| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||

|

iPunter

Supreme |

25-Aug-2010 08:04

|

||

|

x 0

x 0 Alert Admin |

When the market tanks in the midst of a bullish up-run, it is a good thing because it is probably just a correction along the climb. But if the market tanks further when the market is already at a low point, It is nerve-wracking to say the least... Last night, the Dow went below 10000... again...  |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

25-Aug-2010 06:57

|

||

|

x 0

x 0 Alert Admin |

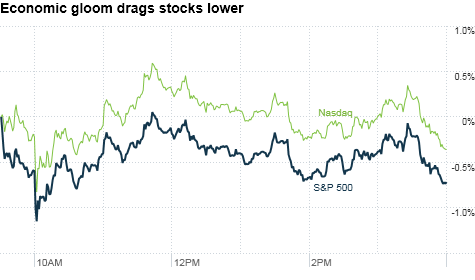

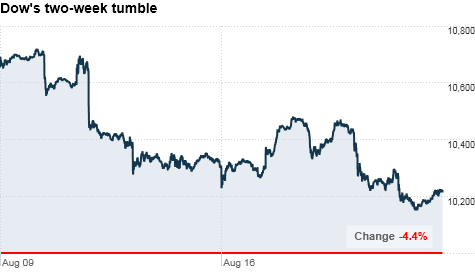

Stocks lose big on home sales shock

NEW YORK (CNNMoney.com) -- U.S. stocks closed sharply lower Tuesday after a report showing showing a worse-than-expected plunge in existing home sales reignited fears about an economic slowdown. The Dow Jones industrial average (INDU) sank 134 points, or 1.3%, the S&P 500 (SPX) lost 15 points, or 1.5%, and the Nasdaq (COMP) composite fell 36 points, or 1.7%. "Economic reports have been close to disastrous," said Joseph Saluzzi, co-head of equity trading at Themis Trading. "People are very concerned about the economy and everyone is talking about a double-dip [recession] at this point." Disappointing economic news has sent investors flocking to the perceived safety of Treasurys and the Japanese yen, which hit a 15-year high against the dollar early Tuesday. Losers outnumbered winners by three to one on the New York Stock Exchange and the Nasdaq. Declines were led by tech, finance and health care stocks, with General Electric (GE, Fortune 500) and Sony (SNE) sliding more than 2%, Citigroup (C, Fortune 500) and Bank of America (BAC, Fortune 500) dropping more than 1% and Pfizer (PFE, Fortune 500) slipping 2%. Among the biggest losers, Medtronic (MDT, Fortune 500) shares sank 11% after the medical device maker booked disappointing quarterly earnings and lowered its full-year outlook. Wall Street struggled through another choppy session Monday, with stocks finishing lower as ongoing worries about the global economy pushed excitement about deal-making talks to the backburner. Economy: The National Association of Realtors said existing home sales plummeted 27% last month to an annual rate of 3.83 million units, marking the lowest sales pace since the association began tracking the figure in 1999. Economists surveyed by Briefing.com forecast a rate of 4.72 million units. "This number coming in lower than even the most bearish expectations just confirms the same deteriorating economic conditions we've been seeing," said Ryan Detrick, a senior technical strategist at Schaeffer's Investment Research. "The economy seems to be very quickly slowing down and not showing signs of life." A report on new home sales is due Wednesday, and economists surveyed by Briefing.com expect a slight increase to an annual rate of 334,000 units in July from 330,000 in June. Meanwhile, a report released Tuesday showed that disagreements among the 17 key Federal Reserve officials about how to handle the economy peaked at a meeting earlier this month, according to The Wall Street Journal. Currencies, bonds and commodities: The dollar fell to a 15-year low against the Japanese yen in early trading, slipped against the euro, but climbed against the British pound.

The yield on the benchmark 10-year note approached a 17-month low Tuesday, falling to 2.50% from 2.6% late Monday.

World markets: European shares finished sharply lower. The CAC 40 in France dropped 1.7%, Britain's FTSE 100 lost 1.5% and the DAX in Germany fell 1.3%.

Companies: Barnes & Noble (BKS, Fortune 500), which put itself up for sale earlier this month, posted a quarterly loss that widely missed expectations and said same-store sales fell in the first quarter. Shares of the bookseller ended more than 2% lower. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

23-Aug-2010 07:34

|

||

|

x 0

x 0 Alert Admin |

Stocks in for summer slip 'n' slide NEW YORK (CNNMoney.com) -- Stocks are likely to face another choppy, downtrodden week, but that's no big surprise. It's the end of the summer, trading volume is light, and even though company earnings are generally strong, dismal economic reports have been kicking fears of a second-half slowdown into higher gear. Add a little uncertainty about Bush tax cuts, interest rates and the logistics of financial regulatory reform to the mix, and investors are jittery to say the least. "We know the economy is not suffering from a lack of money or liquidity. What the economy is desperately short of is confidence and visibility and the willingness to take risk," said Adrian Cronje, chief financial officer of investment firm Balentine. The markets are coming off two weeks of losses as traders have been struggling to find a balance between upbeat company news and downtrodden data on jobs, manufacturing, and other economic indicators. On one hand, the positive: A slew of mergers and acquisitions announced last week shows companies are ramping up their capital spending, which is a sign that they're preparing for better times. Earlier this week, mining giant BHP Billiton's (BHP) $43.8 billion unsolicited bid for Canadian fertilizer-maker Potash Corp. (POT) was the biggest deal this year, bringing weekly M&A volume to $89.8 billion. And on Thursday, Intel (INTC, Fortune 500) agreed to buy security software maker McAfee (MFE) for $7.68 billion, in what would be the chipmaker's biggest acquisition ever.

On the other hand, the negative: The headline economic indicator continues to be jobs, and the news there has been grim at best. The number of first-time filers for unemployment benefits surged to a 9-month high last week and has been stuck in the mid- to higher 400,000s since November.

Cronje is not predicting particularly bad or good news for jobs this week, but if the numbers disappoint, watch out: "Any sign of the job market getting even worse from here will be taken badly," he said. On the docket Monday: No economic reports are on tap. Tuesday: The July report on existing homes sales from the National Association of Realtors is due during morning trading Tuesday. Sales of existing homes fell 5.1% in June to a 5.37 million-unit pace -- a sign of renewed turbulence in the housing market. Economists polled by Briefing.com are expecting July to show another slowdown in sales, down to 5.14 million.

They're also waiting for the latest figures on new home sales, which are expected to show a slight uptick to 338,000 in July, up from 330,000 the month before. Thursday: The government releases its weekly numbers on first-time unemployment filers. Last week, stocks took a hit when the number increased dramatically to 500,000 initial claims.

GDP is the broadest measure of the nation's economic activity. Economists surveyed by Briefing.com are expecting the government to revise the number to 1.4%, showing a significant slowdown from its previous reading of 2.4%. |

||

| Useful To Me Not Useful To Me | |||

|

iPunter

Supreme |

20-Aug-2010 09:27

|

||

|

x 0

x 0 Alert Admin |

The market hanging in mid-air is extremely stressful for many... though many will also feel a sense of secureness. But even more scary will be a slow downtrend in time...  |

||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

20-Aug-2010 09:23

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

Picture describes more than thousand words . . . STI hangs on the middle of the air ! Ha . ha . . ha . . .

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

pharoah88

Supreme |

20-Aug-2010 09:16

|

||

|

x 0

x 0 Alert Admin |

|

||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

19-Aug-2010 16:37

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

STI ?

|

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

19-Aug-2010 07:00

|

||

|

x 0

x 0 Alert Admin |

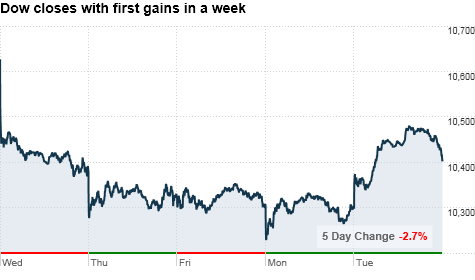

Stocks rally for second day in a row NEW YORK (CNNMoney.com) -- U.S. stocks posted their second consecutive day of gains Wednesday, turning the market around after a week's worth of losses. After starting out the day lower, the Dow Jones industrial average (INDU) rose 10 points, or 0.1%, to 10,416 the S&P 500 (SPX) inched up 2 points, or 0.2%, to 1,094 and the Nasdaq (COMP) composite rose 6 points, or 0.3%, to 2,216. Those gains built on Wall Street's strong advance the day before. But with no major economic releases on tap Wednesday, the market was having trouble finding direction as stocks jumped around throughout the day.

Bonds: Treasury prices eased Wednesday, pushing yields up. The yield on the 10-year note rose to 2.64% from 2.63% late Tuesday. Bond prices and yields move in opposite directions. Companies: Discount retailer Target (TGT, Fortune 500) reported a profit that rose 14% from a year earlier and was in line with expectations, but the company missed revenue forecasts.

Meanwhile, energy companies Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500) dragged on the Dow's gains. Their stocks fell about 1% after the government announced both crude and gasoline inventories were at unusually high levels for August.

Mining giant BHP Billiton (BHP) said Wednesday it was taking its takeover offer for Potash (POT) directly to the fertilizer giant's shareholders. On Tuesday, Potash's board rejected BHP's $38.6 billion bid.

Deere (DE, Fortune 500) posted better-than-expected profit and revenue for its third fiscal quarter, but the farm-equipment maker's earnings forecast for the current quarter of $375 million is below the $385 million analysts were looking for. Shares of Deere fell 1.8%. Just before the closing bell, General Motors filed for an initial public offering that could drastically reduce the holdings of the U.S. government, which currently owns 61% of the company, and repay some taxpayer money used to bail the company out. The company did not disclose how many shares it will sell, or at what price. World markets: Markets in Asia ended the session mixed. Japan's benchmark Nikkei jumped 0.9%. But the Hang Seng in Hong Kong and the Shanghai Composite both finished the session with losses.

Currencies and commodities: The dollar gained against the euro, but fell against the U.K. pound and the Japanese yen. Oil futures for September delivery fell 35 cents to settle at $75.42 a barrel. Gold for December delivery rose $3.10 to settle at $1,231.40. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

18-Aug-2010 14:11

|

||

|

x 0

x 0 Alert Admin |

STI higher at middaySINGAPORE shares were higher at midday on Wednesday, with the benchmark Straits Times Index at 2,927.5, up 0.14 per cent, or 4.14 points. About 844 million shares exchanged hands. Losers beat gianers 208 to 154. |

||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

18-Aug-2010 08:14

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

STI comment? | ||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

18-Aug-2010 07:59

|

||

|

x 0

x 0 Alert Admin |

Stocks come off week-long slump NEW YORK (CNNMoney.com) -- Stocks rallied Tuesday after a Federal Reserve regional president said fears about the central bank's outlook were "unwarranted" and investors shifted their focus to strong earnings from Wal-Mart and Home Depot. The Dow Jones industrial average (INDU) rose 104 points, or 1%, pushing the index to 10,406. The Nasdaq (COMP) composite climbed 28 points, or 1.3%, to 2,209; the S&P 500 (SPX) added 13 points, or 1.2%, to close at 1,092. The gains followed a choppy trading day on Wall Street on Monday. The tech-heavy Nasdaq managed to advance, rising about 0.4%, while the Dow and S&P 500 ended little changed.

Companies: Wal-Mart Stores (WMT, Fortune 500) reported a slightly better-than-expected fiscal second-quarter profit Tuesday, although customers of the world's largest retailer continued to curb spending. Wal-Mart also boosted its full-year guidance. Shares of the retailer were up 1.3%. Home improvement retailer Home Depot (HD, Fortune 500) posted a better-than-expected second-quarter profit that rose from a year earlier, but its sales missed forecasts. Home Depot shares gained 3.6%. Shares of fertilizer producer Potash (POT) rose 28% after it rejected a $38 billion takeover offer by mining company BHP Billiton. Pactiv (PTV), the maker of Hefty trash bags, gained more than 5% after agreeing to be acquired by Reynolds Group Holdings, which is a subsidiary of a New Zealand firm, for $6 billion.

Economy: A wave of economic reports, including data on housing and inflation, showed mixed results before the bell. A report from the Commerce Department showed that housing starts -- the number of new homes starting construction -- rose 1.7% to an annual rate of 546,000 in July. But permits fell 3.1% to an annual rate of 565,000.

World markets: European shares finished higher. The CAC 40 in France gained 1.8%, Germany's DAX rose 1.6% and the FTSE 100 in Britain gained 1.4%.

Currencies and commodities: The dollar fell against the euro, but rose versus the U.K. pound and the Japanese yen.

Bonds: Prices for Treasurys were lower. The yield on the 10-year note rose to 2.64%, coming off a 17-month low of 2.58% late Monday. Bond prices and yields move in opposite directions. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

17-Aug-2010 08:11

|

||

|

x 0

x 0 Alert Admin |

Tech stocks gain in choppy session NEW YORK (CNNMoney.com) -- Stocks ended mixed after a choppy session Monday, as investors were caught between excitement over dealmaking in the tech sector and pessimism about weaker-than-expected economic data. The Dow Jones industrial average (INDU) fell 1.14 points, and the S&P 500 (SPX) rose just 0.13 point. But the tech-laden Nasdaq (COMP) composite climbed 8.39 points, or 0.4%. Investors remained cautious following four straight losing sessions in the wake of the Federal Reserve's bearish outlook last week. A raft of downbeat economic reports and some tepid earnings results added pressure. Wall Street will be bracing for key reports on housing, building permits, prices and quarterly results from retail giants Wal-Mart (WMT, Fortune 500) and Home Depot (HD, Fortune 500) Tuesday before the bell.

Companies: Curbing the Dow's losses, shares of Cisco Systems (CSCO, Fortune 500) rose 2.6%, and shares of Intel (INTC, Fortune 500) advanced 1.7% after acquisition announcements from Intel and Dell (DELL, Fortune 500) sparked excitement about other possible takeover deals in the tech sector. Intel is buying Texas Instruments' cable modem product line, the company said Monday. It did not disclose the cost of the deal. Meanwhile, Dell said it will acquire data-storage company 3PAR for $1.15 billion, a deal the company said could cut its data management costs by 50%. Shares of Dell (DELL, Fortune 500) fell 0.4% after the announcement, but 3PAR (PAR) rose 86%. Lowe's (LOW, Fortune 500) stock edged 0.5% higher after the home improvement retailer posted higher fiscal second-quarter profit and revenue -- although the company missed forecasts and lowered its outlook.

World markets: While stocks in Asia ended mostly higher, Japan's benchmark Nikkei index slipped 0.6% following reports that Japan's economic growth slowed sharply to 0.4% in the second quarter -- putting China another step closer to becoming the world's second-largest economy.

China is forecast to overtake Japan by the end of the year to become the world's No. 2 economy after the United States. Official annual figures won't come until early 2011. Meanwhile, the Shanghai Composite rallied 2.1%, while the Hang Seng in Hong Kong ended the day up 0.2%. European shares ended mixed. France's CAC 40 dropped 0.4%, while the FTSE 100 in Britain and Germany's DAX were fractionally higher. Economy: The Empire Manufacturing survey index jumped to 7.1 in August from 5.08 in July, showing growth in the New York region. Economists polled by Briefing.com had expected a jump to 7.5.

Currencies and commodities: The dollar fell against the euro, the Japanese yen and the British pound.

Bonds: Prices for Treasurys rose. The yield on the 10-year note fell to a 17-month low of 2.58% from 2.68% late Friday. Bond prices and yields move in opposite directions.

Market breadth: Market breadth was positive. On the New York Stock Exchange, winners beat losers on a tight margin on volume of 789 million shares. On the Nasdaq, advancers beat decliners two to one on volume of 1.6 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

11-Aug-2010 08:11

|

||

|

x 0

x 0 Alert Admin |

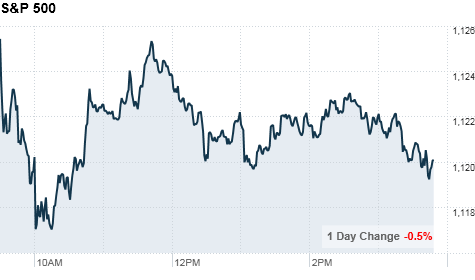

Stocks recoup losses after Fed NEW YORK (CNNMoney.com) -- Stocks pared sharp losses to close only modestly lower Tuesday after the Federal Reserve took a cautious stance about the recovery. After falling as much as 147 points earlier in the session, the Dow Jones industrial average (INDU) was off 53 points, or 0.5%, to close at 10,644.86, according to early tallies. The S&P 500 (SPX) lost 7 points, or 0.6%, to end at 1,121.08, and the Nasdaq (COMP) dropped 29 points, or 1.2%, to close at 2,277.17. As was widely expected, the central bank said it would leave short-term interest rates unchanged in a range between 0% and 0.25%. But the Fed gave its most bearish outlook in more than a year, saying the economic recovery is weakening.

"But actions speak louder than words," White added. "The fact that the Fed will maintain the same level of debt on its balance sheet shows it has some deflation concerns, even though they didn't mention the D-word." Though the repurchase of Treasurys is serving as a "backstop," White said, "everyone is wondering when we won't need the Fed anymore." Tech downgrades: The session's earlier losses were led by tech shares after the sector suffered two downgrades of big chipmakers. Analysts at Robert W. Baird downgraded tech giant Intel's (INTC, Fortune 500) shares to "neutral" from "outperform." The research firm cited concerns about the overall tech sector, noting a "sharp deterioration in PC-related order trends over the past week, following a below-expectation July." JPMorgan (JPM, Fortune 500) analysts echoed this statement, saying in their own report that personal computer orders were "falling off a cliff." JPMorgan lowered its outlook on Intel but kept its rating at "neutral."

Advanced Micro Devices (AMD, Fortune 500) also felt the crunch, after Barclays downgraded shares of the semiconductor maker to "equal weight" from "overweight." AMD shares plummeted to close 8% lower.

Companies: BP (BP) said late Monday that it had made a $3 billion deposit into the $20 billion escrow account, from which the oil giant will pay for claims to those who suffered from the effects of the Gulf Coast oil spill. Shares of BP were down 1.8% to end the day. After the bell, Walt Disney Co. (DIS, Fortune 500) reported fiscal third-quarter earnings that beat Wall Street expectations, led by rebounding sales at its television networks and movie studio divisions.

World markets: European markets closed lower. Britain's FTSE 100 fell 0.6%, while France's CAC 40 dropped 1.2% and Germany's DAX posted a decline of 1%. In Asia, Chinese shares led declines, following a report that showed Chinese imports slowed in July, increasing only 22.7% from a year earlier, compared to a 34.1% year-over-year jump the prior month.

Bonds: The yield on the 30-year bond fell below 4% and the yield on the 10-year note dropped to 2.77%. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

10-Aug-2010 09:52

|

||

|

x 0

x 0 Alert Admin |

Aug 10, 2010S'pore trade up 28% in Q2

Singapore's total external trade rose 28 per cent in the second quarter from a year ago. -- PHOTO: APSINGAPORE'S total external trade rose 28 per cent in the second quarter from a year ago, following the 27 per cent increase in the previous quarter, said trade promotion agency IE Singapore on Tuesday. On a seasonally adjusted quarterly basis, total trade expanded by 4.7 per cent in the April to June period, after the 9 per cent surge in the earlier quarter. Non-oil domestic exports (NODX) grew by 9 per cent in the second quarter, after a growth of 8.3 per cent in the first quarter. From a year ago, NODX went up 28 per cent, following the previous quarter's rise of 23 per cent, on higher shipments of both electronic and non-electronic NODX. Electronic domestic exports rose by 34 per cent in the second quarter, following a growth of 30 per cent in the earlier quarter. The level of total trade reached S$228 billion in the second quarter of the year, while total exports and total imports expanded by 29 and 27 per cent respectively, from the same period a year earlier. IE Singapore attributed the total trade's rise in the second quarter to increases in both oil and non-oil trade. Oil trade grew by 47 per cent year-on-year in the second quarter, after the previous quarter's 58 per cent rise. Non-oil trade climbed by 22 per cent in 2Q, following the 19 per cent expansion in 1Q. All top 10 NODX markets expanded in the second quarter, with China, European Union and and Hong Kong being the biggest contributors, with NODX to these countries growing by 43 per cent, 30 per cent and 42 per cent respectively. For the remainder of 2010, IE Singapore said the weakening of the Euro against the currencies of key trading partners and sluggish domestic demand in the United States and the Europe Union is expected to dampen world trade in the second half year. IE Singapore is maintaining the projection for Singapore's total trade growth for this year at between 17 and 19 per cent, and the forecast for NODX growth at between 17 and 19 per cent. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

10-Aug-2010 09:51

|

||

|

x 0

x 0 Alert Admin |

Aug 10, 2010Q2 GDP up 18.8%Govt maintains growth forecast for this year at 13 to 15 per cent.

Singapore's economy expanded less than initially estimated in the second quarter as manufacturing growth slowed. --ST PHOTO: SAMUEL HESINGAPORE'S economy expanded less than initially estimated in the second quarter as manufacturing growth slowed. Gross domestic product grew by 18.8 per cent from a year ago, stronger than the 16.9 per cent growth in the first quarter, said the Ministry of Trade and Industry in a statement on Tuesday morning. On a seasonally adjusted quarter-on-quarter annualised basis, GDP grew by 24 per cent for the second quarter, following a surge of 45.7 per cent in the earlier quarter. MTI said will maintain the GDP growth forecast for 2010 at 13 to 15 per cent. Manufacturing output expanded by 44.5 per cent in the three months through June, from a year ago. This is less than the preliminary estimate of 45.5 per cent. Growth was led by the biomedical manufacturing and electronics clusters, which increased production of higher value active pharmaceutical ingredients and semiconductor chips. The construction sector grew by 11.5 per cent, supported by an increase in public sector construction activities. Services grew a revised 11.2 per cent in Q2 from the same period last year. The wholesale and retail trade sector expanded by 18.9 per cent on the back of strong global trade flows, while the financial services sector grew by 10.2 per cent due to increased foreign exchange trading activities and domestic bank lending. Hotels and restaurants sector as well as other services industries also saw double-digit growth rates of 10.4 per cent and 12.9 per cent respectively, bolstered by higher visitor arrivals and activities in the new Integrated Resorts. MTI said real GDP grew by 17.9 per cent in the first half of the year, compared to 2.8 per cent in the earlier quarter. On the outlook for the second half, MTI said the global economy is expected to remain on a modest recovery path, 'albeit one that will continue to ease for the rest of the year.' 'For the Singapore economy, the strong growth momentum in the first half of 2010 is not likely to continue into the second half of the year, although growth rates will remain healthy. Anticipated plant maintenance shutdowns in the biomedical manufacturing cluster will also drag down overall growth. 'Taking into account these factors, MTI is maintaining the economic growth forecast for 2010 at 13 to 15 per cent. ' |

||

| Useful To Me Not Useful To Me | |||

|

Laulan

Master |

05-Aug-2010 15:23

|

||

|

x 0

x 0 Alert Admin |

THESE CATEGORY OF DILIGIENT SHAREHOLDERS, WELCOME TO SINGAPORE MARKET.

=========================================================================== Extreme Networks shareholder wants bigger stake On Wednesday August 4, 2010, 4:16 pm EDT

NEW YORK (AP) -- A shareholder of Extreme Networks Inc. said Wednesday that it sent a letter to the company expressing its "deep concern" over the network equipment maker's management and stock price. Ramius Value and Opportunity Advisors LLC, a New York-based investment manager, said it believes changes to the board of Extreme Networks are warranted and "prompt action" needs to be taken by management to boost the company's stock price. "After engaging in active discussions with you approximately one year ago regarding operating performance, corporate strategy, and board effectiveness, we respected your request to give you another year to achieve your goals and maximize shareholder value," Ramius wrote in the letter. "Although the company has made some progress over the past year, we continue to believe there are substantial opportunities to unlock value at Extreme that have gone unrealized." A representative for Extreme Networks declined to comment. Shares of Extreme Networks rose 4 cents to close at $3.03. The stock traded in the triple digits back in the early part of the decade but has sharply declined since. After bottoming at an all-time low of $1.06 in the bear market of March 2009, shares have steadily risen, tripling in value in about a year. In the letter, Ramius also questioned Extreme's recent adoption of a rule designed to prevent shareholders from acquiring more than a 4.95 percent ownership of shares. Those who already own that much stock won't be able to acquire more than another 0.5 percent worth under the new rule -- which is designed to ward off hostile takeovers. Ramius owns about 5.9 percent of Extreme's outstanding shares and recently requested a waiver from Extreme to buy up to 9.9 percent. The Ramius letter noted that Extreme has not yet responded to that waiver. "Given our Schedule 13D filing on June 23 disclosing our 5.6 percent position and trades in the past two months, the company was undoubtedly well aware that Ramius was actively acquiring shares during the month of June," Ramius wrote in the letter. Given that the so-called "poison pill" plan was changed a week later "raises serious questions as to the board's true intentions," Ramius said. |

||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

05-Aug-2010 12:06

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

It strongly indicates SOLAR POWER will be the next best alternative global energy source replacing burning of CRUDE OIL energy, beside other natural resources like WIND, OCEAN WAVE, GEOTHERMAL and wild controlled LIGHTING during the raining day energy etc . . . . . . . .

|

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

05-Aug-2010 07:01

|

||

|

x 0

x 0 Alert Admin |

Stocks edge up as jobs picture comes into focusNEW YORK (CNNMoney.com) -- Stocks closed higher Wednesday, after trading in a narrow range for most of the day, as investors welcomed improved data on private sector hiring and the services industry. The Dow Jones industrial average (INDU) rose 44 points, or 0.4%. The S&P 500 (SPX) index gained nearly 7 points, or 0.6%, and the Nasdaq (COMP) composite added 20 points, or 0.9%. Stocks were supported by a larger-than-expected gain in private sector payrolls, which tempered concerns about the job market ahead of a key report due Friday from the Labor Department. In addition, an industry report showed the services sector of the economy grew in July for the seventh month in a row. "Activity and employment may only be expanding at a modest pace," said Paul Ashworth, senior economist at Capital Economics in Toronto. "But at least today's data suggest that pace is being maintained." After a spate of upbeat corporate earnings boosted the market last month, investors have become increasingly focused on the outlook for economic growth. In particular, traders are worried that the weak job market will undermine consumer confidence and hurt the already faltering recovery. "The numbers were a bit better but they're still pointing to a very blah recovery," said Peter Boockvar, chief market strategist with Miller Taback & Co. "The economy is not falling off a cliff, but growth is going to be mediocre." Investors will get another read on the job market Thursday when the government reports weekly initial claims data before the market opens. The retail sector will also be in focus when the nation's top chain stores report same-store-sales figures for July. Stocks closed lower Tuesday, trimming some of the previous session's big gains, as disappointing reports on housing and consumer spending raised concerns about the strength of the economic recovery. Economy: Payroll processor ADP said private-sector employers added 42,000 jobs to their payrolls in June, following an upwardly revised 19,000 increase in June. Economists surveyed by Briefing.com expected employers to add 25,000 jobs last month. Separately, outplacement firm Challenger, Gray & Christmas said planned job cuts rose for a third straight month in July, fueled by continued weakness in the government and non-profit sector. The reports came as investors awaited Friday's monthly jobs report from the Labor Department, one of the most closely-watched indicators on Wall Street. Economists believe U.S. employers cut payrolls for the second month in a row in July, and that the unemployment rate ticked up slightly. Meanwhile, the Institute for Supply Management's services sector index rose slightly in July, marking the seventh consecutive month of growth in the sector. The ISM services index increased to 54.3 last month from 53.8 in June. A reading above 50 indicates growth. Economists had expected the index to fall to 53. While the rebound in the ISM was modest, the gain was encouraging for investors worried that the economy could slip back into recession. "The fact that there was any rebound at all is important because it suggests the U.S. economy isn't spiraling back into the abyss after all," Capital Economics' Ashworth said in a research report. Companies: Intel said it has agreed to settle antitrust charges levied by the Federal Trade Commission without paying a fine, though the chipmaker did agree to refrain from some activities designed to force its competition out of the market. Intel was accused of refusing to sell chips to some computer manufacturers that also bought chips from rival companies and paying other manufacturers rebates in exchange for promises not to use microchips manufactured by Intel's competitors. Shares of the Dow component were unchanged in afternoon trading. Shares of Priceline (PCLN) were up more than 20% after the online travel company reported second-quarter results that easily beat analysts' expectations. Goldman Sachs (GS, Fortune 500) gained 2% amid talk that the firm could spin off part of its proprietary trading business to get around the Volcker rule. Under the recently enacted Wall Street reform law, the Volcker rule will eventually limit the amount of money a federally insured bank can invest in risky ventures like private equity or hedge funds. BP (BP) said Wednesday that the Gulf of Mexico Macondo well "appears to have reached a static condition -- a significant milestone," as a result of a procedure carried out Tuesday. Shares eased 1.5%. Barnes & Noble (BKS, Fortune 500) put itself up for sale late Tuesday. The board of directors believes the bookseller's shares are "significantly undervalued." The company has hired financial adviser Lazard to explore "strategic alternatives," which may include selling the company. Shares rose 20%. Earnings: Toyota Motor (TM) said that it swung to a profit in its latest quarter and boosted its full-year sales outlook. Shares rose more than 1%. Time Warner (TWX, Fortune 500), the parent company of CNNMoney.com and Fortune, posted earnings of 49 cents per share on revenue of $6.4 billion, topping the consensus forecasts of analysts polled by Thomson Reuters. The media company also raised its outlook for earnings growth for all of 2010. Shares rose 2%. World markets: European markets ended mixed. The CAC 40 in Paris and Germany's DAX both closed about 3% higher. Britain's FTSE 100 fell 0.2%. In Asia, Japan's Nikkei sank 2.1%, while the Hang Seng in Hong Kong and the Shanghai Composite rose more than 0.4%. Currencies and commodities: The dollar rose versus the euro and the British pound. It recovered against the Japanese yen after falling near a 15-year low earlier. U.S. light crude oil for September delivery fell 11 cents to $82.44 a barrel. COMEX gold's December contract rose $15.50 to $1,195.90 per ounce. Bonds: Treasury prices eased, pushing the yield on the 10-year note up to 2.95% from 2.91% late Tuesday. Bond prices and yields move in opposite directions. |

||

| Useful To Me Not Useful To Me | |||

|

pharoah88

Supreme |

04-Aug-2010 14:57

|

||

|

x 0

x 0 Alert Admin |

‘Solar tsunami’ could hit Earth at any moment: Scientists WASHINGTON The solar fireworks at the weekend were recorded by several satellites, including the National Aeronautics and Space Administration’s (Nasa) new Solar Dynamics Observatory, which watched its shock wave rippling outwards. Astronomers from all over the world witnessed the huge flare above a giant sunspot the size of the Earth, which they linked to an even larger eruption across the surface of Sun. The explosion was aimed directly towards the Earth, which then sent a “solar tsunami” racing 150 million km across space. Images from the Nasa observatory hint at a shock wave travelling from the flare into space, the Scientists have warned that a really big solar eruption could destroy satellites and wreck power and communications grids around the globe. Previous reports have said scientists believed the Earth will be hit with unprecedented levels of magnetic energy from solar flares after the Sun wakes “from a deep slumber” sometime around 2013. It remains unclear, however, how much damage this latest eruption will cause the world’s communication tools. Dr Lucie Green, of the Mullard Space Science Laboratory, Surrey, followed the flare-ups using Japan’s orbiting Hinode telescope. “What wonderful fireworks the Sun has been producing,” the British solar expert said. “This was a very rare event — not one, but two almost simultaneous eruptions from different locations on the Sun were launched towards the Earth. “These eruptions occur when immense magnetic structures in the solar atmosphere lose their stability and can no longer be held down by the Sun’s huge gravitational pull. Just like a coiled spring suddenly being released, they erupt into space.” — The Earth could be hit by a wave of violent space weather after a massive explosion of the Sun, scientists have warned.New Scientist reported. Experts said the wave of supercharged gas was likely to reach the Earth as early as yesterday, when it will buffet the natural magnetic shield protecting Earth. It is likely to spark spectacular displays of the Aurora or northern and southern lights.THE DAILY TELEGRAPH |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

04-Aug-2010 06:57

|

||

|

x 0

x 0 Alert Admin |

Stocks rally chilled by economic jitters NEW YORK (CNNMoney.com) -- Stocks closed lower Tuesday, trimming some of the previous session's big gains, as optimism over corporate earnings gave way to concerns about the strength of the economic recovery. The Dow Jones industrial average (INDU) fell 38 points, or 0.3%. The S&P 500 (SPX) index slid 6 points, or 0.5%, and the Nasdaq (COMP) composite dropped 12 points, or 0.5%. The retreat came after stocks surged Monday, lifted by upbeat manufacturing data and strong earnings from Europe. But the investors were more cautious Tuesday following disappointing results from Procter & Gamble, and mixed reports on housing, factory orders and personal spending.

Despite the broad decline on Tuesday, energy stocks rose as oil prices closed above $82 a barrel and BP (BP) appeared poised to permanently seal the ruptured well in the Gulf of Mexico. Chevron (CVX, Fortune 500) and ExxonMobil (XOM, Fortune 500) both gained about 1.5%.

Economy: Government figures showed that both personal income and spending were unchanged in June, adding to concerns about the slowing pace of the economic recovery.

Earnings: Procter & Gamble (PG, Fortune 500) reported that its fiscal fourth-quarter net income fell 12% from a year earlier, missing expectations. Sales rose modestly, but also fell short of forecasts.

Dow Chemical (DOW, Fortune 500) reported second-quarter earnings that missed analysts' expectations, even as sales rose 20%. Excluding certain items, the largest U.S. chemical company said it earned 54 cents in the quarter. Analysts surveyed by Thomson Financial were expecting 56 cents. Archer Daniels Midland's (ADM, Fortune 500) profit rose to $446 million and trounced forecasts, but the agricultural product company's revenue fell, surprising analysts. Drugmaker Pfizer (PFE, Fortune 500) posted second-quarter profit and revenue that beat estimates. Other company news: Most major automakers reported improved U.S. sales in July, making it one of the best months for industrywide sales over the past two years. General Motors, Ford (F, Fortune 500) and Chrysler all said sales rose 5% in the month, versus July 2009. Toyota (TM) said sales slipped 3% in July, but were slightly better than analysts' forecasts. Sales slipped 2% at Honda Motor. (HMC) French drugmaker Sanofi-Aventis (SNY) has reportedly entered into friendly takeover talks with U.S. biotech firm Genzyme (GENZ, Fortune 500). A potential deal would value Genzyme at more than $18 billion, according to the Wall Street Journal. Research in Motion (RIMM) unveiled the much-hyped BlackBerry Torch 9800 on Tuesday, a new touch-screen BlackBerry smartphone with a pull-out keyboard and an updated operating system designed to compete with the likes of the iPhone and Android smartphones. World markets: European markets ended mixed. Germany's DAX gained 0.2%, while Britain's FTSE 100 was little changed. France's CAC 40 fell 0.1%. In Asia, Japan's Nikkei jumped 1.3% and the Hang Seng in Hong Kong gained 0.2%. The Shanghai Composite tumbled 1.7%. Currencies and commodities: The dollar was lower versus the euro, the British pound and the Japanese yen. U.S. light crude oil for September delivery rose $1.16 to settle at $82.49 a barrel. COMEX gold's December contract edged up $2.10 to close at $1,187.50 per ounce. Bonds: Treasury prices rose, pushing the yield on the 10-year note down to 2.91% from 2.97% late Monday. Bond prices and yields move in opposite directions. |

||

| Useful To Me Not Useful To Me | |||