| Latest Forum Topics / Straits Times Index |

|

|

News Update!

|

|

|

krisluke

Supreme |

05-Dec-2011 21:55

|

|

x 0

x 0 Alert Admin |

SilverSilver didn’t provide any 4-hour closing above 32.95, which indicates that the metal failed to incline and the bearish technical structure (rising wedge pattern) is still effective. Stochastic is negative, while the RSI failed to settle above the 50-point level, where all these factors together drive us to expect that the downside movement could return. The trading range for this week is among the key support at 29.15 and key resistance now at 35.10. The short-term trend is to the downside targeting 26.65 as far as areas of 48.50 remain intact. Support: 32.10, 31.45, 31.25, 30.75, 30.30 Resistance: 32.95, 33.40, 33.75, 34.00, 34.60 Recommendation Based on the charts and explanations above, our opinion is selling silver around 32.95, and take profit in stages at (30.75 and 29.80) and stop loss with 4-hour closing above 33.40 might be appropriate

GoldWe defined areas 1755.00 and 1765.00 to be the ceiling of any upside attempts during the previous week and they succeeded in forcing the metal to move lower ahead of Friday's closing as seen on the provided graph. The negative picture will not be activated unless we witness a sustained breakout below 1740.00 zones despite the bearish tendency on the daily chart-secondary image-. Be careful since Stochastic over four-hour interval is on its way to enter oversold areas and may activate heavy fluctuation before the awaited breakout occurs. Finally, taking 1765.00 levels will damage the bearish probability. The trading range for this week is among the key support at 1665.00 and key resistance now at 1825.00. The general trend over the short term basis is to the upside targeting 1945.00 per ounce as far as areas of 1475.00 remain intact with weekly closing. Support: 1740.00, 1728.00, 1715.00, 1703.00, 1695.00 Resistance: 1753.00, 1765.00, 1773.00, 1785.00, 1795.00 Recommendation Based on the charts and explanations above our opinion is, selling gold below 1740.00 targeting 1695.00 and stop loss above 1767.00 might be appropriate.

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

05-Dec-2011 21:48

|

|

x 0

x 0 Alert Admin |

Oil starts the week higher, testing the highs around 101.50 area, the rounding formation is still in progress while a rising wedge formation may be a part of the formation, suggesting a breakout to the downside is more likely. RSI may be in the process of providing a bearish divergence as well, as the indicator is lagging price action. In general, we expect a downside move this week, and we prefer 103.35 to remain intact for our expectations to remain valid. The trading range for the week may be among the major support at 94.00 and the major resistance at 105.00 The short-term trend is to the downside with steady weekly closing below 105.00 targeting 65.00. Support: 101.15, 100.70, 100.30, 99.55, 98.90 Resistance: 101.70, 102.30, 102.85, 103.35, 104.00 Recommendation Based on the charts and explanations above we recommend selling oil with four-hour closing below 100.00 targeting 98.90 and 95.60, stop loss hourly closing above 100.80. OR buying oil with four-hour closing above 101.55 targeting 103.35 , stop loss with hourly closing below 100.80

|

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

05-Dec-2011 21:45

|

|

x 0

x 0 Alert Admin |

Santorum wants Palin's support

SIDNEY, Iowa — Republican presidential hopeful Rick Santorum is trying to work up the nerve to ask Sarah Palin for an endorsement. At a town hall meeting here Sunday afternoon, the former U.S. senator said he's encouraged by Palin's comments last week on Fox News, when Palin praised him for his " ideological consistency." She stopped short of an endorsement, however. " I haven't had the courage to ask her for an endorsement, but I may do that soon," Santorum said. Certainly, an endorsement by the former Alaska governor and 2008 GOP vice presidential candidate might breathe some life into Santorum's campaign. National polls currently have him in last place, with less than a month to go before the Jan. 3 Iowa caucuses. Former Speaker of the House Newt Gingrich is, at least for now, in the lead. Even so, Santorum said he's not giving up his effort to win over Iowans. He spent about an hour and a half with 11 people who showed up for Sunday a town hall meeting at the Sidney Senior Center. The event was informal, as the group gathered around a table — Santorum at the helm — and discussed issues like AIDS, national security, immigration and Social Security. Santorum said he believes U.S. troops should get involved in a conflict only if this country's national security depends on it. Sending troops to Libya during the revolution this year was a mistake on the part of President Barack Obama, the candidate said. " We should not get involved for humanitarian purposes," he said. Santorum has visited all of Iowa's 99 counties as part of his " faith, freedom and family tour." A supporter of the Tea Party movement, Santorum asked the group to put his signs in their yard and to caucus for him next month. " I feel very, very good," he said of his chances to pull off a caucus win. Santorum served 12 years as a U.S. senator from Pennsylvania. He also served four years in the House. He followed up the stop in Sidney with a trip to Council Bluffs later in the day. Contact the writer: 402-444-3100, maggie.obrien@owh.com |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

05-Dec-2011 21:38

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

05-Dec-2011 21:35

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

05-Dec-2011 21:33

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

05-Dec-2011 21:28

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

05-Dec-2011 21:25

|

|

x 0

x 0 Alert Admin |

Euro gains on hopes for progress at EU summit

(Updates prices, adds details)

* EU summit and ECB policy meeting key risk events * Investors encouraged as Italy announces austerity measures * Market looks to Sarkozy-Merkel meet as litmus for Friday summit * ECB rate cut on Thursday could be positive for the euro By Jessica Mortimer LONDON, Dec 5 (Reuters) - The euro rose on Monday after Italy unveiled austerity measures and on expectations that European Union leaders will come up with a credible and comprehensive plan to tackle the euro zone debt crisis at a summit later this week. French President Nicolas Sarkozy and German Chancellor Angela Merkel, under pressure to align their positions on centralising control of euro zone budgets, meet in Paris on Monday to outline proposals to put to the Dec. 9 summit. Analysts and traders said the euro may gain as investors take profits on hefty short euro positions before the summit, though it will stay vulnerable to renewed bouts of selling if there are suggestions leaders are struggling to reach agreement. " The market wants to see some kind of concrete agreement before investors are prepared to liquidate short positions," said Niels Christensen, currency strategist at Nordea in Copenhagen. " I see the euro trading sideways for now. We may need to see negative news that there won't be any fresh agreement for it to test last week's lows." The euro was up 0.3 percent versus the dollar at $1.3440, holding above last week's low around $1.3259 and the Nov. 25 low of $1.3213, having touched a high around $1.3460. Traders cited offers around $1.3480 ahead of stop loss orders placed above $1.3500. Showing just how pessimistic speculators have become on the euro, data from a U.S. financial watchdog on Friday showed speculators on the Chicago futures exchange had their largest net short position in 18 months last week. The poor state of the euro zone's economy was underlined by business surveys suggesting there will be a steep economic contraction in the current quarter. However, market players took encouragement as Italian Prime Minister Mario Monti unveiled a 30 billion euro package of austerity measures on Sunday. Many are hopeful the EU will have taken a step towards fiscal union by Friday, agreeing on a treaty change to anchor coercive budget discipline for the 17-nation currency area. But that outcome is far from certain given the difficulties in securing agreement from so many countries. ECB AHEAD Also in focus this week is a European Central Bank policy meeting on Thursday, which is expected to result in a cut in interest rates and fresh liquidity measures for banks, if not more sovereign bond buying. Although a rate cut would normally be negative for the euro, analysts expect the single currency would come under selling pressure if the ECB fails to take action to help the economy and temper the debt crisis. " Paradoxically, if the ECB fails to cut interest rates from 1.25 percent, the euro is likely to slide sharply as investors will feel the central bank is gravely underestimating the crisis it faces," Mansoor Mohi-uddin, head of FX strategy at UBS said in a note to clients. A Reuters survey of 73 analysts showed a 40 percent chance the ECB will in the next six months start purchasing government bonds from struggling euro zone economies using freshly created money, which European policymakers have so far resisted. " If the ECB continues to take a very hard line then euro/dollar would go lower," said RBS currency strategist Paul Robson. Some of that wariness was reflected in the options market where near term implied volatilities traded stubbornly high, with the one-week trading at 14.75 percent. Risk sensitive commodity currencies drew some comfort from higher stock markets and Friday's data which showed the U.S. unemployment rate fell to a 2-1/2 year low in November, extending a string of better-than-expected U.S. data. The Australian dollar was up 0.4 percent at $1.0252, while the dollar index, which measures the performance of the U.S. unit against a basket of currencies, was down 0.27 percent at 78.417. A Reserve Bank of Australia (RBA) policy meeting was awaited on Tuesday, where analysts see a good chance it will cut rates for the second month in a row. (Additional reporting by Anirban Nag Editing by Anna Willard) |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

05-Dec-2011 21:24

|

|

x 0

x 0 Alert Admin |

Europe stocks hit 5-wk high as Merkel,Sarkozy meet

European flag floating in front of the European Commission building in Brussels

* Italian stocks surge, yields fall on new austerity plan * Euro zone bank index up 23 pct in 10 days * Stocks seen ripe for a pull-back after best week in 3 yrs By Blaise Robinson PARIS, Dec 5 (Reuters) - European stocks rose early on Monday, adding to last week's 8.5 percent jump on growing hopes of a comprehensive solution to the euro zone debt crisis as French President Nicolas Sarkozy and German Chancellor Angela Merkel meet ahead of a key summit. Italy's fresh 30 billion euro package of austerity measures also eased tensions surrounding the country's finances and sparked a rally in Italian shares, with Milan's FTSE MIB index up 3.1 percent while Italian 10-year bond yields dropped towards 6 percent. Banco Popolare surged 7 percent, UniCredit rose 5 percent and Enel was up 3.6 percent. At 1230 GMT, the FTSEurofirst 300 index of top European shares was up 1 percent at 994.84 points, a level not seen in five weeks. " Markets now seem to want to believe that Merkel and Sarkozy will come out with a common point of view and a lot of austerity and structural measures to bring down the debt and increase competitiveness," said Philippe Gijsels, head of research at BNP Paribas Fortis Global Markets in Brussels. " And when you listen at their speeches, it looks like the points of view which were far apart clearly have come closer together. If they manage to come to an understanding, they still have to sell some of these very unpopular measures to the rest of Europe. And this would open the door for the European Central Bank to get more involved." Shares in financial institutions led the gains, with ING Groep up 3 percent, BNP Paribas climbing 5.5 percent and BBVA up 2.6 percent. The STOXX euro zone banking index has surged 23 percent since tumbling to a near-three year low in late November. Commerzbank bucked the trend, sinking 7 percent after announcing the buyback of 600 million euros of hybrid capital instruments in an bid to meet European capital requirements without asking for more state intervention, but the move was seen as too timid by investors. The euro zone's blue chip Euro STOXX 50 index was up 1.5 percent at 2,377.67 points, partly filling a downward gap on the chart left open in early November. The benchmark index was reaching 'overbought' territory, with its 9-day relative strength index (RSI) at 68.5, signalling the index was poised for a short-term pull-back. A reading of 70 and above is considered 'overbought.' Despite Monday's gains on the market, The Euro STOXX 50 volatility index -- Europe's yardstick of investor sentiment known as the VSTOXX -- was steady at 35.7, signalling investors' hesitation about piling up more risky assets before the outcome of the Merkel-Sarkozy meeting. RIPE FOR PULL-BACK? Kepler Capital Markets trader Patrice Perois said the market looked ripe for a pull-back after its best weekly gain in three years. " There are still significant differences between Sarkozy and Merkel, so we're in for a volatile week, and the risk is that any kind of disappointment could trigger a pull-back," he said. " But the medium term looks relatively positive. The Italian government is really regaining credibility, and that's very important to restore confidence." Meeting in Paris on Monday ahead of a key European Union summit later in the week, Sarkozy and Merkel are under pressure to iron out their differences on how to centralise control of euro zone budgets to resolve the region's debt crisis. The two leaders, who are due to meet at 1230 GMT on Monday and are expected to hold a news conference afterwards, will try to reach common ground on measures to boost coercive budget discipline in the euro zone, likely via EU treaty change, which they want all 27 EU leaders to approve at Friday's summit. " Too many times before, eurozone leaders have pledged their determination to end the crisis, but end up merely fudging the issue and delaying any decision until later," said IG Markets analyst Chris Beauchamp. " The fear now is that this week will turn out the same way, with fine words but little action." Around Europe, UK's FTSE 100 index was up 0.7 percent, Germany's DAX index up 0.9 percent, and France's CAC 40 up 1.4 percent. Investors shunned defensive shares on Monday such as big pharmaceutical groups, with Novartis down 0.2 percent and AstraZeneca down 0.3 percent. German business software maker SAP fell 2.5 percent after launching a $3.4 billion takeover offer for SuccessFactors, seen as an expensive price tag for the U.S. software company. " The acquisition is way too expensive. Even if you take into account 2013 yields, the price-to-profit ratio is 165," said analyst Heino Ruland at Ruland Research. " This reminds me of the internet bubble of more than a decade ago." Looking forward, JP Morgan strategists see opportunities in derated cyclical stocks and geographically prefers exposure to core Europe, in particular Germany's DAX, over peripheral countries while the near-term outlook remains challenging. " We believe selected cyclicals have been penalised too much, especially the emerging market sensitive ones. We find value in 'low ROE' (return on equity) and 'Value' styles," they wrote in a note. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

05-Dec-2011 21:22

|

|

x 0

x 0 Alert Admin |

Syria says it could sign Arab peace deal " soon"

Demonstrators protesting against Syria's President Bashar al-Assad display a 1961-63 Syrian flag during a march through the streets in Adlb

BEIRUT (Reuters) - An increasingly isolated Syria imposed retaliatory sanctions on former friend Turkey, but said on Monday it might agree " soon" to an Arab peace plan to avert penalties from Arab states over its eight month crackdown on protests. In a display of muscle that could be intended to deter any idea of foreign military intervention in a crisis which has killed at least 4,000 people, the army staged a big exercise with rockets, tanks and helicopters. Top generals watched the war games on Sunday and Syrian state television made it their top news story. Already hit by economic sanctions from the United States and Europe, Syria was punished last month by regional countries, with sanctions announced by the Arab League and imposed by Turkey, once President Bashar al-Assad's ally. On Monday Syria responded to Turkey with retaliatory measures, imposing a tariff of 30 percent on its imports and prohibitive duties on fuel and freight. State news agency SANA quoted a pro-Assad economist as saying Turkey would be " the biggest loser." The Arab League sanctions have yet to take effect, with the League repeatedly extending deadlines for Damascus to agree to a peace plan that would see Arab monitors oversee its withdrawal of troops from towns. The latest deadline expired on Sunday. Foreign Minister spokesman Jihad al-Makdesi said Damascus was still looking at the plan. " The protocol is intended to be signed soon," he said. " The Syrian government has responded positively to the draft protocol ... I am optimistic, although I await the Arab League response first." Syria says the Arab proposal to admit observers infringes its sovereignty, and has asked for clarification. It has stalled more than once and reneged on promises to rein in its forces. SANA expressed regret mixed with defiance at the prospect of Arab sanctions. " The Arab League sanctions ... have been a shock for every Syrian and Arab citizen ... as these sanctions came from sisterly countries," it said. " Syria will overcome those sanctions by virtue of its strategic location and the diversity of its production sectors," the state agency added. Syria's Arab neighbours Iraq, Lebanon and Jordan have all said they would not join a sanctions campaign. ROCKETS In a reminder to outsiders of Syria's powerful, mainly Russian-supplied armed forces, state TV and SANA showed top generals watching a live-fire exercise by missile units, mechanised brigades and aircraft, to test their capacity in " confronting any attack" on Syria. It did not report the scale of the war games. " General (Dawood Abdullah) Rajiha stressed that the armed forces, under the leadership of President Bashar al-Assad will remain loyal to the homeland and will defend the interests of the Syrian people," SANA said. Rajiha is Minister of Defence. Makdesi, the foreign ministry spokesman, said the war games were a " routine" exercise and not intended to send any message. The first cracks appeared in one of the pillars of Assad's regime at the weekend with the desertion of some members of the secret police to the ranks of a rebel " free army." At least a dozen members of the secret police deserted from the Airforce Intelligence complex in Idlib city, 280 km (175 miles) northwest of Damascus, triggering a gunbattle with defectors in which 10 were killed or wounded on either side, activists said. Opposition sources said a further 16 soldiers defected from units in Idlib on Sunday and a new group of defectors of similar size battled loyalist troops to the south, in the Josieh area on the border with Lebanon. Assad's opponents estimate the strength of the rebel force at several thousand, mainly army recruits from Syria's Sunni Muslim majority. Members of Assad's minority Alawite sect, an offshoot of Shi'ite Islam, have a tight grip on the military and security apparatus. The conscript armed forces have more than 200,000 men. SOONER OR LATER Burhan Ghalioun, head of the opposition Syrian National Council, said it was now " a question of weeks" before the regime collapses. But he offered no firm basis for his projection. " Maybe the regime will implode, or things will get more complicated, and it will take a very long time," he told Austria's Der Standard daily. " I hope that everything will go a lot faster thanks to international pressure, sanctions, the continuation of peaceful protests, the exhaustion of the security forces and especially the mercenaries." He said the Council had told Syrian Free Army leader Riad al-Assad " that we believe it is not in the interest of Syria that this army becomes an army which fights against other military forces in the country. This could mean a civil war which is something that we want to avoid at all costs." Government forces and militiamen loyal to Assad killed at least 30 civilians and five defectors on Sunday, mostly in Homs, Syria's third largest city, activists' reports said. Syrian authorities say they are fighting foreign-backed " terrorist groups" trying to spark civil war, who have killed some 1,100 soldiers and police since March. SANA on Monday reported military funerals for a further seven killed. The agency said a civilian father and his three children were killed by " an armed terrorist gang" that broke into their house. Opposition activists said the family were killed by militiamen loyal to Assad, in a drive-by shooting. U.S. Assistant Secretary of State Jeffrey Feltman accused Assad of forcing his Alawite sect into a bloody conflict with the country's majority Sunnis, " ...fulfilling his own prophecy that Syria is going to move into chaos and civil war." (Additional reporting by Sylvia Westall in Vienna and Khaled Yacoub Oweis in Amman) (Additional reporting by Suleiman al-Khalidi and Patrick Werr Editing by Peter Graff) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

05-Dec-2011 21:16

|

|

x 0

x 0 Alert Admin |

Euro zone and China herald global slowdown

* Euro zone may be shrinking faster than thought -PMIs

* China sees services growth sag to 3-month low * British services sector rebounds unexpectedly in Nov * Economists expect U.S. non-manufacturing to perk up (Adds graphics) By Andy Bruce LONDON, Dec 5 (Reuters) - Europe's debt crisis might have pushed its economy into a far steeper contraction than anyone thought and growth in China is sputtering, according to surveys that point to a sharp global slowdown taking place. While there are fresh signs the U.S. economy is perking up, business surveys on Monday were mainly downbeat and confirmed the economic toll of the euro zone's sovereign debt crisis. They come at the start of a week that could prove crucial in resolving a debt crisis which threatens to tear apart Europe's common currency area - something that would have catastrophic implications for the world economy. The euro zone's composite purchasing managers index (PMI), while improving slightly month-on-month in November, still tallied with a 0.6 percent quarterly rate of decline for the last three months of this year. That would be worse than any forecast from more than 30 economists in a Reuters poll last month, which projected a mere 0.1 percent decline for the fourth quarter. In essence, it was a case of the pace of decline slowing a bit. " Globally if you take the PMIs together, there is great concern. The upward movement in the euro zone composite PMI is just a minor blip in clearly contractionary territory," said Philip Shaw, chief economist at Investec in London. " The Chinese situation needs to be watched as well to see if this is just a blip or part of a trend. The saving grace I guess has been the U.S. ... where there does seem to evidence that it is moving out of its soft patch." ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ Euro zone PMI graphics: http://link.reuters.com/keb34s ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ There was a rare piece of good news from Britain, where its services PMI unexpectedly rose last month, suggesting the UK may avoid recession, although perhaps not stagnation. While recession in the euro zone now looks a foregone conclusion, there are worrying signs the Chinese economy is starting to sag -- perhaps unsurprising given the European Union is China's biggest export partner. Chinese service sector growth cooled in November to its weakest pace in three months, further backing a view that authorities will have to fine-tune monetary policy again. German Chancellor Angela Merkel meets French President Nicolas Sarkozy on Monday to outline joint proposals for EU treaty changes that would involve tough sanctions for fiscally wasteful members. Then on Friday there is a wider EU summit that some see as make-or-break for the euro zone after a string of half-measures that have failed to stop bond market contagion spreading from Greece to Ireland, Portugal and now Italy and Spain. World stocks rose as confidence grew that European leaders would make big strides in solving the debt crisis. But the most recent Reuters polling of leading global economists suggests the euro zone will not survive intact in its current form, unless Europe's leaders are willing to take action on a scale not seen in the last few years. SHRINKING Markit's Eurozone Composite PMI, which measures changes in business activity across the euro zone, rose slightly to 47.0 in November from October's 46.5, albeit still far below the 50 mark that divides growth from contraction. " The major euro zone countries are all now contracting and face the risk of recession," said Chris Williamson, chief economist at survey compiler Markit. The latest Reuters poll of economists showed a 60 percent chance the euro zone would fall into recession. " Italy is faring the worst, with the survey suggesting that GDP could collapse by 1 percent in the fourth quarter, while both France and Spain are likely to see their economies contract by around 0.5 percent." ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ Euro zone composite PMI vs GDP http://bit.ly/rIBXxu ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ Britain's services PMI was an unexpected bright spot, rising to 52.1 in November from 51.3 in October. But survey compiler Markit said it meant the UK economy looks unlikely to grow much, taking into account some dire manufacturing data last week. Analysts expect the European Central Bank will cut interest rates on Thursday and throw more funding lifelines to stressed banks. Further central bank policy easing also looks likely in China, where HSBC's services PMI fell to 52.5, a sharp decline given that October's reading was 54.1 -- the highest in four months. " With price pressures easing further, Beijing can and should use policies that are targeted on small businesses and service sectors to keep GDP growth at above 8 percent for the coming year," Qu Hongbin, HSBC's chief China economist, said in a statement. Economists expect the U.S. ISM non-manufacturing index, comparable to the European and Chinese PMIs and due at 1500 GMT, to show a rise to 53.5 in November from 52.9, which would be further evidence of improving fortunes for the American economy. " However, if the rest of the world continues to perform as badly as November's indicators have suggested, then the U.S. renaissance could prove to be temporary," said Investec's Shaw. (Additional reporting by Zhou Xin and Nick Edwards in Beijing, editing by Ross Finley and Jeremy Gaunt) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

05-Dec-2011 21:14

|

|

x 0

x 0 Alert Admin |

Too early for Christmas rally?

Global Markets

LONDON, Dec 2 (Reuters) - - Investors may be cheered by this week's liquidity move by the world's top central banks and interest rate cuts in key emerging economies, but more is needed to sustain the risk rally into the new year. Wednesday's joint central bank move to ease tensions in European bank funding via swaps came as China eased monetary policy and Brazil cut interest rates and tax. This is raising expectations that Group of 20 powers are finally taking coordinated action, lifting world stocks by 8.6 percent at one point in the past week. The European Union summit on Dec 9 is now seen as a make-or-break for the 12-year-old single currency with policymakers under pressure to follow through with more measures. The focus is whether they will expand the role of the European Central Bank to become the lender of the last resort . Until more clarity emerges, it would be difficult for investors to keep on buying risky assets. " It smacks some sort of coordination. But it's only telling what they should've done. Support for the market came but it is still stressed and there's a question mark there," said Richard Cookson, global chief investment officer at Citi Private Bank. " I take a gloomier view because you don't have any decent solution on the table. They're scrabbling around for solution. All the attention is centered on the ECB whether it will blink." Cookson recommends avoiding generally euro area assets and buying high-quality and non-financial U.S. investment corporate grade debt. With so much uncertainty surrounding government bond markets, investors are also preferring to gain steady income from stocks of top-quality companies. In the week ended Nov 30, equity income funds were the few sectors that took in fresh cash, according to Thomson Reuters' Lipper. This group pulled in $250 million in the latest week, extending an inflow streak that has had redemptions just nine times in the last two years. " Global multi-nationals have low leverage and strong free cashflows and good dividend distributions. They are in a credit upgrade cycle," said Ashok Shah, chief investment officer at London & Capital. " The credit downgrade cycle is in motion for OECD countries. This is the theme that will be played out in the next 5-10 years." RALLY THAT HURTS Many are still sceptical how sustainable the rally would be, but the benchmark MSCI equity index has risen at least 8.5 percent in the past week, its biggest weekly gain since November 2008. What this highlights is that it can be very dangerous for investors to put too much tail risk hedging in place. It's such a policy-driven market that it can periodically lead to a very sharp rally in risky assets. In October, stocks rallied more than 20 percent as European policymakers pledged fresh steps to aid European banks. The rally fizzled in November, but still hurt poorly positioned investors who got caught out by the positive policy response. " You're left in an environment where heavy lifting had to be done by policymakers. It is a politicised market. Policy and policy shifts will continue to dominate market thinking," said Bill O'Neill, chief investment officer at Merrill Lynch Wealth Management. " Correlation and volatility are very high and it is very difficult for asset allocators to diversify. Making tactical calls in this environment is a fearsome challenge." That may be why some investors are starting to put risks back on. Reuters poll of 59 leading investment houses showed an increase in exposure to stocks in November, mainly as a result of demand for emerging market equities. The difficulty of asset allocation is also emphasised by a shrinking universe of safe haven assets. After a brief scare in German government bonds in November after a weak debt sale, investors will closely monitor another auction of German five-year note in the coming week. Italy and Portugal are also scheduled to hold debt sale. |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

05-Dec-2011 21:12

|

|

x 0

x 0 Alert Admin |

Hong Kong shares close up 0.7 pct, turnover slumps

Hong Kong night skyline

The Hang Seng Index closed up 0.73 percent at 19,179.69. The China Enterprises Index of the top mainland companies listed in Hong Kong ended up 0.6 percent at 10,412.96. The Shanghai Composite Index finished down 1.16 percent at 2,333.23, extending its underperformance relative to Asian peers as A-share turnover slumped to the lowest in a week. HIGHLIGHTS: * Turnover in Hong Kong slumped to the lowest in five sessions, totalling about half of the turnover on Dec. 1 after Beijing's first bank reserve requirement cut in three years. * Some investors who were caught cold by last Thursday's surge and eager not to be caught again were seen rolling into Chinese financial and energy names seen to be of a higher quality and with low valuations after being battered last quarter. China Shenhua Energy Co Ltd jumped 3.1 percent, while China Construction Bank Corp gained 0.7 percent. * Want Want China Holdings Ltd and Tingyi (Cayman Islands) Holdings Holding Corp made contrasting debuts as Hang Seng Index components. Volume in both stocks were about twice their respective 30-day averages, but Want Want closed at an all-time high after gaining 3.1 percent, while Tingyi lost 1.8 percent. (Reporting by Clement Tan Editing by Chris Lewis) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

04-Dec-2011 12:33

|

|

x 0

x 0 Alert Admin |

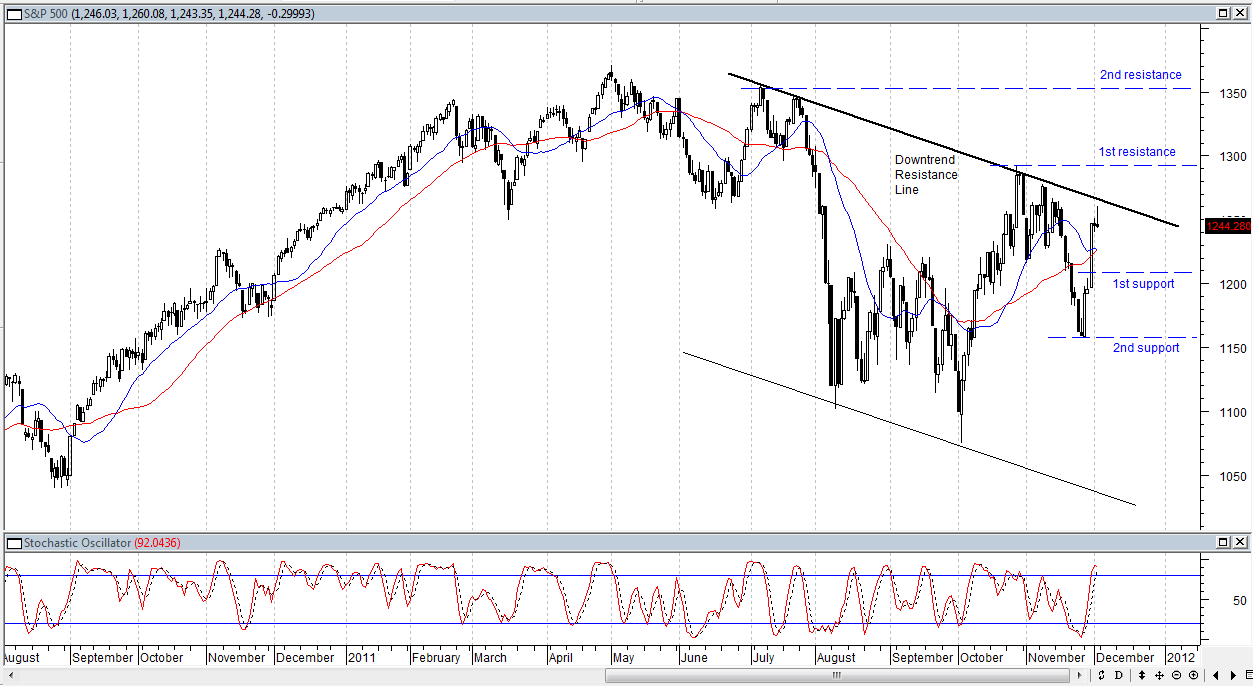

The massive rally last week took place within a large downtrend channel. Friday, the index attempted to

break the downtrend line but failed. It closed the week with a long legged dogi in evening star position

while Stochastic is overbought. We should see some retracement next week to the respective support

levels marked in the chart above. Breakout above 12300 is unlikely but would be a strong bull signal

which will invalidate the bearish view expressed earlier.

Likewise, the S& P500 has rallied to nearly touch the downtrend resistance line and closed the week

with a shooting star candlestick while Stochastic is overbought. The odds favor a retracement from here.

Breakout above 1290 is unlikely but would be a strong bull signal which will invalidate the bearish view implied.

The STI has about 10~15 points more before touching the downtrend resistance line. Late buying interest

Friday afternoon lifted the index to close above the positive territory. There may be residual momentum

on Monday morning pushing prices higher before the index begin to test the downtrend resistance line.

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

03-Dec-2011 13:49

|

|

x 0

x 0 Alert Admin |

Shell to cease activities in Syria

A Shell oil and gas sign is pictured near Nowshera

A Shell spokesman said: " Shell will cease its activities in compliance with sanctions. Our main priority is the safety of our employees of whom we are very proud. We hope the situation improves quickly for all Syrians." (Reporting by Dmitry Zhdannikov editing by Jason Neely) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

03-Dec-2011 13:46

|

|

x 0

x 0 Alert Admin |

Too early for Christmas rally?

Global Markets

LONDON, Dec 2 (Reuters) - - Investors may be cheered by this week's liquidity move by the world's top central banks and interest rate cuts in key emerging economies, but more is needed to sustain the risk rally into the new year. Wednesday's joint central bank move to ease tensions in European bank funding via swaps came as China eased monetary policy and Brazil cut interest rates and tax. This is raising expectations that Group of 20 powers are finally taking coordinated action, lifting world stocks by 8.6 percent at one point in the past week. The European Union summit on Dec 9 is now seen as a make-or-break for the 12-year-old single currency with policymakers under pressure to follow through with more measures. The focus is whether they will expand the role of the European Central Bank to become the lender of the last resort . Until more clarity emerges, it would be difficult for investors to keep on buying risky assets. " It smacks some sort of coordination. But it's only telling what they should've done. Support for the market came but it is still stressed and there's a question mark there," said Richard Cookson, global chief investment officer at Citi Private Bank. " I take a gloomier view because you don't have any decent solution on the table. They're scrabbling around for solution. All the attention is centered on the ECB whether it will blink." Cookson recommends avoiding generally euro area assets and buying high-quality and non-financial U.S. investment corporate grade debt. With so much uncertainty surrounding government bond markets, investors are also preferring to gain steady income from stocks of top-quality companies. In the week ended Nov 30, equity income funds were the few sectors that took in fresh cash, according to Thomson Reuters' Lipper. This group pulled in $250 million in the latest week, extending an inflow streak that has had redemptions just nine times in the last two years. " Global multi-nationals have low leverage and strong free cashflows and good dividend distributions. They are in a credit upgrade cycle," said Ashok Shah, chief investment officer at London & Capital. " The credit downgrade cycle is in motion for OECD countries. This is the theme that will be played out in the next 5-10 years." RALLY THAT HURTS Many are still sceptical how sustainable the rally would be, but the benchmark MSCI equity index has risen at least 8.5 percent in the past week, its biggest weekly gain since November 2008. What this highlights is that it can be very dangerous for investors to put too much tail risk hedging in place. It's such a policy-driven market that it can periodically lead to a very sharp rally in risky assets. In October, stocks rallied more than 20 percent as European policymakers pledged fresh steps to aid European banks. The rally fizzled in November, but still hurt poorly positioned investors who got caught out by the positive policy response. " You're left in an environment where heavy lifting had to be done by policymakers. It is a politicised market. Policy and policy shifts will continue to dominate market thinking," said Bill O'Neill, chief investment officer at Merrill Lynch Wealth Management. " Correlation and volatility are very high and it is very difficult for asset allocators to diversify. Making tactical calls in this environment is a fearsome challenge." That may be why some investors are starting to put risks back on. Reuters poll of 59 leading investment houses showed an increase in exposure to stocks in November, mainly as a result of demand for emerging market equities. The difficulty of asset allocation is also emphasised by a shrinking universe of safe haven assets. After a brief scare in German government bonds in November after a weak debt sale, investors will closely monitor another auction of German five-year note in the coming week. Italy and Portugal are also scheduled to hold debt sale. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

03-Dec-2011 13:43

|

|

x 0

x 0 Alert Admin |

Oil rises on Iran worry, strong gasoline

* Market eyeing Iran supply risk

* U.S. gasoline strong on refinery closure * Euro zone debt crisis continues to weigh on prices * U.S. unemployment rate drops to 8.6 pct from 9 pct (Recasts, updates prices, market activity) By Robert Gibbons NEW YORK, Dec 2 (Reuters) - Oil prices rose on Friday and posted weekly gains, boosted by heightened geopolitical tensions over Iran and strong gasoline futures, while a stronger dollar and concern about the euro zone debt crisis limited gains. U.S. gasoline futures posted the strongest percentage gain in the oil complex, more than 2 percent, from news a Northeast U.S. refinery was shutting earlier than planned. Both Brent and U.S. crude saw choppy and low-volume trading. Oil pared gains as the dollar index recovered from early losses and entered positive territory amid caution about the euro zone. Both crude contracts were on track to post weekly gains, after two straight weekly declines. A hardline Iranian cleric warned the United Nations and the European Union against siding with London after students and militia stormed British embassy compounds in Tehran earlier this week. The EU and the United States tightened their sanctions on Thursday as fears over Tehran's nuclear program intensified, increasing concern over a possible disruption to oil flows from the second-largest OPEC producer. " The Iranian situation is one of those things that could have a really bullish potential impact," said Tony Machacek, energy broker at Jefferies Bache in London. ICE Brent January crude rose 95 cents to settle at $109.94 a barrel, reaching $110.41 intraday and stalling ahead of Brent's 100-day moving average of $110.55. Brent posted a weekly gain of 3.3 percent, best weekly percentage gain since the week to Oct. 14. U.S. January crude rose 76 cents to settle at $100.96 barrel, having swung from $99.76 to $101.56. It posted a 4.3 percent weekly gain, best weekly percentage gain since the week to Nov. 11. Brent crude trading volume was 27 percent below its 30-day average, while U.S. volume was 35 percent under its 30-day average. U.S. employment growth picked up speed in November and the jobless rate dropped to a 2-1/2-year low of 8.6 percent, bolstering the view that the economy was improving. U.S. nonfarm payrolls increased 120,000 last month, nearly matching expectations for a gain of 122,000, and the relative strength of the report was bolstered by upward revisions to the employment counts for September and October. " Oil prices are flagging after the U.S. employment data due to exceedingly high expectations that came rushing into the market after the ADP survey earlier in the week showed a surprisingly strong number," said John Kilduff of hedge fund Again Capital LLC in New York. " There are some troubling signs of economic slowing in the rest of the world that look to be weighing on prices." U.S. employers added 206,000 private-sector jobs in November, the ADP National Employment Report released on Wednesday said, well above expectations. While U.S. economic data has been more supportive to oil this week, reports showing a slowing factory sector in China, much of Asia and the euro zone helped limit oil price gains. EURO ZONE DEBT CRISIS British Prime Minister David Cameron threatened to obstruct a Franco-German drive for swift change to the European Union's treaty, highlighting the difficulty leaders face in trying to save the euro. France and Germany have tried to form a consensus that euro zone economies need to be bound more closely together, suggesting a change to the EU treaty to give Brussels powers to punish euro states that do not keep their budgets under control. SUNOCO TO SHUT REFINERY EARLY Sunoco's late-Thursday announcement that it had begun to shut its 178,000 barrels-per-day Marcus Hook, Pennsylvania, refinery, ahead of its original plan for a summer 2012 close, supported oil prices. (Additional reporting by Gene Ramos in New York, Alex Lawler in London and Francis Kan in Singapore Editing by David Gregorio) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

03-Dec-2011 13:41

|

|

x 0

x 0 Alert Admin |

Egypt election turnout 62 percent, protesters honour dead

By Dina Zayed and Marwa Awad

CAIRO (Reuters) - More than eight million Egyptians voted in the opening round of their first free vote in six decades in what the election chief said Friday was a turnout of 62 percent, far higher than in the rigged polls of deposed President Hosni Mubarak. The Muslim Brotherhood's party and its ultra-conservative Salafi rivals looked set to top the polls, to the alarm of many at home and abroad. Moderate Islamists have won elections in Tunisia and Morocco in the past two months. The emergence of ambitious Salafi parties is one of the starkest measures of change in post-Mubarak Egypt. The world is watching the election for pointers to the future in Egypt, the most populous Arab nation and one hitherto seen as a firm U.S. ally committed to preserving its peace treaty with Israel and fighting Islamist militancy. Abdul Moez Ibrahim, the head of the election committee, joked that the turnout was the highest in any Egyptian election " since the pharaohs." It was even greater than in the " forgeries of the past elections," he added, referring to the Mubarak era. He said 8.3 million of 13.6 million registered voters in areas that voted in the first round had cast their ballots. Other parts of the country will vote in two more rounds, and run-offs must also be held in a six-week election process. " The blood of martyrs has watered the tree of freedom, social justice and the rule of law. We are now reaping its first fruits," Ibrahim said in tribute to more than 850 people killed in a popular revolt that toppled Mubarak in February. Protesters were out again in Cairo's Tahrir Square Friday to mourn 42 people killed in the 10 days before the vote at rallies demanding the generals who replaced Mubarak give way to civilian rule. " Without Tahrir, we wouldn't have had these elections," said Mohamed Gad in the square that cradled the revolt. " God willing, the elections will succeed and the revolution will triumph." But many of the young people who took to the streets early this year now fear their revolution risks being stolen, either by the army rulers or by well-organised Islamist parties. " NO DEALS" Ibrahim announced the results of only a handful of clear-cut victories for individual candidates, with most going to run-offs next week, and gave no figures for party lists in the polls. He said four candidates, two from the Brotherhood's Freedom and Justice Party (FJP) and two liberals, won over 50 percent of votes for outright victory out of 56 individual seats at stake. The FJP said 39 of its candidates would fight run-off races. The party dominates a coalition with other smaller parties. Their coalition will be contesting 45 seats. Yousry Hamad, a senior official of the Salafi Nour Party said 26 of its contenders were involved in run-offs, 24 of them going head-to-head with FJP candidates. " We will go into the run-offs with all our might and there will be no deals with anyone. We will aim to do better than we have already," Nour leader Emad Abdel Ghafour told Reuters. In Egypt's complex election process, two-thirds of the 498 seats will go proportionately to party lists, with the rest to individual candidates. The Muslim Brotherhood, banned but semi-tolerated under Mubarak, has said its FJP expects to win 43 percent of party list votes in the first stage, building on the Islamist group's decades of grassroots social and religious work. But the Brotherhood's website also forecast that the Salafi al-Nour party would gain 30 percent of the vote, a shock for some Egyptians, especially minority Christian Copts, who fear it will try to impose strict Islamic codes on society. Nour said Thursday it expected 20 percent of the vote. As in Saudi Arabia, Salafis want to bar women and Christians from executive posts. They would also ban alcohol, mixed beach bathing and " un-Islamic" art and literature. Such curbs would wreck Egypt's vital tourism industry, which employs about one in eight of the workforce. More secular-minded Egyptian parties, some of which were only formed after Mubarak's fall, had always feared that they would not have enough time to put up a credible challenge to their experienced and better-funded Islamist rivals. The liberal multi-party Egyptian Bloc has said it is on track to secure about a fifth of votes for party lists. Ibrahim, the election chief, acknowledged several violations in Monday and Tuesday's voting, notably campaigning outside polling stations, long queues, failure to stamp some ballots, and late arrival of ballot papers and of a few of the supervising judges. He said these did not affect the results. PROMISE OF CIVILIAN RULE Egypt's ruling generals, who have promised civilian rule by July, have said they will keep powers to appoint or fire a cabinet even after an elected parliament is installed. The United States, which still gives Egypt about $1.3 billion (833.1 million pounds) a year in mostly military aid, has urged the ruling generals to step aside swiftly and make way for civilian rule. The leader of the Brotherhood's FJP appeared to set the stage for a political tussle with the military this week by saying the majority in parliament should form the government, but the party later said it was premature to discuss the issue. The FJP says its priorities are ending corruption, reviving the economy and establishing a true democracy in Egypt. Ever pragmatic, the Brotherhood may avoid allying with Salafis in parliament and seek more moderate coalition partners to reassure Egyptians and foreigners of its intentions. Senior FJP official Essam el-Erian said before the vote that Salafis, who had kept a low profile and shunned politics during Mubarak's 30-year rule, would be " a burden for any coalition." Kamal al-Ganzouri, asked by the army to form a " national salvation government," aims to complete it soon. State television said the cabinet was still being formed, but included at least half of the outgoing team. Protesters in Tahrir have rejected Ganzouri, 78. " It is unacceptable that after the revolution, an old man comes and governs. We don't want the army council anymore. they should go back to barracks," said Menatallah Abdel Meguid, 24. (Additional reporting by Yasmine Saleh, Tom Perry and Edmund Blair Writing by Alistair Lyon Editing by Peter Millership and Peter Graff) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

03-Dec-2011 13:40

|

|

x 0

x 0 Alert Admin |

Panetta: Israel must get to the " damn" peace table

U.S. Defense Secretary Leon Panetta dons his glasses at a Senate hearing in Washington

WASHINGTON (Reuters) - U.S. Defense Secretary Leon Panetta urged Israel on Friday to get back to the " damn" negotiating table with Palestinians and take steps to address what he described as the Jewish state's growing isolation in the Middle East. Panetta, addressing a forum in Washington, also made one of his most extensive arguments to date against any imminent military action against Iran over its nuclear program, saying he was convinced that sanctions and diplomatic pressure were working. " You always have the last resort ... of military action. But it must be the last resort, not the first," Panetta said. Militarily strong, Israel is battling a diplomatic storm as Arab uprisings upset once-stable relationships in the Middle East. But Panetta warned Israel against viewing uprisings like the one in Egypt that toppled president Hosni Mubarak as an excuse to enter a defensive crouch. " I understand the view that this is not the time to pursue peace, and that the Arab awakening further imperils the dream of a safe and secure, Jewish and democratic Israel. But I disagree with that view," Panetta said. He said Israel needed to take risks, including by breathing new life into moribund peace talks with Palestinians. When asked by a moderator what steps Israel needed to take to pursue peace, Panetta said: " Just get to the damn table." " The problem right now is we can't get 'em to the damn table, to at least sit down and begin to discuss their differences," Panetta said. ISOLATION Panetta said the United States would safeguard Israel's security, ensure regional stability and prevent Iran from obtaining a nuclear weapon -- a goal Tehran denies having. " Israel, too, has a responsibility to pursue these shared goals -- to build regional support for Israeli and United States' security objectives," Panetta said. " I believe security is dependent on a strong military but it is also dependent on strong diplomacy. And unfortunately, over the past year, we've seen Israel's isolation from its traditional security partners in the region grow." Panetta suggested that Israel reach out and mend fences with countries like Turkey, Egypt and Jordan which " share an interest in regional stability." Turkey was the first Muslim state to recognize Israel, in 1949, but relations worsened last year when Israeli commandos boarded an aid flotilla challenging a naval blockade of the Palestinian enclave of Gaza and killing nine Turks in ensuing clashes. " It is in Israel's interest, Turkey's interest, and U.S. interest for Israel to reconcile with Turkey, and both Turkey and Israel need to do more to put their relationship back on track," Panetta said. Israel is closely watching developments in Egypt, whose new rulers may be more susceptible to widespread anti-Israeli sentiment than under Mubarak. Egyptians voted on Friday in the opening round of the country's first free election in six decades. The Muslim Brotherhood's party and its ultra-conservative Salafi rivals looked set to top the polls. But Panetta said the best course for the United States and the international community was to continue to put pressure on Egypt to follow through with transition to democracy and ensure any future government stands by its peace treaty with Israel. Turning to Iran, Panetta used some of his strongest language yet to explain U.S. concerns about any military strike against Iran over its nuclear program -- which the West believes is aimed at an atomic bomb. Tehran denies this, saying its uranium enrichment is entirely peaceful. Panetta said a strike could disrupt the already fragile economies of Europe and the United States, trigger Iranian retaliation against U.S. forces, and ultimately spark a popular backlash in Iran that would bolster its rulers. It also may not be effective. Panetta cited estimates from Israelis that a strike might set back Iran's nuclear program by one to two years " at best." He finally warned about engulfing the region in war. " Lastly I think the consequence could be that we would have an escalation that would take place that would not only involve many lives, but I think could consume the Middle East in confrontation and conflict that we would regret," he said. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

03-Dec-2011 13:38

|

|

x 0

x 0 Alert Admin |

U.S. jobless rate drops to 2-1/2 year low

WASHINGTON - * Nonfarm payrolls rise 120,000 in November

* Private-sector jobs up 140,000 gov't down 20,000 * Unemployment rate drops to 8.6 pct from 9 percent * Employment report bolsters stronger Q4 growth views (Adds details, updates markets to close) By Lucia Mutikani WASHINGTON , Dec 2 (Reuters) - The U.S. unemployment rate tumbled to a 2-1/2 year low in November, even though the pace of hiring remained too slow to suggest a significant acceleration in the labor market recovery. Nonfarm payrolls increased by 120,000 jobs, the Labor Department said on Friday, and the jobless rate dropped to 8.6 percent, the lowest since March 2009, from 9 percent in October. It was the biggest monthly decline since January. While part of the decrease was due to people leaving the labor force, the household survey from which the department calculates the unemployment rate also showed solid gains in employment. " The economy is continuing to head in the right direction," said Millan Mulraine, senior macro strategist at TD Securities in New York. " However, the ultimate test of the sustainability of the recovery is for the economy to create a sufficient number of jobs to sustain a consumer-led rebound in activity." " On this measure, this report falls short," he said. Although the gain in the number of jobs created as measured by a survey of employers was relatively modest and most of the hiring was concentrated in the retail sector , the rise in employment topped October's upwardly revised 100,000 increase. In all, 72,000 more jobs were created in October and September than previously reported. The report could temper the appetite among some Federal Reserve officials to ease monetary policy further, although its unlikely to be much help to President Barack Obama in his bid for a second term. In forecasts released earlier this month, the U.S. central bank said the jobless rate would likely average 9 percent to 9.1 percent in the fourth quarter. It did not expect it to drop to an 8.5 percent to 8.7 percent range until late next year. " The drop in the unemployment rate may make them a little less antsy to pull out the big guns, but there is still not enough evidence of sustained, above-trend growth to get them to stop worrying about downside risks," said Michael Feroli, an economist at JPMorgan in New York. FISCAL DRAG So far, data ranging from manufacturing to retail sales suggest the U.S. economy's growth pace could top 3 percent in the fourth quarter , a sharp step up from the second quarter's 2 percent annual rate. In contrast, much of the rest of the world is slowing and the euro zone appears to have already fallen into recession. But economists worry the European debt crisis and upcoming fiscal tightening at home could slow U.S. growth next year. Obama, whose economic stewardship will face the judgment of voters next November, used the data to press Congress to extend a payroll tax cut which expires at the end of this month. " Now is not the time to slam the brakes on the recovery. Right now its time to step on the gas," he said. Stocks on Wall Street surged early in the session on both the employment report and growing optimism of a solution to the European debt crisis, but ended flat as investors took profits from this week's big rally. Prices for U.S. government debt rose and the dollar firmed against a basket of currencies. Although the economy resumed growth two years ago, about 24.4 million Americans are either out of work or underemployed and employment remains 6.3 million below its level in December 2007 when the recession started. Still, the labor market is improving. While the government's survey of employers has shown a still-tepid pace of job growth, its separate poll of households has shown a total of 1.28 millio n jobs created over the last four months. SIGNS OF VIGOR Analysts were unperturbed that 315,000 people exited the labor force last month, noting that more had piled in the prior three months. If the labor force participation rate had held steady, the unemployment rate would have fallen less dramatically to 8.9 percent. The jobless rate is expected to drift higher in coming months as more people come back into the job market. The scheduled expiration of extended long-term unemployment benefits at the end of December may have contributed to the big drop in the labor force last month. In order to qualify for benefits, recipients have to show they are actively looking for work. Analysts said some of the recipients already set to receive benefits may have told the Labor Department they were no longer searching for a job. " It is likely that many long-term unemployed workers are dropping out as their unemployment insurance benefits expire. Many of these workers will likely stay out of the job market permanently," said Sophia Koropeckyj, a director of research at Moody's Analytics in West Chester, Pennsylvania. Still, the report was a relative bright spot for a labor market that has been the Achilles heel of the U.S. recovery. Even as prospective workers gave up the hunt for a job, the share of the working-age population that is employed rose to an eight month high. Also supporting the improving labor market tone, a broad measure of unemployment that includes people who want to work but have stopped looking and those working only part time but who want more work dropped to a 2-1/2 year low of 15.6 percent in November from 16.2 percent in October. The private sector added 140,000 jobs and government employment fell 20,000. The retail sector accounted for more than a third all new private-sector jobs, adding 49,800 workers, the most in seven months, as shops geared up for a busy holiday season. Some analysts said retail hiring could slip in December. Construction payrolls fell for second straight month, while factory jobs edged up 2,000. Temporary hiring -- seen as a harbinger for future hiring - increased 22,300. In one notable weak spot, average hourly earnings fell two cents. (Editing by Andrea Ricci and Diane Craft) |

| Useful To Me Not Useful To Me | |