| Latest Forum Topics / Straits Times Index |

|

|

STI to cross 3000 boosted by long-term investors

|

||||||||||||||||||

|

boyikao3

Master |

11-Sep-2009 13:29

Yells: "Money or reputation ?" |

|||||||||||||||||

|

x 0

x 0 Alert Admin |

Dun forget that MACD is only a lagging trend indicator. Golden crossing, if used without momentum indicators, can generate false signals and eventually, the crossings won't be sustained.

|

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

ozone2002

Supreme |

11-Sep-2009 12:51

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

Insiders sell like there's no tomorrowCorporate officers and directors were buying stock when the market hit bottom. What does it say that they're selling now?

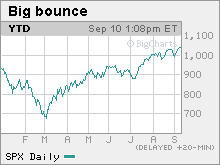

NEW YORK (Fortune) -- Can hundreds of stock-selling insiders be wrong? The stock market has mounted an historic rally since it hit a low in March. The S&P 500 is up 55%, as U.S. job losses have slowed and credit markets have stabilized. But against that improving backdrop, one indicator has turned distinctly bearish: Corporate officers and directors have been selling shares at a pace last seen just before the onset of the subprime malaise two years ago. While a wave of insider selling doesn't necessarily foretell a stock market downturn, it suggests that those with the first read on business trends don't believe current stock prices are justified by economic fundamentals. "It's not a very complicated story," said Charles Biderman, who runs market research firm Trim Tabs. "Insiders know better than you and me. If prices are too high, they sell." Biderman, who says there were $31 worth of insider stock sales in August for every $1 of insider buys, isn't the only one who has taken note. Ben Silverman, director of research at the InsiderScore.com web site that tracks trading action, said insiders are selling at their most aggressive clip since the summer of 2007. Silverman said the "orgy of selling" is noteworthy because corporate insiders were aggressive buyers of the market's spring dip. The S&P 500 dropped as low as 666 in early March before the recent rally took it back above 1,000. "That was a great call," Silverman said. "They were buying when prices were low, so it makes sense to look at what they're doing now that prices are higher." Straightforward trading

In the case of firms such as discount broker TD Ameritrade (AMTD), they are selling with abandon. Chairman Joe Moglia has netted more than $10 million in profits from stock sales since April, by selling shares on each of the last 106 business days, according to Securities and Exchange Commission filings. A TD Ameritrade spokeswoman said Moglia's sales are being made under a pre-arranged selling plan he filed with the SEC last August. Under that plan, his brokers exercise some options he got eight years ago and sell the underlying shares every day the company's stock price is above a certain level. Moglia's not the only insider selling at TD Ameritrade. The company's founder and former chairman, Joe Ricketts, and his wife Marlene last month sold 5.7 million shares to help fund the family's purchase of the Chicago Cubs baseball team. They owned 16% of the company's stock at last count. Silverman said the TD Ameritrade insider sales don't particularly raise concerns about the company's health, because "special circumstances" -- the Cubs deal and the pending expiration of Moglia's options -- are evident. He said it's potentially more worrisome when insiders suddenly make big sales without obvious motivating factors. Fossil (FOSL) CEO Tom Kartsotis has sold $25 million of the watchmaker's stock over the past month. Shares of Fossil have more than doubled since early March. Fossil didn't immediately return a call seeking comment. At video game maker Activision Blizzard (ATVI), CEO Robert Kotick and director Brian Kelly each made more than $10 million last month by selling shares after exercising stock options. While some of Kotick's options were due to expire next year, others weren't due to expire until 2014 in his case and 2012 in Kelly's. The stock sales took place at prices that were about 50% above their 52-week low. Activision didn't respond to a request for comment. Adding to the flurry of stock sales, companies are selling stock to the public at a brisk clip while buybacks have tailed off. All told, U.S. corporations have been net sellers of $105 billion of stock over the past four months, Biderman said. Insiders have managed to cash in on some of those offerings. Healthcare payment administrator Emdeon (EM), for instance, last month raised $155 million in an initial public offering. At the same time, selling shareholders led by private equity investor General Atlantic Partners raised $188 million. Though the wave of selling by insiders doesn't necessarily predict a pullback in their stocks or the market as a whole, it's hard to put a happy spin on the recent trends. "The disparity between buyers and sellers right now is vast," said Silverman. "That's the beauty of following insider trading -- these guys are talking with their checkbooks." |

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

|

||||||||||||||||||

|

loushare

Member |

11-Sep-2009 12:44

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

hi richtan, do we have to subscribe for data or can we put in our data when using the free charting software from chartxus. If we can put in our data, how to do it. If we have to subscribe, what is the cost ? | |||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

richtan

Supreme |

11-Sep-2009 11:53

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

Hi kelly, No offence intended. Never be emotional, read the below article on "Trade wat u see, not wat u hear" (for tat matter, wat u think): Trade What You See, Not What You Hear Never pre-judge the mkt, let the mkt tells u, look at the trend, the TA, intraday, a lot of noises tat can affect u emotionally, u must learn to trade mechanically. Remember my 3 golden mantras (which I formulated, distilled n condensed based on all my past knowledge n read-ups), particularly "Plan your trade n trade your plan" n ignore all this intraday noises. If u r newbie to trading, below is my advice (whether to listen or not is up to u). To succeed in trading, my sincere n genuine advice to newbies: "Learn to master TA n u are the master of your own trades." - Learn how to spot reversal signs in candlestick charts for entry n exit "Learn how to fish n u can fend for yourself forever, relying on others n forever u r dependent on others n at their mercy" "There is no easy way n short-cut to success in life, including trading, all are own hardwork, u need to learn the tools of the trade" Depending on your inclinations and whether u seriously want to learn TA, I had created 3 threads dedicated to newbies under "General", "Trading Techniques": 1. "Learning TA" - websites where u can learn TA for free but of course, TA is not infallible, thus need to set stop-loss) 2. "Some recommended good Trading and TA books" - of course u can also buy TA books. Read as many TA books and money management books, it will definitely stand u in good stead. 3. "Advices to newbies" particular the 3 golden mantras. Take your time to read and learn, dun rush, remember "Rome was not built in one day" I self-learnt, see how analysts do it and practice by covering up the candles and test my knowledge and hone my skills till I m quite confident b4 start trading bcos the mkt is merciless. Those TA courses, wat they teach, all are from books, nothing new. For those paid software,even after the software scan, still need our analysis, cannot assume it is 100% correct, as nothing can replace the human brain and knowledge as analysis is an art of how individual interpret, no matter how much they input all the scientific knowledge into the software If u are not sure, post your charts n hopefully some forumers good in TA will exchange pointers with u. To know how to post, follow the steps on how to post charts in "General", "Trading Techniques", "Learning TA".

|

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

victorf

Master |

11-Sep-2009 11:48

|

|||||||||||||||||

|

x 0

x 1 Alert Admin |

still the same call....by next year May, you will not see "in hindsight" my call....just like my call in april/may this year (not in highsight)....good luck :)

|

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

|

||||||||||||||||||

|

kellychang

Master |

11-Sep-2009 11:42

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

look like STI now dun have much strength.... |

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

DnApeh

Master |

11-Sep-2009 11:23

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

Ok, buy enough already. please cheong.

|

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

gentledove

Member |

11-Sep-2009 10:46

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

hi guys, there is an online voting for young designers competing in Triumph Inspiration International Final Award in Milan. Singapore is competing with 27 other countries may be you guys wish to take a short break to go to the following Triumph's websites to support her. All voters stand a chance to win free air ticket to Milan regardless of whether the contestant you voted win or loose. Details can be found at the following links. If you are keen to vote the closing date is 13th this month, so hurry. By the way, please take note that after you click 'vote' they will reply you with an email for you to confirm your vote. I think your vote will only be counted if you confirm. http://www.triumph-inspiration-award.com/index.php?id=531 http://www.triumph-inspiration-award.com/tiavotes.0.html Good Luck! |

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

|

||||||||||||||||||

|

richtan

Supreme |

11-Sep-2009 10:43

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

I agree with u, also the more than one mth consolidation could have more than mitigate n nullify the correction n it may instead break upwards of the horizontal bullish flag continuation pattern

|

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

Sporeguy

Elite |

11-Sep-2009 10:23

|

|||||||||||||||||

|

x 1

x 0 Alert Admin |

Richtan, the only consolation is that the blue curve seems to be cutting the red curve from the bottom in the MACD chart. | |||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

richtan

Supreme |

11-Sep-2009 09:57

|

|||||||||||||||||

|

x 1

x 0 Alert Admin |

Below is my chart analysis for sharing and exchange pointers. My TA chart is posted to share n exchange pointers with those TA practitioner whom believes in TA. If u are a TA detractor, plse just ignore n refrain from peeping at my chart posting n start making unconstructive comments and plse do not be so childish or lunatic as to abuse the rating system by rating it as "bad post", accumulating for yourself and your next generation, "bad" karma for your "bad" deeds. If u think it is a bad post, then be constructive and kindly post your TA for sharing. This is only my view n I may be right or wrong, so dyodd and SOBAYOR.

|

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

DnApeh

Master |

11-Sep-2009 09:46

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

wah! all want to sell. Then who buy? OK lah, then i buy lah. Can cheaper or not? |

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

|

||||||||||||||||||

|

ozone2002

Supreme |

11-Sep-2009 09:44

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

i posted that STI hit a dble top formation.. also yesterday's close indicated a bearish signal.. I would pare down some holdings.. DYODD |

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

richtan

Supreme |

11-Sep-2009 09:44

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

Read my posting in "Prepare for risk of double-dip recession" thread: Trade What You See, Not What You Hear

|

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

tanzq83

Member |

11-Sep-2009 09:40

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

Agree that today may be profit-taking due to 9-11 incident, we wont know what other terriorism acts may happen today ~ the 8-years ceremony for them. :) However, I see STI to be supported 2592pts region in the next 1-2weeks, just be cautious if it breaches above this level. My ignorant 2-cents worth.

|

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

TuaPekGong9413

Elite |

11-Sep-2009 09:33

Yells: "deity" |

|||||||||||||||||

|

x 0

x 0 Alert Admin |

be careful...today may be a profit taking day since weekend coming too.....i believe most will take profit... | |||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

tanzq83

Member |

11-Sep-2009 09:31

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

Prior that, STI must close firmly above 2700pts (see it as a confidence level) first, before further upsides can be seen. Seems like there is really a strong resistance at that point and once that is crossed firmly, I believe it will test 2850pts.

|

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

lookcc

Master |

10-Sep-2009 22:01

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

maybe sti reach 3000 tis yr. |

|||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||

|

richtan

Supreme |

10-Sep-2009 18:35

|

|||||||||||||||||

|

x 0

x 0 Alert Admin |

The shooting star would be invalidated if it is not followed by a lower high n lower low tomoro.

|

|

||||||||||||||||

x 0

x 0  x 0

x 0