| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||||||||||||||||

|

pharoah88

Supreme |

31-Aug-2010 12:24

|

||||||||||||||||

|

x 0

x 0 Alert Admin |

Nobody doubts the United States President’s team is supremely busy juggling oil spills, Muslim cultural centres, convincing ignoramuses he has a birth certificate and averting recession. Yet there’s no excuse for blowing off last week’s Association of South-east Asian Nations (Asean) trade meeting in Vietnam. It was a dreadful decision and its significance didn’t escape members of the fourth-biggest market for US goods. This is no time for the US to be taking the most dynamic economies for granted. Not with China becoming an ever-bigger player both in Asia and globally. On any list of Mr George W Bush’s failings, ignoring Asia deserves a prominent mention. When his administration bothered with Asia, it was all terrorism all the time. There was little talk about potential, cooperation or partnership. Mr Bush just wanted to know how many bad guys governments were rounding up. He tried to make amends in the twilight of his presidency, naming a US ambassador to Asean in 2008. Recently, Mr Obama tapped that official, Mr Scot Marciel, to be US Ambassador to Indonesia. Mr Obama hasn’t bothered to name a new Asean envoy. The US missed a timely opportunity last week to confer with the economic ministers of Asean’s 10 members — along with counterparts from Australia, China, India, Japan, South Korea, New Zealand and Russia. At a time of global crisis, one the US caused, does Mr Obama really want to be sending a message of indifference to Asia? Coming a week after the announcement that China’s economy has surpassed Japan’s, the US’ closest Asian ally, you would think the White House would be stepping up a charm offensive. Instead, it risks turning off the region. “Confidence in the US and its ability to lead and follow through on commitments is based on its economic well-being, and that status is being questioned by friends and competitors alike in Asia,” Mr Ernest Bower, an analyst at the Centre for Strategic and International Studies in Washington, wrote in a recent report. China’s rapid growth is slowly, but surely, chipping away at the US’ importance. Granted, at almost three times China’s economy, the US will long be a vital customer for Asia’s goods. Officials here also know that depending on growth in a developing economy is risky. Yet neglecting future trade ties with the liveliest economies is just plain dumb. Asia is churning out a fast-growing number of billionaires and is home to 3 billion consumers who aspire to join them. The US wants to be in on that process. For a guy who talked big about reengaging Asiafunny way of showing it., Mr Barack Obama has aA DAMAGED BRAND Mr Obama must not forget just how much the 2008 meltdown damaged the US brand. During Asia’s 1990s crisis, US officials preached the free-market gospel. They told leaders to raise interest rates to support currencies, slash spending and debt, scrap subsidies and avoid bailing out industries. When the US faced a crisis, it did exactly the opposite. There’s also considerable grumbling over the US dollar. True or not, the theory that the US is devaluing to help exporters is making the rounds. That perception is a problem if you want China to let its currency strengthen. It doesn’t play well in Japan, where panic is rising over the strong yen. Nor can the US complain about corruption in Asia. Incestuous ties between Washington and Wall Street helped cause the US crisis. Conflicts of interest between regulators and oil companies led to BP Plc’s devastating Gulf of Mexico leak. The US has little moral high ground on dodgy dealings. That’s a shame, considering the magnitude of Asia’s corruption fight. In Indonesia, for example, officials face an uphill battle to weed out graft and allow more of the nation’s people to benefit from 6 per cent growth. In the Philippines, the honeymoon enjoyed by Mr Benigno Aquino, since becoming President in June, ended last week in gunfire. Eight Hong Kong tourists being held hostage in Manila died in a botched rescue attempt. The tragedy was emblematic of what plagues the nation’s economy. The gunman was a former police inspector who was dismissed on allegations of extortion. The standoff’s surreal finale suggested a breakdown in the nation’s security apparatus, ineptness at many levels and weak diplomacy. Corruption is the common link in all these shortcomings. Mr Obama got off to a good start, becoming the first US leader to meet with Asean in November. Vietnam was the perfect opportunity to go further — to discuss views on credit markets, North Korea’s provocations, China’s currency, Australia’s election, Russia’s growth prospects and Japanese deflation. This last topic is a growing concern. Not only have consumer prices fallen for 17 consecutive months, but Japan now has a leadership battle on its hands. Prime Minister Naoto Kan faces a challenge to remain head of the ruling party by veteran kingmaker Ichiro Ozawa. It’s the last thing Japan needs: Its sixth Prime Minister in three years. Mr Obama’s team could have learned about all of this, and much more, if it had only shown up in Asia. It should do so as soon as possible. The writer is a Bloomberg News columnist. The opinions expressed are his own. |

||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||

|

pharoah88

Supreme |

31-Aug-2010 12:15

|

||||||||||||||||

|

x 0

x 0 Alert Admin |

Obama blows off Asia’s 3 billion wannabe billionaires US misses key opportunity to confer with Asean’s economic ministers william pesek At a time of global crisis, one the US caused, does Mr Obama really want to be sending a message of indifference to Asia? Coming a week after the announcement that China’s economy has surpassed Japan’s, you would think the White House would be stepping up a charm offensive. Instead, it risks turning off the region. |

||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||

|

|

|||||||||||||||||

|

Hulumas

Supreme |

31-Aug-2010 12:04

Yells: "INVEST but not TRADE please!" |

||||||||||||||||

|

x 0

x 0 Alert Admin |

Thank you for the correction. It should be STI 1,600 then corresponding DOW at 36,000.-

|

||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||

|

pharoah88

Supreme |

31-Aug-2010 11:59

|

||||||||||||||||

|

x 0

x 0 Alert Admin |

stI 10,800 [STi 3,000 x 3.6 = 10,800 stI] [dOw 10,000 x 3.6 = 36,000 DOW]

|

||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||

|

pharoah88

Supreme |

31-Aug-2010 11:54

|

||||||||||||||||

|

x 0

x 0 Alert Admin |

US consumer spending up 0.4 per cent WASHINGTON Consumer spending rose 0.4 per cent last month after three lacklustre months, the Commerce Department said yesterday. Personal incomes were up 0.2 per cent last month, an improvement over June, when incomes had not risen at all. The July spending gain was the highest since a 0.5 per cent rise in March. But the concern is that demand could taper off if unemployment remains near double digits. — Americans spent last month at the fastest pace in four months, helped by a jump in demand for automobiles.AP |

||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||

|

|

|||||||||||||||||

|

niuyear

Supreme |

31-Aug-2010 09:00

|

||||||||||||||||

|

x 0

x 0 Alert Admin |

"""""""Stocks drop as fear returns""""""How can they not fear when China is getting stronger over the years..........LOL! |

||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||

|

Blastoff

Elite |

31-Aug-2010 06:56

|

||||||||||||||||

|

x 0

x 0 Alert Admin |

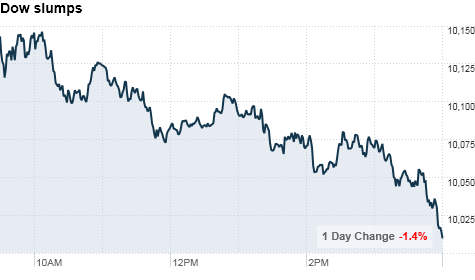

Stocks drop as fear returns NEW YORK (CNNMoney.com) -- Stocks fell sharply late Monday, ending a lackluster session more than 1% lower, as the tone on Wall Street turned bearish ahead of big economic reports due later this week. The Dow Jones industrial average (INDU) slumped 141 points, or about 1.4%, to close The S&P 500 (SPX) slid 15 points, or 1.5%, and the Nasdaq (COMP) composite shed 33 points, or 1.5%. Stocks opened lower as investors responded to a mixed report on American consumers, a pair of billion-dollar corporate deals and a move by the Bank of Japan to shore up its economy. But the selling gained momentum late in the session as the few traders who aren't on vacation this week turned cautious. "There's nothing to take us higher so we're continuing to go lower," said Dan Greenhaus, chief economic strategist at Miller, Tabak and Co. With volume expected to be light this week, Greenhaus said he wouldn't be surprised to see some big swings. "It's tough to read anything into the action on days like this when volume is so low," he said. "What we're hoping for now is for some stability in the data to put a floor under stocks." The economy will continue to be a big driver this week, with reports on consumer spending, home sales and manufacturing activity on tap. But mostly, investors are gearing up for the government's monthly jobs report, due before the opening bell Friday. Looking ahead, investors will take in a reading on consumer confidence before the market opens on Tuesday. Reports on home prices and regional manufacturing activity are also due in the morning. In the afternoon, the Federal Reserve will release minutes from its most recent policy meeting. Meanwhile, Friday's sell-off was broad based, with all but one Dow stock falling. Among the biggest losers on the blue chip measure were 3M (MMM, Fortune 500), Caterpillar (CAT, Fortune 500) and American Express (AXP, Fortune 500). Market breadth was negative. Declining shares outnumbered advancing shares by five to two on the New York Stock Exchange. Trading volume was anemic, with 818 million shares changing hands. Stocks rallied at the end of last week, to gain nearly 2% on Friday. But all three major indexes ended the week lower and are on track to post monthly declines. Economy: A government report showed that personal income rose 0.2% in July, in line with expectations. The report said consumer spending outpaced income growth, rising 0.4% in July. Economists surveyed by Briefing.com were expecting spending to rise 0.3% during the month, after a 0.1% rise the month before. But personal savings, as a portion of disposable income, came in lower than the previous month. Merger Monday French drugmaker Sanofi-Aventis (SNY) agreed to buy biotech firm Genzyme (GENZ, Fortune 500) in an $18.5 billion cash deal. Genzyme has reportedly been snubbing Sanofi's advances for the past month, prompting the French firm to send a so-called 'bear hug' letter that is one stop short of a hostile takeover. Shares of Sanofi fell about 1% and Genzyme's stock rallied 3.4%. Giant chipmaker Intel (INTC, Fortune 500)'s stock fell 1.6% after the company inked a deal to acquire the wireless unit of German chipmaker Infineon Technologies in an all-cash deal valued at $1.4 billion. Intel recently purchased security technology firm McAfee Inc. (MFE) for $7.7 billion in cash on Aug. 19. On Friday, Intel warned its third-quarter sales would fall short of its previous forecast. 3M (MMM, Fortune 500) said it will acquire biometric security company Cogent Systems (COGT) for $10.50 per share in a deal valued at $943 million. Shares of 3M slipped 1.6%. The bidding war for 3PAR (PAR) continues. HP (HPQ, Fortune 500) has currently topped Dell (DELL, Fortune 500), with their bid of $2 billion, or $30 per share, that was made on Friday. "We've seen a lot of cash build up on balance sheets [but] revenue growth prospects are still limited" said Bruce McCain, chief market strategist at Key Private Bank, adding that companies will probably continue to focus on cost cutting to boost profits. Japan: The Bank of Japan announced steps at an emergency meeting Monday to curb the yen's strength and lift the country's struggling economy. The central bank announced a new ¥10 trillion, or $117.15 billion, six-month loan program for financial institutions, in addition to the ¥20 trillion it has been offering in three-month loans. The bank also held its key-interest rate at 0.1%. But some analysts said the move was not aggressive enough to boost Japan's ailing economy. "It's another reminder that growth is slow," said McCain, in reference to the BOJ plan. "That anxiety doesn't help when people are already concerned about the slow growth cycle and double-dip fears haven't been vanquished." World markets: European shares ended the day mixed. The CAC 40 in France and the DAX in Germany both fell about 0.6%. Britain's FTSE 100 climbed 0.9%. Asian markets ended higher, following the Bank of Japan's announcement to ease monetary pressure. Japan's benchmark Nikkei index jumped up 1.8%, and the Shanghai Composite rose 1.6%. The Hang Seng in Hong Kong added 0.7%. Currencies and commodities: The dollar rose against the euro and the British pound, but fell versus the Japanese yen. Oil futures for October delivery slipped 63 cents to $74.54 a barrel. Gold for December delivery gained $1.30 to $1,239.20 an ounce. Bonds: The yield on the 10-year Treasury note fell to 2.54% from 2.64% late Friday. |

||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||

|

Hulumas

Supreme |

30-Aug-2010 14:12

Yells: "INVEST but not TRADE please!" |

||||||||||||||||

|

x 0

x 0 Alert Admin |

SO STI 6,000.-

|

||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||

|

|

|||||||||||||||||

|

pharoah88

Supreme |

30-Aug-2010 10:40

|

||||||||||||||||

|

x 0

x 0 Alert Admin |

|

||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||

|

pharoah88

Supreme |

28-Aug-2010 17:13

|

||||||||||||||||

|

x 0

x 0 Alert Admin |

|

||||||||||||||||

| Previous close | 9,985.81 |

| Open | 9,982.18 |

| Day high | 10,159.88 |

| Day low | 9,936.62 |

| Today's volume | 207,764,070 |

| Average daily volume (3 months) | 204,005,036 |

| Average P/E | 15.5 |

| 1 year change | +6.35% |

Supreme

x 0

Alert Admin

Dow Jones Industrial Average

| 10,150.65

Data as of Aug 27

|

+164.84 / +1.65% +164.84 / +1.65%

Today’s Change

|

9,253

Today|||52-Week Range

11,258

|

-2.66%

Year-to-Date

|

Master

x 0

Alert Admin

SAME FOR STI

- excessive optimism propping up the market seeps away,

Supreme

x 0

Alert Admin

US stock market faces a bloodbath

SocGen strategist: Global economy sliding back into recession

LONDON

He said there was too much hope among investors, with excessive valuations in the United States, but he predicted it would come to an end in the coming months as economic data increasingly pointed to a double-dip recession.

“Equity investors are in for a rude shock. The global economy is sliding back into recession and they are still not even aware that these events will trigger another leg down in valuations, the third major bear market since the equity valuation bubble burst,” he said.

He forecast a return to the “valuation nadir last seen in 1982”, with the Standard and Poor’s 500 Index bottoming at around 450. Early Friday in New York, the benchmark was at 1,050.

Government bonds, which are considered lower risk assets compared with equities, have remained in demand during the crisis and yields are at a low level by historical standards - where low yields indicate strong demand.

Mr Edwards predicted that a “global cyclical failure” would push yields on US 10-year yields down to between 1.5 and 2 per cent and those on German bunds to below 1.5 per cent.

“So far the equity market has shrugged off much of the weaker data that abounds, and has not joined the bond market in a perceptive move.

“The equity market will though crumble like the house of cards it is, when the nationwide US manufacturing Institute of Supply Management slides below 50 into recession territory in coming months.” The ISM index fell to 55.5 in July from 56.2 in June.

Earlier this month, US rating agency Moody’s warned that time was running out for the big countries to prevent a full-blown sovereign debt crisis.

“Genuinely adverse debt dynamics were only expected to materialise in 15 to 20 years.

“This crisis has fast-forwarded history, eroding all the time available to adjust, “ said the group’s quarterly

In its adverse scenario, it said the US would crash by 2013 if growth falters, with interest payments topping 14 per cent of tax revenues.

The US, United Kingdom, Germany, France and Spain are all at risk of an “interest rate shock”, either because they must roll over a cluster of short-term debt or because their deficits are so large, it said.

The equity market will though crumble like the house of cards it is, when the nationwide US manufacturing ISM slides below 50 into recession territory in coming months. Societe Generale market strategist Albert Edwards

Supreme

x 0

Alert Admin

Giving Up on a Big Loan

Homeowners whose properties have a mortgage of more than $1 million have stopped paying at a rate that greatly exceeds those who hold cheaper mortgages. In many cases, the delinquencies appear intentional.

Serious Delinquency Rate (90 Days or more)

OWNER OCCUPIED 17%

SECOND HOME 10%

INVESTOR 22%

Supreme

x 0

Alert Admin

Living in Luxury But Refusing to Pay

By DAVID STREITFELD LOS ALTOS, California — The housing bust that began among the working class in remote subdivisions and quickly progressed to the suburban middle class is striking the upper class in privileged neighborhoods like this one in Silicon Valley.

Whether it is their primary residence, a second home or a house bought as an investment, the rich have stopped paying the mortgage at a rate that greatly exceeds the rest of the population.

More than one in seven homeowners with loans in excess of a million dollars are seriously delinquent, according to data compiled for The New York Times by the real estate analytics firm CoreLogic.

By contrast, homeowners with less lavish housing are much more likely to keep up. About one in 12 mortgages below the million dollar mark are delinquent.

The CoreLogic data suggest that many of the wealthy are purposely dumping their financially draining properties, just as they would a sour investment.

“The rich are different: they are more ruthlessKhater, CoreLogic’s senior economist.,” said Sam

Five properties here in Los Altos were scheduled for foreclosure auctions in a recent issue of The Los Altos Town Crier, the weekly newspaper where local legal notices are posted. Four have unpaid mortgage debt of more than $1 million, with the highest amount $2.8 million.

In Las Vegas, Ken Lowman, a longtime agent for luxury properties, said 4 of the 11 sales he brokered in June were distressed properties.

“I’ve never seen the wealthy hit like this before,” Mr. Lowman said.

“They made their plans based on the best of all possible scenarios — that their incomes would continue to grow, that real estate would never drop. Not many had a plan B.”

The defaulting owners, he said, often remain as long as they can, he said. “They’re in denial.”

In Los Altos, where the median home price of $1.5 million makes it one of the most exclusive towns in the United States, several houses that had been scheduled for auction recently were still occupied.

The people who answered the door were reluctant to explain their circumstances. Lenders are fearful that many of the 11 million or so homeowners who owe more than their house is worth will walk away from them, especially if the real estate market begins to weaken again.

“Those with high net worth have other resources to lean on if they get in trouble,” said Mr. Khater, the analyst. “If they’re going delinquent faster than anyone else, that tells me they are doing so willingly.”

The vast majority of owners in upscale communities are still paying the mortgage, of course. But they appear to be cutting back in other ways. The once thriving Los Altos downtown is pocked with more than a dozen empty storefronts in a sixblock stretch.

In the middle of a workday, one troubled homeowner here leaned over his laptop at the kitchen table, trying to maneuver his way out from under his debt. His fivebedroom house, drained of hundreds of thousands of dollars of equity over the last 13 years, was scheduled for auction. Last year, after his latest business (he has had several) failed in what he called “the global meltdown,” the man, a technology entrepreneur, said he quit making his $9,000 monthly payments.

“I’m going to be downsizing,” he said.

Carol Pogash contributed reporting.

Supreme

x 0

Alert Admin

A double-dip recession for US?

WASHINGTON

US gross domestic product growth in the April-June period fell from 3.7 per cent in the first quarter on the back of weak private inventory investment and a massive trade deficit, the Commerce Department said on Friday.

Corporate profits grew last quarter at the slowest rate in a year and employee wages in the prior three months were revised lower.

The revised GDP growth was sharply lower than the annualised 2.4 per cent projected by the government last month but better than economists’ forecasts of growth to be shaved by nearly half to 1.4 per cent.

“Investors are growing increasingly concerned about the US economy and there are repercussions in the Japanese market,” said Shinkin Asset Management fund manager Naoki Fujiwara.

Federal Reserve Chairman Ben Bernanke said on Friday after the GDP data release that the central bank “will do all that it can” to ensure a continuation of the economic recovery.

Stopping short of committing to any specific action, he outlined steps it might take if the growth continued to slow, such as making another large-scale purchase of securities.

Speaking at the Jackson Hole gathering of central bankers, he described the US economic outlook as “inherently uncertain” and said the economy “remains vulnerable”.

“Incoming data suggests that the recovery of output and employment in the US has slowed in recent months, to a pace somewhat lower than most Federal Open Market Committee participants projected earlier this year,” Mr Bernanke said.

A Fed purchase of securities, most likely government debt or mortgage paper, will drive down rates on debt in a move that it hopes will spur more spending by American consumers and businesses.

The Fed’s previous purchases of about US$1.25 trillion ($1.7 trillion) in mortgagebacked securities were focused on what Mr Bernanke called “credit easing” or pushing down rates on mortgages to support housing.

Chief economist at JPMorgan, Mr Michael Feroli, said that the central bank could buy up to US$1 trillion more in US Treasuries as needed if the economic growth continued to falter.

The other options Mr Bernanke laid out on Friday included cutting to zero the interest rate the Fed pays for banks to keep money parked at the central bank. That rate is now 0.25 per cent.

“The issue at this stage is not whether we have the tools to help support economic activity and guard against disinflation. We do,’’ he said.

About an hour after the opening bell in New York, the Dow Jones Industrial Average was up 0.5 per cent at 10,036 in a knee-jerk response to the GDP data and Mr Bernanke’s stimulus assurance.

— The United States government has slashed second-quarter growth to just 1.6 per cent, signalling a sharp slowdown in the recovery and renewing fears that a double-dip recession in the world’s largest economy would weigh on the export-oriented economies of Asia.AgenciesMaster

x 0

Alert Admin

TELEGRAPH

Stock markets face a 'bloodbath', warns SocGen strategist Albert Edwards

Investors should brace themselves for an equities "bloodbath" and a further fall in bond yields when the current excessive optimism propping up the market seeps away, Albert Edwards, a strategist at Société Générale, has warned.

Supreme

x 0

Alert Admin

Commentary

Stocks rallied to close out the week on Friday, as Federal Reserve Chairman Ben Bernanke reassured investors that the Fed would take action if economic conditions worsen further. The markets also benefited from a downward revision to second quarter GDP growth that was not quite as severe as some had feared. Full Article

Economic News

Economic activity in the second quarter expanded by far less than previously estimated, according to a report released by the Commerce Department on Friday, although the downward revision to the pace of gross domestic product growth was not quite as severe as economists had expected. Full Article

The Federal Reserve stands ready to provide further stimulus if the economic situation deteriorates rapidly, the nation's top central banker said Friday. Soon after government data showed that the US economy grew at a slower pace in the second quarter than initially estimated, Federal Reserve Chairman Ben Bernanke acknowledged that economic activity has been "somewhat less vigorous" than policymakers were expecting. Full Article

Elite

x 0

Alert Admin

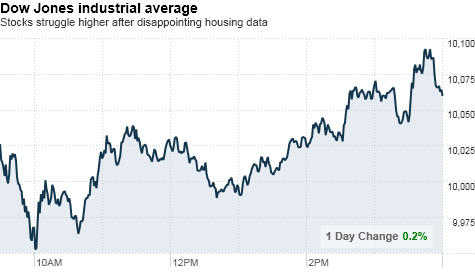

Stocks recover from housing blues

NEW YORK (CNNMoney.com) -- Stocks finished higher Wednesday after spending most of the day in the red, following another round of dismal housing news.

The Dow Jones industrial average (INDU) gained 20 points, or 0.2%, the S&P 500 (SPX) rose 3 points, or 0.3%, and the Nasdaq (COMP) composite climbed 18 points, or 0.8%.

Stocks sold off sharply immediately after the housing data but managed to recoup some losses as homebuilding and housing material stocks crept higher.

Lennar Corp., (LEN) KB Home (KBH) and Toll Brothers (TOL) all gained more than 3%.

"[It's] a sign that they had priced in the bad news, and this has allowed the rest of the market to come back," said Peter Boockvar, chief market strategist with Miller Taback & Co.

But the same news that lifted homebuilding stocks battered the financial sector, with big names like Wells Fargo (WFC, Fortune 500) and Citigroup (C, Fortune 500) edging lower.

"[Banks] have given back the entire year of gains because they are holding mortgage-related debt," said Boockvar. "House prices have taken a leg down because of this data, and if a person pays less for a home, this hurts a bank's balance sheet."

On Tuesday, stocks sank after a 27% plunge in existing home sales fueled worries about an economic slowdown, sending the Dow 134 points lower on the day.

Last week, the Dow and S&P ended down for a second straight week as disappointing economic reports slammed investor confidence.

"It's been a brutal few weeks," said Phil Orlando, chief equity market strategist at Federated Investors. "Stocks are extraordinarily cheap and oversold at this point, but the question is, are they sufficiently cheap to discount the economic weakness?"

Economy: New home sales unexpectedly plummeted to the lowest level on record in July, dropping 12.4% in July, the government reported. Economists had expected sales to bump higher.

The disappointing data comes right on the heels of another dismal housing report on Tuesday, which showed a sharp drop in existing home sales.

Meanwhile, new orders for long-lasting goods fell short of forecasts, edging up a modest 0.3% in July. Economists had expected the government report to show a 3% jump.

Companies: Homebuilder Toll Brothers (TOL) booked its first quarterly profit in three years on Wednesday, thanks largely to a boost from the homebuyer tax credit.

The company said net income was $27.3 million in the quarter, or 16 cents per share, after posting a loss of $472.3 million, or $2.93 a share, a year ago. Shares of Toll Brothers rose 6%.

World markets: European shares slumped. The CAC 40 in France sank 1%, Britain's FTSE 100 lost 0.9%, while the DAX in Germany ended 0.6% lower.

Late Tuesday, Standard & Poor slashed Ireland's sovereign debt rating to double-A-minus due to the massive cost of bailing out the nation's banks.

Asian markets also ended lower. Japan's benchmark Nikkei index dropped 1.7%, hitting a 16-month low. The Hang Seng in Hong Kong shed 0.1%, and the Shanghai Composite sank more than 2%.

Currencies and commodities: The dollar fell against the euro and the British pound, but firmed versus the Japanese yen.

Oil futures for October delivery gained 89 cents to settle at $72.52 a barrel. Gold for December delivery rose $7.90 to settle at $1,1241.30 an ounce.

Bonds: The yield on the 10-year note rose to 2.54%, bouncing off a 19-month low of 2.49% on Tuesday.

Supreme

x 0

Alert Admin

Change this thread to ; China and STI. Forget about DOW.

During the US treasuary secretary's speech in Peking University, he tried to reassure one questioner that China's investments in U.S. government debt were "very safe," the response was perhaps an indication of the onset of a new economic order: the students laughed.

not sure whether did he roll on the floor though. lol!