| Latest Forum Topics / Others |

|

|

Market News that affect STI

|

||||||||||||||

|

Blastoff

Elite |

02-Jul-2010 09:56

|

|||||||||||||

|

x 0

x 0 Alert Admin |

STI opens higherSINGAPORE shares opened higher on Friday, with the benchmark Straits Times Index at 2,834.61 in early trade, up 0.51 per cent, or 14.26 points. Around 90.3 million shares exchanged hands. Gainers beat losers 110 to 52. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

29-Jun-2010 07:03

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Stocks end slightly lowerNEW YORK (CNNMoney.com) -- Stocks ended a choppy session modestly lower Monday as investors welcomed a slight increase in personal spending but remained on guard ahead of key economic reports due later this week. Dow Jones industrial average (INDU) was down 5 points, or less than 0.1%. The S&P 500 (SPX) dipped about 3 points and the Nasdaq (COMP) composite slid 2 points. Stocks struggled for direction throughout the session as investors considered a pledge from world leaders to cut public deficits over the next few years. Consumer staples were among the best performers after a report on personal spending came in somewhat better than expected and the Supreme Court issued a decision that will benefit tobacco companies. Bank stocks were lower as investors continued to digest the Wall Street reform bill Congress finalized last week. Lawmakers are expected to vote on the sweeping overhaul this week and send the bill to President Obama in July. Traders said the tone of Monday's session was cautious as the market remains nervous about the debt crisis in Europe and the possibility of a so-called double dip recession in the United States. "The market is hungry for direction in terms of the labor market and industrial sector," said Nick Kalivas, vice president of financial research at MF Global. "We're in wait-and-see mode on those issues today." Tuesday brings reports on home prices in 20 major U.S. cities and a key measure of consumer confidence. Manufacturing reports are due later in the week and the government's closely-watched monthly jobs report comes out Friday. Stocks closed mixed Friday despite a rebound in the financial sector. All three major gauges booked weekly declines. Economy: Before the open, the Commerce Department reported that personal income rose 0.4% in May, while personal spending edged up 0.2%. The government was expected to report that personal income rose 0.5% in May after climbing 0.4% in April, according to a consensus estimate from Briefing.com. Personal spending was expected to have risen 0.1% from a flat reading in April. Companies: Tobacco companies Altria (MO, Fortune 500) and Philip Morris (PM, Fortune 500) rose after the Supreme Court refused to hear an appeal over the government's ability to collect $280 billion from the industry for alleged fraud in its marketing. The Supreme Court also ruled unconstitutional a long-standing ban on hand guns in Chicago. Smith & Wesson Holding Corp (SWHC). jumped 5.6%. Sprint (S, Fortune 500) gained 6% after President Obama signed a memorandum to expand the amount of broadband spectrum available for smartphones and other wireless devices. Noble announced plans to buy FDR Holdings, an independent drilling company, in a cash transaction that values Frontier at $2.16 billion. Shares of Noble (NE) rose 2.4%. Shares of BP (BP) rose after the oil company said it has spent $2.65 billion on costs related to the spill in the Gulf of Mexico. G-20: Leaders of the world's most important economies agreed to ambitious targets for getting deficits under control, pledging to cut them in half by 2013, according to a statement made following the G-20 summit this weekend in Toronto. But the leaders acknowledged that progress on deficit reduction will take more time for some countries, and included a special provision for Japan, which is heavily reliant on external borrowing. World markets: Asian markets ended mixed Monday. Japan's Nikkei index lost 0.4%, while Hong Kong's Hang Seng index rose 0.2%. Markets in Europe closed higher. France's CAC 40 and Germany's DAX both climbed more than 1% while Britain's FTSE 100 fell ended 0.5% higher. Currencies: The dollar was higher against the euro, but was flat versus the British pound and Japanese yen. Commodities: U.S. light crude oil for August delivery eased 90 cents to $77.96 a barrel. COMEX gold's August contract fell $16.60 to $1,239.20 per ounce. Bonds: Treasury prices rose, pushing the yield on the 10-year note down to 3.03% from 3.11% late Friday. Bond prices and yields move in opposite directions. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

|

||||||||||||||

|

Hulumas

Supreme |

25-Jun-2010 12:53

Yells: "INVEST but not TRADE please!" |

|||||||||||||

|

x 0

x 0 Alert Admin |

However, it is about time for "CRIIB" China, Russia, India, Indonesia and Brazil to lead the capital market!

|

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

25-Jun-2010 07:46

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Stocks slump on economic woesNEW YORK (CNNMoney.com) -- Stocks slumped Thursday, with the Dow losing 145 points, as investors mulled mixed reports on the economy and a sell-off in bank shares as Wall Street reform talk move toward a close. Dow Jones industrial average (INDU) lost around 145 points, or 1.4%. The S&P 500 (SPX) lost 18 points or 1.7% and the Nasdaq (COMP) composite lost 37 points or 1.6%.  Stocks fell after reports showed a still-tough environment for the manufacturing and labor markets and one day after the Federal Reserve sounded a cautious tone on the economy. The Fed issued a cautious growth outlook Wednesday on the back of the day's weak May new home sales report. That left stocks mixed to lower, but the tone turned even more negative overnight, with markets in Europe falling and U.S. stocks opening weaker. "The Fed downgraded their economic outlook, which is not good for the markets," said David Chalupnik, head of equities at First American Funds. "It tells us that the economy is losing steam and earnings are at risk." He said that markets are likely to be particularly volatile in July, as the second-quarter reporting period heats up, with many forecasts still too high relative to the current economic outlook. Economy: The number of Americans filing new claims for unemployment fell to 457,000 last week from a revised 472,000 in the previous week, the Labor Department reported. Economists surveyed by Briefing.com expected 457,000. Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 4,548,000 from 4,571,000. Economists expected 4,580,000 continuing claims, on average. Durable goods orders fell 1.1% in May, the Commerce Department reported. That was better than the 1.3% drop that was expected. Orders rose 3% in April. Orders excluding transportation rose 0.9% in May versus forecasts for a rise of 1.3%. Orders ex-transportation fell 0.8% in the previous month. On the upside, mortgage rates fell this week to the lowest level on record, a boon to individuals looking to buy a home or refinance. Freddie Mac said that the average rate for 30-year fixed loans fell to 4.69% from 4.75%. Federal Reserve: On Wednesday, the central bank policymakers opted to hold interest rates steady at historic lows near zero, as expected. However, in the statement the bankers said that while the economy is recovering, growth is likely to stay moderate for a while. Additionally, they were concerned about the weakness in the housing market and the "less supportive" financial conditions as a result of the European debt crisis. Companies: Thousands of Apple fans lined up Thursday morning to buy the hugely anticipated iPhone 4, which is being released at Apple stores and other retailers Thursday including Wal-Mart Stores (WMT, Fortune 500) and Best Buy (BBY, Fortune 500). Google (GOOG, Fortune 500) won a crucial copyright infringement battle with Viacom (VIA) Wednesday when a federal court ruled Google's YouTube isn't liable for its users' copyright violations. Viacom, which has been seeking more than $1 billion in damages, says it will appeal the ruling. Oracle (ORCL, Fortune 500) shares dipped ahead of its quarterly profit report, due out after the close. The software maker is expected to earn 54 cents per share, up 17% from a year earlier, and revenue of $9.5 billion, up 38% from the prior year. Declines were broad based, with 28 of 30 Dow issues falling. The biggest losers were Chevron (CVX, Fortune 500), Exxon Mobil (XOM, Fortune 500), Walt Disney (DIS, Fortune 500), IBM (IBM, Fortune 500), Hewlett-Packard (HPQ, Fortune 500) and 3M (MMM, Fortune 500). Financial shares tumbled as Washington lawmakers moved closer to reaching a compromise on two different versions of the Wall Street reform bill. The KBW Bank (BKX) sector index fell 2.2%. Market breadth was negative and volume was pretty modest. On the New York Stock Exchange, losers beat winners three to one on volume of 1.26 billion shares. On the Nasdaq, decliners topped advancers three to one on volume of 2.06 billion shares. Currency: The euro was little changed versus the dollar, erasing earlier gains but remaining well above the four-year low of $1.188 hit last week. The dollar was barely changed versus the yen. The direction of the euro and the state of global debt are expected to be in focus at this weekend's G-20 meeting. World markets: European markets slipped. Britain's FTSE 100 lost 1.5%, Germany's DAX gave back 1.4% and France's CAC 40 fell 2.4%. Asian markets were mostly lower. Japan's Nikkei ended little changed, Hong Kong's Hang Seng fell 0.6% and China's Shanghai Composite lost 0.1%. Commodities: U.S. light crude oil for August delivery rose 22 cents to $76.51 a barrel on the New York Mercantile Exchange. COMEX gold for August delivery gained $10.60 to $1,245.90 an ounce after closing at a record $1,258.30 last Friday. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.12% from 3.11% late Wednesday. Treasury prices and yields move in opposite directions. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

22-Jun-2010 08:47

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Stocks end lowerNEW YORK (CNNMoney.com) -- Stocks finished lower Monday, with the Dow industrials erasing a gain of as much as 143 points, as investors chose to be cautious after a recent advance and discounted China's move to strengthen its currency. The Dow Jones industrial average (INDU) lost 8 points, or 0.1%; the S&P 500 index (SPX) fell 4 points, or 0.4%; and the Nasdaq composite (COMP) gave up 21 points, or 0.9%. Stocks rallied in the morning, trimmed some gains in the early afternoon, and then slipped through the close. "We were up over 100 this morning [on the Dow] on the China news, but again we're seeing the pattern that the trend reverses in the last hour or so," said Scott Armiger, portfolio manager at Christiana Bank & Trust Company. "The rallies don't hold, and the declines manage to recover." He said this trend reflects the increased volatility that's been in markets lately but also the fact that stocks are pretty fairly valued at this point, relative to earnings expectations. Stocks had risen for two weeks straight, with the major indexes all up more than 6%, as buyers returned following the May selloff. That selloff followed a roughly 80% rally on the S&P 500 off its March 2009 lows. Worries that Europe's debt problems will slow down the global economic recovery dragged on stocks last month. Weaker-than-expected reports on housing, jobs and manufacturing added to the wariness. But those worries have been set aside lately as investors scooped up shares beaten down in the recent rally. Market gains have also been driven by some supportive technical factors. Investors got good news over the weekend when China said it will allow its currency, the yuan, to rise against the dollar, after it was pegged to the dollar over the last two years. Freeing up the currency could be a boon to U.S. manufacturers and exporters, who suffered as the artificially low yuan made imports to China expensive. However, China cautioned that the yuan's rise would happen only gradually. On Monday, the dollar was barely changed versus the yuan and was 0.5% higher versus the yen. The euro barely budged versus the U.S. currency. The weak euro has been something of a proxy for investor worries about the economy over the last few months. On the move: A variety of stocks declined, with big tech issues leading the way, including Microsoft (MSFT, Fortune 500), Yahoo (YHOO, Fortune 500) and Amazon (AMZN, Fortune 500). Amazon shares fell after the company cut the price of its Kindle electronic reader, the latest salvo in a pricing war that saw Barnes & Noble (BKS, Fortune 500) cut the price of its Nook earlier in the day. Market breadth was negative. On the New York Stock Exchange, losers beat winners four to three on volume of 1.07 billion shares. On the Nasdaq, decliners beat advancers two to one on volume of 1.91 billion shares. World markets: European markets rallied. Britain's FTSE 100 gained 0.9%, Germany's DAX rose 1.2% and France's CAC 40 climbed 1.3%. Asian markets climbed. Japan's Nikkei advanced 2.4%, Hong Kong's Hang Seng rose 3.1%, and China's Shanghai Composite added 2.9%. Commodities: U.S. light crude oil for July delivery rose 64 cents to settle at $77.82 a barrel on the New York Mercantile Exchange. COMEX gold for August delivery fell $6.20 to $1,233.70 an ounce after closing at a record $1,258.30 on Friday. Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.24% from 3.22% late Friday. Treasury prices and yields move in opposite directions. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

|

||||||||||||||

|

Blastoff

Elite |

21-Jun-2010 14:32

|

|||||||||||||

|

x 0

x 0 Alert Admin |

STI higher at middaySINGAPORE shares were higher at midday on Monday, with the benchmark Straits Times Index at 2,879.76, up 1.64 per cent, or 46.36 points. About 882.8 million shares exchanged hands. Gainers beat losers 339 to 97. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

21-Jun-2010 14:30

|

|||||||||||||

|

x 0

x 0 Alert Admin |

China stocks up nearly 2%BEIJING - CHINESE shares surged nearly two percent by midday on Monday after policymakers pledged at the weekend to make the yuan exchange rate more flexible. The Shanghai Composite Index, which covers both A and B shares, was up 1.95 per cent, or 49.13 points, at 2,562.36 by the end of the morning session. The People's Bank of China said on Saturday it would 'strengthen the flexibility' of the yuan exchange rate, which some analysts saw as a sign Beijing was ready to scrap the dollar peg and allow the currency to rise. However, the bank came out on Sunday to douse expectations, saying there would be no 'large swings' in the currency and no one-off adjustment. The central bank on Monday held the central parity rate - the centre point of the currency's allowed trading band - at 6.8275 to the US dollar (S$1.38), unchanged from Friday. The yuan strengthened against the dollar in early trading, however, falling to 6.8154 on the nation's main foreign exchange trading market, the lowest level since October 8, 2008. But the currency was still within the allowed trading range, which was set at between 6.7934 and 6.8616 for Monday. China - under mounting pressure to strengthen the currency - has effectively frozen the yuan at about 6.8 to the dollar since mid-2008 to boost exports during the world financial crisis. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

21-Jun-2010 08:41

|

|||||||||||||

|

x 0

x 0 Alert Admin |

China loosens its currency chokeholdNEW YORK (CNNMoney.com) -- China took steps Saturday to let its currency trade more freely, but investors and U.S. policy makers should not expect a large increase in its value. Since 2008, China has pegged its currency, the yuan, to the dollar, keeping its value artificially low and making it tougher for U.S. companies to compete. Some economists think the yuan is undervalued by 20% or more. The People's Bank of China said that in response to the global economy's continuing recovery, it will enhance its exchange rate's "flexibility," a statement observers interpreted as meaning that China will let the yuan gradually appreciate against the U.S. dollar. But don't expect big hikes: "The basis for large-scale appreciation does not exist," said the bank, which plans to keep its exchange rate "basically stable." The move comes one week before President Obama and other world leaders will gather will gather in Toronto for the G20 economic summit, at which China's currency policy will be in the spotlight. Representatives of several industrialized nations, including India, Brazil, the United States and European countries have previously asked China to allow its currency to float.

While a stronger yuan -- and a weaker dollar -- is widely considered to be a good thing for U.S. manufacturers, it won't come without some pain for Americans.

It also could lead to a slide in the value of the dollar, which in turn could raise the price of imports, such as oil. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

|

||||||||||||||

|

Blastoff

Elite |

21-Jun-2010 08:39

|

|||||||||||||

|

x 0

x 0 Alert Admin |

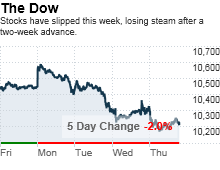

NEW YORK (CNNMoney.com) -- A two-week advance looks to continue this week, as investors consider the latest on the global economy -- but the early summer correction may not be over. After slumping almost 14% in six weeks, stocks, as measured by the broad S&P 500, have now gained back just over 6% in the past two weeks. That's good news for investors who were worried that the correction -- a selloff of more than 10% from the highs -- would become a bear market, a selloff of over 20%. But the stock recovery has been mostly technical and trading-driven, rather than based on changes in the underlying issues that sparked the selling in the first place. That factor suggests another bump down is coming, perhaps later in the summer. But stocks could ride the bounce for another few weeks, with the Dow turning around after it reclaims its 2010 high of 11,205.03 from April, said Dean Barber, president at Barber Financial Group. "I'm still bullish for the next few weeks, but beyond that I think we could be heading into a bear market," he said. "The recent jobs reports have been terrible, housing is stabilized but has another leg down ahead of it, and the consumer is slowing again." His view: "If GDP turns negative in the third and fourth quarter, we're going to see a lot bigger stock selloff." But markets may also just meander for a while, rather than slide further, depending on what the economic news in the U.S. and abroad suggests, said Robert Siewert, portfolio manager at Glenmede. "A number of indicators are suggesting slower growth, and fears of a double-dip recession are growing," he said. "It's going to lead equity investors to proceed with caution." This week brings reports on housing, durable goods orders, employment, consumer sentiment and GDP. The latest on BP in the aftermath of the oil spill and the direction of commodity markets will also be in focus. Gold closed at a record high of $1258.30 an ounce on Friday. The value of the euro, European debt issues and the impact they may have on the global economy will also remain in focus, particularly as the G-8 meeting gets underway in Canada at the end of the week. In terms of European debt issues, the concern of late has focused on Spain as it fights to raise money amid soaring debt levels and rumors that it needs a bailout like Greece. The other PIIGS -- Portugal, Italy and Ireland -- remain on watch as well. Federal Reserve: The central bank is meeting Tuesday and Wednesday to discuss interest rate policy, with a decision expected Wednesday afternoon. The bank is widely expected to hold rates steady at levels near zero. As usual, what the bankers say about the outlook for the economy will be critical. On the docket

Monday: There are no market-moving economic or corporate events expected on Monday. Tuesday: The existing home sales index from the National Association of Realtors is due in the morning. The index is expected to have risen to a seasonally adjusted annual rate of 6.10 million units in May, up from a 5.77 million unit rate in April, according to a consensus of economists surveyed by Briefing.com. The FHFA Housing price index for April is also due in the morning, but is not typically a market mover. Wednesday: The May new home sales index from the Census Bureau is due shortly after the start of trading. The index is expected to have fallen to a seasonally adjusted annual rate of 427,000 units, from a 504,000 unit rate in the previous month. The weekly crude oil inventories report from the government is also due in the morning. Thursday: The Commerce Department releases the durable goods orders report for May in the morning. Orders are expected to have fallen 1.4% after rising 2.8% in April. Orders excluding transportation are expected to have risen 1.25% after falling 1.1% last month. The number of Americans filing new claims for unemployment is expected to have fallen to 458,000 last week from 472,000 the previous week. Continuing claims, a measure of Americans who have been receiving benefits for a week or more, are expected to have risen to 4,580,000, from 4,571,000 last week. Oracle (ORCL, Fortune 500) reports quarterly results Thursday evening. The software maker is expected to report earnings of 54 cents per share, up 17% from a year ago, and revenue of $9.5 billion, up 38% from a year ago. Friday: The revised reading on gross domestic product (GDP) growth in the first quarter is due in the morning. GDP is expected to have grown at a 3% annualized rate, unchanged from the previous reading. The University of Michigan's final reading on consumer sentiment in June is due in the morning. It's expected to hold steady at 75.5, unchanged from the last reading. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

sinetic8

Senior |

18-Jun-2010 10:34

|

|||||||||||||

|

x 0

x 0 Alert Admin |

most investors are trading not by facts, by emotions. because djia rises for the past few days, most are hopping on the ship, hoping to make a quick buck.

|

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

18-Jun-2010 08:11

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Stocks erase losses by closeNEW YORK (CNNMoney.com) -- Stocks erased losses to end higher Thursday as a rally in commodity and consumer shares helped investors to look past dour reports on jobs and manufacturing. The Dow Jones industrial average (INDU) gained 24 points, or 0.2%. The S&P 500 index (SPX) added less than 2 points, or 0.1%, and the Nasdaq composite (COMP) ended just above unchanged.

COMEX gold for August delivery rose $18.20 to settle at $1,248.70 an ounce, an all-time high.

Stocks were mixed Wednesday, after BP said it was canceling its quarterly dividend and establishing a $20 billion fund to cover damages related to the Gulf oil spill. BP (BP) remained in focus Thursday as chief executive Tony Hayward testified before a House committee.

Jobs: The number of Americans filing new claims for unemployment rose last week to 472,000 from 460,000 the previous week. Economists surveyed by Briefing.com thought claims would drop to 450,000.

Other economic news: The Philadelphia Fed index, a regional reading on manufacturing, fell to 8 in June from 21.4 in May, missing forecasts for a drop to 20, as activity slowed far more than expected. Another report, LEI, rose 0.4% in May versus forecasts for a rise of 0.5%. LEI was flat in April. The Consumer Price index, a measure of consumer inflation, fell 0.2% in May versus forecasts for a drop of 0.1%. CPI fell 0.1% in April. So-called core CPI, which strips out volatile food and energy prices, rose 0.1% as expected after showing no change in the previous month. Euro: The euro rose 0.6% versus the dollar, continuing to recover after touching a four-year low of $1.188 last week. The dollar fell 0.7% against the yen. On the move: The Dow managed to end higher, with Caterpillar (CAT, Fortune 500), Chevron (CVX, Fortune 500), Travelers (TRV, Fortune 500), IBM (IBM, Fortune 500) and Wal-Mart Stores (WMT, Fortune 500) providing the lift. In company news, grocery chain Kroger (KR, Fortune 500) gained 3.3% after reporting higher-than-expected quarterly earnings and saying current-quarter sales are tracking roughly in line with the previous quarter. Food and consumer products maker J.M. Smucker (SJM) reported higher quarterly net income, sending shares up 6.6%.

World markets: European markets gained. Britain's FTSE 100 rose 0.3%, Germany's DAX added 0.5% and France's CAC 40 gained 0.2%. Asian markets were mixed. Japan's Nikkei lost 0.7% and Hong Kong's Hang Seng rose 0.4%. China's Shanghai Composite lost 0.4%. Commodities: U.S. light crude oil for July delivery fell $1.10 to settle at $76.57 a barrel on the New York Mercantile Exchange. Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.19% from 3.28% late Wednesday. Treasury prices and yields move in opposite directions. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

zhixuen

Veteran |

17-Jun-2010 22:36

|

|||||||||||||

|

x 0

x 0 Alert Admin |

US jobless claims in surprise rise

WASHINGTON: New claims for jobless insurance benefits in the United States rose unexpectedly for the second straight week, the government said on Thursday on concerns unemployment may derail the economic recovery. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

|

||||||||||||||

|

Blastoff

Elite |

17-Jun-2010 13:32

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Singapore's May NODX up 24% on-year

SINGAPORE : Singapore's non-domestic exports (NODX) continued to see double-digit growth in May compared to the same period last year, albeit at a slower pace. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

17-Jun-2010 13:27

|

|||||||||||||

|

x 0

x 0 Alert Admin |

STI lower at middaySINGAPORE shares were lower at midday on Thursday, with the benchmark Straits Times Index at 2,838.22, down 0.31 per cent, or 8.72 points. About 538.7 million shares exchanged hands. Losers beat gainers 204 to 109. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

tanstg

Senior |

17-Jun-2010 08:44

Yells: "Learn as I trade and trade as I understand" |

|||||||||||||

|

x 0

x 0 Alert Admin |

DOW - CNBC First On Fast: Big Bank Estimates Coming Down 10% as UK Tax to Cost US Banks $2 Billion. US banks will foot a total bill of about $2 billion in their second-quarter results to pay for UK tax on bankers' bonuses - a charge that could significantly reduce earning at financial group such as Citigroup, JPMorgan Chase and BoA.... |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

17-Jun-2010 08:28

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Stocks end flat after choppy sessionNEW YORK (CNNMoney.com) -- U.S. stocks recovered from deep losses Wednesday and finished a choppy session near the previous day's closing levels as investors considered mixed economic news and BP's agreement to establish a $20 billion escrow fund and cancel its quarterly dividend. The Dow Jones industrial average (INDU) closed up 5 points, or 0.1%. It was down by as much as 72 points earlier in the session, following a disappointing report on the housing market. Rebounding from an 8-point loss, the S&P 500 index (SPX) finished less than 1 point down, or 0.1%, and the Nasdaq composite (COMP) added half a point. The tech-heavy index was 16 points lower earlier. Stocks gained Tuesday as fears about Europe's debt crisis continued to fade and the euro rallied, rising above the $1.23 level for the first time in more than a week. The three major indexes added more than 2% and finished above key milestone levels. That momentum initially diminished Wednesday as investors faced disappointing economic reports and less-than-stellar corporate news. But it began to resurface after Obama administration officials confirmed that BP (BP) agreed to put roughly $20 billion in an escrow account to payout claims from the oil spill disaster in the Gulf of Mexico. "After a tremendous rally yesterday and a mixed bag of economic news this morning, that fact that the market is virtually unchanged is a big win," said Art Hogan, chief market analyst at Jefferies & Co. President Obama met with BP executives in the White House on Wednesday, including CEO Tony Hayward and the company's chairman, Carl Henric Svanberg. Following the summit, the company announced it is canceling its quarterly dividend for the rest of the year, and promised it would revisit the issue next year. In his first address from the Oval Office, the president told the nation Tuesday night he will make BP pay for the costs of cleaning up the oil disaster. He also pushed Congress to move on clean energy legislation. Shares of BP finished up 1.4%. Earlier Wednesday, stocks slipped on worse-than-expected housing news and a tempered outlook from FedEx. While economists anticipated new home construction would ease in May -- the first month after the homebuyer tax credit expired -- the drop was steeper than they expected. "We expected a decline, but the inventory of unsold new homes fell to a 40-year low," said John Canally, economist at LPL Financial. And while FedEx (FDX, Fortune 500) posted a fiscal fourth-quarter profit Wednesday morning, the shipping giant said it expects earnings for fiscal 2011 to be "constrained" due to higher costs. The news sent the company's shares down nearly 6% and pressured the broader market earlier in the session. Meanwhile, the Federal Reserve reported that industrial production climbed 0.2% in May, after rising 0.7% the previous month. Economists were expecting the figure to edge up 0.8%. Canally said the surge was a "pleasant surprise" and helped curb some prior weakness in stocks. "The data shows that factory production is still booming, led by exports, so it's comforting to see that the European debt crisis hasn't torpedoed global growth yet," he said. But Canally warned that market participants will remain anxious about the impact of the Europe's fiscal instability on the global economy. "The economy is transitioning from a period of recovery to sustainable growth, and as that expansion phase takes hold, it will be choppy," Canally said. "We'll see the market give and take -- take two steps forward and one step back -- but earnings season in July could change the battleground a bit." Economy. The Commerce Department also said that building permits, a measure of builder confidence, also fell sharply, dropping 5.9% from the previous month. Another report showed that the Producer Price index (PPI), a key measure of wholesale inflation, fell 0.3% in May after slipping 0.1% in April. The so-called Core PPI, which strips out volatile food and energy prices, rose 0.2%. Economists thought Core PPI would rise 0.1%. Companies: Mortgage finance giants Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500), which have been overseen by the government since September 2008, were ordered by their federal regulator to delist from the New York Stock Exchange. Shares of both were closed nearly 40% lower. Nokia (NOK) shares plunged more than 10% after the tech company cautioned investors that its cell phone business will post weaker-than-expected second quarter results, due July 22. World markets: European shares closed slightly higher Wednesday. Britain's FTSE 100, the CAC 40 in France, and Germany's DAX finished up about 0.2% . In Asia, Japan's Nikkei spiked 1.8%, while markets in Hong Kong, Taiwan and China were closed for a holiday. Dollar and commodities: The dollar was higher against rivals. The greenback rose 0.2% against the euro, but the shared currency remained above $1.23. The edged up 0.1% against the British pound, It was slightly lower on the yen to ¥91.43. U.S. light crude oil for July delivery rose 73 cents to settle at $77.67 a barrel, and gold for August delivery rose fell $3.90 cents to settle at $1,1230.50 per ounce. Bonds: Treasury prices edged higher, lowering the 10-year note's yield to 3.28% from 3.31% the day before. Bond prices and yields move in opposite directions. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

15-Jun-2010 14:05

|

|||||||||||||

|

x 0

x 0 Alert Admin |

36,500 jobs added in Q1

Singapore employers added 36,500 more jobs in the first quarter, pushing the unemployment rate to the lowest level in almost two years as robust economic recovery spurred firms to hire again. -- ST PHOTO: MUGILAN RAJASEGERANSINGAPORE employers added 36,500 more jobs in the first quarter, pushing the unemployment rate to the lowest level in almost two years as robust economic recovery spurred firms to hire again. The seasonally adjusted jobless rate fell to 2.2 per cent in March, from 2.3 per cent in December, according to figures released by the Ministry of Manpower on Tuesday. The job gains - for the third straight quarter - were comparable to the seasonal high of 37,500 in the last quarter of 2009. Employment fell by 6,200 in the first quarter a year ago due to the global economic downturn. "The labour market strengthened in the first quarter of 2010, driven by the robust rebound from the economic downturn. Employment grew strongly, contributing to an improvement in unemployment for the second straight quarter as redundancies remained at pre-recessionary levels," said MOM in a statement. "Amid rising job vacancies, labour turnover rose further signalling a tightening of the labour market. Reflecting the cyclical upturn, labour productivity grew strongly." The bulk or 33,400 new jobs came from the services sector - thanks to the opening of Singapore's two casino resorts early this year, which boosted tourism and fuelled employment. The gains were higher than 31,500 in the fourth quarter and 7,500 in the first quarter of 2009. Manufacturing added 3,100 workers, the second consecutive quarter of increase after shedding workers from the fourth quarter of 2008 to the third quarter of 2009. Construction lost 400 workers, after 20 successive quarters of employment gains. The strong job gains pushed the seasonally adjusted overall unemployment rate declined to 2.2 per cent in March. Similarly, among the resident labour force, the unemployment rate dipped to 3.2 per cent Q1, from from 3.3 per cent in December. An estimated 63,300 residents were unemployed in March, compared to the the seasonally adjusted 66,200. Long-term unemployment also improved. The number of residents who had been looking for work for at least 25 weeks shrank to 14,600 in March, from 16,600 a year ago, forming 0.7 per cent of the resident labour force. MOM said 1,800 workers were retrenched and 600 workers had their contracts terminated prematurely. This was comparable to 2,220 in the fourth quarter of 2009 and only one-fifth of the record number - 12,760 - laid off in the first quarter of last year. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

15-Jun-2010 14:04

|

|||||||||||||

|

x 0

x 0 Alert Admin |

SINGAPORE'S retail sales in April fell for a second month as car purchases slumped due largely to a reduction of Certificate of Entitlement (COE) quotas. The retail sales index fell 2.6 per cent in April from a year ago, as sales of cars tanked by 30.9 per cent, according to figures released by the Statistics Department on Tuesday. Excluding motor vehicles, retail sales rose 7.4 per cent from April last year, after a revised 7 per cent increase in March. Seasonally adjusted, retail sales declined by 2.2 per cent in April from March, with sales of motor vehicles down by 15.7 per cent. But petrol service stations, watches and jewellery, apparel and footwear, medical goods and toiletries recorded double-digit year-on-year growths of 11.6 per cent to 17.2 per cent. Furniture, household equipment, department stories, telcommunications apparatus and computers, optical goods, books and supermarkets also reported higher sales of 1.3 per cent to 9.8 per cent. The Straits Times reported last month that new vehicle sales could possibly sink below 55,000 cars this year - less than half the average 117,000 sold each year in the last decade. In the first three months of the year, a total of 1,639 new vehicles were put on the road, versus 2,160 in the same time last year and 2,637 in 2008. Because COE premiums, and consequently car prices, have soared in recent months, motor traders said the $17,000 rebate now represents a smaller saving. This has either turned off would-be buyers, or priced them out. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

15-Jun-2010 07:56

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Stocks erase gains on GreeceNEW YORK (CNNMoney.com) -- Stocks gave up gains by the close Monday after Moody's downgraded Greece's debt rating, reminding investors that Europe's economic woes aren't going away anytime soon. The Dow Jones industrial average (INDU) lost 20 points, or 0.2%, the S&P 500 index (SPX) lost 2 points, or 0.2%, and the Nasdaq composite (COMP) ended little changed. Stocks gained soundly in the morning after a report showed a big jump in industrial output in Europe, boosting the euro and reassuring investors about the global recovery. But the advance lost steam in the early afternoon on news that Moody's cut its debt rating on Greece to "junk status." "The market is very concerned about Greece and Europe and what it means for U.S. growth, but we don't think the problems there are severe enough to send the U.S. or Asia back into recession," said Matt King, chief investment officer at Bell Investment Advisors. He said that the Monday afternoon dip was also reflective of the fact that afternoon trading volume was thin, making the market more volatile. In addition, the market has tended to switch direction of late in the last hour or 30 minutes of each session. However, the reaction to Moody's downgrade was fairly mild compared to how it might have unnerved investors a month ago. That's partly because the news was unsurprising, with Greece continuing to struggle despite European leaders having made billions in loans available to the nation. Six weeks ago, Moody's rival Standard & Poor's cut its rating on Greece's debt to junk. Concerns that problems in Greece and other debt-plagued European nations would slow the global recovery pummeled U.S. stocks for more than a month. The three major gauges lost more than 10% each -- the technical definition of a "correction" -- on worries that the United States could be headed for a double-dip recession. But stocks managed to recover at the end of last week and through early Monday afternoon as the focus expanded to include improving corporate earnings and signs the economy is recovering outside the job market. "We think we've seen a short-term correction, not the start of a bear market," King said. "Hopefully the market will become less manic over the next few months and focus more on the fundamentals. Caterpillar (CAT, Fortune 500), United Technologies (UTX, Fortune 500) and Wal-Mart Stores (WMT, Fortune 500) were among the few gainers on the Dow, while DuPont (DD, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Microsoft (MSFT, Fortune 500) and Travelers (TRV, Fortune 500) were among the decliners. Market breadth was positive. On the New York Stock Exchange, winners topped losers three to two on volume of 1.14 billion shares. On the Nasdaq, advancers topped decliners seven to six on volume of 1.90 billion shares. No major economic news was released Monday, but reports are due later in the week on housing, wholesale and consumer inflation and jobless claims. BP: President Obama reportedly wants the company to set up a fund to pay for damages from the leaking oil well, two months after the initial explosion. Lawmakers want BP (BP) to make as much as $20 billion available. But the company may not be able to comply, as it only had $7 billion in cash on hand at the end of the first quarter and is currently expected to pay out dividends on June 21st. BP is expected to have discussed the issue of dividends at its board meeting Monday. Meanwhile, its stock price continues to plummet, losing 9.7% Monday to $30.67 per share. Euro: The euro rose 0.9% versus the dollar, continuing to recover after touching a four-year low of $1.188 last week. The dollar fell 0.1% against the yen. World markets: European markets gained. Britain's FTSE 100 rose 0.7%, Germany's DAX rose 1.3% and France's CAC 40 gained 2%. Asian markets gained. Japan's Nikkei rose 1.8%, Hong Kong's Hang Seng gained 0.9% and China's Shanghai Composite added 0.3%. Commodities: U.S. light crude oil for July delivery rose $1.18 to $74.96 a barrel on the New York Mercantile Exchange. COMEX gold for August delivery fell $7.60 to $1,222.60 an ounce. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.28% from 3.22% late Friday. Treasury prices and yields move in opposite directions. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

14-Jun-2010 13:59

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Investors could be in for a bumpy ride next weekNEW YORK (CNNMoney.com) -- Markets could be in for another bumpy ride next week as investors continue to look for clues on where the global economy is headed. There will be no shortage of data to fuel the debate between bears and bulls. Economic reports are due on manufacturing, real estate and inflation, among others. "The economic news will be important as investors look for direction on the second half of the year," said Lawrence Creatura, a portfolio manager with Federated Clover Investment Advisors. "There are multiple, overlapping uncertainties right now and any illumination from the macro data could tilt the balance." Stocks ended last week on a high note, with the Dow Jones industrial average booking its first weekly gain in a month. But analysts expect trading to remain volatile in the weeks ahead as investors await clear direction on the economy in the United States and abroad and the debt situation in Europe. While fears of a full-scale meltdown in Europe eased slightly last week, questions about the fiscal health of some economies in the region will continue to weigh on stocks, according to Peter Cardillo, chief market economist at Avalon Partners. "The rhetoric out of the EU will continue to be a dominating factor," he said. The energy sector will also be in focus, as executives from BP travel to Washington next week to answer questions about the ongoing oil spill in the Gulf of Mexico. Shares of the British oil company have plunged recently amid growing speculation that it will be forced to cut its dividend payment. Some analysts think BP (BP) could end up in bankruptcy court because of the spill. In addition to corporate and economic drivers, the ongoing debate in Washington over Wall Street reform will also be in focus. The House and Senate will meet to merge two proposed bills that would mandate sweeping changes, including steps to curb risk taking, protect consumers and prevent financial firms from getting too big to fail. "Investors as well as leaders of corporations are awaiting stability in the regulatory environment so they can make plans for the future," said Creatura. "We don't know what the rules of the road are, and markets hate uncertainty." Meanwhile, trading is expected to be volatile due to the simultaneous expiration of stock index futures and options as well as individual stock futures and options next week. The event can cause wild fluctuations in the underlying stocks and greater volatility in the broader market. "Next week I think volatility will remain quite high due to quadruple expiration," said Cardillo. "With the market already in a downward trend, we could retest the lows we saw earlier this week." On the docket Monday: No significant economic reports are scheduled to be released. Tuesday: Government data on import and export prices is due before the market opens, though the report is usually not a market mover. Consumer electronics giant Best Buy (BBY, Fortune 500) releases quarterly results and a report on manufacturing activity in New York comes out before the opening bell.

In corporate news, parcel delivery service FedEx (FDX, Fortune 500) is scheduled to report quarterly results in the morning.

Friday: The Labor Department will release a report on state unemployment levels at 10 a.m. ET. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||