| Latest Forum Topics / Others |

|

|

Market News that affect STI

|

|

|

Blastoff

Elite |

28-Apr-2011 07:46

|

|

x 0

x 0 Alert Admin |

Dow, S& P 500 at highest levels since 2008

NEW YORK (CNNMoney) -- It was a 'no news is good news' kind of day for the stock market. After waiting on the sidelines most of Wednesday in anticipation of the Federal Reserve's statement and Fed chief Ben Bernanke's first press conference, investors waded back in. As expected, the central bank said it would keep interest rates low and end its $600 billion Treasury buying program in June, while Bernanke reassured investors that the nation's economic recovery is on track. " The Fed statement and Bernanke's speech didn't offer any surprises, and that's good for the market because Wall Street hates uncertainty," said Doug Roberts, chief investment officer at Channel Capital Research and author of Follow the Fed to Investment Success. The lack of news pushed the Dow Jones industrial average (INDU) up 96 points, or 0.8%. The S& P 500 (SPX) rose 8 points, or 0.6%, and the Nasdaq Composite (COMP) added 22 points, or 0.8%.

Bernanke said the Fed would end its bond-buying program " without tapering," and that there were no plans to do more. " The trade-offs are getting less attractive," he said. Bernanke also noted that the central bank's balance sheet would remain constant after QE2 ends. On Tuesday, U.S. stocks finished at their highest levels in three years. Companies: GE's (GE, Fortune 500) stock jumped 2.7%, leading the Dow's gainers. At an annual shareholder's meeting, the conglomerate's CFO said the company's profit growth over the next few years will be the fastest it has seen in a decade. Shares of Merck (MRK, Fortune 500) rose 1.6% after the Dow component got the green light from its board for a $5 billion share buyback program. Shares of Boeing (BA, Fortune 500) rose 0.8% after the aeronautics company reported a 13% increase in its first-quarter profit. Amazon.com (AMZN, Fortune 500)'s stock was the biggest winner on the S& P 500 and Nasdaq, with shares rising 8%, even though the online merchant reported first-quarter earnings that fell by one-third compared to a year earlier and sharply missed Wall Street forecasts. For-profit educator DeVry's (DV) stock was also a strong performer on the S& P 500 after popping more than 7%. Late Tuesday, DeVry reported a 14% rise in its quarterly profit Meanwhile, shares of Broadcom (BRCM, Fortune 500) sank 12.3% after the semiconductor company issued a disappointing outlook. Broadcom was the worst performing company in the S& P 500 and Nasdaq. After Tuesday's close, Starbucks (SBUX, Fortune 500) posted quarterly results roughly in line with expectations, but the coffee giant disappointed investors with a lower-than-expected outlook. Shares slipped 2% in after-hours trading. Economy: The government said new orders for durable goods increased 2.5% in March, after a 0.7% rise the month before. Economists surveyed by Briefing.com expect an increase of 1.8% in March. World markets: European stocks closed mixed. The DAX in Germany rose 0.7%, France's CAC 40 gained 0.7%, while Britain's FTSE 100 ended slightly lower.

Standard & Poor's warned that Japan's government could face a downgrade of its credit rating within the next few years, as the nation's economy recovers from the March 11 earthquake and tsunami.

Currencies and commodities: The dollar fell against the euro and the British pound, but rose versus the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, with the yield rising to 3.37% from Tuesday's yield of 3.32%. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

27-Apr-2011 12:25

|

|

x 0

x 0 Alert Admin |

Apr 27, 2011Japan shares up 1.29% by noonTOKYO Japanese shares rose 1.29 per cent on Wednesday morning, tracking a strong rise on Wall Street following solid US earnings reports. The benchmark Nikkei index at the Tokyo Stock Exchange gained 123.52 points to 9,682.21 by the lunch break. The Topix index of all first section shares went up 0.80 per cent or 6.67 points to 840.31. Soon after the market stopped for lunch ratings agency Standard & Poor's said it had lowered its outlook on Japanese sovereign debt to negative - citing last month's quake-tsunami disaster - which sent the dollar up against the yen. Wall Street shares rose sharply on Tuesday on the back of strong company results and as investors awaited the outcome of a two-day Federal Reserve meeting to be wound up on Wednesday. The Dow Jones Industrial Average leaped 115.49 points (0.93 per cent) to finish at 12,595.37. Trading volume was expected to remain thin in Tokyo. HONG KONG Hong Kong shares opened 1.01 higher per cent on Wednesday, with the Hang Seng Index jumping 243.10 points to 24,250.48. SHANGHAI Chinese shares rose at the opening on Wednesday with the benchmark Shanghai Composite Index up 0.25 percent to 2,946.33, Xinhua reported. The Shenzhen Component Index opened 0.43 per cent higher at 12,502.96. KUALA LUMPUR At 10.30am on Wednesday, there were 298 gainers, 177 losers and 284 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,533.14 up 5.80 points, the FBMACE was at 4,420.59 up 17.88 points, and the FBMEmas was at 10,568.66 up 31.91 points. |

| Useful To Me Not Useful To Me | |

|

|

|

|

Blastoff

Elite |

26-Apr-2011 13:32

|

|

x 0

x 0 Alert Admin |

Apr 26, 2011Japan shares down 0.98% by noonTOKYO Japanese shares lost 0.98 per cent on Tuesday morning on a firmer yen, worries over automobile production and a disappointing earnings report from Nintendo, brokers said. The Nikkei index at the Tokyo Stock Exchange fell 94.32 points to 9,577.64 by noon. The Topix index of all first section shares declined 0.70 per cent or 5.89 points to 834.79. Exporters fell on a stronger yen and major automakers have been hit by a sharp dip in March domestic production, said Mr Hisatsune Kobayashi, general manager of global investment strategy at SMBC Nikko Securities. The automakers said on Monday that domestic production plummeted last month after the massive quake and tsunami of March 11, which shut off parts supplies and led to widespread power shortages. Ratings agency Standard & Poor's revised from 'stable' to 'negative' its outlook for the trio. -- AFP HONG KONG Hong Kong shares opened lower on Tuesday, with the Hang Seng Index falling 190.16 points or 0.79 per cent to 23,948.15 in early trade following a long Easter holiday weekend. SHANGHAI Chinese shares were flat in early trade on Tuesday as persistent concerns over inflation weighed on sentiment, dealers said. The Shanghai Composite Index, which covers both A and B shares, was down 0.06 per cent or 1.74 points at 2,963.21. The Shanghai A-share index shed 0.06 per cent, or 1.80 points, to 3,102.65, while the Shenzhen A-share index lost 0.39 per cent, or 5.11 points, to 1,301.91. KUALA LUMPUR At 9.30am on Tuesday, there were 112 gainers, 177 losers and 198 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,522.76 down 1.29 points, the FBMACE was at 4,402.63 down 33.08 points, and the FBMEmas was at 10,513.38 down 8.81 points. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

26-Apr-2011 13:31

|

|

x 0

x 0 Alert Admin |

Apr 26, 2011STI lower at middaySINGAPORE shares were lower at midday on Tuesday, with the benchmark Straits Times Index at 3,173.44, down 0.45 per cent, or 14.28 points. About 483.4 million shares exchanged hands. Losers beat gainers 221 to 127. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

26-Apr-2011 07:35

|

|

x 0

x 0 Alert Admin |

Stocks end mixed amid investor caution

NEW YORK (CNNMoney) -- U.S. stocks ended mixed Monday, with technology shares rising modestly, amid a pause in the flow of corporate results and ahead of a statement from the Federal Reserve later this week. In the commodities market, gold and silver prices held gains but closed off session highs. Oil held near $112 a barrel. The Dow Jones industrial average (INDU) fell 26 points, or 0.2%, to 12,479. The S& P 500 (SPX) slipped 2 points, or 0.1%, to 1,335. But the Nasdaq Composite (COMP) bucked the trend, rising nearly 6 points, or 0.2%, to 2,825. Stocks retreated after the Dow ended last week near a 3-year high on a batch of strong corporate earnings. While there were no top-tier corporate results released Monday, the week ahead brings quarterly results from nine Dow components and 180 members of the S& P 500. Shares of Netflix (NFLX) fell nearly 5% in extended hours after the company reported strong quarterly gains in sales and profits, but offered a conservative outlook for the current quarter. Investors were also awaiting comments from Federal Reserve chairman Ben Bernanke, who is scheduled to hold a first-ever news conference Wednesday after the central bank releases its official policy statement. Ryan Larson, a senior equity trader at RBC Global Asset Management, said corporate reports due after the closing bell could help set the tone for trading in the following session. But he expects the market to drift between small gains and losses in the meantime as investors hold off on big bets before hearing from Bernanke. The market was closed Friday in observance of Good Friday. Currencies and commodities: Gold futures for June delivery rose $4.70 to $1,508.70 an ounce, after setting a new intraday trading high of $1,518.60 earlier Monday. Silver futures for May delivery were up $1.33 to $47.40 an ounce. Earlier, prices rose to $49.82, near an all-time high.

Economy: Sales of new homes rose more than expected in March, although the weak housing market remains a concern for many investors.

Companies: Shares of Kimberly-Clark (KMB, Fortune 500) were down 2.7% after the maker of paper products said first-quarter earnings fell 6.5% from the same period last year. World markets: Asian markets ended lower. The Shanghai Composite fell 1.5% and Japan's Nikkei slipped 0.1%.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.36% from 3.4% late Thursday. The bond market closed early Thursday and remained closed in observance of Good Friday. |

| Useful To Me Not Useful To Me | |

|

|

|

|

Blastoff

Elite |

25-Apr-2011 14:24

|

|

x 0

x 0 Alert Admin |

THE consumer price index (CPI) or inflation increased by 5 per cent in March compared to a year ago, according to figures released by the Department of Statistics Singapore on Monday. Compared to the previous month, the CPI rose by 0.1 per cent. Transport costs saw the biggest increase with a 13.4 per cent jump on car and petrol prices. Meanwhile higher accommodation costs and electricity tariffs raised housing costs by 7.1 per cent. Food prices increased by a modest 2.6 per cent. Overall, the first quarter of 2011 saw inflation increased by 5.2 per cent compared with the same period of the previous year. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

12-Apr-2011 13:26

|

|

x 0

x 0 Alert Admin |

Apr 12, 2011Asian stocks mostly lower at middayTOKYO TOKYO stocks were lower at midday on Tuesday, as a strong aftershock highlighted the challenges of stabilising a stricken nuclear plant, with Japan upgrading the crisis to the same level as Chernobyl. The benchmark Nikkei 225 Index was down 1.60 per cent, or 155.77 points, at 9,563.93. The Topix index was down 1.39 per cent at 840.52. HONG KONG Hong Kong stocks were lower at midday on Tuesday, amid fresh concerns over the Japan nuclear crisis following strong aftershocks from the March 11 tragedy. The benchmark Hang Seng Index was down 323 points, at 23,980.07. SHANGHAIChina?s stocks were higher at midday on Tuesday. The Shanghai Composite Index, which covers both A and B shares, was up 0.4 per cent, or 11.01 points, at 3,033.76. KUALA LUMPUR At 12.30pm today, there were 127 gainers, 590 losers and 228 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,529.45 down 14.55 points, the FBMACE was at 4,260.72 down 12.77 points, and the FBMEmas was at 10,532.81 down 96.14 points. Turnover was at 558.701 million shares valued at RM674.064 million (S$280.449 million). |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

12-Apr-2011 07:23

|

|

x 0

x 0 Alert Admin |

Stocks under pressure ahead of earnings

NEW YORK (CNNMoney) -- U.S. stocks gave up an early advance and closed little changed Monday as investors looked ahead to corporate reports due throughout the week. The Dow Jones industrial average (INDU) rose 1 point, or less than 0.1%, to close at 12,381. The S& P 500 (SPX) slipped about 4 points, or 0.3% to 1,324. The Nasdaq Composite (COMP) sank 9 points, or 0.3%, to 2,771. Stocks posted broad-based gains earlier in the session on a spate of deal news and a drop in oil prices following talk of a cease fire in Libya. But the tone turned more cautious in the afternoon, as investors were awaiting the early results of the first-quarter reporting period. After the market closed, Alcoa said it earned 28 cents per share in the first quarter, beating analysts' estimates by a penny. JPMorgan (JPM, Fortune 500), another Dow component, and Google (GOOG, Fortune 500) are also slated to post results later this week.

However, he said investors will be looking for clues on how companies are coping with rising prices for oil and other basic commodities. " I think that will be the real story this quarter," Luschini said. In addition, the 3% pullback in oil prices weighed on shares of energy producers and industrial companies. Alcoa (AA, Fortune 500) and Caterpillar (CAT, Fortune 500) dragged on the Dow, while Exxon Mobil (XOM, Fortune 500) and Chevron (CVX, Fortune 500) were also weak.

Investors also looked past comments from Janet Yellen, vice chairman of the Federal Reserve, who suggested that the central bank will remain accommodative for some time.

Companies: Endo Pharmaceuticals (ENDP) announced plans to buy American Medical Systems (AMMD) for $2.9 billion in cash and stock. Shares of American Medical jumped 32%, while Endo stock rose 5%. Communications services company Level 3 (LVLT) announced plans to buy rival Global Crossing (GLBC) in an all-stock deal valued at $3 billion. Shares of Tyco (TYC) were up 3.5%, amid speculation that France's Schneider Electric is considering a bid for the Swiss industrial conglomerate. On the down side, shares of Tenet Healthcare (THC, Fortune 500) sank 15% as the company filed suit against Community Health Systems, which is pursuing a hostile takeover bid for Tenet. Shares of major U.S. automakers Ford and GM were also under pressure. Ford (F, Fortune 500) fell 3%, while GM (GM) was down 2.8%. NYSE Euronext, the parent company of the New York Stock Exchange, said Sunday that its board rejected a takeover offer from the owner of Nasdaq and another rival exchange. Economy: Late Friday, lawmakers pushed through a last-minute budget bill to keep the federal government open for business. Uncertainty about a possible shutdown kept investors on edge last week, sending stocks down on Friday. While investors may welcome the deal -- because it creates more certainty about this year's government spending -- lawmakers will now refocus on even more difficult budget battles ahead. Questions still loom about raising the debt ceiling and dealing with long-term deficits in the 2012 budget. World markets: London's FTSE ended flat, while the Dax in Frankfurt eased 0.2% and Paris' CAC-40 fell 0.6%, after an earthquake shook northeastern Japan -- sending a landslide into Iwaki City. That's the same region that was devastated by a deadly earthquake-tsunami on March 11. Over the weekend, the Chinese government reported its first quarterly deficit in seven years, as imports outweighed exports by more than $1 billion.

Asian markets had already closed in the red prior to Monday's earthquake. Currencies and commodities: The dollar rose against the euro and the British pound, but fell versus the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury was little changed, with the yield unchanged from Friday at 3.57%. |

| Useful To Me Not Useful To Me | |

|

|

|

|

Blastoff

Elite |

01-Apr-2011 11:03

|

|

x 0

x 0 Alert Admin |

Apr 1, 2011Asian stocks open mostly higherTOKYO Japanese stocks opened higher on Friday as a weaker yen provided support after posting solid gains over the last two sessions, but investors were reluctant to take large positions ahead of US jobs data later in the day. The benchmark Nikkei 225 Index was up 0.2 per cent at 9,757.28 after early trade. The Topix index was up 0.18 per cent at 870.96. HONG KONG Hong Kong shares opened higher on Friday. The benchmark Hang Seng Index was up 49.19 points, 0.21 per cent, at 23,576.71 in early trade. SHANGHAIChinese shares opened higher on Friday. The Shanghai Composite Index, which covers both A and B shares, was up 3.7 points, or 0.1 per cent, to 2,931.84 in early trade. KUALA LUMPUR At 9.30 a.m. today, there were 204 gainers, 129 losers and 176 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,548.51 up 3.38 points, the FBMACE was at 4,322.88 down 10.59 points, and the FBMEmas was at 10,633.93 up 21.47 points. Turnover was at 230.132 million shares valued at RM157.194 million (S$65.48 million). |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

31-Mar-2011 13:07

|

|

x 0

x 0 Alert Admin |

Mar 31, 2011Asian stocks open mostly higherTOKYO Tokyo stocks opened higher on Thursday, with the Nikkei 225 index up 56.49 points or 0.58 per cent at 9,765.28 points. HONG KONG Hong Kong shares gained 0.53 per cent in early trade Thursday. The benchmark Hang Seng Index was up 124.94 points at 23,576.37 SHANGHAIChinese shares opened almost flat. The Shanghai Composite Index, which covers both A and B shares, was down 0.04 per cent to 2,954.65 in early trade. KUALA LUMPUR At 9.30 am on Thursday, there were 265 gainers, 125 losers and 192 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,537.12 up 5.49 points, the FBMACE was at 4368.14 up 19.90 points, and the FBMEmas was at 10,576.99 up 38.61 points. Turnover was at 440.840 million shares valued at RM218.45 million (S$91.07 million). |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

31-Mar-2011 09:21

|

|

x 0

x 0 Alert Admin |

Mar 31, 2011Tokyo stocks open higherTOKYO Tokyo stocks opened higher on Thursday, with the Nikkei 225 index up 56.49 points or 0.58 per cent at 9,765.28 points. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

26-Mar-2011 13:02

|

|

x 0

x 0 Alert Admin |

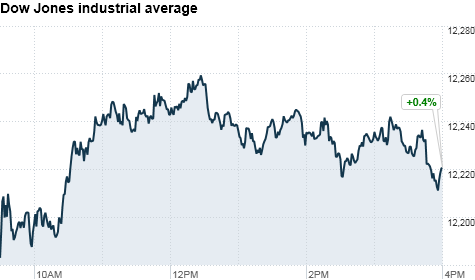

Stocks post third straight day of gains

NEW YORK (CNNMoney) -- U.S. stocks rose for a third straight day Friday, as investors shrugged off geopolitical concerns and focused on positive news out of the technology sector. The Dow Jones industrial average (INDU) rose 50 points, or 0.4%, to 12,221. The S& P 500 (SPX) index climbed 4.1 points, or 0.3%, to 1,313.80 and the Nasdaq Composite (COMP) gained 6.6 points, or 0.2%, to 2,743. For the week, the Dow rose more than 3% while the S& P 500 gained 2.7% and the Nasdaq surged 3.7%. It was the best weekly performance for the Dow since mid-July. Tech stocks were among the biggest movers. Shares of Oracle (ORCL, Fortune 500) gained 1.5%, after the software company reported results late Thursday that were mostly in line with expectations. Dow component IBM (IBM, Fortune 500) closed up 1.5%. IBM, like Oracle, is a big seller of software to businesses.

Mostly positive earnings news from the technology sector boosted U.S. stocks on Thursday as well. Economy: Investors reacted little to the third and final reading of fourth-quarter U.S. GDP, which showed an annual growth rate of 3.1%, up from a prior estimate of 2.8%.

Companies: Research in Motion (RIMM) shares plunged more than 11% after the BlackBerry maker gave weak guidance late Thursday. Electronics retailer Best Buy (BBY, Fortune 500) was among the worst performers in the S& P 500, falling 3% after Wall Street analysts downgraded the company following its earnings report earlier this week. Shares of Darden Restaurants (DRI, Fortune 500), operator of Red Lobster and Olive Garden, dropped 5% despite the fact that the company's earnings beat analyst estimates. Darden hinted that rising food costs could be a problem down the road. World markets: European stocks closed higher. Britain's FTSE 100 ticked up by 0.3%, the DAX in Germany gained 0.2% and France's CAC 40 rose 0.1%.

Currencies and commodities: The dollar rose against the euro, the Japanese yen and the British pound.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.40% from 3.39% late Thursday. |

| Useful To Me Not Useful To Me | |

|

|

|

|

Blastoff

Elite |

24-Mar-2011 09:47

|

|

x 0

x 0 Alert Admin |

Mar 24, 2011Japan shares open higherOSAKA Tokyo shares opened 0.32 per cent higher on Thursday, with the Nikkei index adding 30.30 points to 9,479.77 in early trade after falling the previous day on a water radiation scare. The Topix index slipped 1.01 points, or 0.12 per cent, to 860.09. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

24-Mar-2011 07:57

|

|

x 0

x 0 Alert Admin |

Stocks finish higher thanks to afternoon boost

NEW YORK (CNNMoney) -- U.S. stocks finished higher Wednesday, thanks to a late-day advance, as investors shrugged off jitters about turmoil in the Middle East and Japan's nuclear issues. The Dow Jones industrial average (INDU) closed 67 points higher, or 0.6%, led by a 3% jump in shares of Alcoa (AA, Fortune 500). Bank of America (BAC, Fortune 500) was the worst performer on the blue-chip index. The bank said it will need to revise its dividend plan after the Fed rejected the bank's initial proposal. The S& P 500 (SPX) rose 4 points, or 0.3%, and the Nasdaq Composite (COMP) added 14 points, or 0.5%. Traders spent most of Wednesday and the previous session on the sidelines, unwilling to place any big bets as global concerns linger.

Prior to the afternoon upturn, investors had been taking a wait-and-see approach, and volume has remained light. A disappointing housing report didn't help matters much, but after a brief blip, investors largely shrugged off the data, which showed new home sales tumbled to a record low last month. World markets: The Egyptian market plunged Wednesday. The stock market in Egypt had been closed since Jan. 27, and most traders had already anticipated the sharp drop.

Japan's Nikkei closed 1.7% lower, but it was the smallest percentage change in the index since the massive earthquake and devastating tsunami. On Wednesday, the Japanese government said the quake would cost the nation $300 billion -- more than double the cost of the Kobe quake in 1995, according to published reports.

Companies: Shares of General Mills (GIS, Fortune 500) dropped 1.8%. The cereal maker, which raised prices in October, said its fiscal third-quarter earnings rose 18%, though U.S. sales were slightly lower. Adobe Systems (ADBE) was the biggest decliner on the S& P 500 and Nasdaq. Shares sank 3.7% after the software maker lowered its second-quarter earnings forecast, saying the earthquake and tsunami in Japan will curb sales. Shares of homebuilder PulteGroup (PHM) rose 3.6% after Goldman Sachs raised its price target on the stock. Jabil Circuit's (JBL, Fortune 500) stock jumped almost 11%, leading the gainers in the S& P 500. The electronics manufacturing company posted a profit and sales figures above expectations late Tuesday. Currencies and commodities: The dollar rose against the euro and British pound, but fell versus the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury was slightly lower, pushing the yield up to 3.35% from 3.33% late Tuesday. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

22-Mar-2011 16:14

|

|

x 0

x 0 Alert Admin |

Mar 22, 2011Asian stocks mixed at middayTOKYO Tokyo stocks surged more than 4.0 per cent on Tuesday, helped by signs of progress in containing Japan's post-quake nuclear crisis and as the Bank of Japan pumped nearly US$25 billion (S$32 billion) more into the market. The key Nikkei share index closed 4.36 per cent higher, adding 401.57 points to 9,608.32. The broader Topix index added 4.54 per cent, or 37.74 points, to 868.13. HONG KONG Hong Kong shares rose 0.23 per cent by midday on Tuesday, extending gains from the previous session and following a strong performance on Wall Street. The benchmark Hang Seng Index gained 52.66 points to 22,737.88. SHANGHAI The Shanghai Composite Index was up 0.2 per cent at midday to to 2,913.52, as the financial sub-index rose 1.2 per cent ahead of earnings announcements over the next several weeks. KUALA LUMPUR At 12.30pm on Tuesday, there were 407 gainers, 226 losers and 264 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,508.41 down 0.47 of a point, the FBMACE was at 4,075.19 down 2.16 points, and the FBMEmas was at 10,342.23 up 12.88 points. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

18-Mar-2011 07:11

|

|

x 0

x 0 Alert Admin |

Dow jumps 160 after two days of losses

NEW YORK (CNNMoney) -- U.S. stocks closed broadly higher Thursday, after two days of heavy losses on Wall Street, as investors cheered an upbeat outlook from economic bellwether FedEx. Despite today's gains, trading has been volatile this week as investors remain jumpy about the nuclear crisis in Japan. The Dow Jones industrial average (INDU) jumped 161 points, or 1.4%, to 11,775. The Dow had 26 out of its 30 members close higher during the session, led by shares of Hewlett-Packard (HPQ, Fortune 500) and Pfizer (PFE, Fortune 500). The S& P 500 (SPX) rose 17 points, or 1.3%, to 1,274, and the Nasdaq Composite (COMP) gained 19 points, or 0.73%, to 2,636. Among the best performers in the S& P 500 were Federal Express (FDX, Fortune 500) and United Parcel Service (UPS, Fortune 500). FedEx issued earnings guidance that topped analysts' forecasts and said it still expected moderate economic growth this year.

Railroad stocks also rose, with shares of CSX (CSX, Fortune 500), Norfolk Southern (NSC, Fortune 500) and Union Pacific (UNP, Fortune 500) all up 2.5% or more. The recovery came a day after U.S. stocks posted steep losses, with all three major indexes hitting their lowest levels of the year on ongoing concerns about Japan's nuclear reactor.

Japan has been aggressively working to avert a meltdown at the Fukushima Daiichi nuclear power plant, following last week's devastating earthquake and tsunami. (CNN.com's Japan coverage)

World markets: Asian markets fell, with the Nikkei in Japan (NKY) falling 1.4%, the Shanghai Composite sliding 1.1%, and the Hang Seng in Hong Kong losing 1.8%. But stocks in London, Frankfurt and Paris closed higher after French Finance Minister Christine Lagarde initiated a Group of Seven conference call to discuss ways to support Japan. The U.S. dollar hit an all-time low against the yen on Wednesday.

Companies: Shares of The New York Times (NYT). rose as much as 4% Thursday after the company revealed details about its much-anticipated pay wall system. Shares closed up only 0.3% at the end of the day, however. Shares of Nike (NKE, Fortune 500) dropped 6% after the market close after the athletic apparel maker said it had a third-quarter profit of $1.08. The earnings were well short of the $1.12 a share analysts were looking for, according to Briefing.com. Economy: The U.S. consumer price index has risen 2.1% in the past year, according to the Commerce Department. That marked the fastest rate since April 2010. Underlying inflation remained low. In other reports, the number of first-time claims for unemployment benefits fell to 385,000 last week. Continuing claims hit their lowest level since September 2008. Currencies and commodities: The disaster in Japan has driven the yen sharply higher against the dollar on demand for safe-haven assets and speculation that more cash will flow back into the country as it rebuilds. After the dollar hit an all-time low versus the yen on Wednesday, it edged about 1% higher early Thursday.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.27%. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

17-Mar-2011 13:21

|

|

x 0

x 0 Alert Admin |

Mar 17, 2011Nikkei down 2.09% by middayTOKYO - TOKYO shares ended the morning session down 2.09 per cent on Thursday as a surging yen added to fears about the economic fallout from a huge earthquake and nuclear power plant troubles. The Nikkei index fell 189.86 points to 8,903.86 by the break. SHANGHAI Weak performance of regional markets and lingering concerns over nuclear crisis in Japan continued to weigh on Chinese shares on Thursday, Xinhua reported, sending the indexes down by more than half percent in the morning session. The benchmark Shanghai Composite Index dropped 14.83 points, or 0.51 per cent, to finish the morning session at 2,915.98. The Shenzhen Component Index weakened 77.08 points, or 0.6 per cent, to end the morning break at 12,788.68. HONG KONG Hong Kong shares fell 1.79 per cent on Thursday as the nuclear crisis in Japan continued to weigh heavily on global markets. The benchmark Hang Seng Index shed 406.57 points to 22,294.31 on turnover of HK$47.12 billion (S$7.8 billion). KUALA LUMPUR At 11.30am on Thursday, there were 123 gainers, 466 losers and 183 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,487.10 down 5.34 points, the FBMACE was at 3,950.68 down 15.11 points, and the FBMEmas was at 10,157.47 down 50.48 points. |

| Useful To Me Not Useful To Me | |

|

rickyw

Master |

17-Mar-2011 12:38

Yells: "keep happy..." |

|

x 0

x 0 Alert Admin |

Do u all notice, all US gov statement is different with Japan gov statement?? Who is the liar one?? Must be there is liar among themself... |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

17-Mar-2011 12:30

|

|

x 0

x 0 Alert Admin |

Mar 17, 2011Nikkei down 2.09% by middayTOKYO - TOKYO shares ended the morning session down 2.09 per cent on Thursday as a surging yen added to fears about the economic fallout from a huge earthquake and nuclear power plant troubles. The Nikkei index fell 189.86 points to 8,903.86 by the break. SHANGHAI Weak performance of regional markets and lingering concerns over nuclear crisis in Japan continued to weigh on Chinese shares on Thursday, Xinhua reported, sending the indexes down by more than half percent in the morning session. The benchmark Shanghai Composite Index dropped 14.83 points, or 0.51 per cent, to finish the morning session at 2,915.98. The Shenzhen Component Index weakened 77.08 points, or 0.6 per cent, to end the morning break at 12,788.68. HONG KONG Hong Kong shares fell 1.79 per cent on Thursday as the nuclear crisis in Japan continued to weigh heavily on global markets. The benchmark Hang Seng Index shed 406.57 points to 22,294.31 on turnover of HK$47.12 billion (S$7.8 billion). KUALA LUMPUR At 11.30am on Thursday, there were 123 gainers, 466 losers and 183 counters traded unchanged on the Bursa Malaysia. The FBM-KLCI was at 1,487.10 down 5.34 points, the FBMACE was at 3,950.68 down 15.11 points, and the FBMEmas was at 10,157.47 down 50.48 points. |

| Useful To Me Not Useful To Me | |

|

Blastoff

Elite |

17-Mar-2011 08:16

|

|

x 0

x 0 Alert Admin |

Rough day for stocks: S& P 500, Nasdaq erase year's gains The S& P 500 lost nearly 25 points, or 2%, Wednesday. That steep drop put the benchmark index down 0.1% for the year. The S& P 500 lost nearly 25 points, or 2%, Wednesday. That steep drop put the benchmark index down 0.1% for the year.NEW YORK (CNNMoney) -- A sell-off in U.S. stocks accelerated Wednesday, with all three major indexes ending at their lowest levels of 2011. The S& P 500 and Nasdaq composite erased their gains for the year, while the Dow is barely hanging on, up only 0.3% in 2011. Trading was extremely choppy as investors tried to sort out disappointing U.S. housing data against the backdrop of developments in Japan. It didn't help that European Union energy commissioner GŁnther Oettinger sounded a warning bell about increased risks related to Japan's crippled nuclear reactors at a meeting in Brussels. Moreover, the U.S. Embassy in Tokyo cautioned American citizens who live within 50 miles of the damaged Fukushima Daiichi nuclear plant to evacuate or take shelter indoors. " Today's not a good news day, and the market is reacting emotionally," said Fred Dickson, chief market strategist at D.A. Davidson & Co. The Dow Jones industrial average (INDU) tumbled 242 points, or 2%, with all 30 components of the blue chip index in the red. IBM (IBM, Fortune 500), General Electric (GE, Fortune 500) and American Express (AXP, Fortune 500) led the decline. The index was down almost 300 points at its low for the day. The S& P 500 (SPX) slipped 25 points, or 2%, to end at 1,256.88. The broad index closed 2010 at 1,257.64. The Nasdaq (COMP) lost 51 points, or 1.9%, to finish at 2,616.82. The tech-heavy index closed at 2,652.87 last year. Global concerns also pushed the dollar below •80 briefly, hitting •79.75, matching the record low hit in April 1995 (More on currencies). Wall Street's most widely cited measure of volatility, the VIX (VIX), surged more than 20% to 29.40. Earlier, it climbed above 30 for the first time since July. Dickson is advising his clients to get to the sidelines until the picture of the nuclear threat in Japan becomes clearer. Wednesday's declines came on the heels of a sharp sell-off in the previous session, which was dominated by worries about Japan. Japan in crisis: In a televised speech Wednesday, Japan's emperor told citizens not to give up hope as the country grapples with an epic earthquake. " It's quite rare of the emperor to appear on television, and that has made investors a little nervous," said David Jones, chief market strategist with IG Markets in London. Prior to the speech, Tokyo's Nikkei index rose 5.7%, rebounding from two days of losses that had drained more than 16% from the index. The increasingly desperate situation at Japan's nuclear plants is keeping investors on edge. Stunned by the devastation in Japan, they have been reducing their exposure to risky assets and flocking to investments that are considered safe, including U.S. Treasuries. Investors continued to buy up U.S. government debt Wednesday, sending the 10-year yield down to 3.23% from 3.32% late Tuesday. Aside from Japan, Moody's Investors Service cut Egypt's rating by one notch, further into non-investment grade quality. And late Tuesday, Moody's downgraded Portugal's credit rating from A1 to A3 -- a lower investment grade status. And Fitch downgraded Bahrain's debt to below investment grade, following a government clash with protesters. Asian markets ended higher, with the Shanghai Composite index rising 1.2% and Hong Kong's Hang Seng index edging up 0.1%. European markets closed sharply lower. The FTSE 100 dropped 0.8%, and France's CAC 40 and DAX in Germany tumbled more than 1%. (World markets) Economy: The government said new home construction fell 22.5% in February, more than economists were expecting, while the number of permits for future housing construction fell 8.2% to all all-time low. Separately, the government's Producer Price Index showed that prices at the wholesale level jumped 1.6% in February, which was much more than expected. Commodities: Oil prices -- which fell nearly 4% on Tuesday -- were higher Wednesday, as concerns about the ongoing turmoil in North Africa and the Middle East were revived. Oil for April delivery gained 80 cents, or 0.8%, to settle at $97.98 a barrel. Gold futures for April delivery climbed $3.30 to settle at $1,396.10 an ounce. |

| Useful To Me Not Useful To Me | |