| Latest Forum Topics / Straits Times Index |

|

|

News Update!

|

|

|

krisluke

Supreme |

03-Dec-2011 13:37

|

|

x 0

x 0 Alert Admin |

Most dealers see Fed buying more MBS to boost economy

By Chris Reese

NEW YORK, Dec 2 (Reuters) - Most Wall Street economists expect the Federal Reserve will undertake another major economic stimulus program, probably early next year, due to tepid U.S. growth and fallout from Europe's debt crisis, according to a Reuters poll on Friday. Thirteen of 20 economists at primary dealers, the large financial institutions that do business directly with the U.S. central bank, said they expect the Fed to undertake a new program of buying mortgage-backed securities (MBS). Two more dealers said another program of MBS buying was possible. Six of the 13 dealers who expected further MBS purchases said the Fed would also embark on a new program of buying Treasury debt to boost the economy. The median of forecasts from 11 dealers who provided estimates of the size of a new asset-buying program was for the purchase of $550 billion of securities. That would be near the size of the Fed's second round of quantitative easing, known as QE2, under which it bought $600 billion of Treasuries. Under QE1 and QE2 the Fed's purchases of MBS and Treasury debt totaled $2.3 trillion. Seventeen of 20 dealers in the Reuters poll said the Fed would ease monetary policy by changing the way it communicates with financial markets. In August, the Fed embarked on this route when it first said high unemployment and low inflation meant interest rates were likely to be held at " exceptionally low levels" until " at least through mid-2013." Previously, the Fed had not set specific targets as to how long it might keep interest rates at certain levels. Wall Street does not expect the Fed to wait long before it takes further action. Ten of the primary dealers predicted the Fed will ease monetary policy, either through Treasury and MBS purchases or a change in communications policy, in the first quarter of 2012. The poll was conducted on Friday after the government announced the U.S. unemployment rate fell to a 2-1/2-year low in November, although the pace of hiring remained sluggish. For details see [ID:nOAT004918]. The dip in the jobless rate boosted some hopes of at least a modest recovery in the jobs market but economists at primary dealers nearly all said the potential for more U.S. stimulus, and the risk of the United States falling back into recession, rests largely on how the euro zone debt crisis plays out. " So much remains dependent on the goings-on across the pond and the acceleration there, or the deceleration, of the crisis," said Jacob Oubina, senior U.S. economist at RBC Capital Markets in New York. " It doesn't make a lot of sense (for the Fed) to do anything now toward the year end when we have already been suffering from a ton of volatility and liquidity issues in the market," he said. The Fed's current stimulus plan, dubbed " Operation Twist," is a $400 billion program that extends the maturity of the central bank's Treasuries holdings in a bid to lower mortgage rates and other long-term borrowing costs. The program is scheduled to last through the end of June 2012. " They could modify the Twist program to twist into mortgages rather than Treasuries in the first part of next year, but that is not a certain event though it would be the most likely development," said Carl Riccadonna, senior U.S. economist at Deutsche Bank Securities in New York. " If the economy is shifting into a faster pace of growth they will not do it, but if we do weaken in response to developments in Europe then that would be the route they would pursue," he said. While events in Europe remained a fear, economists did not seem to be increasing the chances the United States would fall back into recession. The median of forecasts from 19 dealers ascribed a 25 percent chance of another U.S. recession in the next year, which was unchanged from a similar poll conducted Nov. 4. There are 21 U.S. primary dealers. Morgan Stanley & Co did not respond to the Reuters poll. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

03-Dec-2011 13:35

|

|

x 0

x 0 Alert Admin |

Euro drops 1st time in 5 days before crucial events

NEW YORK -

* Euro vulnerable before ECB and EU meetings * ECB's Stark says crisis cure needed to avoid disaster * British PM threatens to obstruct a Franco-German drive * Speculators raise bets in favor of dollar (Updates prices, adds quotes) By Julie Haviv NEW YORK, Dec 2 (Reuters) - The euro faced make-or-break time ahead of a European Central Bank meeting and a European Union summit next week, as the single currency fell against the dollar on Friday for the first time in five sessions. Investors were wary of placing aggressive bets in favor of the 12-year-old currency ahead of the ECB meeting next Thursday and the EU summit the following day. French and German leaders are to meet on Monday to outline joint proposals to be discussed at the EU meeting. " People have been playing up the fact that the euro zone is running out of time because their steps have been incremental and not big enough to calm fears," said Mark McCormick, currency strategist at Brown Brothers Harriman in New York. " They are making progress, but everyone is looking for a game-changer." The euro rose early on reports the ECB may lend to weak euro zone countries through the International Monetary Fund in hopes of easing the debt crisis. The euro zone's common currency was also buoyed on rising risk appetite after the U.S. Labor Department reported the unemployment rate fell to a 2-1/2-year low in November, but it reversed course on various market rumors, which included a downgrade of Spain's debt. Investors were also hesitant to buy the euro in the aftermath of a strong rally this week. The ECB is expected to cut interest rates again next week, a negative for the euro because it would make higher-yielding currencies more attractive. The ECB hinted Thursday it was ready to move more aggressively to tackle the debt crisis if regional politicians agree on much tighter budget controls, though it stopped short of detailing what exact measures it would take. " Risks for the euro are still to the downside," McCormick said. " A move toward fiscal integration by circumventing the EU treaty and not rewriting it could be a potential positive for the euro in the short-term, but the economic landscape is much more negative for the euro and we expect it to end the year at $1.29." In contrast, the drop in the U.S. unemployment rate tempered expectations that Federal Reserve officials will ease monetary policy further, a positive for the dollar. The euro fell as low as $1.33630, blowing through stops at $1.34150. It was last at $1.3398 on trading platform EBS, down 0.5 percent on the day. It rose to a 10-day high of $1.35505 immediately after the U.S. non-farm payrolls report. Juergen Stark, one of the European Central Bank's top policymakers, warned on Friday that leaders must urgently find a solution to the euro zone debt crisis or there will be widespread macroeconomic and financial disaster. British Prime Minister David Cameron threatened to obstruct a Franco-German drive for swift change to the European Union's treaty, a sign of the difficulty leaders will face in transforming Europe to save the euro. ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ Other stories on euro zone crisis Ten days of secret planning Euro zone in graphics http://r.reuters.com/hyb65p Market disconnect graphic http://r.reuters.com/van64s< /A1 > Interactive timeline http://link.reuters.com/rev89r< /A1 > INSTANT VIEW- US jobless rate drops Graphic - U.S. payrolls: http://link.reuters.com/suf45s Graphic - U.S. jobless rate, payroll change. http://r.reuters.com/was53s Graphic - U.S. nonfarm payrolls by type. http://r.reuters.com/kus53s ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^> Uncertainty about the upcoming key euro zone events is likely to remain elevated, according to Greg Anderson, G10 strategist at CitiFX, a division of Citigroup, in New York. " Past experience has also taught investors not to get overly excited about the outcome of yet another EU summit," he said. The euro could continue to consolidate only gradually against the background of growing market expectations of a coordinated and comprehensive approach to deal with the euro zone debt crisis, he said. Currency speculators raised their bets in favor of the U.S. dollar in the latest week to the highest level since June 2010, according to data from the Commodity Futures Trading Commission released on Friday. The dollar rose 0.4 percent against a currency basket , to 78.646. Against the yen, the dollar rose 0.3 percent to 77.94 yen. (Additional reporting by Gertrude Chavez-Dreyfuss Editing by Leslie Adler) |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

01-Dec-2011 20:34

|

|

x 0

x 0 Alert Admin |

Keppel T& T and Keppel Corp: Keppel T& T's subsidiaries have sold $34.3m of group relief qualified tax deductions to Keppel Corp and K-REIT for $5.8m (17% of $34.3m, the prevailing corp tax rate). Generally beneficial for Keppel T& T as it allows them to make use of tax deductions earlier. Currently, Kep T& T trades at approx P/E 7.6x. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

01-Dec-2011 20:20

|

|

x 0

x 0 Alert Admin |

US Market: US stocks surged Wed, with the Dow chalking up their best day in more than 2 ½ yrs, as the Fed and five other central banks moved to help banks hit by Europe’s debt crisis. The Blue Chip DJIA shot up 490pts to 12,046 while the broader based S& P500 jumped 52pts to 1,247 and the tech-based Nasdaq soared 105pts to end at 2,620. Vol was very high with 10b shares traded, while advancers thrashed decliners by about 7 to 1 on the NYSE. US stocks joined a global rally, after the central banks of US, euro, Canada, UK, Japan and Switzerland agreed to cut the cost of providing dollar funding via swap arrangements and agreed to make other currencies available as needed, while China said it would reduce the reserve requirement ratio for banks by 0.5 ppt from Dec 5, marking its first cut since 2008. In the US, positive economic data further contributed to the rally, as Co’s boosted payrolls in Nov by the most this yr and US businesses expanded at the fastest pace in 7 mths. Financials were the outperformer, rallying 6.6% as a grp, with Goldman Sachs, Morgan Stanley, Citigroup, Jefferies and JP Morgan spiking more than 7%. BofA which hit its 52-wk low onTuesday, also closed up 7.3%. Commodities and materials also outperformed with the S& P materials sector index jumping 5.9%, as oil gained 4.4% to close at $103.50, with Chevron and Exxon Mobile all up at least 4.6%. Caterpillar, the world’s largest construction and mining- equipment maker, rose 8.1%, while US Steel surged 15%. A measure of homebuilders in S& P increased 6.5%, led by PulteGroup who jumped 8% to pace gains in homebuilders. Among other stocks in focus, Cisco Systems gained 5.4% after Deutsche recommended buying the world’s biggest maker of networking equipment, while Netflix slumped 4.5% as the video- streaming and DVD subscription service was cut to U/p from neutral at Wedbush Securities, citing rising content costs, continued customer losses and concerns about the Co’s growth. Traders note that yesterday’s global coordinated move was the first since Nov08 and the degree of coordination sends a message to the mkts that global leaders are going to do whatever they need to do to instill confidence in the markets. Add that an indicator called McClellan Oscillator, which measures the moving average of net advancing shares in a market, has moved into a low phase from where a ‘lasting bounce’ may start and continue for several days, which simply means the market is back in tactical bull mode. Meanwhile UBS recommended investors should buy US stocks as an indicator of momentum and breadth, as the S& P 500 has reached oversold levels. |

| Useful To Me Not Useful To Me | |

|

bsiong

Supreme |

01-Dec-2011 08:42

Yells: "The Greatest Wealth is Health" |

|

x 0

x 0 Alert Admin |

November 30, 2011 • 11:29:03 PSTMarc Faber - Be Careful, The Chinese Economy May Crash“The European situation is basically hopeless, but it will lead to money printing. In China, if the economy slows down meaningfully or a crash... Read More |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

01-Dec-2011 01:40

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

29-Nov-2011 21:09

|

|

x 0

x 0 Alert Admin |

Irish budget to produce longer-term savings

DUBLIN, Nov 29 (Reuters) - Over one-quarter of Ireland's almost 5.5 billion euros in planned expenditure savings for the period 2013-15 will arise from policy steps to be announced in next week's budget for 2012, government documents showed on Tuesday.

Ireland will outline on Monday the breakdown of 1.45 billion euros of expenditure savings planned for next year, detailing how much it will save through cutting public sector workers by 7,000, reforming its social welfare system and reducing costs in other departments. The continued savings on the public sector wage bill and from entitlement reforms in social welfare will be " substantial" and account for the over one-quarter of savings to 2015, according to the updated memorandum of understanding between Ireland and its creditors, published on Tuesday. A draft version of the memorandum, first obtained by Reuters, was leaked by German lawmakers earlier this month and caused a political storm as it detailed budgetary plans -- including an increase in sales tax -- not yet announced by the government. The draft did not detail the carryover effects of planned expenditure savings but it did note that Ireland hoped to raise 670 million euros from next year's two percentage point sales tax hike, a figure not included in the signed version. The updated memorandum also said that the additional cut in public sector numbers of 11,500 -- confirmed by government this month -- together with efficiency and equity-enhancing social welfare system adjustments, as well as contributions from other non-pay programmes will deliver the remaining new 2013-15 savings. Under the terms of its EU/IMF bailout, Ireland has pledged to make budgetary adjustments of 12.4 billion euros between 2012 and 2015 to push its budget deficit below 3 percent of gross domestic product by the end of the process from an estimated 10.3 percent this year. (Reporting by Padraic Halpin editing by Stephen Nisbet) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

29-Nov-2011 21:05

|

|

x 0

x 0 Alert Admin |

UK cuts growth forecast, warns of recession risk

LONDON, Nov 29 (Reuters) - The British government announced sharply lower economic growth forecasts on Tuesday and warned that a recession in the euro zone could send the British economy into reverse.

The economy was forecast to grow by only 0.7 percent next year, against a March budget forecast of 2.5 percent, finance minister George Osborne said, presenting figures from the independent Office for Budget Responsibility. Growth was expected to recover to 2.1 percent in 2013 but Osborne told parliament the reality could be much worse if the euro zone debt crisis was not solved. |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

29-Nov-2011 21:04

|

|

x 0

x 0 Alert Admin |

Futures gain on relief over Italy bond auction

The New York Stock Exchange building

* American Airlines parent AMR files for Chapter 11 * Futures up: S& P 8.2 pts, Dow 57 pts, Nasdaq 8 pts NEW YORK, Nov 29 (Reuters) - U.S. stock index futures rose on Tuesday on investor relief over a well-received Italian bond auction that showed the highly indebted country still had access to capital markets. * Italy sold debt in volumes close to the upper end of its target, but borrowing costs continued to soar. European stocks reversed course to trade higher. * S& P 500 futures rose 8.2 points and were above fair value, a formula that evaluates pricing by taking into account interest rates, dividends and time to expiration on the contract. Dow Jones industrial average futures gained 57 points, and Nasdaq 100 futures added 8 points. * French bank stocks BNP Paribas and Societe Generale were down after a French newspaper reported Standard & Poor's could change the outlook for France's triple-A rating to " negative" within the next 10 days. * Also, Moody's said it could downgrade the subordinated debt of 87 banks across 15 European Union nations on concerns that governments would be too cash-strapped to bail them out. * Late Monday, Fitch revised its outlook on the U.S. credit rating to negative, citing the failure of a special congressional committee to reach an deficit-reduction agreement. Fitch gave the United States until 2013 to come up with a " credible plan" to tackle its ballooning budget deficit or risk a downgrade of the country's coveted AAA rating. * In company news, American Airlines parent AMR Corp filed for Chapter 11 reorganization. The shares tumbled 97 percent to 64 cents in premarket trade. * On the macro front, investors awaited the Standard & Poor's/Case-Shiller home price index for September, due for release at 9 a.m. EST (1400 GMT). index 20-city index is expected to show no changes in September. * Also the Conference Board's November consumer confidence is due at 10 a.m. EST. (1500 GMT) The report is forecast to show a reading of 44.0, up from 39.8. * U.S. stocks rebounded from seven days of losses on Monday as investors used the latest effort by European leaders to resolve the region's debt crisis as an opportunity to cover short positions. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

29-Nov-2011 20:04

|

|

x 0

x 0 Alert Admin |

With the start of the session today, gold fluctuated heavily within narrow levels, yet biased to the downside after the correctional movement seen yesterday, where the metal is affected by the mixed sentiment seen in the market ahead of the finance ministers meeting, the Italian bond sale and Osborne’s Autumn statement. Yesterday, gold was able to cover the bearish opening gap and then gained more strength however the gains were limited as the optimism seen was only a correctional movement as we indicated in the analysis, and now the metal returned to decline as pessimism is still dominating the market and sharp volatility is seen. Gold started the session in Asia at $1711.20 per ounce, and fluctuated heavily between the highest level recorded at $1714.34 and the lowest one recorded at $1703.50, and is trading now around $1706.77 per ounce, and is expected to extend the downside movement. Technically, gold could extend the downside movement in case the metal was able to breach the level of 1702.00 bearishly however, a daily closing above the ascending resistance level at 1719.00 could support the metal to rebound to the upside, targeting the level of 1740.00 and then 1750.00. Europe remains the main focus in the market, while pessimism is still evident ahead of the finance minister meeting today, where investors are looking forward with hopeful eyes that policy makers will finally implement the measures approved earlier, including the usage of the European rescue fund in fighting back the debt crisis, providing governments with credit lines especially when the euro-area region is projected to slip back into recession and finally intervening in the bonds market to quell jitters and control the rapid incline seen on yields. In addition, Moody’s announcement that 87 European banks will be put under review for a possible downgrade was added to concerns that European leaders must act in unity and as soon as possible to prevent the spread of the crisis, especially when Europe is facing more challenges by time since leaders are not showing sufficient commitment to overcome the debt crisis, as we can see growth is weakening, recession is on the doors, unemployment is rising and the debt crisis is spreading in terms of rising bond yields. Moreover, Italy is to sell as much as 8 billion euros of bonds with three different maturities, with expectations yields are to remain above the 7.0% seen in the last auction, which if confirmed, could support pessimism to extend further in the market and urge European leaders to act fast to tackle the debt crisis before time runs out and the debt crisis moves to another level. Among other precious metals, silver started the session in Asia at $31.75 per ounce, and recorded a high of $32.08 and a low of $31.50, and is trading in the moment around $31.68 per ounce and is expected to rebound slightly to cover the opening gap seen today. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

29-Nov-2011 20:01

|

|

x 0

x 0 Alert Admin |

Volatility is dominating crude trading ahead of Finance ministers' meeting Crude oil declined today as reversal moves started yesterday when oil breached $100 level, as it retreated after to the downside due to prevailing uncertainty and heav market movements, where global stocks declined as well ahead of major news that would take place today in Europe. Crude oil opened today’s session at $97.76 and reached a low of $97.21, where it recorded so far a high of $98.24, and it is currently fluctuating around $97.86. Crude is so volatile today ahead of Euro area finance ministers’ meeting which would put headlines to the EFSF and make an agreement on how the facility would ease market pressures by buying debt laden countries’ bonds, as borrowing costs are still at record levels. Bond auctions that would be held in Europe today are adding more volatility in markets, as Italy is to sell as much as 8 billion Euros of three different maturities bonds, Malta and Belgium will sell bonds as well, where fears had already drove yields to high levels and countries today will sell bonds despite the surging costs that reached very sensitive levels amid fears that cover the European sky. On the other hand, George Osborne will admit today the British economy is weak as he will make his autumn statement today, and he will talk about the royal economy and challenges that face it, but he may also announce a stimulus plan for small and medium businesses in order to ease the pressure on those companies which will support the pace of growth in the country and especially support employment. Volatility is the direction for today’s trading, as it will dominate global markets ahead of finance ministers meeting which may ease fears that dominate the continent, but it may intensify it if no convenient solutions for the crisis appear, ministers may approve as well on Greece sixth tranche worth 8 billion Euros, despite the lack of any written commitment from some parties in Greece. On the other hand, rating agencies are preparing for more downgrade moves that may be seen in the coming period amid deepening debt crisis and weakening banking sector, as S& P warned today that it may lower the rating for 87 European banks, and rumors said that the agency may change its outlook on the French credit rating in the coming days. In Asia, Japan has reported a higher unemployment in October at 4.5%, which put more pressure on the country to consider more stimulus to support the economy as many negative factors such as European crisis are affecting it and most importantly the surging yen. Yesterday, crude rose to high levels backed by different factors that pushed it to the upside, as hopes were seen in Europe that leaders may make more efforts in order to contain the crisis, as rumors of possible IMF aid for Italy appeared, but both parties had denied it, also, a weaker dollar was one of the majors factors that supported crude. Crude had supported as well by a good start for the holiday season shopping in the world’s biggest consumer which started with strong Black Friday sales which supported hopes for the U.S. economic outlook and consumption status. Good demand expectations were also supported by supply woes as the situation in the Middle East continues to be edgy. Volatility will be the status for crude today ahead of the Euro finance ministers’ meeting which put the headlines for EFSF as we said, but hopes that leaders would do something may take crude higher. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

29-Nov-2011 19:58

|

|

x 0

x 0 Alert Admin |

After testing 100.30 areas crude retraced sharply toward 97.00, trading remains above the critical 94.50-95.00 support level. As shown on daily chart above, oil may be in the process of forming a bottom at the 200-days SMA, the continuation of the bullish wave will be confirmed by settling above 100.30. In general, we expect further upside attempts for today, where the upside bias should remain intact so long as price is above 95.00 areas. The trading range for the week is among the major support at 95.00 and the major resistance at 101.00. The short-term trend is to the downside with steady weekly closing below 105.00 targeting 65.00. Support: 97.90, 97.15, 96.60, 95.65, 95.00 Resistance: 98.65, 99.50, 100.30, 101.70, 102.85 Recommendation Based on the charts and explanations above we recommend buying oil around 97.10 targeting 100.00 and 103.30, stop loss with four-hour closing below 95.30

|

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

29-Nov-2011 19:54

|

|

x 0

x 0 Alert Admin |

SilverSilver is stable below the simple moving average 50, and also below 38.2% Fibonacci correction at 32.95, which supported the rising wedge pattern to remain effective. Therefore, our negative expectations remain valid. Stochastic is positive, but consolidation above 33.35 is required to activate this positivity seen on the indicator The trading range for this week is among the key support at 29.55 and key resistance now at 33.50. The short-term trend is to the downside targeting 26.65 as far as areas of 48.50 remain intact. Support: 31.60, 31.25, 30.95, 30.50, 30.30 Resistance: 32.10, 32.60, 32.95, 33.05, 33.35 Recommendation Based on the charts and explanations above, our opinion is selling silver around 32.10, and take profit in stages at (30.30 and 29.55) and stop loss with 4-hour closing above 33.35 might be appropriate

GoldRespecting our previous analysis, gold has moved towards the PRZ –potential reversal zones- of the hourly bearish harmonic Gartley pattern at 1720.00 where it started to move downwards once more.-check the previous report for more details about this intraday harmonic overview. In the interim, the four-hour chart succeeded in drawing a bearish crossover on its Stochastic which took the metal towards the sensitive areas-shaded in yellow- thereby, the bearishness is still favored over intraday basis noting that a break below 1705.00 is required to confirm it. Conversely, gold should be well capped below 1740.00 to protect our scenario. The trading range for today is among the key support at 1650.00 and key resistance now at 1765.00. The general trend over the short term basis is to the upside, targeting $ 1945.00 per ounce as far as areas of 1475.00 remain intact with weekly closing. Support: 1703.00, 1698.00, 1687.00, 1673.00, 1665.00 Resistance: 1715.00, 1720.00, 1728.00, 1732.00, 1735.00 Recommendation Based on the charts and explanations above our opinion is, selling gold below1705.00 targeting 1650.00 and stop loss above 1740.00 might be appropriate.

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

29-Nov-2011 19:49

|

|

x 0

x 0 Alert Admin |

Oil up above $110 after Italian bond auction

* Brent up, worries about Iran, Syria sanctions support

* Italian bond auction raises targeted amount * Tight supply also supporting oil (Recasts, adds fresh quotes, updates prices, previous SINGAPORE) LONDON, Nov 29 (Reuters) - Oil pushed above $110 a barrel on Tuesday after Italy successfully completed a closely-watched bond auction, which boosted investor confidence, lifting European stocks and the euro to a session high. Brent crude futures were up $1.29 to $110.29 a barrel by 1107 GMT, and U.S. crude was up 81 cents to $99.02 a barrel after pushing to an intraday high of $99.30 following the bond auction. Italy paid record yields of nearly 8 percent to sell its three-year paper but crucially managed to raise 7.5 billion euros, close to the top of the targeted 5 billion to 8 billion range. European stocks and the euro rallied on news of the result and oil prices also received a strong boost. " This is helping to restore a bit of confidence," said Simon Wardell, oil analyst at IHS Global Insight. Both oil contracts had drifted sideways earlier in the session, but the auction's success galvanised traders to build on Monday's strong rally. Brent finished up $2.60 a barrel on Monday - its biggest single day rise in a month - and U.S. crude closed up $1.44. Analysts and traders said oil was being supported by geopolitical risk and supply fundamentals given tight inventories in the United States. " We get inventory data later today and tomorrow which may show a further decline in product stocks and could lend support to crude oil prices. Brent will stay range-bound at $105-$110 a barrel," said Carsten Fritsch, an analyst at Commerzbank in Frankfurt. The market is also eyeing a meeting of eurozone finance ministers to be held in Brussels from 1400 GMT. The meeting brings together ministers from the 17 eurozone members to agree the details of leveraging the European Financial Stability Fund (EFSF) so it can help Italy or Spain should they need aid. Data showed that eurozone economic sentiment had fallen more than expected in November, as business managers turned more pessimistic across almost all sectors of the economy, particularly in France and the Netherlands. But Christopher Bellew, a trader at Jefferies Bache in London, said that all the bad economic news had been priced in so the oil price was unlikely to be greatly impacted by anything negative coming out of the finance ministers' meeting. " People's expectations for demand growth in the eurozone are pretty minimal so I doubt that will affect it," he said. Bellew added that oil could climb if there was some strength seen in the metals markets and signs of demand improving in China. Wardell argued that strong fundamental factors were keeping oil prices relatively high and something " calamitous" would be needed to drive them lower. " We see oil prices trending sideways, but there are huge risks to the downside in the near term," he said. MIDDLE EAST TENSIONS Tensions around Syria and Iran are continuing to support oil prices, with some governments seeking further sanctions. Paris has argued that Europe should ban Iranian oil as part of Western steps to ratchet up pressure on the country, following a report by the International Atomic Energy Agency that suggested Iran had worked on designing an atom bomb. Diplomats say EU powerbrokers Britain and Germany support the proposal, although London is still conducting an analysis of the costs. But some EU states, led by crisis-stricken Greece, have expressed concerns about the economic impact of an oil embargo. An apparent explosion was heard from Iran's Isfahan city on Monday afternoon, the head of the judiciary in the province said, but the province's deputy governor denied that there had been a big blast. An important Iranian nuclear facility involved in processing uranium is located near Isfahan. Separately, Syria faces growing economic sanctions and condemnation over what the United Nations calls " gross human rights violations" , but President Bashar al-Assad shows no sign of buckling under pressure to end his military crackdown on popular unrest. China and Russia have oil concessions in Syria. Moscow also has a naval repair base on Syria's Mediterranean coast and announced on Monday that it was sending warships there in an apparent display of determination to defend its interests. (Additional reporting by Seng Li Peng in Singapore Editing by Anthony Barker) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

29-Nov-2011 19:46

|

|

x 0

x 0 Alert Admin |

SE Asia Stocks-Mixed Region boosted by banks, foreign inflows

* Jakarta, Kuala Lumpur, Bangkok end firmer led by banks

* Mixture of optimism, caution about Europe developments * Jakarta, Manila, KL, Bangkok see foreign inflows By Shihar Aneez Nov 29 (Reuters) - Banking shares helped boost stock markets in Indonesia, Malaysia, and Thailand on Tuesday on hopes for euro zone recovery but others fell as investors cautiously waited to see strong steps taken in Europe. Optimism over euro zone recovery hopes has been eroding with investors stayed in the sidelines as Europe's finance ministers try to agree on how to bolster the European Financial Stability Facility bailout fund in a bid to stem contagion in bond markets. Malaysia gained 0.9 percent with a $32.2 million foreign inflow and Indonesia jumped 1.1 percent with a net foreign buying of $27.4 million, while the Philippines saw net foreign buying of $27.9 million, its highest since Aug. 9 , even though the market fell 0.4 percent. Thailand, which ended 0.4 percent firmer saw net foreign buying of $16.9 million. Singapore closed 0.2 percent weaker as investors took profits. Vietnam edged down 0.1 percent. On Monday, analysts said investor sentiment was dented after speculation over an Italy bailout by the International Monetary Fund proved to be wrong. Except Jakarta, all other markets saw trading volume on Tuesday that topped 30-day averages with Malaysia's volume hitting 1.45 times and the Philippines seeing 1.33 times its 30-day average. Banks led regional markets on hopes of strong credit growth. Malaysia, which was closed on Monday for a holiday, saw financials AMMB Holdings Bhd and CIMB Group Holdings Bhd, considered proxies of the broader market, jumping 5 percent and 4.6 percent respectively. Indonesia's largest lender Bank Mandiri gained 2.3 percent and Bank Central Asia, Indonesia's biggest lender by market value, rose 2 percent, Bangkok's Siam Commercial Bank adding 3.8 percent and Singapore's DBS rose 0.9 percent. MSCI's broadest index of Asia Pacific shares outside Japan was up 1 percent at 1017 GMT. (Additional reporting by Fong Min Hun in Kuala Lumpur and Singapore bureau Editing by Richard Borsuk) For Asian Companies click For Asia-Pacific News click For South East Asia Hot Stock reports, click |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

29-Nov-2011 19:44

|

|

x 0

x 0 Alert Admin |

HK shares close up 1.2 pct, Chinese consumer plays strong

view of Hong Kong CBD from the sea with One International Finance Centre clearly visible

The Hang Seng Index closed up 1.21 percent at 18,256.2. The China Enterprises Index closed up 1.08 percent at 9,714.09. The Shanghai Composite Index ended up 1.23 percent at 2,412.39 points, led by strong gains in material and energy names in A-share turnover that stayed below average despite hitting the highest since Nov. 18. HIGHLIGHTS: * Chinese consumer names led gains, with footwear retailer Belle International Holdings Ltd surging 8.8 percent in almost twice its 30-day average volume as investors rolled into the sector, seen as relatively safer in a difficult market compounded by an uncertain global macroeconomic outlook, especially for the world's second-largest economy. * Short-selling interest in some stocks in the sector stayed high. Despite strong gains since the Hang Seng Index manager announced in early November that Tingyi (Cayman Islands) Holdings Corp would join the benchmark from Dec. 5, short-selling has slipped below 12 percent of its total daily turnover only three times this month. (Reporting by Clement Tan Editing by Chris Lewis) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

29-Nov-2011 00:13

|

|

x 0

x 0 Alert Admin |

DJ 30 resistance @ 12200 points. STI most likely scenario (refer to Posted: 28-Nov-2011 23:30) would be scenario 2. Dec is the month for BANKING stock. Let's hope and pray my prediction was X wrong... ... |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

29-Nov-2011 00:07

|

|

x 0

x 0 Alert Admin |

Pivot: 18160 Our preference: Short positions below 18160 with targets @ 17385 & 17180 in extension. Alternative scenario: Above 18160 look for further upside with 18485 & 18650 as targets. Comment: the RSI is mixed with a bearish bias. Key levels 18650 18485 18160 17645 last 17385 17180 17000  Click to view chart in actual size. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

28-Nov-2011 23:32

|

|

x 0

x 0 Alert Admin |

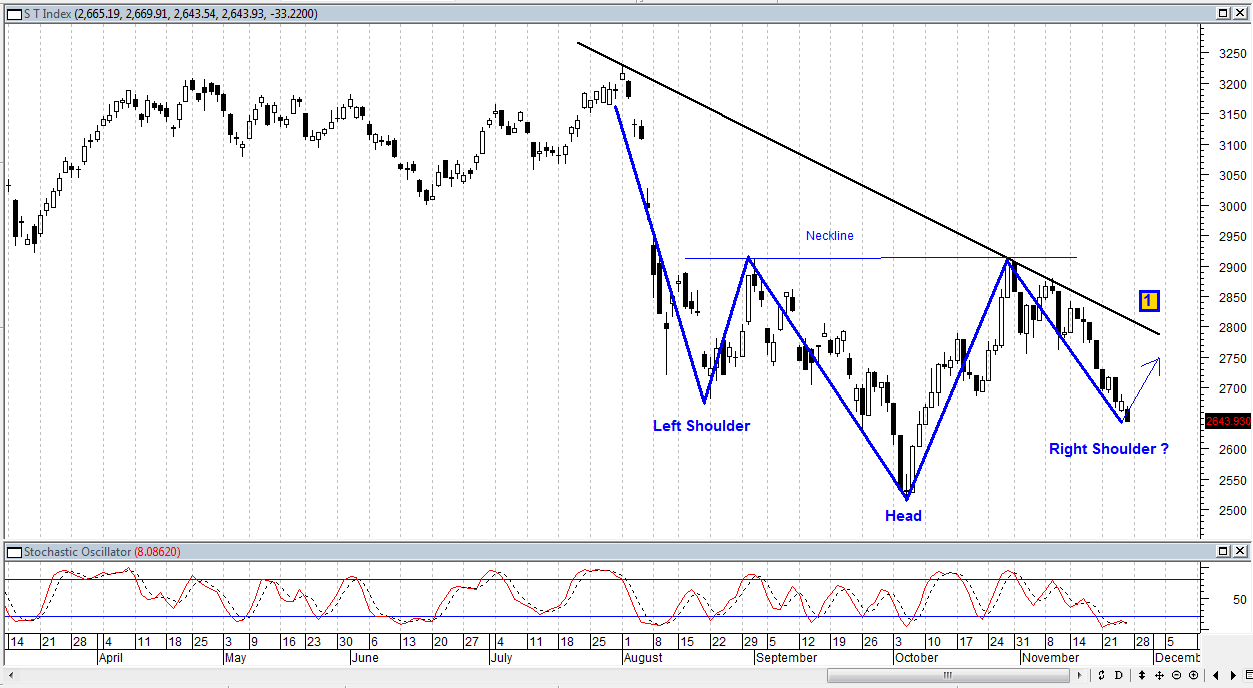

continue....

Within the next 1~2 weeks, we will know which of the two scenarios will come true. What we need to watch is whether prices will rebound from here and break above downtrend line 1 - this is the first foray toward an Inverted Head & Shoulders Pattern. On the other hand, if prices continue to dip ( most likely after a short-lived rebound since the market is quite oversold now ), this will indicate the market is opting for scenario 2.

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

28-Nov-2011 23:30

|

|

x 0

x 0 Alert Admin |

The Straits Times Index is facing two possible scenarios: 1. An Inverted Head & Shoulder Pattern ( Bullish ):

2. Trapped Within a Large Downtrend Channel ( Bearish ):

|

| Useful To Me Not Useful To Me | |