| Latest Forum Topics / Others |

|

|

DOW & STI

|

||||||||||||||

|

richtan

Supreme |

04-Sep-2009 00:37

|

|||||||||||||

|

x 0

x 0 Alert Admin |

U.S. Stocks Gain as Retail Sales Beat Forecasts, China Rallies By Lynn Thomasson Sept. 3 (Bloomberg) -- U.S. stocks rose, snapping a four- day losing streak for the Standard & Poor’s 500 Index, as chain stores from Costco Wholesale Corp. to Gap Inc. reported sales that topped projections and Chinese equities rallied the most in six months. Costco posted the steepest gain in the S&P 500, rallying as much as 9 percent, after the largest U.S. warehouse club boosted overseas revenue. Gap added 7.2 percent on August sales that fell half as much as analysts’ estimated. Bank of America Corp. and Alcoa Inc. led the Dow Jones Industrial Average higher following a 4.8 percent advance in the Shanghai Composite Index. “If China continues to grow, then it’ll become the engine for the world,” said Jonathan Vyorst, senior vice president at New York-based Paradigm Capital Management Inc., which oversees about $1.7 billion. “We may have just had a little hiccup in a stronger bull market.” The S&P 500 climbed 0.4 percent to 998.64 at 12:13 p.m. in New York after tumbling 3.3 percent over the previous three days. The Dow average added 30.46 points, or 0.3 percent, to 9,311.13. The MSCI World Index of 23 developed countries rose 0.3 percent. The S&P 500 snapped its longest losing streak since May even as jobless claims topped forecasts and a report on service industries failed to bolster speculation that the economic recovery will be strong enough to justify a six-month rally in equities. The government is scheduled to release its monthly jobs report tomorrow and may say the unemployment rate climbed to 9.5 percent in August, the highest level since 1983. Costco Jumps Costco Wholesale Corp. rose 8.4 percent to $54.92. Costco’s sales declined 2 percent, less than the 5.6 percent estimated. Gap added 7.2 percent to $21.10. The operator of Old Navy and Banana Republic clothing stores said sales at stores open at least a year fell 3 percent in August from a year earlier, less than the 6.7 percent estimated. American Eagle Outfitters Inc. jumped 8 percent to $14.66. The retailer of clothing for 15-to 25-year-olds said August sales at stores open at least a year fell 7 percent from a year earlier, less than the 8.9 percent estimated by Retail Metrics. Bank of America added 3.6 percent, while Alcoa climbed 3.7 percent after boosting its forecast for global aluminum demand because of stimulus spending in China. S&P 500 financial shares climbed 1.8 percent collectively for the best gain among 10 groups. Ciena, Del Monte Ciena Corp. added 5.6 percent to $12.96. The maker of fiber-optic network gear that provides faster data-download speeds reported a third-quarter loss of 5 cents a share. Analysts estimated a 14-cent loss, according to the average forecast in a Bloomberg survey. Del Monte Foods Co. rose 8.5 percent to $11.24. The maker of canned fruit and Meow Mix cat food reported fiscal first- quarter profit excluding some items of 30 cents a share, more than seven times the 4-cent average estimate of seven analysts in a Bloomberg survey. Chinese stocks jumped after Liu Xinhua, vice chairman of the China Securities Regulatory Commission, said authorities will promote a “stable and healthy” market, tempering concern the government wants to curb equity speculation. Ministers from the Group of 20 nations are likely to suggest the global economy is healing when they meet in London this weekend, while the European Central Bank kept interest rates at a record low today. ‘Massive’ “The contribution of China to the global growth recovery story is massive,” said Michael Ganske, head of emerging markets strategy at Commerzbank AG in London. “That’s part of why everybody is so obsessed.” The Shanghai stock index has climbed for the past three days after slumping 22 percent last month as banks reined in lending to avert asset bubbles and policy makers advised industries from steel to cement to curb overcapacity. The measure had rallied 103 percent from a November low on prospects a 4 trillion yuan ($586 billion) stimulus package and record lending would revive growth in the world’s third-largest economy. China’s stock market has foreshadowed moves in global equities the past two years. It peaked on Oct. 16, 2007, two weeks before the MSCI All-Country World Index. The Shanghai index fell 72 percent from its 2007 high and bottomed on Nov. 4, 2008, four months before the MSCI index. To contact the reporter on this story: Lynn Thomasson in New York at lthomasson@bloomberg.net. Last Updated: September 3, 2009 12:14 EDT |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

03-Sep-2009 21:17

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Stocks poised to reboundRecovery in several global markets and some better-than-expected chain-store sales readings lift futures.NEW YORK (CNNMoney.com) -- U.S. stocks appeared set for a rebound Thursday amid signs of stabilization in global markets and some encouraging retail sales activity.

Less than an hour before the opening bell, Dow Jones industrial average, Nasdaq 100 and Standard & Poor's 500 futures pointed to a higher open. Futures measure current index values against their perceived future performance and offer an indication of how markets may open when trading begins. Stocks have declined over the last three sessions amid ongoing concerns that the market rally may have outpaced any recovery. Trading activity this week has been light however as Wall Street enters a three-day holiday weekend. "It's been a slow period going into Labor Day," said Todd Leone, managing director at Cowen & Co. "I think people are waiting after the holiday to see what the market is going to do." Economy: Investors appeared encouraged by initial August sales figures published Thursday by a few chain retailers. Costco (COST, Fortune 500) and Limited Brands, which owns Bath & Body Works and other specialty chains, reported declines in sales that were better than analysts were anticipating. Sone teen retailers, including Hot Topic (HOTT), posted disappointing results. In employment news, the number of workers filing for jobless benefits declined last week, falling 4,000 to 570,000, the Labor Department said. Also on tap is a reading on service activity from the Institute for Supply Management, which is due out at 10 a.m. ET. Companies: News of corporate dealmaking also provided a lift to futures, as Japan's Dainippon Sumitomo Pharma unveiled plans to buy U.S. drugmaker Sepracor (SEPR) for about $2.6 billion, the companies said Thursday. Brazilian meat producer JBS SA will reportedly make a $2.5 billion bid for Texas' Pilgrim's Pride (PPC), according to the Wall Street Journal. In other corporate news, European antitrust regulators announced plans Thursday to investigate Oracle's (ORCL, Fortune 500) $7 billion bid for computer maker Sun Microsystems (JAVA, Fortune 500), citing competition concerns. And Google's (GOOG, Fortune 500) YouTube may offer online movie rentals for a fee, according to several news reports. The video site is said to have held talks with many studios, including Lions Gate Entertainment, Sony Pictures and Warner Bros. Warner Bros. is a unit of Time Warner (TWX, Fortune 500), as is CNNMoney.com. World markets: Stocks around the world were in recovery mode. In Asia, China stocks rose but Japan's Nikkei bucked the trend and ended the session in negative territory. Major European markets were midday Thursday. In currency trading, the dollar was lower against the euro and the yen. And oil prices recovered following Wednesday's decline, as crude gained 93 cents to $68.98 a barrel. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

|

||||||||||||||

|

el7888

Veteran |

03-Sep-2009 08:18

|

|||||||||||||

|

x 0

x 0 Alert Admin |

NEW YORK - THE United States lost fewer private sector jobs in August than in July while companies planned fewer layoffs, suggesting modest improvement in the beleaguered US labour market. Major US stock indexes slipped, though, as economists had expected the data to paint an even brighter picture of the US outlook, while US government bond prices rose. Wall Street rallied aggressively over the summer on signs that the economy was pulling out of its worst recession in 70 years, but investors have since grown more cautious. 'We're in the process of turning around, with the economy shifting from contraction to expansion, but the turn is happening slowly,' said Mike Moran, chief economist at Daiwa USA in New York. 'It's not going to be a V-shaped recovery.' Those clinging to hopes of recovery have latched onto evidence that the rate of job losses is slowing. ADP Employer Services said Wednesday that US private employers cut 298,000 jobs in August, below the 360,000 seen in July. While that was more than the 250,000 private job losses economists had expected, it still marked a shrinking from the previous month. That left investors hoping to see similar improvement reflected in the government's more comprehensive jobs report on Friday. In July, it showed the US economy shed 247,000 public and private jobs, and economists polled by Reuters expect losses to have slipped to 225,000 last month. Between January and March, US employers were cutting an average of 697,000 jobs a month, according to US data. -- REUTERS |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

el7888

Veteran |

03-Sep-2009 08:16

|

|||||||||||||

|

x 0

x 0 Alert Admin |

US sees 'first signs of growth', says Geithner

WASHINGTON: Treasury Secretary Timothy Geithner said on Wednesday that the "first signs of growth" were already being seen in the United States, which has been in recession since December 2007. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

el7888

Veteran |

03-Sep-2009 08:13

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Dow was down 4th consecutive days.

|

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

|

||||||||||||||

|

Blastoff

Elite |

03-Sep-2009 07:34

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Jittery day on Wall StreetStocks end lower, after falling sharply in the previous session, as worries about the pace of an economic recovery keep investors sidelined.

NEW YORK (CNNMoney.com) -- Stocks slipped Wednesday, ending a choppy session lower following the previous day's battering as nervous investors continued to worry that the market rally may have outpaced any recovery.

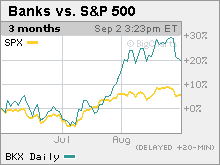

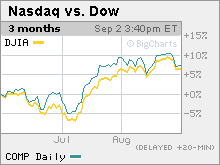

The Dow Jones industrial average (INDU) lost 30 points, or 0.3%. The S&P 500 (SPX) index slid 3 points, or 0.3%. The Nasdaq composite (COMP) managed a tiny gain of 2 points, or 0.2%. Stocks seesawed throughout the session Wednesday as investors mulled a pair of unemployment reports that signaled the pace of job cuts was moderating, ahead of Friday's bigger August jobs report. With little else on tap to provoke investors in any direction, trading remained largely rangebound. The 2 p.m. ET release of the minutes from the last Fed meeting failed to propel markets in either direction. The minutes showed the central bankers thought the economy was stabilizing, after weakening in 2008 and early 2009, and that construction was starting to pick up, which is a good sign for the housing market. The bankers also discussed the need to keep refining the Fed's so-called exit strategy after injecting billions into the financial system to help manage the meltdown. "Investors have built in a lot of the numbers we've been seeing showing economic improvement," said Haag Sherman, managing director at Salient Partners. "What they want to see now is some of that improvement manifesting in topline growth for businesses, not just cost cutting." Second-quarter earnings were generally better than expected, due to trimming costs, but revenue growth was moderate. Thursday preview: The nation's chain stores will be releasing August sales info throughout the morning. Investors will be looking to see if the stock rally and signs of recovery in the economy have had any impact on consumer spending. The Institute for Supply Management's services sector index for August is also due in the morning, along with the weekly jobless claims report. Rally running out of steam: Stocks slumped on Tuesday, with the three major gauges all losing around 2% as investors bet the six-month run has gotten ahead of the economic rebound. Since bottoming on March 9 at a 12-year low, the S&P 500 has basically been on the rise, adding 52% through Monday. Stocks saw a minor retreat in late June and early July, with the S&P 500 losing about 7% heading into the start of the second-quarter financial reporting period. But other than that small selloff, the direction has mostly been up. Reports on Tuesday showed housing and manufacturing are recovering, but investors remain worried about the labor market and how rising joblessness will impact consumer spending. Consumer spending fuels two-thirds of economic growth, and economists say any recovery will be mild without the consumer's participation. Jobs: Two reports on the labor market were released Wednesday morning, two days ahead of Friday's bigger non-farm payrolls report. Payroll services firm ADP said employers in the private sector cut 298,000 jobs from their payrolls last month after cutting a revised 360,000 in July. Economists were expecting 250,000 job cuts according to a Briefing.com survey. Separately, outplacement firm Challenger, Gray & Christmas reported 76,456 job cut announcements in August, 21% fewer than in July. Although both reports indicate the pace of job cuts has slowed, the economy is still shedding jobs. "An abatement in job losses is a far cry from a turnaround in the labor market," Sherman said. However, many economists were forecasting no abatement or improvement until later this year or early next. "The reports show that the labor market is progressing toward the recovery phase ahead of schedule," said Gregory Miller, chief economist at SunTrust Banks. He said that if the pace of the recovery in the jobs market continues - and business spending picks up - the recovery could be be stronger than current forecasts. But without those two factors, growth will remain sluggish. Other economic news: A Labor Department report showed that non-farm productivity rose at a 6.6% annual rate during the second quarter versus the initially reported 6.4% pace. That was in line with forecasts. Factory orders rose 1.3% in July, the Commerce Department reported. Orders rose a revised 0.9% in June. Economists thought orders would rise 2.2% in July. Company news: Wells Fargo (WFC, Fortune 500) is set to repay the $25 billion in bailout funds it took from the U.S. government. The bank expects to pay it back from internal funds, rather than through issuing new shares. Financial stocks as a sector retreated for the second session in a row, although the declines were fairly modest. The KBW Bank index lost nearly 8% in Tuesday and Wednesday's sessions after rallying 20% in the three months ended Aug. 31. The financial sector rallied through the summer on a mix of speculation and momentum. Pfizer (PFE, Fortune 500) will plead guilty to a criminal charge related to how it promoted now-defunct pain killer Bextra. The Dow component will pay $2.3 billion to settle charges it wrongly marketed 13 medicines. In January, Pfizer said it took the charge but didn't specify why. Shares of Sepracor (SEPR) rallied 26.5% on published reports that Japan's Dainippon Sumitomo Pharma plans to make a $2.7 billion bid for the drugmaker. Fellow Dow component Coca-Cola (KO, Fortune 500) rallied, while JPMorgan (JPM, Fortune 500), Merck (MRK, Fortune 500), Walt Disney (DIS, Fortune 500) and Home Depot (HD, Fortune 500) declined. Diversified manufacturer Danaher (DHR, Fortune 500) said it is cutting more jobs as part of its restructuring plan -- and is buying two businesses that make scientific instruments for about $1.1 billion. The company is buying the life sciences instrument business of Canadian MDS for $650 million in cash. That purchase includes a 50% stake in AB SCIEX, which makes instruments used by researchers. Danaher will also buy the rest of AB SCIEX for $450 million. Danaher shares gained 2%, while MCS (MDZ) shares gained 32%. Oil: U.S. light crude oil for October delivery settled at $68.05 a barrel on the New York Mercantile Exchange after a mixed weekly inventory report from the Energy Information Administration. The settle price was unchanged from the previous session. Oil prices have been slipping since hitting a 10-month high just below $75 a barrel late last month. In other energy sector news, BP (BP) said Wednesday that it has made a "giant" oil discovery in the Gulf of Mexico. Although the company doesn't yet know the volume of oil present, it is thought to be in excess of 3 billion barrels. Gold: COMEX gold for December delivery rose $22 to settle at $978.50 an ounce. That gave a boost to a variety of metal and mining companies, including Goldcorp (GG), Barrick Gold (ABX) and Yamana Gold (AUY). Yamana announced a quarterly dividend of a penny per share after the close of trade Tuesday. World markets: The global market selloff continued, with Asian shares slumping. The Japanese Nikkei lost 2.4%. In Europe, markets tumbled as well. Bonds and currency: Treasury prices rose, lowering the yield on the benchmark 10-year note to 3.29% from 3.36% late Tuesday. Treasury prices and yields move in opposite directions. In currency trading, the dollar fell versus the euro and the Japanese yen. Market breadth was negative. On the New York Stock Exchange, losers beat winners three to two on volume of 1.38 billion shares. On the Nasdaq, decliners narrowly edged advancers on volume of just under 2 billion shares. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

iPunter

Supreme |

02-Sep-2009 00:33

|

|||||||||||||

|

x 0

x 0 Alert Admin |

The Dow earlier 'Cheonged Arrhhh' fiercely to positive... But now it's down -168.98...  |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

01-Sep-2009 20:28

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Stocks poised to tumbleFutures sink ahead of batch of economic readings, including existing home, auto sales.NEW YORK (CNNMoney.com) -- U.S. stocks were poised to extend their previous session losses Tuesday, ahead of a slew of economic reports and amid worries about how quickly markets have risen in recent months.

At 8:12 a.m. ET, Dow Jones industrial average, Nasdaq 100 and Standard & Poor's 500 futures were modestly lower. Futures measure current index values against their perceived future performance and offer an indication of how markets may open when trading begins. Stocks tumbled Monday after another rout in Chinese stocks triggered a flight to safety worldwide. The Dow lost 0.5%, the S&P 500 fell 0.8%, while the Nasdaq composite shed about 0.9%. Investors have been bracing for a possible pullback following a surprisingly strong summer advance. And some traders suggested that the recent market movement might indicate the beginning of a selloff period, or at least sideways movement. "September historically has been a very tough month for the market," said Ryan Larson, head of equity trading at Voyager Asset Management. "I think people have in the back of their mind that it might be time to take money off the table." Economy: Clouding investors' position will be a series of economic reports due out later Tuesday, including a 10 a.m. ET report on existing home sales. A survey on nationwide manufacturing activity is due out then, as is a report on construction spending. Auto sales follow at noon ET. The most closely watched reading however, will come later this week when the government releases its monthly employment report on Friday. Companies: Stocks to watch include eBay (EBAY, Fortune 500), which has reached a deal to sell its Skype Internet phone calling unit, according to a report in the New York Times. In other corporate news, Bank of America (BAC, Fortune 500) is reportedly looking to repay a portion of the $45 billion in taxpayer aid it received from the U.S. government, according to the Wall Street Journal. World markets: Asian stocks rebounded and ended the session with modest gains. But in Europe, major markets were over 1% lower in midday trading. The dollar was little changed against the yen, while it gained against the euro. And crude prices rebounded a bit after declining more than 4% in Monday trading, gaining 7 cents to $70.03 a barrel in pre-market trading. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

|

||||||||||||||

|

Blastoff

Elite |

01-Sep-2009 08:05

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Stocks: A down day in a strong monthWall Street follows overseas markets lower as nervous investors brace for a choppy September. Disney, Marvel deal fails to improve the mood.  NEW YORK (CNNMoney.com) -- Stocks closed lower Monday after a big drop in Chinese shares heightened concerns that U.S. markets have risen too far, too fast. But August was a good month for Wall Street.

The Dow Jones industrial average (INDU) shed 47 points, or 0.5%, on the last day of the month. The S&P 500 (SPX) index lost 8 points, or 0.8%, while the Nasdaq composite (COMP) slid 20 points, or 0.9%. Despite Monday's weakness, the Dow and S&P turned in their best August performance since 2000. For the entire month, the Dow gained about 3.5% and the S&P added roughly 3.3%. The Nasdaq rose 1.5% in August. Stocks opened sharply lower Monday, following a 6% drop in the Shanghai Composite index. The selloff in China raised concerns about the global economy and prompted investors to shy away from risky assets. Oil prices sank nearly 5%, falling below $70 a barrel. That dragged on shares of oil services firms Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500). Industrial names such as Boeing (BA, Fortune 500) and Caterpillar (CAT, Fortune 500) also fell sharply. Bank stocks, which have led the market higher in recent sessions, came under pressure. Citigroup (C, Fortune 500) was down 4%, while Morgan Stanley (MS, Fortune 500) lost about 2%. Troubled insurance giant AIG (AIG, Fortune 500) fell nearly 12%. The retreat came despite a pair of big corporate mergers and a stronger-than-expected regional manufacturing report. Analysts said the market's tone is jittery heading into what is expected to be a volatile month. 'September smack down.' September is historically the worst month for stocks and market participants are bracing for a possible pullback following a surprisingly strong summer advance. Between the March 9 lows and Friday's close, the S&P 500 gained 52%, as investors responded to stronger corporate results and improved economic data. For the year, stocks, as measured by the S&P 500 index, are up nearly 13%. However, analysts say more concrete signs of economic growth are now necessary to keep the rally going. "As we head into September, the fundamentals this first week could set the tone for the entire month," said Dan Cook, senior market analyst at IG Markets. As money managers come back from vacation to an uncertain economic outlook, the market could be in for a "September smack down," he said. Among the fundamental economic indicators due out this week: The ISM index of manufacturing activity and auto sales for August come out Tuesday. On Friday, the Labor Department's monthly employment report is expected to show a slight increase in the nation's unemployment rate. Mergers and acquisitions: Walt Disney (DIS, Fortune 500) said it would acquire comic book publisher Marvel Entertainment (MVL) for approximately $4 billion. Shares of Marvel surged 25%. In other deals, oilfield services company Baker Hughes (BHI, Fortune 500) said that it would purchase rival BJ Services (BJS, Fortune 500) in a cash-and-stock deal worth approximately $5.5 billion. Economy: A report showed manufacturing activity in the Midwest was stronger than expected during August. The Institute for Supply Management's Chicago PMI rose to 50 in August from 43.4 in July. Economists surveyed by Briefing.com had forecast a reading of 47.2. The report comes one day before the ISM releases its national manufacturing report, which is forecast to rise to a level signaling expansion for the first time since January 2008. Other markets: In currency trading, the dollar fell against the euro and retreated versus the yen. Oil for October delivery was down $3.07 to settle at $69.68 a barrel in New York. Bond prices rose, with the benchmark 10-year note gaining 9/32 to 101-23/32. Its yield, which moves inversely, was 3.41%. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

31-Aug-2009 20:51

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Investors brace for rocky startFutures slip following drop in China shares. World markets stumble at start of another slow trading week.At 7:40 a.m. ET, the Dow Jones industrial average, Nasdaq 100 and Standard & Poor's 500 futures were sharply lower. Futures measure current index values against their perceived future performance and offer an indication of how markets may open when trading begins. With U.S. stocks more than 50% above their March lows, predictions of a Wall Street pullback have been getting louder. World markets: The mood in global markets was downbeat Monday, with world stock indexes falling after Shanghai stocks sank 6% to a three-month low on worries about bank lending. Elsewhere in Asia, Japan's Nikkei fell after a surge in the yen that was sparked by an election victory for the opposition Democratic Party. Major European markets were lower in morning trading. London markets were closed for a bank holiday. Overall market sluggishness ahead of next week's Labor Day holiday did not help futures for U.S. markets either, noted Dave Lutz, managing director equity trading for Stifel Nicolaus. "There is not a tremendous amount of liquidity out there today, so it's not very difficult to push things around," he said. Oil and other key commodities such as gold slipped in pre-market trading on economic growth concerns. Crude prices slid $1.64 to $71.10 a barrel. And in currency trading, the dollar rose against the euro and retreated versus the yen. Economy: The Chicago PMI, a regional reading on manufacturing, is due at 9:45 a.m. ET. The index is expected to have risen to 47.2 in August from 43.4 in July, according to a Briefing.com survey of economists. Investors are looking toward a number of economic reports later in the week. Among them: Auto sales for August on Tuesday, manufacturing activity data on Wednesday and the widely watched monthly employment report on Friday. Companies: Activity on the corporate front was also muted on Monday. The sole deal announced before the opening bell was by oilfield services company Baker Hughes (BHI, Fortune 500) which said it planned to purchase rival BJ Services (BJS, Fortune 500) in a cash-and-stock deal worth approximately $5.5 billion. First Published: August 31, 2009: 5:06 AM ET |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

iPunter

Supreme |

29-Aug-2009 11:27

|

|||||||||||||

|

x 0

x 0 Alert Admin |

The market is now at a spluttering stage... It may possibly back down a lot first before resuming the next leg up...

|

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

29-Aug-2009 10:35

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Dow snaps winning streakIntel's improved sales forecast and Dell's profit surprise encourage tech investors, but stocks struggle one day after the Dow, S&P 500 and Nasdaq hit fresh 2009 highs.The Dow Jones industrial average (INDU) lost 36 points, or 0.4%. The S&P 500 (SPX) index lost 2 points or 0.2%. The Nasdaq composite (COMP) rose 1 point, or 0.1% and managed to squeak out a fresh 2009 high, closing at the highest point since Oct. 1. All three major indexes had gained in the morning, thanks to the tech boost, but lost steam as the session wore on. Trading volume was light on the second-to-last trading session of August. Stocks managed slim gains Thursday, with the Dow stretching its winning streak to eight straight sessions, its longest run since the period ended April 10, 2007. But the gains have been tepid this week on the back of a surprisingly strong summer advance. Between the March 9 lows and Friday's close, the S&P 500 gained 52%. Intel and Dell: Chipmaker Intel (INTC, Fortune 500) boosted its revenue forecast for the third quarter, thanks to stronger PC demand, saying it expects sales of $8.8 billion to $9.2 billion. Previously, it forecast sales of $8.1 billion to $8.9 billion. Analysts surveyed by Thomson Reuters are currently forecasting sales of $8.55 billion. Although many companies reported better-than-expected earnings in the second quarter, revenue growth has been tepid with results mostly driven by cost-cutting. Intel, a Dow component, rallied 4%. PC maker Dell (DELL, Fortune 500) reported weaker sales and earnings late Thursday that beat expectations, sending shares 1.8% higher Friday. Economy: Personal income was essentially flat in July, the government reported, versus forecasts for a rise of 0.1%. Income declined 1.1% in June. But spending perked up, thanks to the government's Cash for Clunkers program. Personal spending rose 0.2% after falling 1.1% in June. The rise was in line with estimates. Consumer sentiment was revised up to 65.7 in August from an earlier reading of 63.2. Economists expected a reading of 64. In July, sentiment stood at 66. Company news: Apple (AAPL, Fortune 500) has signed a multiyear deal with China Unicom to bring the iPhone to China, the world's largest cellphone market. The deal ends months of speculation as to which Chinese firm would enable Apple's expansion into the lucrative market. Shares were little changed. Oil: U.S. light crude oil for October delivery rose 25 cents to settle at $72.74 a barrel on the New York Mercantile Exchange. World markets: European markets ended higher, while Asian markets ended mixed. Bonds: Treasury prices rose, lowering the yield on the benchmark 10-year note to 3.43% from 3.44% late Thursday. Treasury prices and yields move in opposite directions. Treasury sold $109 billion in debt this week to moderate demand. Other markets: COMEX gold for December delivery rose $11.50 to settle at $958.80 an ounce. In currency trading, the dollar fell versus the euro and gained against the Japanese yen. Market breadth was mixed. On the New York Stock Exchange, winners narrowly beat losers on volume of 1.19 billion shares. On the Nasdaq, decliners topped advancers eight to five on volume of 2.38 billion shares. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

|

||||||||||||||

|

warren

Member |

28-Aug-2009 23:46

|

|||||||||||||

|

x 0

x 0 Alert Admin |

still room for blue or non-blue to move up but small caps will play catch up buy good laggards (pay up) and wait for big bull to charge up.. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

risktaker

Supreme |

28-Aug-2009 23:20

Yells: "Sometimes you think you know, but in fact you dont" |

|||||||||||||

|

x 3

x 0 Alert Admin |

Blue chip days have passed..... Its smaller cap market atm. A market dip is expected in September mid to Early Oct. Careful. BOSAYOR HUAT AH

|

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Peg_li

Master |

28-Aug-2009 21:45

|

|||||||||||||

|

x 0

x 0 Alert Admin |

If Dow stands above 9600, next week blue chips will soar! Believe me! |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

smartrader

Elite |

28-Aug-2009 21:36

|

|||||||||||||

|

x 0

x 0 Alert Admin |

|

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

28-Aug-2009 13:56

|

|||||||||||||

|

x 0

x 0 Alert Admin |

SINGAPORE shares were lower at midday on Friday with the benchmark Straits Times Index down 3.98 points, or 0.15 per cent, to 2,638.25. About 1.6 billion shares were traded until the break. Losers beat gainers 232 to 226. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

Blastoff

Elite |

28-Aug-2009 06:35

|

|||||||||||||

|

x 0

x 0 Alert Admin |

Dow makes it 8: Best win streak since April '07Wall Street closes at fresh 2009 highs, with blue chip average managing longest winning streak in nearly 2-1/2 years. Dell (DELL, Fortune 500) reported weaker sales and earnings that beat expectations, in a profit report that was released minutes before the close of trading, ahead of schedule. Shares gained 6.5% in extended-hours trading. The Dow Jones industrial average (INDU) added 37 points, or 0.4%. The blue-chip average ended higher for the eighth session in a row, marking its longest winning streak since the period ended April 10, 2007. The S&P 500 (SPX) index gained 3 points, or 0.3%. The Nasdaq composite (COMP) edged up 3 points, or 0.2%. Stocks ended Wednesday's session with the Dow, S&P 500 and Nasdaq at their highest levels since last fall. But investors found few reasons to extend the push Thursday, despite better-than-expected readings on housing and jobless claims. Nonetheless, the early weakness disappeared as the session ran on. "There's a floor in this market and it's probably at least 5% below the recent highs," said Tyler Vernon, chief investment officer at Biltmore Capital. "There's still so much cash on the sidelines that when we see a selloff, there are retail investors and institutional investors ready to jump back in." Stocks have essentially risen for the last five months, with the S&P 500 ending Wednesday's session up 52% from the 12-year low it hit on March 9. But the pace of the run, coupled with light August trading volume, has left markets churning over the last two weeks. Better-than-expected economic news -- and a healthy infusion of monetary and fiscal stimulus -- drove the rally. But the latest batch of economic reports have had less of an impact on investor sentiment. Reports are due Friday on July personal income and spending from the Commerce Department and August consumer sentiment from the University of Michigan. GDP: Gross Domestic Product, the broadest measure of the health of the economy, declined at a 1.0% annual pace in the second quarter, unchanged from the initial reading last month. Economists thought GDP would be revised to show it slowed at a 1.5% annualized pace, according to Briefing.com estimates. In the first quarter, GDP declined at a 6.4% annualized rate. Job market: The number of Americans filing new claims for unemployment last week dipped to 570,000 from a revised 580,000 the previous week. Economists surveyed by Briefing.com thought claims would fall to 565,000. Oil: The price of oil turned higher, erasing morning lows. Oil hit 10-month highs earlier in the week. U.S. light crude oil for October delivery rose $1.06 to settle at $72.49 a barrel on the New York Mercantile Exchange. Dow components Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500) both posted modest losses after sliding 2% through the early afternoon. Financials: On the upside, shares of AIG (AIG, Fortune 500) rallied 27% after the company's CEO told Reuters that he doesn't support a fire sale of the insurer's assets. New CEO Robert Benmosche said in a year, people will say the bailed-out insurer is performing well. The stock has jumped 274% in August alone. Other financials rallying included Freddie Mac (FRE, Fortune 500), Fannie Mae (FNM, Fortune 500), Citigroup (C, Fortune 500) and Bank of America (BAC, Fortune 500) -- all of which have also received government help. The four have been responsible for much of the trading volume over the last few sessions. Also in active trading, bond insurer AMBAC Financial (ABK) jumped 28%, while CIT Group (CIT, Fortune 500) gained 12%. Company news: Dow component Boeing (BA, Fortune 500) said it will have its long-in-the works 787 Dreamliner in the air by the end of the year and that it will make deliveries in the fourth quarter of 2010. The airplane manufacturer said it will take a non-cash charge of $2.5 billion, or $2.21 per share, in the third quarter. Shares rallied 8.7%. Toll Brothers (TOL) reported a quarterly loss of $2.93 per share, versus a loss of 18 cents a year ago. The luxury homebuilder was expected to report a loss of $1.79 per share, according to Briefing.com estimates. Toll Brothers also reported a drop in revenue that nonetheless managed to top estimates. Problem banks: The number of financial institutions on the government's watch list surpassed 400 in the second quarter, the highest level in 15 years, the government said Thursday. World markets: European markets tumbled in afternoon trading, while Asian markets mostly ended higher, with the Japanese Nikkei rising 1.4%. Bonds: Treasury prices slipped, raising the yield on the benchmark 10-year note to 3.47% from 3.43% late Wednesday. Treasury prices and yields move in opposite directions. Treasury sold $42 billion of 2-year notes Tuesday, $39 billion of five-year notes Wednesday. The sale of $28 billion of 7-year notes Thursday saw a weaker-than-expected demand, but it didn't seem to impact the bond market much. Other markets: COMEX gold for December delivery rose $6 to settle at $951.80 an ounce. In currency trading, the dollar rose versus the euro and fell versus the Japanese yen. Market breadth was negative. On the New York Stock Exchange, losers beat winners eight to seven on volume of 1.16 billion shares. On the Nasdaq, decliners beat advancers by a narrow margin on volume of 2.16 billion shares. First Published: August 27, 2009: 9:47 AM ET |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

el7888

Veteran |

28-Aug-2009 06:22

|

|||||||||||||

|

x 1

x 0 Alert Admin |

US stays on recovery track after unrevised GDP drop

WASHINGTON: The US economy stayed on a path of recovery from its deep recession as output shrank at an unrevised 1.0 percent annual pace in the second quarter, the government said on Thursday. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||

|

el7888

Veteran |

28-Aug-2009 06:21

|

|||||||||||||

|

x 0

x 0 Alert Admin |

US new jobless claims fall after two weeks of increases

WASHINGTON: New claims for US unemployment benefits dipped over the past week in a sign of modest improvement in the job situation for the recession-mired economy, the Labour Department said on Thursday. |

|||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||