| Latest Forum Topics / Straits Times Index |

|

|

STI to cross 3000 boosted by long-term investors

|

|||||

|

Isolator

Supreme |

09-Dec-2011 23:32

Yells: "STI is hard landing to below 2000..." |

||||

|

x 0

x 0 Alert Admin |

Towkay, dont worry about the shorts... The night is so young..... Anyway, Asia markets need to crash down soon... lol

|

||||

| Useful To Me Not Useful To Me | |||||

|

doggydoodoo

Member |

09-Dec-2011 23:26

|

||||

|

x 1

x 0 Alert Admin |

Me no shortist me don't think can tahan until session end as well..think red.. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

JUNWEI9756

Supreme |

09-Dec-2011 23:22

|

||||

|

x 0

x 0 Alert Admin |

No matter the outcome.. I will still hold tight my shorts... | ||||

| Useful To Me Not Useful To Me | |||||

|

Isolator

Supreme |

09-Dec-2011 23:10

Yells: "STI is hard landing to below 2000..." |

||||

|

x 0

x 1 Alert Admin |

Honestly, it is the markets that want a bear.... Tonight it seems scary to see Dow jump..... But after looking closely, it can actually be another bullsh.t.... Let's see whether I see it correctly in a few hr time.... Dow will turn red soon....No way market can bull rally before Asia crash.... lol My short on dow still open losing 100pt.... Let see how it can turn to profit 100pt tonight.... lol

|

||||

| Useful To Me Not Useful To Me | |||||

|

JustinQuek

Veteran |

09-Dec-2011 23:10

|

||||

|

x 0

x 0 Alert Admin |

Monday should buy call warrant hsi19000 looks set to rise. and its cheap 3 weeks till month end still long time to trade.i have already loaded some at 0.69 cents 29 lots exact | ||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

SGG_SGG

Master |

09-Dec-2011 23:04

Yells: "karma karma karma chameleon" |

||||

|

x 0

x 0 Alert Admin |

to be cont on monday I think.. hehe

|

||||

| Useful To Me Not Useful To Me | |||||

|

medivh

Elite |

09-Dec-2011 22:55

|

||||

|

x 0

x 0 Alert Admin |

How come no one's chanting " red red red" ? Where is that sifu? LOL |

||||

| Useful To Me Not Useful To Me | |||||

|

louis001

Master |

09-Dec-2011 22:50

|

||||

|

x 0

x 0 Alert Admin |

hey...not too bad....again DOW dancing around 12000.... 12,101.39 |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

iPunter

Supreme |

09-Dec-2011 21:34

|

||||

|

x 0

x 0 Alert Admin |

Many would have longed after two day dropped like sheet...

|

||||

| Useful To Me Not Useful To Me | |||||

|

Moneysense

Senior |

09-Dec-2011 20:54

|

||||

|

x 0

x 0 Alert Admin |

US futures cheong. Katek die pain pain! | ||||

| Useful To Me Not Useful To Me | |||||

|

victortan

Master |

09-Dec-2011 20:40

|

||||

|

x 0

x 0 Alert Admin |

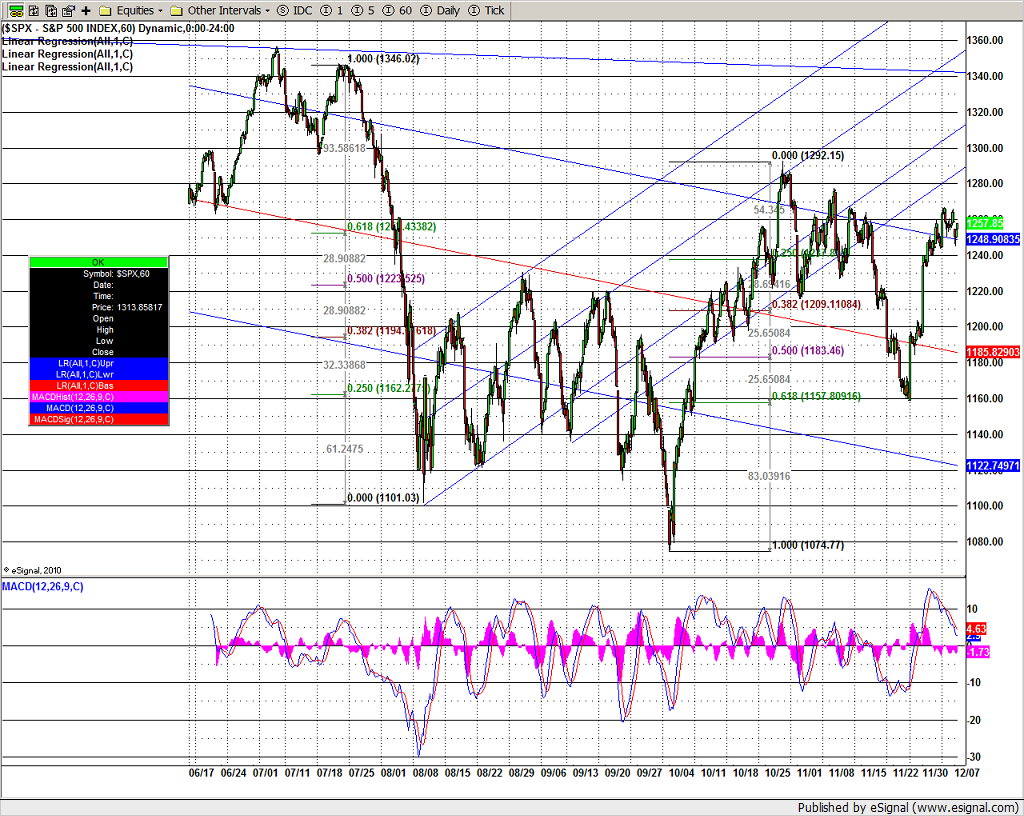

S& P Target 1600: Europe Shrugged, Not Atlas, Part IIWhat a difference a month makes. I wrote the last of this “S& P Target 1600” article series on November 8 at 12:50 EST. We were at S& P 1259, and the euro-dollar December futures were at 1.378. Most of the bad news seemed out, and I was expecting an upside break of the 1261 resistance. I was right for a few hours, as it reached a high of 1276 by the close. Then Europe shrugged again. We went up and down for a few days and on November 14, when Angela Merkel called for “perhaps the darkest hour since WWII,” I pulled the trigger. The next day, at 9:15, I posted the following comment:

We then reached an intraday low of 1158 on November 28. I had covered my shorts the week before (posted on My Inbox correspondence with some readers who asked) and I have been long since then. A Stampede it was, impressive and tough to stay in the saddle. The question is, now what? I say, ride it. What have we learned in the meantime? Well, Europe shrugged and did what it had to do when faced with the inevitable. Before interbank lending freezes, it’s all talk. When it happens, it’s all action. I have said it for a while: First guarantee, then nationalize, then monetize – I don’t remember which of my articles mention this, but they have all been written along the same script. The volatility leading to the event is just the illustration of how hard it is to get to it. Now, to be sure, we are not there yet, and volatility is here to stay for a while. But the trendline is the stampede, i.e. excess reserves trickling down to the financial system, after having been hoarded at various central banks, et al. Given the current earnings yield of some 8%, my target of S& P 1600 is on the horizon the question is when. I originally thought 2014. The political agenda may make it happen sooner. First, there is Europe. Sarkozy is due in April/May 2012, Merkel in early 2013. Greece, Italy and Spain are back into the conservative camp. France and Germany are not about to leave it. On that score, I was amazed by Merkel’s WWII comment. At first read, I thought “how indecent!" This is just a financial crisis how could one compare it to WWII, even as a figure of speech? At second read -- and to give Merkel the benefit of the doubt, which I’ll give anyway -- it may have been her version of “don’t waste a good crisis.” The idiom has been used by many dubious people why not her? The net of it: The eurozone reform will happen in due time, and this is only a few months away. Second, the US. Finally, a reasonably serious Republican candidate is emerging, Newt Gingrich. Contrary to most, if not all, he is quite candid: “I am not the perfect candidate,” he admits. So, assuming he is elected, there will be no surprise. Can he be, and should he be? I have my own opinion, but not to be debated on SA. From a market standpoint, I believe this new leadership and credibility helps. The best data point may actually be the dollar, which has been pretty strong of late (yes, I know, there are many other factors affecting the dollar, but political stability differential is one). Suffice it to say, the main thing I disagree with Gingrich on is his opinion on Ben Bernanke. This, from my book, is a scenario I dubbed “The Three Little PIIGS”:

From a practical portfolio standpoint, here is a hint at my stock-picking methodology. I do not use ETFs except to hedge. I classify stocks in potential gain/loss categories, 5 to 10%, 10 to 20%, 20 to 30%, and 30% plus for the upside. For the downside, the potential percentages have to be lower than the upside, so that my expected return is positive. And for each category, I add a time dimension: The greater the upside, the longer the horizon. I add it all up, and it works pretty well. Even with this run-up, I feel quite comfortable in the way the portfolios look. For the record, the time of this writing is December 7, at 12:30 EST, with S& P at 1257, euro-dollar December futures at 1.341. Since a month ago, only the dollar has changed, and it is stronger. It is Europe that Sshruged, not Atlas. I still say, " Go for it, John Galt." Disclosure: I am long AGM, CTAS, FIATY.PK, IMAX, IR, IPG, JCI, SANM, SLM, WSBC, VECO, WCC. Disclaimer: As a Registered Investment Advisor, there are a few things we must tell you. We at Capital Max do not know your personal financial situation or investment objectives, so this article does not constitute a solicitation to purchase or sell any of the securities mentioned, nor is it intended to provide specific investment advice. Past performance is no guarantee of future performance. We live this every day, and you should know it too. The value of the securities mentioned herein may fall or rise and are not insured by any government or private company, even if it meant something. We believe what we write, and we take your audience quite seriously. However, since we cannot be held responsible for any loss or damage caused by reliance on the information and data herein, you should consult with your own advisor and/or do your own research before acting on any of our opinions, which we change without notice. |

||||

| Useful To Me Not Useful To Me | |||||

|

victortan

Master |

09-Dec-2011 20:37

|

||||

|

x 0

x 0 Alert Admin |

3 Reasons Why Equities Are The New Safe HavenIt has been a while but I am back and I have not changed my bullish stance of large cap U.S. stocks one bit! Let me tell you why in a few words - very few people own them! One can talk about valuations, dramas in Europe, and what other crisis you can imagine - but unless there is a large enough pool of marginal sellers, any weakness in equities is likely to be shallow and short lived. Of course the opposite applies - if everyone is up to their eyeballs in common stocks then who is left to push prices higher? There is no one index that gives investors' percentage holdings of common stocks. To get an idea of just how fully invested consumers are in the stock market we need to piece a few things together. I use three indices to give me an idea:

We have a very interesting situation right now:

It is almost a certainty that this is the most " under-invested" U.S. consumers (ordinary average people on the street) have been in the stock market since at least the early 1990s. And it wouldn't surprise me in the slightest that this is the most under-invested they have been since the early 1980s, perhaps even going way back to the mid 1960s. Again, not being one to sit on the fence (or flip flop like so many other commentators) I believe that this is one of the few times in modern history where the shareholder base of large cap stocks in the U.S. has been so strong. Bull markets begin when there are relative few holders of stocks. Bear markets begin when common stocks are widely held by consumers and there is a high complacency towards risk. Mutual Fund Cashflows: The fact that the S& P 500 is unchanged this year given that more funds have flowed out of mutual funds than in 2008 (where the market sold off by some 50%) suggests to me that the market is now dominated by strong hands. Note the funds flowing into Mutual funds at the start of 2000 - who was left to buy? Also, note the magnitude of funds flowing out of mutual funds in 2011 - who is left to sell? ICI Net Cashflows of " Growth" Equity Mutual Funds.

Consumer Confidence: the astute amongst you will note that bull markets kicked into gear from extreme low levels of consumer confidence. Bear markets started from high levels of consumer confidence. If you exclude 2008, then consumer confidence is more or less as bad as it has ever been since the mid 1960s! With consumer confidence this low do you really think that investors would be overly invested in the stock market? I think not. Conference Board Consumer Confidence Index

Relative Valuations: If you are bearish on equities now, which implies you are bullish on treasuries, then in essence something much worse than what we have experienced over the last 35 years must now occur. It is not enough for another GFC of 2008 magnitude to occur, because markets are already priced for this. Yield Differential Between S& P 500 and the US 10yr.

To me the extreme valuation differential between equities and treasuries indicates, beyond reasonable doubt, just how crowded treasuries are and " uncrowded" equities are. How can treasuries be " safe havens" when they are crowded by individual investors. How can equities be risky when very few own them? It takes a brave contrarian to say that equities are the new safe haven. But that is exactly what I am saying! |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

victortan

Master |

09-Dec-2011 20:33

|

||||

|

x 0

x 0 Alert Admin |

3 Reasons Why The Bears Are Wrong

On Monday, after the market close in the U.S., Standard and Poor's put 15 EU countries under threat of downgrade. More notably was that Germany made the list of potential targets by the Standard and Poor's credit rating agency. Yes, that is the same credit agency that missed the ball about big banks five years ago. Typically, when a major economic country like Germany is threatened with a downgrade the stock market will fall. Added to the threat were 14 other European countries, so the stock market should have really plummeted. Yet, the exact opposite occurred - the indices rose or marginally decreased. Many subscribers wondered how this could be. Why would the market rise on a day after Standard and Poor's all but said, " Europe is screwed" to the investment community? I think there are three reasons why no one cared about a 15 nation downgrade threat. And keep in mind, everyone understands that there is a very real threat in Europe, and all the hot air we've blown into the economy to inflate growth could cause it to burst. My first reason is somewhat basic: it was a threat, not an actual downgrade. Standard and Poor's only threatened to downgrade and they cited the EU Summit this weekend as one of their reasons for delaying a downgrade. Clearly, the rating agency sees the potential to form a solution and restore economic growth to the EU. My second reason is a continuation of the first. The Standard and Poor's rating agency waited to downgrade 15 countries in Europe because of the EU Summit this week. Clearly, investors are optimistic a deal will be done. Additionally, investors have fought through worse news this year, such as lower GDP revisions, higher unemployment and rising interest rates. It will take a lot more than a threat to frighten investors after this crazy Fall. My third reason is more abstract. But as a trader it's the most critical. Back in October the indices looked to have bottomed. I went aggressively long during that time and the market complied and went on a ridiculous rally higher. I view the action in late October and all of November as a consolidation phase of a bull trend that began October 4. And within that bullish trend I view November 25 as a lesser swing low. Until either of those lows are violated, the trend is bullish. And in bullish trends stocks go up. The news can be as bearish as possible, but with institutional funds very under-invested and bearish sentiment on a private level higher than normal, odds favor a sluggish push higher for all major indices. I don't expect too much more from the market this week. A general index-wide pullback is normal after an 8% push higher. Only a complete breakdown in EU negotiations, a la U.S. Congressional budget talks, could halt the bullish momentum and turn the indices bearish this week. SPX continues to consolidate at 1250, although I think it should retest 1220. But that level should be heavy support. What is your biggest investment concern right now? Do you hold back on long-term investment because of the problems occurring throughout Europe? |

||||

| Useful To Me Not Useful To Me | |||||

|

monk999

Master |

09-Dec-2011 17:21

Yells: "TA is an art!" |

||||

|

x 0

x 0 Alert Admin |

goodluck. enjoy the weekend. its friday night..time to unwind and party...you have earned a lot already..give the bulls some chance to win. lol.

|

||||

| Useful To Me Not Useful To Me | |||||

|

medivh

Elite |

09-Dec-2011 17:13

|

||||

|

x 0

x 0 Alert Admin |

Iso: its time to start your chanting " Europe deep red, Dow 10k, STI 2400 "

|

||||

| Useful To Me Not Useful To Me | |||||

|

GuavaXF30

Master |

09-Dec-2011 16:55

|

||||

|

x 0

x 0 Alert Admin |

Europe has turned around. FTSE now up from earlier loss of more than 60 pts.

|

||||

| Useful To Me Not Useful To Me | |||||

|

Isolator

Supreme |

09-Dec-2011 16:33

Yells: "STI is hard landing to below 2000..." |

||||

|

x 0

x 0 Alert Admin |

I have shorted DOW again.... Tonight DOW and Europe will be red..... | ||||

| Useful To Me Not Useful To Me | |||||

|

bishan22

Elite |

09-Dec-2011 16:32

|

||||

|

x 0

x 0 Alert Admin |

Meeting after meeting. Price falling and falling. Who is buying, who is selling. Where are all the $$$$. haha. | ||||

| Useful To Me Not Useful To Me | |||||

|

Sgshares

Elite |

09-Dec-2011 15:55

|

||||

|

x 0

x 0 Alert Admin |

Polish Fin Min: Expect Another EU Summit Soon If No Accord Friday WARSAW (Dow Jones)--Polish Finance Minister Jan Vincent-Rostowski said Friday he would expect to return to Brussels for another European Union summit " in a few days" if the meeting that ends later in the day fails to deliver an accord. So far, the talks are not moving in the right direction, he said. In an overnight meeting in Brussels, European leaders failed to conclude a treaty change for the entire 27 members of the EU for more centralized budget controls and settled instead on an intergovernmental treaty between the 17 members of the euro zone and six other countries. -By Marynia Kruk, Dow Jones Newswires +48 22 447-2431 marynia.kruk@dowjones.com (END) Dow Jones Newswires December 09, 2011 02:47 ET (07:47 GMT) |

||||

| Useful To Me Not Useful To Me | |||||

|

aleoleo

Master |

09-Dec-2011 15:09

|

||||

|

x 0

x 0 Alert Admin |

market crash liao ......... lelong lelong ........... sell loh |

||||

| Useful To Me Not Useful To Me | |||||

The market hardly budged Tuesday. Volume ran low once again as the indices moved sideways all session. To the bulls' credit, some indices managed slight gains during the session despite the tumult in Europe.

The market hardly budged Tuesday. Volume ran low once again as the indices moved sideways all session. To the bulls' credit, some indices managed slight gains during the session despite the tumult in Europe.