| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||||

|

Blastoff

Elite |

11-Oct-2010 21:41

|

||||

|

x 0

x 0 Alert Admin |

Stocks set to post modest gainsNEW YORK (CNNMoney.com) -- U.S. stock futures rose Monday, as investors continued to bet that the sluggish recovery would spur the Federal Reserve to step in and boost the economy. Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were slightly higher ahead of the opening bell. Futures measure current index values against perceived future performance. The U.S. government and Treasury market are closed for Columbus Day, but all other financial markets are open. "Absent of any news, the market will continue to drift higher, given that the focus remains to be likelihood of the Fed's action," said Mark Luschini, chief investment strategist at Janney Montgomery Scott. "Anything that gives investors reason to pause and reconsider the idea that the Fed will pump more liquidity into the system would be a detriment to equity prices," he added. Stocks rallied Friday, pushing the blue-chip Dow above 11,000, after the U.S. Labor Department reported a sharp drop in jobs in September. The disappointing employment figures have raised expectations among investors, that the central bank will move to jolt the economy with another round of stimulus.

Economy: No major economic reports are on tap, but Janet Yellen, vice chairman of the Federal Reserve Board, will address the annual meeting of the National Association for Business Economics at 2:45 p.m. ET. Companies: Microsoft (MSFT, Fortune 500) will unveil a new line of phones running the Windows Phone 7 operating system in New York at 9:30 a.m. ET. The tech giant's stock was up 0.6% in premarket trading. World markets: European stocks moved higher in afternoon trading. Britain's FTSE 100, France's CAC 40 and the DAX in Germany were all up about 0.2%.

Currencies and commodities: The dollar rose against the Japanese yen, the British pound and the euro.

Gold futures for December delivery climbed $3.90 to $1,349.20 an ounce. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

08-Oct-2010 07:10

|

||||

|

x 0

x 0 Alert Admin |

Stocks sag ahead of monthly jobs report

NEW YORK (CNNMoney.com) -- Stocks finished mixed after a sluggish session Thursday afternoon, as cautious investors paused and geared up for the monthly jobs report due Friday. The Dow Jones industrial average (INDU) closed down 19 points, or 0.2%. The blue chip index started off the day with a pop and was less than 2 points shy of the 11,000 mark, a level it hasn't traded at since May. But the Dow drifted as the session wore on and sank almost 75 points before recovering. The S&P 500 (SPX) lost 2 points, or 0.2%, while the tech-heavy Nasdaq (COMP) added 3 points, or 0.1%. Stocks surged earlier this week, with all three major indexes hitting 5-month highs. But investors have had trouble keeping up that momentum, as reports showed continued weakness in the labor market.

While PepsiCo (PEP, Fortune 500) reported results in line with forecasts before the bell Thursday, Ghriskey said the company's performance is not as reflective of broader economic conditions as a company like aluminum maker Alcoa (AA, Fortune 500). Alcoa, which delivered results after the market close Thursday, will also be in focus during Friday's trading session.

Economy: The initial jobless claims number was the lowest in nearly 3 months, providing a breath of fresh air to the market. The Labor Department on Thursday reported that jobless claims totaled 445,000 in the week ended Oct. 2 -- down 11,000 from the prior week.

Investors are also eyeing retailers' September same-store sales figures Thursday for indications about consumer spending. Thomson Reuters, which tracks same-store sales for a group of 28 national chains, said total sales for the group rose 2.8% in September -- better than its initial forecast of a 2.1% gain in the month. Companies: Rumors that Apple (AAPL, Fortune 500) is preparing a version of its iPhone for Verizon (VZ, Fortune 500) -- the phone is currently only carried by AT&T (T, Fortune 500) -- started swirling again, after the Wall Street Journal published a report saying the phone may be on shelves early next year. Apple's stock edged higher as Verizon's slipped. PepsiCo (PEP, Fortune 500) was the first major company to report third-quarter results Thursday. Pepsi earned $1.22 per share during the quarter, in line with analysts' forecasts and up 13% from the year-ago quarter. But the beverage giant reduced the higher end of its profit outlook for the the year. Pepsi decreased about 3%. Alcoa (AA, Fortune 500) was the first Dow component to report results. The aluminum giant raked in $61 million, or 6 cents per share. Excluding certain items, Aloca brought in 9 cents per share, topping forecasts for earnings of 5 cents per share. Sales rose 15% to $5.3 billion, beating expectations for $4.96 billion in revenue. Adobe (ADBE) shares jumped almost 12% late Thursday after a New York Times blog reported a Microsoft (MSFT, Fortune 500) team, including chief executive Steve Ballmer, held a secret meeting with Adobe CEO Shantanu Narayen on a number of topics including the possibility of a merger between the two tech giants. World markets: European shares finished mixed. Britain's FTSE 100 fell 0.3%, while the DAX in Germany and France's CAC 40 closed with slight gains.

Currencies and commodities: As investors anticipate another round of asset purchases from the Federal Reserve, the dollar has continued to fall against the Japanese yen.

Bonds: Despite the bid for safer investments, Treasury prices were flat. The yield for the benchmark 10-year U.S. Treasury held steady at 2.40%. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

07-Oct-2010 07:09

|

||||

|

x 1

x 0 Alert Admin |

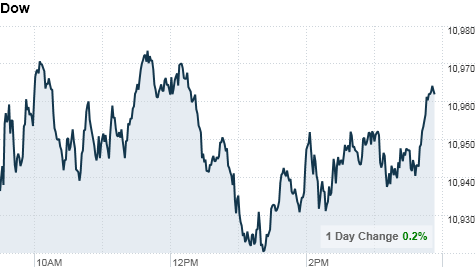

Dow hits 5-month high, Nasdaq sinks

NEW YORK (CNNMoney.com) -- Stocks ended Wednesday's choppy session mixed, as cautious investors mulled two reports showing continued weakness in the job market. The news comes ahead of the closely-watched monthly jobs report due Friday. The Dow Jones industrial average (INDU) added 23 points, or 0.2%, with GE (GE, Fortune 500) and Alcoa (AA, Fortune 500) leading the advance. The modest gains allowed the blue chip index to close at a fresh five-month high. The index's laggards included AT&T (T, Fortune 500) and Bank of America (BAC, Fortune 500). The S&P 500 (SPX) seesawed between gains and losses, but ended the session flat, down less than one point from the five-month high it closed at Tuesday. The Nasdaq (COMP) slumped throughout the day, and ended the session 19 points lower, or 0.8%. The tech-heavy index was dragged down as telecommunications company Equinix (EQIX) plunged 33% and computer software firm Citrix Systems (CTXS) sank 14.3%. All three major indexes rallied 2% Tuesday to the highest levels since May. A report showing that service sector activity improved in September, and a surprise move by Japan's central bank to cut interest rates, sparked a broad-based rally.

But King said corporate earnings season, which unofficially kicks off after the closing bell on Thursday when Alcoa (AA, Fortune 500) reports its results, could lift the markets.

Economy: Payroll processing firm ADP reported the private sector jobs plunged in September, trouncing the forecast of an increase.

The number of job cuts planned by employers edged up slightly in September. However, the number remained near a rock bottom 10-year low reported in August, according to a report from outplacement firm Challenger, Gray & Christmas.

Meanwhile, the International Monetary Fund said a double dip recession is unlikely, but global economic growth will slow from 4.8% this year to 4.2% in 2011. Companies: Johnson & Johnson (JNJ, Fortune 500) announced a deal to aquire Dutch biotechnology company Crucell (CRXL) for about $2.43 billion. J&J already owns 17.9% of Crucell's outstanding shares and last year, the two companies started working together on a flu vaccine. Both companies' stocks finished higher. Costco (COST, Fortune 500) said its fourth-quarter income rose 16% to $432 million, or 97 cents per share -- beating analysts' estimates of 95 cents per share. The wholesaler's earnings got a boost from increased membership sales and strength overseas. Shares rallied 1.2%. In a continued effort to expand its $40 billion energy business, GE (GE, Fortune 500) said it is buying energy technology and service provider Dressing Inc. for $3 billion. GE's stock rose 2.4%. Shares of AMR (AMR, Fortune 500), the parent company of American Airlines, rose 1.6% after the airline said it is bringing back hundreds of furloughed pilots and attendants, after forming joint businesses with several other airlines. Verizon's (VZ, Fortune 500) stock climbed out of negative territory and spiked 0.9% after rumors that Apple (AAPL, Fortune 500) is building a "Verizon-ready" iPhone resurfaced in a story in the Wall Street Journal. World markets: European shares closed with solid gains. Britain's FTSE 100 climbed 0.8%, while France's CAC 40 and the DAX in Germany advanced 0.9%.

Currencies and commodities: The dollar slipped against the euro, the British pound and the Japanese yen.

Bonds: Prices for U.S. Treasurys rose, pushing the yield on the 10-year note down to 2.40% from 2.48% late Tuesday. Bond prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

06-Oct-2010 07:06

|

||||

|

x 0

x 0 Alert Admin |

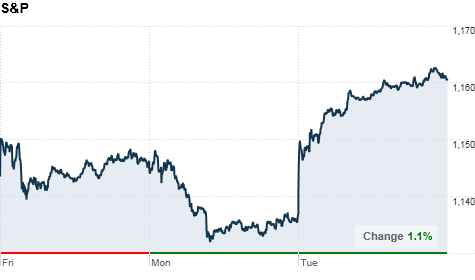

Stocks surge to 5-month highs on Japan, services

NEW YORK (CNNMoney.com) -- U.S. stocks rallied right out of the gate and continued to surge Tuesday, with all three major indexes gaining about 2% and finishing at their highest levels since May. Investors welcomed a surprise move by the Bank of Japan to cut its key lending rate, as well as improved data for the U.S. service sector. The Dow Jones industrial average (INDU) jumped 193 points, or 1.8%, to finish at 10,945, its highest level since May 3. Gains were broad-based as 29 of 30 Dow issues closing higher, with Boeing (BA, Fortune 500), Bank of America (BAC, Fortune 500) and DuPont (DD, Fortune 500) logging the biggest increases. The S&P 500 (SPX) added 24 points, or 2.1%, with Harley-Davidson (HOG, Fortune 500) closing up 9.1%. The tech-heavy Nasdaq (COMP) climbed 55 points, or 2.4%. Both indexes closed at their highest levels since May 12. Early Tuesday, Japan's central bank announced a move to lower its key interest rate to between 0% and 0.1%. It previously stood at 0.1%. The bank also said it would purchase about $60 billion of government bonds and other assets, to boost the pace of the country's recovery.

U.S. stocks are coming off of a big dip on Monday, when investors were feeling cautious ahead of corporate earnings season and key employment data due later in the week. Last week, they kicked off the start of October and the fourth quarter with modest gains. Experts said stocks will likely continue treading water, lacking day-to-day consistency, until the upcoming reports give the market a better direction. "The lynchpin economically is still unemployment," said Erick Maronak, senior portfolio manager at Victory Capital Management. "That's what gets people off the ledge. Some improvement there would be more than welcome by investors and non-investors alike." Economists polled by Briefing.com expect the unemployment rate to have risen to 9.7% in September, up from 9.6% in August, when the government reports the figure Friday. World markets: Japan's Nikkei rallied 1.5% after the Bank of Japan's decision, and the Hang Seng in Hong Kong ended the session up 0.1%. The Shanghai Composite was closed for the week-long Golden Week holiday.

Economy: The Institute for Supply Management's index -- measuring the nation's non-manufacturing business activity -- rose to 53.2 in September, from 51.5 the previous month. Economists were expecting the gauge to inch up to 51.8. Any number above 50 indicates growth in the sector. Currencies and commodities: The dollar fell sharply against major currencies Tuesdays, with the dollar index touching its lowest levels since January.

Rather, the dollar fell to the lowest level against the yen since the Japanese government announced intervention, a 15-month low. News of fiscal woes in Ireland have been largely ignored as well, Sylvester said. "The currency market has a blinkered attitude at the moment" he said. "But if upcoming economic data consistently shows that the worst of the U.S. economy has been seen, investors may start to shift focus." The buck's softness has helped boost prices of commodities priced in U.S. dollars, including gold and oil. Gold futures for December continued to run in record territory. Prices spiked $23.50 to settle at an all-time high of $1,340.30 an ounce, after reaching a fresh intraday record trading high of $1,342.60 an ounce earlier Tuesday. The price of crude oil for November delivery rose $1.35 to settle at $82.82 per barrel. Bonds: Prices for U.S. Treasurys rose, pushing the yield on the 10-year note down to 2.47% from 2.48% late Monday. Bond prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

05-Oct-2010 13:19

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

Dow will be back to around 10,000 again! | ||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

05-Oct-2010 07:14

|

||||

|

x 0

x 0 Alert Admin |

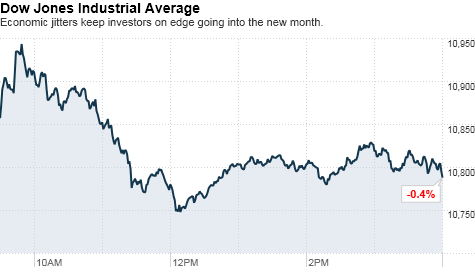

Stocks finish near session lows

NEW YORK (CNNMoney.com) -- Stocks finished near session lows Monday following a midday sell-off, with the Dow and Nasdaq indexes posting their largest one-day losses in nearly a month, as investors remain cautious ahead of corporate earnings season and key employment data due later in the week. The Dow Jones industrial average (INDU) tumbled 78 points, or 0.7%, with components Intel (INTC, Fortune 500), Alcoa (AA, Fortune 500), American Express (AXP, Fortune 500) and Microsoft (MSFT, Fortune 500) sinking the most. The S&P 500 (SPX) lost 9 points, or 0.8%. The Nasdaq (COMP) dropped 26 points, or 1.1%, with a Microsoft downgrade dragging the tech-heavy index lower. Other big tech shares losing ground included Apple (AAPL, Fortune 500) and Google (GOOG, Fortune 500).

Stocks had started October on a positive note -- although Friday's advance was limited. But with economic uncertainty continuing to underpin the markets, investors could be in for a rough month. Economy: A report from the Commerce Department showed that factory orders fell 0.5% in August, heightening fears about a slowdown in U.S. manufacturing growth. Economists were expecting order to decrease by 0.4%.

Companies: Shares of American Express tumbled 6.5%, after the Department of Justice filed an antitrust lawsuit against the company. The credit card giant said it has "no intention of settling the case." The suit comes as rivals Visa (V, Fortune 500) and Mastercard (MA, Fortune 500) settled their antitrust case regarding their credit card policies. Neither company admitted any wrongdoing. French pharmaceutical giant Sanofi-Aventis (SNY) launched a hostile takeover of Genzyme (GENZ, Fortune 500). Sanofi said it was taking its $18.5 billion offer for its rival directly to shareholders, after its efforts to work with the board of Genzyme were "blocked at every turn." Shares of Sanofi fell 0.8%, while Genzyme's stock rose 0.2%. Shares of Sara Lee (SLE, Fortune 500) climbed 7.2%, after the New York Post reported that the company turned down a $12 billion buyout offer from investment firm KKR & Co. Microsoft (MSFT, Fortune 500) fell 1.9%, after the tech giant's shares were cut by a Goldman Sachs analyst. World markets: European stocks declined Monday. The CAC 40 in France and Germany's DAX closed down at 1.2%. Britain's FTSE 100 fell 0.7%

Currencies and commodities: The dollar rose against the euro and the Japanese yen, but fell slightly against the British pound.

Bonds: Prices for U.S. Treasurys rose, pushing the yield on the 10-year note down to 2.48% from 2.51% late Friday. Bond prices and yields move in opposite directions. The 2-year yield touched a record low just below 0.40% |

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

04-Oct-2010 10:55

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

Good idea . However, Singaporean lack of entrepreneurship spirit to implement that.

|

||||

| Useful To Me Not Useful To Me | |||||

|

StarLine

Senior |

04-Oct-2010 00:57

|

||||

|

x 0

x 0 Alert Admin |

I see one business opportunity here. Setup a Singapore firm, to become an importer and exporter to act as a middle-man for the 2 countries.

|

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

01-Oct-2010 07:10

|

||||

|

x 1

x 0 Alert Admin |

Stocks post best September in 71 years

NEW YORK (CNNMoney.com) -- U.S. stocks fizzled Thursday, but that didn't stop the market from logging its best September in decades. Dow Jones industrial average (INDU) slipped 47 points, or 0.4%, after soaring more than 100 points at the start of trading. The S&P 500 (SPX) fell 4 points, or 0.3%, and the Nasdaq (COMP) ticked down 8 points, or 0.3%. Economic jitters have kept stocks from breaking out of a narrow range this week. And while upbeat readings on employment and economic growth helped spark an early rally Thursday, gains subsided as worries about the euro zone bubbled up. Despite the stomach churning month, stocks ended September on a high note. The Dow jumped 7.7%, the biggest September gain in 71 years. The S&P also posted the biggest gain since 1939, rising 8.7% in the month, while the Nasdaq climbed 12%. All 30 Dow components were on track to end September with gains, as of Wednesday's market close. Caterpillar (CAT, Fortune 500), Alcoa (A, Fortune 500), GE (GE, Fortune 500), Home Depot (HD, Fortune 500) and 3M (MMM, Fortune 500) are among the biggest gainers. And only 18 of the S&P 500 were down on the month. Carmax (KMX, Fortune 500), JC Penney (JCP, Fortune 500) and Office Depot (ODP, Fortune 500) are among the biggest gainers on the broader index.

Economy: The number of Americans filing for unemployment insurance edged down to 453,000 in the week ended Sept. 25, according to the Labor Department. The figure was slightly better than the 457,000 jobless claims economists had expected.

Meanwhile, the Commerce Department released its final reading on second-quarter gross domestic product, raising it slightly to a gain of 1.7% from the previously reported 1.6%.

World markets: Despite the wave of upbeat readings on the U.S. economy, bad news from overseas reignited fears about a slowing global recovery. Ireland's central bank unveiled a bank bailout that could reach about $46 billion. Ireland's budget deficit is on track to hit 10 times the European Union guidelines for eurozone members. Meanwhile, Moody's downgraded Spain's credit rating.

Companies: AIG (AIG, Fortune 500) took a major step toward paying back its government bailout Thursday, after announcing an agreement to pay down its debt to U.S. taxpayers. Part of this includes the insurer's plan to sell its Japan-based units for $4.8 billion. Shares of AIG gained more than 4%. Shares of Johnson & Johnson (JNJ, Fortune 500) slipped less than a percent after CEO William Weldon took responsibility for the company's recall issues and admitted to hiding a Motrin recall effort. Overall, Johnson & Johnson's stock has emerged unscathed from the recall issue as investors have largely shrugged off the issue since there were no reports of people getting sick. Currencies and commodities: The dollar rose against the euro and the British pound, but fell versus the Japanese yen. On Wednesday, Congress overwhelmingly passed legislation to impose tariffs on China for undervaluing its currency, the yuan, in order to keep export prices cheap. Gold futures for December delivery slipped 70 cents to settle at $1,309.60 an ounce, after hitting another intra-day trading record of $1,316.20 an ounce earlier in the session. Crude oil futures for November delivery gained $2.11 to settle at $79.97 a barrel. Bonds: The price on the benchmark 10-year bond fell, pushing up the yield up to 2.52% from 2.5% late Wednesday. |

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

30-Sep-2010 11:55

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

DOW JONES and S&P500 . . . . NO. SSE, SZSE, STI and some other Asian countries indices . . . YES.

|

||||

| Useful To Me Not Useful To Me | |||||

|

iPunter

Supreme |

30-Sep-2010 07:03

|

||||

|

x 0

x 0 Alert Admin |

This is a non-event.... Market resilience, or stability is still intact..  |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

30-Sep-2010 06:59

|

||||

|

x 0

x 0 Alert Admin |

Stocks stumble at the close

NEW YORK (CNNMoney.com) -- U.S. stocks ended slightly lower Wednesday, as uneasiness about the global economy continued to hang over the market and a light economic calendar gave investors little reason to jump in. Dow Jones industrial average (INDU) slipped 23 points, or 0.2%, the S&P 500 (SPX) fell 3 points, or 0.3%, and the Nasdaq (COMP) lost 3 points, or 0.1%. After rallying to 4-month highs and gaining for a fourth straight week last week, stocks have been stuck in a rut, swinging between small gains and losses. "The economy still hasn't improved measurably," said Brian Battle, director of Performance Trust Capital Partners. "If there is a recovery taking place, it's very uneven." Stocks finished modestly higher Tuesday, but trading was choppy as a disappointing reading on consumer morale fueled worries about the recovery.

World markets: With little in the way of economic news on tap Wednesday, concerns about the health of the euro zone pressured global markets.

"The U.S. Congress wanting to tick off our largest trading partner certainly doesn't bode well for the market," Schrader said. Asian markets ended mostly higher. Japan's Nikkei added 0.7% and the Hang Seng in Hong Kong rallied 1.2%. The Shanghai Composite finished near breakeven. Currencies and commodities: The dollar also suffered Wednesday, as worries about the recovery boosted speculation that the Federal Reserve will step in sooner rather than later to provide additional support to the U.S. economy.

Gold for December delivery continued to break records Wednesday, gaining $2 to settle at an all-time high of $1,310.30 an ounce after hitting an intra-day trading record earlier in the session. Crude oil futures for November delivery gained $1.68 to settle at $77.86 a barrel. Bonds: The yield on the benchmark 10-year bond rose to 2.5% from 2.46% late Tuesday. Companies: AIG is reportedly preparing to sell two of its Japanese life insurance divisions to Prudential Financial Inc. for $4.8 billion in cash, according to Bloomberg News. Shares of AIG edged slightly higher on Wednesday. The U.S. government and AIG (AIG, Fortune 500) are also reportedly working out a deal that would allow the Treasury Department to gradually exit its majority stake in the insurer. Shares of AOL (AOL) climbed 4.6% Wednesday after the media giant added another blog to its portfolio on Tuesday, buying technology blog TechCrunch. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Hulumas

Supreme |

29-Sep-2010 15:56

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

At Sgd. 0.045 historical lowest with 4 lots done only during global financial crisis and subsequently > Sgd. 0.045 to Sgd. 0.055 total only about 830 lots done. >Sgd. 0.06 I do not know since it is no longer counted by me. Hope, the above information might be useful to you.I am queueing to buy at Sgd. 0.07 >100 lots now.

|

||||

| Useful To Me Not Useful To Me | |||||

|

niuyear

Supreme |

29-Sep-2010 11:12

|

||||

|

x 0

x 0 Alert Admin |

Hulumas, what price was China Jishan at its lowest? Tks

|

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

29-Sep-2010 10:14

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

However, downward risk is growing up day by day. I am going into my safe heaven stock i.e. CHINA JISHAN at Sgd. 0.07.

|

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

29-Sep-2010 10:11

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

Hidden risk is going up day by day, be cautious!

|

||||

| Useful To Me Not Useful To Me | |||||

|

iPunter

Supreme |

29-Sep-2010 07:57

|

||||

|

x 0

x 0 Alert Admin |

This type of steady rise is good..

|

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

29-Sep-2010 07:02

|

||||

|

x 0

x 0 Alert Admin |

Stocks claw out gains

NEW YORK (CNNMoney.com) -- U.S. stocks finished higher Tuesday as a drop in consumer confidence and a mixed reading on home prices failed to sink recovery hopes. The Dow Jones industrial average (INDU) climbed 46 points, or 0.4%, the S&P 500 (SPX) added 5.5 points, or 0.5%, and the Nasdaq (COMP) gained 10 points, or 0.4%. After rallying for a fourth straight week last week, stocks slipped from 4-month highs and ended the day lower Monday amid a flurry of deal-making activity and ongoing economic jitters.

Economy: The Consumer Confidence Index dropped to 48.5 in September from a downwardly revised 53.2 in August, the Conference Board reported. Economists had been expecting the number to edge to 53. The index is a far cry from 90 -- a level that typically indicates a stable economy.

But the disappointing reading on consumer morale was countered by a slightly encouraging report on home prices. The Case-Shiller 20-city home price index showed home prices inched up 0.6% in July compared with June, according to the S&P/Case-Shiller 20-city home price index. On a year-over-year basis, prices rose 3.2% compared with July 2009. Experts polled by Briefing.com had forecast a year-over-year rise of 3.3%.

Companies: AOL (AOL) shares gained nearly 3% after the media giant announced plans to acquire news outlet TechCrunch. Shares of Barnes & Noble (BKS, Fortune 500) closed slightly higher after the bookseller said shareholders rejected investor Ronald Burkle's bid to expand his ownership of the company. Meanwhile, BlackBerry maker Research in Motion (RIMM) on Monday unveiled the PlayBook, a new tablet computer to compete with Apple's (AAPL, Fortune 500) iPad. Shares of RIM slipped 3% Tuesday, and the stock is down about 30% this year due to concerns that the company is falling behind Apple, as well as smartphone makers using Google's (GOOG, Fortune 500) Android operating system. Shares of Walgreens (WAG, Fortune 500) surged more than 11% after the drugstore chain reported its fiscal fourth-quarter revenue rose 7.4% to a record $16.9 billion, driven by strong prescription drug sales. The company's quarterly earnings rose 7.8% to $470 million, or 49 cents per share. World markets: European stocks ended mixed. Britain's FTSE 100 edged up 0.1%, France's CAC 40 lost 0.1%, and Germany's DAX was flat.

Currencies and commodities: The dollar fell against the euro and the Japanese yen, but rose versus and British pound. Gold futures for December delivery surged $9.70 to settle at a new record of $1,308.30 an ounce, after hitting an all-time intraday trading high of $1,311 earlier Tuesday.

Bonds: Prices for U.S. Treasurys rose, with the yield on the 10-year note falling to 2.47% from 2.53% late Monday. Bond prices and yields move in opposite directions. |

||||

| Useful To Me Not Useful To Me | |||||

|

iPunter

Supreme |

28-Sep-2010 20:54

|

||||

|

x 0

x 0 Alert Admin |

Dow futures are green at the moment... Hope the Dow rises moderately and maintain it's resilience... A huge "Cheong Aaarrrhhh!!! type of rally is not healthy, whereas a gradual climb amidst a wall of worry is best...  |

||||

| Useful To Me Not Useful To Me | |||||

|

teeth53

Supreme |

28-Sep-2010 20:35

Yells: "don't learn through life, learn to grow with life " |

||||

|

x 0

x 0 Alert Admin |

Yup...better world for all. (less dangerous) To each and each everyone, hope there's better tomorrow and they shall be. (Trade war?) will come to term with it. U win some, I win some. If not then. World senior leaders tend to think alike this 21st century and for their own prosperity and though threat or whatever threat there is...it will not end prosperity in or for next few decades. unless we have man like Adolf Hitler and or General Tomoyuki Yamashita from 20th century.

|

||||

| Useful To Me Not Useful To Me | |||||