| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||||

|

Blastoff

Elite |

08-Mar-2011 14:43

|

||||

|

x 0

x 0 Alert Admin |

Mar 8, 2011STI higher at middaySINGAPORE shares were higher at midday on Tuesday, with the benchmark Straits Times Index at 3,080.15, up 0.44 per cent, or 13.63 points. About 526.6 million shares exchanged hands. Gainers beat losers 166 to 142. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

08-Mar-2011 08:04

|

||||

|

x 0

x 0 Alert Admin |

Stocks sink on oil fears

NEW YORK (CNNMoney) -- Surging oil prices continued to rain on the stock market's parade at the start of the week. Add a lagging tech sector and Greece's latest debt woes to the mix, and Monday was a downer to say the least. The Dow Jones industrial average (INDU) sank 80 points, or 0.7% the S& P 500 (SPX) fell 11 points, or 0.8% and the tech-heavy Nasdaq (COMP) shed 40 points, or 1.4%. " It's pretty clear that we're dealing with international and Middle East tensions here," said Jason Pride, director of investment strategy at Glenmede. " The reality is, oil is getting into the price range now where people are going to start questioning its impact on the broader economy." Investors are keeping a close eye on commodities, after crude oil rose to more than $106 a barrel early Monday on continued tensions in Libya. Oil finished the day at about $105.44, an increase of more than a dollar.

Meanwhile, gold set a new intraday record in early trading, rising to $1,445 an ounce, as investors sought safety in the precious metal. It pared back those gains later in the day though, settling at $1,434.50 an ounce on the Chicago Mercantile Exchange.

Companies: Tech stocks dragged on the entire market after Wells Fargo downgraded the semiconductor sector Monday. Intel (INTC, Fortune 500) fell 1.6% and the Philadelphia Semiconductor Index (SOX) dropped 2.7%. Western Digital's (WDC, Fortune 500) stock climbed 15.6%, after the company agreed to acquire Hitachi's (HIT) hard disk drive business. The stock and cash transaction is valued at $4.3 billion. Western Digital's top rival, Seagate Technology (STX), rose 9% on the news. Starbucks (SBUX, Fortune 500) stock rose 1.5%, after Morgan Stanley analysts upgraded the company's price target and CEO Howard Schultz told the Wall Street Journal the coffee company is planning several acquisitions over the next 12 to 18 months to bolster its consumer products division.

World markets: Analysts at Moody's slashed Greece's credit rating three notches Monday to B1.

Asian markets ended mixed. The Shanghai Composite jumped 1.8%, while the Hang Seng in Hong Kong slid 0.4% and Japan's Nikkei tumbled 1.8%. Economy: Consumer credit increased by $5 billion in January, according to a report by the Federal Reserve released Monday afternoon. Economists surveyed by Briefing.com had expected consumer credit to have increased by $3.3 billion in January. Currencies: The dollar gained against the euro and the British pound, but fell versus the Japanese yen. Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.50% from 3.55% late Friday. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

07-Mar-2011 12:57

|

||||

|

x 0

x 0 Alert Admin |

Mar 7, 2011STI higher at middaySINGAPORE shares were higher at midday on Monday, with the benchmark Straits Times Index at 3,064.12, up 0.09 per cent, or 2.81 points. About 607.4 million shares exchanged hands. Losers beat gainers 202 to 149. |

||||

| Useful To Me Not Useful To Me | |||||

|

tonylim

Master |

06-Mar-2011 09:08

|

||||

|

x 0

x 0 Alert Admin |

Watch out for Technogas& oil next week : On Wednesday (Mar 3), the TDR of Technics - a full service integrator of compression systems and process modules for blue-chip oil and gas customers - hit limit up again at NTD14.25, translating into a stock price of S$1.25.

Robin Ting being interviewed by Taiwan media. Photo by: Tan Su Li

Same happy story today.....as of this morning, the TDR was trading at NTD 15.20 (S$1.33), up by 6.7%.

|

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

04-Mar-2011 17:46

|

||||

|

x 0

x 0 Alert Admin |

Mar 4, 2011STI closes 0.79% higherSINGAPORE shares closed higher on Friday, with the benchmark Straits Times Index at 3,061.31, up 0.79 per cent, or 23.96 points. About 1.2 billion shares exchanged hands. Gainers beat losers 264 to 181. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

04-Mar-2011 06:58

|

||||

|

x 0

x 0 Alert Admin |

Dow jumps 190 on jobs data, lower oil

NEW YORK (CNNMoney) -- U.S. stocks posted their best day in three months on Thursday as Wall Street rallied behind a strong unemployment claims report along with a modest drop in energy prices. At the preliminary close, the Dow Jones industrial average (INDU) rose 191 points, or 1.6%, to 12,258. The gains were the best for the blue-chip indicator in 2011 and the largest since Dec. 1. The S& P 500 (SPX) added 22.5 points, or 1.7%, to 1331 and Nasdaq (COMP) composite climbed 51 points, or 1.9%, to 2799. Thursday's rally was fairly broadbased and held steady the entire day. Twenty of the Dow's 30 members advanced more than 1%, while the worst-performing member of the Dow was AT& T (T, Fortune 500), falling a modest 0.1%.

Oil fell 40 cents a barrel on news reports that Libyan leader Moammar Gadhafi mightagree to a peace negotiations mediated by Venezuela's Hugo Chavez.

Economy: The Labor Department reported that initial jobless claims totaled 368,000 in the week ended Feb. 26 -- the lowest weekly figure since May 31, 2008.

Companies: Valero Energy (VLO, Fortune 500) was the best-performing stock in the S& P 500 on Thursday, jumping 7.7%, after the oil refining company said it expects to post adjusted earnings between 76 cents and 91 cents a share, well ahead of the 48 cents a share analysts had forecast. Shares of Big Lots (BIG, Fortune 500) rose 4% after the company reported a 15% increase in earnings to $1.46 a share. Analysts were looking for $1.38 a share, according to Briefing.com. World markets: European stocks closed broadly higher. Britain's FTSE 100 rose 1.4%, the DAX in Germany ticked up 0.5% and France's CAC 40 added 0.5%. Asian markets ended mixed. The Shanghai Composite slipped 0.4%, while the Hang Seng in Hong Kong edged higher 0.3% and Japan's Nikkei gained 0.9%. Currencies and commodities: The dollar rose versus the British pound, and made slight gains against the Japanese yen and the euro.

Gold futures for April delivery fell $21.30 to $1,416.40 an ounce. On Wednesday gold hit an intraday all-time high of $1,441 an ounce, before setting a settlement record of $1,437.70. Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.52% from 3.46% late Wednesday. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

03-Mar-2011 13:46

|

||||

|

x 0

x 0 Alert Admin |

Mar 3, 2011STI higher at middaySINGAPORE shares were higher at midday on Thursday, with the benchmark Straits Times Index at 3,062.30, up 1.15 per cent, or 34.79 points. About 672.8 million shares exchanged hands. Gainers beat losers 280 to 113. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

03-Mar-2011 07:55

|

||||

|

x 0

x 0 Alert Admin |

Stocks: $102 oil has investors on edge

NEW YORK (CNNMoney) -- U.S. stocks ended slightly higher Wednesday, as nervous investors focus on oil prices, which rose above $102 a barrel on renewed concerns about oil and the Libyan conflict. The Dow Jones industrial average (INDU) rose 9 points, or 0.1%, with Caterpillar (CAT, Fortune 500) and 3M (MMM, Fortune 500) posting the biggest gains. The S& P 500 (SPX) added 2 points, or 0.2%, and the Nasdaq (COMP) gained 11 points, or 0.4%. Yahoo (YHOO, Fortune 500) was a big winner on both of those indexes, with the stock popping 3.3% amid reports that the online portal company is in talks to sell its 30% stake in its Yahoo Japan venture. U.S. stocks sank Tuesday, with all three major indexes falling more than 1%, as oil prices spiked almost 3%. " We're seeing a bit of a recovery in the market from yesterday, but we're still in a tug of war period," said Karl Mills, president and chief investment officer at Jurika Mills & Keifer. " The swing factor is what's happening with the price of oil." Oil prices continued to advance Wednesday, rising $2.60, or 2.6%, to settle at $102.23 a barrel, the highest since September 2008.

World markets: World markets slumped Wednesday, a day after the big U.S. sell-off, as forces loyal to leader Moammar Gadhafi attacked rebels in eastern Libya.

Economy: ADP released its latest private-sector jobs report, showing a gain of 217,000 jobs for February. Economists had forecast the ADP report to show that private businesses hired 165,000 new workers last month. Employers announced plans to cut 50,702 jobs in February, a 32% increase over last month, according to Challenger, Gray & Christmas. In the Federal Reserve's Beige Book report, a reading of the economic situation from the regional Fed banks, the central bank said manufacturers and retailers across all 12 of the Fed's districts are passing on rising commodity prices to consumers, but the economy continues to grow at a moderate pace. Companies: Shares of Apple (AAPL, Fortune 500) rose 0.8% after the company's CEO Steve Jobs made a surprise appearance on stage in San Francisco to debut the iPad 2, which received a new, thinner design and an updated " A5" dual-core microprocessor. Currencies and bonds The dollar fell against the euro and the British pound but rose versus the Japanese yen.

|

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Hulumas

Supreme |

02-Mar-2011 09:58

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

Generally speaking, (it is in the transition period) It was not in 2010, but it will be reflected that way in 2011 ! Sooner or later, market will fully follow that running pattern! I am so sure!

|

||||

| Useful To Me Not Useful To Me | |||||

|

warrenbegger

Elite |

02-Mar-2011 08:53

Yells: "Anyhow Buy Anyhow Die ^_^" |

||||

|

x 0

x 0 Alert Admin |

LOL! OMG!! She really siao liao!!!

|

||||

| Useful To Me Not Useful To Me | |||||

|

teeth53

Supreme |

02-Mar-2011 08:48

Yells: "don't learn through life, learn to grow with life " |

||||

|

x 0

x 0 Alert Admin |

After Feb chairman spoken, over night US scenario has changed for all three indicated, turn negative (-) STI maybe range bound after yesterday rebound and may profit take --end of the day. Just sharing my thot.

|

||||

| Useful To Me Not Useful To Me | |||||

|

iPunter

Supreme |

02-Mar-2011 08:06

|

||||

|

x 0

x 0 Alert Admin |

So if the Dow falls below 12000 tonight, it will be extreemely bullish for the rest of the world?...

|

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Hulumas

Supreme |

02-Mar-2011 08:04

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

World venture money flow pattern phenomenon!

|

||||

| Useful To Me Not Useful To Me | |||||

|

iPunter

Supreme |

02-Mar-2011 08:02

|

||||

|

x 0

x 0 Alert Admin |

What kind of warpulated logic is that? ...

|

||||

| Useful To Me Not Useful To Me | |||||

|

Hulumas

Supreme |

02-Mar-2011 07:44

Yells: "INVEST but not TRADE please!" |

||||

|

x 0

x 0 Alert Admin |

As DOW and all US stock indices down then Asian market leading by SSE & SZSE up then! | ||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

02-Mar-2011 06:56

|

||||

|

x 0

x 0 Alert Admin |

Stocks drop more than 1% as oil spikes near $100

NEW YORK (CNNMoney) -- U.S. stocks tumbled Tuesday, with all three major indexes down more than 1%, as oil prices spiked to nearly $100 a barrel. The Dow Jones industrial average (INDU) sank 168 points, or 1.4%, with Alcoa (AA, Fortune 500) and Caterpillar (CAT, Fortune 500) leading the decline. The S& P 500 (SPX) fell 21 points, or 1.6%, and the Nasdaq (COMP) lost 45 points, or 1.6%. The sell-off came as oil prices for April delivery continued to head higher, climbing $2.66 to settle at $99.63 a barrel amid ongoing uprisings in Libya and the Middle East. In electronic trading, crude prices topped $100 a barrel Tuesday afternoon, after crossing that mark last week for the first time since 2008. As crude climbed, gas prices rose for a seventh straight day. Meanwhile, gold prices surged $21.30, or 1.5%, to settle at a record high of $1,431.20 an ounce.

Investors also tuned into Federal Reserve Chairman Ben Bernanke's testimony on Capitol Hill. Bernanke warned that a sustained rise in oil prices could pose a danger to economic growth.

Markets also came under pressure after the Securities and Exchange Commission filed a lawsuit against former Goldman Sachs (GS, Fortune 500) director Rajat Gupta for insider trading.

Investors are also looking ahead to the government's monthly payroll report on Friday, which will reveal how many jobs were created in February. Despite a slight step back last week, stocks closed out February on an upbeat note -- posting their third-straight month of gains. Overall, all three major indexes were up nearly 3% during the month, and have risen more than 5% since the beginning of the year. Economy: The Institute for Supply Management's manufacturing index rose for a 19th consecutive month, reaching 61.4% -- a level last seen in May 2004. The level signals continuing expansion in the sector. Companies: General Motors (GM) said total U.S. sales rose 46% last month on an annual basis, while Ford's sales rose 14%. Shares of both U.S. automakers fell about 2%. Shares of Japanese automaker Toyota (TM) slipped 0.5% after the company said sales rose 42% last month from a year earlier, when monthly sales fell 8.7% on recall problems. Shares of Las Vegas Sands (LVS, Fortune 500) dropped 6.3% after the casino operator said that it has received a subpoena from the SEC requesting documents related to the Foreign Corrupt Practices Act. The company said it is also being investigated by the Department of Justice. Shares of J. Crew Group (JCG) rose 1% after stockholders agreed to adopt the previously announced merger agreement with Chinos, an affiliate of private equity firms TPG Capital and Leonard Green & Partners. World markets: European stocks closed lower. Britain's FTSE 100 lost 0.8%, the DAX in Germany fell 0.5% and France's CAC 40 declined by 0.7%.

Currencies and commodities: The dollar rose against the euro, was weaker versus the British pound and firmer versus the Japanese yen. Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.41% from 3.43% late Monday. |

||||

| Useful To Me Not Useful To Me | |||||

|

bsiong

Supreme |

02-Mar-2011 01:40

Yells: "The Greatest Wealth is Health" |

||||

|

x 0

x 0 Alert Admin |

SAN FRANCISCO (MarketWatch) — Oil futures climbed Tuesday as violence in Libya and the potential spread of the turmoil in the Middle East region continued to feed concerns over global oil supplies. Light, sweet crude for April delivery (CLJ11 98.92, +1.95, +2.01%) gained $1.41, or 1.4%, to $98.38 a barrel on the New York Mercantile Exchange. The contract traded as high as $98.83. |

||||

| Useful To Me Not Useful To Me | |||||

|

bsiong

Supreme |

02-Mar-2011 01:39

Yells: "The Greatest Wealth is Health" |

||||

|

x 0

x 0 Alert Admin |

NEW YORK (MarketWatch) — U.S. stocks let go of Tuesday gains as oil climbed back above $98 a barrel and Federal Reserve Chairman Ben Bernanke addressed inflation concerns on Capitol Hill. “The oil pop today tempered gains” that were quickly erased after the opening bell, said Jay Suskind, senior vice president at Duncan-Williams. The Dow Jones Industrial Average(DJIA 12,146, -80.30, -0.66%) fell 12.15 points to 12,214.19, with 20 of its 30 components falling. The Standard & Poor’s 500(SPX 1,316, -11.03, -0.83%) declined 2.66 points to 1,324.56, with financials falling the most and consumer staples the best-performing of its 10 major industry groups. The Nasdaq Composite Index (COMP 2,755, -26.87, -0.97%) fell 5.60 points to 2,776.67. For every five stocks rising nine fell on the New York Stock Exchange, where 253 million shares traded as of 10:40 a.m. Eastern. On the New York Mercantile Exchange, oil bounced back from a one-week low on worry ongoing unrest in the Middle East and North Africa might interrupt supplies. The crude-oil futures contract for April delivery (CLJ11 98.95, +1.98, +2.04%) rose $1.31 to $98.28 a barrel. Read more on oil. Fed factorTestifying before the Senate Banking Committee, Bernanke reiterated that by the Fed’s measures, inflation remains low, but conceded that recent hikes in commodity prices could translate into headline inflation in the near term. The Fed chief also repeated borrowing costs would likely remain low, and that the central bank is still looking for a “sustained period of stronger job creation.” Economic reports had U.S. manufacturing in February expanding at its most rapid pace since mid-2004, illustrating heightened demand for factory goods. Read more about Institute for Supply Management’s index. |

||||

| Useful To Me Not Useful To Me | |||||

|

teeth53

Supreme |

01-Mar-2011 21:49

Yells: "don't learn through life, learn to grow with life " |

||||

|

x 0

x 0 Alert Admin |

https://www.ketrade.com.sg/page/SLQG_NewsArticleFrame.jsp?ARTICLE_ID=4835181 Title: Morning Briefing: U.S. Equities Set to Build on Feb Gains Description: U.S. stock futures point to a higher open on the first day of March trading, with U.S. economic data on chain-store sales, manufacturing and testimony by Fed Chairman Ben Bernanke in focus.

|

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

01-Mar-2011 06:57

|

||||

|

x 0

x 0 Alert Admin |

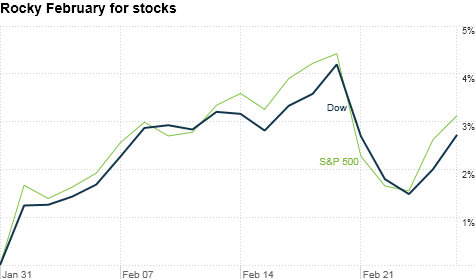

Stocks end 'tough month' in the black

NEW YORK (CNNMoney) -- Despite a slight step back last week, stocks closed out February on an upbeat note, posting their third straight month of gains. The Dow Jones industrial average (INDU) rose 96 points, or 0.8%, on Monday the S& P 500 (SPX) rose 3 points, or 0.2% the Nasdaq (COMP) was flat for the day. Overall, all three major indexes were up nearly 3% during the month and have risen more than 5% since the beginning of the year. " All being said, the market did very well in February," said Rich Ilczyszyn, market strategist with futures broker Lind-Waldock. But that doesn't mean the ride wasn't a bumpy one. While stocks started February off strong thanks to solid earnings reports, uprisings in the Middle East sent oil prices skyrocketing and stocks falling last week.

Investors are looking ahead to the government's monthly payroll report on Friday, which will reveal how many jobs were created in February. Economy: A report showing that personal incomes climbed 1% in January got investors in an upbeat mood early in the day, even though most of that increase was due to a 2% payroll tax holiday passed by legislators in late 2010.

A report on the housing market came in slightly better than expected, showing pending home sales fell 2.8% instead of the deeper 3.2% fall economists had been forecasting. Investors remain generally unfazed by a potential shutdown of the federal government, which could occur if Congress fails to approve a spending bill before midnight Friday. Companies: Humana (HUM, Fortune 500) shares rose 3.9% after the company announced the Department of Defense awarded the health insurer a major contract, covering military personnel and their families in the South. UnitedHealth Group (UNH, Fortune 500) had previously held the contract, and its shares were flat Monday. Kenneth Cole Productions (KCP) shares tumbled 7% Monday, after the high-end clothing company announced its CEO Jill Granoff is stepping down, effective immediately. The company posted a loss of $2.7 million in the fourth quarter, an improvement over a $52 million loss in the year-ago quarter. The fashion house's namesake had recently come under fire in the social media sphere, for tweeting a promotion that joked about protests in Egypt. Shares of Overstock.com (OSTK) soared 9%, after the online retailer announced earnings that beat Wall Street estimates. 3M (MMM, Fortune 500) gained 2.2%, after a Barrons article reported the company will launch a " blizzard" of new products and soon see rising sales in international markets. Over the weekend, 3M CEO George Buckley slammed President Obama as " anti-business," calling his policies " Robin Hood-esque." Amazon (AMZN, Fortune 500) shares fell more than 2.2%, after UBS downgraded its stock to " neutral." World markets: European stocks ended the day mixed. Britain's FTSE 100 fell 0.1%, the DAX in Germany ticked up 1.2% and France's CAC 40 edged up 1.3%.

Currencies and commodities: The greenback fell against the euro, the British pound and the Japanese yen.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.43% from 3.59% late Friday. |

||||

| Useful To Me Not Useful To Me | |||||