| Latest Forum Topics / Others |

|

|

DOW & STI

|

|

|

Blastoff

Elite |

02-Dec-2011 08:45

|

|

x 0

x 0 Alert Admin |

Blue chips can't keep up the rally@CNNMoneyMarkets December 1, 2011: 4:28 PM ETNEW YORK (CNNMoney) -- U.S. stocks ended mixed Thursday, after a big rally on Wednesday, as investors were reluctant to push prices higher amid ongoing worries about Europe. The Dow Jones industrial average (INDU) lost 26 points, or 0.21%, to 12,020. The S& P 500 (SPX) fell 2 points, or 0.2% to 1,244. But the Nasdaq (COMP) composite added 6 points, or 0.2%, to end at 2,626. On Wednesday, all three major stock indexes closed the session more than 4% higher. The Dow's 490-point gain is the largest of 2011, and the best percentage gain since March, 2009. Art Hogan, a managing director at Lazard Capital Markets, said a retreat is not surprising given the strong gains stock markets have made this week. " We've virtually clawed back everything we gave up in November -- in three days," Hogan said. " It's difficult to not expect a bit of a pullback." Stocks surged Wednesday after the Federal Reserve said it will work with other central banks to support the global economy. The move gave investors hope that world leaders are taking the necessary steps to avoid a credit crunch stemming from Europe's sovereign debt crisis. It was also seen as a sign of how acute the problems have become and the continued lack of a long-term solution. Tobias Blattner, economist at Daiwa Capital Markets, said the action " provided further momentum to the general improvement in investor sentiment this week." " But yesterday's (over)reaction by markets to a policy measure that did little else than lowering the cost of U.S. dollar funding for banks in Europe and elsewhere just shows how desperately markets are searching for positive news during these difficult times," Blattner wrote in a note to clients. Meanwhile, French President Nicolas Sarkozy called for a new treaty to increase solidarity and financial discipline across Europe. " Let's face it, Europe can be swept by the crisis if it does not pull itself together, if it does not change," Sarkozy said in a lengthy speech addressed to the French people. German Chancellor Angela Merkel is expected to discuss the need for a more centralized budget policies in a speech Friday. Meanwhile, European Central Bank president Mario Draghi said Europe needs a " new fiscal compact" to ensure that budget rules are respected and enforced. In a comment that some investors interpreted as a sign the ECB could step up its rescue efforts, Draghi told the European Parliament that " other elements might follow" if the compact is adopted. Fears about U.S. keep investors in EuropeInvestors have been clamoring for the ECB to intervene in eurozone sovereign debt markets on a large and unlimited basis. But the central bank is reluctant to prop up government finances and risk inflation by printing money. The ECB is widely expected to announce a second interest rate cut at its policy meeting next week, after the bank lowered rates to 1.25% last month. In addition, European political leaders are expected to announce details of their plan to ensure fiscal discipline at a summit next week. Economy: The number of people filing for initial unemployment benefits rose by 6,000 to 402,000 in the latest week, the government said. That was higher than expected, with economists forecasting jobless claims to have totaled 390,000 for the week ending Nov. 26. Setting the stage for Friday's closely-watched government jobs data, a report from Automatic Data Processing showed Wednesday that private-sector employment grew by 206,000 jobs in November. Young workers getting hired againA CNNMoney survey of 21 economists predicts that the monthly jobs report due Friday will show that the economy added 110,000 jobs in November. In October, 80,000 jobs were added to payrolls. Most of the gain will likely come from the private sector, where it's estimated another 135,000 jobs were added. The ISM manufacturing Index, a survey of purchasing managers, rose 1.9 to 52.7 in November. Analysts were expecting the index to hit 51.0, according to consensus estimates from Briefing.com. Construction spending in October rose 0.8% to $798.5 billion, compared with a forecasted 0.3% increase. Same-store sales for several major retailers rose in November, according to preliminary figures from Thomson Reuters. Companies: Shares of Yahoo (YHOO, Fortune 500) jumped more than 3% Thursday, amid speculation that Chinese Internet giant Alibabaand several private equity firms are planning to bid for all of Yahoo. The news followed reports on Wednesday, that Microsoft (MSFT, Fortune 500) and private equity firm Silver Lake were considering making an offer for a minority stake in Yahoo. Shares of Lululemon (LULU) sank 5%, after the athletic appeal maker reported quarterly profits and sales figures that rose from last year, but missed analysts' expectations. Barnes and Nobel (BKS, Fortune 500) shares plunged 16%, after the bookseller reported a $6.6 million net loss for the second quarter as total sales declined. Currencies and commodities: The dollar slumped against the euro and British pound, but rose versus the Japanese yen. Oil for January delivery slipped 13 cents to $100.06 a barrel. Gold futures for December delivery fell $9.10 to $1,749 an ounce. Bonds: The price on the benchmark 10-year U.S. Treasury slipped, pushing the yield up to 2.08% from 2.07% late Wednesday. World markets: European stocks ended their session lower Thursday. Britain's FTSE 100 (UKX) slipped 0.3%, the DAX (DAX) in Germany edged lower 0.9% and France's CAC 40 (CAC40) shed 0.8%. Asian markets ended sharply higher during the trading session, after Wall Street's big rally Wednesday. The Shanghai Composite (SHCOMP) jumped 2.3%, the Hang Seng (HSI) in Hong Kong rallied 5.6% and Japan's Nikkei (N225) rose 1.9%. The gains came despite a report showing that Chinese manufacturingslowed in November. The HSBC Purchasing Managers' Index (PMI) for China fell to a reading of 47.7 last month -- the lowest level since March 2009, and down from the previous month's level of 51. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

01-Dec-2011 20:00

|

|

x 0

x 0 Alert Admin |

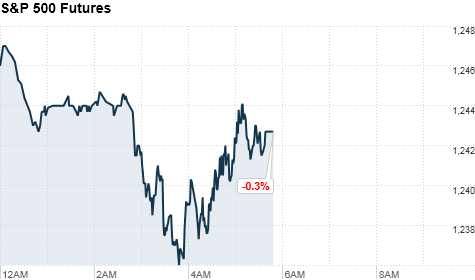

Stocks: Investors take a breather@CNNMoneyMarkets December 1, 2011: 6:16 AM ETNEW YORK (CNNMoney) -- U.S. stocks were poised to open little changed Thursday, as investors took a breather following the Dow's biggest gains since 2009. The Dow Jones industrial average (INDU), S& P 500 (SPX) and Nasdaq (COMP) futures were mixed ahead of the opening bell. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET. On Wednesday, all three major stock indexes closed the session more than 4% higher. The Dow's 489-point gain is the largest of 2011, and the best percentage gain since March 2009. Investors around the world raced to scoop up stocks, after the Federal Reserve said it will work with other central banks to support the global economy. The central banks' coordinated move gave investors hope that world leaders are taking the necessary steps, to avoid a credit crunch stemming from Europe's sovereign debt crisis. The move is an attempt to " ease strains in financial markets, and thereby mitigate the effects of such strains on the supply of credit to households and businesses, and so help foster economic activity," the banks said in a statement. Adding to the markets' enthusiasm was more evidence that the U.S. economy could be picking up steam, after better-than-expected reports onprivate-sector jobs, housing and Midwest manufacturing. World markets: Asian markets ended sharply higher during the trading session, after Wall Street's big rally Wednesday. The Shanghai Composite (SHCOMP) jumped 2.3%, the Hang Seng (HSI) in Hong Kong rallied 5.6% and Japan's Nikkei (N225) rose 1.9%. The gains came despite a report showing that Chinese manufacturing slowed in November. The HSBC Purchasing Managers' Index (PMI) for China fell to a reading of 47.7 last month -- the lowest level since March 2009, and down from the previous month's level of 51. European stocks were mixed in morning trading. Britain's FTSE 100 (UKX) added 0.4%, while the DAX (DAX) in Germany ticked down 0.5% and France's CAC 40 (CAC40) fell 0.3%. A report from Standard & Poor's early Thursday warned that another recession may be on its way to Europe, as the debt crisis in the region continues to spread. " Europe's approaching recession first took hold in Spain, Portugal and Greece, and the economic woes are now spilling over into the eurozone's core of France and Germany," said S& P's chief economist in Europe Jean-Michel Six in a statement. Economy: Thursday will bring a handful of fresh economic reports, including data on unemployment claims, construction, manufacturing and auto sales. Analysts surveyed by Briefing.com expect initial unemployment claims to have totaled 390,000 for the week ending Nov. 26, up from 393,000 the week prior. The ISM manufacturing Index, a survey of purchasing managers, is expected to hit 51.0 for November, up slightly from 50.8 in October. Construction spending in October is expected to have increased by 0.3%. Setting the stage for Friday's closely-watched government jobs data, a report from Automatic Data Processing showed Wednesday that private-sector employment grew by 206,000 jobs in November. A CNNMoney survey of 21 economists predicts that the monthly jobs report due Friday will show that the economy added 110,000 jobs in November. In October, 80,000 jobs were added to payrolls. Most of the gain will likely come from the private sector, where it's estimated another 135,000 jobs were added. Currencies and commodities: The dollar slumped against the euro and British pound, but rose versus the Japanese yen. Oil for January delivery edged up 21 cents to $100.57 a barrel. Gold futures for December delivery gained $5.50 to $1,751 an ounce. Bonds: The price on the benchmark 10-year U.S. Treasury slipped, pushing the yield up to 2.10 from 2.07% late Wednesday. |

| Useful To Me Not Useful To Me | |

|

|

|

|

Blastoff

Elite |

30-Nov-2011 23:12

|

|

x 0

x 0 Alert Admin |

Stocks surge on Fed liquidity plan@CNNMoneyMarkets November 30, 2011: 9:42 AM ETNEW YORK (CNNMoney) -- U.S. stocks surged Wednesday, after the Fed said that it will act with other central banks to boost liquidity and support the global economy. Global markets rallied on the news as well. The Dow Jones industrial average (INDU) rose 244 points, or 2%. The S& P 500 (SPX) added 25 points, or 2.1%. The Nasdaq (COMP) composite moved up 70 points, or 2.8%. The central banks' coordinated moves also gave a big boost to bank stocks and helped investors ignore Tuesday evening's Standard & Poors' downgrade of big bank stocks. Shares of Goldman Sachs (GS, Fortune 500), Morgan Stanley, (MS, Fortune 500) Citigroup (C, Fortune 500), and JPMorgan Chase (JPM, Fortune 500) spiked more than 4%. Bank of America (BAC, Fortune 500), which hit its 52-week low Tuesday, also moved up 4.5%. The Federal Reserve, along with five other central banks including the European Central Bank and the Central Bank of Canada, announced a joint action to lower interest rates on dollar liquidity swaps -- to make it cheaper for banks around the world to trade in U.S. dollars. The move is an attempt to " ease strains in financial markets and thereby mitigate the effects of such strains on the supply of credit to households and businesses and so help foster economic activity," the banks said in a statement. European markets also posted sharp gains in the wake of the news. Germany's DAX (DAX) rose more than 4%, while England's FTSE 100 (UKX) and France's CAC 40 (CAC40) were up more than 3%. World markets had already been modestly higher prior to the announcement, as reports said eurozone finance ministers have approved an increase to the region's bailout fund, and may potentially receive help from the IMF. Market to ECB: Do something!" There's a feeling we'll have a bit of action from the eurozone on the debt crisis, which has, for a change, put markets in a much more positive mood," said David Jones, chief market strategist at IG Markets. China also announced Wednesday that it will cut its banks' reserve requirements, to help ease liquidity and prop up the global economy. " This was a surprise, because for much of the last year China has been making things tougher for the banks," said Jones. " This shows China is being a bit less restrictive on its banks, and banks will now potentially be able to be more aggressive with their lending." For now, the positive news out of China and Europe is enough to overshadow the cuts made to the credit ratings of some of the biggest U.S. banks, said Jones. After the close Tuesday, Standard and Poor's cut the ratings on dozens of major banks -- including Bank of America (BAC, Fortune 500), Goldman Sachs (GS, Fortune 500) and Citigroup (C, Fortune 500). The downgrades were the result of the agency's new ratings criteria for the world's 37 largest financial institutions. French downgrade could derail eurozone rescueU.S. stocks finished mostly higher Tuesday, with the Dow and S& P extending gains from the previous day's rally, as investors remained hopeful that European leaders are making progress towards resolving the continent's debt crisis. World markets: Asian markets ended lower as all of the markets closed before the news from various central banks came out. The Shanghai Composite (SHCOMP) tumbled 3.3%, the Hang Seng (HSI) in Hong Kong dropped 1.5% and Japan's Nikkei (N225) ticked down 0.5%. Economy: A report from Automatic Data Processing showed that private sector employment grew by 206,000 jobs in November. Economists surveyed by Briefing.com expect private sector jobs to have increased by 125,000 for the month of November. The government will also release revisions of its third-quarter figures for productivity and unit labor costs. In the afternoon, the Fed's Beige Book will summarize economic outlooks from the 12 district banks across the country. Companies: Shares of American Eagle (AEO) rose after it released quarterly results before the opening bell. Meanwhile, shares of Jos. A. Bank (JOSB) fell after the retailer released its quarterly results Wednesday morning. The startup choice: Get big or get boughtOn Tuesday, American Airlines' parent company, AMR Corp. (AMR, Fortune 500), announced it had filed for Chapter 11 bankruptcy. The company's stock plunged more than 80% during trading Tuesday, but rose 59% in early trading Wednesday. Currencies and commodities: The dollar gained against the euro, the British pound and the Japanese yen. Oil for January delivery slipped $1.33 to $101.12 a barrel. Gold futures for December delivery moved up $3.02 to $1,743.60 an ounce. Bonds: The price on the benchmark 10-year U.S. Treasury rose slightly, yielding 2%. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

30-Nov-2011 08:11

|

|

x 0

x 0 Alert Admin |

Stocks edge higher on hopes for Europe@CNNMoneyMarketsNovember 29, 2011: 5:18 PM ETNEW YORK (CNNMoney) -- U.S. stocks finished mostly higher Tuesday, with the Dow and S& P extending gains from the previous day's rally, as investors remained hopeful that leaders are making progress on addressing the eurozone debt crisis. The Dow Jones industrial average (INDU) rose 33 points, or 0.3%, and the S& P 500 (SPX) added 3 points, or 0.2%. The Nasdaq composite (COMP) finished lower, losing 12 points, or 0.5%, with Green Mountain Coffee Roasters (GMCR), Wynn Resorts (WYNN) and Netflix (NFLX) dragging on the index. Financial stocks, which led Monday's advance, were also among the losers Tuesday. Bank of America (BAC, Fortune 500) and JPMorgan Chase (JPM, Fortune 500) posted the biggest declines in the Dow. Shares of Morgan Stanley (MS, Fortune 500) and Goldman Sachs (GS, Fortune 500) also fell. Bank of America's stock dropped to $5.03, the lowest since March 2009. After the closing bell Tuesday, Standard and Poor's cut the ratings on dozens of major banks, including Bank of America, Goldman Sachs, and Citigroup. The downgrades were the result the agency's new ratings criteria for the world's 37 largest financial institutions. A French downgrade could derail eurozone rescueNerves were strained after Moody's warned that 87 banks across 15 of the 17 eurozone countries could face downgrades and Italy auctioned €7.5 billion of 3- and 10-year bonds that drew the highest yields in years. Borrowing costs in Italy have been above the uncomfortable 7% mark for days. But investors are banking on European leaders to step up and agree to a detailed resolution to Europe's debt crisis. European leaders are working on a new plan to ensure fiscal discipline across the euro area. The proposal is expected to give the European Union greater authority over the budget policies of individual eurozone nations. " The story continues to be Europe, and signs of anything positive coming out of there in a deeply oversold market are enough to trigger a rally," said Fred Dickson, chief market strategist at D.A. Davidson & Co. A two-day meeting of eurozone finance ministers got underway Tuesday. However, investors aren't expecting any major announcements until a European Union summit next week. Market to ECB: Do something!Optimism about a possible Europe solution, along with strong Black Friday weekend sales, also sent stocks surging on Monday. But Dickson remains unconvinced that the enthusiasm will last. " We've had short-term rallies based on frequent bursts of positive news, but those are quickly dampened by reality when nothing comes of these European meetings," he said. " I'm not negative, but I'm skeptical. I'll view these rallies as short-term events until we see signs of a more definitive agreement reached by the eurozone and the European Central Bank." Economy: Stocks also found support after the Conference Board's Consumer Confidence Index shot up to 56 in November from 40.9 the prior month. Economists were expecting the reading to come in at 42.5. The S& P/Case Shiller index, a gauge of home prices, dropped 3.9% in the third quarter compared to a year earlier, following a 5.8% year-over-year decline in the previous quarter. Companies: American Airlines' parent company, AMR Corp. (AMR, Fortune 500), announced that it has filed for Chapter 11 bankruptcy in order to " achieve a cost and debt structure that is industry competitive." The company's stock plunged more than 80%. Shares of rival airlines, including Delta (DAL, Fortune 500) and United Continental (UAL, Fortune 500), gained traction. Shares of Tiffany & Co (TIF). sank after the luxury jewelry retailer reported earnings that topped forecasts, but reeled in its guidance for the fourth quarter. Corning's (GLW, Fortune 500) stock tumbled after the company slashed its fourth-quarter outlook for profit and production of glass for LCD displays, after a major Korean customer notified Corning that it will not honor its contract for the remainder of the year. World markets: European stocks closed slightly higher. Britain's FTSE 100 (UKX) ticked up 0.5%, the DAX (DAX) in Germany rose 1% and France's CAC 40 (CAC40) added 0.4%. Asian markets ended with sharp gains. The Shanghai Composite (SHCOMP) and the Hang Seng (HSI) in Hong Kong climbed 1.2%, and Japan's Nikkei (N225) rallied 2.3%. Currencies and commodities: The dollar slumped against the euro, the British pound and the Japanese yen. Oil for January delivery rose $1.58 to settle $99.79 a barrel. Gold futures for December deliver rose $2.60 to settle at $1,713.40 an ounce. Bonds: The price on the benchmark 10-year U.S. Treasury edged lower, pushing the yield up to 2% from 1.96% late Monday. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

09-Nov-2011 15:08

|

|

x 0

x 0 Alert Admin |

Singapore shares lower at midday on Wednesday

Published on Nov 9, 2011

Singapore shares were 0.04 per cent lower at 12.46pm on Wednesday. The STI was down 1.27 points at 2,865.25.

About 701.5 million shares were traded. Gainers beat losers 182 to 174. |

| Useful To Me Not Useful To Me | |

|

|

|

|

Blastoff

Elite |

02-Nov-2011 11:20

|

|

x 0

x 0 Alert Admin |

STI now green.... |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

02-Nov-2011 07:17

|

|

x 0

x 0 Alert Admin |

Stocks fall hard on Greece fearsNovember 1, 2011: 4:49 PM ET

NEW YORK (CNNMoney) -- New fears about the fate of the European rescue plan reverberated through stock markets in the United States and around the world Tuesday. Following European markets, U.S. stocks ended sharply lower across the board. Bank stocks were hit especially hard. The bad news was propelled by Greek Prime Minister George Papandreou's surprise announcement that he would put his country's participation in last week's European debt plan to a voter referendum.

In the end, the Dow Jones industrial average (INDU) finished 297 points lower, falling 2.5%, the S& P 500 (SPX) sank 35 points, or 2.8%, and the Nasdaq (COMP) lost 77 points, or 2.9%. Earlier, all three indexes were off around 3%.

Papandreou may be demonstrating " political brinkmanship in order to solidify his position in the view of the public," despite the highly unpopular austerity measures, said Mark Luschini, chief investment strategist at Janney Montgomery Scott. The referendum could also be Greece's way of warning European officials that they need better terms that the public will support, or else the deal will fall apart, added Luschini. Or it could be a " complete policy blunder." " Investors don't know what the referendum is going to mean, but they're selling first and will ask questions later," said Luschini. " If Greece ends up demanding different terms to the deal, European officials will be less willing to help. And that could put the prospect of a disorderly Greek default back on the table." The market's fear gauge, the VIX (VIX), spiked 19% to 35.60. Any reading above 30 signals investor worry. Earlier, the index has surged 25%. Stocks are coming off sharp losses Monday, as questions and doubts arose regarding the rescue package agreed upon by European leaders last week.

MF Global may have millions missingCompanies: Bank stocks were hit especially hard in Tuesday's sell-off, with shares of Morgan Stanley (MS, Fortune 500) and Citigroup (C, Fortune 500) shares off nearly 8%. Bank of America (BAC, Fortune 500), JP Morgan Chase (JPM, Fortune 500) and Goldman Sachs (GS, Fortune 500) were down more than 5%. Pfizer (PFE, Fortune 500) shares rose after the company reported quarterly earnings that beat Wall Street's estimates. The drugmaker was the only gainer on the Dow, and among a handful of S& P 500 stocks in positive territory. Shares of Baker Hughes (BHI, Fortune 500) plunged, making it the big decliner on the S& P 500. The oilfield contractor missed earnings estimates. MetroPCS (PCS) shares also fell after the wireless service provider reported lackluster earnings results. Meanwhile, Bank of America said it will drop its planned $5 debit card usage fee after widespread customer complaints. World markets: World markets tumbled Tuesday, with banks leading the decline globally. Germany's DAX (DAX) lost 5%, Britain's FTSE 100 (UKX) dropped 2.2%, and France's CAC 40 (CAC40) tumbled 5.4% Societe Generale, BNP Paribas, and Credit Agricole shed between 12% and 17% in Paris. In Germany, shares of Deutsche Bank (DB) dropped 8%. Asian markets ended mostly in the red, after a report showed China's manufacturing activity slowed in September. The Shanghai Composite (SHCOMP) was flat, while the Hang Seng (HSI) in Hong Kong fell 2.5% and Japan's Nikkei (N225) shed 1.7%. Economy: The ISM index show manufacturing activity barely expanded in October, coming in at 50.8. Any level above 50 indicates growth in the sector. But the reading fell from September and came in below expectations.

Currencies and commodities: The dollar rose against the euro and British pound, and versus the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 2.00% from 2.18% late Monday. -- CNN's Elinda Labropoulou in Athens, Greece, contributed to this report. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

25-Oct-2011 13:18

|

|

x 0

x 0 Alert Admin |

Singapore shares edge lower by midday on TuesdayPublished on Oct 25, 2011

Singapore shares were lower at 12.44pm on Tuesday, with the benchmark Straits Times Index at 2,757.49, down 0.13 per cent, or 3.46 points.

About 574 million shares exchanged hands. Gainers beat losers 169 to 161. |

| Useful To Me Not Useful To Me | |

|

|

|

|

Blastoff

Elite |

25-Oct-2011 13:14

|

|

x 0

x 0 Alert Admin |

Singapore manufacturing output up 12.8% in SeptemberPublished on Oct 25, 2011

On a year-on-year basis, Singapore's manufacturing output increased 12.8 per cent in September 2011. Excluding biomedical manufacturing, output declined 12.5 per cent.

On a seasonally adjusted month-on-month basis, manufacturing output declined 0.7 per cent in September 2011. Excluding biomedical manufacturing, output declined 2.3 per cent. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

25-Oct-2011 08:28

|

|

x 0

x 0 Alert Admin |

Stocks get merger, earnings boostOctober 24, 2011: 4:54 PM ETNEW YORK (CNNMoney) -- U.S. stocks ended sharply higher Monday, as investors welcomed two merger announcements and strong earnings from Caterpillar.

The Dow Jones industrial average (INDU) gained 105 points, or 0.9%, the S& P 500 (SPX) rose 16 points, or 1.3%, and the Nasdaq composite (COMP) 62 points, or 2.4%. Caterpillar (CAT, Fortune 500) led the Dow's gains, after the equipment manufacturer reported record revenue for the third quarter and issued a strong outlook. Caterpillar said the eurozone debt problems and slowing U.S. economic growth are " concerning," but they are not signaling " the onset of recession." Financial stocks were also big winners, with Citigroup (C, Fortune 500), JPMorgan Chase (JPM, Fortune 500), and Bank of America (BAC, Fortune 500) shares all rising more than 3%. Investors were also cautiously optimistic about progress made toward addressing Europe's debt crisis. Europe's leaders nearing debt solutionEurope's top leaders said Sunday that they were getting closer to finalizing a plan to solve the continent's debt crisis. But with a final agreement not expected before Wednesday, the actual details remained under wraps.

Euro headlines offer opportunities - StockTwitsOn Friday, U.S. stocks rallied to their highest levels since early August, as investors grew increasingly hopeful about a resolution to Europe's debt crisis.

Companies: Health insurer Cigna (CI, Fortune 500) agreed to acquire HealthSpring (HS) for $3.8 billion, sending shares of the health care medical plan provider up more than 30%. Shares of RightNow Technologies (RNOW) spiked after Oracle (ORCL, Fortune 500) said it will buy the company for $1.5 billion, or $43 a share. Shares of WebMD (WBMD) advanced, after an SEC filing revealed that Carl Icahn, of Icahn Enterprises, owns 7.94% of the health care information site. Icahn said he believes that WebMD shares are " undervalued from a long-term perspective." Shares of Netflix (NFLX) tumbled 21% in after-hours trading when the company announced third-quarter earnings after the closing bell. Netflix beat earnings and revenues estimates for the quarter, but said it lost 800,000 U.S. subscribers. Netflix also issued a weaker-than-expected forecast for the fourth quarter. Economy: U.S. housing finance agencies -- the Federal Housing Finance Agency, with Fannie Mae and Freddie Mac -- unveiled changes aimed at helping troubled homeowners refinance mortgages.

Troubled homeowners get a lifelineNew York Fed President William Dudley called for policymakers to make it easier for homeowners to refinance at lower mortgage rates and prop up home prices, while speaking at Fordham University on Monday. World markets: European stocks ended sharply higher. Britain's FTSE 100 (UKX) added 1.1%, the DAX (DAX) in Germany rose 1.5% and France's CAC 40 (CAC40) gained 1.4%. Asian markets also rallied, after an HSBC reading on Chinese manufacturing showed activity in the sector rose to a five-month high in October. The report lessens fears that China's economy is slowing too quickly. The Shanghai Composite (SHCOMP) climbed 2.3%, the Hang Seng (HSI) in Hong Kong surged 4.1% and Japan's Nikkei (N225) rose 1.9%. Currencies and commodities: The dollar fell against the euro, British pound, and the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury fell slightly, pushing the yield up to 2.23%. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

20-Oct-2011 07:55

|

|

x 0

x 0 Alert Admin |

Slowing economy stifles stocksOctober 19, 2011: 4:19 PM ET

NEW YORK (CNNMoney) -- U.S. stocks closed lower Wednesday, after the Federal Reserve released a pessimistic report on regional economic activity. The Dow Jones industrial average (INDU) closed down 72 points, or 0.6%. The S& P 500 (SPX) shed 15 points, or 1.3%. The Nasdaq composite (COMP) lost 53 points, or 2%. The three " E" s -- the economy, Europe, and earnings -- continue to dominate. But with few reports of consequence out of Europe, investors had been focusing on the latest earnings reports, keeping stocks mostly near the breakeven line for much of the day. But stocks took a hit in the afternoon after the Fed's " Beige Book" painted a picture of an economy that's losing steam. The report made caused investors nervous.

Travelers (TRV, Fortune 500) sparked a rally among insurance stocks when it reported earnings Wednesday. The company told investors that consumers were willing to accept higher insurance premiums. Travelers' stock closed the day up 6%. Chubb (CB, Fortune 500), and Allstate (ALL, Fortune 500) followed suit, ending the day up 0.1% and 2.1% respectively. Got the market blues? Try being a hedge fundStill, market participants said that trading was relatively light, with many investors remaining gun shy, following the recent volatile roller coaster moves. On Tuesday, stocks surged into the close, following a report suggesting that Europe's bailout fund may get a big boost. The gains pushed the Nasdaq into positive territory for 2011, while the Dow is at breakeven. The S& P 500 remains in the red, but the broad index finished at its highest level since Aug. 3. Economy: The latest economic report showed inflation took a bigger bite out of consumers' wallets in September. A 3.9% jump in prices over the last 12 months marked the biggest rise in three years.

On Tuesday, Moody's Investors Service downgraded Spain's government bond ratings to A1 from Aa2. This follows similar action taken by Standard & Poor's last week. Companies: After the market closed Tuesday, Apple (AAPL, Fortune 500), the maker of Macs and iPhones, reported a 39% increase in third quarter sales to $28.3 billion. But the figures fell short of forecasts. Morgan Stanley (MS, Fortune 500), which has had investors worried about its exposure to Europe, posted a solid $2.2 billion profit before Wednesday's opening bell. Also late Tuesday, Dow component Intel (INTC, Fortune 500) announced earnings that beat analysts' estimates and sales that hit a new high. And Yahoo (YHOO, Fortune 500) said reported third-quarter sales and earnings that fell compared to last year, but came in ahead of analyst forecasts. Early Wednesday, Dow component United Technologies (UTX, Fortune 500) beat revenue estimates. BlackRock (BLK, Fortune 500), the world's largest money manager, surpassed forecasts on both sales and profit for the quarter. Shares of Abbott Laboratories (ABT, Fortune 500) rose after the medical company said it will split into two separate publicly traded companies. One company will be focused on medical products, and retain the name Abbott, and the other will focus on research-based pharmaceuticals, with a name to be revealed at a later date.

American Express (AXP, Fortune 500) and eBay (EBAY, Fortune 500) announced quarterly earnings after the markets closed. World markets: European markets all closed slightly higher. Britain's FTSE 100 (UKX) ended up 0.6%, the DAX (DAX) in Germany gained 0.4% and France's CAC 40 (CAC40) added 0.3%. Asian markets ended mixed. The Shanghai Composite (SHCOMP) slipped 0.3%, while the Hang Seng (HSI) in Hong Kong rose 1.3% and Japan's Nikkei (N225) ticked up 0.4%. Currencies and commodities: The dollar fell against the euro, the Japanese yen and the British pound.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, barely pushing the yield up to 2.16% from 2.15% late Tuesday. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

19-Oct-2011 10:59

|

|

x 0

x 0 Alert Admin |

Singapore shares open higher on WednesdayPublished on Oct 19, 2011

Singapore shares opened 0.72 per cent higher on Wednesday. The STI rose 19.52 points to 2,744.21.

About 110.3 million shares exchanged hands. Gainers beat losers 145 to 32. |

| Useful To Me Not Useful To Me | |

|

|

|

|

Blastoff

Elite |

14-Oct-2011 11:07

|

|

x 0

x 0 Alert Admin |

Singapore avoids technical recession, growth outlook dimsPublished on Oct 14, 2011

Singapore narrowly avoided a technical recession by growing 1.3 per cent in the third quarter from the second quarter. Growth was boosted by the pharmaceuticals sector, but growth prospects have weakened and the Ministry of Trade and Industry narrowed its growth forecast for the full year from 5 per cent to 6 per cent to 'around 5 per cent'. With the growth outlook deteriorating due to the euro zone debt crisis and weakening growth in the United States, the Government said that Singapore will likely grow below its potential growth rate of 3 per cent to 5 per cent next year. Economists said the focus has now turned from inflation to growth. The Monetary Authority of Singapore eased monetary policy, by reducing the slope of the exchange rate band, allowing for a slower pace of strengthening of the Singapore dollar. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

14-Oct-2011 08:48

|

|

x 0

x 0 Alert Admin |

Singapore economy grows by 5.9% in Q3Published on Oct 14, 2011

The Singapore economy grew by 5.9 per cent on a year-on-year basis in the third quarter of 2011, an improvement from the 1.0 per cent growth in the second quarter.

The Singapore economy grew by 5.9 per cent on a year-on-year basis in the third quarter of 2011, the Ministry of Trade and Industry (MTI) said on Friday. Advanced estimates showed an improvement from the 1.0 per cent growth in the second quarter, the MTI said. On a seasonally-adjusted quarter-on-quarter annualised basis, Singapore's economy grew by 1.3 per cent, after contracting by 6.3 per cent in the previous quarter. For the year as a whole, the MTI expects GDP growth to be around 5.0 per cent. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

14-Oct-2011 08:34

|

|

x 0

x 0 Alert Admin |

Financials drag stocks lowerOctober 13, 2011: 4:38 PM ET

NEW YORK (CNNMoney) -- U.S. stocks ended mixed Thursday, as investors took a breather from the recent rallies and turned cautious after a lackluster earnings report from JPMorgan Chase. The Dow Jones industrial average (INDU) dropped 41 points, or 0.4%, and the S& P 500 (SPX) fell 4 points, or 0.3%. Financials were among the big losers, as JPMorgan Chase (JPM, Fortune 500) and Bank of America (BAC, Fortune 500) dragged on the Dow with shares falling about 5%. Citigroup (C, Fortune 500) and Morgan Stanley (MS, Fortune 500) also sank. Meanwhile, technology stocks were among the strongest performers. The tech-heavy Nasdaq composite (COMP) was up 16 points, or 0.6%, with Nvidia (NVDA) and Micron Technology (MU, Fortune 500) gaining between about 6%. After the closing bell, Google (GOOG, Fortune 500) reported third-quarter earnings that handily beat estimates, and said that its Google+ social network now has 40 million users. Shares spiked more than 5% in after-hours trading. But throughout the trading day, JPMorgan's earnings results weighed on the market. The bank reported profit and revenue figures that topped Wall Street estimates, but fell from a year earlier. Investors were disappointed as CEO Jamie Dimon said the investment bank is being " extremely cautious, while navigating through this challenging economic environment."

JPMorgan 'cautious' as income dipsEurope's ongoing debt troubles have been weighing on Wall Street for months. A survey by CNNMoney shows that 80% of the experts agree that the most challenging hurdle for the stock market is the eurozone debt crisis. On Thursday, Slovakia became the final euro area country to ratify overhauling the European Financial Stability Facility (EFSF), which is essentially a bailout for Greece and other troubled eurozone countries. The approval was widely expected, after it had previously voted the measure down earlier this week. Later this week, finance ministers from the world's leading economies will meet to discuss ways to strengthen the faltering global recovery, focusing on the European debt crisis.

On Wednesday, stocks finished sharply higher, as investors grew optimistic about a resolution for Europe's debt crisis, after European Commission President Jose Manuel Barroso announced a plan to recapitalize European banks.

Companies: Research in Motion (RIMM) shares continued to struggle, after the BlackBerry-maker company's worst-ever outage that started in Europe on Monday. RIM said BlackBerry service has been fully restored worldwide Thursday morning. Apple's (AAPL, Fortune 500) stock ticked higher. The company's iPhone 4S goes on sale in Apple stores Friday, as well Sprint (S, Fortune 500), Verizon (VZ, Fortune 500) and AT& T (T, Fortune 500) locations and select Best Buy (BBY, Fortune 500), Target (TGT, Fortune 500) and Wal-Mart (WMT, Fortune 500) stores. The pre-order of the iPhone 4S was wildly successful, topping 1 million sales in 24 hours. Raj Rajaratnam, former manager of the the defunct hedge fund Galleon Group, was sentenced on Thursday to 11 years in federal prison and fined $10 million for insider trading. Congress passes trade dealsEconomy: First-time filings for unemployment benefits fell 1,000 to 404,000, according to the government's weekly report. Economists were expecting 406,000 initial jobless claims. Continuing claims slipped to 3.67 million, slightly below estimates for 3.7 million ongoing claims.

World markets: European stocks ended lower. Britain's FTSE 100 (UKX) lost 0.7%, the DAX (DAX) in Germany shaved 1.3% and France's CAC 40 (CAC40) slid 1.5%. Asian markets ended higher. The Shanghai Composite (SHCOMP) ticked up 0.8%, the Hang Seng (HSI) in Hong Kong jumped 2.3% and Japan's Nikkei (N225) added 1%. Currencies and commodities: The dollar gained against the euro and British pound, but slipped against the Japanese yen. Peanut butter prices get nutty - StockTwitsOil for November delivery dropped $1.34 to settle at $84.23 a barrel. Gold futures for December delivery fell $14.10 to settle at $1,668.50 an ounce. Bonds: The price on the benchmark 10-year U.S. Treasury edged slightly higher, pushing the yield down to 2.18% from 2.23% late Wednesday. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

13-Oct-2011 11:06

|

|

x 0

x 0 Alert Admin |

Singapore shares open lower on ThursdayPublished on Oct 13, 2011

Singapore shares opened 0.02 per cent lower on Thursday. The STI fell 0.42 points to 2,737.33 in early trade.

About 111.5 million shares exchanged hands. Gainers beat losers 106 to 64. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

13-Oct-2011 08:09

|

|

x 0

x 0 Alert Admin |

Stock advance on Europe hopesOctober 12, 2011: 5:01 PM ET

NEW YORK (CNNMoney) -- A broad rally lost steam during the final minutes of trading, but stocks still ended sharply higher Wednesday as investors welcomed the latest plan to recapitalize European banks. " We're continuing to see a shift in investor sentiment," said Art Hogan, managing director at Lazard Capital Markets. " Last week, it seemed like the sky was falling and there was no end in sight. Now, there's a perception that Europe will come up with a TARP-like backstop for European banks." European Commission president Jose Manuel Barroso said Wednesday that policymakers need to act immediately to resolve the long-running crisis. Barroso also said that banks that do not satisfy capital requirements should be barred from paying out dividends and bonuses.

The Dow Jones industrial average (INDU) rose 102 points, or 0.9%, the S& P 500 (SPX) added 12 points, or 1%, and the Nasdaq composite (COMP) gained 22 points, or 0.8%. Earlier in the session, all three indexes were up about 2%, and the the Dow briefly turned positive for the year. Barroso calls for immediate action on debt crisisFinancial stocks were leading the gains, with JPMorgan Chase (JPM, Fortune 500), Bank of America (BAC, Fortune 500), Citigroup (C, Fortune 500) and Wells Fargo (WFC, Fortune 500) up between 2% and 5%.

Wednesday's advance was the sixth out of the last seven days for the S& P 500 and Nasdaq, and fifth for the Dow. The three major indexes are up between 8% and 11% since Oct. 3, when stocks hit their lowest levels in more than a year. Every development overseas is getting investors' front-and-center attention. More than 80% of the experts surveyed by CNNMoney agree that debt problems overseas are the most challenging hurdle for the market. U.S. stocks ended mixed Tuesday as investors spent most of the day waiting for the outcome of Slovakian parliament's vote to overhaul the EFSF. Shortly after U.S. markets closed Tuesday, Slovakia voted the measure down.

Companies: Shares of Alcoa (AA, Fortune 500) slipped after the aluminum producer reported quarterly income that fell short of analysts' expectations, but the company brought in more revenue than anticipated. PepsiCo (PEP, Fortune 500)'s stock rose after the company reported stronger revenue Wednesday on global snack and beverage volume. PepsiCo also saw gains from its the acquisition of Wimm-Bill-Dann, a Russian dairy and juice company.

Meanwhile, shares of Liz Claiborne (LIZ) surged after the apparel and accessories maker announced it is selling several of its brands for $328 million. J.C. Penney (JCP, Fortune 500) is buying the company's namesake Liz Claiborne brand as well as the Monet brand. Liz Claiborne also sold its Dana Buchman brand to Kohl's (KSS, Fortune 500). Shares of Wal-Mart (WMT, Fortune 500) moved higher after company executives told an annual meeting for analysts that same-store sales have been positive for the past three months. Sales at the world's largest retailer have been declining for nine straight quarters. Wal-Mart is scheduled to report third-quarter results next month. Research in Motion's (RIMM) stock dipped as the BlackBerry outage that started on Monday in Europe, the Middle East and Africa continued to spread, hitting customers in the United States and Canada on Wednesday. Economy: Federal Reserve policymakers left the door open to another round of asset purchases, or QE3, in the near future, according to minutes of their most recent meeting. In September, the central bank stopped short of expanding its balance sheet and launched so-called Operation Twist, a program to shift assets from short-term Treasuries into long-term Treasuries. The U.S. Senate failed Tuesday to approve President Obama's jobs bill. The 50-49 vote in favor of the measure fell short of the 60 senators needed to advance the $447 billion dollar plan. The city council of Harrisburg, Pa., voted to file for bankruptcy protection Tuesday night. The state capital of Pennsylvania, with just under 50,000 residents, was facing a possible takeover of its operations by the state government under a receivership. World markets: European stocks finished with strong gains. Britain's FTSE 100 (UKX) ticked up 0.7%, the DAX (DAX) in Germany gained 2% and France's CAC 40 (CAC40) added 2.2%. Asian markets ended mixed. The Shanghai Composite (SHCOMP) jumped 3% and the Hang Seng (HSI) in Hong Kong added 1%, while Japan's Nikkei (N225) slipped 0.4%. Currencies and commodities: The dollar lost ground against the euro and the British pound, but rose versus the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 2.23% from 2.16% late Tuesday. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

12-Oct-2011 21:23

|

|

x 0

x 0 Alert Admin |

Stocks set to rise at the openOctober 12, 2011: 8:53 AM ETNEW YORK (CNNMoney) -- U.S. stocks were set to open higher Wednesday, as investors await the latest plan for European bank recapitalization and sort through Slovakian politics. Dow Jones industrial average (INDU), S& P 500 (SPX) and Nasdaq (COMP) futures were all between 0.7% and 1.1% higher ahead of the opening bell. Stock futures indicate the possible direction of the markets when they open at 9:30 a.m. ET. " Market sentiment is improving. Expectations are that we will get some resolution in Europe," said Peter Cardillo, chief market economist at Rockwell Global Capital. The president of the European Commission, Jose Manuel Barroso, will lay out his plan for European bank recapitalization Wednesday in a speech at 9 a.m. ET. Every development overseas is getting investors' front-and-center attention. More than 80% of the experts surveyed by CNNMoney agree that debt problems overseas are the most challenging hurdle for stocks, which have been struggling to claw back from monthly lows. U.S. stocks ended mixed Tuesday, with the technology sector rally bucking a broader decline, as investors watched the unfolding drama in Europe. Investors had been awaiting the outcome of Slovakian parliament's vote to overhaul the European Financial Stability Fund (EFSF) -- essentially a bailout fund for the region's most troubled nations. But, shortly after U.S. markets closed Tuesday, Slovakia voted the measure down. Europe bank rescue is not enoughThe proposed bailout needs to be ratified by all 17 eurozone nations, and Slovakia was the last country to vote. The development is a bit of a setback for European leaders that are struggling to deal with the continent's growing debt crisis. However, Tuesday's " no" vote does not necessarily mean that the plan to expand the EFSF is dead. Actually, investors expect that in its second round of voting with a new government in place, Slovakia will manage to pass the bailout. " In a second round of voting, they will probably pass the EFSF here," said Cardillo. Meanwhile, on the domestic front, the U.S. Senate failed to approve President Obama's jobs bill. The 50-49 vote in favor of the measure fell short of the 60 senators needed to advance the $447 billion dollar plan. Companies: In addition to watching the debt drama unfold across the Atlantic, investors will be tuning in for the latest round of company earnings, Cardillo said. Alcoa (AA, Fortune 500) reported quarterly income that fell short of analysts' expectations, but the company brought in more revenue than anticipated. Shares of Alcoa were down 3% in premarket trade. The aluminum producer is the first Dow component to report third-quarter results. PepsiCo (PEP, Fortune 500) reported stronger revenue Wednesday on global snack and beverage volume. PepsiCo also saw gains from its the acquisition of Wimm-Bill-Dann, a Russian dairy and juice company. Shares were up 1.2% in premarket trade. Meanwhile, shares of clothing company Liz Claiborne (LIZ) surged almost 18% in premarket trade, after the company announced it would sell off a few of its brands. 7 banks that are still awesomeOverall, S& P 500 company earnings are expected to have climbed almost 13% in the third quarter of 2011, according to earnings tracker Thomson Reuters. Revenue of the companies in the benchmark index are expected to have risen 10%. Economy: The latest minutes from the Federal Open Market Committee's meeting will be released at 2 p.m. ET. World markets: European stocks rose in midday trading. Britain's FTSE 100 (UKX) ticket up 0.4%, the DAX (DAX) in Germany gained 1.2% and France's CAC 40 (CAC40) added 1.4%. Asian markets ended mixed. The Shanghai Composite (SHCOMP) jumped 3% and the Hang Seng (HSI) in Hong Kong added 1%, while Japan's Nikkei (N225) slipped 0.4%. Currencies and commodities: The dollar lost ground against the euro and the British pound and was nearly flat against the Japanese yen. Oil for November delivery gained 14 cents to $85.95 a barrel. Gold futures for December delivery rose $24.90 to $1,685.90 an ounce. Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 2.22%. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

12-Oct-2011 11:36

|

|

x 0

x 0 Alert Admin |

Singapore shares open lower on WednesdayPublished on Oct 12, 2011

Singapore shares opened 0.57 per cent lower on Wednesday. The STI fell 15.41 points to 2,677.64 in early trade.

About 54.5m shares exchanged hands. Losers beat gainers 84 to 48. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

12-Oct-2011 07:46

|

|

x 0

x 0 Alert Admin |

Stocks mixed on Europe uncertaintyOctober 11, 2011: 5:21 PM ET

NEW YORK (CNNMoney) -- U.S. stocks ended mixed Tuesday, with a technology sector rally bucking a broader decline, as investors await the next step after Slovakia voted against overhauling the European bailout fund. The Dow Jones industrial average (INDU) fell 17 points, or 0.1%, to end at 11,416. The S& P 500 (SPX) ended little changed at 1,195. The Nasdaq composite (COMP) gained 17 points, or 0.6%, to 2,583. The choppy trading came a day after stocks rallied sharply, as investors cheered a pledge from European leaders to unveil a plan for solving the eurozone's debt crisis by the end of the month.

But the tone remains cautious. All day, investors were eagerly awaiting the outcome of the deeply divided Slovakian parliament's vote to overhaul the European Financial Stability Fund (EFSF) -- essentially a bailout fund for the region's most troubled nations. Shortly after U.S. markets closed Slovakia voted the measure down.

In another reminder of Europe's debt problems, Standard & Poor's cut the credit ratings or lowered the outlook on 15 Spanish banks. Meanwhile, international monitors in Greece completed a review of the nation's finances, suggesting the latest installment of bailout money could be disbursed in early November. Volcker rule raises more questionsIn the United States, the Federal Deposit Insurance Corp. released a draft of the Volcker Rule, which intends to take risky bets out of the financial system in hopes of preventing another crisis. The rule aims to rein in how banks use their own accounts to chase profits -- so-called proprietary trading. Companies: Alcoa (AA, Fortune 500) reported quarterly income that fell short of analysts' expectations, but the company brought in more revenue than anticipated.

Peter Boockvar, chief market strategist with Miller Taback & Co., said he expects " a mixed bag" of profits and losses in the quarter. " There will definitely be some disappointments," he said, adding that other companies will continue to report earnings and sales growth. Overall, S& P 500 company earnings are expected to have climbed almost 13% in the third quarter of 2011, according to earnings tracker Thomson Reuters. Revenue of the companies in the benchmark index are expected to have risen 10%. Shares of Dollar Thrifty (DTG) fell 1.8% after the rental car company said it plans to remain an independent company after seeking a buyer for over a year. Avis dropped out of the running last month, and Hertz (HTZ, Fortune 500) didn't raise its offer. Currencies and commodities: The dollar rose against the euro, the British pound and the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 2.16% from 2.07% late Friday. World markets: European stocks closed mixed. Britain's FTSE 100 (UKX) was flat and France's CAC 40 (CAC40) shed 0.2%, while the DAX (DAX) in Germany added 0.3%. Asian markets ended higher. The Shanghai Composite (SHCOMP) rose 0.2%, the Hang Seng (HSI) in Hong Kong jumped 2.4%, and Japan's Nikkei (N225) gained 2%. Markets were reacting to Monday's news that China's sovereign wealth fund's investment arm purchased shares of four state-owned banks: Agricultural Bank of China, Industrial & Commercial Bank of China, Bank of China and China Construction Bank. |

| Useful To Me Not Useful To Me | |