| Latest Forum Topics / Others |

|

|

DOW & STI

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

niuyear

Supreme |

09-Sep-2010 15:58

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

US dollars are floating everywhere, all over the world, how to let it fail or simply it is just too big to fail, though it looks like it is failing.....

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Hulumas

Supreme |

09-Sep-2010 14:44

Yells: "INVEST but not TRADE please!" |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

There will be consolidation period throughout September for SGX and catalist this year!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

09-Sep-2010 13:56

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Sep 9, 2010 STI higher at midday SINGAPORE shares were higher at midday on Thursday, with the benchmark Straits Times Index at 3,014.38, up 0.10 per cent, or 2.96 points. About 808.2 million shares exchanged hands. Gainers beat losers 196 to 156. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

08-Sep-2010 07:37

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks fall on European bank woes By Annalyn Censky, staff reporterSeptember 7, 2010: 4:47 PM ET NEW YORK (CNNMoney.com) -- U.S. stocks fell Tuesday as renewed worries about European banks weighed on financial stocks and investors flocked to such safe-haven assets such as the dollar, Treasurys and gold. All three indexes fell about 1%. The Dow Jones industrial average (INDU) fell 107 points to 10,341, the S&P 500 (SPX) slipped 13 points to close at 1,092 and the Nasdaq (COMP) lost 25 points to 2,209, according to early tallies. During last week's stock rally, the Dow turned positive for the year. But Tuesday's losses quickly turned the index back into the red. On Friday, the major indexes gained more than 1%, after a government report showed fewer jobs were lost in July than economists had expected. U.S. markets were closed Monday for Labor Day. "We're in September, which is traditionally a softer month for stocks, and so far we've escaped that," said Peter Cardillo, chief market economist for Avalon Partners. "But lingering worries won't diminish until we get more indicators that show the decline in economic activity is leveling off and beginning to turn around again." Bank stress socks Europe Economy: Fears that European banks may be in worse shape than indicated by recent financial stress tests spooked investors, said Anthony Conroy, head trader at BNY ConvergEx Group. "Investors are questioning the shape of the banks, because reports are saying that their sovereign debt holdings are weaker than previously thought," he said. "People see this news coming out and begin to worry more about a possible double-dip [recession], because you can't have a healthy economy without healthy financials." The renewed worries came after an analysis in Tuesday's Wall Street Journal that said Europe's stress tests -- aimed at measuring the health of the continent's financial sector -- understated major banks' holdings of government debt. Financial stocks sank after the report, with American Express (AXP, Fortune 500) leading the way with nearly 4% losses and Citigroup (C, Fortune 500) and JP Morgan Chase (JPM, Fortune 500) both falling more than 2%. Shares of Bank of America (BAC, Fortune 500) also fell 2%. 0:00 /2:32Obama's $300 billion New Deal President Obama will introduce a new $200 billion tax cut on Wednesday that will allow businesses to write off all new investments in equipment made between now and the end of 2011. A reading on hiring from employment firm Manpower showed that employers are likely to remain reluctant to boost hiring in the fourth quarter. Is Mark Hurd really worth $6 billion to Oracle? Companies: Shares of Oracle (ORCL, Fortune 500) gained 6% after the business software maker said it has hired former Hewlett-Packard (HPQ, Fortune 500) CEO Mark Hurd as its president. Later in the day, HP filed suit to block Hurd from the taking the job. Meanwhile, Barclays (BCS) shares sank 5.4% after the British bank announced its CEO John Varley will retire March 31. Bob Diamond, the bank's U.S.-born president and investment banking chief, will replace Varley. World markets: European shares dipped. The CAC 40 in France tumbled 1.1%, the DAX in Germany fell 0.6%, and Britain's FTSE 100 lost 0.6%. Asian markets ended mixed. Japan's benchmark Nikkei index dropped 0.8%, while the Shanghai Composite edged up 0.1% and the Hang Seng in Hong Kong gained 0.2%. Currencies and commodities: Gold for December delivery rose $8.20 to settle at $1,259.30 an ounce, after surging to a two-month high of $1,261.60 earlier in the day. Oil futures for October delivery dropped 51 cents to settle at $74.09 a barrel. Bonds: The reignited eurozone fears also spurred investors to buy U.S. Treasurys, sending prices higher and yields lower. The yield on the 10-year Treasury note fell to 2.61% from 2.71% late Friday. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

pharoah88

Supreme |

05-Sep-2010 18:07

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Better than expected ... WASHINGTON — Fears that the world’s largest economy was spiralling back into recession eased as US unemployment data on Friday turned out to be not as bad as expected. The Dow Jones Industrial Average jumped 1 per cent to 10,419, half an hour after the opening bell in New York, following the US government release that said employers shed almost half as many jobs as markets predicted. Revisions also showed the picture in previous months to be brighter than first thought. Overall non-farm payrolls showed a drop of 54,000 jobs in August. Economists had forecast on average a decline of about 100,000 jobs. The private sector, regarded as a key barometer of the economic outlook, added 67,000 jobs, above the 41,000 forecast. “Double dip fears will dissipate on the back of this result, though we suspect that the US labour market is not out of the woods yet. Employment growth is still insufficient to stabilise the unemployment rate,” said Mr Rob Carnell at ING Financial Markets. The unemployment rate nudged higher to 9.6 per cent from 9.5 per cent in July as the size of the workforce increased. The latest figures will come as a relief to President Barack Obama who has faced criticism that the US recovery has so far largely been a jobless one. Still, the payrolls data marked the third monthly drop in jobs. Many workers in the US continue to struggle to find full-time work. The number of people employed part time rose by 331,000 over the month to 8.9 million. With the economy still not adding any jobs, many analysts expect the US Federal Reserve to step in with extra support for the recovery in the form of quantitative easing — a way of pumping money into the economy. “One swallow does not make a summer and looking behind these figures, slow growth is still the order of the day. This does not change anything and does not alter our expectations of further quantitative easing in the future,” said Mr Jeremy Cook, chief economist at World First. Agencies | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

pharoah88

Supreme |

04-Sep-2010 01:19

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

10,417.81

+97.71 (0.95%)

Real-time: 1:16PM EDT

more »

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Hulumas

Supreme |

03-Sep-2010 18:53

Yells: "INVEST but not TRADE please!" |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

No harm, right?

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

epliew

Supreme |

03-Sep-2010 18:51

Yells: "no worries be happy !" |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

strong belief ! | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

pharoah88

Supreme |

03-Sep-2010 18:31

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

BELIEF !  dOn't knOw mUch abOUt d-O-w dOw dOn't knOw mUch abOUt s t I dOn't knOw mUch abOUt F A dOn't knOw mUch abOUt T A dOn't knOw mUch abOUt MBA dOn't knOw mUch abOUt PhD dOn't knOw mUch abOUt S E X dOn't knOw mUch abOUt H I V dOn't knOw mUch abOUt rIsk dOn't knOw mUch abOUt FEAR dOn't knOw mUch abOUt warrant dOn't knOw mUch abOUt C I A dOn't knOw mUch abOUt C F A dOn't knOw mUch abOUt C M A dOn't knOw mUch abOUt C P A dOn't knOw mUch abOUt B O B dOn't knOw mUch abOUt C O C dOn't knOw mUch abOUt P A P dOn't knOw mUch abOUt T A T dOn't knOw mUch abOUt C F D dOn't knOw mUch abOUt merItOcracy dOn't knOw mUch abOUt medIOcrIty dOn't knOw mUch abOUt lOngIng dOn't knOw mUch abOUt shOrtIng dOn't knOw mUch abOUt lOsIng dOn't knOw mUch abOUt faIlIng Only knOw hOw tO lOve GENTING Only knOw hOw tO lOve TWiNS Only knOw abOUt PROPHECY Only knOw abOUt LEGACY Only knOw abOUt LEGEND Only knOw abOUt BELIEF Only knOw abOUt TRUTH Only knOw abOUt SUCCESS Only knOw abOUt wInnIng Only knOw abOUt CHEERS Only knOw abOUt lOve |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

pharoah88

Supreme |

03-Sep-2010 18:15

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

03-Sep-2010 08:07

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Sep 3, 2010S'pore factory output downKey barometer delivers its lowest reading since April last yearFACTORY output is showing signs of faltering with a key indicator suggesting that Singapore's manufacturing sector has shrunk for the first time in 16 months.

The Purchasing Managers' Index (PMI), a barometer of factory production, fell to 49.4 in August, an early warning sign of slowing output given that a reading of less than 50 indicates contraction. Such a low reading has not been seen since April last year when the PMI index hit 49.2. The data, released on Thursday, comes after figures last week showed that production in July grew at the slowest pace in eight months. That ended a string of strong double-digit expansions in manufacturing output since the end of last year. Firm data for August's factory production are not out until later this month but, with the PMI coming in well below expectations, economists are apprehensive. 'This was a little worse than expected,' said Action Economics' David Cohen of the PMI numbers. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

03-Sep-2010 07:10

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

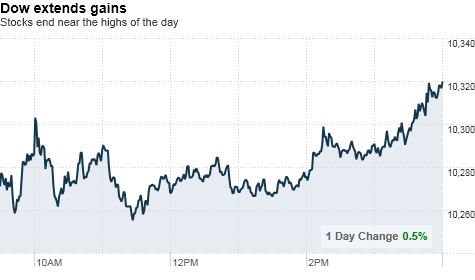

Stocks drift higher ahead of jobs report

NEW YORK (CNNMoney.com) -- Stocks pushed higher at the end of a listless session Thursday, extending gains from the previous day, as investors prepare for a critical report on the U.S. job market on Friday. The Dow Jones industrial average (INDU) gained 50 points, or 0.5%. The S&P 500 (SPX) gained 9 points, or 0.9%, and the Nasdaq (COMP) composite rose 23 points, or 1%. Stocks were supported by better-than-expected sales from major U.S. retailers and an increase in pending home sales. But the tone was relatively subdued following a big rally on Wednesday and ahead of the government's monthly jobs report on Friday. "The market is holding its own," said Peter Cardillo, chief market economist at Avalon Partners. "The fact that we're holding yesterday's gains is a good indication that we could rally after Labor Day if the jobs report is within expectations." The job market has been a major source of worry on Wall Street. Consumer spending, which drives the bulk of U.S. economic activity, is closely linked to unemployment. In particular, investors are eager to see signs that private sector employers could begin hiring again as public sector jobs related to the Census have disappeared. "It all depends how bad that private sector number is," said Cardillo. On Wednesday, payroll processing firm ADP said private sector employers cut 10,000 jobs in August -- a drop from the downwardly revised 37,000 jobs they added the month before. Economists had expected the report to show an increase in private sector payrolls.

IBM (IBM, Fortune 500) and Merck (MRK, Fortune 500) led decliners on the Dow, while Boeing (BA, Fortune 500), 3M (MMM, Fortune 500) and Home Depot (HD, Fortune 500) gained. Of the 30 stocks in the blue-chip average, 24 were higher. After closing out a dismal August, stocks rallied more than 2% on Wednesday to start September on a strong note. But the market is still down between 1% and 3% year to date.

Sales tracker Thomson Reuters said 65% of the retailers in its index, that have reported sales so far, have beat expectations. Shares of major retailers were higher in early trading. JC Penny (JCP, Fortune 500), Macy's (M, Fortune 500) and Nordstrom (JWN, Fortune 500) led the charge. Economy: Weekly jobless claim figures dipped slightly, by 6,000 claims, to 472,000 in the week ended Aug. 28. Economists expected the number of Americans filing new claims for unemployment insurance to have edged up slightly last week to 475,000.

The housing data helped boost shares of homebuilders Hovnanian (HOV), PulteGroup (PHM) and D.R. Horton. (DHI)

Companies: Shares of Mariner Energy (ME) fell 2.5% after a fire occurred on an oil and gas production platform the company owns in the Gulf of Mexico.

Burger King (BKC) said Thursday that it has agreed to be acquired by investment firm 3G Capital in a deal valued at $4 billion. Shares of the fast-food company rose 25% after surging 14% in the previous session on rumors of the deal. HP (HPQ, Fortune 500) raised its offer to buy data storage company 3PAR to $33 per share, topping a $32 bid from Dell (DELL, Fortune 500). The computer makers have been engaged in a bidding war for 3PAR since Dell made an $18 per share offer on Aug. 16. Asian markets closed higher. Japan's benchmark Nikkei index added 1.5%. The Shanghai Composite rose 1.3%, and the Hang Seng in Hong Kong gained 1.2%. Oil futures for October delivery rose $1.03 to $74.94 a barrel. Gold for December delivery added $5.30 to $1,253.40 an ounce. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

epliew

Supreme |

02-Sep-2010 19:17

Yells: "no worries be happy !" |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

what is the catch ? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

02-Sep-2010 19:13

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks poised for flat startNEW YORK (CNNMoney.com) -- U.S. stocks were set for a flat start Thursday, following 2% gains the previous day, as investors remained cautious ahead of a wave of economic data. Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were little changed ahead of the opening bell. Futures measure current index values against perceived future performance. After closing out a dismal August, stocks began the new month with a bang Wednesday, rallying more than 2% after strong readings on manufacturing boosted investor confidence. Economy: Weekly jobless claim figures are due before the opening bell. Economists expect the number of Americans filing new claims for unemployment insurance to have edged up slightly last week to 475,000 from 473,000 in the previous week.

A separate government report is expected to show that second-quarter business productivity was downwardly revised to a decline of 1.7%, from the 0.9% drop that was initially projected. Asian markets closed higher. Japan's benchmark Nikkei index added 1.5%. The Shanghai Composite rose 1.3%, and the Hang Seng in Hong Kong gained 1.2%. Oil futures for October delivery rose 9 cents to $74.00 a barrel. Gold for December delivery added 50 cents to $1,248.60 an ounce. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

02-Sep-2010 14:22

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Sep 2, 2010STI higher at middaySINGAPORE shares were higher at midday on Thursday, with the benchmark Straits Times Index at 2,991.31, up 0.28 per cent, or 8.48 points. About 1.08 billion shares exchanged hands. Gainers beat losers 251 to 129. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Hulumas

Supreme |

02-Sep-2010 09:01

Yells: "INVEST but not TRADE please!" |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

The posting topic is "DOW & STI" so . . . how about STI ?

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

02-Sep-2010 08:01

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

September surprise: Stocks soar

NEW YORK (CNNMoney.com) -- The bulls are back on Wall Street. After a bearish August, stocks roared into September with a major rally Wednesday, as investors cheered signs of strength in the manufacturing sector. The Dow Jones industrial average (INDU) gained 256 points, or 2.2%.The S&P 500 (SPX) soared 31 points, or 2.9%. The Nasdaq (COMP) composite rallied 63 points, or 3%. Stocks rallied right out of the gate as investors welcomed a rebound in Chinese manufacturing and robust economic growth in Australia. The advance kicked into high gear following an unexpectedly strong report on U.S. manufacturing activity. The manufacturing data boosted industrial names and companies in the materials sector. Caterpillar (CAT, Fortune 500), United Technologies (UTX, Fortune 500), Boeing (BA, Fortune 500) all gained between 2% and 4%. Energy producers Exxon (XOM, Fortune 500) and Chevron (CVX, Fortune 500) also rose as oil prices spiked 3%. But the rally was broad-based. Six stocks gained for every one that fell on the New York Stock Exchange. All 30 Dow components closed higher, with Bank of America (BAC, Fortune 500) gaining over 6%. While the improvement in manufacturing allayed some concerns about the U.S. economy, traders said the market remains vulnerable given the uncertain outlook for growth this year. Investors shrugged off a weaker-than-expected report from payroll processing firm ADP, which is widely seen as a leading indicator for Friday's jobs report from the Labor Department. "This market is looking for something to grab on to," said Mark Luschini, chief investment strategist for Janney Montgomery Scott. "And for the moment it's manufacturing." The focus could shift to jobs Thursday morning when the government's weekly report on initial claims for jobless benefits comes out. Investors will also take in the latest readings on factory orders and pending home sales shortly after the market opens. "The manufacturing number is nice to hang your hat on, but the state of the consumer is still paramount for what's happening in the economy, " said Luschini. The major gauges ended Tuesday's session essentially unchanged, closing out a lackluster August. Stocks typically start September strong, but often end on a weak note due to end-of-the-quarter movements by mutual funds. Economy: The Institute for Supply Management's (ISM) said its index of manufacturing activity rose to 56.3 in August. Economists were expecting the index to edge lower. Any number above 50 indicates growth in the sector. Meanwhile, payroll processing firm ADP reported that employers cut 10,000 jobs in August. Economists were expecting private sector employers to add 13,000 jobs during the month, after adding 37,000 in July. A separate report showed that planned job cuts plummeted to a 10-year low in August, as employers shed 34,768, down 17% from the previous month, according to outplacement firm Challenger, Gray & Christmas. The reports come two days before the government's monthly report on jobs and unemployment. Economists expect the government to report that the economy lost 120,000 jobs in August, after employers cut payrolls by 131,000 in July. The unemployment rate is expected to edge up to 9.6% from 9.5%. Other reports on Wednesday included construction spending, which fell 1% in July, versus a forecasted 0.7% decline. Companies: General Motors, Ford Motor (F, Fortune 500) and Toyota (TM) all reported disappointing sales Wednesday, kicking off what is expected to be the worst August for industrywide auto sales in 27 years. The drop in auto sales is partly a result of tough comparisons to the Cash for Clunkers program of last summer. Shares of Burger King Holdings (BKC) jumped 14%, following a report that the fast food chain is considering a possible sale to buyout firms. The Wall Street Journal reported that that private equity firms that have expressed interest in buying Burger King include Britain's 3G Capital Group. Apple's (AAPL, Fortune 500) stock was up 2.8% as the company held its annual music-themed special event. CEO Steve Jobs is expected to unveil its newest iPods and advances in the iTunes music store. Shares of BP (BP) climbed 3.7% as the oil giant said it has agreed to sell its interests in ethylene and polyethylene production in Malaysia to government-owned Petronas for $363 million in cash. World markets: European shares closed sharply higher. The FTSE 100 in Britain jumped 2.7%, the CAC 40 in France added 3.8% and the DAX in Germany gained 2.7%. In Asia, Japan's benchmark Nikkei index gained nearly 1.2%, rebounding after hitting a 16-month low on Tuesday, and the Hang Seng in Hong Kong rose 0.4%. The Shanghai Composite fell 0.6%, despite a report that showed China's manufacturing sector bounced back in August after several months of slowing. Currencies and commodities: The dollar fell against the euro and the British pound, but rose versus the Japanese yen. Currency trading volume around the world has hit $4 trillion a day, a 20% jump compared to 2007, said the Bank of International Settlement. Oil futures for October delivery rose $2.08 to $74.03 a barrel. Gold for December delivery fell $2.20 to $1,248.10 an ounce. Bonds: The yield on the 10-year Treasury note rose to 2.58% from 2.48% late Tuesday. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Hulumas

Supreme |

01-Sep-2010 12:06

Yells: "INVEST but not TRADE please!" |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

How about STI ?

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

01-Sep-2010 06:54

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks end August with a whimper

NEW YORK (CNNMoney.com) -- Stocks were little changed at the end of a choppy session Tuesday, closing out a lackluster August for the market as investors weighed meeting minutes from the Federal Reserve against upbeat economic reports. The Dow Jones industrial average (INDU) gained 4 points, or less than 0.1%. The S&P 500 (SPX) edged up less than 1 point. The Nasdaq (COMP) composite lost 6 points, or 0.3%. All three indexes posted monthly declines. The Dow lost about 4.3% in August, while the S&P 500 fell 4.7%, and the Nasdaq slumped 6.2% in the month. The lackluster performance in August came after stocks rallied 7% in July on strong profit growth from major U.S. corporations. But the market is still down for the year. The Dow has lost nearly 4% so far in 2010. On Tuesday, stocks were supported earlier in the session by a larger-than-expected rise in consumer confidence and a jump in U.S. home prices. But the tone turned bearish late in the day after the Fed released minutes from its Aug. 10 meeting.

The uncertainty surrounding the economic outlook and historically low trading volumes led to increased turbulence on Wall Street during August. The CBOE Market Volatility Index, or VIX (VIX), rose more than 18% in August to 26.05. Trading volumes continued to be light Tuesday with many market participants on vacation this week. Stocks dropped more than 1% in thin trading Monday. Economy: Investors welcomed a slight improvement in the economic news Tuesday with better-than-expected readings on consumer confidence and home prices. The Conference Board's index of consumer confidence rose to a reading of 53.5 in August from an adjusted 51 in July. Economists were expecting the index to come in at 50, according to consensus estimates from Briefing.com.

Before the market opened, a report showed that national home prices jumped a substantial 3.6% in the past year, versus a forecasted 3.1% gain. The S&P/Case-Shiller Home Price Index also showed that prices climbed 4.4% in the second quarter, compared with a 2.8% plunge in the first quarter.

Companies: Technology shares came under pressure after research firm Gartner lowered its forecast for PC sales in the second half of 2010, citing an uncertain economic outlook in the United States and Europe. The Philadelphia Semiconductor Index, or SOX (SOX), fell nearly 2%. Monsanto (MON, Fortune 500) fell almost 6% after the company warned that its fiscal year earnings per share will be at the lower end of its forecasted range. The agribusiness giant said it expects to earn between $2.40 and $2.45 a share this fiscal year. Analysts surveyed by Thomson Financial expect $2.48 per share. Shares of Saks Inc. (SKS) spiked 20% after a report from the Daily Mail said a group of U.S. and U.K. private equity companies may soon bid $1.7 billion, or $11 per share, for the high-end retailer. Data-storage company 3PAR (PAR) rose nearly 1% as a Reuters survey revealed that most analysts and investors expect Dell (DELL, Fortune 500) to bow out of the bidding war with Hewlett-Packard Co. (HPQ, Fortune 500) Dell has until Wednesday to match HP's $2 billion bid for 3PAR. World markets: European shares closed higher. The CAC 40 in France edged up 0.1%, the DAX in Germany rose 0.2%, Britain's FTSE 100 gained 0.4%. Asian markets ended lower. Japan's benchmark Nikkei index sank 3.6% to a 16-month closing low. The Shanghai Composite decreased 0.5% and the Hang Seng in Hong Kong lost 1%.

Currencies and commodities: The dollar edged lower against the euro and the Japanese yen but was higher versus the British pound.

Bonds: The yield on the 10-year Treasury note fell to 2.48% from 2.54% late Monday. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Hulumas

Supreme |

01-Sep-2010 00:05

Yells: "INVEST but not TRADE please!" |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Sorry STI should read 16,000. instead of 1,600.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||