| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

krisluke

Supreme |

11-Feb-2011 09:44

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Obama to offer solutions for housing financeBy JIM KUHNHENN (AP:WASHINGTON) Homebuyers will face potentially higher interest rates under any of three Obama administration options for reducing government support of the mortgage market, the price of ending the country's dependence on financially teetering housing finance giants Fannie Mae and Freddie Mac. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

krisluke

Supreme |

11-Feb-2011 05:24

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

How does the U.S. budget proposal work?

By Richard Cowan WASHINGTON, Feb 10 (Reuters) - U.S. President Barack Obama on Monday submits to Congress his third annual budget plan, one for the fiscal year 2012 that begins on Oct. 1. Given the horrible shape of the nation's finances -- successive years of record budget deficits that have piled onto a federal debt that many economists deem unmanageable -- this budget proposal is particularly important to politicians and financial markets. But what exactly is in budgets produced by presidents and how key are they in determining fiscal policy? WHAT IS THE BUDGET? It's a political document that gives the president another forum for unveiling new policy initiatives, but it is not a single bill that is put up for a vote. While it's chock full of numbers, the budget is an opportunity for presidents to show where they want to take the country over the next few years and how they will pay the bill. In a budget message introducing last year's proposal, Obama spoke of the need to improve healthcare and the environment, which were hot topics all year. This year, people will watch whether Obama calls for major changes to Social Security, Medicare and Medicaid and whether he goes beyond his State of the Union call for $400 billion in savings by freezing many federal programs for five years. Another question is whether Obama will formally embrace some recommendations that his deficit commission submitted last year to cut spending and raise taxes. In hard times, presidents can use the budget to try to pep up a dispirited country. Just look at last year's budget message, which concluded: " These have been tough times and there will be difficult months ahead. But the storms of the past are receding the skies are brightening and the horizon is beckoning once more." Fostering optimism is one way presidents get re-elected. WHAT IS IN THE BUDGET? Beyond the rhetoric in the opening message, the thick volumes that make up the document are filled with economic projections that analysts and financial markets pore over. The Obama administration's latest forecasts of annual budget deficits, economic growth, inflation, debt and interest rates are embedded, although sometimes these figures can be sugar-coated to put the administration in the best possible light. Or, projections might be made to look even worse than expected, making it easier for the administration to later boast about fantastic progress. The budget also can contain programs that the president says he wants to terminate immediately. WHAT HAPPENS AFTER CONGRESS RECEIVES OBAMA'S BUDGET? This is a request to Congress for around $3.5 trillion to pay for everything from federal retirement benefits to military programs, law enforcement and space exploration, so it's not to be taken lightly. But members of Congress, especially those not from the president's own political party, often describe the president's budget this way: " Dead on arrival." Even some members of the president's own party have different priorities for spending and taxes. Nevertheless, submission of the president's budget kicks off a series of hearings on Capitol Hill where administration officials and outside experts offer their views on the programs Obama is requesting. DOES THE BUDGET EVER GET ENACTED INTO LAW? Not quite. After budget committees in the House of Representatives and Senate wrap up their hearings on the president's budget, they try to produce their own budget blueprints. If the committees succeed, the full House and full Senate will vote on those budgets, possibly as early as March or April. But these measures are called " resolutions," meaning they are not bills that eventually get sent to the president for signing into law. THEN WHY BOTHER PASSING A BUDGET RESOLUTION? These resolutions are important because if passed by Congress, they provide marching instructions to other committees, which then try to write legislation that can be enacted into law. And that's where the rubber hits the road. Once the appropriations committees get their budget instructions, they will try to write a dozen separate bills to fund programs. It's as if the budget committees set up checking accounts and the appropriations committees write the checks. Republicans who control the House want the FY12 budget resolution to require steep spending cuts. But some are concerned that if Obama is presented with spending bills that are too austere, there could be a deadlock that could even lead to government shutdowns toward the end of this year. Tax-writing committees in Congress also play an important role in trying to implement new tax cuts or tax increases called for in a budget resolution. HOW DOES THE DEBT LIMIT FIT INTO ALL OF THIS? The Treasury Department has told Congress that between early April and late May the government could bump up against a $14.3 trillion statutory limit on borrowing. The administration wants Congress to quickly raise the limit. Failure to do so, it warns, could force the government to default on loans which could spark a global financial crisis. Some Republicans want to include language in a debt limit bill tying it to the budget resolution, and want a budget resolution with spending cuts that they know Obama wouldn't swallow. Senate Democrats likely will work to change whatever budget the House passes, but there are worries that a congressional budget blueprint with too many spending cuts could prompt Obama to veto a debt limit bill. It's a highly unlikely scenario, but one that could rattle markets in coming weeks. (Reporting by Richard Cowan Editing by Vicki Allen) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

10-Feb-2011 09:33

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

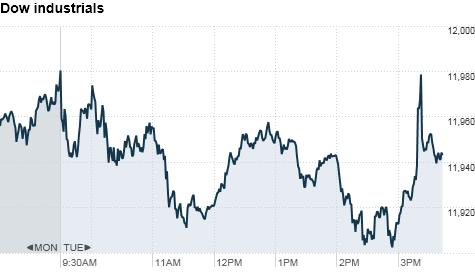

Dow ends higher for 8th-straight day

NEW YORK (CNNMoney) -- U.S. stocks lifted from session lows Wednesday and ended a lackluster trading session mixed. The Dow inched higher for an eighth straight session, but the S& P 500 and Nasdaq finished lower as investors took a breather following four consecutive days of gains. After spending most of the day in the red, the Dow Jones industrial average (INDU)managed to add 7 points, or 0.1%, led by a 5% jump in shares of Walt Disney Co. (DIS, Fortune 500) following strong fourth-quarter earnings. The blue-chip index rose to 12239.89, the highest level since June 16, 2008. The S& P 500 (SPX) slipped 4 points, or 0.3%, and the tech-heavy Nasdaq (COMP) fell 8 points, or 0.3%. Energy and financial companies were among the biggest laggards. Chevron (CVX, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and Exxon Mobil (XOM, Fortune 500) were among the Dow's biggest losers. Meanwhile, drops in shares of Southwestern Energy Co. (SWN), Cliffs Natural Resources (CLF) andWells Fargo (WFC, Fortune 500) weighed on the S& P 500.

" Bernanke's speech is pretty much a repeat of what he's been saying," said Tom Schrader, managing director at Stifel Nicolaus. " Investors seem to be content with their current investments, and are taking a wait-and-see attitude. There's nothing on the immediate horizon that could cause the markets to drift significantly one way or the other." Stocks posted solid gains Tuesday, with the Dow ending at its highest level since June 2008, as traders cheered news in the consumer sector and looked past China's latest interest rate hike. Economy: Investors will be keeping an eye out for a proposal due Friday from the Obama administration recommending a phase-out plan for Fannie Mae and Freddie Mac, two government-sponsored mortgage backers.

Treasury Secretary Tim Geithner offered an optimistic economic outlook Wednesday, although he acknowledged that the job market will take time to recover. Companies: Shares of NYSE Euronext (NYX, Fortune 500) -- the parent company of the New York Stock Exchange -- jumped 14% after the company confirmed that it is in advanced merger talks with Germany's Deutsche Boerse. Polo Ralph Lauren's (RL, Fortune 500) stock rallied 8.3%, after the retailer delivered a $168.4 million profit -- thanks to solid holiday season sales. Computer Sciences (CSC, Fortune 500) plunged 14% after the information-technology company missed revenue estimates and lowered its forecast for the year. Shares of Wells Fargo (WFC, Fortune 500) fell 2.8% after the bank announced late Tuesday that chief financial officer Howard Atkins is retiring. The company said the retirement wasn't due to Wells' financial condition or reporting. Shares of Cisco Systems (CSCO, Fortune 500) slipped 1.3% in after-hours trading after the company posted a quarterly profit that fell from year-ago results but beat Wall Street's forecasts. World markets: European stocks ended the session lower. Britain's FTSE 100 slid 0.6%, the DAX in Germany was flat and France's CAC 40 edged down 0.4%. Asian markets ended below breakeven, in reaction to China's central bank raising key interest rates the day before. The Shanghai Composite fell 0.9%, the Hang Seng in Hong Kong lost 1.4%, and Japan's Nikkei slid 0.2%. Currencies and commodities: The dollar was slightly lower versus the euro, but rose against the Japanese yen and the British pound.

Bonds: The price of the benchmark 10-year U.S. Treasury was higher Wednesday, pushing the yield down to 3.64%. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

09-Feb-2011 07:11

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

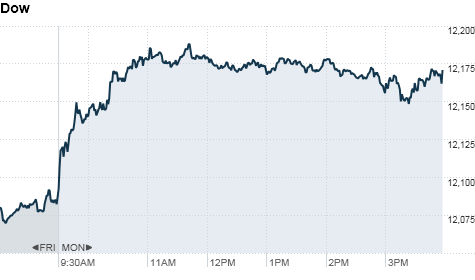

Stocks post broad gains, led by consumer names

NEW YORK (CNNMoney) -- U.S. stocks posted another day of solid gains Tuesday, with the Dow Jones industrial average climbing for the seventh straight day, as traders cheered news in the consumer sector and looked past China's latest interest rate hike. The Dow Jones industrial average (INDU) gained 72 points, or 0.6% to 12,233, the S& P 500 (SPX) rose 5.2 points, or 0.4%, to 1,324.6 and the Nasdaq (COMP) composite advanced 13 points, or 0.5%, to 2,797. The blue chips were led higher by shares of McDonald's (MCD, Fortune 500), which climbed 2.6% after the fast food giant reported better-than-expected January same-store sales. Other consumer discretionary names in the S& P 500 posted solid gains including Urban Outfitters (URBN), Family Dollar (FDO, Fortune 500) and JCPenney (JCP, Fortune 500) among others. The Dow's 70-point gain came despite the People's Bank of China announcement early Tuesday that it would raise bank's borrowing and lending rates by a quarter percentage point. The move, the bank's third since October, comes as Chinese policymakers look to gradually cool the world's second-largest economy without halting growth.

Investors started the week in high spirits Monday, as several major mergers pushed the Dow Jones industrial average (INDU) up for a sixth day in a row. The 30-stock index closed up 69 points, or 0.6%. The deals of the day included AOL's (AOL) acquisition of news blog The Huffington Post for $315 million, and a merger between oil drillers Ensco (ESV) and Pride International (PDE). Companies: Toyota shares advanced 4% after a 10-month U.S. government probe found no electronic flaws in the automaker's safety systems, which were blamed for unintended acceleration in Toyota cars and trucks. Toyota also issued an upbeat financial forecast with three months left in its fiscal year. Avon Products (AVP, Fortune 500) shares fell 3% after the company reported a 15% decline in quarterly earnings, missing estimates. Kindred Healthcare (KND, Fortune 500) shares jumped more than 28% after it received a $900 million buyout offer from competitor RehabCare Group (RHB). Walt Disney (DIS, Fortune 500) shares rose 4% in after-market trading after the media giant reported adjusted earnings of 68 cents a share, well above analysts' estimates. World markets: European stocks closed higher. Britain's FTSE 100 rose 0.7, France's CAC 40 added 0.4% and the DAX in Germany ticked up 0.5%.

Currencies and commodities: The dollar fell against the euro, but gained versus the British pound and Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.66% from 3.65% from Monday. The U.S. government auctioned $32 billion in 3-year notes, which received mixed demand from investors. The notes auctioned at a yield of 1.349%, slightly higher than expected. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

krisluke

Supreme |

08-Feb-2011 21:46

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Live Indice |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

krisluke

Supreme |

08-Feb-2011 20:56

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Global Market Outlook |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

08-Feb-2011 06:51

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks rally on Merger Monday

NEW YORK (CNNMoney) -- Investors started the week in high spirits Monday, welcoming several major mergers as signs that Big Business is more bullish about the economy. At the closing bell, the Dow Jones industrial average (INDU) was up 69 points, or 0.6% the S& P 500 (SPX) rose 8 points, or 0.6% and the Nasdaq (COMP) gained 15 points, or 0.5%. The biggest deals of the day include AOL's (AOL) acquisition of news blog The Huffington Post for $315 million, and a merger between oil drillers Ensco (ESV) and Pride International (PDE). The diversified manufacturing company Danaher (DHR, Fortune 500) will also buy medical device maker Beckman Coulter (BEC) for $6.8 billion.

Meanwhile, the AOL-Huffington Post deal boosted shares of other media companies. The New York Times (NYT) climbed 2.5% and Gannett (GCI, Fortune 500) shares rose 2.8%. Economy: In a speech to more than 200 members of the U.S. Chamber of Commerce Monday, President Obama made the case for ramping up spending on education and infrastructure to promote economic growth. The speech is seen as another sign of the thawing relationship between the administration and business community.

Companies: In addition to some major deals, company earnings were also market movers. Humana (HUM, Fortune 500) fell 3.1% after the health benefits provider reported fourth-quarter earnings that missed analysts' expectations. The company said it earned 63 cents per share, versus a forecast of 81 cents. Hasbro (HAS) said its fourth-quarter earnings fell to 99 cents per share from $1.09 a year ago, but its shares rose 1.9%. U.S.-listed shares of Nokia (NOK) were up 2.1% following reports that a management shake-up is brewing at the Finnish cellphone company. Sysco (SYY, Fortune 500) said its second-quarter earnings fell 3.8% due to higher commodities prices, sending shares of the food company falling 6.1%. World markets: European stocks finished the day higher. Britain's FTSE 100 ticked up 0.9%, the DAX in Germany rose 0.9% and France's CAC 40 gained 1.1%.

Currencies and commodities: The dollar fell against the British pound and the euro, but rose against the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.65% from 3.58% late Friday. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

krisluke

Supreme |

07-Feb-2011 01:11

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Technical Analysis: DJ, NASDAQ and S& P The March NASDAQ 100 closed higher on Friday as it extends this week's rally. The high-range close sets the stage for a steady to higher opening on Monday. Stochastics and the RSI are bullish signaling that sideways to higher prices are possible near-term. Today's close above last Thursday's high crossing at 2334.50 confirms that a short-term top has been posted and sets the stage for a test of January's high crossing at 2346.50. Closes below Monday's low crossing at 2248.50 would confirm that a short-term top has been posted. First resistance is today's high crossing at 2339.50. Second resistance is January's high crossing at 2346.50. First support is Monday's low crossing at 2248.50. Second support is the 25% retracement level of the August-January rally crossing at 2197.43. The March S& P 500 index closed higher on Friday as it extends this week's rally. The high-range close sets the stage for a steady to higher opening on Monday. Stochastics and the RSI are overbought but remains bullish signaling that sideways to higher prices are possible near-term. If March extends this winter's rally, weekly resistance crossing at 1313.30 is the next upside target. Closes below Monday's low crossing at 1270.00 would confirm that a short-term top has been posted. First resistance is today's high crossing at 1308.60. Second resistance is weekly resistance crossing at 1313.30. First support is the 10-day moving average crossing at 1293.07. Second support is Monday's low crossing at 1270.00. The Dow closed higher on Friday as it extends the rally off last year's low. The high-range close sets the stage for a steady to higher opening on Friday. Stochastics and the RSI are overbought but remain bullish signaling that sideways to higher prices are possible near-term. If the Dow extends this winter's rally, the 75% retracement level of the 2007-2009-decline crossing at 12,289 is the next upside target. Closes below last Friday's low crossing at 11,803 are needed to confirm that a short-term top has been posted. First resistance is Thursday's high crossing at 12,080. Second resistance is the 75% retracement level of the 2007-2009-decline crossing at 12,289. First support is the 10-day moving average crossing at 11,985. Second support is the 20-day moving average crossing at 11,873. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

iPunter

Supreme |

06-Feb-2011 18:46

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

vonntan

Senior |

06-Feb-2011 18:45

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

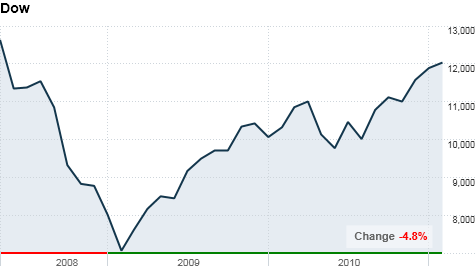

DJIA is currently on an uptrend, trading above 12000 points (major resistence). watch out as bearish divergence is forming. http://sgsharemarket.com/home/2011/02/dow-jones-upward-trading-momentum/ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

02-Feb-2011 07:15

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Dow, S& P 500 close at highest levels in 2 years

NEW YORK (CNNMoney) -- U.S. stocks started February with a bang Tuesday, with the Dow and S& P 500 closing above key psychological levels for the first time in more than two years, and the Nasdaq gaining almost 2%. Investors overcame ongoing jitters over protests in Egypt and new developments in Jordan, where the king dismissed his government and appointed a new prime minister. The Dow Jones industrial average (INDU) rallied 148 points, or 1.3%, to finish at 12,040, the highest June 19, 2008. All but three of the 30 blue-chip components moved higher. A 5.5% jump in shares of Pfizer (PFE, Fortune 500) led the advance, with the drugmaker posting better-than-expected fourth-quarter earnings. Alcoa (AA, Fortune 500) and Bank of America (BAC, Fortune 500) were also big Dow gainers. The S& P 500 (SPX) added 21 points, or 1.7%, to close at 1,307, also the highest since June 2008. Shares of printer manufacturer Lexmark (LXK) soared more than 13% following strong earnings and an upbeat forecast. The Nasdaq (COMP) gained 51 points, or 1.9%. Baidu (BIDU) was the tech-heavy index's big winner, with shares spiking more than 9%. China's main Internet search provider said its fourth-quarter profit nearly tripled from a year earlier, to $176 million. Chinese online media firm Sohu.com (SOHU) also jumped more than 6%, a day after reporting strong earnings. Much stronger-than-expected manufacturing data added fuel to the buying spree.

U.S. stocks posted solid gains Monday and ended January about 2% higher, as positive earnings from Exxon Mobil (XOM, Fortune 500) and rising commodity prices overshadowed the political unrest in Egypt. The Dow finished the month 2.7% higher, representing the first January gain since 2007, and the best first-month performance since 1997. Economy: Construction spending dropped 2.5% in December, following a rise of 0.4% in November. Economists were expecting spending to ease 0.4% during the month. General Motors (GM) kicked off the year with stronger-than-expected sales in January, driven by increased demand from individual customers. GM stock was slightly higher.

At the end of the week, the government releases its January jobs report, and investors will be eyeing the report closely for signs of improvement in the labor market. Companies: Before the opening bell, United Parcel Service (UPS, Fortune 500) logged a 44% jump in profit that beat forecasts and said it expects earnings per share to climb to a record high for 2011. Shares of the package delivery company finished up 4.2%. Shares of Borders (BGP) plunged more than 35% in the final minutes of trading following a Bloomberg report that the bookseller may file for bankruptcy protection as early as next week. The report, which cited people familiar with the matter, also said several private equity firms are considering whether to provide a junior loan to the company, which will likely close at least 150 stores. World markets: Protests in Egypt resumed Tuesday and tensions were still far from resolved, with Standard & Poor's announcing it cut Egypt's foreign currency rating. The news came a day after Moody's downgraded its rating on Egypt's debt.

Egyptian President Hosni Mubarak has decided not to seek re-election, a senior U.S. official involved in the Obama administration's deliberations on Egypt said Tuesday afternoon.

Currencies and commodities: The dollar slumped against the euro, the Japanese yen and the British pound. Oil for March delivery slipped $1.42 cents to settle at $90.77 a barrel. On Monday, crude prices jumped to their highest level since October 2008, gaining 2.9% to settle at $92.19 a barrel, amid worries about potential disruptions to shipments through the Egypt-controlled Suez Canal.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.44% from 3.35% late Friday. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

krisluke

Supreme |

31-Jan-2011 22:00

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Civil unrest in Egypt served as the excuse to bring the January rally to halt last Friday, and temporarily ended the DJIA move thru the 12,000 level on its 2nd attempt, often it takes 3 or 4 attempts to make a clear break thru Key overhead resistance. It is interesting to note that the Russell 2000 Index and the S& P 500 Index are also trading near Key round-number resistance marks, pointing to the short-term risk factors that have been in the news recent weeks. Next, the January barometer augurs Bullishness for February, and the remainder of the year. The good news for Bulls is that hedge fund managers continue to accumulate, as evident by the heavy buy-to-open Put volume relative to buy-to-open Call volume on major exchange-traded funds that are used as hedging vehicles. When these players purchase index portfolio protection, events like Friday are less apt to create a “sell first and ask questions later” mentality among this savvy group. But a short-term market risk is heavy Put open interest below current levels acting as “magnets” due to delta-hedge selling, which occurs when sellers of the Puts short futures to hedge their own exposure to further declines. As an example: on the SPDR S& P 500 ETF Trust (SPY – 127.72), huge Put open interest resides around the 125, 126, and 127 strikes. A clear break of 127 could likely lead to an immediate decline to 125, at which point one would expect stabilization to occur in the context of option traders squaring their positions, and the 125 area corresponds to the index’s rising 50 Day Moving Average. While I am on the SPY, there was huge SPY volume last Friday, which was on par with levels that have marked bottoms during declines going back to mid-July 2010. These events must occur within the context of an extended short-term decline or big down day. Below is review of the risk factors identified over the past couple of weeks: 1. January has not been seasonally Strong during the past 10 yrs, marking various corrections or beginning of corrections, and days like Friday make one wonder if was is the start of another January correction, as major indexes get rejected at Key psych round-number resistance. Friday’s action pushed small caps into the Red for the year, while the SPX remains in the Black 2. The CBOE Market Volatility Index (VIX) is trading at a significant premium to SPX historical volatility, and this premium has rolled over from its highs. Such high premiums amid a rollover have preceded setbacks. Historical volatility on major indexes has risen since the rollover of the VIX premium at the end of last year, but rising historical volatility occurred within the context of advancing stock prices – until Friday’s setback. Implied volatility is still double that of historical volatility, which means this indicator continues to dictate caution. 3. Equity option players hit an extreme in Call buying relative to Put buying 2 weeks ago, these players continue to become a little less enthusiastic, but the continued unwinding of optimism remains a risk factor. Short-term risk-reward seems to be balanced from a chart perspective, but there is a lot riding on how hedge fund managers will react to last Friday’s pullback. For now, pullbacks should be viewed as buying opportunities, but savvy players should continue to have portfolio protection in place to weather short-term setbacks. Say tuned…Paul A. Ebeling. www.livetradingnews.com |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Hulumas

Supreme |

31-Jan-2011 17:40

Yells: "INVEST but not TRADE please!" |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

DOW correction is coming! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

krisluke

Supreme |

31-Jan-2011 10:54

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

US Major Markets Support and Resistance Points DJIA Close 11,823.70 Resistance: 11,893, the March 2008 low 12,110 the March 2007 low Support: The 18-day EMA: 11,711 The 50-day EMA: 11,491 11,452 the November 2010 high 11,258 the April 2010 high 11,205 the April closing high 11,100 from the July 2008 low 10,963 the July 2008 low 10,920 the recent May 2010 high The 200-day SMA: 10,798 S& P 500 Close 1276.35 Resistance 1313 the August 2008 interim high 1325-27 the March 2008 closing low 1364 the March 2007 low 1370 the August 2007 low Support: 1276/1278 Zone is the 127% Fiboi extension of the August 2010 mark The 18-day EMA: 1274 The 50-day EMA: 1242 1227 the November 2010 high 1220 the April 2010 high 1185 from a September 2008 mark 1174 the May 2010 high, 78% Fibo retracement of the April high 1173 the November 2010 low 1170 the prior March 2010 high 1156 the Sept 2008 low The 200-day SMA: 1153 NAS Close 2686.98 Resistance: The 10-day EMA: 2716 2725 from July 2007 interim peak 2729 the 127% Fibo extension of the August 2010 mark 2735 from late 2007 interim high 2825 the 2007 closing high. 2862 the 2007 high Support: The 50-day EMA: 2631 2593 the November 2010 high 2580 the November 2010 closing high 2569 the November gap up point through the April 2010 high 2550 from the May and June 2008 highs 2540 the Gap up point from early November 2010 2530 the April 2010 closing high 2518 the interim high from April 2010 2511 the lower range of the November 2010 Gap up mark 2482 the recent October 2010 high 2460 the November 2010 low. 2434 the May 2010 interim high and the 78% Fibo retracement of the April sell mark. 2425 an interim high from May 2010 The 200-day SMA: 2395 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

spyeo168

Member |

30-Jan-2011 23:12

Yells: "Wealth" |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Last friday 28th Jan 11, DJIA reacted to the resistance region 12,000 and closed down by -166.13 to a level of 11823.70. One of the main reason that DJIA decide to go down is due to the fears of unrest situation in Egypt that have the potential to spread to the rest of the middle east. The real concern is boils down to the oil. The worry of Suez Canal being forced to close down could become a real possibility. That’s mean oil prices would be affected as the oil tanker need to take much longer times to travel from middle east to the rest of the world. The second reason that DJIA is down is because of disappointed earnings results from the heavy weight companies such as Microsoft, Ford, Amazon and Chevron. Investors find that the 4th quarter of USA economy had grown less than expected. DJIA level must not fall below the blue uptrend line and the green line. To see DJIA chart go to Always trade with what you have and know how much you are willing to lose first. Happy trading and always remember do your own homework and research. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

vonntan

Senior |

30-Jan-2011 22:44

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Dow Jones met resistence at 12000 points. however, uptrend is still intact. http://sgsharemarket.com/home/2011/01/dow-jones-met-resistence/ currently it is supported by its MA line. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

krisluke

Supreme |

27-Jan-2011 09:45

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

NO NEWS IS GOOD NEWS LIAO. FOMC decision to maintain the status quo on its ultra-loose monetary policy... trade less, got profit remember to grab hor... |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Hulumas

Supreme |

27-Jan-2011 09:32

Yells: "INVEST but not TRADE please!" |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Beware of in coming CORRECTION! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

27-Jan-2011 08:03

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Dow, S&P end at two-year highs after Fed snoozer

NEW YORK (CNNMoney) -- Stocks held onto gains Wednesday afternoon, with the Dow and S&P finishing at their highest levels since the summer of 2008, after the Fed kept rates steady and left its bond-buying plan alone. The Dow finished up 8 points, or 0.1%, at 11,985.44, the highest close since June 19, 2008. Earlier in the session, the Dow rose as much as 43 points, or 0.4%, to 12,020.52, hitting its highest intraday level since June 20, 2008. However, the index is still far from its all-time highs above 14,000 reached in October 2007. The S&P 500 (SPX) added 5 points, or 0.4%, to close at 1,296, its highest level since August 28, 2008. The broader index had reached as high as 1,299.74, but failed to break above the key resistance level of 1,300. Meanwhile, the Nasdaq (COMP) gained 20 points, or 0.7%. President Obama's State of the Union address late Tuesday helped push stocks higher from the open.

Sheldon said a better-than-expected report showing new home sales jumped to an 8-month high in December also added support. Later in the day, the Federal Reserve announced its unanimous decision to leave interest rates unchanged near historic lows and continue to move forward with its $600 billion bond buying program to stimulate the economy.

On Tuesday, stocks closed mixed after staging a late comeback. Companies: Toyota (TM) announced it is recalling more than 1.5 million vehicles worldwide for issues that could result in fuel leakage. News of the recall sent shares of the automaker 1.9% lower. Shares of home improvement retail chain Lowe's (LOW, Fortune 500) edged up 1.1% after the company said it is cutting 1,700 managerial jobs while adding up to 10,000 part-time workers in order to better staff its stores for weekend shoppers. Shares of online content creator Demand Media (DMD) rose 33% Wednesday as the company made its public debut, raising $66.5 million in an IPO that valued the company at more than $1 billion. Shares of media conglomerate Nielsen (NLSN) were up 8.7% as the company also made its public debut. Xerox (XRX, Fortune 500) was the biggest loser on the S&P 500, with shares dropping more than 7%. The company issued a disappointing outlook and announced its Chief Financial Officer Larry Zimmerman will retire next month. US Airways (LCC, Fortune 500) posted its first quarterly profit since 2006 and widely beat Wall Street forecasts, lifting shares of the airline by 6.6%. Shares of Yahoo (YHOO, Fortune 500) slipped 2.8% after the company reported quarterly results late Tuesday that missed expectations and announced more layoffs. Eastman Kodak's (EK, Fortune 500) stock sank almost 18% after the company posted a fourth-quarter profit that plunged 95% from a year earlier. Revenue dropped 25% and missed expectations. World markets: European stocks closed higher. Britain's FTSE 100 climbed 1%; the DAX in Germany surged 0.9%; and France's CAC 40 rose 0.7%.

Currencies and commodities: The dollar edged lower versus the euro and the British pound. It was slightly higher against the Japanese yen.

After rallying for seven straight session, cocoa prices softened Wednesday, slipping 0.2% to 3,330 per ton amid a one-month export ban in the Ivory Coast, the world's largest cocoa supplier. Earlier in the session, prices rose 1.5% to 3,385 per ton.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.43% from 3.32% late Tuesday. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

26-Jan-2011 07:43

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks end mixed after late-day recovery

NEW YORK (CNNMoney) -- Stocks closed mixed Tuesday, after making a come-back in the final hour, as investors digested earnings results from a host of blue-chip companies, mixed reports on the U.S. economy and surprisingly slow growth in the United Kingdom. The Dow Jones industrial average (INDU) fell 3 points, or less than 0.1%, according to early tallies. The S&P 500 (SPX) closed flat; and the Nasdaq (COMP) added nearly 2 points to 2,719. Stocks opened lower after government data showed the U.K. economy shrank unexpectedly in the fourth quarter. The selling gained momentum as investors responded to dour quarterly results from 3M (MMM, Fortune 500), Johnson & Johnson (JNJ, Fortune 500) and American Express. But upbeat results from Travelers (TRV, Fortune 500) helped curb some of the selling. The insurance giant reported a 30% drop in quarterly net income, but issued an optimistic outlook for the rest of the year. Verizon was another bright spot. Shares rose 1.3% after the telecom announced a $30 unlimited data plan for the iPhone. The company amended the statement later in the day, saying the package would be available "for a limited time."

Investors were also responding to a sharp drop in home prices, and a stronger-than-expected report on consumer confidence.

Jean-Claude Trichet, president of the European Central Bank, warned over the weekend that central banks should be wary of rising commodity prices. The comments fueled speculation that the ECB is planning to raise interest rates. Stocks began the week with a solid start, logging modest gains on Monday. The Dow has been on an upward trend since Thanksgiving, and is now within a stone's throw of 12,000 -- a level last seen on June 18, 2008.

Companies: Shares of Tellabs (TLAB) plunged 19% after the communications equipment maker issued a lackluster outlook for first-quarter earnings. Harley-Davidson (HOG, Fortune 500), the iconic motorcycle company, reported a quarterly loss that narrowed from last year, and topped analysts expectations. Shares gained 8%. After the bell on Monday, American Express (AXP, Fortune 500) reported earnings of 94 cents per share on revenue of $7.32 billion. The numbers fell a hair short of analyst estimates. Shares sank 2.3%. Yahoo (YHOO, Fortune 500) is slated to report the market closes Tuesday, and is expected to report earnings per share of 22 cents on $1.19 billion in revenue. Economy: The Case-Shiller index of home prices in 20 major U.S. markets was released before the opening bell. Signaling that the slump in home prices has deepened, the index fell 1% in November compared with October.

President Obama is scheduled to deliver his State of the Union address Tuesday night, during which he is expected to talk about the health of the U.S. economy -- especially the labor market. World markets: European stocks were lower. Britain's FTSE 100 fell 0.4%, after data showed the U.K. economy shrank 0.5% in the fourth quarter, versus a projected 0.5% increase. The DAX in Germany slid 0.1% and France's CAC 40 tumbled 0.3%.

Currencies and commodities: The dollar surged 1% versus British pound, but fell against the euro and Japanese yen. Cocoa futures were up 1.5%, after soaring more than 4% in the previous session as the Ivory Coast called for a one-month export ban. Cotton futures for March delivery rose to an intra-day high of $1.67 a pound, reaching the highest level on record at the InterContinental Exchange. Oil for March delivery slipped $1.68 to settle at $86.19 a barrel. Gold futures for February delivery tumbled $12.20 to end at $1,332.20 an ounce. "It's been a mixed market for commodities lately, but it's generally been favoring oil and not gold," said Winmill. "There's going to be a rough patch for gold now, because with rising equity prices there will be more optimism for U.S. markets and less worry about finding a safe haven." Bonds: The price on the benchmark 10-year U.S. Treasury rose, with the yield falling to 3.32% from 3.41% late Monday. The Treasury sold $35 billion in 2-year notes Tuesday in the first of this week's debt sales totaling $99 billion. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||