| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||||

|

Blastoff

Elite |

28-Jul-2010 06:55

|

||||

|

x 0

x 0 Alert Admin |

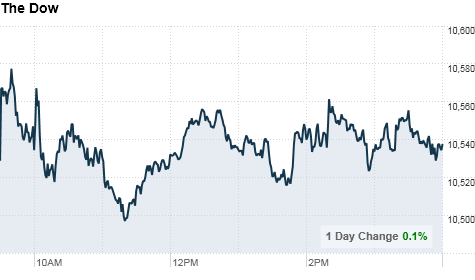

Stocks: Earnings help, economy hurts NEW YORK (CNNMoney.com) -- Stocks churned Tuesday, losing steam after a three-session run, after a big drop in consumer confidence offset better-than-expected profit growth from DuPont, UBS and others. The Dow Jones industrial average (INDU) added 12 points, or 0.1%. The S&P 500 (SPX) lost just over 1 point. The Nasdaq (COMP) composite lost 8 points, or 0.4%.

Stocks gained Monday after FedEx (FDX, Fortune 500) lifted its profit forecast and new home sales grew more than expected in June. The advance built on last week's rally, pushing the Dow into positive territory for the year, along with the Nasdaq. The S&P 500 moved into positive territory for the year on Tuesday morning, before retreating. Company results: Dow component DuPont (DD, Fortune 500) reported higher quarterly sales and earnings that topped estimates, thanks to higher prices and increased demand. The chemical maker also boost its earnings forecast for the year. Shares gained 3.6%. Swiss bank UBS (UBS) reported higher quarterly profit that topped estimates, thanks to the stock market rally and currency trading gains. U.S.-traded shares gained 9%. Swiss rival Credit Suisse (CS) also reported a better-than-expected profit as tax and accounting gains tempered the impact of investment banking losses. Shares gained 4.4%. German competitor Deutsche Bank (DB) reported higher quarterly earnings. But revenue was weaker due to a decline in its investment banking profit. Shares gained 2.8%. Tellabs (TLAB) reported higher quarterly sales and earnings that beat estimates and lifted its fiscal second-quarter outlook. But shares of the communications gear maker dropped on concerns that it will lose some of its business building wireless networks for AT&T to a rival vendor. Shares fell 5.9%.

BP: BP posted a huge quarterly loss of $17.2 billion due to costs connected to the Gulf of Mexico oil spill. The company also said that British CEO Tony Hayward will be replaced by American Robert Dudley Oct. 1. BP (BP) shares fell 1.7%. Housing: The Case-Shiller 20-city home price index rose 1.3% in May versus April and up 4.6% from a year earlier, suggesting pricing has stabilized. World markets: European shares rose. The CAC 40 in France gained 0.8%, Germany's DAX rose 0.2% and the FTSE 100 added 0.3%. Asian markets finished mixed. Japan's benchmark Nikkei index edged down 0.1% and the Hang Seng in Hong Kong ended 0.6% higher.

U.S. light crude oil for September delivery settled down $1.48 to $77.50 a barrel on the New York Mercantile Exchange. COMEX gold's August contract fell $25.10 to $1,158 per ounce. Bonds: Treasury prices fell, and the yield on the 10-year note climbed to 3.05% from 2.99% late Monday. Bond prices and yields move in opposite directions. Market breadth: Breadth was negative. On the New York Stock Exchange, losers beat winners by eight to seven on volume of 1.11 billion shares. On the Nasdaq, decliners edged advancers by seven to six on volume of 2.07 billion shares. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

27-Jul-2010 22:21

|

||||

|

x 0

x 0 Alert Admin |

Stocks try to extend rallyNEW YORK (CNNMoney.com) -- Stocks struggled to rise as investors welcomed improved quarterly profits from DuPont, UBS and others, but were cautious after the recent rally. The Dow Jones industrial average (INDU) added 18 points, or 0.2%. The S&P 500 (SPX) index rose 2 points, or 0.2%. The Nasdaq (COMP) composite gained 4 points, or 0.2%. After ending the previous week higher, stocks climbed again Monday,rising after FedEx (FDX, Fortune 500) boosted its forecast and better-than-expected housing data eased worries about the economic outlook.

Company results: Dow component DuPont (DD, Fortune 500) reported higher quarterly sales and earnings that topped estimates, thanks to higher prices and increased demand. The chemical maker also boost its earnings forecast for the year. Shares gained 3.6%. Swiss bank UBS (UBS) reported higher quarterly profit that topped estimates, thanks to the stock market rally and currency trading gains. U.S. traded shares gained 7%. Swiss rival Credit Suisse (CS) also reported a better-than-expected profit as tax and accounting gains tempered the impact of investment banking losses. Shares gained 4%. German competitor Deutsche Bank (DB) reported higher quarterly earnings. But revenue was weaker due to a decline in its investment banking profit. BP: BP (BP) booked a massive quarterly loss of $17.2 billion due to costs related to the Gulf of Mexico oil spill. The company also announced early Tuesday that Tony Hayward will step down as chief executive and be replaced by American Robert Dudley effective Oct. 1.

The Case-Shiller 20-city home price index rose 1.3% in May versus a year ago after rising 3.8% in April. World markets: European shares were higher. The CAC 40 in France gained 1%, Germany's DAX rose 0.7% and the FTSE 100 added 0.8%. Asian markets finished mixed. Japan's benchmark Nikkei index edged down 0.1% and the Hang Seng in Hong Kong ended 0.6% higher. Currencies and commodities: The dollar was flat versus the euro, up versus the Japanese yen, but down against the British pound . U.S. light crude oil for September delivery edged up 12 cents to $79.10 a barrel. COMEX gold's August contract gained 50 cents to $1,183.60 per ounce. Bonds: Treasury prices fell, and the yield on the 10-year note edged up to 3.02% from 3% late Monday. Bond prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

pharoah88

Supreme |

27-Jul-2010 16:53

|

||||

|

x 0

x 0 Alert Admin |

LARISSA R ROBBED http://sports.xin.msn.com/world-cup-2010/photogallery.aspx?cp-documentid=4191441 |

||||

| Useful To Me Not Useful To Me | |||||

|

niuyear

Supreme |

27-Jul-2010 11:35

|

||||

|

x 0

x 0 Alert Admin |

He wld better serve his sentence as soon as possible all he will be haunted by that spirit who being knocked down by him. 7th month is coming soon.............hahaha!

|

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

27-Jul-2010 10:41

|

||||

|

x 0

x 0 Alert Admin |

Ionescu trial begins today, Singapore envoy to attend Singapore says the trial of former Charge d’Affaires Silviu Ionescu in Romania, which begins today, is an important step forward in ensuring that justice is served. The Ministry of Foreign Affairs (MFA) said in a statement yesterday that its Special Envoy to Romania, Ambassador Anil Kumar Nayar, will attend the start of the trial. Ionescu has been indicted by Romania’s General Prosecutor’s Office for homicide, and is also accused of causing physical injuries and making false statements. He was arrested by the Romanian authorities in May, for allegedly hitting three pedestrians while driving a car belonging to the Romanian Embassy in Singapore. One of the victims died. Ionescu has publicly denied he was the driver, claiming the car was stolen. The MFA has repeatedly called on the Romanian government to “ensure that justice is served and seen to be served” in the case. MORAL: CASINO is BETTER than ANOTHER MAN'S WIFE |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

27-Jul-2010 07:15

|

||||

|

x 0

x 0 Alert Admin |

Stocks rally on housing, FedExNEW YORK (CNNMoney.com) -- Stocks rallied Monday after FedEx's improved forecast and a better-than-expected housing market report tempered worries about the economic outlook. The Dow Jones industrial average (INDU) added 100 points, or 1%. The S&P 500 (SPX) index rose 12 points, or 1.1%. The Nasdaq (COMP) composite gained 27 points, or 1.2%. Both the Dow and Nasdaq are now positive for the year, while the S&P 500 stands roughly where it stood at the end of 2009. All three major gauges had rallied soundly through late April, sold off through the end of June and have recovered in July. Stocks gained in the morning and built on those gains as the session wore on, with investors scooping up a variety of shares. 29 of 30 Dow shares gained, led by oil stocks Exxon Mobil (XOM, Fortune 500) and Chevron (CVX, Fortune 500).

But the gains also reflect the recent more positive tone to the market, said Stephen Goldman, market strategist at Weeden & Co. Stocks slid in the second quarter as investors factored in a slower pace of recovery for the economy. But July has been a strong month as market pros anticipated improved quarterly results, a development that has played out so far. Goldman said that the market is currently in a "reflex rally" following the selling in the second quarter, in which the major gauges lost more than 15% off the highs and flirted with a bear market -- a plunge of at least 20% off the highs. "We're still going to see choppy trading after this rally fades out," Goldman said. "The economy is fragile and while it's not going to be a double-dip recession, growth is still going to be slow." FedEx: Package shipper FedEx (FDX, Fortune 500) lifted its fiscal first-quarter earnings-per-share guidance to a range of $1.05 to $1.25, from 58 cents per share a year ago. Analysts are currently expecting earnings of $1.10 per share, according to Thomson Reuters. The company also boosted its forecast for fiscal year 2011, citing improved demand particularly for international shipments. Like UPS (UPS, Fortune 500), FedEx is seen as a proxy for the economy, due to the nature of its business. Last week, UPS reported better-than-expected quarterly sales and earnings and also boosted its full-year forecast.

Housing: New home sales rose to a seasonally adjusted annual unit rate of 330,000 in June, bouncing from a revised 267,000 unit rate in May, the lowest reading on record, dating to 1963. Sales were expected to rise to 310,000, according to a consensus of economists surveyed by Briefing.com.

Quarterly results: Roughly 157 major companies, or 31% of the S&P 500, reports results this week. Standouts include Dow companies Boeing (BA, Fortune 500), DuPont (DD, Fortune 500), Exxon Mobil (XOM, Fortune 500), Chevron (CVX, Fortune 500) and Merck (MRK, Fortune 500). Also, BP (BP) reports on Tuesday, providing the first snapshot of the company's performance during the quarter in which the oil spill began. Separately, BP CEO Tony Hayward will step down in October and be offered a job with the company's joint venture in Russia, according to published reports Monday. World markets: European markets rose as investors mulled the results of the bank stress tests released after European markets closed Friday. Britain's FTSE 100 rose 0.7%, Germany's DAX rose 0.5% and France's CAC 40 added 0.8%. Asian markets ended the session higher, with Japan's Nikkei index up 0.8%, the Hong Kong Hang Seng up 0.2% and the Shanghai Composite up 0.7%. Currencies: The euro fell versus the dollar, giving up earlier gains, while the dollar gained versus the Japanese yen. Commodities: U.S. light crude oil for September delivery fell 6 cents to $78.92 a barrel on the New York Mercantile Exchange. COMEX gold for August delivery fell $2.70 to $1,185.10 an ounce. Bonds: Treasury prices fell, boosting the yield on the 10-year note to 3.00% from 2.99% late Friday. Debt prices and yields move in opposite directions. Market breadth: Breadth was positive. On the New York Stock Exchange, winners beat losers by almost three to one on volume of 470 million shares. On the Nasdaq, advancers beat decliners by over two to one on volume of 1.22 billion shares. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

26-Jul-2010 20:37

|

||||

|

x 0

x 0 Alert Admin |

Stocks set for tepid startNEW YORK (CNNMoney.com) -- U.S. stocks were set for a weak start Monday, as investors awaited a report on new home sales and braced for another round of earnings due out this week. Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were narrowly lower ahead of the opening bell. Futures measure current index values against perceived future performance. U.S. stocks finished higher last week, boosted by strong financial results, which offset worries about the European debt crisis and pace of the global economic recovery. "Since there isn't much else going on this week, everyone's going to be looking closely at earnings reports from the bigger companies that propel the market, and [results] have been really good and better than expected so far," said Dave Rovelli, managing director at Canaccord Adams. Earnings: It's still early in the reporting period, and 157 companies are on tap to post their results this week.

This week, Dow components Boeing (BA, Fortune 500), DuPont (DD, Fortune 500), Exxon Mobil (XOM, Fortune 500), Chevron (CVX, Fortune 500) and Merck (MRK, Fortune 500) are on deck. Also, BP (BP) reports Tuesday, the first snapshot of the company's performance during the quarter in which the oil spill began.

Companies: BP's (BP) board is planning to meet in London Monday evening. The meeting comes amid reports that the company is planning to announce the departure of CEO Tony Hayward. World markets: European shares edged lower in the early going as investors digested the results of stress tests published after European markets closed Friday. Britain's FTSE 100, the CAC 40 in France and Germany's DAX posted slim losses in morning trading. Asian markets finished the session in positive territory. Japan's benchmark Nikkei index rose 0.8%, the Hang Seng in Hong Kong added 0.2% and the Shanghai Composite gained 0.7%. Currencies and commodities: The dollar was up against the euro, but down versus the British pound and the Japanese yen. U.S. light crude oil for September delivery fell 64 cents to $78.34 a barrel. COMEX gold's August contract lost $1 to $1,186.80 per ounce. Bonds: Treasury prices rose, and the yield on the 10-year note edged lower to 2.99%. Bond prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

26-Jul-2010 09:49

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

STI ?

|

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

pharoah88

Supreme |

25-Jul-2010 16:44

|

||||

|

x 0

x 0 Alert Admin |

10,424.62

+102.32 (0.99%)

Jul 23 - Close

|

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

25-Jul-2010 16:39

|

||||

|

x 0

x 0 Alert Admin |

|

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

24-Jul-2010 18:27

|

||||

|

x 0

x 0 Alert Admin |

http://www2.journalnow.com/content/2010/jul/23/report-payouts-unjustified/news/ With the financial system on the verge of collapse in late 2008, a group of troubled banks doled out more than $2 billion in bonuses and other payments to their highest earners. Now, the federal authority on banker pay says that nearly 80 percent of that sum was unmerited. In a report to be released today, Kenneth Feinberg, the Obama administration's special master for executive compensation, is expected to name 17 financial companies that made questionable payouts totaling $1.58 billion immediately after accepting billions of dollars of taxpayer aid, according to two government officials with knowledge of his findings who requested anonymity because of the sensitivity of the report. The group includes such Wall Street giants as Goldman Sachs, JPMorgan Chase and the American International Group as well as small lenders such as Boston Private Bank. Feinberg's report points to companies that he says paid eye-popping amounts or used haphazard criteria for awarding bonuses, people with knowledge of his findings said, and he singles out Citigroup as the biggest offender. Even so, Feinberg has very limited power to reclaim any money. He can use his status as President Obama's point man on pay to jawbone the companies into reimbursing the government, but he has no legal authority to claw back excessive payouts. Feinberg's political leverage has been weakened by the banks' speedy repayment of their bailout funds. Eleven of the 17 companies that received criticism in the report have repaid the government with interest, so they have no outstanding obligations to reimburse. As a result, Feinberg will merely propose that the banks voluntarily adopt a "brake provision" that would allow their boards to nullify or alter any bonus payouts or employment contracts in the event of a future financial crisis. All 17 companies have told Feinberg that they will consider adopting the provision, though none has committed to do so. Feinberg is expected to call the payouts ill-advised but not unlawful or contrary to the public interest, people with knowledge of his report said. On Wall Street, meanwhile, profits and pay have already rebounded. Goldman Sachs is on pace to hand out an average of $544,000 per worker in salary and bonuses, although many could earn several times that amount. JPMorgan Chase's investment bank is on track to pay its workers, on average, about $400,000, while the average Morgan Stanley employee could collect about $262,000. Reader Comments Voice your opinion by posting a comment.

1

Posted by (modified1) on 07/23/2010 at 08:42 am.

|

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

24-Jul-2010 18:21

|

||||

|

x 0

x 0 Alert Admin |

Saturday, July 24, 2010

Winston-Salem 79.0º Partly Cloudy

|

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

pharoah88

Supreme |

24-Jul-2010 18:08

|

||||

|

x 0

x 0 Alert Admin |

By combining transparency regarding the results of stress tests with appropriate measures ... European authorities will send a clear message to market participants about the resilience of the financial system. European Central Bank executive board member Gertrude Tumpel-Gugerell |

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

24-Jul-2010 18:06

|

||||

|

x 0

x 0 Alert Admin |

Clear message that banks are resilient: ECB Special measures to help Spanish, Portuguese lenders extended LONDON “Stress tests contribute to the effectiveness of financial intermediation by providing more information about the condition of financial institutions and of the financial system as a whole. “By combining transparency regarding the results of stress tests with appropriate measures to deal with potential weaknesses, European authorities will send a clear message to market participants about the resilience of the financial system,” she said. The markets were a shade higher as investors awaited the findings. About one hour after the opening bell in New York on Friday, the Dow Jones Industrial Average was up 0.3 per cent at 10,351. Europe’s Stoxx 600 benchmark was up 0.2 per cent at 254.93. The Committee of European Banking Supervisors (CEBS) was set to publish the results of stress tests on 91 European lenders after the close of regional markets on Friday ( Regulators are scrutinising banks to assess if they have enough capital, defined as a Tier 1 capital ratio of at least 6 per cent, to withstand a recession and sovereign debt crisis, according to a CEBS document. Although most of the banks were expected to get the all-clear, there was concern that the tests were not as stringent as they should be, or even as rigorous as those in the United States a year ago. “Given the recalcitrant and rather secretive way in which it has been prepared, the release of bank stress tests results is unlikely to be the silver bullet that guarantees a rapid normalisation of the financial system,’’ said UniCredit London’s chief economist Marco Annunziata. A A survey by Goldman Sachs forecast that 10 of the 91 banks would fail, the On Friday, hours before the release of the findings, European authorities announced the extension of special measures to help the Spanish and Portuguese banking sectors until the end of this year. The European Commission said it had prolonged authorisation of schemes in both countries originally set up in the wake of the global financial crisis. Among the banks subjected to the tests were 27 Spanish and four Portuguese lenders. In Spain, permission was extended for an amended system allowing individual banks in trouble to be recapitalised with state involvement. A Portuguese scheme obliging banks to pay extra premiums in exchange for public guarantees in the event of collapse was also extended. Anxiety about Europe’s banks in recent months mounted in tandem with the sovereign debt crisis, which eventually led to a €110 billion ($193.5 billion) bailout of Greece and a €750 billion backstop for the region’s troubled governments. — Stress test results of 91 banks in 20 countries in Europe will send a “clear message” about the resilience of the continent’s financial system, European Central Bank executive board member Gertrude Tumpel-Gugerell said on Friday a few hours before the release of the findings.early Saturday morning, Singapore time).Guardian report had earlier cited analysts saying they expected that a few banks — located in Spain, Portugal, Germany and Slovenia —might not pass the tests.BBC reported.AGENCIES |

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

24-Jul-2010 17:16

|

||||

|

x 0

x 0 Alert Admin |

Can the Arabs Save the World?

By Christian A. DeHaemer | Friday, July 23rd, 2010

You may remember the Middle East as that part of the world that overspent on opulent development. It was easy to do in the mid 2000s, as oil was ticking up to $147 a barrel... Then last year, we heard news that Dubai World had run out of money and needed to restructure its debts, as it could no longer make payments. There was even fear that the loss would take down some well-placed banks in Europe. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

23-Jul-2010 19:48

|

||||

|

x 0

x 0 Alert Admin |

Futures want to extend the rallyNEW YORK (CNNMoney.com) -- U.S. stocks were set for a higher open early Friday, although Wall Street may find trouble pushing significantly higher after the previous session's massive rally. Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were narrowly higher. Futures measure current index values against perceived future performance. U.S. stocks leapt Thursday after a slew of companies reported earnings that topped Wall Street's estimates. The Dow gained nearly 2%, the Nasdaq soared 2.7% and the S&P 500 surged 2.3%.

Earnings: Before the market open on Friday, Ford (F, Fortune 500) posted second-quarter earnings that easily beat estimates, and shares of the company rose 1.7%. Other companies on tap to release their results ahead of the opening bell Friday include Verizon (VZ, Fortune 500) and McDonald's (MCD, Fortune 500). After U.S. markets closed Thursday, Microsoft (MSFT, Fortune 500) posteda jump in quarterly sales and profits. Amazon (AMZN, Fortune 500) also reported a sharp rise in sales and profit, but analysts had hoped for better. Shares of the Internet retailer sank more than 11% in pre-market trading Friday. Banks: Pay czar Kenneth Feinberg is due to release a report on how much bank executives were paid after their firms received taxpayer bailout funds. In Europe, report cards on the health of big banks are due to be released at noon ET. The tests are aimed at determining how well European financial firms would fare in the case of another economic downturn.

|

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

23-Jul-2010 13:56

|

||||

|

x 0

x 0 Alert Admin |

STI higher at middaySINGAPORE shares were higher at midday on Friday, with the benchmark Straits Times Index at 2,972.71, up 0.58 per cent, or 17.04 points. About 752 million shares exchanged hands. Gainers beat losers 234 to 133. |

||||

| Useful To Me Not Useful To Me | |||||

|

rickyw

Master |

23-Jul-2010 12:35

Yells: "keep happy..." |

||||

|

x 0

x 0 Alert Admin |

2 0 1 2 Target >4 0 0 0

|

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

23-Jul-2010 12:25

|

||||

|

x 0

x 0 Alert Admin |

2010 TARGET 3 1 0 0

|

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

23-Jul-2010 12:21

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

There you are . . . . . . . . A clear sign of STI > 3,000 is on its path, sooner than later! | ||||

| Useful To Me Not Useful To Me | |||||