The rebound phase is facing a hurdle as prices approach the $4.05-to-$4.10 range. Quarterly momentum, which rebounded off an oversold low, has also met with resistance and is retreating from both its equilibrium line and moving average. In addition, the rebound took place on significantly lighter volume than the selldown, and the move was peppered with black candles.

On July 3 and 4, the counter formed a dark cloud cover on the candlestick chart, establishing resistance at $4.20. Support is raised to $3.84 for the upcoming retreat. An earlier breakdown provided a significant downside objective, which would be negated if prices can hold at $3.84.

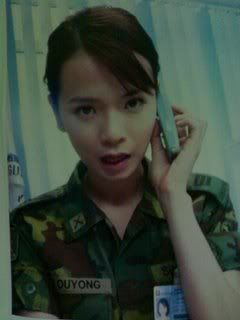

Training to be a soldier....

Training to be a soldier....