| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||||

|

pharoah88

Supreme |

30-Jun-2010 14:18

|

||||

|

x 0

x 0 Alert Admin |

United States President Barack Obama suggests the Germans are sending the world back into recession. Billionaire investor George Soros says they are destroying the euro. French Finance Minister Christine Lagarde thinks they are pushing the euro zone into deflation. It is all crazy talk. |

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

30-Jun-2010 14:15

|

||||

|

x 0

x 0 Alert Admin |

Donít blame the Germans Working hard, making great products, living within your means ó these arenít bad principles |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

rickyw

Master |

30-Jun-2010 08:49

Yells: "keep happy..." |

||||

|

x 0

x 0 Alert Admin |

This is BUY call...lets unite and we make STI stronger... | ||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

30-Jun-2010 08:29

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

Buying opportunities emerge then! | ||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

30-Jun-2010 07:01

|

||||

|

x 1

x 0 Alert Admin |

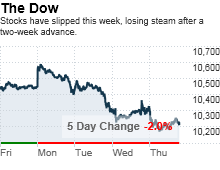

Stocks slammed by global slowdown fearsNEW YORK (CNNMoney.com) -- Stocks tumbled Tuesday, with the Dow falling as much as 326 points and the S&P hitting an 8-month low after a big drop in consumer confidence and signs of a bigger slowdown in the global economy. Investors plowed into the safety of government debt, sending the 10-year note yield below 3% for the first time in 14 months. Dow Jones industrial average (INDU) dropped 268 points, or 2.7%, after having earlier lost as much as 326 points. The Nasdaq (COMP) composite fell 85 points, or 3.9%. The S&P 500 (SPX) slid 33 points, or 3.1%, falling to a fresh 2010 low of 1035.18 before recovering a little to close at 1041.24. It was the lowest close since November and could bring in more selling in the next few days, according to technical market pros. Stocks slipped at the open on global concerns but the selling picked up steam after the release of the Consumer Confidence index for June. Confidence slumped to 52.9 from 62.7 in May, the Conference Board reported, with the decline reflecting worries about the labor market and economic outlook. Confidence was expected to fall to 62, according to economists surveyed by Briefing.com. Concerns about the job market and economy have dragged on stocks on and off for the last two months, with the major gauges falling into a correction after hitting rally highs in late April. A correction is a plunge of at least 10% off the highs. As of Tuesday's close, the S&P is off 14.6% from the highs of late April. Tuesday's woes were sparked by a weak reading on Japanese export demand and household spending and a revised reading on Chinese leading economic indicators. In Europe, a fresh round of protests by Greek citizens opposed to government austerity measures kept worries about Europe's ability to cut its debt front and center. The euro, something of a proxy for European debt worries, fell. "Between euro worries, some notes of a slowdown out of Asia and a bad consumer sentiment number, there are very few reasons for stocks to rise, and plenty for them to fall or flatten out," said Karl Mills, president and chief investment officer at Jurika Mills & Keifer. "The largest concern on a broad level remains the issue of debt, both in Europe and the U.S.," he said. Stocks ended a choppy session lower Monday after leaders of the G-20 nations agreed to both continue to promote economic recovery and to cut deficits in half by 2013. The group of 19 countries and the European Union met at a summit last weekend in Toronto. On the move: Declines were broad based, with all 30 Dow issues falling, led by Boeing (BA, Fortune 500), Caterpillar (CAT, Fortune 500), Chevron (CVX, Fortune 500), IBM (IBM, Fortune 500) and United Technologies (UTX, Fortune 500). A variety of financial stocks slumped, with the KBW Bank (BKX) sector index off by 3.5%. Components JPMorgan Chase (JPM, Fortune 500), Bank of America (BAC, Fortune 500) and Wells Fargo (WFC, Fortune 500) all lost 4%, while Citigroup (C, Fortune 500) fell 6%. World markets: European markets stumbled across the board, with Britain's FTSE 100 losing 3.1%, Germany's DAX giving back 3.3% and France's CAC 40 falling 4%. Asian markets slumped. Japan's Nikkei fell 1.3%, Hong Kong's Hang Seng slid 2.3% and China's Shanghai Composite slumped 4.3%. Housing market: Home prices rose 3.8% in April versus a year ago, according to the S&P/Case-Shiller Home Price Index of 20 major housing markets. That was a bigger jump than expected, with economists looking for a climb of 3.4% after a boost of 2.3% in March. Home prices also rose 0.8% in April from March levels. However, prices remain off over 30% from the peak. Companies: Electric car maker Tesla Motors debuted on the Nasdaq under the ticker TSLA, rising 12% from its IPO price late Monday. Tesla priced its shares at $17 each, above the $14 to $16 target range, allowing it to raise over $226 million in the IPO. Currency: The euro slumped 0.7% versus the dollar but remained above the four-year low of $1.188 hit earlier in the month. The dollar was down 1.1% versus the yen. Commodities: U.S. light crude oil for August delivery fell $2.83 to settle at $75.94 a barrel on the New York Mercantile Exchange. COMEX gold for August delivery gained $3.60 to $1,242 an ounce. Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 2.97% from 3.03% late Monday. Treasury prices and yields move in opposite directions. Market breadth: Market breadth was negative and volume was moderate. On the New York Stock Exchange, losers beat winners 11 to one on volume of 1.6 billion shares. On the Nasdaq, decliners topped advancers eight to one on volume of 2.58 billion shares. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Hulumas

Supreme |

29-Jun-2010 09:02

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

Double posted!

|

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

29-Jun-2010 07:02

|

||||

|

x 0

x 0 Alert Admin |

Stocks end slightly lowerNEW YORK (CNNMoney.com) -- Stocks ended a choppy session modestly lower Monday as investors welcomed a slight increase in personal spending but remained on guard ahead of key economic reports due later this week. Dow Jones industrial average (INDU) was down 5 points, or less than 0.1%. The S&P 500 (SPX) dipped about 3 points and the Nasdaq (COMP) composite slid 2 points. Stocks struggled for direction throughout the session as investors considered a pledge from world leaders to cut public deficits over the next few years. Consumer staples were among the best performers after a report on personal spending came in somewhat better than expected and the Supreme Court issued a decision that will benefit tobacco companies. Bank stocks were lower as investors continued to digest the Wall Street reform bill Congress finalized last week. Lawmakers are expected to vote on the sweeping overhaul this week and send the bill to President Obama in July. Traders said the tone of Monday's session was cautious as the market remains nervous about the debt crisis in Europe and the possibility of a so-called double dip recession in the United States. "The market is hungry for direction in terms of the labor market and industrial sector," said Nick Kalivas, vice president of financial research at MF Global. "We're in wait-and-see mode on those issues today." Tuesday brings reports on home prices in 20 major U.S. cities and a key measure of consumer confidence. Manufacturing reports are due later in the week and the government's closely-watched monthly jobs report comes out Friday. Stocks closed mixed Friday despite a rebound in the financial sector. All three major gauges booked weekly declines. Economy: Before the open, the Commerce Department reported that personal income rose 0.4% in May, while personal spending edged up 0.2%. The government was expected to report that personal income rose 0.5% in May after climbing 0.4% in April, according to a consensus estimate from Briefing.com. Personal spending was expected to have risen 0.1% from a flat reading in April. Companies: Tobacco companies Altria (MO, Fortune 500) and Philip Morris (PM, Fortune 500) rose after the Supreme Court refused to hear an appeal over the government's ability to collect $280 billion from the industry for alleged fraud in its marketing. The Supreme Court also ruled unconstitutional a long-standing ban on hand guns in Chicago. Smith & Wesson Holding Corp (SWHC). jumped 5.6%. Sprint (S, Fortune 500) gained 6% after President Obama signed a memorandum to expand the amount of broadband spectrum available for smartphones and other wireless devices. Noble announced plans to buy FDR Holdings, an independent drilling company, in a cash transaction that values Frontier at $2.16 billion. Shares of Noble (NE) rose 2.4%. Shares of BP (BP) rose after the oil company said it has spent $2.65 billion on costs related to the spill in the Gulf of Mexico. G-20: Leaders of the world's most important economies agreed to ambitious targets for getting deficits under control, pledging to cut them in half by 2013, according to a statement made following the G-20 summit this weekend in Toronto. But the leaders acknowledged that progress on deficit reduction will take more time for some countries, and included a special provision for Japan, which is heavily reliant on external borrowing. World markets: Asian markets ended mixed Monday. Japan's Nikkei index lost 0.4%, while Hong Kong's Hang Seng index rose 0.2%. Markets in Europe closed higher. France's CAC 40 and Germany's DAX both climbed more than 1% while Britain's FTSE 100 fell ended 0.5% higher. Currencies: The dollar was higher against the euro, but was flat versus the British pound and Japanese yen. Commodities: U.S. light crude oil for August delivery eased 90 cents to $77.96 a barrel. COMEX gold's August contract fell $16.60 to $1,239.20 per ounce. Bonds: Treasury prices rose, pushing the yield on the 10-year note down to 3.03% from 3.11% late Friday. Bond prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

susan66

Master |

26-Jun-2010 11:50

|

||||

|

x 0

x 0 Alert Admin |

|

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

25-Jun-2010 17:09

|

||||

|

x 0

x 0 Alert Admin |

Stocks set for shaky startLONDON (CNNMoney.com) -- U.S. stock futures slipped Friday morning amid anxiety about the economic outlook and as investors awaited the outcome of Wall Street reform talks. At 4:42 a.m. ET,Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were narrowly lower. Futures measure current index values against perceived future performance. Economic woes have worried investors all week and are likely to hang over investors until there is a definitive sign that the economy is on solid footing. Stocks retreated Thursday, dragged lower by fears that the slowing pace of the economic recovery would hurt corporate results. Economy: Reports on the calendar Friday include an updated estimate of economic growth for the first three months of the year. The University of Michigan's final reading on June consumer sentiment is also on tap. Wall Street reform: Investors are also keeping tabs on developments in Washington as lawmakers continue to try to reconcile House and Senate versions of a bill that would overhaul the financial system. The marathon talks, which started at 9:30 a.m. ET Thursday, were still ongoing Friday morning, with negotiations focusing on a measure calling for Wall Street banks to spin off their swaps desks. World markets: Markets in Europe fell in morning trading. The FTSE 100 in Britain, the CAC 40 in France and Germany's DAX all posted mild losses in the early going. Asian shares finished the session in negative territory. Japan's benchmark Nikkei index tumbled 1.9% and the Hang Seng in Hong Kong dipped 0.2%. The Shanghai Composite fell 0.5%. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

25-Jun-2010 07:45

|

||||

|

x 0

x 0 Alert Admin |

Stocks slump on economic woesNEW YORK (CNNMoney.com) -- Stocks slumped Thursday, with the Dow losing 145 points, as investors mulled mixed reports on the economy and a sell-off in bank shares as Wall Street reform talk move toward a close. Dow Jones industrial average (INDU) lost around 145 points, or 1.4%. The S&P 500 (SPX) lost 18 points or 1.7% and the Nasdaq (COMP) composite lost 37 points or 1.6%.  Stocks fell after reports showed a still-tough environment for the manufacturing and labor markets and one day after the Federal Reserve sounded a cautious tone on the economy. The Fed issued a cautious growth outlook Wednesday on the back of the day's weak May new home sales report. That left stocks mixed to lower, but the tone turned even more negative overnight, with markets in Europe falling and U.S. stocks opening weaker. "The Fed downgraded their economic outlook, which is not good for the markets," said David Chalupnik, head of equities at First American Funds. "It tells us that the economy is losing steam and earnings are at risk." He said that markets are likely to be particularly volatile in July, as the second-quarter reporting period heats up, with many forecasts still too high relative to the current economic outlook. Economy: The number of Americans filing new claims for unemployment fell to 457,000 last week from a revised 472,000 in the previous week, the Labor Department reported. Economists surveyed by Briefing.com expected 457,000. Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 4,548,000 from 4,571,000. Economists expected 4,580,000 continuing claims, on average. Durable goods orders fell 1.1% in May, the Commerce Department reported. That was better than the 1.3% drop that was expected. Orders rose 3% in April. Orders excluding transportation rose 0.9% in May versus forecasts for a rise of 1.3%. Orders ex-transportation fell 0.8% in the previous month. On the upside, mortgage rates fell this week to the lowest level on record, a boon to individuals looking to buy a home or refinance. Freddie Mac said that the average rate for 30-year fixed loans fell to 4.69% from 4.75%. Federal Reserve: On Wednesday, the central bank policymakers opted to hold interest rates steady at historic lows near zero, as expected. However, in the statement the bankers said that while the economy is recovering, growth is likely to stay moderate for a while. Additionally, they were concerned about the weakness in the housing market and the "less supportive" financial conditions as a result of the European debt crisis. Companies: Thousands of Apple fans lined up Thursday morning to buy the hugely anticipated iPhone 4, which is being released at Apple stores and other retailers Thursday including Wal-Mart Stores (WMT, Fortune 500) and Best Buy (BBY, Fortune 500). Google (GOOG, Fortune 500) won a crucial copyright infringement battle with Viacom (VIA) Wednesday when a federal court ruled Google's YouTube isn't liable for its users' copyright violations. Viacom, which has been seeking more than $1 billion in damages, says it will appeal the ruling. Oracle (ORCL, Fortune 500) shares dipped ahead of its quarterly profit report, due out after the close. The software maker is expected to earn 54 cents per share, up 17% from a year earlier, and revenue of $9.5 billion, up 38% from the prior year. Declines were broad based, with 28 of 30 Dow issues falling. The biggest losers were Chevron (CVX, Fortune 500), Exxon Mobil (XOM, Fortune 500), Walt Disney (DIS, Fortune 500), IBM (IBM, Fortune 500), Hewlett-Packard (HPQ, Fortune 500) and 3M (MMM, Fortune 500). Financial shares tumbled as Washington lawmakers moved closer to reaching a compromise on two different versions of the Wall Street reform bill. The KBW Bank (BKX) sector index fell 2.2%. Market breadth was negative and volume was pretty modest. On the New York Stock Exchange, losers beat winners three to one on volume of 1.26 billion shares. On the Nasdaq, decliners topped advancers three to one on volume of 2.06 billion shares. Currency: The euro was little changed versus the dollar, erasing earlier gains but remaining well above the four-year low of $1.188 hit last week. The dollar was barely changed versus the yen. The direction of the euro and the state of global debt are expected to be in focus at this weekend's G-20 meeting. World markets: European markets slipped. Britain's FTSE 100 lost 1.5%, Germany's DAX gave back 1.4% and France's CAC 40 fell 2.4%. Asian markets were mostly lower. Japan's Nikkei ended little changed, Hong Kong's Hang Seng fell 0.6% and China's Shanghai Composite lost 0.1%. Commodities: U.S. light crude oil for August delivery rose 22 cents to $76.51 a barrel on the New York Mercantile Exchange. COMEX gold for August delivery gained $10.60 to $1,245.90 an ounce after closing at a record $1,258.30 last Friday. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.12% from 3.11% late Wednesday. Treasury prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

24-Jun-2010 22:52

|

||||

|

x 0

x 0 Alert Admin |

Unemployment claims dropNEW YORK (CNNMoney.com) -- The number of first-time filers for unemployment insurance fell last week, according to a government report released Thursday. There were 457,000 initial jobless claims filed in the week ended June 19, down 19,000 from a revised 476,000 in the previous week, the Labor Department said. The number of claims was slightly lower than expected. Economists surveyed by Briefing.com expected new claims to drop to 460,000. "We at least went in the right direction this time, but it certainly doesn't indicate an overall improving trend," said Robert Dye, senior economist at PNC Financial Services. "The broader pattern is a sideways movement and an overall lack of improvement." The 4-week moving average of initial claims was 462,750, down 1,500 from the previous week. Moving averages are tracked to smooth out the volatility week-to-week figures. Continuing claims: The government said 4,548,000 people filed continuing claims in the week ended June 12, the most recent data available. That's down 45,000 from the previous week. The 4-week moving average for ongoing claims fell by 21,750 to 4,586,500 from the previous week's revised 4,608,250. Continuing claims reflect people who file each week after their initial claim until the end of their standard benefits, which usually last 26 weeks. The figures do not include those who have moved to state or federal extensions, or people who have exhausted their benefits. State-by-state data: Despite the overall drop in new claims, no states reported a decrease of more than 1,000 for the week ended June 12. Nine states said initial claims rose by more than 1,000. Claims in California rose the most, by 17,572, due to layoffs in the service industry. Claims in Pennsylvania jumped 5,266, which the state attributed to layoffs in the transportation and service sectors. Florida and Texas also saw jobless claims rise last week, ticking up 4,958 and 2,971 respectively. "The large increases in these two states possibly indicate the affects the Gulf oil spill has had on those economies so far," said Dye. "We can't call it a trend yet, but this is something we're definitely going to be watching going forward."

Despite discouraging signs from the labor and housing markets recently, Dye said he expects the economy to gradually recover. "I'm still expecting a moderate or half-speed recovery, but it's really going to depend on private sector job creation, income growth and consumer confidence," he said. "If we get all these things moving in the right direction I think we'll be headed on the right track." |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

22-Jun-2010 20:32

|

||||

|

x 0

x 0 Alert Admin |

Stocks poised for lackluster startNEW YORK (CNNMoney.com) -- U.S. stocks were poised for a lackluster open Tuesday, as investors moved to the sidelines ahead of key housing data and a two-day Federal Reserve meeting. Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were slightly lower before the opening bell. Futures measure current index values against perceived future performance. U.S. stocks had another up-and-down session on Monday. Stocks opened higher after China said it would let its currency rise against the dollar, but then gave up gains in the final hour as investors turned jittery. Volatility is likely to continue Tuesday as the market searches for direction, said Philip Isherwood, equities strategist at Evolution Securities. "There is less conviction about China's announcement about the Chinese renminbi, so it looks like the market is now just waiting to see if the housing market shows signs of stabilizing," he said. Economy: A report on existing home sales from the National Association of Realtors is due after the market open. Sales are expected to have risen to a seasonally adjusted annual rate of 6.1 million units in May, up from a 5.77 million unit rate in April, according to a consensus of economists surveyed by Briefing.com. The FHFA Housing price index for April is also due in the morning. White House budget director Peter Orszag plans to step down from his post, an administration official told CNN. Orszag, a key member of the Obama administration's economic team, will leave in July. Fed: Investors are likely to hang back as the central bank kicks off a two-day policy meeting Tuesday. The meeting will conclude on Wednesday with the release of the Fed's policy statement. Economists widely expect the Fed to keep rates at historic lows but there are growing concerns that policymakers have run out of ways to jumpstart a slumping economy. World markets: European markets fell in morning trading. France's CAC 40 declined 1.2%, the FTSE 100 lost 1.5% and Germany's DAX slipped 0.8%. Asian shares finished the session mixed. The Shanghai Composite edged higher, but Japan's Nikkei tumbled 1.2% and the Hang Seng in Hong Kong fell 0.5%. Dollar and Commodities: The dollar rose against the euro and the British pound, but fell versus the Japanese yen. U.S. light crude oil for July delivery fell $1.14 to $76.68 a barrel on the New York Mercantile Exchange. COMEX gold for August delivery fell $5.60 to $1,234.30 an ounce. Bonds: Treasury prices rose, pushing the yield on the 10-year note down to 3.23% from 3.24% on Monday. Treasury prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

thulasiappan

Senior |

22-Jun-2010 04:30

Yells: "Just a Beginner in trading" |

||||

|

x 0

x 0 Alert Admin |

Stocks end lower By

Alexandra Twin, senior writerJune 21, 2010: 4:15 PM ET

The Dow Jones industrial average (INDU) lost 8 points, or 0.1%, the S&P 500 index (SPX) fell 4 points, or 0.4%, and the Nasdaq composite (COMP) gave up 21 points, or 0.9%. Stocks

rallied in the morning, trimmed some gains in the early afternoon, and then

slipped through the close. "We

were up over 100 this morning (on the Dow) on the China news, but again we're

seeing the pattern that the trend reverses in the last hour or so," said

Scott Armiger, portfolio manager at Christiana Bank & Trust Company.

"The rallies don't hold and the declines manage to recover" He said

this trend reflects the increased volatility that's been in markets lately but

also the fact that stocks are pretty fairly valued at this point, relative to

earnings expectations. Stocks

have risen for two weeks straight, with the major indexes all up more than 6%,

as buyers returned following the May sell-off. That selloff followed a roughly

80% rally on the S&P 500 off the March 2009 lows. Worries

that Europe's debt problems will slow down the global economic recovery dragged

on stocks last month. Weaker-than-expected reports on housing, jobs and

manufacturing added to the wariness. But those

worries have been set aside lately as investors scooped up shares beaten down

in the recent rally. Market gains have also been driven by some supportive

technical factors. Investors

got good news over the weekend when China said it will allow its currency, the

yuan, to rise against the dollar, after it was pegged to the dollar over the

last two years. Freeing

up the currency could be a boon to U.S. manufacturers and exporters, who

suffered as the artificially low yuan made imports to China expensive. However,

China cautioned that the yuan's rise would happen only gradually. On

Monday, the dollar was barely changed versus the yuan and was

0.5% higher versus the yen. The euro barely budged versus the U.S. currency.

The weak euro has been something of a proxy for investor worries about the

economy over the last few months. On the

move: A

variety of stocks declined, with big tech issues leading the way, including

Microsoft (MSFT, Fortune 500), Yahoo (YHOO, Fortune 500) and Amazon (AMZN, Fortune 500). Amazon

shares fell after the company cut the price of its Kindle electronic reader,

the latest salvo in a pricing war that saw Barnes & Noble cut the

price of its Nook earlier in the day. Market

breadth was negative. On the New York Stock Exchange, losers beat winners three

to two on volume of 850 million shares. On the Nasdaq, decliners beat advancers

two to one on volume of 1.57 billion shares.

World

markets: European

markets rallied. Britain's FTSE 100 gained 0.9%,

Germany's DAX rose 1.2% and France's CAC 40 climbed 1.3%. Asian markets

climbed. Japan's Nikkei advanced 2.4%, Hong Kong's Hang Seng rose 3.1%, China's

Shanghai Composite added 2.9%. Commodities: U.S. light crude oil for July delivery rose 64 cents to settle at $77.82 a

barrel on the New York Mercantile Exchange. COMEX gold for August delivery fell $17.60 to $1,240.70 an ounce

after closing at a record $1,258.30 on Friday. Bonds: Treasury prices

tumbled, raising the yield on the 10-year note to 3.24% from 3.22% late Friday.

Treasury prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

21-Jun-2010 22:47

|

||||

|

x 0

x 0 Alert Admin |

Stocks surge on China moveLONDON (CNNMoney.com) -- U.S. stocks rallied Monday, joining markets around the globe, after China said it will allow its currency to gain against the dollar, a move that could help U.S. exports and the world economy. The Dow Jones industrial average (INDU) added 108 points or 1%, the S&P 500 index (SPX) added 10 points or 0.9% and the Nasdaq composite (COMP) added 21 points or 0.9%. Last week, the Dow, the S&P and the Nasdaq ended higher for a second week, gaining more than 2% as buyers returned to the market following May's sell-off. Investors became more confident in the global economy following news that China will let its currency trade more freely. As a result, stocks are likely to extend gains this week as well, said Peter Cardillo, chief market economist at Avalon Partners. "The thinking is that a more flexible Chinese currency will help exports, and that means it will help the global economy, too. So in the short term this is positive for global markets and commodities," he said. "But the stock market has been faring better on its own anyway, so it looks like we are headed for a nice summer rally just on technicals and domestic outlook," he added. China: Investors around the world are cheering signs that China is prepared to relax its hold over its currency, the yuan. On Saturday, China's central bank said on its website that it would enhance its exchange rate's "flexibility." Since 2008, China has pegged the yuan to the dollar. Critics have said that by doing so China has held down the value of the yuan, thereby protecting its exporters. World markets: Stocks around the world advanced as China's steps to end the peg of the yuan to the dollar boosted investors' confidence in the global economy. In afternoon European trading, France's CAC 40 surged 1.4%, Germany's DAX gained 1.1% and the FTSE 100 in Britain rose 1%. Asian markets finished the session sharply higher. The Shanghai Composite climbed 2.9%, the Hang Seng in Hong Kong surged 3.1% and Japan's Nikkei rallied 2.4%. Dollar and commodities: The dollar was stronger against the euro but fell versus the Japanese yen. U.S. light crude oil for July delivery rose $1.39 to $78.57 a barrel. COMEX gold's August contract rose 70 cents to $1,259 per ounce. Gold closed Friday at a record high of $1,258.30 per ounce. Bonds: Treasury prices fell, as the 10-year note's yield rose to 3.3% from 3.22% on Friday. Bond prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

21-Jun-2010 14:31

|

||||

|

x 0

x 0 Alert Admin |

STI higher at middaySINGAPORE shares were higher at midday on Monday, with the benchmark Straits Times Index at 2,879.76, up 1.64 per cent, or 46.36 points. About 882.8 million shares exchanged hands. Gainers beat losers 339 to 97. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

21-Jun-2010 08:38

|

||||

|

x 0

x 0 Alert Admin |

NEW YORK (CNNMoney.com) -- A two-week advance looks to continue this week, as investors consider the latest on the global economy -- but the early summer correction may not be over. After slumping almost 14% in six weeks, stocks, as measured by the broad S&P 500, have now gained back just over 6% in the past two weeks. That's good news for investors who were worried that the correction -- a selloff of more than 10% from the highs -- would become a bear market, a selloff of over 20%. But the stock recovery has been mostly technical and trading-driven, rather than based on changes in the underlying issues that sparked the selling in the first place. That factor suggests another bump down is coming, perhaps later in the summer. But stocks could ride the bounce for another few weeks, with the Dow turning around after it reclaims its 2010 high of 11,205.03 from April, said Dean Barber, president at Barber Financial Group. "I'm still bullish for the next few weeks, but beyond that I think we could be heading into a bear market," he said. "The recent jobs reports have been terrible, housing is stabilized but has another leg down ahead of it, and the consumer is slowing again." His view: "If GDP turns negative in the third and fourth quarter, we're going to see a lot bigger stock selloff." But markets may also just meander for a while, rather than slide further, depending on what the economic news in the U.S. and abroad suggests, said Robert Siewert, portfolio manager at Glenmede. "A number of indicators are suggesting slower growth, and fears of a double-dip recession are growing," he said. "It's going to lead equity investors to proceed with caution." This week brings reports on housing, durable goods orders, employment, consumer sentiment and GDP. The latest on BP in the aftermath of the oil spill and the direction of commodity markets will also be in focus. Gold closed at a record high of $1258.30 an ounce on Friday. The value of the euro, European debt issues and the impact they may have on the global economy will also remain in focus, particularly as the G-8 meeting gets underway in Canada at the end of the week. In terms of European debt issues, the concern of late has focused on Spain as it fights to raise money amid soaring debt levels and rumors that it needs a bailout like Greece. The other PIIGS -- Portugal, Italy and Ireland -- remain on watch as well. Federal Reserve: The central bank is meeting Tuesday and Wednesday to discuss interest rate policy, with a decision expected Wednesday afternoon. The bank is widely expected to hold rates steady at levels near zero. As usual, what the bankers say about the outlook for the economy will be critical. On the docket

Monday: There are no market-moving economic or corporate events expected on Monday. Tuesday: The existing home sales index from the National Association of Realtors is due in the morning. The index is expected to have risen to a seasonally adjusted annual rate of 6.10 million units in May, up from a 5.77 million unit rate in April, according to a consensus of economists surveyed by Briefing.com. The FHFA Housing price index for April is also due in the morning, but is not typically a market mover. Wednesday: The May new home sales index from the Census Bureau is due shortly after the start of trading. The index is expected to have fallen to a seasonally adjusted annual rate of 427,000 units, from a 504,000 unit rate in the previous month. The weekly crude oil inventories report from the government is also due in the morning. Thursday: The Commerce Department releases the durable goods orders report for May in the morning. Orders are expected to have fallen 1.4% after rising 2.8% in April. Orders excluding transportation are expected to have risen 1.25% after falling 1.1% last month. The number of Americans filing new claims for unemployment is expected to have fallen to 458,000 last week from 472,000 the previous week. Continuing claims, a measure of Americans who have been receiving benefits for a week or more, are expected to have risen to 4,580,000, from 4,571,000 last week. Oracle (ORCL, Fortune 500) reports quarterly results Thursday evening. The software maker is expected to report earnings of 54 cents per share, up 17% from a year ago, and revenue of $9.5 billion, up 38% from a year ago. Friday: The revised reading on gross domestic product (GDP) growth in the first quarter is due in the morning. GDP is expected to have grown at a 3% annualized rate, unchanged from the previous reading. The University of Michigan's final reading on consumer sentiment in June is due in the morning. It's expected to hold steady at 75.5, unchanged from the last reading. |

||||

| Useful To Me Not Useful To Me | |||||

|

sinetic8

Senior |

18-Jun-2010 11:25

|

||||

|

x 0

x 0 Alert Admin |

all the problems stated have already surfaced and still lingering around. in my opinion, i feel that the europe crisis is not that simple. more bad news will surface after the bank stress tests results coming up. i think china yuan is overvalued. US unemployment rate still high, most major earning reports are down. i just feel this bubble going to burst sooner or later. what people forget is the 1000 points that dow dropped during may. hehe. good luck to all traders too! bet world cup better..

|

||||

| Useful To Me Not Useful To Me | |||||

|

alexchia01

Elite |

18-Jun-2010 10:46

Yells: "Catch The Stars And Ride With Them" |

||||

|

x 0

x 0 Alert Admin |

What kind of bad news are you referring to? If you are referring to Europe Crisis, the effect has already been felt in May. If you are referring to US Job Data, that is pretty much contain within US. If you are referring to China Property Bubble, the Chinese government are already having measures to curb it. US, China and Asia corporate data are pretty good in the last 2 Quarters. So far since Jun, all bad news are either expected or minor news contain within US. So long as there are no Unexpected Major Bad News, this Bull can ride until end of World Cup. Then we will see if this is a Mini-Bull or Major-Bull. Good luck to you.

|

||||

| Useful To Me Not Useful To Me | |||||

|

sinetic8

Senior |

18-Jun-2010 10:24

|

||||

|

x 0

x 0 Alert Admin |

yea. so many bad news keep popping up but still bullish. i think this is a bubble in a making. gonna burst soon i feel..

|

||||

| Useful To Me Not Useful To Me | |||||

|

alooloo

Veteran |

18-Jun-2010 09:19

Yells: "I am not young enough to know everything. " |

||||

|

x 0

x 0 Alert Admin |

mini bulls... shit a lot... keep an eye for bullshit...

|

||||

| Useful To Me Not Useful To Me | |||||