| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||

|

Blastoff

Elite |

23-Jul-2010 07:04

|

||

|

x 0

x 0 Alert Admin |

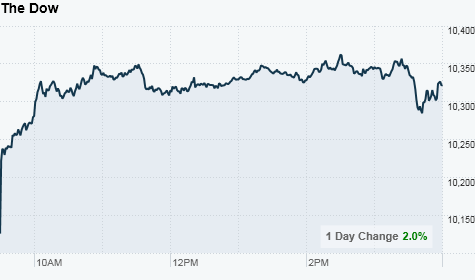

Dow's 200-point rebound Better-than-expected earnings from 3M, Caterpillar and UPS helped lift stocks Thursday. Better-than-expected earnings from 3M, Caterpillar and UPS helped lift stocks Thursday.NEW YORK (CNNMoney.com) -- Stocks rallied Thursday after better-than-expected earnings and forecasts from 3M, Caterpillar, AT&T and UPS helped reassure investors about the pace of the economic recovery. The Dow Jones industrial average (INDU) rose 202 points, or 2%. The S&P 500 (SPX) index jumped 24 points, or 2.3%. The Nasdaq (COMP) composite gained 58 points, or 2.7%. Stocks slumped Wednesday after Federal Reserve Chairman Ben Bernanke told Congress the outlook for the economy was "unusually uncertain," adding to worries about the pace of the recovery.

After the close, Dow component Microsoft (MSFT, Fortune 500) reported higher quarterly sales and earnings that topped estimates, thanks to strong sales of its Windows 7 and a better personal computer market than in recent months. Shares were barely changed after the close. Also after the close, Dow component American Express (AXP, Fortune 500) reported higher quarterly sales and earnings that topped expectations. But AmEx's CEO said the company remains cautious about the economic outlook and shares dipped 1% in after-hours trading. Quarterly results: Dow component Caterpillar (CAT, Fortune 500) reported higher quarterly sales and earnings that topped estimates due to better sales of gear for the mining, infrastructure and energy industries. Caterpillar also boosted its 2010 profit forecast. Shares gained 1.7%. Fellow Dow component 3M (MMM, Fortune 500) reported higher quarterly sales and earnings and said that full-year 2010 profit will exceed its earlier targets, thanks to strong demand in both the United States and abroad. The company is seen as a good proxy for the economy due to the breadth of its business, which includes everything from Scotch tape to films for flat-screen TVs. Shares gained 3%. UPS (UPS, Fortune 500) reported higher quarterly sales and earnings that topped estimates and said that 2010 earnings will surpass its earlier forecasts. The delivery company cited an increase in package revenue in both the United States and abroad. Shares gained 6%. UPS is often seen as an economic bellwether due to the nature of its business. Dow component AT&T (T, Fortune 500) reported higher quarterly earnings that topped estimates and higher revenue that was shy of estimates. The company also lifted its 2010 forecast, citing cost cutting and a surge in wireless business, thanks to its exclusive iPhone deal with Apple. Shares gained 2.4%. Late Wednesday, eBay (EBAY, Fortune 500) reported higher quarterly sales and earnings that topped estimates, thanks to strength at its PayPal only payments unit. The online auctioneer also lowered the high end of its full-year 2010 profit forecast, citing the impact of the weaker euro. Shares gained 3.8% Thursday. Housing: Sales of existing home sales fell 5.1% in June from May levels, according to a report from the National Association of Realtors released Thursday. But the drop was smaller than expected. Sales rose nearly 10% from a year earlier. Jobs: The House voted to extend jobless claims benefits until November, ending a seven-week old debate between lawmakers that saw federal benefits for the long-term unemployed run out. President Obama is expected to sign the extension shortly. Earlier, the Department of Labor reported that the number of Americans filing new claims for unemployment rose to 464,000 last week from a two-year low of 427,000 in the prior week. Economists surveyed by Briefing.com thought claims would rise to 445,000. Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 4,487,000 from 4,710,000 in the previous week. Economists surveyed by Briefing.com expected 4,600,000. Deals: General Motors said it will buy auto financing firm AmeriCredit (ACP) in a $3.5 billion all-cash deal. The deal gives GM a lending unit after selling its majority stake in GMAC in 2006. The deal was also seen as a key step as GM prepares its initial public offering for later this year, after the government restructured it in bankruptcy. AmeriCredit shares jumped 23%. Dell: Computer maker Dell (DELL, Fortune 500) agreed to pay $100 million to settle fraud charges with the Securities and Exchange Commission. Chairman Michael Dell and former CEO Kevin Rollins will pay $4 million each. Dell shares finished 2.5% higher.

World markets: European markets rose, with Britain's FTSE 100 up 1.9%, Germany's DAX up 2.5% and France's CAC 40 up 3%. Asian markets ended mixed. Japan's Nikkei fell 0.6%, while Hong Kong's Hang Seng gained 1.1% and the Shanghai Composite gained 0.3%. Currencies: The euro gained versus the dollar. The dollar rose versus the Japanese yen. Commodities: U.S. light crude oil for September delivery rose $2.46 to $79.02 a barrel on the New York Mercantile Exchange. COMEX gold for August delivery rose $2.80 to $1,194.60 an ounce. Bonds: Treasury prices fell, raising the yield on the 10-year note to 2.93% from 2.89% late Wednesday. Debt prices and yields move in opposite directions. Market breadth: Breadth was positive. On the New York Stock Exchange, winners beat losers by over six to one on volume of 1.18 billion shares. On the Nasdaq, advancers beat decliners by five to one on volume of 2.28 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

22-Jul-2010 20:31

|

||

|

x 0

x 0 Alert Admin |

Stocks set for a bounceNEW YORK (CNNMoney.com) -- U.S. stocks were set to rise at Thursday's open as investors set their sights on recouping some of the losses from the previous session's selloff. Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were higher. Futures measure current index values against perceived future performance. Wall Street took a dive Wednesday after Federal Reserve Chairman Ben Bernanke told Congress the outlook for the economy was "unusually uncertain."

Companies: AmeriCredit (ACF) surged 23% in pre-market trading after General Motors said it will buy the automobile financing company for $3.5 billion. Shares of Xerox (XRX, Fortune 500) climbed more than 6% before the market open after the copier maker reported second-quarter earnings that topped forecasts. Companies due to report their latest financial results after Thursday's close includeMicrosoft (MSFT, Fortune 500) and American Express (AXP, Fortune 500).

World markets: European markets got off to a positive start. Britain's FTSE 100 rose 1%, France's CAC 40 jumped 1.8% and the DAX in Germany gained 1.6% in morning trading. In Asia, Japan's benchmark Nikkei index lost 0.6%. But the Shanghai Composite and Hang Seng both ended the session higher. Currencies and commodities: The dollar was down against the euro, the British pound and the Japanese yen. U.S. light crude oil for September delivery rose 33 cents to $76.89 a barrel.

Bonds: Treasury prices fell, pushing the yield on the 10-year note up to 2.91% from 2.89% late Wednesday. Bond prices and yields move in opposite directions. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

pharoah88

Supreme |

22-Jul-2010 12:40

|

||

|

x 0

x 0 Alert Admin |

Obama claims US finance bill ‘strongest’ in history WASHINGTON — The law aims to usher in a new era of consumer protections and banking restrictions, a signature achievement that comes after Wall Street’s failures knocked the economy into the worst recession since the 1930s. It also represents a major legislative victory for Mr Obama just before election-year politics overtakes the rest of his ambitious agenda. In excerpts of Mr Obama’s remarks released by the White House ahead of the signing, the President praised the law’s creation of a Consumer Financial Protection Bureau to write and enforce rules for banks on credit card and mortgage lending. “These protections will be enforced by a new consumer watchdog with just one job: Looking out for people — not big banks, not lenders, not investment houses,” he said. “That’s not just good for consumers; that’s good for the economy.” The overhaul will also make way for a new councilof regulators to monitor systemic risks in the banking system and gives the government new powers to unwind failing financial firms whose collapse would undermine the markets. United States President Barack Obama yesterday signed into law the biggest overhaul of the US financial-regulatory system since the Great Depression, calling it “the strongest consumer financial protections in history”.AGENCIES |

||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

22-Jul-2010 09:56

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

However, STI >3,000.- is imminent! | ||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

22-Jul-2010 07:19

|

||

|

x 0

x 0 Alert Admin |

Stocks slump on Bernanke commentsNEW YORK (CNNMoney.com) -- Stocks tumbled Wednesday after Federal Reserve Chairman Ben Bernanke told Congress that the outlook for the economy is "unusually uncertain," adding to worries about the pace of the recovery. The Dow Jones industrial average (INDU) lost 109 points, or 1.1%, the S&P 500 (SPX) index dropped 14 points, or 1.3%, and the Nasdaq (COMP) composite tumbled 35 points, or 1.6%.

But the selling picked up steam in the afternoon following the 2 p.m. ET release of Bernanke's prepared testimony for a Senate committee. The Fed chief told lawmakers that, despite ongoing signs of weakness in the economy, central bankers expect gradual recovery over the next few years, although the labor market healing will be slower than previously thought.

After the close, eBay (EBAY, Fortune 500) reported higher quarterly sales and earnings that topped estimates, thanks to strength at its PayPal only payments unit. The online auctioneer also lowered the high end of its full-year 2010 profit forecast, citing the impact of the weaker euro. Shares gained 3% in after-hours trading. Results: After the close Tuesday, Apple (AAPL, Fortune 500) posted its best quarter ever, thanks to sales of its Mac computers, iPads and iPhones. Shares gained 1% Wednesday. But search engine operator Yahoo (YHOO, Fortune 500) reported results that disappointed investors. The Internet company reported higher earnings that beat estimates on revenue that was barely higher from a year earlier and was shy of analysts' expectations.

Dow component Coca-Cola (KO, Fortune 500) reported higher quarterly sales and earnings that topped estimates, helped by increased sales in most of its markets, with particularly strong demand overseas. Shares gained 1.6%. Morgan Stanley (MS, Fortune 500), Wells Fargo (WFC, Fortune 500) and US Bancorp (USB, Fortune 500) all reported strong profits, but bank shares were mixed. The KBW Bank (BKX) index lost 2.4%. Morgan Stanley reported a profit of $1.4 billion, better than expected and reversing a loss from the same quarter a year ago. The company also reported higher earnings that topped estimates. Wells Fargo reported a higher second-quarter profit that topped expectations, thanks to smaller loan losses. Shares gained 4.7%.

Wall Street reform: President Obama signed the Wall Street reform bill into law Wednesday, enacting the most far-reaching financial overhaul since the Great Depression. World markets: European markets rose, with Britain's FTSE 100 up 1.5%, Germany's DAX up 0.4% and France's CAC 40 up 0.8%. Asian markets ended mixed. Japan's Nikkei fell 0.2%, while Hong Kong's Hang Seng gained 1.1% and the Shanghai Composite gained 0.3%. Currencies: The euro fell versus the dollar. The dollar fell versus the Japanese yen. Commodities: U.S. light crude oil for September delivery fell $1.16 to $76.56 a barrel on the New York Mercantile Exchange. COMEX gold for August delivery fell $5.90 to $1,191.80 an ounce. Bonds: Treasury prices rose, lowering the yield on the 10-year note to 2.89% from 2.93% late Wednesday. The two-year note hit a record low. Debt prices and yields move in opposite directions.

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

21-Jul-2010 13:30

|

||

|

x 0

x 0 Alert Admin |

STI lower at middaySINGAPORE shares were lower at midday on Wednesday, with the benchmark Straits Times Index at 2,938.27, down 0.35 per cent, or 10.34 points. About 783.1 million shares exchanged hands. Losers beat gainers 199 to 144. |

||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

21-Jul-2010 13:23

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

Do not worry, second economic stimulus package is on its path!

|

||

| Useful To Me Not Useful To Me | |||

|

des_khor

Supreme |

21-Jul-2010 12:54

Yells: "Tell me who is the God or MFT from this forum??" |

||

|

x 0

x 0 Alert Admin |

Too long ... can't take it !! tak boleh tahan !! |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

pharoah88

Supreme |

21-Jul-2010 12:53

|

||

|

x 0

x 0 Alert Admin |

A hot-cold Goldilocks global economy spells trouble SIMON TAY E Recently, Spain, another economy under scrutiny, issued a 10-year bond and allocated some US$500 million ($700 million) to China. Even the Chancellor of euro-giant Germany Angela Merkel was reassured during a state visit that the Chinese would continue to back the euro and hold European assets. Some see Europe depending on China as a sign that the latter continues to grow in global stature, payback for its past humiliation by colonial powers. I see instead an unequal, hotcold global economy that can cause problems. Problems in the eurozone loom large and will likely be protracted. Surveys show young Europeans do not expect a future that is better than their parents’. Vising Brussels last week, even amid a heat wave and the all-European World Cup Final, the economic cold could be felt. By contrast, the Chinese economy is hot, growing at more than 10 per cent, and it is not alone. The Asian Development Bank predicts Asia, excluding Japan, will grow 7.5 per cent this year. For Singapore, after the depths of last year, the first half rebound was spectacular at 19.3 per cent. Undergrads are again becoming picky in their choice of employer and government bonuses for civil servants will resume. Yet, this hot-cold contrast with Europe does not mean Asia has emerged triumphant from the crisis. Problems in Europe can affect Asia in the future. Greece is not really the problem. The core of Europe is affected too. The United Kingdom is reining in government debt. Next year, expect Germany — Europe’s largest economy and the ultimate guarantor of the Euro and Greek bailout — to also start serious tightening. This will touch Asia. About 10 per cent of Asian products goes into Europe — mostly Germany and the key economies — and Europe is a major trader and investor. uropeans are asking Beijing to invest in their economy and the euro, even as China seeks to cool its own burgeoning growth rates. Some may see a triumph in this, that China is the big winner in the ongoing crisis. When problems in Greece began to crystallise last year, one of their first efforts was to seek assistance from Beijing.TOO GOOD TO BE TRUE ? For Asia, the current figures may be too good. China shows signs of over heating. Beijing is struggling to prevent asset bubbles but too much credit tightening could lead to collapse. Events in their housing market will be anxiously watched. For Singapore, the numbers rise steeply from the lows of last year. Some sectors are driven by restocking inventory and could be temporary oneoff factors, rather than indicators of a broad and sustained recovery. The euro depreciation bears attention. It has already come down some 17 per cent compared to the yuan. German exports in recent months have soared on the back of Chinese demand. Asian consumers too will find European holidays and luxury goods cheaper. Europeans are tightening their belts to cut government spending, while hoping that selling to China and elsewhere can keep their factories busy. The hot-cold economies will seek to rebalance themselves. The process, however, can neither be simple nor without consequences. Reacting to domestic circumstances, each region may take action that could have untoward results for others. Asia must hope that Europeans are not entirely inward looking and pre-occupied. The way Europeans have turned to In this engagement, equality and mutual respect in the relationship must follow. The historical European sense of superiority must be put aside and any growing sense of Asian triumphalism resisted. The contrast between the hotcold economies reminds me of the three bears in Goldilocks. Two bowls of porridge, like today’s economy, were too hot or too cold. Only the last bowl was just right. This is not easy to emulate in the global economy. If we can’t get it right, the danger is we alternately burn, freeze and then live with the tepid. China is not, in this sense, a bad sign. But it would be best that others in Asia are also engaged.The writer is chairman of the Singapore Institute of International Affairs and author of Asia Alone: The Dangerous Post Crisis Divide From America. He was a keynote speaker at the Asia-Europe meeting public conference in Brussels. |

||

| Useful To Me Not Useful To Me | |||

|

pharoah88

Supreme |

21-Jul-2010 08:58

|

||

|

x 0

x 1 Alert Admin |

TRUST T RUST Tempered RUST

|

||

| Useful To Me Not Useful To Me | |||

|

pharoah88

Supreme |

21-Jul-2010 08:51

|

||

|

x 0

x 0 Alert Admin |

msnbc.com

commentary

It's been a long season of embarrassment for BP, but leaking oil isn't what the blogosphere is ripping the company for today. A site called Americablog spotted a photo of BP's Houston command center, ostensibly taken on July 16. The image had quite visibly been Photoshopped — badly — to include more on-screen camera action. Once word got out — the story was picked up by the Washington Post, where it was then spotted by the tech blog Gizmodo and others — BP 'fessed up. A spokesman admitted that the image was altered, said that a photographer had inserted shots where the TV screens were blank, and provided the original image. "We've instructed our post-production team to refrain from doing this in the future," said the spokesman in an e-mail to the Washington Post. Though the command center alteration doesn't seem to be an attempt to hide facts or confuse the public, it heightens skepticism for the company at a time when it should be trying to build trust. As the Americablog reporter John Aravosis wrote, "I guess if you're doing fake crisis response, you might as well fake a photo of the crisis response center." As it happens, the command center shot isn't the end of the issue. Today, Aravosis published evidence of another altered photo, this one depicting a meeting from the failed "top kill" maneuver. "How many other crisis response photos from BP have been faked?" wrote Aravosis. "Did they fake any videos?" Please don't tell us that the people in those sucking-it-up-and-taking-responsibilty ads are actually paid models! http://www.msnbc.msn.com/id/38333456/ns/technology_and_science-tech_and_gadgets/ |

||

| Useful To Me Not Useful To Me | |||

|

pharoah88

Supreme |

21-Jul-2010 08:45

|

||

|

x 0

x 0 Alert Admin |

MERiTOCRACY is ALL FAKE ? ? ? ?

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

pharoah88

Supreme |

21-Jul-2010 08:44

|

||

|

x 0

x 0 Alert Admin |

BP digitally alters press photo, confesses it's a fakeAmateurish use of Photoshop causes yet another BP embarrassment |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

21-Jul-2010 07:14

|

||

|

x 0

x 0 Alert Admin |

Wall Street stages a comebackNEW YORK (CNNMoney.com) -- Stocks closed higher Tuesday, recovering from steep loses earlier in the session, as investors looked forward to earnings from Apple and speculated about possible moves by the Federal Reserve. The Dow Jones industrial average (INDU) rose 75 points, or 0.7%. The S&P 500 (SPX) index rose 12 points, or 1%, and the Nasdaq (COMP) composite gained 24 points, or 1%.

Shortly after the market closed, Apple (APPL) reported its best quarterly results on record due to strong Macintosh sales and overwhelming demand for its iPad device.

Also after the close, Yahoo (YHOO, Fortune 500) said its second-quarter net income rose 51% versus the same period last year. The Internet company said sales rose 2% to $1.6 billion, which beat analysts' forecast of $1.16 billion. But shares fell nearly 5% in extended trading.

Stocks ended Monday's session with gains, although economic worries tempered positive earnings results. Companies: After the market closed, BP (BP) announced plans to sell $7 billion worth of assets to Apache Corp. The sale of assets in the United States, Canada and Egypt is part of a plan to raise money to cover costs related to the oil spill in the Gulf of Mexico. Goldman Sachs (GS, Fortune 500) said profit fell 82% in the second quarter to $613 million, due to a slowdown in the bank's trading business. Results were also hurt by a bonus tax in the United Kingdom and the $550 million settlement Goldman reached with the Securities and Exchange Commission. Shares gained about 2%. Drugmaker Johnson & Johnson (JNJ, Fortune 500) fell more than 2% after the company lowered its full-year earnings estimate to a range between $4.65 to $4.75 a share, compared with earlier guidance of $4.80 to $4.90 a share.

Harley-Davidson (HOG, Fortune 500) soared over 13% after the motorcycle maker said it earned 59 cents a share, versus expectations for 41 cents a share. Shares of Toyota (TM) fell 1.4% after the automaker said it was cooperating with a subpoena from a U.S. federal grand jury for documents related to steering problems in its vehicles. IBM (IBM, Fortune 500) fell 2.5% after the company reported late Monday second-quarter earnings that beat expectations, while sales growth was weaker than expected. Economy: Housing starts fell to their lowest level of the year in June, down 5% to an annual rate of 549,000. But building permits showed surprising strength, climbing 2.1% to an annual rate of 586,000. Economists surveyed by Briefing.com had expected starts to come in at an annual rate of 575,000, according to consensus estimates. Building permits were forecast have dipped to an annual rate of 572,000. Separately, a monthly report from the Labor Department showed that unemployment eased in more than half of U.S. states in June.

World markets: European shares ended lower. The FTSE 100 in Britain lost 0.2%, France's CAC 40 slid 0.5% and Germany's DAX fell 0.7%. Asian markets ended mixed. The Shanghai Composite rallied 2.2% but Japan's Nikkei tumbled 1.2%. The Hang Seng in Hong Kong added 0.9%. Dollar and commodities: The dollar was up against the euro, the British pound and the Japanese yen. U.S. light crude oil for August delivery edged up 78 cents to settle at $75.53 a barrel. The September contract, which becomes active Wednesday, rose 85 cents to $77.75 a barrel.

Bonds: Treasury prices rose, pushing the yield on the 10-year note down to 2.93% from 2.96% late Monday. Bond prices and yields move in opposite directions. |

||

| Useful To Me Not Useful To Me | |||

|

thomas_low

Veteran |

20-Jul-2010 22:14

Yells: "Gong Xi Money Made" |

||

|

x 0

x 0 Alert Admin |

Intermitten noise, the wave is coming | ||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

20-Jul-2010 22:08

|

||

|

x 0

x 0 Alert Admin |

Stocks tumble as Goldman disappointsNEW YORK (CNNMoney.com) -- Stocks opened sharply lower Tuesday after Goldman Sachs reported disappointing second-quarter results. The Dow Jones industrial average (INDU) was down 137 points, or 1.3%, shortly after the opening bell. The S&P 500 (SPX) index sank 13 points, or 1.2%, and the Nasdaq (COMP) composite shed 36 points, or 1.7%. Stocks ended Monday's session with gains, although economic worries tempered positive earnings results.

Earnings: Goldman Sachs (GS, Fortune 500) posted a profit of $613 million in the second quarter, down 82% from a year earlier due to its settlement with the Securities and Exchange Commission and other charges. Shares of the company sank 2% in early trading. Johnson & Johnson (JNJ, Fortune 500) fell more than 2% after the drugmaker lowered its full-year earnings estimate to a range between $4.65 to $4.75 a share, compared with earlier guidance of $4.80 to $4.90 a share.

Other companies due to report their results Tuesday, after the close, include tech heavyweights Apple (AAPL, Fortune 500) and Yahoo (YHOO, Fortune 500). After U.S. markets closed Monday, IBM (IBM, Fortune 500) posted a jump in second-quarter earnings, but the tech bellwether's sales fell short of estimates. Shares of IBM were down about 5% in early trading.

World markets: European shares were lower in midday trading. The FTSE 100 in Britain lost 1%, France's CAC 40 dropped 1.7% and Germany's DAX fell 0.5%. Asian markets ended mixed. The Shanghai Composite rallied 2.2% but Japan's Nikkei tumbled 1.2%. The Hang Seng in Hong Kong added 0.9%. Dollar and commodities: The dollar was up against the euro, the British pound and the Japanese yen. U.S. light crude oil for August delivery edged down 70 cents to $75.84 a barrel.

Bonds: Treasury prices rose, pushing the yield on the 10-year note down to 2.92% from 2.96% late Monday. Bond prices and yields move in opposite directions. |

||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

20-Jul-2010 14:15

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

STI >3,000 is imminent!

|

||

| Useful To Me Not Useful To Me | |||

|

pharoah88

Supreme |

20-Jul-2010 14:07

|

||

|

x 0

x 0 Alert Admin |

The frustration of his untold story Obama has achieved more than most US Presidents — except convince voters he’s boosted the economy F Within hours of each other on Thursday, BP capped the oil leak in the Gulf of Mexico and the Senate passed the financial regulatory reform Bill. The former brought an end to three months of political agony for the White House as Americans watched those daily video feeds of crude oil gushing into the sea. The latter mercifully concluded an even uglier display — that of the Senate spending a year crafting a Bill. These events inspired a round of commentary agreeing that between healthcare and “finreg”, Mr Obama was the most consequential Democratic President (in terms of domestic legislation) since Lyndon Johnson in the mid-1960s. And yet most of the buzz in the political press over the week involved more chest-thumping about how terrible things were for Mr Obama. A The explanation for this incongruity — a President of accomplishment whose party faces a wipe-out — is not complicated. It rests on the 9.5-per-cent unemployment rate. And in the conviction, shared by up to three-quarters of the public, according to polls, that the steps the administration has taken have not helped and have maybe even hurt. This is maddening, because those steps have helped avert a depression, a possible run on banks, the probable bankruptcy of two major car-makers and other nightmares. It’s standard operating procedure in United States political journalism at this point to note grimly that trying to describe to the public how much worse it could have been is a fool’s errand. I disagree with that strenuously, and think the Democrats could have done a far, far better job of it. For instance, thousands of small businesses have had work because of the stimulus Bill: Why didn’t someone run a television advertising campaign featuring testimonials to this effect from business owners? Too late now: The storyline is set. inally, the old wheel of fate cut Barack Obama a couple of breaks last week.Washington Post poll showing a majority disapproves of his handling of the economy spurred unusually fervent declarations that the Republicans were poised to regain control of the House of Representatives and, for the first time, speculation that now even the Senate might fall too, like overripe fruit, into Republican hands.GRUESOME NEWS FOR DEMOCRATS The Democrats’ failure to mount a stronger case has had massive ramifications, because the storyline is much larger than merely that the stimulus has failed. It is that government is a failure. A poll came out last week that got less attention than the This survey was conducted by the White House’s own pollster for a non-profit group called Third Way, a centrist think-tank. It found that by 48 per cent to 43 per cent, Americans think the administration’s actions have made things worse, not better. By a whopping 54 per cent to 32 per cent, they prefer tax cuts for business over more government spending as a spur to growth. Finally, people were given a choice between two descriptions of corporations. Are they “the backbone of the US economy and we need to help them grow, whether they are large or small”, or do they “have too much power, hurt the middle class, and government needs to keep them in check”. By 55 per cent to 37 per cent, respondents chose the former. American liberals need to think about these numbers. The great bottomline hope back in November 2008 was that Mr Obama was going to restore trust in government and prove it could solve problems. That hasn’t happened. Put aside the Tea Party people. Independent voters who backed Mr Obama over John McCain now give him 38 per cent of their support. And the Third Way poll suggests more large-scale attempts to interject government into the economy won’t fly. Maddening and ahistorical, insofar as history demonstrates that public investment helps a sick economy. But again, the Democrats have already lost this argument. That’s not an argument about the midterm elections. It’s about the party of government’s very raison d’etre. And it’s one the Democrats have backed off from. Mr Obama has tried, albeit without enough conviction or imagination. Certain Democrats in Congress have tried. But many other Democrats in Congress have decided the argument is a loser. It may serve their short-term electoral interests to say so, but it serves their party’s long-term interests quite poorly. Mr Obama has a small gust of wind at his back now. The well is capped. He will sign finreg on Wednesday. His Supreme Court nominee Elena Kagan will cruise this month towards confirmation. These are important victories. But the larger war is being lost — to a bunch of people whose only agenda is to cut taxes on corporations and millionaires. Americans going back to work is the only thing that can reverse this. Washington Post survey but is more interesting because it gets at these deeper problems, and it heralds gruesome news for Democrats. THE GUARDIANThe writer is editor-at-large at Guardian America. Michael Tomasky |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

20-Jul-2010 13:38

|

||

|

x 0

x 0 Alert Admin |

STI higher at middaySINGAPORE shares were higher at midday on Tuesday, with the benchmark Straits Times Index at 2,954.01, up 0.29 per cent, or 8.59 points. About 703.6 million shares exchanged hands. Gainers beat losers 240 to 107. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

20-Jul-2010 10:40

|

||

|

x 0

x 0 Alert Admin |

STI opens higherSINGAPORE shares opened higher on Tuesday, with the benchmark Straits Times Index at 2,946.31 in early trade, up 0.03 per cent, or 0.89 points. Around 71.9 million shares exchanged hands. Gainers beat losers 64 to 37. |

||

| Useful To Me Not Useful To Me | |||