| Latest Forum Topics / Straits Times Index |

|

|

STI to cross 3000 boosted by long-term investors

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

Oldbird

Senior |

13-Nov-2013 08:46

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

The last US wayang show see only their government last till mid january 2014.

I think Fed with right mind will not reduce their printing press overtimes before they can really kick their can farther down the road. Hopefuly we are safe for this christmas and or chinese new year. Beyong that when tapering does happen..all EM markets will be quite badly affected .STI in time to hit 2920 is not impossible...

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

risktaker

Supreme |

13-Nov-2013 07:41

Yells: "Sometimes you think you know, but in fact you dont" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Market condition will worsen ..... expect market to retreat at least to 2920 level.... good luck.... we expect fed to taper dec 2013/jan 2014

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

Oldbird

Senior |

13-Nov-2013 07:23

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

STI needs to see China face now not only Dow...

Need to pay some attention on China A Share, it had been quite negative in last two to three weeks, it dragged down HSI n the region. Should recover somewhat or stabilize from now.... |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

13-Nov-2013 06:01

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

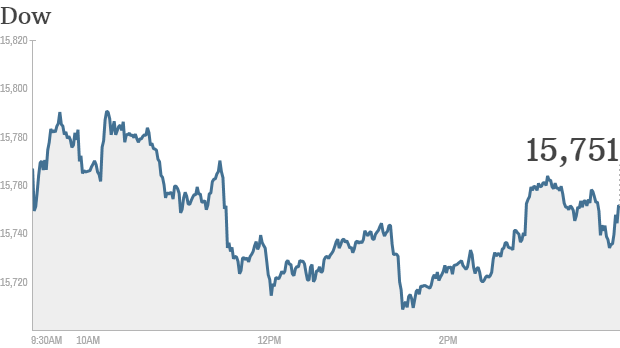

Stocks snap winning streak

Click the chart for more market data. The bull market took a breather on Tuesday, with stocks retreating from their recent highs.The S& P 500 and Dow closed lower, and the Nasdaq ended flat, snapping a two-day winning streak. Still, stocks are not far off from their record highs. Overall, the S& P 500, Dow and Nasdaq are all up more than 20% in 2013, thanks to a slowly recovering economy and continued bond buying from the Fed. Investors are fixated on one question: When will the Federal Reserve be ready to start slowing its stimulus program? Stronger-than-expected reports on economic growth and the job market have led some economists to expect the Fed to announce it will slow its stimulus program at its next meeting in December. " The market is basically doing pretty good, considering that tapering is back on the table," said Peter Cardillo, chief market economist at Rockwell Global Capital. Investors previously thought the Fed may wait until the spring to taper. But now that some think the Fed could pull back as soon as next month, interest rates are rising again. The benchmark 10-year Treasury yield temporarily hit 2.78% Tuesday morning -- its highest level in about two months. Minneapolis Fed President Narayana Kocherlakota and Atlanta Fed President Dennis Lockhart both argued in speeches Tuesday afternoon that the Fed still needs to do more to aid the job market. " The labor market remains disturbingly weak," Kocherlakota said. " The good news is that, with low inflation, the FOMC has considerable monetary policy capacity at its disposal with which to address this problem." Kocherlakota is scheduled to rotate into a voting role on the Fed's policymaking committee in January. European markets ended their trading day lower. Most Asian markets, however, closed on a positive note, as China's Communist Party wrapped up a four-day meeting with a pledge to allow markets to play a bigger role in allocating resources. Japan's Nikkei spiked 2.2% after the country reported a larger-than-expected trade surplus in September. |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

13-Nov-2013 05:56

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

World MarketsNorth and South American markets finished broadly lower today with shares in Brazil leading the region. The Bovespa is down 1.56% while U.S.'s S& P 500 is off 0.24% and Mexico's IPC is lower by 0.23%.

North and South American Indexes

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

aysaibey

Member |

13-Nov-2013 00:27

Yells: "Listen to the Wind. - Kungfu Master." |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

You are supreme. PLEASE contribute to my thread New World Order. My friends need you.

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

teeth53

Supreme |

12-Nov-2013 23:44

Yells: "don't learn through life, learn to grow with life " |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Oil / gas, RIG plus SOV play...Pacific Radiance first trading day tmr in play... Marine stock..in play?, CHEONG...woww hahaha...whao.

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

gufeng88

Senior |

12-Nov-2013 19:10

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Short sell orders executed on 12 November 2013 http://www.sgx.com/wps/wcm/connect/sgx_en/home/market_info/short_sale/short_sale_daily/DailyShortSell20131112.txt http://www.sgx.com/wps/portal/sgxweb/home/company_disclosure/cdp_buying_info/!ut/p/c5/04_SB8K8xLLM9MSSzPy8xBz9CP0os3gjR0cTDwNnA0sDC3cLA0_XsDBfFzcPQws_E6B8JJK8f6ihuYFnqFOgiVNYqKG3owkB3X4e-bmp-gW5EeUAfAYSFA!!/dl3/d3/L2dBISEvZ0FBIS9nQSEh/ |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

xerces

Member |

12-Nov-2013 15:01

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Why does STI lag so much behind USA, it really doesn't make sense....given that STI is more stable...It's getting kinda boring to watch STI in comparison to NIKKEI and DOW. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Peter_Pan

Supreme |

12-Nov-2013 14:59

Yells: "did you order dunkin' donuts" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

not much retail actions, all dry liao, awaiting for operators to push up..dyodd | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Peter_Pan

Supreme |

12-Nov-2013 14:15

Yells: "did you order dunkin' donuts" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Iceberg Order is an order (generally a large volume order) that allows the investor to disclose only a small part of the order, leaving a large undisclosed quantity to be ?hidden? from the public, for the purpose of hiding the actual quantity of the order. This order is normally used by institutional investors when they need to buy / sell large amounts of securities for their portfolio. In this case, they can divide their large orders into smaller portions, so that the public can only see a small part of the order at a time (just as the 'tip of the iceberg' is the only visible portion of a huge mass of ice). |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Peter_Pan

Supreme |

12-Nov-2013 14:03

Yells: "did you order dunkin' donuts" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

12-Nov-2013 14:01

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Singapore shares tread water, eyeing China policy: Reuters

Singapore shares lingered near their lowest level in more than three weeks, awaiting cues on China's economic agenda from a key four-day Communist Party policy meeting. The benchmark Straits Times Index was nearly flat at 3,186.95 at 0528 GMT, in line with a 0.1 percent fall in the MSCI's broadest index of Asia-Pacific shares outside Japan. ... China's leaders will unveil a reform agenda for the next decade later on Tuesday, seeking to balance the need to overhaul the world's second-largest economy as it loses steam with preserving stability and to reinforce the Communist Party's power. Shares of Sembcorp Industries Ltd dropped 0.4 percent to S$5.30, with trading volume exceeding its 30-day average, after the company posted margins below expectations, despite a 9 percent increase in net profit in the first nine months from a year earlier. " We see limited near-term share price upside with lingering concerns over power prices in Singapore amid intense competition," Maybank Kim Eng wrote in a research note. Sembcorp's overseas operations could post positive earnings surprise, but long-term prospects would depend on the pipeline of utilities project," Maybank said. Maybank has a " hold" rating on the stock and maintains its target price of S$5.50. Commodities firm Noble Group and property developer City Developments Ltd were up 1.4 percent and 0.8 percent respectively, ahead of their earnings to be released on Tuesday after market hours. |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

12-Nov-2013 09:12

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

SINGAPORE DAYBOOK: Singapore Air, Sembcorp Industries, Goodpack

Nov. 12 (Bloomberg) -- Singapore Airlines (SIA SP) and Noble Group (NOBL SP) are among companies expected to report earnings today.... WHAT TO WATCH: * Sembcorp Industries (SCI SP) 3Q net S$254.4m vs S$181.2m * Vicom Ltd. (VCM SP) 3Q net S$6.8m vs S$6.5m * Goodpack Ltd. (GPACK SP) 1Q net $13.9m vs $13m * Gaylin Holdings (GHL SP) 2Q net S$3.8m vs S$3.2m * Wheelock Properties (WP SP) 3Q rev S$27.6m vs S$37.7m * QAF Ltd. (QAF SP) 3Q net S$3.8m vs S$4.3m * Sim Lian Group (SLG SP) 1Q net S$27.7m vs S$37.2m * Yongnam Holdings (YNH SP) 3Q loss S$3.4m vs S$10.3m profit MARKETS: * S& P 500 up 0.1% to 1,771.52 * Stoxx Europe 600 up to 323.57 * MSCI Asia Pacific up 0.2% to 139.21 * Straits Times Index rose 0.3% to 3,186.72 EARNINGS: * Singapore Airlines (SIA SP) 2Q, City Developments (CIT SP) 3Q, Golden Agri-Resources (GGR SP) 3Q, Noble Group (NOBL SP) BTV: * 07:10am: Sri-Kumar Global Strategies President Komal Sri- Kumar * 08:10am: Amundi Asia CIO and Deputy CEO (Ex Japan) Ayaz Ebrahim * 09:10am: Fitch Head of Asia-Pacific Sovereigns Andrew Colquhoun * 09:40am: World Food Program Country Director Praveen Agrawal * 10:10am: Philippines Finance Secretary Cesar Purisima * 10:40am: UFC Asia MD Mark Fischer * 11:10am: Puru Saxena Wealth Mgmt. CEO Puru Saxena |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

12-Nov-2013 08:12

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 1 Alert Admin |

U.S. Stocks Rise as Dow Extends Record on Stimulus Bets U.S. stocks rose, with the Dow Jones Industrial Average extending a record, as investors awaited retailer earnings reports to gauge the strength of consumer demand and the likelihood of cuts to monetary stimulus. The Standard & Poor?s 500 Index climbed 0.1 percent to 1,771.89 at 4 p.m. in New York to close within a point of its record. The Dow rose 21.32 points, or 0.1 percent, to 15,783.1. About 4.8 billion shares changed hands on U.S. exchanges today, 21 percent below the three-month average. Bond markets were closed because of the Veterans Day holiday. ?Sometimes a boring day is nice,?John Carey, a portfolio manager at Pioneer Investment Management who oversees $200 billion in assets globally, said by phone from Boston. ?People will be watching over the next few weeks to see if the Fed does decide to begin tapering this year. If earnings continue trending higher the support will be there for better share prices.? The S& P 500 added 0.5 percent last week for a fifth week of gains, the longest streak since February. Better-than-forecast data on jobs and growth indicated the economy is strong enough to withstand a reduction in Federal Reserve stimulus, even as consumer spending climbed last quarter at the slowest pace since 2011. There were no economic reports today. Earnings ScorecardCorporate earnings that surpassed estimates and unprecedented monetary support from the Federal Reserve have propelled the S& P 500 higher by more than 160 percent from a March 2009 low. Of the 449 S& P 500 companies that have released third-quarter profits so far, 75 percent have beaten analysts? forecasts, data compiled by Bloomberg showed. Earnings per share for the companies on the gauge probably increased 4.7 percent in the third quarter, and will rise 6.2 percent in the fourth, according to estimates compiled by Bloomberg. ?We can put in the books that the third quarter earnings season was another positive surprise,? Phil Orlando, New York-based chief equity market strategist at Federated Investors, said by phone. His firm oversees about $380 billion in assets. ?The market was way too pessimistic going in.? News Corp. was the only S& P 500 member to post results today, releasing its report after the market closed. Wal-Mart Stores Inc., Macy?s Inc. and Nordstrom Inc. are among retail companies reporting earnings later this week. Home Depot Inc. posts results on Nov. 19. ?Fairly Restrained??Investors want to know the strength of the U.S. consumer going into what might be a tepid holiday season,? said Alison Porter, who helps oversee $108 billion as U.S. equities fund manager at Ignis Asset Management. ?Consumer spending has been fairly restrained. With big retailers like Wal-Mart and Home Depot yet to report, we?ll want to see whether that has picked up.? Economists still forecast the Fed will delay tapering asset purchases until March even after the payrolls data beat forecasts. Policy makers will probably pare the monthly pace of bond buying, known as quantitative easing, to $70 billion at their March 18-19 meeting from the current pace of $85 billion, according to the median of 32 estimates in a Bloomberg survey Nov. 8. The median forecast in an Oct. 17-18 survey of 40 economists also called for a cut to $70 billion in March. ?There?s been a correlation between rising share prices and low interest rates and the QE program,? Carey said. ?People legitimately are wondering if and when the Fed begins the tapering.? Equity ValuationsThe S& P 500 has rallied 24 percent in 2013, heading for the best annual gain in a decade. The gauge is trading at 16 times projected earnings, more than the five-year average of 14 times earnings, according to data compiled by Bloomberg. Investors have poured money into exchange-traded funds tracking U.S. stocks, pushing assets in the iShares Core S& P 500 ETF above the Vanguard FTSE Emerging Markets (VWO) ETF for the first time since 2010. The iShares S& P 500 fund manages $50.5 billion, compared with $48.3 billion for the ETF linked to shares of developing nations, according to data compiled by Bloomberg. The SPDR S& P 500 ETF Trust is the world?s largest ETF with about $156 billion. European markets ended with narrow gains. Asian markets were mixed as Typhoon Haiyan swept through the region. Online sales on China's " Cyber Monday" smashed last year's record by early afternoon |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

risktaker

Supreme |

12-Nov-2013 07:57

Yells: "Sometimes you think you know, but in fact you dont" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

U still donno what happen do u.... many BB are seriously injured if they survived.....market is kinda dead....

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

tanglinboy

Elite |

12-Nov-2013 07:13

Yells: "hello!" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Today chiong ar! | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

new6ie

Senior |

12-Nov-2013 07:07

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

They love their money, they love their status and best of all they love their country, what with all the support they can't say no. Wahahaha!

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Peter_Pan

Supreme |

12-Nov-2013 07:02

Yells: "did you order dunkin' donuts" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

ang moh really loves green huat kueh. so fwahny..! | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

SynapseX

Member |

12-Nov-2013 06:00

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Thanks! Will continue to monitor the price action. Spencer Synapse Trading - Mind over Markets

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||