| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||

|

Hulumas

Supreme |

19-Sep-2010 18:28

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

Are those ethical acts? | ||

| Useful To Me Not Useful To Me | |||

|

pharoah88

Supreme |

19-Sep-2010 18:25

|

||

|

x 0

x 0 Alert Admin |

beTTer stIll CHiNA gOOds wIll be chEapEr thEn eVeryOne stIll bUys CHiNA

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Hulumas

Supreme |

17-Sep-2010 08:52

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

Severe TRADE WAR will commence between PRC against USA next year ! Will that happen ? What shall we do ? | ||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

17-Sep-2010 07:17

|

||

|

x 0

x 0 Alert Admin |

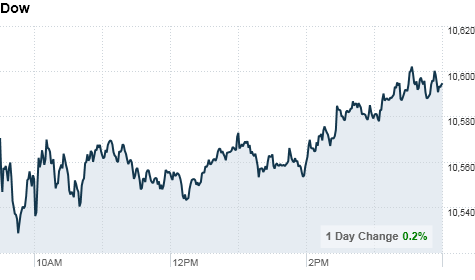

Stocks stuck in a rut

NEW YORK (CNNMoney.com) -- On paper, investors have plenty of reasons to get off the sidelines. The jobs landscape has been improving, manufacturing has expanded for 13 straight months, and other economic reports have been pointing to steady growth. But company hiring reports have been mixed, leaving investors confused. On Thursday, FedEx said it would cut jobs, while Boeing said the industry needs to ramp up hiring. Small business hiring is similarly mixed. Stocks have drifted on this muddied picture, trading in a narrow range. On Thursday the Dow Jones industrial average (INDU) rose 22 points, or 0.2%, to end at 10,594.83. The S&P 500 (SPX) was flat at 1,124.66 and the Nasdaq (COMP) added 2 points, or less than 0.1%, to close at 2,303.25.

Investors remained nervous Thursday about Japan's intervention in the currency market. On Tuesday, the nation's government said it would buy up yen in an attempt to curb deflation. The yen purchase boosted the U.S. dollar, which helped lift stocks Wednesday. But it also kept uncertainty about the recovery at the forefront of investors' minds, sending gold prices to new record highs. The precious metal is considered a "safe" spot to park cash during times of uncertainty. Economy: The Labor Department's weekly report on initial jobless claims showed 450,000 people filed for first-time unemployment benefits last week. Economists expected 460,000 new claims.

RealtyTrac said the number of homeowners falling behind on their loans -- enough to attract initial notices of default -- fell 30% in August. The lower rate should translate into fewer people losing their homes, but the report also showed lenders repossessed a record 95,000 homes last month.

The Senate passed a $42 billion bill aimed at helping small businesses. The Senate's version of the Small Business Jobs Act will now have to go back to the House, where it's expected to pass, before President Obama can sign it into law. Companies: FedEx (FDX, Fortune 500) said it expected to see moderate growth in the global economy, but the shipping company will still cut 1,700 jobs.

Boeing said the airline industry will need to hire more than 460,000 pilots and almost 600,000 maintenance workers over the next 20 years, to meet growing demand in the airline industry. The company predicted the industry as a whole will need to hire more than one million workers over the same time period. Microsoft (MSFT, Fortune 500) said its new video game "Halo: Reach" earned $200 million in sales on its launch day. The company will start selling Kinect, a full-body motion-sensing game system, on November 4. After the bell, Oracle (ORCL, Fortune 500) reported a quarterly profit and sales that beat Wall Street's forecasts. The corporate software company said its net income in its fiscal first quarter rose to $1.4 billion, or 27 cents per share, up 20% from a year earlier. Sales rose 48% to $7.5 billion.

BlackBerry maker Research in Motion (RIMM) reported quarterly profit that beat analysts expectations and issued an upbeat forecast. The Canadian company reported net income of $796.7 million, or $1.46 per share in its fiscal second quarter. Sales increased 31% over the quarter to $4.62 billion.

World markets: Asian markets closed lower. Japan's benchmark Nikkei index fell 0.1%, and Hong Kong's Hang Seng index fell 0.2%. The Shanghai Composite sunk 1.9%.

Currencies and commodities: The dollar fell against the euro and the Japanese yen, but posted slight gains against Britain's pound.

Gold futures for December delivery jumped to a fresh record intraday high early Thursday of $1,279.50 an ounce. That trumps the previous intraday record of $1,276.50 an ounce, which was just set on Tuesday.

Bonds: The yield on the 10-year Treasury note rose to 2.76% from 2.72% late Wednesday. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

16-Sep-2010 10:47

|

||

|

x 0

x 0 Alert Admin |

STI opens higherSINGAPORE shares opened higher on Thursday, with the benchmark Straits Times Index at 3,082.46 in early trade, up 0.37 per cent, or 11.43 points. Around 173.1 million shares exchanged hands. Gainers beat losers 114 to 48. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Hulumas

Supreme |

16-Sep-2010 09:46

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

HOWEVER, SSE, SZSE, STI and some other countries indices will be decoupling to DOW JONES index sometime beginning next year! | ||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

16-Sep-2010 09:41

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

I am afraid. DOW JONES index mega trend will be on its range trading between 9,000 to 11,000 throughout next decade as my prediction!

|

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

16-Sep-2010 06:59

|

||

|

x 0

x 0 Alert Admin |

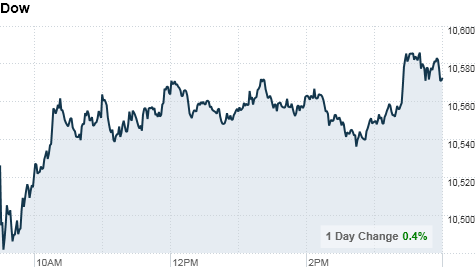

Stocks end higher on dollar moves

NEW YORK (CNNMoney.com) -- Stocks surged in the last half hour of trading to close higher Wednesday, tracking the U.S. dollar's strength after Japan moved to rein in the surging yen. The Dow Jones industrial average (INDU) rose 46 points, or 0.4%, to close at 10,572.73. The Nasdaq (COMP) added 12 points, or 0.5%, to end at 2,301.32, and the S&P 500 (SPX) ticked up 4 points, or 0.4%, to settle at 1,125.07. Energy and technology shares had been lower earlier in the session, dragging down the broader indexes, but they turned mixed in the last hour of trade. Housing shares remained mostly lower. Foreign exchange rates were in the spotlight after the Japanese government's first jump into the currency market since 2004. The yen rose to a fresh 15-year high against the dollar Tuesday, prompting recently re-elected Japanese Prime Minister Naoto Kan to announce the nation will sell yen and buy dollars. The move boosted the dollar Wednesday.

Stocks ended mixed Tuesday, as a recent rally on Wall Street ran out of steam. Investors welcomed a slightly better-than-expected report on U.S. retail sales, but the Dow and S&P 500 both closed lower. Spotlight on manufacturing: The manufacturing sector has expanded for 13 straight months, making it a bright spot against a backdrop of fears of a slower recovery. A report released earlier this month showed activity grew well beyond expectations in August.

Economy: The government said U.S. import prices increased 0.6% in August, driven by rising gas prices. Export prices rose 0.8% in the month. Former Fed chairman Alan Greenspan called for the government to raise taxes in a speech before the Council on Foreign Relations in New York. Companies: MasterCard (MA, Fortune 500) shares gained to end 5.3% higher. The company said it expects its net income to rise at least 20% this year, due to a decline in expenses and favorable foreign exchange rates. Shares of most big banks closed mixed Wednesday, the second anniversary of the failure of Lehman Brothers. Novell (NOVL) shares rose to end up almost 6% on unconfirmed talk that the network software company is preparing to sell itself in two parts. World markets: European shares ended lower. The CAC 40 in France fell around 0.4%, Germany's DAX slipped 0.1%, and Britain's FTSE 100 was 0.2% lower.

Currencies and commodities: The dollar rose against the euro and the British pound, and surged more than 2.5% against the Japanese yen. Oil futures for October delivery fell $1 to $75.80 a barrel. A report late Tuesday from the American Petroleum Institute showed an unexpected increase in crude supplies last week, while the more closely watched inventory report from the Energy Information Administration showed that supplies fell. Gold for December delivery eased $3 to settle at $1268.70. On Tuesday, the December contract settled at a record high of $1,271.70. Bonds: The yield on the 10-year Treasury note rose to 2.72% from 2.67% late Tuesday. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Hulumas

Supreme |

15-Sep-2010 17:45

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

STI 3,111 is imminent !

|

||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

15-Sep-2010 17:36

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

That is the way . . . SGX's "QUALITATIVE MEASURE" I like it very much !

|

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

15-Sep-2010 13:33

|

||

|

x 0

x 0 Alert Admin |

OVERALL employment in Singapore rose for the fourth straight quarter from April to June while redundancies remained at a pre-recessionary low level, helping to stabilise the jobless rate at 2.2 per cent. Some 24,900 jobs were added in the second quarter, bringing the total gains in the first half year to 61,400, against a loss of 13,800 jobs a year ago. With the growing manpower demand, job openings have outnumbered job seekers for the first time in this economic recovery, said the Ministry of Manpower in its Q2 labour market report on Wednesday. The services sector added 25,400 workers in the second quarter, fewer than the 33,400 jobs added in the earlier quarter. Construction took in 2,000 more workers, compared to a drop of 400 in the first quarter. However, manufacturing jobs fell by 2,300, after rising by 3,100 in the first quarter. 'Unemployment has stabilised, after declining sharply at the end of 2009,' said MOM, noting that the seasonally adjusted unemployment rates were unchanged over the quarter at 2.2 per cent (overall) and 3.2 per cent for residents in June, reflecting significant improvements from the 3.2 per cent and 4.5 per cent respectively from a year ago. There were 84,400 jobless residents in June. Seasonally adjusted, the number was 65,500, comparable to 66,200 in March, but is down 27 per cent from 90,300 a year ago. MOM added that long-term unemployment also improved significantly. The number of residents who had been looking for work for at least 25 weeks fell substantially from 25,800 or 1.3 per cent of the resident labour force in June last year to 16,500 or 0.8 this June. Their share among the pool of job seekers also improved from 22 per cent to 20 per cent over the year. Redundancies remained at around pre-recessionary quarterly levels, with 2,280 workers made redundant in the second quarter. This is slightly lower than the 2,400 in the earlier quarter. Redundancies in manufacturing rose over the quarter from 1,120 to 1,220, while that in construction and services fell from 340 to 150 and 940 to 920 respectively. |

||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

15-Sep-2010 13:24

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

Buying call! Just focus on S chips!

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

15-Sep-2010 13:22

|

||

|

x 0

x 0 Alert Admin |

STI opens higherSINGAPORE shares were higher at midday on Wednesday, with the benchmark Straits Times Index at 3,062.93, up 0.46 per cent, or 14.28 points. About 1.6 billion shares exchanged hands. Gainers beat losers 280 to 118. |

||

| Useful To Me Not Useful To Me | |||

|

pharoah88

Supreme |

15-Sep-2010 10:52

|

||

|

x 0

x 0 Alert Admin |

SGX to quote ADRs of Chinese firms Ephraim Seow ephraimseow@mediacorp.com.sg SINGAPORE The Singapore Exchange (SGX) said yesterday it would launch the American Depository Receipts (ADRs) of these companies on Oct 22. ADRs are certificates that represent a specified number of shares in a foreign stock traded on a US exchange. They are denominated in US dollars, with the underlying security held by a US financial institution overseas. As a start, SGX will quote ADRs of 19 firms on its new GlobalQuote board. Besides PetroChina — currently the world’s second-largest listed company after Exxon Mobil — the others include Chinese language Internet search giant Baidu and the world’s biggest telco, China Mobile. SGX said the move marked the start of its cooperation with Nasdaq OMX to bring ADRs to GlobalQuote. It will link market participants from both trading pools, with the ADRs on GlobalQuote fully interchangeable with US-listed ADRs. BNY Mellon is the depository bank for SGX’s GlobalQuote. If it proves popular, the exchange may extend the platform to the ADRs of South Korean, Taiwanese and Indian firms, SGX executive vice-president Chew Sutat said. Industry experts welcomed the move, saying the ADRs are a good product with which investors can diversify their portfolios. ADRs could also be a more efficient and cost-effective system since investors here do not have to open a separate trading account and incur additional broking fees, they said. However, they expect a slow initial subscription rate. “It may take about half a year for investors to know the way around the trading system and understand the companies they are buying into. The take up rate also depends on the marketing of these firms and the accessibility of research information,” noted Mr Roger Tan, vice-president of Sias Research. Analysts also warn investors to be aware of the risks related to investing in ADRs. “Beyond the regular risks of equities trading, there is the added currency risk. Even if the shares appreciate, the overall value may be decreasing if the US dollar is weakening while the Singapore dollar is strengthening,” said Mr Albert Fong, president of The Society of Remisiers. — Singapore-based investors will soon have the opportunity to trade in shares of some of the large Chinese firms listed in the United States, such as PetroChina and Baidu, during the Asian time zone. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

15-Sep-2010 07:08

|

||

|

x 0

x 0 Alert Admin |

Stocks end mixed after choppy day

NEW YORK (CNNMoney.com) -- Stocks managed to pare some losses Tuesday on better-than-expected retail sales data, but indexes ended mixed as investors stepped back from a recent runup. The Dow Jones industrial average (INDU) fell 18 points, or 0.2%, to end at 10,526.49. The Nasdaq (COMP) added 4 points, or 0.2%, to close at 2,289.77 and the S&P 500 (SPX) fell 1 point, or 0.1%, to end at 1,121.10. Before Tuesday, the blue-chip Dow and the S&P had closed higher for eight out of nine straight sessions. After that kind of run, analysts say it's not uncommon for investors to take a breather. Stocks opened weakly Tuesday and turned lower in the morning, but they had pared most of the morning's losses by the afternoon. "The market has a bipolar effect to it right now -- it doesn't know what it's doing," said Joseph Saluzzi, co-head of equity trading at Themis Trading. Stocks had rallied Monday after the release of new global banking rules, upbeat economic data from China and some acquisition activity helped boost investor sentiment. Investors will continue to take their cues from the economy. While retail sales rose for the second consecutive month, the increase was still modest, keeping stock gains in check. Meanwhile, with the dollar falling to a fresh 15-year low against the yen, some investors are turning to the safety of gold, sending the precious metal to a new intraday record high. Economy: U.S. retail sales rose 0.4% in August, or a gain of 0.6% excluding auto sales. This slightly outpaced economists' expectations. Retail sales were expected to have risen 0.3% last month, according to consensus estimates from Briefing.com. "Sales were slightly better than expected, but July was revised lower," Saluzzi said. "With that kind of back-and-forth, people don't know what to make of these figures." After the opening bell, another government report showed business inventories rose 1% in July, following an upwardly revised 0.5% increase in June. The July figure is the highest increase in two years. Additionally, a $42 billion bill to spur small business job creation cleared a key test in the Senate Tuesday. The Small Business Jobs Act includes $30 billion to spur lending and $12 billion in tax breaks. Companies: Shares of electronics retailer Best Buy (BBY, Fortune 500) surged to end 6% higher Tuesday, after the company reported earnings that beat expectations and also raised its outlook. Best Buy earned 60 cents per share on revenue of $11.3 billion in its latest quarter. Analysts polled by Thomson Reuters expected a profit of 44 cents a share and $11.5 billion in revenue. Best Buy also raised its earnings-per-share guidance for 2011 to $3.70 from $3.55. Citigroup analysts said Tuesday that incoming BP (BP) Chief Executive Bob Dudley told them the company believes claims will be less than the $20 billion it has set aside for the "Independent Claim Fund." But in separate news, the Justice department expects to sue BP for damages from the Deepwater Horizon oil spill, according to a filing made last night with the U.S. District Court in New Orleans. BP shares ended 0.4% higher. Cisco Systems Inc. said on Tuesday that it will begin to pay a dividend yielding between 1% and 2% in the current fiscal year, which ends in July 2011. Shares of Cisco (CSCO, Fortune 500) initially rose 2% on the announcement, but gains slowed and the stock ended 0.9% higher. Toyota Motor Co. (TM) said it will put out six all-new hybrid vehicles worldwide by 2012. Shares closed down 0.7%. World markets: European shares hovered around breakeven for most of the day but closed higher. France's CAC 40 and Germany's DAX ended 0.3% higher, while and Britain's FTSE 100 added 0.2%. Asian markets ended mixed. Japan's benchmark Nikkei index fell 0.2% and the Hang Seng in Hong Kong rose 0.2%. The Shanghai Composite ended flat. Currencies and commodities: The dollar edged up against the euro and the British pound, but slipped versus the yen. Earlier in the session, the dollar hit a fresh 15-year low against the yen. News reports said the Japanese government may take steps to curb the currency's strength amid growing concerns about the pace of the recovery. But most traders still don't expect to see any intervention just yet. Oil futures for October delivery fell 39 cents to settle at $76.80 a barrel. Gasoline prices are spiking across the Midwest, because of several pipeline closures by Ontario-based Enbridge Inc. Gold for December delivery rose to $1,276.50 an ounce earlier in the session, a new intraday record. The previous record was about $1,264.80 an ounce on June 21. Tuesday's settlement price, $1,271.70 an ounce, was also a new record. Bonds: The yield on the 10-year Treasury note fell to 2.67% from 2.76% late Monday. |

||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

14-Sep-2010 09:53

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

>100 American BANKS are on the edge of huge CAR deficiencies, by next year. What will the world economy look like?

|

||

| Useful To Me Not Useful To Me | |||

|

pharoah88

Supreme |

14-Sep-2010 08:21

|

||

|

x 0

x 0 Alert Admin |

####WHY IS THIS THREAD RESTRICTED TO PLAIN VANILA POSTING FONT#### <><><><>With EQ<><><><> [][][][]CREATIVITY STIFFLED[][][][] {}{}{}{}INNOVATION TERMINATE{}{}{}{} ^^^^Humans redUced tO ROBOTS^^^^ ???? WHY ???? | ||

| Useful To Me Not Useful To Me | |||

|

pharoah88

Supreme |

14-Sep-2010 08:18

|

||

|

x 0

x 0 Alert Admin |

US Market Stocks are up by notable margins in mid-morning trading on Monday, as the markets are reacting to fresh banking regulations and another spike in merger-and-acquisition activity. The strength in the markets has lifted the major averages to their best intraday levels in a month. The major averages have been moving sideways in recent trading, hovering near their session highs. The Dow is currently up 92.03 points or 0.9 percent at 10,554.80, the Nasdaq is up 33.98 points or 1.5 percent at 2,276.46 and the S&P 500 is up 12.59 points or 1.1 percent at 1,122.14. The banking sector has been spearheading the day's gains after the Basel Committee on Banking Supervision's new Basel III requirements for bank capital reserves were less stringent than some had expected, despite a tripling of reserve requirements. The impact of the new regulations has also been lessened as most financial firms have already raised substantial reserves in the wake of the global economic crisis. | ||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

14-Sep-2010 07:04

|

||

|

x 0

x 0 Alert Admin |

Stocks: Investors find reason to cheer By Julianne Pepitone, staff reporterSeptember 13, 2010: 4:31 PM ET NEW YORK (CNNMoney.com) -- Stocks finished higher Monday as new global banking rules, upbeat economic data from China and some acquisition activity helped boost investor sentiment. The Dow Jones industrial average (INDU) added 0.8% to end at 10,544.13. The S&P 500 (SPX) rose 1.1% to close at 1,121.90, and the Nasdaq (COMP) led the gains with a 1.9% jump to 2,285.71. Markets around the world gained on news of the global banking agreement. The historic new reform will force financial institutions to more than double their capital reserves as a cushion protecting against future meltdowns. Stocks posted modest gains in a light trading session Friday, as ongoing worries about the economy dampened enthusiasm over an increase in wholesale inventories. Several economic reports are on tap for the week, and investors are also likely to focus on tax policy as lawmakers return from recess. Congress is expected to work on possible legislation to extend the Bush tax cuts. Banking shares get a boost: The bank reform came after top central bankers met in Basel, Switzerland, over the weekend. The new rules would require financial institutions to increase their core capital cushions to at least 4.5% of assets, up from the current 2%. Banks will have until 2019 before the rules come into full force -- a longer timeline than some had predicted. But that relief will likely be short-lived, said Steven Goldman, market strategist at Weeden & Co. "This is more a help for overseas banks rather than the U.S.," Goldman said. "Our markets are riding global stocks higher today, but it won't be sustained." Bank stocks rallied, and the KBW Bank Index (BKX) soared to close 3.1% higher. Shares of JPMorgan Chase (JPM, Fortune 500), PNC Bank (PNC, Fortune 500) and BB&T (BBT, Fortune 500) also surged to end up about 3%. Shares of Marshall and Ilsley (MI), based in Milwaukee, leapt 4.5%. Companies: Hewlett-Packard (HPQ, Fortune 500) announced it has agreed to acquire cyber-security firm ArcSight (ARST) for $1.5 billion, or $43.50 per share -- a 24% premium over the stock's Friday closing price. Shares of ArcSight surged to end 25.1% higher. Rental car company Hertz Global Holdings (HTZ, Fortune 500) said Monday that it had raised its offer for Dollar Thrifty Automotive (DTG), to $50 per share, or $1.56 billion. Dollar Thrifty shares rose to close up 5.4%, while Hertz added 7.8%. In April, Hertz originally offered to pay $1.2 billion to acquire its rival, but competing car rental company Avis (CAR, Fortune 500) later offered $1.36 billion for the company. Genzyme said it will sell its genetic testing unit to Laboratory Corp. of America Holdings for $925 million. Last month, Sanofi-Aventis went public with an $18.5 billion cash offer for Genzyme, with the French firm hinting it may consider a hostile takeover if Genzyme refuses to talk. Genzyme (GENZ, Fortune 500) shares closed down by almost 0.8%, while Laboratory Corp. (LH, Fortune 500) was fell almost 5%. Xerox (XRX, Fortune 500) shares ended almost 8% higher after a favorable article in Barron's said chief executive Ursula Burns is rebranding the copier giant as a data-services provider. Economy: In a Saturday report, China reported stronger-than-expected growth in its industrial sector in August. Inflation in the country also accelerated last month, driven by rising food prices. The data spurred China's central bank on Monday to set the yuan's daily reference rate at its highest level against the dollar since it scrapped its peg against the greenback in 2005. China's inflation battle intensifies New pressure has been building on China to let its currency increase in value. Treasury Secretary Timothy Geithner told The Wall Street Journal that China's decision in June to end its peg to the dollar was an "important step ... but they've done very, very little ... in the interim." The Treasury Department released August budget numbers, which showed a $90.5 billion deficit in the month, following a shortfall of $103.6 billion in July. World markets: The Basel bank reform helped European markets finish higher. The CAC 40 in France rose 1.1%, the DAX in Germany climbed 0.8% and Britain's FTSE 100 added 1.2%. 0:00 /2:442010: A repeat of 2008 crisis? Asian markets ended higher. Japan's benchmark Nikkei index rose 0.9%, the Hang Seng in Hong Kong surged 1.9% and the Shanghai Composite ended 0.9% higher. Currencies and commodities: The dollar fell against the euro, the British pound and the Japanese yen. Oil for October delivery rose 74 cents to settle at $77.19 a barrel after a leak forced officials to close a Chicago-area pipeline. Gold for December delivery gained 60 cents to settle at $1,247.10 an ounce. Bonds: The yield on the 10-year Treasury note fell to 2.74% from 2.81% late Friday. Bond prices and yields move in opposite directions. | ||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

09-Sep-2010 23:14

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

Rotational interest on play to all CHINA related penny stocks within September, I presume!

|

||

| Useful To Me Not Useful To Me | |||