| Latest Forum Topics / Others |

|

|

Market News that affect STI

|

|||||

|

Blastoff

Elite |

02-Sep-2010 08:03

|

||||

|

x 0

x 0 Alert Admin |

September surprise: Stocks soar

NEW YORK (CNNMoney.com) -- The bulls are back on Wall Street. After a bearish August, stocks roared into September with a major rally Wednesday, as investors cheered signs of strength in the manufacturing sector. The Dow Jones industrial average (INDU) gained 256 points, or 2.2%.The S&P 500 (SPX) soared 31 points, or 2.9%. The Nasdaq (COMP) composite rallied 63 points, or 3%. Stocks rallied right out of the gate as investors welcomed a rebound in Chinese manufacturing and robust economic growth in Australia. The advance kicked into high gear following an unexpectedly strong report on U.S. manufacturing activity. The manufacturing data boosted industrial names and companies in the materials sector. Caterpillar (CAT, Fortune 500), United Technologies (UTX, Fortune 500), Boeing (BA, Fortune 500) all gained between 2% and 4%. Energy producers Exxon (XOM, Fortune 500) and Chevron (CVX, Fortune 500) also rose as oil prices spiked 3%. But the rally was broad-based. Six stocks gained for every one that fell on the New York Stock Exchange. All 30 Dow components closed higher, with Bank of America (BAC, Fortune 500) gaining over 6%. While the improvement in manufacturing allayed some concerns about the U.S. economy, traders said the market remains vulnerable given the uncertain outlook for growth this year. Investors shrugged off a weaker-than-expected report from payroll processing firm ADP, which is widely seen as a leading indicator for Friday's jobs report from the Labor Department. "This market is looking for something to grab on to," said Mark Luschini, chief investment strategist for Janney Montgomery Scott. "And for the moment it's manufacturing." The focus could shift to jobs Thursday morning when the government's weekly report on initial claims for jobless benefits comes out. Investors will also take in the latest readings on factory orders and pending home sales shortly after the market opens. "The manufacturing number is nice to hang your hat on, but the state of the consumer is still paramount for what's happening in the economy, " said Luschini. The major gauges ended Tuesday's session essentially unchanged, closing out a lackluster August. Stocks typically start September strong, but often end on a weak note due to end-of-the-quarter movements by mutual funds. Economy: The Institute for Supply Management's (ISM) said its index of manufacturing activity rose to 56.3 in August. Economists were expecting the index to edge lower. Any number above 50 indicates growth in the sector. Meanwhile, payroll processing firm ADP reported that employers cut 10,000 jobs in August. Economists were expecting private sector employers to add 13,000 jobs during the month, after adding 37,000 in July. A separate report showed that planned job cuts plummeted to a 10-year low in August, as employers shed 34,768, down 17% from the previous month, according to outplacement firm Challenger, Gray & Christmas. The reports come two days before the government's monthly report on jobs and unemployment. Economists expect the government to report that the economy lost 120,000 jobs in August, after employers cut payrolls by 131,000 in July. The unemployment rate is expected to edge up to 9.6% from 9.5%. Other reports on Wednesday included construction spending, which fell 1% in July, versus a forecasted 0.7% decline. Companies: General Motors, Ford Motor (F, Fortune 500) and Toyota (TM) all reported disappointing sales Wednesday, kicking off what is expected to be the worst August for industrywide auto sales in 27 years. The drop in auto sales is partly a result of tough comparisons to the Cash for Clunkers program of last summer. Shares of Burger King Holdings (BKC) jumped 14%, following a report that the fast food chain is considering a possible sale to buyout firms. The Wall Street Journal reported that that private equity firms that have expressed interest in buying Burger King include Britain's 3G Capital Group. Apple's (AAPL, Fortune 500) stock was up 2.8% as the company held its annual music-themed special event. CEO Steve Jobs is expected to unveil its newest iPods and advances in the iTunes music store. Shares of BP (BP) climbed 3.7% as the oil giant said it has agreed to sell its interests in ethylene and polyethylene production in Malaysia to government-owned Petronas for $363 million in cash. World markets: European shares closed sharply higher. The FTSE 100 in Britain jumped 2.7%, the CAC 40 in France added 3.8% and the DAX in Germany gained 2.7%. In Asia, Japan's benchmark Nikkei index gained nearly 1.2%, rebounding after hitting a 16-month low on Tuesday, and the Hang Seng in Hong Kong rose 0.4%. The Shanghai Composite fell 0.6%, despite a report that showed China's manufacturing sector bounced back in August after several months of slowing. Currencies and commodities: The dollar fell against the euro and the British pound, but rose versus the Japanese yen. Currency trading volume around the world has hit $4 trillion a day, a 20% jump compared to 2007, said the Bank of International Settlement. Oil futures for October delivery rose $2.08 to $74.03 a barrel. Gold for December delivery fell $2.20 to $1,248.10 an ounce. Bonds: The yield on the 10-year Treasury note rose to 2.58% from 2.48% late Tuesday. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

01-Sep-2010 06:57

|

||||

|

x 0

x 0 Alert Admin |

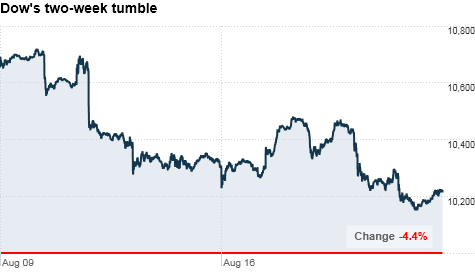

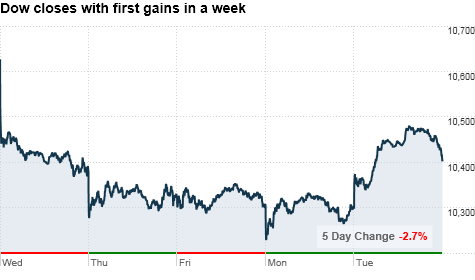

Stocks end August with a whimper

NEW YORK (CNNMoney.com) -- Stocks were little changed at the end of a choppy session Tuesday, closing out a lackluster August for the market as investors weighed meeting minutes from the Federal Reserve against upbeat economic reports. The Dow Jones industrial average (INDU) gained 4 points, or less than 0.1%. The S&P 500 (SPX) edged up less than 1 point. The Nasdaq (COMP) composite lost 6 points, or 0.3%. All three indexes posted monthly declines. The Dow lost about 4.3% in August, while the S&P 500 fell 4.7%, and the Nasdaq slumped 6.2% in the month. The lackluster performance in August came after stocks rallied 7% in July on strong profit growth from major U.S. corporations. But the market is still down for the year. The Dow has lost nearly 4% so far in 2010. On Tuesday, stocks were supported earlier in the session by a larger-than-expected rise in consumer confidence and a jump in U.S. home prices. But the tone turned bearish late in the day after the Fed released minutes from its Aug. 10 meeting.

The uncertainty surrounding the economic outlook and historically low trading volumes led to increased turbulence on Wall Street during August. The CBOE Market Volatility Index, or VIX (VIX), rose more than 18% in August to 26.05. Trading volumes continued to be light Tuesday with many market participants on vacation this week. Stocks dropped more than 1% in thin trading Monday. Economy: Investors welcomed a slight improvement in the economic news Tuesday with better-than-expected readings on consumer confidence and home prices. The Conference Board's index of consumer confidence rose to a reading of 53.5 in August from an adjusted 51 in July. Economists were expecting the index to come in at 50, according to consensus estimates from Briefing.com.

Before the market opened, a report showed that national home prices jumped a substantial 3.6% in the past year, versus a forecasted 3.1% gain. The S&P/Case-Shiller Home Price Index also showed that prices climbed 4.4% in the second quarter, compared with a 2.8% plunge in the first quarter.

Companies: Technology shares came under pressure after research firm Gartner lowered its forecast for PC sales in the second half of 2010, citing an uncertain economic outlook in the United States and Europe. The Philadelphia Semiconductor Index, or SOX (SOX), fell nearly 2%. Monsanto (MON, Fortune 500) fell almost 6% after the company warned that its fiscal year earnings per share will be at the lower end of its forecasted range. The agribusiness giant said it expects to earn between $2.40 and $2.45 a share this fiscal year. Analysts surveyed by Thomson Financial expect $2.48 per share. Shares of Saks Inc. (SKS) spiked 20% after a report from the Daily Mail said a group of U.S. and U.K. private equity companies may soon bid $1.7 billion, or $11 per share, for the high-end retailer. Data-storage company 3PAR (PAR) rose nearly 1% as a Reuters survey revealed that most analysts and investors expect Dell (DELL, Fortune 500) to bow out of the bidding war with Hewlett-Packard Co. (HPQ, Fortune 500) Dell has until Wednesday to match HP's $2 billion bid for 3PAR. World markets: European shares closed higher. The CAC 40 in France edged up 0.1%, the DAX in Germany rose 0.2%, Britain's FTSE 100 gained 0.4%. Asian markets ended lower. Japan's benchmark Nikkei index sank 3.6% to a 16-month closing low. The Shanghai Composite decreased 0.5% and the Hang Seng in Hong Kong lost 1%.

Currencies and commodities: The dollar edged lower against the euro and the Japanese yen but was higher versus the British pound.

Bonds: The yield on the 10-year Treasury note fell to 2.48% from 2.54% late Monday. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

31-Aug-2010 06:58

|

||||

|

x 0

x 0 Alert Admin |

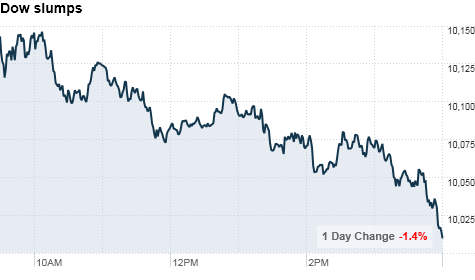

Stocks drop as fear returns NEW YORK (CNNMoney.com) -- Stocks fell sharply late Monday, ending a lackluster session more than 1% lower, as the tone on Wall Street turned bearish ahead of big economic reports due later this week. The Dow Jones industrial average (INDU) slumped 141 points, or about 1.4%, to close The S&P 500 (SPX) slid 15 points, or 1.5%, and the Nasdaq (COMP) composite shed 33 points, or 1.5%. Stocks opened lower as investors responded to a mixed report on American consumers, a pair of billion-dollar corporate deals and a move by the Bank of Japan to shore up its economy. But the selling gained momentum late in the session as the few traders who aren't on vacation this week turned cautious. "There's nothing to take us higher so we're continuing to go lower," said Dan Greenhaus, chief economic strategist at Miller, Tabak and Co. With volume expected to be light this week, Greenhaus said he wouldn't be surprised to see some big swings. "It's tough to read anything into the action on days like this when volume is so low," he said. "What we're hoping for now is for some stability in the data to put a floor under stocks." The economy will continue to be a big driver this week, with reports on consumer spending, home sales and manufacturing activity on tap. But mostly, investors are gearing up for the government's monthly jobs report, due before the opening bell Friday. Looking ahead, investors will take in a reading on consumer confidence before the market opens on Tuesday. Reports on home prices and regional manufacturing activity are also due in the morning. In the afternoon, the Federal Reserve will release minutes from its most recent policy meeting. Meanwhile, Friday's sell-off was broad based, with all but one Dow stock falling. Among the biggest losers on the blue chip measure were 3M (MMM, Fortune 500), Caterpillar (CAT, Fortune 500) and American Express (AXP, Fortune 500). Market breadth was negative. Declining shares outnumbered advancing shares by five to two on the New York Stock Exchange. Trading volume was anemic, with 818 million shares changing hands. Stocks rallied at the end of last week, to gain nearly 2% on Friday. But all three major indexes ended the week lower and are on track to post monthly declines. Economy: A government report showed that personal income rose 0.2% in July, in line with expectations. The report said consumer spending outpaced income growth, rising 0.4% in July. Economists surveyed by Briefing.com were expecting spending to rise 0.3% during the month, after a 0.1% rise the month before. But personal savings, as a portion of disposable income, came in lower than the previous month. Merger Monday French drugmaker Sanofi-Aventis (SNY) agreed to buy biotech firm Genzyme (GENZ, Fortune 500) in an $18.5 billion cash deal. Genzyme has reportedly been snubbing Sanofi's advances for the past month, prompting the French firm to send a so-called 'bear hug' letter that is one stop short of a hostile takeover. Shares of Sanofi fell about 1% and Genzyme's stock rallied 3.4%. Giant chipmaker Intel (INTC, Fortune 500)'s stock fell 1.6% after the company inked a deal to acquire the wireless unit of German chipmaker Infineon Technologies in an all-cash deal valued at $1.4 billion. Intel recently purchased security technology firm McAfee Inc. (MFE) for $7.7 billion in cash on Aug. 19. On Friday, Intel warned its third-quarter sales would fall short of its previous forecast. 3M (MMM, Fortune 500) said it will acquire biometric security company Cogent Systems (COGT) for $10.50 per share in a deal valued at $943 million. Shares of 3M slipped 1.6%. The bidding war for 3PAR (PAR) continues. HP (HPQ, Fortune 500) has currently topped Dell (DELL, Fortune 500), with their bid of $2 billion, or $30 per share, that was made on Friday. "We've seen a lot of cash build up on balance sheets [but] revenue growth prospects are still limited" said Bruce McCain, chief market strategist at Key Private Bank, adding that companies will probably continue to focus on cost cutting to boost profits. Japan: The Bank of Japan announced steps at an emergency meeting Monday to curb the yen's strength and lift the country's struggling economy. The central bank announced a new ¥10 trillion, or $117.15 billion, six-month loan program for financial institutions, in addition to the ¥20 trillion it has been offering in three-month loans. The bank also held its key-interest rate at 0.1%. But some analysts said the move was not aggressive enough to boost Japan's ailing economy. "It's another reminder that growth is slow," said McCain, in reference to the BOJ plan. "That anxiety doesn't help when people are already concerned about the slow growth cycle and double-dip fears haven't been vanquished." World markets: European shares ended the day mixed. The CAC 40 in France and the DAX in Germany both fell about 0.6%. Britain's FTSE 100 climbed 0.9%. Asian markets ended higher, following the Bank of Japan's announcement to ease monetary pressure. Japan's benchmark Nikkei index jumped up 1.8%, and the Shanghai Composite rose 1.6%. The Hang Seng in Hong Kong added 0.7%. Currencies and commodities: The dollar rose against the euro and the British pound, but fell versus the Japanese yen. Oil futures for October delivery slipped 63 cents to $74.54 a barrel. Gold for December delivery gained $1.30 to $1,239.20 an ounce. Bonds: The yield on the 10-year Treasury note fell to 2.54% from 2.64% late Friday. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

26-Aug-2010 07:04

|

||||

|

x 0

x 0 Alert Admin |

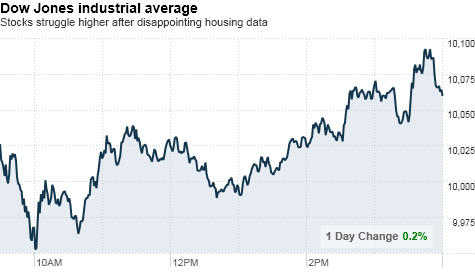

Stocks recover from housing blues

NEW YORK (CNNMoney.com) -- Stocks finished higher Wednesday after spending most of the day in the red, following another round of dismal housing news. The Dow Jones industrial average (INDU) gained 20 points, or 0.2%, the S&P 500 (SPX) rose 3 points, or 0.3%, and the Nasdaq (COMP) composite climbed 18 points, or 0.8%. Stocks sold off sharply immediately after the housing data but managed to recoup some losses as homebuilding and housing material stocks crept higher. Lennar Corp., (LEN) KB Home (KBH) and Toll Brothers (TOL) all gained more than 3%.

But the same news that lifted homebuilding stocks battered the financial sector, with big names like Wells Fargo (WFC, Fortune 500) and Citigroup (C, Fortune 500) edging lower.

On Tuesday, stocks sank after a 27% plunge in existing home sales fueled worries about an economic slowdown, sending the Dow 134 points lower on the day.

Economy: New home sales unexpectedly plummeted to the lowest level on record in July, dropping 12.4% in July, the government reported. Economists had expected sales to bump higher. The disappointing data comes right on the heels of another dismal housing report on Tuesday, which showed a sharp drop in existing home sales.

Companies: Homebuilder Toll Brothers (TOL) booked its first quarterly profit in three years on Wednesday, thanks largely to a boost from the homebuyer tax credit.

World markets: European shares slumped. The CAC 40 in France sank 1%, Britain's FTSE 100 lost 0.9%, while the DAX in Germany ended 0.6% lower. Late Tuesday, Standard & Poor slashed Ireland's sovereign debt rating to double-A-minus due to the massive cost of bailing out the nation's banks.

Currencies and commodities: The dollar fell against the euro and the British pound, but firmed versus the Japanese yen.

Bonds: The yield on the 10-year note rose to 2.54%, bouncing off a 19-month low of 2.49% on Tuesday. |

||||

| Useful To Me Not Useful To Me | |||||

|

iPunter

Supreme |

25-Aug-2010 08:03

|

||||

|

x 0

x 0 Alert Admin |

When the market tanks in the midst of a bullish up-run, it is a good thing because it is probably just a correction along the climb. But if the market tanks further when the market is already at a low point, It is nerve-wracking to say the least... Last night, the Dow went below 10000... again...  |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

25-Aug-2010 06:59

|

||||

|

x 0

x 0 Alert Admin |

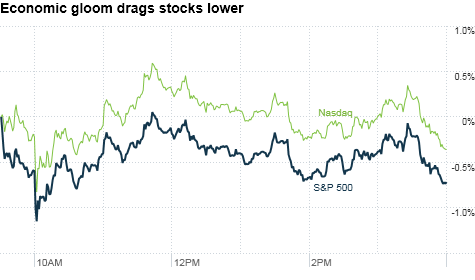

Stocks lose big on home sales shock

NEW YORK (CNNMoney.com) -- U.S. stocks closed sharply lower Tuesday after a report showing showing a worse-than-expected plunge in existing home sales reignited fears about an economic slowdown. The Dow Jones industrial average (INDU) sank 134 points, or 1.3%, the S&P 500 (SPX) lost 15 points, or 1.5%, and the Nasdaq (COMP) composite fell 36 points, or 1.7%. "Economic reports have been close to disastrous," said Joseph Saluzzi, co-head of equity trading at Themis Trading. "People are very concerned about the economy and everyone is talking about a double-dip [recession] at this point." Disappointing economic news has sent investors flocking to the perceived safety of Treasurys and the Japanese yen, which hit a 15-year high against the dollar early Tuesday. Losers outnumbered winners by three to one on the New York Stock Exchange and the Nasdaq. Declines were led by tech, finance and health care stocks, with General Electric (GE, Fortune 500) and Sony (SNE) sliding more than 2%, Citigroup (C, Fortune 500) and Bank of America (BAC, Fortune 500) dropping more than 1% and Pfizer (PFE, Fortune 500) slipping 2%. Among the biggest losers, Medtronic (MDT, Fortune 500) shares sank 11% after the medical device maker booked disappointing quarterly earnings and lowered its full-year outlook. Wall Street struggled through another choppy session Monday, with stocks finishing lower as ongoing worries about the global economy pushed excitement about deal-making talks to the backburner. Economy: The National Association of Realtors said existing home sales plummeted 27% last month to an annual rate of 3.83 million units, marking the lowest sales pace since the association began tracking the figure in 1999. Economists surveyed by Briefing.com forecast a rate of 4.72 million units. "This number coming in lower than even the most bearish expectations just confirms the same deteriorating economic conditions we've been seeing," said Ryan Detrick, a senior technical strategist at Schaeffer's Investment Research. "The economy seems to be very quickly slowing down and not showing signs of life." A report on new home sales is due Wednesday, and economists surveyed by Briefing.com expect a slight increase to an annual rate of 334,000 units in July from 330,000 in June. Meanwhile, a report released Tuesday showed that disagreements among the 17 key Federal Reserve officials about how to handle the economy peaked at a meeting earlier this month, according to The Wall Street Journal. Currencies, bonds and commodities: The dollar fell to a 15-year low against the Japanese yen in early trading, slipped against the euro, but climbed against the British pound.

The yield on the benchmark 10-year note approached a 17-month low Tuesday, falling to 2.50% from 2.6% late Monday.

World markets: European shares finished sharply lower. The CAC 40 in France dropped 1.7%, Britain's FTSE 100 lost 1.5% and the DAX in Germany fell 1.3%.

Companies: Barnes & Noble (BKS, Fortune 500), which put itself up for sale earlier this month, posted a quarterly loss that widely missed expectations and said same-store sales fell in the first quarter. Shares of the bookseller ended more than 2% lower. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

23-Aug-2010 08:08

|

||||

|

x 0

x 0 Alert Admin |

Aug 23, 2010Aussie dollar falls 0.44%SYDNEY - THE Australian dollar fell 0.44 per cent in early trade on Monday on political uncertainty after weekend elections failed to produce a clear winner. The dollar was trading at 88.63/66 US cents, dropping from Friday's close of 89.03/06, after the knife-edge polls which looked set to end with the first hung parliament since World War II. Bank of New Zealand currency strategist Mike Jones said the political situation had dealt the currency a 'heavy blow'. 'It looks to remain pretty heavy into the first part of this week as the uncertainty descends into the Australian political situation,' Mr Jones said. Economists say Australian share prices are also likely to take a hit from the unusual turmoil in a country which is known for its stability and sailed through the financial crisis without entering recession. The uncertainty will 'likely add to jitters in the Australian share market and in the Australian dollar in the week ahead,' AMP Capital Investors chief economist Shane Oliver said. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

23-Aug-2010 07:35

|

||||

|

x 0

x 0 Alert Admin |

Stocks in for summer slip 'n' slide NEW YORK (CNNMoney.com) -- Stocks are likely to face another choppy, downtrodden week, but that's no big surprise. It's the end of the summer, trading volume is light, and even though company earnings are generally strong, dismal economic reports have been kicking fears of a second-half slowdown into higher gear. Add a little uncertainty about Bush tax cuts, interest rates and the logistics of financial regulatory reform to the mix, and investors are jittery to say the least. "We know the economy is not suffering from a lack of money or liquidity. What the economy is desperately short of is confidence and visibility and the willingness to take risk," said Adrian Cronje, chief financial officer of investment firm Balentine. The markets are coming off two weeks of losses as traders have been struggling to find a balance between upbeat company news and downtrodden data on jobs, manufacturing, and other economic indicators. On one hand, the positive: A slew of mergers and acquisitions announced last week shows companies are ramping up their capital spending, which is a sign that they're preparing for better times. Earlier this week, mining giant BHP Billiton's (BHP) $43.8 billion unsolicited bid for Canadian fertilizer-maker Potash Corp. (POT) was the biggest deal this year, bringing weekly M&A volume to $89.8 billion. And on Thursday, Intel (INTC, Fortune 500) agreed to buy security software maker McAfee (MFE) for $7.68 billion, in what would be the chipmaker's biggest acquisition ever.

On the other hand, the negative: The headline economic indicator continues to be jobs, and the news there has been grim at best. The number of first-time filers for unemployment benefits surged to a 9-month high last week and has been stuck in the mid- to higher 400,000s since November.

Cronje is not predicting particularly bad or good news for jobs this week, but if the numbers disappoint, watch out: "Any sign of the job market getting even worse from here will be taken badly," he said. On the docket Monday: No economic reports are on tap. Tuesday: The July report on existing homes sales from the National Association of Realtors is due during morning trading Tuesday. Sales of existing homes fell 5.1% in June to a 5.37 million-unit pace -- a sign of renewed turbulence in the housing market. Economists polled by Briefing.com are expecting July to show another slowdown in sales, down to 5.14 million.

They're also waiting for the latest figures on new home sales, which are expected to show a slight uptick to 338,000 in July, up from 330,000 the month before. Thursday: The government releases its weekly numbers on first-time unemployment filers. Last week, stocks took a hit when the number increased dramatically to 500,000 initial claims.

GDP is the broadest measure of the nation's economic activity. Economists surveyed by Briefing.com are expecting the government to revise the number to 1.4%, showing a significant slowdown from its previous reading of 2.4%. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

19-Aug-2010 07:01

|

||||

|

x 0

x 0 Alert Admin |

Stocks rally for second day in a row NEW YORK (CNNMoney.com) -- U.S. stocks posted their second consecutive day of gains Wednesday, turning the market around after a week's worth of losses. After starting out the day lower, the Dow Jones industrial average (INDU) rose 10 points, or 0.1%, to 10,416 the S&P 500 (SPX) inched up 2 points, or 0.2%, to 1,094 and the Nasdaq (COMP) composite rose 6 points, or 0.3%, to 2,216. Those gains built on Wall Street's strong advance the day before. But with no major economic releases on tap Wednesday, the market was having trouble finding direction as stocks jumped around throughout the day.

Bonds: Treasury prices eased Wednesday, pushing yields up. The yield on the 10-year note rose to 2.64% from 2.63% late Tuesday. Bond prices and yields move in opposite directions. Companies: Discount retailer Target (TGT, Fortune 500) reported a profit that rose 14% from a year earlier and was in line with expectations, but the company missed revenue forecasts.

Meanwhile, energy companies Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500) dragged on the Dow's gains. Their stocks fell about 1% after the government announced both crude and gasoline inventories were at unusually high levels for August.

Mining giant BHP Billiton (BHP) said Wednesday it was taking its takeover offer for Potash (POT) directly to the fertilizer giant's shareholders. On Tuesday, Potash's board rejected BHP's $38.6 billion bid.

Deere (DE, Fortune 500) posted better-than-expected profit and revenue for its third fiscal quarter, but the farm-equipment maker's earnings forecast for the current quarter of $375 million is below the $385 million analysts were looking for. Shares of Deere fell 1.8%. Just before the closing bell, General Motors filed for an initial public offering that could drastically reduce the holdings of the U.S. government, which currently owns 61% of the company, and repay some taxpayer money used to bail the company out. The company did not disclose how many shares it will sell, or at what price. World markets: Markets in Asia ended the session mixed. Japan's benchmark Nikkei jumped 0.9%. But the Hang Seng in Hong Kong and the Shanghai Composite both finished the session with losses.

Currencies and commodities: The dollar gained against the euro, but fell against the U.K. pound and the Japanese yen. Oil futures for September delivery fell 35 cents to settle at $75.42 a barrel. Gold for December delivery rose $3.10 to settle at $1,231.40. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

18-Aug-2010 14:12

|

||||

|

x 0

x 0 Alert Admin |

Internet sales soar in ChinaBEIJING - INTERNET sales in China, the world's biggest web market, soared 60 per cent on year in the first half, as more consumers and businesses went shopping online, state media said on Wednesday. Transactions hit 2.25 trillion yuan (S$449 billion) in the January-June period, the China Daily said, citing a report by the China e-Business Research Centre. That compares with 3.6 trillion yuan for all of 2009, Qian Xiaoqian, deputy director of the State Council Information Office, was quoted as saying. The data covers business-to-business, business-to-consumer and consumer-to-consumer transactions. E-commerce has been expanding in China as more companies set up online stores to cut costs and improve efficiency, the report said. There were 20,700 e-commerce websites in China at the end of June and the figure is likely to reach 23,000 by the end of the year, it said. Underlining the growing appeal of the country's Internet market, which now has around 420 million web users, US sportswear giant Adidas said this week it had opened a flagship online store on China's largest auction site Taobao. Web sales are likely to soar more than 35 per cent a year on average in the next few years as more people shop online and more convenient ways of paying for transactions, such as using mobile phones, are made available, Mr Qian said. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

18-Aug-2010 08:00

|

||||

|

x 0

x 0 Alert Admin |

Stocks come off week-long slump NEW YORK (CNNMoney.com) -- Stocks rallied Tuesday after a Federal Reserve regional president said fears about the central bank's outlook were "unwarranted" and investors shifted their focus to strong earnings from Wal-Mart and Home Depot. The Dow Jones industrial average (INDU) rose 104 points, or 1%, pushing the index to 10,406. The Nasdaq (COMP) composite climbed 28 points, or 1.3%, to 2,209; the S&P 500 (SPX) added 13 points, or 1.2%, to close at 1,092. The gains followed a choppy trading day on Wall Street on Monday. The tech-heavy Nasdaq managed to advance, rising about 0.4%, while the Dow and S&P 500 ended little changed.

Companies: Wal-Mart Stores (WMT, Fortune 500) reported a slightly better-than-expected fiscal second-quarter profit Tuesday, although customers of the world's largest retailer continued to curb spending. Wal-Mart also boosted its full-year guidance. Shares of the retailer were up 1.3%. Home improvement retailer Home Depot (HD, Fortune 500) posted a better-than-expected second-quarter profit that rose from a year earlier, but its sales missed forecasts. Home Depot shares gained 3.6%. Shares of fertilizer producer Potash (POT) rose 28% after it rejected a $38 billion takeover offer by mining company BHP Billiton. Pactiv (PTV), the maker of Hefty trash bags, gained more than 5% after agreeing to be acquired by Reynolds Group Holdings, which is a subsidiary of a New Zealand firm, for $6 billion.

Economy: A wave of economic reports, including data on housing and inflation, showed mixed results before the bell. A report from the Commerce Department showed that housing starts -- the number of new homes starting construction -- rose 1.7% to an annual rate of 546,000 in July. But permits fell 3.1% to an annual rate of 565,000.

World markets: European shares finished higher. The CAC 40 in France gained 1.8%, Germany's DAX rose 1.6% and the FTSE 100 in Britain gained 1.4%.

Currencies and commodities: The dollar fell against the euro, but rose versus the U.K. pound and the Japanese yen.

Bonds: Prices for Treasurys were lower. The yield on the 10-year note rose to 2.64%, coming off a 17-month low of 2.58% late Monday. Bond prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

17-Aug-2010 08:13

|

||||

|

x 0

x 0 Alert Admin |

Tech stocks gain in choppy session NEW YORK (CNNMoney.com) -- Stocks ended mixed after a choppy session Monday, as investors were caught between excitement over dealmaking in the tech sector and pessimism about weaker-than-expected economic data. The Dow Jones industrial average (INDU) fell 1.14 points, and the S&P 500 (SPX) rose just 0.13 point. But the tech-laden Nasdaq (COMP) composite climbed 8.39 points, or 0.4%. Investors remained cautious following four straight losing sessions in the wake of the Federal Reserve's bearish outlook last week. A raft of downbeat economic reports and some tepid earnings results added pressure. Wall Street will be bracing for key reports on housing, building permits, prices and quarterly results from retail giants Wal-Mart (WMT, Fortune 500) and Home Depot (HD, Fortune 500) Tuesday before the bell.

Companies: Curbing the Dow's losses, shares of Cisco Systems (CSCO, Fortune 500) rose 2.6%, and shares of Intel (INTC, Fortune 500) advanced 1.7% after acquisition announcements from Intel and Dell (DELL, Fortune 500) sparked excitement about other possible takeover deals in the tech sector. Intel is buying Texas Instruments' cable modem product line, the company said Monday. It did not disclose the cost of the deal. Meanwhile, Dell said it will acquire data-storage company 3PAR for $1.15 billion, a deal the company said could cut its data management costs by 50%. Shares of Dell (DELL, Fortune 500) fell 0.4% after the announcement, but 3PAR (PAR) rose 86%. Lowe's (LOW, Fortune 500) stock edged 0.5% higher after the home improvement retailer posted higher fiscal second-quarter profit and revenue -- although the company missed forecasts and lowered its outlook.

World markets: While stocks in Asia ended mostly higher, Japan's benchmark Nikkei index slipped 0.6% following reports that Japan's economic growth slowed sharply to 0.4% in the second quarter -- putting China another step closer to becoming the world's second-largest economy.

China is forecast to overtake Japan by the end of the year to become the world's No. 2 economy after the United States. Official annual figures won't come until early 2011. Meanwhile, the Shanghai Composite rallied 2.1%, while the Hang Seng in Hong Kong ended the day up 0.2%. European shares ended mixed. France's CAC 40 dropped 0.4%, while the FTSE 100 in Britain and Germany's DAX were fractionally higher. Economy: The Empire Manufacturing survey index jumped to 7.1 in August from 5.08 in July, showing growth in the New York region. Economists polled by Briefing.com had expected a jump to 7.5.

Currencies and commodities: The dollar fell against the euro, the Japanese yen and the British pound.

Bonds: Prices for Treasurys rose. The yield on the 10-year note fell to a 17-month low of 2.58% from 2.68% late Friday. Bond prices and yields move in opposite directions.

Market breadth: Market breadth was positive. On the New York Stock Exchange, winners beat losers on a tight margin on volume of 789 million shares. On the Nasdaq, advancers beat decliners two to one on volume of 1.6 billion shares. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

11-Aug-2010 08:13

|

||||

|

x 0

x 0 Alert Admin |

Stocks recoup losses after Fed NEW YORK (CNNMoney.com) -- Stocks pared sharp losses to close only modestly lower Tuesday after the Federal Reserve took a cautious stance about the recovery. After falling as much as 147 points earlier in the session, the Dow Jones industrial average (INDU) was off 53 points, or 0.5%, to close at 10,644.86, according to early tallies. The S&P 500 (SPX) lost 7 points, or 0.6%, to end at 1,121.08, and the Nasdaq (COMP) dropped 29 points, or 1.2%, to close at 2,277.17. As was widely expected, the central bank said it would leave short-term interest rates unchanged in a range between 0% and 0.25%. But the Fed gave its most bearish outlook in more than a year, saying the economic recovery is weakening.

"But actions speak louder than words," White added. "The fact that the Fed will maintain the same level of debt on its balance sheet shows it has some deflation concerns, even though they didn't mention the D-word." Though the repurchase of Treasurys is serving as a "backstop," White said, "everyone is wondering when we won't need the Fed anymore." Tech downgrades: The session's earlier losses were led by tech shares after the sector suffered two downgrades of big chipmakers. Analysts at Robert W. Baird downgraded tech giant Intel's (INTC, Fortune 500) shares to "neutral" from "outperform." The research firm cited concerns about the overall tech sector, noting a "sharp deterioration in PC-related order trends over the past week, following a below-expectation July." JPMorgan (JPM, Fortune 500) analysts echoed this statement, saying in their own report that personal computer orders were "falling off a cliff." JPMorgan lowered its outlook on Intel but kept its rating at "neutral."

Advanced Micro Devices (AMD, Fortune 500) also felt the crunch, after Barclays downgraded shares of the semiconductor maker to "equal weight" from "overweight." AMD shares plummeted to close 8% lower.

Companies: BP (BP) said late Monday that it had made a $3 billion deposit into the $20 billion escrow account, from which the oil giant will pay for claims to those who suffered from the effects of the Gulf Coast oil spill. Shares of BP were down 1.8% to end the day. After the bell, Walt Disney Co. (DIS, Fortune 500) reported fiscal third-quarter earnings that beat Wall Street expectations, led by rebounding sales at its television networks and movie studio divisions.

World markets: European markets closed lower. Britain's FTSE 100 fell 0.6%, while France's CAC 40 dropped 1.2% and Germany's DAX posted a decline of 1%. In Asia, Chinese shares led declines, following a report that showed Chinese imports slowed in July, increasing only 22.7% from a year earlier, compared to a 34.1% year-over-year jump the prior month.

Bonds: The yield on the 30-year bond fell below 4% and the yield on the 10-year note dropped to 2.77%. |

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

10-Aug-2010 13:12

|

||||

|

x 0

x 0 Alert Admin |

during the National Day Celebration Walkabout HEARD: there is a CASINO MENTOR at Marina Bay Sand ? ? ? ? |

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

10-Aug-2010 12:37

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

In the large extent . . . you are right!

|

||||

| Useful To Me Not Useful To Me | |||||

|

niuyear

Supreme |

10-Aug-2010 12:33

|

||||

|

x 0

x 0 Alert Admin |

|

||||

pharoah88 ( Date: 08-Aug-2010 17:05) Posted:

|

Elite

x 0

Alert Admin

China property prices slow

BEIJING - PROPERTY prices in China rose at a slower pace in July from the previous month, government data showed on Tuesday, as efforts to curb speculative investment in the real estate sector started to bite.

Housing prices in 70 major cities rose 10.3 per cent on year in July, the National Bureau of Statistics said, down from 11.4 per cent in June.

The figure marked the third straight month that year-on-year growth in prices has slowed after Beijing issued a slew of measures to prevent the real estate sector overheating and causing a bubble that could derail the economy.

Prices rose 12.8 per cent in April, the biggest on-year rise for a single month since July 2005, when the survey was widened to 70 cities from 35. On a monthly basis, property prices were unchanged from June, the statistics bureau said.

Total floor space - commercial and residential - sold last month fell 15.4 per cent year-on-year to 64.66 million square metres, the data showed.

The value of sales fell 19.3 per cent on-year to 306.6 billion yuan (S$61.2 billion). In recent months, authorities have tightened restrictions nationwide on advance sales of new developments, introduced curbs on loans for third home purchases and raised minimum down-payments for second homes.

Supreme

x 0

Alert Admin

Another DEATH at Foxconn plant

BEIJING

The 22-year-old woman, who died late on Wednesday, was an employee at a packaging department in Foxconn’s Kunshan plant in eastern Jiangsu province, it said.

The company said it is working with the local authorities to investigate the incident.

Foxconn, which assembles Apple’s iPhone and other well-known products, has seen a series of 13 suicides in its Chinese plants this year that has put the spotlight on conditions for millions of factory workers in the “workshop of the world”.

It was unclear whether the latest death was also suicide.

Labour rights activists have blamed suicides at Foxconn — the world’s largest maker of computer components and a supplier to leading brands such as Dell and Nokia — on tough working conditions in its factories.

Elite

x 0

Alert Admin

JAKARTA - INDONESIA said on Thursday its gross domestic product (GDP) grew 6.2 per cent in the second quarter of 2010 from a year earlier as household consumption, exports and investment picked up.

South-east Asia's biggest economy grew 2.8 per cent in the April-June period, faster than the 1.9 per cent expansion seen in the first quarter, the Central Statistics Agency said.

'The economic growth was helped by improving domestic and external factors,' agency deputy chairman Slamet Sutomo told reporters.

Household consumption rose five percent on-year during the quarter, investment grew eight percent and exports increased 15 per cent, the agency said.

The country's central bank on Wednesday kept its key interest steady at 6.50 per cent despite higher inflation in July, which it blamed on seasonal factors.

The annual inflation rate climbed to its highest point this year due to rising food prices, which had put pressure on the central bank to hike rates at Wednesday's meeting.

Elite

x 0

Alert Admin

Stocks edge up as jobs picture comes into focus

NEW YORK (CNNMoney.com) -- Stocks closed higher Wednesday, after trading in a narrow range for most of the day, as investors welcomed improved data on private sector hiring and the services industry.

The Dow Jones industrial average (INDU) rose 44 points, or 0.4%. The S&P 500 (SPX) index gained nearly 7 points, or 0.6%, and the Nasdaq (COMP) composite added 20 points, or 0.9%.

Stocks were supported by a larger-than-expected gain in private sector payrolls, which tempered concerns about the job market ahead of a key report due Friday from the Labor Department. In addition, an industry report showed the services sector of the economy grew in July for the seventh month in a row.

"Activity and employment may only be expanding at a modest pace," said Paul Ashworth, senior economist at Capital Economics in Toronto. "But at least today's data suggest that pace is being maintained."

After a spate of upbeat corporate earnings boosted the market last month, investors have become increasingly focused on the outlook for economic growth. In particular, traders are worried that the weak job market will undermine consumer confidence and hurt the already faltering recovery.

"The numbers were a bit better but they're still pointing to a very blah recovery," said Peter Boockvar, chief market strategist with Miller Taback & Co. "The economy is not falling off a cliff, but growth is going to be mediocre."

Investors will get another read on the job market Thursday when the government reports weekly initial claims data before the market opens. The retail sector will also be in focus when the nation's top chain stores report same-store-sales figures for July.

Stocks closed lower Tuesday, trimming some of the previous session's big gains, as disappointing reports on housing and consumer spending raised concerns about the strength of the economic recovery.

Economy: Payroll processor ADP said private-sector employers added 42,000 jobs to their payrolls in June, following an upwardly revised 19,000 increase in June. Economists surveyed by Briefing.com expected employers to add 25,000 jobs last month.

Separately, outplacement firm Challenger, Gray & Christmas said planned job cuts rose for a third straight month in July, fueled by continued weakness in the government and non-profit sector.

The reports came as investors awaited Friday's monthly jobs report from the Labor Department, one of the most closely-watched indicators on Wall Street. Economists believe U.S. employers cut payrolls for the second month in a row in July, and that the unemployment rate ticked up slightly.

Meanwhile, the Institute for Supply Management's services sector index rose slightly in July, marking the seventh consecutive month of growth in the sector.

The ISM services index increased to 54.3 last month from 53.8 in June. A reading above 50 indicates growth. Economists had expected the index to fall to 53.

While the rebound in the ISM was modest, the gain was encouraging for investors worried that the economy could slip back into recession.

"The fact that there was any rebound at all is important because it suggests the U.S. economy isn't spiraling back into the abyss after all," Capital Economics' Ashworth said in a research report.

Companies: Intel said it has agreed to settle antitrust charges levied by the Federal Trade Commission without paying a fine, though the chipmaker did agree to refrain from some activities designed to force its competition out of the market.

Intel was accused of refusing to sell chips to some computer manufacturers that also bought chips from rival companies and paying other manufacturers rebates in exchange for promises not to use microchips manufactured by Intel's competitors.

Shares of the Dow component were unchanged in afternoon trading.

Shares of Priceline (PCLN) were up more than 20% after the online travel company reported second-quarter results that easily beat analysts' expectations.

Goldman Sachs (GS, Fortune 500) gained 2% amid talk that the firm could spin off part of its proprietary trading business to get around the Volcker rule. Under the recently enacted Wall Street reform law, the Volcker rule will eventually limit the amount of money a federally insured bank can invest in risky ventures like private equity or hedge funds.

BP (BP) said Wednesday that the Gulf of Mexico Macondo well "appears to have reached a static condition -- a significant milestone," as a result of a procedure carried out Tuesday. Shares eased 1.5%.

Barnes & Noble (BKS, Fortune 500) put itself up for sale late Tuesday. The board of directors believes the bookseller's shares are "significantly undervalued." The company has hired financial adviser Lazard to explore "strategic alternatives," which may include selling the company. Shares rose 20%.

Earnings: Toyota Motor (TM) said that it swung to a profit in its latest quarter and boosted its full-year sales outlook. Shares rose more than 1%.

Time Warner (TWX, Fortune 500), the parent company of CNNMoney.com and Fortune, posted earnings of 49 cents per share on revenue of $6.4 billion, topping the consensus forecasts of analysts polled by Thomson Reuters. The media company also raised its outlook for earnings growth for all of 2010. Shares rose 2%.

World markets: European markets ended mixed. The CAC 40 in Paris and Germany's DAX both closed about 3% higher. Britain's FTSE 100 fell 0.2%.

In Asia, Japan's Nikkei sank 2.1%, while the Hang Seng in Hong Kong and the Shanghai Composite rose more than 0.4%.

Currencies and commodities: The dollar rose versus the euro and the British pound. It recovered against the Japanese yen after falling near a 15-year low earlier.

U.S. light crude oil for September delivery fell 11 cents to $82.44 a barrel.

COMEX gold's December contract rose $15.50 to $1,195.90 per ounce.

Bonds: Treasury prices eased, pushing the yield on the 10-year note up to 2.95% from 2.91% late Tuesday. Bond prices and yields move in opposite directions.