| Latest Forum Topics / Straits Times Index |

|

|

STI to cross 3000 boosted by long-term investors

|

||||

|

xing78

Elite |

06-Aug-2011 23:27

|

|||

|

x 0

x 0 Alert Admin |

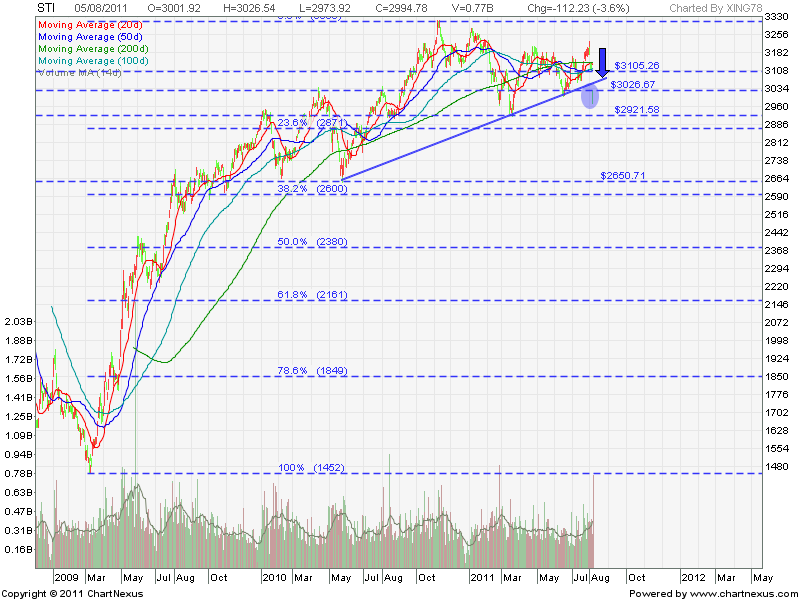

Here's the STI Chart.

|

|||

| Useful To Me Not Useful To Me | ||||

|

ktnpl2005

Member |

06-Aug-2011 22:51

Yells: "Be Happy!" |

|||

|

x 0

x 0 Alert Admin |

Be prepared for Black Monday ... 2830 | |||

| Useful To Me Not Useful To Me | ||||

|

|

||||

|

xing78

Elite |

06-Aug-2011 20:58

|

|||

|

x 0

x 0 Alert Admin |

You will celebrate National Day with Reds all over the place next week. Asian Market will plunge on Monday open, this is my view. Get ready your bullets to short. STI still quite high in my opinion. Major support 1 = 2900 Major support 2 = 2600 |

|||

| Useful To Me Not Useful To Me | ||||

|

hpong5

Master |

06-Aug-2011 20:28

|

|||

|

x 0

x 0 Alert Admin |

We will have a national day rally next week. | |||

| Useful To Me Not Useful To Me | ||||

|

bishan22

Elite |

06-Aug-2011 19:26

|

|||

|

x 0

x 0 Alert Admin |

Looking forward to another sell down on Monday after S& P downgrade. Prices will fall to new attractive level. Good luck all.

|

|||

| Useful To Me Not Useful To Me | ||||

|

|

||||

|

iPunter

Supreme |

06-Aug-2011 14:24

|

|||

|

x 0

x 0 Alert Admin |

It is all a continuation of the sub-prime crisis. Bailouts cannot cure the underlying sickness. They can only defer the final outcome to manifest later. In fact, bailouts tend to make the final outcome worse. But bailouts (QEs) offer superb opportunities in the resulting market rebounds, particularly in the initial stages. But there's no guarantee that more bailouts are the final solution...  |

|||

| Useful To Me Not Useful To Me | ||||

|

teeth53

Supreme |

06-Aug-2011 13:04

Yells: "don't learn through life, learn to grow with life " |

|||

|

x 0

x 0 Alert Admin |

They are using fastest available, super computer. I think.

|

|||

| Useful To Me Not Useful To Me | ||||

|

teeth53

Supreme |

06-Aug-2011 13:02

Yells: "don't learn through life, learn to grow with life " |

|||

|

x 0

x 0 Alert Admin |

Dow - Stock futures do not always accurately predict how stocks will trade once the market opens. When there is down grade. DOW chances of going up grade is bright, enjoy d roller coaster ride. Sounded like it is too wild this ride...

|

|||

| Useful To Me Not Useful To Me | ||||

|

|

||||

|

lowchia

Veteran |

06-Aug-2011 10:40

|

|||

|

x 0

x 0 Alert Admin |

In last week, STI dives lower 194 points from the opening of 3189 and close lower at 2995. A long black candle sticks with short upper/lower shadow affirms that investors have no qualms in selling their stocks for safety. Friday was the biggest daily loss in percentage terms since March 2, 2009 and its lowest closing level since March 21, 2011. Key Economics Data report: On Friday, S& P reduce the long-term U.S. credit rating by one notch to AA-plus on concerns about growing budget deficits. This downgrade came despite President Barack Obama signed legislation to reduce the fiscal deficit by $2.1 trillion over 10 years. For the week, the DOW tumbled 5.75 percent, logging its steepest weekly decline since Mar. 2009 while S& P 500 plunged 7.18 percent posting their biggest fall since Nov. 2008. In addition, both indexes are in correction mode since Apr 29 as they drop of 10 percent from its peak . Volume also at the heaviest level since the day after the Flash Crash in May 2010 with the consolidated tape of the NYSE at 8.18 billion shares, while 2.25 billion shares changed hands on the floor. Technical Analysis on STI STI index has broke the 3000 psychological support area and closed at 2995. 1) In weekly chart, a long black candle sticks with short upper/lower shadow indicates that investors sold indiscriminately reacting to the possibility of double dip 2) The weekly trading volume rose greatly as investors sell on fear. 3) MACD and RSI indicators are bearish as MACD lines cross down. 4) STI is currently supported by the resistance at 2973. 5) The critical support at 2936 is expected to be very strong and likely that bulls will put up a good fight at that level. Important resistance of STI: 3000 (Daily charts) Immediate Support of STI: 2973 (Daily charts) MY tactics: STI has............. READ MORE |

|||

| Useful To Me Not Useful To Me | ||||

|

MasterNg9999

Senior |

06-Aug-2011 10:33

Yells: "Isnt Human center of the universe???" |

|||

|

x 0

x 0 Alert Admin |

AND MADDER!!!!!! ... if there is such a word.... lolx... Presenting Today's 21 (At Least) Mini Flash CrashesSubmitted by Tyler Durden on 08/05/2011 17:47 -0400 Think you were the only one who could not get within 100 feet of any liquidity in today's market which bounced up and down by 5 points on any chatic whim? Think again. The day after the market saw 844 stocks trigger short-sale restrictions (meaning they dropped more than 10% in one day), not even the robots were able to pull a rabbit out of a hat and at least 21 stocks ended up flash crashing for a millisecond or much longer during today's trading session. Below are the charts of the 21 identified victims of overzealous ask-side algos, as usual courtesy of Nanex. http://www.zerohedge.com/news/presenting-todays-21-least-mini-flash-crashes now the market is an enigma... Cheer |

|||

| Useful To Me Not Useful To Me | ||||

|

timqoo

Senior |

06-Aug-2011 10:22

|

|||

|

x 0

x 0 Alert Admin |

their market news also like wall street last night. change direction very fast. ting tong ting tong.  with so much available info at hand due to tech improvement over so many years. market movement becomes faster and faster and better. |

|||

| Useful To Me Not Useful To Me | ||||

|

risktaker

Supreme |

06-Aug-2011 10:20

Yells: "Sometimes you think you know, but in fact you dont" |

|||

|

x 0

x 0 Alert Admin |

S& P Downgrades US Credit Rating to AA-PlusBy: CNBC with wires The United States lost its top-notch triple-A credit rating from Standard & Poor's Friday, in a dramatic reversal of fortune for the world's largest economy.

S& P cut the long-term U.S. credit rating by one notch to AA-plus on concerns about growing budget deficits. " The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government's medium-term debt dynamics," S& P said in a statement. " More broadly, the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenges to a degree more than we envisioned when we assigned a negative outlook to the rating on April 18, 2011," the statement said. The outlook on the new U.S. credit rating is negative, the S& P said in its statement, a sign that another downgrade is possible in the next 12 to 18 months. On Aug. 2, President Barack Obama signed legislation designed to reduce the fiscal deficit by $2.1 trillion over 10 years. But that was well short of the $4 trillion in savings S& P had called for as a good " down payment" on fixing America's finances. The political gridlock in Washington and the failure to seriously address U.S. long-term fiscal problems came against the backdrop of slowing U.S. economic growth and led to the worst week in the U.S. stock market in two years. " I did not expect this to happen this soon. This is something they gave the criteria on and I guess they stuck to it," said George Goncalves, chief Treasury strategist for Nomura Americas. " I really thought they'd take the two-stage approach and see how further cuts would come along." This came after a confusing day of reports: Standard & Poor's told the U.S. government early Friday afternoon that it was preparing to downgrade the U.S.'s triple-A credit rating but U.S. officials notified S& P that it had made a $2 trillion mathematical error. The error was in the calculation of the U.S. debt-to-GDP ratio over time and was based on a misreading of what the correct congressional baseline was, government sources indicated. They said that once informed of the error S& P revised its rate-cut rationale to emphasize the political aspects of the country's debt situation. " A judgment flawed by a $2 trillion error speaks for itself," a Treasury spokesperson said. Throughout Friday, markets were rife with speculation that S& P, which has had a negative outlook on the U.S. since April 18, would downgrade the country’s credit from its current triple-A level and that it could come as early as Friday night.

Goncalves said the downgrade could hit market confidence. U.S. Treasurys, once undisputedly seen as the safest investment in the world, are now rated lower than bonds issued by countries such as the UK, Germany, France or Canada. On July 14, S& P put the government on a credit watch with negative implications, meaning there was at least a one in two chance the U.S.’s long-term debt would be downgraded within 90 days. Earlier Friday an S& P spokesman declined to comment on any possible plans for a downgrade or statement. On Tuesday, both Fitch and Moody's backed their triple-A rating on the U.S.—but with caveats. Fitch warned that the U.S. rating " will remain under pressure for some time," while Moody's [MCO

32.88

— John Harwood, Patti Domm, Allen Wastler and Kate Kelly contributed to this report. |

|||

| Useful To Me Not Useful To Me | ||||

|

|

||||

|

timqoo

Senior |

06-Aug-2011 10:14

|

|||

|

x 0

x 0 Alert Admin |

ai zai. A mathematical error discovered late Friday by Treasury Department officials has thrown into limbo — at least temporarily — plans by ratings firm Standard & Poor’s to downgrade the top-notch AAA credit rating the U.S. has held for 70 years, people familiar with the matter said. Source: U.S. Debt Rating in Limbo as Treasury Finds Math Mistake by S& P in Downgrade Warning |

|||

| Useful To Me Not Useful To Me | ||||

|

MasterNg9999

Senior |

06-Aug-2011 09:29

Yells: "Isnt Human center of the universe???" |

|||

|

x 0

x 0 Alert Admin |

Gona hope and pray..... S& P Downgrades U.S. Debt for First Timehttp://online.wsj.com/article/SB10001424053111903366504576490841235575386.html then its Moody's , then Fitch..... more fun and drama...... Cheer |

|||

| Useful To Me Not Useful To Me | ||||

|

gohcsn

Member |

06-Aug-2011 08:47

|

|||

|

x 0

x 0 Alert Admin |

Get ready to see uptrend on monday on STI, time to hurry and get some bargains and make some quick bucks | |||

| Useful To Me Not Useful To Me | ||||

|

timqoo

Senior |

06-Aug-2011 08:28

|

|||

|

x 0

x 0 Alert Admin |

Dow closes up +60.93. The bulls won the battle last night. | |||

| Useful To Me Not Useful To Me | ||||

|

Salute

Master |

06-Aug-2011 07:05

|

|||

|

x 0

x 0 Alert Admin |

read some bullshitting statements again............Americans have confident in reducing debt and QE3 is on the way but don't know when. will Monday night DOW going to drop, or DOW is going to be slightly stable for the next week. Monday will be a one day national day rally, Wednesday??? |

|||

| Useful To Me Not Useful To Me | ||||

|

andreytan

Veteran |

06-Aug-2011 01:51

|

|||

|

x 0

x 0 Alert Admin |

I think come Monday will still see STI in sell mode. Reason being Tues is a holiday for us., but not Wall st. and the fear is still strong. Use this weekend to ponder over the next step of action , unfortunately , if anything happen on Tuesday, there is nothing we can do. that is why today i clear all. i hope nothing serious happen. may all forumer here be well and safe. |

|||

| Useful To Me Not Useful To Me | ||||

|

susan66

Master |

06-Aug-2011 00:51

|

|||

|

x 0

x 0 Alert Admin |

Just went for a roller-coaster ride, nearly vomitted, heart-attack! +100pts become -100pts now back coming back to original position. Please stop there, cannot take it.

|

|||

| Useful To Me Not Useful To Me | ||||

|

rotijai

Supreme |

06-Aug-2011 00:22

|

|||

|

x 0

x 0 Alert Admin |

just now reversed all within 15 mins.. now tank again

|

|||

| Useful To Me Not Useful To Me | ||||