| Latest Forum Topics / Straits Times Index |

|

|

STI to cross 3000 boosted by long-term investors

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

eurekaw

Master |

23-Oct-2013 18:01

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 1

x 0 Alert Admin |

http://www.bloomberg.com/news/2013-10-22/biggest-china-banks-triple-debt-write-offs-to-brace-for-defaults.html |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

23-Oct-2013 17:10

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

China?s Stocks Fall as Small Companies Tumble on Money Rates Oct. 23 (Bloomberg) -- China?s stocks fell, with the benchmark index for smaller companies posting the biggest two- day loss in 21 months, after money-market rates surged. Leshi Internet Information & Technology (Beijing) Co., the operator of online-video portal LeTV.com, plunged by the 10 percent daily limit for a second day. Inner Mongolia Yili Industrial Group Co., China?s biggest dairy producer by sales, declined by the most in five months. Huaneng Power International Inc., the listed unit of China?s largest power group, slumped 4.9 percent after third-quarter earnings missed estimates. The Shanghai Composite Index slid 1.3 percent to 2,182.09 at 1:02 p.m., while the ChiNext index of smaller companies plunged 3.9 percent. China?s benchmark money-market rate jumped the most since July as the People?s Bank of China refrained from adding funds to markets. The nation?s consumer-price index rose the most since February last month and Song Guoqing, an academic adviser to the PBOC, said on Oct. 20 the authority may tighten policy this year if inflation quickens. ?Monetary policies will be slightly tight for the rest of the year as the pressure from rising housing prices and inflation is building up,? said Wang Weijun, a strategist at Zheshang Securities Co. in Shanghai. ?The valuations of small- caps are too high and it looks like the bubble has started to burst.? The CSI 300 Index sank 1.2 percent to 2,417.08. The Hang Seng China Enterprises Index slipped 0.4 percent. The Bloomberg China-US Equity Index fell 0.1 percent yesterday. Trading volumes on the Shanghai index rose 8.7 percent above the 30-day average for this time of day, according to data compiled by Bloomberg. The Shanghai measure was headed for a three-week low. Smallcaps Slump Leshi Internet tumbled 10 percent to 41.55 yuan, trimming its gain to 320 percent this year. Beijing TRS Information Technology Co. slumped 8.7 percent to 18.92 yuan. Lepu Medical Technology (Beijing) Co. lost 7.9 percent to 13.83 yuan. Film company Huayi Brothers Media Corp. fell 1.2 percent to 26.44 yuan after posting a 69 percent drop in net income last quarter and adding to yesterday?s 10 percent plunge. The ChiNext has rallied 82 percent this year, taking its estimated price-to-earnings ratio to 42 times for the next 12 months. The Shanghai Composite trades at 9.6 times, compared with the seven-year average of 15.4, according to data compiled by Bloomberg. A measure of consumer-staples stocks in the CSI 300 slid 3.5 percent, the second most among 10 industry groups. Inner Mongolia Yili fell 4.5 percent to 48.69 yuan after posting a 132 percent gain this year through yesterday. Tighter Liquidity The People?s Bank of China has suspended selling reverse- repurchase contracts since Oct. 17, leading to a net withdrawal of 44.5 billion yuan ($7.3 billion) from the financial system last week. The seven-day repurchase rate, a gauge of funding availability in the banking system, surged 45 basis points, or 0.45 percentage point, to 4.03 percent in Shanghai, according to a weighted average compiled by the National Interbank Funding Center. That was the biggest advance since July 29. The overnight repo rate jumped 70 basis points, the most since June 20, to 3.79 percent. With the economy on course to meet growth targets and inflation quickening, the central bank may start tightening policy, said Li Yiming, a Beijing-based analyst at Citic Securities Co., China?s largest brokerage. Property Curbs Consumer prices rose 3.1 percent in September as food costs advanced the most since May 2012, statistics bureau figures showed on Oct. 14. Home prices in China?s four major cities jumped last month by the most since January 2011, government figures showed this week. China may issue new property curbs in the fourth quarter, the China Securities Journal reported today on its front page, citing unidentified analysts. Huaneng Power lost 4.9 percent to 5.60 yuan. The company said it posted third-quarter net income of 3.29 billion yuan, trailing the median analyst estimate of 3.87 billion yuan. Sichuan province-based companies rallied after the Sichuan Daily said the province plans to unveil investment projects worth 4.3 trillion yuan. Sichuan Road & Bridge Co. surged by the 10 percent daily limit to 7.05 yuan. Sichuan Expressway Co. jumped 10 percent to 3.42 yuan. The Shanghai index has rebounded 12 percent from its four- year low on June 27 on speculation the government will take reform measures to sustain long-term economic growth. China may signal plans to ease the nation?s one-child policy, encourage companies to increase dividend payouts and start pilot programs to reform rural land rights and allow more free-trade zones during next month?s meeting of the Communist Party, according to Bank of America Corp. There won?t be material reforms of state-owned enterprises nor a major breakthrough in reform of Hukou residency permits, Ting Lu, an economist at BofA, wrote in a report. |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

eurekaw

Master |

23-Oct-2013 16:43

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

may have some retracement for a few days before coming back up | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Tempest

Senior |

23-Oct-2013 16:38

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Minor profit taking for today. Tml will be a better green day! Chiong ah.. Huat | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

eurekaw

Master |

23-Oct-2013 16:33

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stock Futures Americas Index Future Future Date Last Net Change Open High Low Time Dow Jones Indus. Avg Dec 13 15,314.00 -84.00 15,392.00 15,395.00 15,310.00 04:19:03 S& P 500 Dec 13 1,738.10 -11.30 1,748.10 1,748.50 1,737.60 04:19:29 NASDAQ 100 Dec 13 3,335.25 -21.25 3,351.00 3,354.50 3,334.25 04:19:03 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

teeth53

Supreme |

23-Oct-2013 14:41

Yells: "don't learn through life, learn to grow with life " |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Tomique

Master |

23-Oct-2013 14:00

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Am out of the market. Will be busy from tomorrow until Mid November. Won't be posting from tomorrow. Wish everybody huat arh!!! | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

teeth53

Supreme |

23-Oct-2013 13:48

Yells: "don't learn through life, learn to grow with life " |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

teeth53

Supreme |

23-Oct-2013 12:41

Yells: "don't learn through life, learn to grow with life " |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Octavia

Elite |

23-Oct-2013 10:32

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

USA: Another One Trillion Dollars ($1,000,000,000,000) In Debt

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Octavia

Elite |

23-Oct-2013 08:44

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

STI (60 MIN) One scenario: as long as 3174 is support, we are bullish. In this case, the upside breakout of 3220 will trigger a bullish acceleration towards 3260. Alternative scenario: a break below 3174 would open the way to 3155.  |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Octavia

Elite |

23-Oct-2013 08:42

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

PUBLISHED OCTOBER 23, 2013

STOCKS Market bets on weak US jobs report STI up for fifth straight session, accumulating a total gain of 45 points BY R SIVANITHY HE Straits Times Index yesterday rose for the fifth consecutive trading day - this time by 14.45 points to 3,210.21, taking its five-day gain to about 45 points or 1.4 per cent - due most likely to positioning ahead for the release later in the day of a weak US jobs report for Sept - PHOTO: SPH THE Straits Times Index yesterday rose for the fifth consecutive trading day - this time by 14.45 points to 3,210.21, taking its five-day gain to about 45 points or 1.4 per cent - due most likely to positioning ahead for the release later in the day of a weak US jobs report for September. Activity in the broad market was mainly in penny stocks, though volume this time was enhanced by heavy selling of Keppel Reit, whose four cent fall to $1.19 with 163 million traded came after rumours that Temasek Holdings was selling and after the counter traded ex-dividend. In total, turnover came to 3.1 billion units worth $1.5 billion, which means that business done in Keppel Reit - valued at $194 million - accounted for 13 per cent of the dollar value. Overall, it was a session very much in keeping with recent weeks, marked mainly by cautious optimism because of expectations that the US Federal Reserve would delay tapering its quantitative easing (QE) programme worth US$85 billion a month, which should provide liquidity support for stocks for the immediate future. |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

yummygd

Supreme |

23-Oct-2013 07:33

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

My sharejunction a bit ki siao on my iphone. Cannot load properly | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

23-Oct-2013 06:15

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

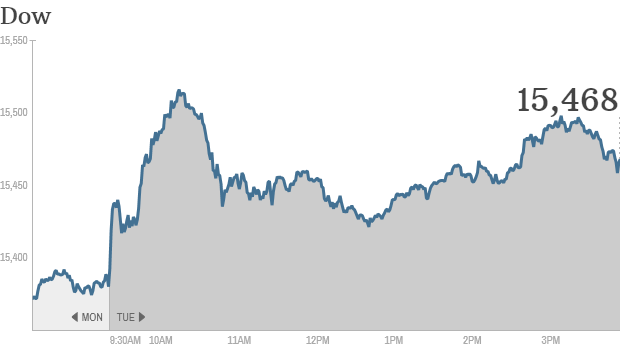

Stocks up on hopes Fed stimulus will continueOctober 22, 2013: 4:32 PM ET

Click the chart for more stock market data. NEW YORK (CNNMoney)

The September jobs report wasn't great, but stocks rose Tuesday as investors anticipated that lackluster hiring will push the Federal Reserve to keep its monetary stimulus as is in the months ahead.The Dow Jones industrial average, S& P 500 and the Nasdaq ended modestly higher, with the S& P 500 closing at a fresh record high for a fourth straight day. The Dow finished at its highest level in a month. The jobs report, which was delayed more than two weeks because of the government shutdown, showed the economy gained just 148,000 jobs last month. But the unemployment rate ticked down to 7.2%, the lowest since November 2008. Still, the numbers suggest that the U.S. economic recovery remains fragile and that the Fed will likely keep buying $85 billion in bonds each month for a bit longer. In light of the " moderate tone" of the jobs report, Barclays economist Michael Gapen said in a note to clients Tuesday that he now thinks the Fed will wait until March 2014 to scale back, or taper, its bond buying program. He had previously expected the Fed would taper this December. The Fed has repeatedly said it wants to see more improvement in the job market before it begins to cut back on its $85 billion a month in bond purchases. Plus, economists expect the Fed will want more data on how the shutdown impacted the economy before it will be ready to start tapering. |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

23-Oct-2013 06:11

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

World MarketsNorth and South American markets finished broadly higher today with shares in Mexico leading the region. The IPC is up 1.16% while Brazil's Bovespa is up 0.68% and U.S.'s S& P 500 is up 0.57%.

North and South American Indexes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

tea444u

Master |

23-Oct-2013 00:09

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

look at VALLIANZ- mINI kREUZ IN THE MAKING....

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Isolator

Supreme |

22-Oct-2013 23:09

Yells: "STI is hard landing to below 2000..." |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Huat la my Dow... Getting more and more profit... | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Octavia

Elite |

22-Oct-2013 22:32

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Goldman: " Weaker Than Expected" Jobs Report Means No Taper Before March | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Peter_Pan

Supreme |

22-Oct-2013 22:18

Yells: "did you order dunkin' donuts" |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

yummy good..! |

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

22-Oct-2013 22:14

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

U.S. Stocks Rise as Hiring Data Spur Fed Stimulus BetsBy Inyoung Hwang & Nikolaj Gammeltoft - Oct 22, 2013 9:30 PM GMT+0800

U.S. stocks rose, extending a record for the Standard & Poor?s 500 Index, as weaker-than-forecast hiring in September fueled speculation the Federal Reserve will delay trimming monetary stimulus. The S& P 500 gained 0.2 percent to 1,748.27 at 9:30 a.m. in New York after the gauge closed at a record yesterday. ?This report indicates the Fed is joining us for the holiday season at the current level of quantitative easing,? Darrell Cronk, the New York-based regional chief investment officer at Wells Fargo Private Bank, which oversees $170 billion, said by phone. ?And it will probably be ringing in the New Year with us as well as it continues QE through the end of 2013. Right now the data is not suggesting any kind of tapering.? Payrolls climbed by 148,000 last month, less than the 180,000 projected by economists in a Bloomberg survey, indicating the U.S. economy had little momentum leading up to the federal government shutdown. The jobless rate fell to an almost five-year low. Progress in the labor market depends on how quickly the world?s largest economy can bounce back from the loss of business caused by the 16-day closure. The budget dispute weighed on fourth-quarter growth and will prompt Fed policy makers to wait until March before starting to scale back the $85 billion of monthly bond purchases, a Bloomberg survey showed last week. World MarketsNorth and South American markets are higher today with shares in Brazil leading the region. The Bovespa is up 0.88% while U.S.'s S& P 500 is up 0.72% and Mexico's IPC is up 0.54%.

North and South American Indexes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||