Throughout today, I have been seeing a lot of TV personalities saying that this is a great buying opportunity. In my humble trading opinion based on extensive trading experience, bottoms are not formed when everyone knows that it is a buying opportunity. This being said, we have certainly started to see some very good PANIC signs. Therefore, we can say that based on psychological analysis and market understanding we are near a bottom but might not have bottomed yet.

Inflection Point Model

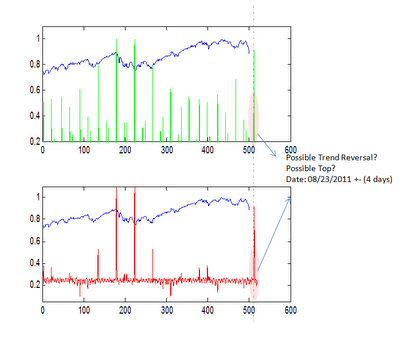

In any case, our trades are governed by the Trading Algorithm, not by our opinion. In this regard, we re-ran the proprietary Inflection Point Model, to discern the next possible Stock Market Turn date (Pick the Turn Point). The program output is given below:

Analysis

According to the two models, the next turn date is scheduled for August 23, 2011 (+/- 4 days). Moreover, both models are showing a potential turn, thus amplifying turn possibility. To our amazement, the amplitude of the turn point is very high. In fact, this amplitude is comparable to the amplitude we saw at the March 2009 bottom. Hence, we might be in for a significant turn point. Interestingly, this time frame also coincides with " Options Expiration Week" and Federal Reserves' Jackson Hole summit, where FED last year announced QE2.

All of these observations, collectively force us to observe that we might witness another significant announcement from the Fed, which might mark the bottom of the current decline. (If the uptrend is intact). Otherwise, if we have entered a bear market, next turn point could mark a top.

The Inflection Point Model is the primary reason why we has not tried to pick the bottom in this market, even when various famous individuals like Lazlo Brinyi and Biggs are recommending to hold the stocks.

Bottom picking is hard, and can result in significant declines. Some people might assume that we will rally based on employment numbers tomorrow, but we believe that any significant rally cannot take place until unless the Trading Algorithm gives a buy signal. Hence, even if the market rallies tomorrow, we will intently and safely wait on the sidelines for the turn window.

Conclusion

Now that we have a turn window date, we will concentrate on how to evaluate the market going into the turn window. Risk management is the key to success. In the next post, we will evaluate different market structure scenarios which can take place and how to play them for profitable trade in these tumultuous times.