| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||||

|

iPunter

Supreme |

28-Sep-2010 19:39

|

||||

|

x 0

x 0 Alert Admin |

You mean you simply want to go against me? It will be yourself you are going against.. hehe

|

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

28-Sep-2010 19:37

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

Since you say so, I start selling tomorrow then.

|

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

iPunter

Supreme |

28-Sep-2010 19:23

|

||||

|

x 0

x 0 Alert Admin |

But I think the market will most probably continue to climb a wall of worry...

|

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

28-Sep-2010 19:10

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

Hope so, but do not expect too much.

|

||||

| Useful To Me Not Useful To Me | |||||

|

iPunter

Supreme |

28-Sep-2010 10:18

|

||||

|

x 0

x 0 Alert Admin |

Things may or may not be very bad... because everyone wants to build a better world for all...  |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

niuyear

Supreme |

28-Sep-2010 10:14

|

||||

|

x 0

x 0 Alert Admin |

singapore to be peace maker

|

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

28-Sep-2010 09:27

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

BEWARE of : "It is highly likely trade war between PRC and USA commencing due to global existing currency exchange rate system disorder" !

|

||||

| Useful To Me Not Useful To Me | |||||

|

epliew

Supreme |

28-Sep-2010 08:43

Yells: "no worries be happy !" |

||||

|

x 0

x 0 Alert Admin |

so today downward trend.......

|

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Hulumas

Supreme |

28-Sep-2010 08:40

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

PRC USA trade war is unavoidable, I suppose . . . . so how?

|

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

28-Sep-2010 08:36

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

Load SSE, SZSE and unload DOW, S&P. | ||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

28-Sep-2010 06:56

|

||||

|

x 1

x 0 Alert Admin |

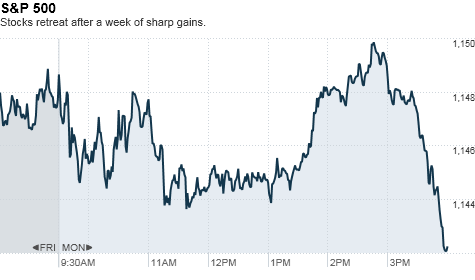

Stocks drop from 4-month highs

NEW YORK (CNNMoney.com) -- U.S. stocks kicked off the week with losses Monday, backing off strong gains logged in the previous week, as investors digested a small flurry of corporate dealmaking. The Dow Jones industrial average (INDU) slipped 48 points, or 0.4%, the S&P 500 (SPX) ticked down 6.5 points, or 0.6%, and the Nasdaq (COMP) lost 11 points, or 0.5%. Wall Street has been on a nice tear lately, as economic readings have started convincing investors that the recovery is gaining ground. U.S. stocks soared to their highest levels in four months Friday, and are still poised to end September with the biggest monthly gains in more than a year.

With the government's seizure of three credit unions on Friday and Moody's downgrade of Anglo Irish Bank on Monday, the health of global financial institutions remains a huge concern, he said.

And while declines were generally broad-based Monday, financial stocks took a hit, with industry leaders JPMorgan Chase (JPM, Fortune 500) and Bank of America (BAC, Fortune 500) sliding more than 1%.

Painfully high unemployment, home prices and the government's enormous deficit are other issues still weighing on the minds of investors, he said. Companies: Southwest Airlines (LUV, Fortune 500) announced a $1.4 billion offer for AirTran Holdings (AAI), the parent company of AirTran Airways. The bid amounts to a 69% premium over AirTran's Friday closing price. The announcement sent AirTran stock surging 61%, while shares of Southwest rose 9%. Consumer goods giant Unilever said it is buying Alberto Culver (ACV), manufacturer of the Tresemme and Noxzema brands, for $3.7 billion. Shares of Alberto Culver jumped 20%, while Unilever (UN) shares edged up 1%.

Meanwhile, Progress Energy (PGN, Fortune 500) tripped a circuit breaker, causing trading of the energy company to pause for five minutes after shares briefly plunged 90%. After the market close, BlackBerry maker Research in Motion (RIMM) announced plans for PlayBook, a new tablet computer to compete with Apple's iPad. Shares of the company jumped more than 1% in after-hours trading. World markets: European stocks ended lower. Britain's FTSE 100 fell 0.5%, Germany's DAX slid 0.3% and France's CAC 40 dropped 0.4%. Asian markets finished the session with strong gains. Japan's Nikkei and the Shanghai Composite climbed 1.4%, and the Hang Seng in Hong Kong rallied 1%. Currencies and commodities: The dollar rose against the euro and the Japanese yen, but fell versus the British pound.

Gold futures for December delivery surged to a new record, settling at $1,298.60 an ounce. On Friday, gold hit a new intra-day record of $1,301.60. Bonds: The yield on the 10-year Treasury note fell to 2.53% from 2.61% late Tuesday. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

27-Sep-2010 10:07

|

||||

|

x 0

x 0 Alert Admin |

STI opens higherSINGAPORE shares opened higher on Monday, with the benchmark Straits Times Index at 3,114.01 in early trade, up 0.69 per cent, or 21.33 points. Around 126.1 million shares exchanged hands. Gainers beat losers 202 to 21. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

24-Sep-2010 14:31

|

||||

|

x 0

x 0 Alert Admin |

STI higher at middaySINGAPORE shares were higher at midday on Friday, with the benchmark Straits Times Index at 3,089.31, up 0.2 per cent, or 6.18 points. About 1.3 billion shares exchanged hands. Losers beat gainers 228 to 185. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

24-Sep-2010 07:09

|

||||

|

x 0

x 0 Alert Admin |

Stocks end with a late-stage slide

NEW YORK (CNNMoney.com) -- Stocks stumbled in the final hours of a lackluster session and ended near session lows, as nervous investors weighed a surprise jump in weekly jobless claims with a better-than-expected reading on the housing market. The Dow Jones industrial average (INDU) dropped for a second straight day, falling 77 points, or 0.7%. The blue-chip index had tumbled as much as 94 points during the first hour of the session, then recovered to add 23 points before slumping just below the breakeven line for a majority of the trading day. The S&P 500 (SPX) ended 9 points lower, or 0.8%, while the tech-heavy Nasdaq (COMP) slipped 8 points, or 0.3%, after spending most of the day in positive territory. Stocks took a slide at the open after a surprise jump in jobless claims, but clawed back from the deep losses following reports that showed a bounce in existing homes and an improvement in the index of leading indicators, which gauges the economy's performance over the next three to six months. Trading remained in a tight range most of the day as worries about the job market and the broader economy continued to weigh on sentiment, but stocks lost steam in the late afternoon. "We got a bit of good news in housing and the overall economy, but there's still a great amount of uncertainty about the labor market," said Peter Tuz, president at Chase Investment Council. And though the rebound in home sales was a welcome change since they plunged 30% to a record low the previous month, the housing market recovery remains sluggish. "The housing report is helping, but investors know that as soon as there's one good report on housing, there will be a bad one two days later," said Gary Webb, chief executive of Webb Financial Group. Webb said trading will remain choppy as investors react to each piece of economic news. But he expects the market to trend upward for the remainder of the year. So far, the S&P is up almost 1%, while the Dow and the Nasdaq are more than 2% higher on the year. Much of that comes from the market's recent performance, with stocks on track to log the biggest monthly gains since April 2009. Stocks slumped Wednesday amid concerns about the economy and after gold prices touched a new all-time record just shy of $1,300 an ounce. Investors continued to eye gold prices, which settled at another all-time high Thursday. Economy: The weekly report on initial jobless claims was worse than expected. The number of people claiming unemployment benefits for the first time jumped by 12,000 to 465,000 last week, the Labor Department reported. Economists surveyed by Briefing.com were looking for claims to drop to 450,000 from 453,000 the previous week. The National Association of Realtors reported that existing home sales rose 7.6% 4.13 million units in August. That's just slightly better than economists' predictions. And compared with a year earlier, sales are down 19%. Meanwhile, the index of leading economic indicators -- a measure of the economy's future performance -- rose 0.3% in August, the Conference Board said. Analysts had forecast a 0.1% increase for the month. Companies: Shares of Apple (AAPL, Fortune 500) climbed for a fourth straight session, nearing $300 per share. The company's market capitalization became the world's second largest with a market value of $267 billion, surpassing PetroChina (PTR) which is worth $264 billion. Apple still lags behind Exxon Mobil (XOM, Fortune 500), which boasts a market cap of $313 billion. Blockbuster (BBI, Fortune 500) filed for its much-anticipated bankruptcy as it tries to recover from nearly $1 billion of debt. Blockbuster has struggled for survival ever since media conglomerate Viacom (VIA) spun off the company in 2004. Shares of Blockbuster tumbled 22%. McDonald's (MCD, Fortune 500) announced an 11% dividend hike to 61 cents per share for the fourth quarter. This is equal to $2.44 per share annually. Shares of the fast food chain fell 0.7%. Avis (CAR, Fortune 500) boosted its offer to buy Dollar Thrifty (DTG) to $1.52 billion, or about $53 per share, beating Hertz's (HTZ, Fortune 500) most recent offer of $1.45 billion, or $50 per share. Avis rose the cash portion of its bid by 12% to $45.79. Shares of Avis and Hertz fell about 4%, while Dollar Thrifty's advanced 1.9%. Starbucks (SBUX, Fortune 500) said late Wednesday that it was hiking the price of its "labor-intensive" drinks because of rising coffee bean prices. Shares of the coffee giant lost 1.9%. World markets: European shares fell Thursday. Britain's FTSE 100 lost 0.1%, Germany's DAX slipped about 0.4% and France's CAC 40 fell 0.7%. Major stock markets in Asia were closed in observance of mid-autumn festivals. Currencies and commodities: The dollar rose against the euro, and slipped versus the British pound and Japanese yen. Gold for December delivery rose $4.20 to settle at a record high of $1,296.30. Oil prices for November delivery rose 47 cents to settle at $75.18 a barrel. Bonds: The price on the 10-year Treasury note was higher, pushing down the yield to 2.55% from 2.56% late Wednesday. |

||||

| Useful To Me Not Useful To Me | |||||

|

iPunter

Supreme |

23-Sep-2010 07:59

|

||||

|

x 0

x 0 Alert Admin |

Looking at the term chart, the Dow is still at a resilient stage.. The nominal fall should not be viewed as 'slump'..  |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

23-Sep-2010 07:00

|

||||

|

x 0

x 0 Alert Admin |

Stocks slump, gold surges

NEW YORK (CNNMoney.com) -- Stocks slumped Wednesday, with the Dow ending a 5-day winning streak, as gold prices hit new highs and investors remained on edge about the recovery. The Dow Jones industrial average (INDU) finished 22 points lower, or 0.2%, and the S&P 500 (SPX) lost 6 points, or 0.5%. The Nasdaq (COMP) declined 15 points, or 0.6%, as the tech-heavy index was dragged down by Adobe's (ADBE) 20% plunge. Investors were disappointed after the software developer said that sales and earnings for its next quarter might fall short of expectations. Stocks have already logged significant gains in September and are still on track to post the biggest monthly gains since April 2009. So far this month, the S&P 500 is up more than 8%. "Sentiment has really changed this month," said Ron Kiddoo, CIO at Cozad Asset Management. "Investors are thinking maybe things aren't quite as bad, and the economy isn't headed for a double-dip." Because of the nice run over the past few weeks, Kiddoo expects stocks to trade in a narrow range through the end of the month. "There's no major catalyst to move the market due until the monthly jobs report in early October, and then earnings season," he said. Stocks rallied Tuesday after the Fed said it would take any action necessary to support the recovery, but gains were short-lived as investors considered the Fed's downbeat economic outlook. While the Fed said it expects improvement ahead, the central bank also cautioned that "the pace of economic recovery is likely to be modest in the near-term." The uncertainty drove investors toward gold, with the precious metal surging to a new record. Traders are also closely watching the Fed's securities purchases for any indication of how Tuesday's statement about the possibility of more quantitative easing (buying long-term U.S. Treasurys to boost the economy) translates into real action. The yields on the 2-year and 5-year notes eased toward new lows, signaling some strong buying as prices and yields move in opposite direction. Companies: Microsoft (MSFT, Fortune 500) said late Tuesday that it was hiking its quarterly dividend by 23% to 16 cents a share. Shares of Microsoft fell 2.2%. Shares of Adobe Systems (ADBE) got slammed after the company issued a sales and earnings outlook that fell far short of analysts estimates. After the closing bell Tuesday, Adobe reported a solid quarterly profit but the disappointing guidance sent the stock tumbling. Shares closed down 19%. World markets: Stocks in Europe closed lower. Britain's FTSE 100 edged down 0.4% while the CAC 40 in France sank 1.3% and Germany's DAX declined about 1.1%. Asian shares ended the session mixed. The Nikkei in Japan lost 0.4%, while the Hang Seng in Hong Kong and Shanghai Composite closed the session with modest gains. Currencies and commodities: The dollar tumbled against the euro, the Japanese yen and the British pound. Crude oil for November delivery, the most active contract, fell 26 cents to settle at $74.71 a barrel. Gold futures continued their march toward $1,300 an ounce. Gold for December delivery climbed $17.80 to settle at all-time high of $1,292.10 an ounce, after posting a new intra-day record of $1,298.00 earlier. Bonds: The price on the 10-year Treasury note was higher, pushing down the yield to 2.56% from 2.62% late Tuesday. |

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

22-Sep-2010 18:39

|

||||

|

x 0

x 0 Alert Admin |

fUll mOOn magnetIc fOrce tOO pOwer thIs eVenIng |

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

22-Sep-2010 11:45

|

||||

|

x 0

x 0 Alert Admin |

|

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

21-Sep-2010 21:32

|

||||

|

x 0

x 0 Alert Admin |

Stocks poised for early popNEW YORK (CNNMoney.com) -- U.S. stocks were poised for early gains ahead of the market open Tuesday, after reports that showed an bigger-than-expected uptick in new home construction. Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures all rose nearly 0.2% ahead of the opening bell. Futures measure current index values against perceived future performance. Early Tuesday, investors welcomed two government reports on new home construction. Housing starts hit a four-month high, surging 10.5% to an annual rate of 598,000, the Commerce Department said. Economists were expecting the annual rate to rise to 550,000 for the month, up from 541,000 in July, according to consensus estimates from Briefing.com. Building permits also rose, edging up 1.8% to an annual rate of 569,000 in August. Investors are also gearing up for the Fed's announcement on interest rates, due at 2:15 p.m. ET. The Fed is widely expected to leave rates unchanged. But, as has been the case for nearly two years, investors will be looking for signals about the economic outlook and for references to quantitative easing, the central bank's recent policy of buying bonds to stimulate the economy. At its previous meeting, the Federal Reserve took a cautious stance about the recovery, saying it plans to reinvest its debt into longer-term Treasury securities. Going forward, it's unlikely that Fed policymakers will authorize new asset purchases at the meeting, but might want to signal their intentions to do so in the future, Kathy Lien, director of currency research at Global Forex Trading said in a note to investors. "The Fed could wait until the economy deteriorates further before implementing additional quantitative easing, but if they want to pre-empt the potential slowdown, it may be smarter to act before the slowdown materializes because it will be a more difficult fix," she said. Companies: Hewlett-Packard said late Monday that it has settled its lawsuit against Mark Hurd, the company's ousted CEO, after the tech giant claimed he breached his separation agreement by taking a job at rival Oracle. Hurd resigned from HP (HPQ, Fortune 500) in August after he was cleared of sexual harassment charges but accused of violating the company's code of ethics. Shares of HP rose 0.8% in pre-market trading. World markets: European shares edged higher in mid-day trading. Britain's FTSE 100 gained 0.5%, the CAC 40 in France rose 0.6% and Germany's DAX rose rose 0.5%. In Asia, the Hang Seng index in Hong Kong and Shanghai Composite finished the session slightly higher. Japan's Nikkei index fell about 0.3%. Currencies and commodities: The dollar fell against the euro and the Japanese yen and was up slightly against the British pound. The expiring October oil futures contract fell 98 cents to $73.88 a barrel. Oil futures for November delivery, which will be the active contract beginning Wednesday, fell 37 cents to $75.82 a barrel. Gold for December delivery fell $4.80 to $1,276 an ounce. Gold continues to break records, settling at a record-high close at $1,280.80 an ounce on Monday. Bonds: The yield on the benchmark 10-year note fell to 2.71% from 2.72% late Monday. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

21-Sep-2010 06:38

|

||||

|

x 0

x 0 Alert Admin |

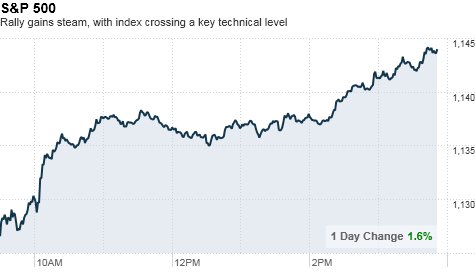

Stocks rally to 4-month highs

NEW YORK (CNNMoney.com) -- A U.S. stock rally continued to pick up speed through Monday afternoon, with all three major indexes closing at four-month highs after a key group of economists called an official end to the recession. The Dow Jones industrial average (INDU) gained 146 points, or 1.4%, to end at 10,753, its highest close since mid-May. The tech-heavy Nasdaq (COMP) rallied 40 points, or 1.7%, to finish at 2,355. The S&P 500 (SPX) added 17 points, or 1.5%, to close at 1,142. The index crossed 1,130, a key technical level watched closely by analysts, early in the session and continued to surge in the afternoon to cross the next short-term technical level of 1,140.

Buying picked up steam Monday after the National Bureau of Economic Research, the independent body of economists in charge of dating when recessions begin and end, announced that the 18-month Great Recession officially ended in June 2009.

"Housing is a zombie market," said Joseph Saluzzi, co-head of equity trading at Themis Trading. "The housing index reading today was horrible, but the stock market is reacting positively, meaning that investors are looking for more stimulus." But Saluzzi warned that if the gains aren't sustained for several sessions, stocks could edge down since market fundamentals are pointing lower. "Any rally that is induced by stimulus is not sustainable," Saluzzi said. "I think you have the let the cycle play through." In fact, trading could drift back into choppy waters this week as investors return their focus to more economic news on the housing market. Economy: A report from the National Association of Home Builders -- the first of a number of readings on the housing market due out this week -- showed builder confidence for newly built single-family homes remained steady in September, after falling for three consecutive months.

Fed: Investors will also be watching the Federal Reserve's announcement on interest rate policy Tuesday. The central bank is widely expected to hold rates steady, but investors will parse the Fed's policy statement for clues on the economic outlook. Companies: Against the backdrop of housing data due out this week, two major homebuilders are also releasing their latest earnings reports. Lennar (LEN) reported $825 million in revenue -- a 14% rise over the year-earlier quarter. Profit was $30 million, or 16 cents per share, well above analysts' forecasts of 4 cents per share on $760.2 million in revenue. Shares of Lennar rose 8.2%. Rival homebuilder KB Home (KBH) will report earnings on Friday. IBM (IBM, Fortune 500) announced Monday that it plans to acquire data storage company Netezza (NZ) for $27 per share, or about $1.7 billion. Netezza shares rose 15%. In another tech merger, shares of Nu Horizons Electronics (NUHC) more than doubled to $6.90 on news that Arrow Electronics (ARW, Fortune 500) will buy the company for $7 a share. Verizon Communications (VZ, Fortune 500) named Lowell McAdam as its president and chief operating officer, putting him second in line to Chairman and CEO Ivan G. Seidenberg. Shares were up 1.3%. BP (BP) announced Sunday that its Macondo well in the Gulf of Mexico has been cemented shut and is "effectively dead." The well ruptured 5 months ago, causing the worst oil spill in U.S. history. BP's stock rose about 1.7%. Spirit Airlines filed for an initial public offering with the Securities and Exchange Commission. World markets: European shares closed with strong gains. Britain's FTSE 100 jumped 1.7%, the CAC 40 in France rose 1.8%, and Germany's DAX added 1.4%.

Currencies and commodities: The dollar fell against the euro and the Japanese yen, but rose slightly against Britain's pound.

Bonds: The price on the 10-year Treasury note was slightly higher, pushing down the yield to 2.71% from 2.75% late Friday. |

||||

| Useful To Me Not Useful To Me | |||||