall St. mend its rift with President Obama? (CBS News) |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 17:22

|

||

|

x 0

x 0 Alert Admin |

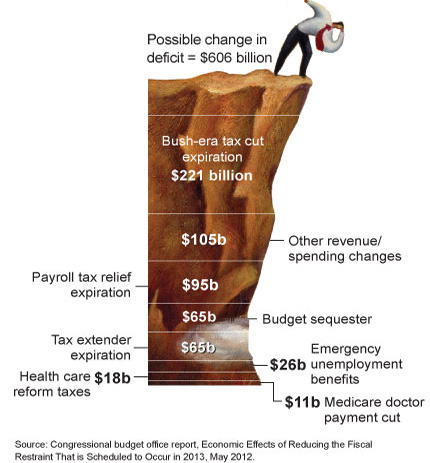

Fidelity: Here’s Your Fiscal Cliff Cheat Sheet

I can tell you that the Fiscal Cliff has now officially crossed over from being a financial media wonky thing to becoming a mainstream fear point as of this afternoon. How do I know? Because Fidelity just did an e-blast to god knows how many million mom-n-pop recipients just now. Here's Gary Blank, senior vice president, public affairs and policy at Fido on what you need to be aware of before the hysteria begins...

Expect more, much more, as the summer wears on and mainstream awareness grows. I'm really glad I snagged the official Twitter handle of the Fiscal Cliff: @thefiscalcliff Source: Fiscal cliff ahead: What it may mean (Fidelity) |

||

| Useful To Me Not Useful To Me | |||

|

bishan22

Elite |

09-Nov-2012 17:15

|

||

|

x 0

x 0 Alert Admin |

Watch out for myanmar related stocks.

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

krisluke

Supreme |

09-Nov-2012 17:15

|

||

|

x 0

x 0 Alert Admin |

Today - Friday, November 9, 20124:10 AM Asian shares are ending the week in the red and European stocks look like they will as well as concerns about the U.S.'s fiscal cliff outweigh some rather upbeat data coming out of China. Japan -0.9%, Hong Kong -0.8%, China -0.1%, India -0.8%. EU Stoxx 50 -0.4%, London -0.1%, Paris -0.2%, Frankfurt -0.6%, Madrid -0.7%, Milan -0.4%. [Top Stories, Global & FX, On the Move] Comment!

3:58 AM The CBO yesterday gave its view of how precipitous the drop from the fiscal cliff would be, forecasting that it would cause GDP to shrink 0.5% next year and unemployment to climb to 9.1% from 7.9%. However, growth would be stronger in the long run. If the cliff is avoided, the economy would expand 1.7% but would still remain " below its potential." President Obama is due to have his say later today. (CBO report) [U.S. Economy, Top Stories] Comment!

3:36 AM Carl Icahn tells CNBC he has thought about making a hostile bid for Netflix (NFLX) but says he doesn't think he " would ever get it," explaining that he wouldn't be able to pay as much for Netflix as a " synergistic buyer." Icahn also can't understand why Netflix isn't an acquisition target, given that - in his opinion - it's undervalued, its 27M subscribers, which make it difficult to compete with, and low interest rates. [Consumer, M& A, Tech] Comment!

3:13 AM Reuters firms up investor speculation that following a sharp fall in Best Buy's (BBY) share price, founder Richard Schulze could make a lower bid for the retailer than the $24-$26 he suggested in August. That would have valued the deal at $8.16B-$8.84B, or up to $10.9B including debt. P-E firms Apollo, TPG and Leonard Green could join Schulze, although Cerberus has dropped out. A bid's not expected before December. [Consumer, M& A] Comment!

|

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 17:14

|

||

|

x 0

x 0 Alert Admin |

Polish PM says veto of EU budget is possible

WARSAW (Reuters) - Polish Prime Minister Donald Tusk said on Friday that a veto of the European Union's proposed long-term budget by one or more member states was a possibility, but should be used only as a last resort.

Tusk said that if a veto was exercised, Poland, the biggest net recipient of EU funds, would seek to find common ground with countries that are net contributors. " In case of plan B, a coalition with large net contributors will be important to ensure that the provisional budget is also applied to Poland," Tusk said in a speech to the parliament. EU negotiators remain hopeful of a deal later this month on the bloc's next long-term budget, despite differences of opinion between Germany, Britain and other major financial contributors. (Reporting by Pawel Sobczak Editing by Catherine Evans) |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 17:12

|

||

|

x 0

x 0 Alert Admin |

Obama to make landmark visit to Myanmar this month

By Aung Hla Tun and Matt Spetalnick

YANGON/WASHINGTON (Reuters) - President Barack Obama will become the first U.S. leader to visit Myanmar this month, the strongest international endorsement of the fragile democratic transition in the Southeast Asian country after half a century of military rule. Obama will travel to Myanmar during a November 17-20 tour of Southeast Asia that will also take in Thailand and Cambodia, the White House said on Thursday, confirming his first international trip since he won a second term in Tuesday's election. He is going ahead with the trip despite recent sectarian violence in western Myanmar that has drawn concern from the United States and European Union. U.N. human rights investigators have criticised the quasi-civilian government's handling of the strife between Buddhists and minority Muslims, and some Myanmar exiles see Obama's trip as premature before political reforms have been consolidated. The visit to Myanmar, the first by a sitting U.S. president, will give Obama a chance to meet President Thein Sein and opposition leader Aung San Suu Kyi to encourage the " ongoing democratic transition" , White House spokesman Jay Carney said. Suu Kyi spent years in detention under the military as the figurehead of the movement for democracy. She was elected to parliament in April, when her National League for Democracy (NLD) ran in by-elections after boycotting a 2010 poll. Obama will be in Myanmar on November 19, according to a senior government source in Yangon, where people expressed delight. " I believe it is a clear sign of improved ties between the two countries and I am very glad that our NLD party played an important role in working for the emergence of this situation," said NLD executive committee member Han Tha Myint. Myint Soe, vice-chairman of the Federation of Chambers of Commerce and Industry, said the historic visit showed Myanmar had now been admitted into the international community. " It's good for President Obama to see things with his own eyes," he said. " I would like to request him to keep encouraging the democratisation process in our country by helping to promote the socioeconomic standards of the people." Obama's presence in Myanmar, also known as Burma, will highlight what his administration sees as a first-term foreign policy achievement and a development that could help counter China's influence in a strategically important region. Washington takes some credit for a carrot-and-stick approach that pushed Myanmar's long-ruling generals toward democratic change and led to Thein Sein taking office as a reformist president in 2011. But Obama also risks criticism for rewarding the new government too soon, especially after security forces failed to prevent bloody ethnic violence in the west of the country. At least 89 people were killed in the recent clashes between Buddhist Rakhines and minority Muslim Rohingyas. Many thousands more have been displaced by the violence. The U.S. Campaign for Burma, an exile group, said Obama's trip could " undermine the democracy activists and ethnic minorities" , but added that if the president was intent on going, he should broaden his agenda to include meetings with the still-powerful military and an address to parliament. A senior administration official said Obama, who will also speak to civil society groups, was " acutely aware" of concerns about human rights, ethnic violence and political prisoners in Myanmar and would address those issues during his visit. SANCTIONS EASED The United States eased sanctions on Myanmar this year in recognition of the political and economic change under way, and many U.S. companies are looking at starting operations in the country located between China and India, with its abundant resources and low-cost labour. In November 2011, Hillary Clinton became the first U.S. secretary of state to visit Myanmar in more than 50 years. Obama has sought to consolidate ties and reinforce U.S. influence across Asia in what has been dubbed a policy " pivot" toward the region as wars in Iraq and Afghanistan wind down. Myanmar grew close to China during decades of isolation, reinforced by Western sanctions over its poor human rights record, but is now seeking to expand relations with the West. Obama met Suu Kyi, a fellow Nobel Peace Prize laureate, on her visit to the United States in September. Thein Sein was also in the United States to attend the opening of the U.N. General Assembly in New York but the two leaders did not meet. U.S. Democratic Representative Joe Crowley, who is active on Myanmar issues, said Obama's trip could be " the most significant step" in support of democracy there. But he said: " There is still much more to be done. Too many political prisoners remain locked up, ethnic violence must be stopped, and not all necessary political reforms have been put in place." Obama will be in Southeast Asia to attend meetings in Cambodia centred on an annual summit of the 10-country Association of Southeast Asian Nations, which is usually extended to take in leaders of partner countries. Preliminary details for this year show the event will run from November 15 to November 20. The Cambodian government has said Obama will be in the capital, Phnom Penh, on November 18. The White House has yet to release a detailed itinerary. The heads of government of China, Japan, Russia and other countries are also expected in Cambodia for the meetings. (Writing by Matt Spetalnick and Alan Raybould Editing by Peter Cooney and Robert Birsel) |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 17:10

|

||

|

x 0

x 0 Alert Admin |

Greece and growth worries support safe haven Bunds

* Bunds to hold recent gains as Greece aid saga drags on

* Looming U.S. fiscal cliff to support Bunds in medium term By William James LONDON, Nov 9 (Reuters) - Low-risk German bonds rose on Friday with demand solid after sizeable gains this week spurred by worries over Greece's debt problems and the prospect of growth-crushing spending cuts in the United States. Greece will vote to approve the country's 2013 budget on Sunday, the next big step towards unlocking access to urgently-needed international aid after Wednesday's tight vote in favour of a 13.5 billion euro austerity package. However, on Thursday the German finance minister said it may be too early to decide next week on granting Greece further aid, dashing the hopes of those who expected the aid to be approved at a meeting of euro zone finance ministers on Monday. Bund futures rose 10 ticks on the day to 143.08, adding to gains of more than a point since last Friday's close, although market participants cautioned that after such a good run, the rally may not extend much further. " Bunds have had a good run this week and obviously the situation in Greece and Spain is still out there, but I get the feeling a lot of that is in the price now," a trader said, adding that he was looking for a break to around 142.80. Traders also highlighted the December contract's Aug. 2 high of 143.35 as a resistance level which may curb rising prices. Debt issued by Spain also came under modest pressure, with traders citing persistent uncertainty over when and if the country would seek a bailout to resolve its debt problems. Spanish 10-year yields were 2 basis points higher at 5.89 percent. HEADED FOR THE CLIFF The safety bid has been fuelled in part by the re-election of Barack Obama as U.S. president and the risk that politicians will be unable to negotiate a way around $600 billion in spending cuts and tax hikes which could extinguish growth in the world's largest economy. Market participants said the likelihood of protracted wrangling should maintain demand for less risky, " core" bonds as a shelter from the uncertainty. " Looking at the next few weeks we would expect both Bunds and U.S. Treasuries to trade supported at about current levels," said Rainer Guntermann, strategist at Commerzbank in Frankfurt. " Obviously the fiscal cliff is the big issue and over here in Europe we have economic weakness coming through in the core countries." In recent days, both the European Commission and the European Central Bank have acknowledged a worsening outlook for the euro zone's struggling economy -- supporting bonds and deterring investment in riskier assets such as stocks. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

krisluke

Supreme |

09-Nov-2012 17:08

|

||

|

x 0

x 0 Alert Admin |

China data shows economic recovery gaining pace

* Oct industrial output +9.6 pct y/y vs +9.4 pct f'cast

* Oct retail sales +14.5 pct y/y vs f'cast +14.0 pct * Jan-Oct fixed asset investment +20.7 pct y/y vs f'cast +20.6 pct * Oct CPI +1.7 pct y/y vs f'cast unchgd from Sept +1.9 pct * PPI -2.8 pct vs f'cast -2.7 pct and -3.6 pct in Sept By Nick Edwards and Kevin Yao BEIJING, Nov 9 (Reuters) - China's economy strode further along the road of recovery from its slowest growth in three years, data for October showed on Friday, as infrastructure investment accelerated and output from the country's factories ran at its fastest in five months. The uptick in key economic activity indicators last month, after signs of a rebound emerged in September data, cemented the view of many analysts and investors that China's rebound was now gathering momentum thanks to a raft of pro-growth policies rolled out by the government in recent months. " It's pretty clear that there is no hard landing risk, that the economy will improve in the fourth quarter and we're going to see 9 percent year-on-year growth in the first half of next year," Dariusz Kowalczyk, senior economist and strategist for non-Japan Asia, Credit Agricole CIB, told Reuters. That's a bold call on growth after seven successive quarters of slowing activity dragged the annual rate of economic expansion down to 7.4 percent in Q3 - its lowest since early 2009 - leaving the world's second biggest economy on track to mark its most sluggish year since 1999. The benchmark Reuters poll taken in October after Q3 GDP data forecasts first half growth in 2013 of 7.8 percent, but Kowalczyk is not alone in being above consensus - and being further convinced that October's numbers are a turning point. " The key question for investors is whether China's economic growth has truly bottomed out," Ting Lu, chief China economist at Bank of America/Merrill Lynch in Hong Kong, wrote in a note to clients. " Based on October data, especially the 9.6 percent industrial production growth reading, the answer is firmly 'yes'," said Lu, who expects China's GDP growth to run at an 8.3 percent pace in the first half of 2013, picking up from a 7.8 percent rate in Q4. Risk assets were somewhat less emphatic in their response to numbers that showed upside surprises in industrial output, fixed asset investment - up 20.7 in the first 10 months of the year - and retail sales, up 14.5 percent in October on the year. While Asian currencies were broadly steady to firmer and Brent crude and base metals nudged higher, equities were subdued by worries about the risks from the so-called " fiscal cliff" in the United States and fresh concerns about sovereign debt problems in Europe. " Equities in China are highly correlated with the economic cycle in and I strongly believe that the economic cycle in China justifies higher valuations going forward," Kowalczyk said. BASE EFFECTS FLATTER Lu meanwhile cautioned that there is risk of a strong base effect flattering the H1 numbers next year, but points out that infrastructure investment has accelerated solidly since the government began fast-tracking major projects a few months ago, underpinning domestic economic activity. Lu says total planned investment in newly started projects, a leading indicator of FAI, accelerated to 35.2 percent year-on-year in October from 31.3 percent in September. Despite signs of strength, analysts broadly say that further gains depend largely on the government maintaining its commitment to pro-growth monetary and fiscal policies, even though few economists expect additional action in the near term. " I don't expect any easing in monetary policy until the end of this year because it would be unnecessary as the economy is recovering," Yao Wei, China economist at Societe Generale in Hong Kong, told Reuters. Beijing has been fine-tuning economic policy for a year to support growth, and analysts expect that programme to broadly remain in place after a new leadership of the ruling Communist Party is unveiled at a congress that began on Thursday. Outgoing party chief, President Hu Jintao - almost certain to be succeeded by Vice President Xi Jinping - said in a speech to the congress that China would stick to policies fostering sustainable, long-term economic development with the aim of doubling GDP over the 10 years to 2020. China has cut benchmark interest rates twice this year, lowered bank reserve ratios three times since late 2011 and made repeated, large-scale liquidity injections into the financial system to underpin slowing growth in the short-term. NAGGING DOWNSIDE RISKS Friday's data, key barometers of both domestic activity and output from China's export-oriented factory sector, offered further evidence that policy loosening had worked and had left the authorities with room to do more if necessary. Consumer inflation eased to its slowest pace in nearly three years in October, with the 1.7 percent rise from a year ago slower than the 1.9 percent posted in September. Economists polled by Reuters had expected inflation to hold steady. Factory-gate prices in October fell 2.8 percent from a year earlier, a touch faster than the forecast fall of 2.7 percent but easing from September's 3.6 percent annual drop, which bodes well for a corporate sector struggling to cope with falling profits due to producer price deflation. The nagging downside for company earnings of falling producer prices and industrial production still firmly below its double-digit trend, despite the latest uptick, are reasons why Alistair Thornton, an economist with IHS Global Insight in Beijing, believes it is too early to declare that growth has definitively stabilised. " The bottom line is that the economy remains very sluggish," he wrote in a note to clients. " Over the next couple of months, the economy will most likely continue to bounce off the bottom, although the balance of economic forces is shifting more to the upside than the downside." |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 17:07

|

||

|

x 0

x 0 Alert Admin |

Hong Kong shares post worst week in 4 months, China down too

* HSI down 0.9 pct, falls 3.3 percent on week

* China banks, energy shares hit by profit-taking after rally * CSI300 down 2.9 percent, Shanghai Comp down 2.3 pct on week * Railway stocks up again in China on investment spending hopes By Vikram Subhedar Nov 9, (Reuters) - Hong Kong shares eased further from their 2012 highs as weak overseas markets spurred more profit-taking, particularly in China-focused shares, dragging the benchmark to its worst weekly performance since mid-July. The Hang Seng Index fell 0.9 percent to 21,384.4, its worst week in four months, while the China Enterprises Index was down 0.7 percent, with recent outperformers such as banking and energy shares the biggest drags. Both indices fell more than 3 percent for the week. On the mainland, the CSI300 of top Shanghai and Shenzhen listings and the Shanghai Composite both edged down slightly, but pared earlier losses on the back of strength in railway stocks. On the week, the two indices were down 2.9 percent and 2.3 percent, respectively. China's annual consumer inflation in October eased to its slowest pace in nearly three years, official data showed on Friday, giving policymakers room to further loosen monetary policy to support growth if needed. Stock markets were little changed following the data. " It's one of these situations where capital flows are driving prices and there's a lot of rotation going on," said Chrisian Keilland, head of trading at BTIG in Hong Kong. " You see people unloading winners and looking into ideas that have been ignored for a while," said Keilland, adding that while losses on the S& P 500 in the United States were affecting markets, there were few signs of any major selling pressure. China Construction Bank and oil major Sinopec contributed the most to weakness on the China Enterprises Index with losses of 1 percent and 1.6 percent, respectively. PetroChina fell 1 percent. Encouraged by signs of stabilising growth in China, investors have flocked to growth-sensitive sectors and banking shares that had lagged the broader market over the first three quarters of the year. But a 3.5 percent drop over the past two days for the S& P 500 which could be headed for its worst weekly performance in a year and renewed euro-zone growth worries has prompted some investors to lock in sectors that drove last month's rally. Bucking the weaker trend on the day, Lenovo Group added 5.8 percent following second-quarter results to close at its highest since June 20 this year. Telecom hardware maker ZTE rose 1.9 percent. Warren Buffet-backed BYD Co rose 7.6 percent. RAILWAYS JUMP IN CHINA Hopes of more spending on rail infrastructure drove up shares of rail equipment makers in Shanghai. CSR Corp was up 4.2 percent and among the top gainers on the CSI300 index. China Railway Group rose 3.3 percent and China Railway Construction was up 3.5 percent. According to Haitong Securities, China's Ministry of Railways is estimated to spend up to 160 billion yuan ($25.63 billion) in the last two months of 2012 on infrastructure spending. Oil companies were weak on mainland bourses too, with PetroChina off 0.3 percent and the top drag on the CSI300. |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 17:03

|

||

|

x 0

x 0 Alert Admin |

World shares steady as U.S. fiscal worries, Europe weigh

Graph with stacks of Australian dollars

* European shares extend losses to third day * Euro steadies near 2-month low vs dollar * Gold firms, set for biggest weekly gain since end-January LONDON, Nov 9 (Reuters) - World share markets were on course for their worst weekly performance since June on Friday as concerns over the United States fiscal cliff and the outlook for Europe hit sentiment. But better-than-expected Chinese economic data for October, pointing to a modest rebound in the world's second largest economy, helped ease concerns over global growth, keeping market moves within tight ranges. The MSCI world equity index was flat at around 323.6 points but has lost just over two percent this week and is on track for its worst performance since early June. European shares extended their losses into a third day, partly due to worries over whether Greece will secure a deal to unlock access to urgently needed international aid. The FTSE Eurofirst index of top European shares fell 0.1 percent to 1096.51 in early trading. London's FTSE 100 , Paris's CAC-40 and Frankfurt's DAX barely changed at the open. Greece votes to approve the country's 2013 budget on Sunday, the next big step towards allowing bailout money to flow again so it can avoiding defaulting on its debt. " We still have the situation in Greece, the volatility indexes are showing that investors are not too worried at the moment but that can change quickly so politicians need to act quickly," said Emile Cardon, a market economist at Rabobank. The euro steadied at around $1.2750 to the dollar, just above a two-month low of $1.2717 hit on Thursday after the European Central Bank kept rates on hold and its president, Mario Draghi, sounded downbeat on the euro zone economy. The dollar was down 0.1 percent after hitting a two-month high against a basket of major currencies of 81.001 on Thursday. Rising demand on the back of the looming U.S. fiscal crisis underpinned the greenback, seen as a safe haven. Since the U.S. elections on Tuesday investors have become worried that Washington could struggle to find a compromise to cut the budget deficit before nearly $600 billion worth of spending cuts and tax increases kick in early 2013. Markets are also eyeing the debt ceiling, which needs to be raised to avoid a government shutdown. Gold rose to a three-week high of $1,737.60 an ounce on Friday, and is on track for its first weekly gain in a month as the fiscal worries boosted the appeal of the precious metal. Analysts say the fiscal cliff could derail the U.S. economy, which had recently defied a general trend in other parts of the world by showing signs of a modest recovery, and a U.S. recession could drag the global economy down further. Those concerns ease somewhat after Chinese data showed industrial output and retail sales for October slightly exceeded expectations, while annual October consumer inflation eased to its slowest pace in nearly three years, giving policymakers scope to further loosen monetary policy if needed. " But given the uncertainties in the outside world, we expect the recovery momentum to be limited and the full-year industrial output is likely to be around 10 percent for this year," said Iang Chao, analyst at Guotai Junan Securities in Shanghai. The slightly better outlook for China left U.S. crude up 34 cents to $85.43 a barrel and Brent rose 13 cents to $107.38. |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 16:56

|

||

|

x 0

x 0 Alert Admin |

2012 Election Winners and Losers: Coal, Dividends, Health Care, Utilities, Oil and More Election Day has come and gone. President Obama won a second term. The current electoral vote was by a margin of about 3 to 2 (unofficial), but the percentage last seen was only about 51% of the populous voting for Obama (also still unofficial). Many investors have keyed off of the presidential election, but the balance of power did not shift too much either way in the congressional challenges. 24/7 Wall St. has highlighted many of the sectors, and the companies or exchange-traded funds (ETFs) leading those sectors, and how they would have been treated under Romney or Obama. We have also added caveats and color if applicable This sector and company list was put together in a nonpartisan manner. Alternative Energy: This is the most obvious sector that was hoping for an Obama win. The implication is that the Department of Energy will keep spending on alternative energy investing. First Solar Inc. (NASDAQ: FSLR) is the biggest of the solar players in the United States, and its shares are indicated above $25 after closing at $24.79 on Tuesday. In ETFs there is the PowerShares WilderHill Clean Energy (NYSEMKT: PBW), which is now only $4.00 per share. While this sector seems an obvious winner, be advised that alternative energy has been such a bad investment that these have turned 401(k) plans into 201(k) plans. At the peak of the energy craze in 2007 to 2008, PBW was at $28 and First Solar was above $300. Autos: Despite the debate over Romney’s GM handling or Obama being more prounion, ultimately the industry is going to try to sell more cars regardless. General Motors Co. (NYSE: GM) in theory will be more protected than Ford Motor Co. (NYSE: F), as the U.S. still has its massive stake in the company. Tesla Motors Inc. (NASDAQ: TSLA) will shine as the model car company. Banks: Bank regulation is higher under Obama and Dodd-Frank, but now the banks likely have this incredibly low-rate environment to deal with. The flip side is that Romney would likely have allowed the too big to fail banks to fail. Jamie Dimon of J.P. Morgan Chase & Co. (NYSE: JPM) did not exactly win new friends in the election. Big Dividend Stocks: Higher taxes under Obama are said to be an issue, but it is amazing that many of these stocks already have pulled back. This applies to the likes of Altria Group Inc. (NYSE: MO), utilities under the Utilities Select Sector SPDR (NYSEMKT: XLU) and others. It may even apply to the likes of an AT& T Inc. (NYSE: T), although the stock is down 10% from its highs in anticipation of higher dividend taxes and as the dividend trades became too crowded in 2012. Bonds: The bond market would prefer the status quo of easy money and low rates, as we have already seen. Bond prices (lower yields) are theoretically set to remain where they are for the foreseeable future. Merrill Lynch’s latest RIC report said:

Brokerage Firms: Goldman Sachs Group Inc. (NYSE: GS), Morgan Stanley (NYSE: MS) and the rest of the large investment banks will be disappointed with the election outcome. Wall St. bonus attacks are likely to remain a focus. Buffett: Warren Buffett has been a strong supporter of Obama, and that in theory protects the interests of Berkshire Hathaway Inc. (NYSE: BRK-A). Casinos: Casino owners have been very negative against President Obama after he bashed companies for expensive junkets in Las Vegas after the 2008 election. Sheldon Adelson of Las Vegas Sands Corp. (NYSE: LVS) was a huge Republican supporter, and Steve Wynn of Wynn Resorts Ltd. (NASDAQ: WYNN) has been very vocal against the administration. Neither one of those bosses is happy about the outcome, but both stocks are down substantially from their 52-week highs. Coal: Let’s just say that “I like coal!” came from Romney, and coal has not exactly been very favorable under Obama. Peabody Energy Corp. (NYSE: BTU) was around $70 at the start of 2011 and is now around $29.00. There had been a Romney-bounce in the last month from $22 so watch for some potential pressure to remain. The ETF that has all of the major coal names is the Market Vectors Coal ETF (NYSEMKT: KOL), and at almost $26 this has been cut in half since early 2011. Defense: Romney wanted to keep defense spending higher, although there has been a debate over how much the cuts really will be because of the job losses that will come from defense spending cuts. Defense cuts are a huge portion of the coming fiscal cliff. It is interesting that Lockheed Martin Corp. (NYSE: LMT), at almost $95, is still within almost 1% of a 52-week high and carries almost a 5% dividend yield. Gold and Silver: Gold bulls want the same Fed policy we have been seeing, as the printing of money and low rates help it. Therefore, ditto for silver. Gold started to bounce handily in the past few sessions and is trading up so far on the Obama victory. Merrill Lynch noted in its RIC report:

The SPDR Gold Trust (NYSEMKT: GLD) is worth a whopping $72.5 billion in market value, but the smaller ETF Physical Swiss Gold Shares (NYSEMKT: SGOL) has a lower management fee and its gold is kept in Swiss vaults. The Market Vectors Gold Miners ETF (NYSEMKT: GDX) tracks the mining sector for gold and is barely above $50, which is down about 20% from its year high of $63.05. iShares Silver Trust (NYSEMKT: SLV) is the largest silver ETF, with just over $10 billion in market value, while Silver Wheaton Corp. (NYSE: SLW) is the go-to player in the Devil’s Metal when it comes to silver miners. Housing: On the surface, the housing sector would initially prefer Obama because of the Fed policy, QE3 and interest rates. Ultimately this is debatable, but that has been the take of market pundits. Just keep in mind that this sector already has rallied massively, and the key ETF SPDR S& P Homebuilders (NYSEMKT: XHB), at $26.70, has a 52-week range of $14.96 to $27.06. Luxury Goods: Will display of wealth be shunned? That depends on whom you speak with, and it is still up for debate whether higher taxes will curb spending on luxury items. The question is whether it is really only millionaires and billionaires, or if the basis dips down to those families making $250K. Tiffany & Co. (NYSE: TIF) is perhaps the poster child of luxury spending companies, but with shares close to $65, its 52-week range is $49.72 to $78.43. Michael Kors Holdings Ltd. (NYSE: KORS) would fit in along the higher-end apparel and accessories theme as well, and its shares are up massively from the initial public offering. Media: TV, Web, papers, radio and every other form of media had more media spending in this election that ever. The full tally is not yet known, but this should have given a real boost to quarterly earnings. Some outlets are conservative and some are liberal. We will not identify individual companies here on either side because there are so many units and local efforts that may not be the same as the parent company might indicate. Nuclear: While nuclear has never been officially killed, it has never really been embraced either. USEC Inc. (NYSE: USU) has been all but left for dead. Oil and Gas: The United States has had no real energy policy in three decades, and let’s just say that the oil and gas sector was hoping for a Romney victory. Exxon Mobil Corp. (NYSE: XOM) is the largest of big oil, with a $400+ billion market value. United States Oil Fund (NYSEMKT: USO) tracks the price of oil each day, while Market Vectors Oil Services ETF (NYSEMKT: OIH) tracks the major oil and gas services companies. REITs: Real Estate Investment Trusts fall under the high dividend classification, but the reality is that the REIT sector involves too many facets of land use to target in general. The key ETF here is the Vanguard REIT Index ETF (NYSEMKT: VNQ), but its price peaked in September around $69 and is around $65 now. Technology: Outside of the government spending plans, technology is probably a net neutral. Most investors believe that White House policies and the efforts of Congress do not (currently) target Apple Inc. (NASDAQ: AAPL) or Microsoft Corp. (NASDAQ: MSFT). Technology should be a net neutral, minus of course whatever infrastructure spending gets cut in the coming fiscal cliff. One question up for debate, which has not gone its way yet: Can Obama make Research in Motion Ltd. (NASDAQ: RIMM) cool again? Telecom: Ultimately, this sector is a neutral, based on the election outcome. The exception here is that both AT& T Inc. (NYSE: T) and Verizon Communications Inc. (NYSE: VZ) are the behemoths, and they are classified along with utilities under the high-dividend theme stocks. That could pose more selling if investors think that the dividend taxes will really more than double. Utilities: This sector wanted a Romney victory almost across the board. This was due to regulation, what source of energy can be used (coal versus other) and due to perceived higher dividend taxes coming down the pipe. Utilities Select Sector SPDR (NYSEMKT: XLU) is the key ETF, but American Electric Power Co. Inc. (NYSE: AEP) has been the industry champion of lobbying and has even been very vocal in dividend taxation on behalf of investors. And finally the big kahuna … Health care is generally too big to group under one header, and the reality is that whether or notthe sector liked Obamacare, most subsectors of health care already have moved their business models and expectations based on Obamacare remaining.

Also, the small public sector of retail gun selling should benefit as well but this is a very small segment in the grand scheme of the economy. JON C. OGG |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 16:54

|

||

|

x 0

x 0 Alert Admin |

Oil Demand, Prices to Rise: OPEC In its latest World Oil Outlook released today, the Organization of Petroleum Exporting Countries (OPEC) is forecasting that demand for energy will rise 54% by 2035. Fossil fuels, including oil, natural gas and coal, which now account for 87% of demand, will continue to supply 82% of the world’s energy in 2035. The cartel does see, however, a shift within fossil fuels:

In other words, demand for fossil fuels will be split almost evenly among the three fuels by 2035, and the biggest loser is oil. OPEC’s medium-term projection for crude oil demand has fallen by more than 1 million barrels a day from last year’s outlook to 92.9 million barrels a day. The report says that about 70% of the medium-term increase comes from developing countries in Asia. Over the long-term, crude demand will rise to 107.3 million barrels a day, from 87 million barrels a day in 2010. OPEC forecasts that developing countries in Asia account for 87% of that increase, and that by 2035 Asian demand will equal 90% of demand from the developed nations of the Organization for Economic Cooperation and Development. Crude oil supply is expected to increase the most from non-OPEC members, especially Russia, the Caspian Sea region, Brazil and the United States, where supplies will jump by more than 10 million barrels a day by 2035 to 62.7 million barrels a day. OPEC’s crude supply will rise by about 5.6 million barrels a day in 2035, to 34.9 million barrels a day. And prices? Well, they will be higher. OPEC estimates the total investment needed to hit the forecast demand will be $4.2 trillion through 2035. The cartel sees an average price of $100 a barrel over the medium term and a rise to $125 a barrel by 2025 and $135 a barrel by 2035. OPEC’s crude oil price assumptions are more a function of the cost of finding and producing new barrels than they are a reflection on demand, at least in the near term. If (when) the global economy really recovers, demand for energy will increase, and the world has not yet made enough of a commitment to alternative fuels to dent the demand for fossil fuels. The full World Oil Outlook is available here. Paul Ausick |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 16:31

|

||

|

x 0

x 0 Alert Admin |

-Brent holds above $107 U.S., Europe fiscal woes in focus

(Corrects to say China is the world's biggest energy consumer, not 2nd biggest, in 14th paragraph)

* ECB warns Greece that help is nearing an end * Tensions in Iran, Syria escalate * Snowstorm in U.S. northeast triggers gasoline rationing * Coming up: OPEC monthly report for October, time unknown By Ramya Venugopal SINGAPORE, Nov 9 (Reuters) - Brent crude futures steadied above $107 on Friday and were poised to end the week with a marginal gain, their first in four, but prices are likely to remain under pressure as the outlook for the global economy, and fuel demand, remains weak. Oil prices went on a rollercoaster ride this week. U.S. President Barack Obama's re-election ended weeks of political uncertainty and lifted prices, but a possible U.S. fiscal crisis and more grim news about Europe's economic woes weakened futures. Supply worries caused by tension in the Middle East over Iran's nuclear programme and rising violence in Syria, however, are likely to continue to lend support to prices. " Politics is going to take centre-stage as far as commodity markets are concerned," said Natalie Rampono, a commodity strategist at ANZ. " At the same time, Syria and Iran will provide a little bit of support, so we expect choppy and sideways trading next week." Front-month Brent futures were trading 13 cents higher at 107.38 per barrel by 0500 GMT, posting a 1.7 percent gain on the week so far. It rose as much as 3 percent and dropped as far as 4 percent on some days this week. U.S. crude added 34 cents to $85.43 per barrel, after posting gains of 4 percent and 5 percent during some of the week's sessions. It is up 0.7 percent so far this week. A snowstorm in the northeastern United States, and gasoline rationing, are also likely to curtail demand and pressure prices further. RATHER BLEAK Greece remains the focus of the European crisis, with European Central Bank chairman Mario Draghi saying that the bank was done helping the near-bankrupt nation with its problems. Draghi also gave a rather bleak outlook for the overall euro zone economy, saying it showed little sign of recovering before the year-end, despite easing financial market conditions. In the United States, investors are now focused on the looming " fiscal cliff" - a $600 billion package of spending cuts and tax measures which may pull the economy into deep recession. The International Monetary Fund on Thursday urged the U.S to quickly reach an agreement on a permanent fix to avoid the fiscal cliff, saying a stop-gap solution could be harmful to the global economy. " Financial markets are finding it difficult to adopt a 'business as usual approach' in the wake of the U.S. election, with Wall Street fixated by fiscal cliff ramifications," Tim Waterer, a senior trader at CMC Markets, wrote in a note. Oil prices may get a boost next week after China announces October trade data on Saturday which is expected to show a slight pickup in imports, pointing to a recovery in domestic demand in the wor ld's biggest energy consumer. China's consumer inflation eased to its slowest in nearly three years in October, giving policymakers scope to further loosen monetary policy, data showed on Friday. " (That was) one positive development amid all the doom and gloom from the U.S. and Europe which is putting markets on a tentative footing," Waterer said. Tension between Iran and the West over its nuclear programme also appeared to take a turn for the worse after the Pentagon said on Thursday that Iranian warplanes fired at an unarmed U.S. drone in international airspace last week but did not hit the aircraft. In Syria, rebels are fighting a 19-month battle against government forces, and skirmishes along the country's borders are escalating tensions with its neighbours, especially Turkey. On Thursday, President Bashar al-Assad said he would " live and die" in Syria and warned that any Western invasion to topple him would have catastrophic consequences for the Middle East. (Editing by Miral Fahmy and Joseph Radford) |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 16:30

|

||

|

x 0

x 0 Alert Admin |

Hong Kong's HSI slips 3.3 pct on week as investors lock in profits

Nov 9 (Reuters) - Hong Kong shares eased further from their 2012 highs on Friday, as weak overseas markets spurred profit-taking in China-focused shares, dragging the benchmark to its worst weekly performance since mid-July.

The Hang Seng index fell 0.9 percent to 21,384.4 while the China Enterprises index fell 0.7 percent, with recent outperformers, such as banking and energy shares, the biggest drags. Both indices lost more than 3 percent this week. On the mainland, the CSI300 of top Shanghai and Shenzhen listings fell 0.2 percent while the Shanghai Composite closed down 0.1 percent. The indices lost 2.9 percent and 2.3 percent on the week respectively. HIGHLIGHTS: * Chinese banking and energy shares, the best performing sectors in October, were hit by more profit-taking and were the biggest drags on the Hang Seng. China Construction Bank and Petrochina fell 1 percent while Sinopec dropped 1.6 percent. * Shares of Chow Tai Fook Jewellery Group Ltd fell nearly 5.6 percent after China's top jewellery retailer warned of lower profit margins due to gold hedging activities. * Bucking the weaker trend, Lenovo Group added 5.8 percent and neared a three-month high following second-quarter results. Telecom hardware maker ZTE rose 1.9 percent. |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

09-Nov-2012 16:28

|

||

|

x 0

x 0 Alert Admin |

European shares edge higher, led by Novo Nordisk

European flag flying in front of the European Commission building in Brussels

Sentiment remained fragile, however, given persistent concerns over the near-term U.S. fiscal outlook and the funding needs of austerity hit Greece. At 0818 GMT, the FTSEurofirst 300 index of top European shares was up 0.1 percent at 1,099.30 points, after falling 0.2 percent in the previous session. China's annual industrial output growth rose more than expected in October and fixed asset investment ticked higher, further raising expectations of a modest rebound in the last quarter. " The pace of growth of 8 or 9 percent that we saw over the last few years will probably not return, but that's not what is in the price. What's in the price is slowing economic growth, so if we see some resilience in the Chinese economy then that will be rewarded by higher prices," Gerard Lane, equity strategist at Shore Capital, said. " You would want to be long on China-exposed companies and on the emerging market-orientated stocks such as luxury goods. That would provide cyclical risks in portfolios, which should otherwise be very defensive because elsewhere in the world things are slowing, if not contracting." Leading gainers across the FTSEurofirst 300 was Novo Nordisk, up more than 10 percent after an advisory panel to the U.S. Food and Drug Administration late on Thursday voted to recommend approval of its long-acting insulin degludec. |

||

| Useful To Me Not Useful To Me | |||

![[image]](http://si.wsj.net/public/resources/images/OB-VH554_usmyan_D_20121108212331.jpg)