| Latest Forum Topics / Straits Times Index |

|

|

News Update!

|

|

|

krisluke

Supreme |

16-Feb-2012 17:58

|

|

x 0

x 0 Alert Admin |

CIMB in talks to buy RBS’ Asia units: SourcesFebruary 16, 2012

KUALA LUMPUR, Feb 16 – Malaysia’s CIMB Group Holdings Bhd is in talks to buy the Asian equities and investment banking units of Royal Bank of Scotland Group Plc, two sources with direct knowledge of the matter said today. “Negotiations are ongoing but nothing is confirmed,” one of the sources said. The other source confirmed that CIMB, the second-largest bank by assets in Malaysia, was in talks with RBS but did not know whether the negotiation was exclusive. The Financial Times reported on Feb. 8 that CIMB and China International Capital Corp. are the remaining bidders in the running to buy RBS’ Asian equities, mergers and acquisitions and research businesses. An official with China International Capital declined to comment when contacted. RBS said today that it remained in active discussions with potential buyers for various parts of the Asian businesses that it had identified for sale. “We will provide a further update based on material developments,” said one RBS’ company official. RBS has been selling some of its businesses as part of its plan to scale down its non-core units on its road to recovery from the 2008 financial crisis. The bank recently sold its aircraft leasing unit to Sumitomo Mitsui Financial Group and Sumitomo Corp for US$7.3 billion (RM22.36 billion). |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

16-Feb-2012 17:56

|

|

x 0

x 0 Alert Admin |

Singapore’s economy contracts less than previously estimated Singapore’s economy shrank less than initially estimated last quarter as a surge in pharmaceutical production supported manufacturing at the year end, reported Bloomberg. Gross domestic product fell an annualized 2.5% in the fourth quarter of 2011 from the previous three months, less than an initial estimate of a 4.9% decline, the trade ministry said in a report today. Non-oil domestic exports will probably rise 3% to 5% in 2012, the trade promotion agency said in a separate statement, reiterating an earlier forecast. Asian economies from China to India have seen an improvement in manufacturing this year based on purchasing managers indexes, suggesting the region is withstanding the impact of the European sovereign-debt crisis. The gains may wane as Europe faces its second recession in less than three years, and pressure on Singapore’s central bank to support growth may persist after it eased its policy stance last quarter. “There seems to be some near-term stabilization signs but it should not be taken as a concrete signal of sustained demand,” Vishnu Varathan, an economist at Mizuho Corporate Bank in Singapore, said before the report. “As fiscal austerity plans in the euro zone intensify and with Greece still on the edge, we don’t want to call a premature dawn.” The Singapore dollar fell 0.3 % to $1.2638 against its US counterpart at 7:51 a.m. today. The central bank uses the exchange rate as a policy tool to manage inflation. Policy Moves The economy grew 4.9% in 2011, faster than an earlier estimate of 4.8%, the trade ministry said. The government reiterated today its forecast for an expansion of 1% to 3% this year. GDP increased 3.6% from a year earlier last quarter, after rising a revised 6% the previous three months. The expansion matched the January estimate. The central bank had tightened monetary policy at each of the three half-yearly reviews before its October decision to slow gains in the currency while continuing with a modest and gradual appreciation. It guides the local dollar against a basket of currencies within an undisclosed band, and adjusts the pace of appreciation or depreciation by changing the slope, width and center of the band. Gross domestic product in the 17-nation euro area fell 0.3% from the prior three months, the first drop since the second quarter of 2009, a report showed this week. Singapore’s manufacturing rose 9.2% from a year earlier in the three months ended Dec. 31, after climbing a revised 13.7% in the third quarter, the trade ministry said today. The services industry grew 2.1% last quarter from a year earlier, after gaining a revised 3.6% in the previous three months. The construction industry expanded 2.9%. Malaysia’s Q4 GDP up 5.2pc on year, beats forecast February 15, 2012

KUALA LUMPUR, Feb 15 – Malaysia’s economy grew at an annual pace of 5.2 per cent in the fourth quarter of 2011, slowing from the previous three months as the trade-dependent country felt the effects of weaker global activity, the central bank said today. The fourth-quarter growth, which beat economists’ expectations of a 5 per cent expansion, was underpinned by strong domestic consumption. The expansion in the last three months of the year took the economy’s full-year growth to 5.1 per cent. That is a marked slowdown from 7.2 per cent in 2010 as the Southeast Asian country felt the impact of weaker activity in advanced economies and uncertainties over the euro zone debt crisis. “For the Malaysian economy, the favourable growth in the fourth quarter was underpinned by sustained domestic demand amid (a) weaker external environment,” the central bank said in a statement. “Going forward, the more challenging external environment could present greater downside risks to Malaysia’s growth prospects.” Private consumption rose 7.1 per cent from a year ago, while public spending jumped 23.6 per cent. GDP growth had accelerated in the third quarter to 5.8 per cent but the central bank cautioned of a weaker outlook as global uncertainties erode demand for exports. The central bank has kept monetary policy on hold since May 2010, when it hiked the benchmark interest rate for the fourth time after starting a tightening cycle in 2010. Inflation in December eased to an annual pace of 3.0 per cent from 3.3 per cent in November and is expected to fall further, which could give the central bank leeway to cut interest rates at its next meeting in March. – Reuters |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

16-Feb-2012 12:16

|

|

x 0

x 0 Alert Admin |

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

16-Feb-2012 11:51

|

|

x 0

x 0 Alert Admin |

Apple falls, drags Wall Street lowerFebruary 16, 2012

NEW YORK, Feb 16 — Stocks fell yesterday for the third session in four, with market direction largely dictated by the swings in shares of Apple, the largest company in the world. The S& P 500 appeared set for a strong move off a nine-month high as Apple Inc shares gained three per cent in early trading, helped by Tuesday’s disclosures that prominent hedge-fund managers had been buying the stock. But Apple, the largest company by market capitalization, turned negative around midday and closed down 2.3 per cent to US$497.67 (RM1,494), quickly reversing the Nasdaq index’s advance. The stock had climbed as high as US$526.29 during the session. The fortunes of both S& P and Nasdaq have been closely tethered to Apple of late, with the benchmark S& P index and Nasdaq a near-perfect correlation over the last 50 days, showing they are moving almost in lockstep. Doreen Mogavero, chief executive of trading firm Mogavero, Lee & Co, said from the floor of the New York Stock Exchange investors were concerned about a report that Apple had asked online retailer Amazon to halt sales of its iPad in China. A Chinese technology firm is trying to ban shipments of Apple’s iPad tablet in and out of the country in a legal battle over the iPad name. An Apple spokeswoman referred to the company’s website that says Amazon is not an authorised reseller of iPads in China or the United States. Volume on the iPhone maker’s shares surged to 50 million shares, an increase of over 400 per cent when compared with its 30-day average. “This morning, in a bout of panic buying, Apple was up another 17 points, dragging a reluctant market along with it,” said Larry McMillan, president of McMillan Analysis Corp. in Morristown, New Jersey, in a report. The sharp decline “broke the market, and for the first time in quite a while, an early rally has degenerated into afternoon selling.” Apple option flow was a total of 1.77 million contracts, surpassing the record of 1.3 million contracts set last Thursday, according to Trade Alert President Henry Schwartz. About nine per cent of the option volume market-wide was on Apple. The S& P hit a peak of 1,355.87, just shy of its July 2011 high. A break above that level would take the benchmark to its strongest since at least May of last year. “You are looking at good old exhaustion inside of the market,” said Keith Bliss, senior vice president at Cuttone & Co in New York. “From a technical standpoint, we had strong resistance at 1350, 1355 in the market, and there was no real appetite to get through it.” The Dow Jones industrial average dropped 97.33 points, or 0.76 per cent, to 12,780.95. The Standard & Poor’s 500 Index lost 7.27 points, or 0.54 per cent, to 1,343.23. The Nasdaq Composite Index fell 16.00 points, or 0.55 per cent, to 2,915.83. Industrial stocks led declines on the S& P 500, with Deere & Co off 5.4 per cent at US$84.28 after investors expected the farm equipment company to give a stronger full-year forecast. US manufacturing output rose solidly in January and a gauge of factory activity in New York state hit a 1-1/2-year high in February, adding to a run of fairly upbeat data, even though overall industrial production was flat last month. Decliners on the Dow, which underperformed the broader market, included industrial and material stocks like Caterpillar Inc, down 1.7 per cent at US$112.53. Earlier the Dow industrials were trading near a 3 1/2 high and the Nasdaq was at a more than 11-year high. Also weighing on the market, European Union sources said finance officials were examining ways of delaying parts or even all of a second bailout for Greece, while still avoiding a disorderly default. That rekindled fears about the region’s debt crisis. Volume was solid with about 7.38 billion shares traded on the New York Stock Exchange, NYSE Amex and Nasdaq, above the daily average of 6.98 billion. Declining stocks outnumbered advancing ones on the NYSE by 1,723 to 1,273, while on the Nasdaq, decliners beat advancers 1,586 to 925. — Reuters |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

16-Feb-2012 11:49

|

|

x 0

x 0 Alert Admin |

Euro zone ponders delay of new Greek bailoutFebruary 16, 2012

BRUSSELS, Feb 16 — Euro zone finance officials are examining ways of delaying parts or even all of a second bailout programme for Greece while still ensuring it avoids a disorderly default, several EU sources said yesterday. The delays could possibly last until after Greece holds elections expected in April, they said, although it depends to what extent Greek political leaders make firm commitments on further spending cuts and labour reforms unpopular with voters. While most elements of the package, which will total €130 billion (RM520 billion), are in place, some euro zone finance ministers are not satisfied that all Greece’s political party leaders are fully behind the reforms and so want legal guarantees. It is also not clear that Greece’s debt-to-GDP ratio, which currently stands at around 160 per cent, will be cut to 120 per cent by 2020 via the agreement, as demanded by the “troika” of the European Commission, IMF and European Central Bank. “There are proposals to delay the Greek package or to split it, so that an immediate default is avoided, but not everything is committed to,” one official briefed on preparations for a euro zone finance ministers call later in the day told Reuters. “They’ll discuss the options,” he said, adding: “There is pressure from several countries to hold off until there is a concrete commitment from Greece, which may not come until after they’ve held elections.” Under the “split” proposal, a debt swap agreement between Greece and private sector Greek bondholders could go ahead. The process, which aims to cut Athens’ debt burden by €100 billion via banks and insurers taking losses, was supposed to begin tomorrow but is now likely to begin next week, depending on the outcome of talks among euro zone finance ministers in the coming days. If successfully completed, the swap would allow Greece to meet a €14.5 billion bond redemption payment on March 20, which if missed would result in default. But the bulk of the €130 billion bailout would be held back as leverage over Athens. The euro slid to its lowest in more than a week against the dollar in response to the Reuters report and safe-haven German Bund futures rose to session highs. Greece’s conservative party leader Antonis Samaras, widely tipped as the country’s next prime minister, pledged in writing that if elected he would stick to an agreed programme of welfare and job cuts – a commitment demanded by euro zone ministers before they would agree to the new bailout. “It is fair to say that my patience has run out,” Dutch Finance Minister Jan Kees de Jager told US National Public Radio. “We have to see the evidence of implementing the measure into law and just promises are not enough, not anymore.” One senior euro zone diplomat said the pressure being applied on Athens to meet its commitments seemed to be working, and suggested that as long as that held, more radical proposals for re-examining the second package may not be necessary. “With every small piece of news that we get from Athens, the situation is becoming better. Whether it will hold all the way through, we can’t know. They’ll have to discuss that tonight and come back to it on Monday, I imagine.” Germany, Finland and the Netherlands are the countries pushing to delay the package, two other officials said, with Germany the most adamant and suggesting that final approval should only be granted after new elections are held. Euro zone finance ministers began a conference call at 1600 GMT to discuss how to proceed. The call replaces a face-to-face meeting that was cancelled late on Tuesday because Greece had not provided sufficient commitments from its side. Asked whether the package could be split, a spokesman for the European Commission said it was not yet decided. “Up until now in the discussions, this has always been treated as an entire package,” Amadeu Altafaj, spokesman on economic and monetary affairs told reporters, adding specifically on the private-sector portion: “Up until now, that’s never been separated out. Now what will happen tonight, I don’t know, I can’t pre-empt that. But that’s certainly the logic we’ve been following so far.” One major problem with splitting the package is whether private holders of Greek bonds would be willing to sign up to a swap if Greece’s financing, which makes up the bulk of the second package, is not in place, since that would mean the state might not be able to meet future bond payments. As a result, one euro zone source said it was possible that the entire second package – the private sector portion and the remainder – could be delayed until after Greek elections, when everyone hopes for greater clarity and commitment. “This would mean we have to pay the €14.5 billion on March 20, which would be a total waste,” said the euro zone source, who took part in discussions among deputy heads of euro zone finance ministries on Tuesday. “But there is still money left from the first programme so we could do it,” the source said, referring to Greece’s first, €110 billion bailout programme, agreed in May 2010. “This would mean that the talks on the second programme, including PSI (private sector involvement), which is part of the package, would be moved until there is a new Greek government in place.” The frustration expressed by Germany, the Netherlands and others, reflected in the proposal to delay the rescue package, is in part designed to put political pressure on Athens. But officials say it is also genuine and a sign that patience is wearing thin after two years of trying to sort out Greece. Data from Athens on Tuesday showed the economy shrank 7.0 per cent in the fourth quarter of 2011 on an annualised basis, making it all the harder for Greece to meet its debt targets. One official estimated that Greece’s debt-to-GDP ratio may only fall to 140 per cent by 2020 given the latest figures, way above the targeted 120 per cent. For now, the central aim of euro zone finance ministers remains to push ahead with the second package as agreed last October, which would mean signing off on PSI in the coming week, possibly at a Eurogroup meeting set for Monday. |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

16-Feb-2012 11:47

|

|

x 0

x 0 Alert Admin |

Moody’s warns may downgrade 17 global banks, securities firmsFebruary 16, 2012

Moody’s cut the ratings of six European countries last Monday. — Reuters pic

The US rating agency said its action on financial institutions from 16 European nations reflected the impact of the debt crisis and deteriorating creditworthiness of its governments. It cited more fragile funding conditions, increased regulatory burdens and a tougher economic environment for its review of banks and securities firms with global reach. Moody’s salvo follows rounds of downgrades in European sovereign ratings as the euro zone’s struggle to keep its weakest link Greece afloat has been driving up borrowing costs and straining finances of other nations. Last Monday, Moody’s cut the ratings of six European nations including Italy, Spain and Portugal and warned it could strip France, Britain and Austria of their top-level AAA grade. Last month, Standard & Poor’s cut France’s and Austria’s top ratings and downgraded seven other euro zone nations. It also cut the euro zone’s bailout fund by one notch. Moody’s said it was reviewing the long-term ratings and standalone credit assessments of Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Royal Bank of Canada. The long-term ratings and standalone credit review of European banks includes Barclays, BNP Paribas , Credit Agricole, Deutsche Bank, HSBC, Royal Bank of Scotland and Societe Generale. Moody’s said it was also extending the reviews of the long-term ratings and standalone credit assessments of Credit Suisse, Macquarie, Nomura and UBS. “Capital markets firms are confronting evolving challenges, such as more fragile funding conditions, wider credit spreads, increased regulatory burdens and more difficult operating conditions,” Moody’s said in a statement. As a result, the longer-term profitability and growth prospects of the institutions under review had diminished. In its review of European banks, Moody’s said that once it is completed, the ratings will “fully reflect the currently foreseen adverse credit drivers.” European banks’ bond holdings of struggling euro zone nations Greece, Portugal, Ireland, Spain and Italy have trapped Europe in a vicious circle. The falling value of the debt puts pressure on banks, which in turn weighs on lending and economic activity, making it tougher to sustain the growth that governments badly need to shore up their finances. European Union leaders have been trying to put a financial “firewall” around the most afflicted nations, but jittery market sentiment suffered a fresh setback on Wednesday when several EU sources told Reuters that the euro zone was considering a delay in parts of a second bailout plan for Greece. Moody’s said that for 99 European financial institutions, the standalone credit assessments have been placed on review for downgrade. For 109 institutions, the long-term debt and deposit ratings have been placed on review for downgrade. For 66 institutions, the short-term ratings have been placed on review for downgrade. — Reuters |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

12-Feb-2012 21:58

|

|

x 0

x 0 Alert Admin |

Crude Oil Weekly Technical OutlookNymex Crude Oil (CL)Crude oil's recovery from 95.44 failed to take out 101.29 and weakened sharply towards the end of the week. Crude oil is staying inside the near term falling channel from 103.74. Thus, choppy fall from there might extend below 95.44. Nonetheless, we'd expect strong support from 92.52 cluster support (38.2% retracement of 74.95 to 103.74 at 92.74). to contain downside and bring rebound. On the upside, break of 101.29 will be the first signal that recent consolidative trading has finished and flip bias back to the upside for a test on 103.74 resistance. In the bigger picture, the medium term up trend from 33.2 shouldn't be completed yet. Rise from 74.95 is indeed tentatively treated as resumption of such rally. Sustained break of 114.83 will target 61.8% projection of 33.2 to 114.83 from 74.95 at 125.40. On the downside, though, break of 92.52 support will indicate that correction pattern from 114.83 is going to extend further with another falling leg to 74.95 and below before completion. In the long term picture, crude oil is in a long term consolidation pattern from 147.27, with first wave completed at 33.2. The corrective structure of the rise from 33.2 indicates that it's second wave of the consolidation pattern. While it could make another high above 114.83, we'd anticipate strong resistance ahead of 147.24 to bring reversal for the third leg of the consolidation pattern. Nymex Crude Oil Continuous Contract 4 Hours Chart

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

12-Feb-2012 21:56

|

|

x 0

x 0 Alert Admin |

Gold Weekly Technical OutlookComex Gold (GC)Gold stayed in tight range below 1765.9 last week. With daily MACD crossed below signal line, the development argue that a short term top is formed and rebouind from 1523.9 might be finished already. Initial bias is neutral this week with focus on 1703 minor support. Break will affirm this beraish case and bring deeper decline through 55 days EMA (Now at 1687.5). On the upside, above 1765.9, though, will extend the rise form 1523.9 to 1804.4 key near term resistance next. In the bigger picture, price actions form 1923.7 high are viewed as a medium term consolidation pattern. The loss of momentum ahead of 1804.4 resistance dampens the view that such consolidation is finisehd at 1523.9. In other words, another fall could be seen to extend the pattern fro 1923.7. Nonetheless, even in that case, continue to expect strong support from 1478.3/1577.4 support zone to contain downside to finish the consolidation and bring up trend resumption eventually. Meanwhile, break of 1804.4 resistance will be the first signal of long term up trend resumption. In the long term picture, with 1478.3 support intact, there is no change in the long term bullish outlook in gold. While some more medium term consolidation cannot be ruled out, we'd anticipate an eventual break of 2000 psychological level in the long run Comex Gold Continuous Contract 4 Hours Chart

|

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

12-Feb-2012 21:50

|

|

x 0

x 0 Alert Admin |

Eurozone will collapse this year, says Nouriel RoubiniNouriel Roubini, the economist credited with having foreseen the credit crunch, has warned that the eurozone will collapse within the year - with Greece and Portugal leaving |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

12-Feb-2012 21:47

|

|

x 0

x 0 Alert Admin |

Iran to confront pre-election opposition protest

TEHRAN (Reuters) - Iranian authorities will crack down this week on any public protest against the year-long house arrest of opposition leaders, Mirhossein Mousavi and Mehdi Karoubi, an official was quoted as saying on Sunday.

Iran, at odds with the West over its disputed nuclear programme, holds a parliamentary election on March 2, its first national poll since Mousavi and Karoubi were beaten by President Mahmoud Ahmadinejad in a 2009 vote they said was rigged. The government denied any fraud in the election, which ignited eight months of street protests, prompting a violent state response and deep splits in the ruling establishment. The two leaders were placed under house arrest on February 14 last year after they urged their supporters to join a rally in support of popular uprisings across the Arab world. Tehran provincial governor Morteza Tamaddon said a call by reformists for a rally on Wednesday to mark the anniversary of the curbs imposed on Mousavi and Karoubi was a " publicity stunt" by opponents of Iran's Islamic revolution. " We will confront such moves with full preparation and all kinds of security apparatus," the reformist Kaleme website quoted Tamaddon as saying. Tens of thousands of Iranians joined state-organised rallies on Saturday to mark the 33rd anniversary of Iran's revolution. The parliamentary election, now less than three weeks away, will test the popularity of Ahmadinejad's supporters and those who back the supreme leader, Ayatollah Ali Khamenei, in a power struggle between conservative factions. Reformists have said they are boycotting the election as their demands for a " free and just" vote have not been met. A low turnout would hurt the leadership's efforts to contain the damage to its legitimacy caused by the 2009 election and the forcible suppression of the opposition " Green" movement. Dozens of people were killed and thousands arrested during the post-election unrest that engulfed major towns and cities in the worst political upheaval in the Islamic Republic's history. |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

12-Feb-2012 21:45

|

|

x 0

x 0 Alert Admin |

Saadi Gaddafi warns of uprising in Libya - TV

By Marie-Louise Gumuchian and Ali Shuaib

TRIPOLI (Reuters) - Muammar Gaddafi's son Saadi warned on Friday of an imminent uprising in Libya, saying he was in regular contact with people in the country who were unhappy with the authorities put in place after the ousting and killing of his father. Speaking to Al-Arabiya television by phone - the first time he has spoken publicly in months - Saadi said he wanted to return to Libya " at any minute" after escaping across the border to Niger when National Transitional Council forces captured the capital Tripoli in August. He said he was in contact from Niger with the army, the militias, the NTC and other members of the Gaddafi family. It was impossible to verify where he was calling from as the station showed only an old still picture of Saadi as a backdrop to his words. " First of all, it is not going to be an uprising limited to some areas. It will cover all the regions of the Jamahiriya and this uprising does exist and I am following and witnessing this as it grows bigger by the day," he said, referring to Libya. " There will be a great uprising in the south, in the east, in the centre and in the west. All the regions of Libya will witness this new popular uprising." A transitional government appointed in November is leading the country to elections in June but is struggling to restore services and impose order on myriad armed groups. These groups fought hard in the campaign to topple Gaddafi but still refuse to hand in their weapons. The government lost control of the former Gaddafi stronghold of Bani Walid last month after local people staged an armed revolt, posing the gravest challenge yet to the NTC's authority. However elders in the desert city dismissed accusations they wanted to restore the late dictator's family to power or had any ambitions beyond their local area. Saadi told Al-Arabiya: " The Libyan people should revolt against these militias and against this deteriorating situation. The NTC is not a legitimate body ... and is not in control of the militias," he added. " We call on all to be ready for the coming uprising." " We have to exert pressure to change this situation and to remove this evil doing that exists in Libya. We do not know any such thing as elections. We are a Muslim nation," he said. ANNIVERSARY Government officials were not immediately available for comment. Mohammed al-Alagy, former interim justice minister and who now heads the human rights council, told Al-Arabiya Saadi's comments were " an attempt to drive a wedge between the Libyan people." Saadi, a businessman and former professional footballer, said he was in contact with people in Libya. Interpol last year issued a " red notice" requesting member states to arrest Saadi with a view to extradition if they find him in their territory. " I have daily communications with Libya from Niger and these contacts are not just to start the uprising but also to follow up the status of our tribes, our relatives and the people," he said. " The situation of the people is deteriorating. I am in contact with the militias, the tribes, the NTC and the national army. I can confirm that more than 70 percent of those who are in Libya now whether they support the February 17th (revolution) or not, all are not satisfied with the situation and are ready to cooperate to change this situation." Libya is preparing for the first anniversary of the start of the February 17 uprising which began in the eastern city of Benghazi. Libyan armed forces chief Yousef al-Mangoush this week said there were concerns for potential sabotage of the anniversary by Gaddafi loyalists. " A large number of February 17th members do regret this and we are now in full cooperation with the February 17th and our supporters to change this deteriorating situation," Saadi said. " As for my return, yes I must return to Libya and this will happen at any minute. If I do return I will prevent any revenge." Saadi said he was also in contact with his family members. Gaddafi's wife Safiya, his daughter Aisha and his sons Mohammed and Hannibal fled to Algeria in August. Saadi's brother Saif al-Islam was captured in the Sahara desert in November and is now being held in the town of Zintan. " I am in contact with my family inside and outside Libya and in the neighbouring countries and in Europe," Saadi said. " I call on all the elders, the youth, the militias and the tribes to come and to sit with each other and to negotiate with each other and to come up with a true reconciliation." Mexican authorities said in December they had uncovered and stopped an international plot to smuggle Saadi into the country using fake names and false papers. (Reporting by Ali Shuaib and Omar Fahmy in Cairo Writing by Marie-Louise Gumuchian Editing by Alison Williams) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

12-Feb-2012 21:43

|

|

x 0

x 0 Alert Admin |

Japanese emperor to undergo heart bypass surgery

Emperor Akihito waves through the window of his limousine upon his arrival at the Imperial Palace after he was discharged from a hospital in Tokyo

TOKYO (Reuters) - Japanese Emperor Akihito will undergo heart bypass surgery this week after a detailed examination found a heart problem had worsened, the Imperial Household Agency was quoted as saying on Sunday. Kyodo news agency, quoting the Imperial Household Agency, said the emperor, 78, would have the surgery on February 18. Akihito had undergone an angiogram on Saturday which showed that blood vessels had narrowed over the past year. He had been treated in hospital for three weeks in November for cold, fever and symptoms of bronchitis. The Imperial Household Agency was unavailable for comment. Kyodo said the test was performed after the emperor experienced difficulty while engaging in light exercise. Television footage on Sunday showed the emperor greeting doctors after being discharged from hospital following the examination. Akihito had surgery for prostate cancer in 2003 and suffered stress-related health issues in late 2008, including irregular pulse and stomach bleeding. The following year, the royal agency said he would cut back on official duties such as speeches and meeting foreign dignitaries. Akihito ascended to the throne after the death of his father Hirohito in 1989. He has spent much of the past two decades working to heal the wounds of a war waged across Asia in his father's name and helped bring the monarchy closer to ordinary citizens. Having witnessed as a boy the rise of Japanese militarism and its defeat in 1945, the soft-spoken Akihito said he wanted to deepen international understanding through visits abroad, sometimes defying protests to do so. CONTROVERSIAL TRIPS One of his more controversial trips came in 1992, when he became the first Japanese monarch in living memory to visit China, where bitter memories of Japan's invasion and occupation in the 1930s and 1940s run deep. Another defining moment came in 2001 when Akihito tried to smooth relations with South Korea, at times strained by lingering resentment over Japan's 1910-1945 colonisation of the Korean Peninsula. At a news conference marking his birthday, he said he felt " a certain kinship" with Korea because one of his ancestors had come from there, an unprecedented statement from a Japanese royal that made front page headlines in Seoul. Save for such rare occasions, the Japanese imperial family is not an object of such intense public attention or media scrutiny as the British royals. It serves as important link with tradition and a comforting presence at times of distress. Five days after last year's March 11 earthquake and tsunami that struck Japan's northeast, Akihito made a rare televised address and in April travelled to the ravaged area with Empress Michiko. Akihito's hospital stay in November gave the Japanese a rare opportunity to see Akihito's designated successor, Crown Prince Naruhito, 51, step in for his father and perform public duties. While Akihito's reign was defined by his reconciliation efforts, it is less clear what role the scholarly Naruhito may play, though royal commentators expect him to continue his father's efforts to reach out to ordinary citizens. (Reporting by Chikafumi Hodo Writing by Tomasz Janowski Editing by Ron Popeski) |

| Useful To Me Not Useful To Me | |

|

|

|

|

krisluke

Supreme |

12-Feb-2012 21:38

|

|

x 0

x 0 Alert Admin |

Iraq opens new Gulf crude export outlet

* Extra 300,000 bpd exports seen once outlet loads

* Oil shipments from north stable at 400,000 bpd (Adds details on export figures, official comment) By Francois Murphy FAW, Iraq, Feb 12 (Reuters) - Iraq opened a new Gulf crude export outlet in the southern oil hub of Basra on Sunday, clearing the way for Baghdad to increase exports by around 300,000 barrels per day soon after crude begins loading. Loading at the Single Point Mooring or SPM outlet for tankers in the Gulf, part of Iraq's large-scale export facility expansion plan, has already been delayed several times by bad weather and technical hitches. Oil will be pumped through offshore pipelines in a last test procedure before tankers start loading in a week to 10 days, the head of state-run South Oil Company, Dhiya Jaffar, told Reuters at an opening ceremony for the SPM. " We expect that exports will increase not less than 250,000 or 300,000 barrels per day," he said. " The plan is to have the first oil inside the tanker within ten days." If the project goes according to plan, exports from Iraq's southern oilfields will rise to around 1.9 million bpd by March and bring Iraq's total shipments to 2.3 million bpd, the highest level since the 2003 invasion that ousted Saddam Hussein. Iraqi officials have said they are targeting 2.6 million bpd by May for total exports. That will require monthly increase of 100,000 bpd in the south through mid-year when maximum rates of 2.2 million bpd are reached and exports from Iraq's north steady at 400,000 bpd. The OPEC member has a $1.3 billion plan to expand its export facilities in the south, including two undersea pipelines, one offshore pipeline and four single-point mooring terminals. Another SPM could be ready in three to four months, Jaffar said. Iraq's infrastructure is outdated and lacks the capacity to handle increasing output from foreign companies such as Shell , Exxon and BP, who signed massive development contracts for its Rumaila, West Qurna-1 and Zubair oilfields. Bringing three SPMs online by the end of the year would expand Iraq's export capacity in the Gulf by 2.7 million bpd, more than double Basra's current capacity. Its current Gulf terminals can handle around 1.7 million bpd. (Additional reporting by Aref Mohammed in Basra Writing by Patrick Markey Editing by Alistair Lyon and Erica Billingham) |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

12-Feb-2012 21:37

|

|

x 0

x 0 Alert Admin |

UPDATE 4-Obama budget signals election-year tax battle

(Refiles with new headline, explanation of Buffett Rule, paragraphs 12-13)

* Obama budget sees $901 bln 2013 deficit vs $1.33 trln 2012 * Proposes over $800 bln for jobs, infrastructure spending By Alister Bull and Richard Cowan WASHINGTON, Feb 10 (Reuters) - President Barack Obama will seek billions of dollars for jobs and infrastructure in his 2013 budget, an appeal to voters that draws election-year battle lines over taxes and spending as Republicans slammed him for " debt, doubt and decline." Obama's budget proposal, which he will submit to Congress on Monday, will project a much smaller deficit in 2013 compared with this year, White House officials said on Friday. " The budget targets scarce federal resources to the areas critical to growing the economy and restoring middle class security," the White House said in a statement, echoing Obama's recent messages on the campaign trial. The budget gives Obama one of his biggest platforms before the election to tell voters how he would govern in a second White House term, helping him cast Republicans as the party of the rich, while they paint him as a tax and spend liberal. Congress is free to ignore his proposal and Republicans, seeking to defeat him on Nov. 6, declared it dead on arrival. " This unserious budget is a recipe for debt, doubt and decline," said Brendan Buck, spokesman for the top Republican lawmaker, Speaker of the House of Representatives John Boehner. " It would make our economy worse by imposing massive tax increases on small business and still pile up enormous debt that stirs greater economic uncertainty," he said. The budget will include a multi-year request for over $800 billion for job creation programs and spending on roads and other surface infrastructure, including over $300 billion that could be felt starting this year in tax breaks and other steps to spur hiring. Obama's request projects a deficit in fiscal 2013 of $901 billion, down from $1.33 trillion this year, the officials said. The numbers, both higher than the White House estimated in September, indicate a deficit equivalent to 5.5 percent of gross domestic product in 2013, versus 8.5 percent in 2012. BRIGHTER OUTLOOK In addition, recent indicators from the labor market have been better than expected and the White House has already announced that a predicted 2012 unemployment rate in the budget of 8.9 percent was " stale" and should be lower. The U.S. jobless rate fell to 8.3 percent in January. The president will repeat a call for millionaires to pay a minimum effective tax rate of 30 percent, as suggested by billionaire investor Warren Buffett, and identify $4 trillion in deficit reducing steps over 10 years that echo plans he laid out in September. More details on what has become known as the " Buffett Rule" will come later in the month, together with details of Obama's proposed minimum international tax on the foreign profits of U.S. firms and his administration's broad principles of corporate tax reform. The budget will also propose raising $1.5 trillion over a decade via higher taxes, with around half coming from allowing tax breaks for families earning more than $250,000 a year to expire at the end of 2012 - a longstanding Obama goal. Breaking down the job and infrastructure spending, the budget would earmark $476 billion for roads and transportation upgrades over six years, and $350 billion for job creation. A senior administration official said that, as much as possible, the money directly aimed at jobs would be funnelled into the economy this year to kick start job creation. The plans were previewed in Obama's State of the Union address last month, under a call for more economic fairness in America that sets up a stark contrast with the approaches being pushed by Republican candidates vying to face him in November. The jobs measures include extending a payroll tax cut over 2012, allowing firms to fully deduct fresh investment and a call to allocate $60 billion to modernise schools and keep teachers on the job, also repeating a request Obama made in September. Nor is it the first time the president has sought funds from Congress for infrastructure. In 2012 he proposed $35 billion a year over six years for transportion, claiming this would create hundreds of thousands of jobs, and $50 billion to set up a National Infrastructure Bank. Congress did not fund that plan. Federal government spending has already been capped for 2013 in a deal Obama and Republicans reached last summer to raise the U.S. debt ceiling. Last month Obama announced defense spending cuts of $487 billion over 10 years. The budget must still spell out where the ax falls on domestic spending. But it identifies $360 billion in savings from Medicare and Medicaid, federal healthcare programs for elderly and poor Americans, over 10 years. (Additional reporting by Caren Bohan, Laura MacInnis and David Lawder, editing by Stacey Joyce, Eric Beech and Jackie frank) |

| Useful To Me Not Useful To Me | |

|

56mimosa

Member |

28-Jan-2012 17:13

|

|

x 0

x 0 Alert Admin |

The commentary below is taken from : http://marketwizardsllp.blogspot.com

The Straits Times Index ( 2,916.26 )

The STI closed above the key resistance at 2,910 by 6 points. Should we

consider this a successful violation of the key resistance? My take is

not (yet) ! Real life application of Technical Analysis differs from

academic model. Support and resistance isn't going to be textbook

fashion all the time. When we said a key resistance is 2,910, the

resistance is likely to fall within a band of +/- 5 points to 10 points.

The rationale is that market participants aren't going to enter or exit

their positions at the exact same spot. Therefore, when we talk about

successful violation. We should apply some filters to qualify the

violation. Some common filters are the " 1% ~ 3% rule" and the " 2 day

rule" . In other word, unless the STI closed above 2,910 by at least 29

points ( 1% ) and/or for at least 2 days, it is not considered a

successful violation yet.

Given the facts that the STI is still sitting on the key resistance as

explained above, RSI has reached overbought, volume has declined the

past three days while prices edged higher and DJIA felt by 74 points

over the weekend... The odd favors a weakening start for the upcoming

week. There is, however, a wild card : All of the 21 points gain on

Friday was rack-up on the last trading hour. Normally, late Friday rally

would mean renewed buying interest on Monday morning.

To sum up, STI may have breached 2,910 by a tinny margin but the

violation was not decisive enough to have considered a breakout. It may

be worthwhile to stay at the sidelines to see if STI will overcome ( breakout ) or succumb ( triple-top reversal ) to 2,910 in a decisive fashion.

|

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

25-Jan-2012 15:23

|

|

x 0

x 0 Alert Admin |

* S'pore Dec inflation 5.5 pct, in line with forecasts * Core inflation may rise in coming months * Reiterates full-year inflation outlook of 2.5 to 3.5 pct By Kevin Lim SINGAPORE, Jan 25 (Reuters) - Singapore on Wednesday reported annual inflation of 5.5 percent for December, slightly down from November's three-year high of 5.7 percent, but it warned that cost pressures will stay elevated for a few more months before easing. " Year-on-year inflation in CPI-All Items will likely remain elevated over the next few months," the Monetary Authority of Singapore (MAS) and Ministry of Trade and Industry (MTI) said in a joint statement. " Notably, the continued increase in housing rentals, due to a temporary shortage of completed dwellings, will cause imputed rentals on owner-occupied accommodation to rise further in the near term," MAS and MTI added. The two government bodies, however, reiterated their forecast for consumer price index inflation to average between 2.5 and 3.5 percent in 2012, down from 5.2 percent last year. Singapore authorities are grappling with inflation that remains high by historical standards even as the economy contracts, hurt by a shortage of apartments and government policies that have pushed up the price of car ownership. The situation in the city-state contrasts with other Asia-Pacific countries such as India and the Philippines where inflation is slowing, giving central banks room to ease monetary policy. Singapore's trade-driven economy contracted in the last three months of 2011, and several forecasters expect the city-state to slip into a recession this quarter. For the whole of 2012, the government is projecting economic growth of just 1-3 percent, down from last year's 4.8 percent. A change in immigration policies to make it harder for employers to recruit low-skilled workers from overseas has also contributed to inflationary pressures. INFLATION 'REMARKABLY STICKY' " Headline inflation remains remarkably sticky, and is showing less signs of coming off compared to past downturns or other countries," said Bank of America-Merrill Lynch economist Chua Hak Bin. " Upside risk appears to be emerging from rising wage cost pressures, given the tight foreign worker policy," he added. CapitaMall Trust MAS, Singapore's central bank, said its core inflation measure rose 2.6 percent in December from a year ago, accelerating from November's 2.4 percent pace. " Core inflation will likely face some upward pressure in the next few months due to the ongoing pass-through of earlier cost increases," MAS and MTI said, although they added core inflation for the full year will likely be around 1.5 to 2 percent. Singapore sets monetary policy by managing the value of its dollar against an unnamed basket of currencies. At its half-yearly monetary policy statement in October, MAS retained its bias for a modest and gradual appreciation of the Singapore dollar, but said it would reduce the pace of appreciation. The local currency The central bank's next policy statement will be published in April. ((Kevin.Lim@thomsonreuters.com)(65)(6403 5663)) Keywords: SINGAPORE ECONOMY/INFLATION |

| Useful To Me Not Useful To Me | |

|

krisluke

Supreme |

21-Jan-2012 21:41

|

|

x 0

x 0 Alert Admin |

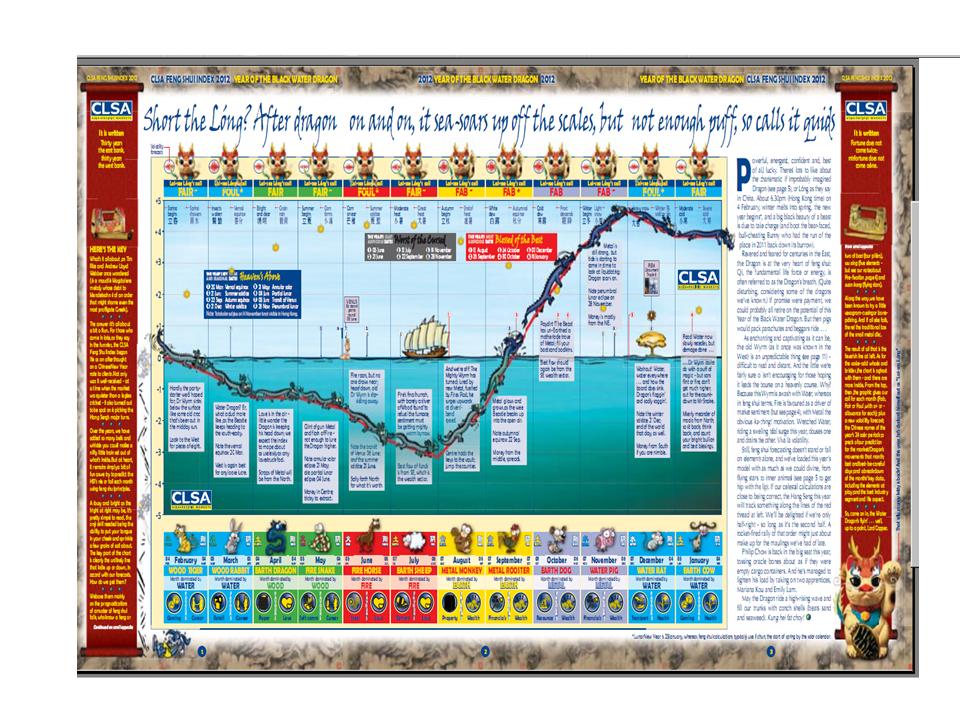

18th CLSA Fengshui Index 2012

|

| Useful To Me Not Useful To Me | |

|

tanglinboy

Elite |

16-Jan-2012 07:37

Yells: "hello!" |

|

x 0

x 0 Alert Admin |

What does it mean? Break out of the channel? |

| Useful To Me Not Useful To Me | |

|

56mimosa

Member |

15-Jan-2012 21:56

|

|

x 0

x 0 Alert Admin |

Weekly Technical Update - DJIA , STI  |

| Useful To Me Not Useful To Me | |

|

3SGreen

Member |

03-Jan-2012 21:36

|

|

x 0

x 0 Alert Admin |

Weekly Technical Update - The STI

The STI rose 42.01 points or 1.59% to 2,688.36 on the first trading day

of 2012. This is in accordance with our view on December 29 where we

stated the market is likely to stage a mini rally until January 5~6.

The rally today occurred within the downtrend channel. The bulls need a sustained violation of the downtrend resistance line for further rally to the next resistance at 2,795. Failure to surpass the downtrend resistance line calls for a pull back to 2,520. The above was extracted from Market Wizards Blogspot. For details of the STI chart and NOL / SembCorp charts, please visit the Blog: |

| Useful To Me Not Useful To Me | |