| Latest Forum Topics / Others |

|

|

DOW & STI

|

||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

28-Sep-2009 17:21

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks poised for mild openTrading expected to be light on Yom Kippur. Abbott Laboratories in focus after pharma deal.NEW YORK (CNNMoney.com) -- U.S. stock futures were poised for a mild start Monday, as investors digested a deal in the pharma sector. At 4:50 a.m. ET, S&P 500, Nasdaq-100 and Dow Jones industrial average futures were modestly higher. Futures measure current index values against their perceived future performance and offer an indication of how markets may open when trading begins. Stocks, which have been on the upswing for 6-1/2 months, hit some resistance last week and are at a tipping point. There's little in the way of economic and earnings news due out Monday. Trading volumes could also be dampened by the Yom Kippur holiday. Companies: Although deal news could offer a slight boost. Abbott Laboratories (ABT, Fortune 500) agreed to pay $6.6 billion in cash for the pharma unit of Belgian rival Solvay. World markets: Global stock indexes pulled back. In Asia, Japan's Nikkei tumbled 2.5%. European shares were mostly lower in morning trading, although stocks in Germany were slightly higher. |

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

lookcc

Master |

24-Sep-2009 21:24

|

|||||||||||||||||||||||||||||||||

|

x 0

x 1 Alert Admin |

dow on uptrend, think 10k mth end possible. | |||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

24-Sep-2009 21:16

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks head for modest gainsMarkets seen opening slightly higher on lower-than-expected jobless claims.NEW YORK (CNNMoney.com) -- U.S. stocks were poised to open slightly higher Thursday as a lower-than-expected report on jobless claims helped to alleviate economic jitters.

At 8:40 a.m. ET, S&P 500, Nasdaq-100 and Dow Jones industrial average futures were modestly higher. Futures measure current index values against their perceived future performance and offer an indication of how markets may open when trading begins. U.S. stocks fell Wednesday, retreating from one-year highs, after the Fed left interest rates unchanged and said the economy is improving but that ongoing job losses could dampen a recovery. "Apparently, the stock market was not as excited about Mr. [Federal Reserve Chairman Ben] Bernanke's comments today as it first appeared," wrote Dan Cook, senior market analyst for IG Markets in Chicago, in a note to investors. But David Jones, chief market strategist at IG Markets in London, believes that positive sentiment could push up stocks Thursday. "Barring any real negative surprises from today's data, it wouldn't surprise me to see it push back up," said Jones, prior to the jobless report. "10,000 is what everybody's looking for in the Dow." Wednesday's trading left the Dow Jones industrial average at 9,748. Economy: The Labor Department released its weekly figures for initial jobless claims. In the week ended Sept. 19, 530,000 people filed claims, down 21,000 from the prior week's revised figure. According to a consensus of economist opinion from Briefing.com, 550,000 people were expected to have filed jobless claims. After the opening bell, the National Association of Realtors will reveal the level of existing home sales in August. Home sales are expected to rise to an annualized rate of 5.35 million, according to a consensus of economist opinion compiled by Briefing.com. This would be up from a rate of 5.24 million the prior month. The G-20 summit in Pittsburgh begins Thursday. The Group of 20 leading developed and emerging countries will discuss the ongoing efforts to stabilize economies after the financial market meltdown. Companies: Electric car battery maker A123 Systems is due to make its trading debut on the Nasdaq after raising $380 million in an initial public offering that priced well above expectations. The company will trade under the ticker AONE (AONE). Rite Aid narrowed its net loss for the second quarter, to a loss of 14 cents per diluted share compared to the year-ago loss of 27 cents. The drugstore and consumer products chain also lowered its forecast for fiscal year 2010, "based on expectations for a continued weak economy." The company expects a sales range of $25.7 billion to $26.2 billion, with a net loss per diluted share of 48 cents to 74 cents. Rite Aid's (RAD, Fortune 500) stock price fell 10% in pre-market trading. World markets: Global stock indexes mostly declined. In Asia, most markets finished in negative territory, although Japan shares rose. Major European shares were mixed in midday trading. Money and oil: The dollar fell versus most major international currencies, including the euro and the yen, but rose against the British pound. The price of oil fell 42 cents to $68.55. |

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

el7888

Veteran |

24-Sep-2009 08:21

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Fed acknowledges recovery under way, extends stimulusWASHINGTON (AFP) - – The Federal Reserve acknowledged Wednesday the US economy is emerging from prolonged recession but maintained its near-zero interest rate and trillion-plus dollar effort to support the fragile recovery. The Federal Open Market Committee voted unanimously to maintain the federal funds rate of zero to 0.25 percent in place since last December to help jolt the economy out of its worst recession in decades. The FOMC statement said it expects that sluggish conditions will "warrant exceptionally low levels of the federal funds rate for an extended period." The statement noted however that "economic activity has picked up following its severe downturn" amid improvements in financial markets and the housing sector. The panel headed by Fed chairman Ben Bernanke also pledged to continue a program of more than one trillion dollars to help keep credit flowing to the housing market and other segments of the economy by purchasing mortgage securities and other bonds. The panel said it would maintain a plan to buy a total of 1.25 trillion dollars of government agency mortgage-backed securities and up to 200 billion dollars of other agency debt, continuing that effort into the first quarter of 2010. The statement offered few clues as to when the Fed might end its extraordinary policy, but the outlook on the economy was somewhat more upbeat than in August, when the panel said economic activity was "leveling out." The statement "reaffirms the Fed is a long way from executing an exit strategy" from its multipronged stimulus, said Sal Guatieri, economist at BMO Capital Markets. "If anything, it continues to want to prime the monetary pump by extending the mortgage purchase program a few more months." Guatieri said the central bank "is being extra cautious, it fears slipping back into recession more than rampant inflation, and if it is to err it will be on the side of excessive monetary stimulus." "The Fed seems to be saying that it is not starting to reverse any of its stimulus yet," said Robert Brusca at FAO Economics. Adolfo Laurenti, economist at Mesirow Financial said but the Fed statement "is very consistent with what they have been saying all along, particularly on resource slack and the inflation outlook." Laurenti said the FOMC fears "that that if they abruptly interrupt this process they would create some disruption in the markets." He said that while recovery is underway, this is mainly due to industries rebuilding inventories drawn down over the past year rather than strength from consumers, who appear to be still retrenching in the face of high unemployment. "Even if in the current quarter we are in line for 3.0 to 3.5 percent growth, the real question is when this inventory rebuilding will be done and when consumer demand will come back to support a more sustainable recovery," he said. US gross domestic product (GDP), the broadest measure of the economy's activity, fell at an annualized rate of 1.0 percent in the second quarter, after a 6.4-percent plunge in the January-March period. But unemployment rose in August to a 26-year high of 9.7 percent amid a growing fear joblessness may hit 10 percent before a full recovery is in gear. |

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

24-Sep-2009 07:11

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks abandon rally post-FedMarkets give up rally that left Dow, Nasdaq and S&P 500 at a nearly 1-year high, after the central bank says economy is improving and holds interest rates near zero percent.   NEW YORK (CNNMoney.com) -- Stocks tumbled Wednesday, retreating from one-year highs, as investors took a sell-the-news reaction to the Fed's decision to hold interest rates steady and keep its economic outlook relatively unchanged.

The Dow Jones industrial average (INDU) lost 81 points, or 0.8%. The Dow ended the previous session at the highest point since Oct. 6, 2008. The S&P 500 (SPX) index fell 10 points, or 1%, after ending the previous session at the highest level since Oct. 3. The Nasdaq composite (COMP) fell 14 points, or 0.7%, after finishing the previous session at the highest mark since last Sept. 26. The major indexes have repeatedly closed at near 1-year highs over the past two weeks. Stocks are likely to keep batting up against those levels until the start of the third-quarter financial reporting period late next month, said Jeff Kleintop, chief market strategist at LPL Financial. "I think there will be a lot of upside surprises," Kleintop said. "In the second-quarter, we saw better-than-expected earnings mostly on cost cutting and little revenue growth. This time we'll still see the impact of cost cutting but I think we'll also see revenue growth." He said that this fundamental improvement in Corporate America should give the rally another push. Stocks initially rallied after the Fed announcement Wednesday, but failed to hold gains as investors used the latest nearly one-year milestone for the market as a reason to sell. A milder-than-expected response to a government auction of $40 billion in five-year notes also contributed to the late declines. There wasn't much in the statement that had market-moving potential, said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc. "The outlook was consistent with the reports we've seen recently and with what the Fed has been saying." Thursday brings the weekly jobless claims report from the Labor Department and the existing home sales report from the National Association of Realtors (NAR). Also, the G-20 summit in Pittsburgh begins. The Group of 20 leading developed and emerging countries will discuss the ongoing efforts to stabilize economies after the financial market meltdown. Fed: The Federal Reserve kept the fed funds rate, a key short-term bank lending rate, at a level near zero, as expected. The announcement was made at the end of its two-day policy meeting. In the statement, the bankers said that "economic activity has picked up following its severe downturn. Conditions in financial markets have improved further, and activity in the housing sector has increased." But the bankers also noted that consumer spending has remained under pressure due to the rough jobs market and still-tight credit conditions. Last week, Federal Reserve chief Ben Bernanke said the recession was very likely over, but the labor market still has a long way to go. In light of the continued challenges, the Fed reiterated Wednesday that it was likely to keep the fed funds rate at the historic lows for the foreseeable future. Investors were also looking for more on how the Fed plans to eventually wind down programs that have pumped as much as $1 trillion into the economy to cushion the blow of the recession. To that end, the Fed said it will stretch its purchases of $1.25 trillion of mortgage-backed securities from Freddie Mac and Fannie Mae through the end of the first quarter of 2010. Previously, the program was set to end through Dec. 31. The program has so far succeeded in helping to lower mortgage rates. Shapiro said that this change was the most interesting detail in the statement. "In terms of buying mortgage-backed securities, the Fed is the only game in town and so maybe they hope that in six months, the world will have had enough time to heal so that someone else can jump in." One-year highs: The major gauges are back near levels not seen since shortly after the collapse of Lehman Bros. last September. Despite rampant calls for a fall selloff, investors have used any modest pullback this month as an opportunity to get back into stocks at a slightly lower level. Analysts say fears of having missed the boat on the rally have driven the latest spate of gains. Since bottoming at a 12-year low March 9, the S&P 500 has gained 56.8% and the Dow has gained 48.9%, as of Wednesday's close. After hitting a six-year low, the Nasdaq has gained 68%. Stocks have risen during this period on signs that the economy is slowly starting to recover, and on extraordinary amounts of fiscal and monetary stimulus. Company news: American Airlines and US Airways Group both slipped after announcing plans to raise cash, dragging down the whole airline sector. American said it has priced its offering of 48.5 million shares of common stock, as well as $400 million in 5-year notes, with both offerings due to close Monday. The two sales should give American about $770.5 million after fees and expenses. American parent AMR (AMR, Fortune 500) fell 7.8%. US Airways Group (LCC, Fortune 500) said it will sell 26.3 million shares of its common stock to Citigroup, the offering's underwriter, with the sale due to close Monday. US Airways fell 13.6%. The NYSE Arca Airline (XAL) index lost 2%. General Mills (GIS, Fortune 500) reported higher quarterly earnings that topped forecasts and boosted its full-year outlook, due to strong sales of Cheerios, Trix and its other cereal brands. Shares rose over 4%. Washington: Treasury Secretary Timothy Geithner told a House committee that U.S. economic growth appears to be picking up, but that reforms must be enacted to fix a broken system. He was testifying at a House Financial Services committee hearing on regulatory reform. At least one million people could be eligible for an additional 13 weeks of unemployment benefits, following a House of Representatives bill approved Tuesday night. The Senate is expected to take up the issue soon, although it faces some questions about how it should be funded. World markets: Global markets were mostly higher. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all ended lower, giving up gains. In Asia, the Hong Kong Hang Seng fell 0.5%, while Japan's market was closed for a holiday. Currency and commodities: The dollar held on to gains versus the yen and euro following the Fed announcement. The greenback had touched a fresh one-year low against a basket of currencies in the morning. The strength in the dollar dragged on dollar-traded oil and gold prices. U.S. light crude oil for October delivery fell $2.79 to settle at $68.97 a barrel on the New York Mercantile Exchange, dropping after a government report showed a big jump in weekly crude supplies. COMEX gold for December delivery fell $1.10 to settle at $1,014.40 an ounce. Gold closed at a record high of $1,020.20 last week. Bonds: Treasury prices rose, lowering the yield on the benchmark 10-year note to 3.41% from 3.44% late Tuesday. Treasury prices and yields move in opposite directions. Market breadth was positive. On the New York Stock Exchange, winners narrowly topped losers three to two on volume of 1.32 billion shares. On the Nasdaq, advancers topped decliners eight to five on volume of 2.72 billion shares. |

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

23-Sep-2009 09:00

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

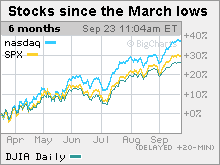

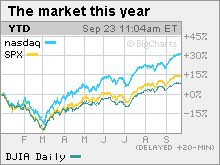

Stocks returning to highs not seen since last fallWall Street surges, with the Dow, S&P 500 and Nasdaq ending at the highest point since last fall. Financial and commodity shares lead the way. NEW YORK (CNNMoney.com) -- Stocks rallied Tuesday, finding momentum after a choppy morning, with the Dow, S&P 500 and Nasdaq all hitting one-year highs. The Dow Jones industrial average (INDU) rose 0.5% to end at 9,829.87 -- its highest point since Oct. 6, 2008. The S&P 500 (SPX) index added 0.7%, ending at 1,071.66 -- its highest point since Oct. 3, 2008. The Nasdaq composite (COMP) gained 0.4% to end at 2,146.30 -- its highest point since Sept. 26, 2008. Stocks have carved out one-year highs repeatedly over the past two weeks, with the Nasdaq ending Monday's session at its highest level since shortly after the collapse of Lehman Brothers a year ago. The slow, steady move up is creating anxiety in investors that they are missing out, which in turn is drawing more money into the market, said Larry Glazer, managing director at Mayflower Advisors. "As the equity market keeps going up, its giving investors a reason to put their money to work," he said. "The bulk of (mutual) fund flows have been fixed income driven, but they are now starting to move incrementally into equities." In the short term, investors are also attuned to the Federal Reserve meeting that concludes Wednesday and the Dow's climb toward 10,000. Although 10,000 is not a key technical level, it is a significant psychological level. Despite ongoing calls for a September slide, investors continue to use any declines as an opportunity to get back in. "The sign on a money manager's door is not 'Larry the cash hoarder,' it's 'Larry the money manager,'" said Jamie Cox, managing partner at Harris Financial Group. "And if he's sitting on a lot of cash, he's behind." Dollar impact: Stocks have also benefited from the weakness of the dollar versus other major currencies. Dollar-traded commodities and corresponding commodity stocks tend to rise when the greenback weakens. In addition, the weaker dollar impacts the stocks of companies that have a strong presence overseas. Harris said that over the last six months it's been the most volatile names, leading the charge. He said that the leadership is now shifting to so-called higher quality names, as evidenced by the recent spikes in companies such as GE (GE, Fortune 500), AT&T (T, Fortune 500) and Verizon Communications (VZ, Fortune 500). Since bottoming at a 12-year low March 9, the S&P 500 has gained 57.4% and the Dow has gained 49%, as of Monday's close. After hitting a six-year low, the Nasdaq has gained 68.5%. Stocks have risen during those 6-1/2 months on signs that the economy is starting to recover -- and due to extraordinary amounts of fiscal and monetary stimulus. On the move: Dow gainers were fairly broad based, with 20 of 30 issues rising, including Chevron (CVX, Fortune 500), Caterpillar (CAT, Fortune 500), Alcoa (AA, Fortune 500), Hewlett-Packard (HPQ, Fortune 500) and United Technologies (UTX, Fortune 500). A number of financial stocks gained too, including Dow components Bank of America (BAC, Fortune 500) and JPMorgan Chase (JPM, Fortune 500). Among other gainers, Citigroup (C, Fortune 500) rose 5% after Singapore sovereign wealth fund GIC said it sold half of its stake in the company. GIC had bought a 9% stake in Citigroup at its lows and opted to cash in on the recent market rally to earn $1.6 billion. The KBW Bank (BKX) sector index gained 2.3%. Market breadth was positive. On the New York Stock Exchange, winners beat losers seven to three on volume of 1.26 billion shares. On the Nasdaq, advancers topped decliners five to four on volume of 2.51 billion shares. Fed: The Federal Reserve concludes its two-day policy meeting Wednesday, with an announcement expected at around 2:15 p.m. ET. The central bank is expected to hold short-term interest rates unchanged at levels near zero. Investors will also look to the central bank's statement for clarity on how they see the economic outlook. Fed chief Ben Bernanke said last week that the recession is likely over, but the labor market still has a long way to go. Investors will also be looking to see if they say anything about how they plan to wind down programs that pumped trillions into the economy to cushion the blow of the recession. Also Wednesday, Treasury Secretary Timothy Geithner is set to testify before the House Financial Services committee on regulatory reform, starting at around 9:30 a.m. ET. Economy: July home prices rose 0.3%, according to a report from the Federal Housing Finance Agency (FHFA) released shortly after the start of trading. That was short of forecasts for a rise of 0.5%, according to Briefing.com survey of economists. Home prices rose a revised 0.1% in June. World markets: Global markets rallied. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all advanced. Asian markets ended higher. Commodities: The weaker dollar helped boost oil and gold prices. U.S. light crude oil for October delivery rose $1.84 to settle at $71.55 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery rose $10.60 to settle at $1,015.50 an ounce. Gold closed at a record high of $1,020.20 last week. Bonds: Treasury prices rose, lowering the yield on the benchmark 10-year note to 3.46% from 3.48% late Monday. Treasury prices and yields move in opposite directions. |

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

22-Sep-2009 07:00

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks sputter after hitting recordsWall Street churns, as the six-month market advance hits some turbulence. Dow falls after ending last week at a nearly one-year high. One year after the collapse of Lehman Brothers, these CNNMoney.com readers are repairing their portfolios. Here's what they're doing.

NEW YORK (CNNMoney.com) -- Falling commodity prices and financial shares dragged on blue chips Monday, keeping the market choppy after a more than six-month advance. The Dow Jones industrial average (INDU) lost 41 points, or 0.4%. The S&P 500 (SPX) index lost about 4 points, or 0.3%. The Nasdaq composite (COMP) gained 5 points, or 0.2%, ending at a fresh one-year high. Stocks managed to hit fresh 2009 highs Friday as investors continued to shake off calls for a September selloff. But with the major indexes up substantially since March, stocks are vulnerable to a pullback, analysts said. Since bottoming at a 12-year low March 9, the S&P 500 has gained 58% and the Dow has gained 50%, as of Friday's close. After hitting a six-year low, the Nasdaq has gained 68%. Stocks have risen during those 6-1/2 months due to slowly improving economic news and extraordinary amounts of fiscal and monetary stimulus. But analysts say that the run has been too much, too soon. "The biggest challenge in the next few weeks and month is going to be corporate earnings," said Kevin Mahn, managing director at Hennion & Walsh. He said that the profit reports as a whole are likely to be less upbeat than what some investors are looking for. "I think the disappointing earnings will be a validation that the recovery hasn't really started." This could provide the catalyst for a modest pullback of 5% to 7% that would then bring back in buyers who have been waiting for a selloff to provide an in at lower levels. This week: The Federal Reserve, meeting Tuesday and Wednesday, is likely to hold short-term interest rates steady at historic lows near zero. Last week, Fed chief Ben Bernanke said the recession is likely over but the labor market still has a long way to go. Over the weekend, President Obama said that job growth won't kick in until the end of the recovery, sometime next year. Also Tuesday, the Federal Housing Finance Agency (FHFA) releases its July home price index. Prices are expected to have risen 0.5% after rising 0.5% in June. Reports on housing and consumer sentiment are due later in the week. On Thursday, the Group of 20 leading developed and emerging countries will meet in Pittsburgh to discuss the global economy in the wake of the recession. Economy: The August index of leading economic indicators rose 0.6%, according to a report from the Conference Board released Monday. That was short of forecasts for a rise of 0.7%, according to a consensus of economists surveyed by Briefing.com. LEI rose 0.6% in July. Company news: PC maker Dell (DELL, Fortune 500) is buying Perot Systems (PER), a provider of information technology services, in a $3.9 billion all-cash deal. Dell shares fell 4% in Monday trading, while Perot Systems rose 65%. AIG (AIG, Fortune 500) shares rallied 21% after a Congressional report said the company has stabilized although it was unclear whether it would ever be able to pay back its federal bailout. AIG received as much as $182 billion from Treasury and the Federal Reserve at different points in time over the last year. Home builder Lennar (LEN) reported a wider quarterly loss Monday morning, but also said it will be profitable next year if the economy remains stable. Shares fell 3%. Among the decliners, Dow financial stocks American Express (AXP, Fortune 500), Bank of America (BAC, Fortune 500) and JPMorgan Chase (JPM, Fortune 500) all declined. Coca-Cola (KO, Fortune 500), McDonald's (MCD, Fortune 500), Caterpillar (CAT, Fortune 500), Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500) were among the Dow's other losers. Market breadth was mixed. On the New York Stock Exchange, losers beat winners two to one on volume of 1.20 billion shares. On the Nasdaq, decliners topped advancers seven to six on volume of 2.42 billion shares. Currency and commodities: The dollar gained against the yen and euro, reversing its recent declines. The rising greenback pressured dollar-traded commodities such as oil and gold. U.S. light crude oil for October delivery tumbled $2.33 to settle at $69.71 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery fell $5.40 to settle at $1004.90 an ounce. Gold hit a record high of $1,020.20 last week. Bonds: Treasury prices rose, lowering the yield on the benchmark 10-year note to 3.47% from 3.46% Friday. Treasury prices and yields move in opposite directions. World markets: Global markets tumbled. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all slipped. Asian markets ended lower. |

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

lawcheemeng

Master |

19-Sep-2009 14:01

Yells: "fly me to the mooon" |

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

ipunter.....wat u think of this qtr report.......?....my thinking is the 3rd qtr will been a better one then last....would this will be a boost to the current run?....yah me too waiting for the correction.....some how it kept runing.........is this the classic......everyone is so happy inthe party..knowing there is a time bomb...going to blow at 12 midnite...but no one has a watch........

|

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Bon3260

Supreme |

19-Sep-2009 13:29

Yells: "Ooo Ooo Aaa Aaa!" |

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

18.09.2009 (Fri) Dow index rose 36.28 pts. But STI index dropped 24.69 pts. If 21.09.2009 (Mon) Dow index drop, STI index might expect drop on 22.09.2009 (Tue). Unless Dow index has again up on Mon, and STI index might can reach 2,700 pts on Tue. Once STI index reaches 2,700 pts... Everybody'll hv confidents 2 invest... ('',) |

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

iPunter

Supreme |

19-Sep-2009 13:11

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

When the market started rallying in March 2009, people are very scared of shares because of the prevailing doom talk... Thus now more than 6 months of rally have changed the mass thinking of the majoirity... Now, talk of a confirmed market recovery and confidence is in the air all around.. And people are buying like hell after knowing many have made huge profits in the rally... So normally, the market moves quietly in the opposite direction to people's thinking...  |

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

iPunter

Supreme |

19-Sep-2009 13:01

|

|||||||||||||||||||||||||||||||||

|

x 0

x 1 Alert Admin |

Dow Cheong Aarrhhh!!!days are superb for selling into strength... Proven time and again... Very lucrative... hehehe...  |

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

cheongwee

Elite |

19-Sep-2009 11:11

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

If we can sail thro this yr end and Mar 2010 then May 2010..peacefully, i thk this recession is most likely over for good. but for current..this yr end smooth..we see rally for 1 quater 2010..hope so.. |

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

freeme

Elite |

19-Sep-2009 11:06

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

My view is pending breakout..

|

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

kellychang

Master |

19-Sep-2009 11:00

|

|||||||||||||||||||||||||||||||||

|

x 0

x 1 Alert Admin |

yes... well....i notice that now sti already dun feel like cheong even dow up 100 or 50 points.. well...double dip... well w shape... well PM Lee and Mr Tharman said so.... now i think we should really take note of this liao...

|

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

cheongwee

Elite |

19-Sep-2009 10:58

|

|||||||||||||||||||||||||||||||||

|

x 0

x 1 Alert Admin |

Oh kellychang...what is so bad abt a post...dont let that hurt u or stop u fr posting...ppl got right to rate as well....let them be...dont be sensitive..i cannot see anything bad in that...only most man cannot see eye to eye are making a fuse out of it...we woman dont do this... but pls dont stop posting good info for all benefit..becos of one guy rate bad... i was rate bad also, before, but i receive hundreds of pm..asking me for this and that buy...so??? just concentrate on doing the good,,,then all bad will be really BAD..

|

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

kellychang

Master |

19-Sep-2009 10:00

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

hi cheongwee... welcome u... i miss u so much.... well.....they rate my post as bad post.... sigh...i say so much till no saliva they also dun believe....useless...

|

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

cheongwee

Elite |

19-Sep-2009 03:26

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

When you read the newslatter below, it did not tell you how the unwind will take place...becos the author is only interested that u buy his investment product...or did he purposely leave it out... if US$ unwind stock and gold will collpase big time...this is what i fear most.. right now, American are not borrowing much, and most of the $ are borrow by invester to chase oil and stock and gold...if unwind come home to roast, we will be in trouble...

|

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

smartrader

Elite |

18-Sep-2009 21:38

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

the volume is 100 times more than usual... | |||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

smartrader

Elite |

18-Sep-2009 21:36

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

|

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

18-Sep-2009 20:48

|

|||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks poised for quiet startInvestors look to catch their breath after recent rally on Wall Street. Light trading expected in quiet day for economic news.NEW YORK (CNNMoney.com) -- Investors readied for a moderately higher open on Wall Street Friday, as optimism about the economic recovery offset concerns about the recent surge in stocks.

At 7:45 a.m. ET, the S&P 500, Nasdaq-100 and Dow Jones industrial average futures were all slightly higher after pointing narrowly lower earlier in the morning. Futures measure current index values against their perceived future performance and offer an indication of how markets may open when trading begins. Wall Street edged lower Thursday after surging to almost one-year highs earlier in the week. Trading could be volatile as Friday is the day of quadruple witching, when contracts expire on stock index futures, stock index options, stock options and single stock futures. But a lack of economic reports and the start of Rosh Hashanah -- the Jewish new year -- Friday evening could lead to lighter trading toward the end of the day. "The story today is quadruple witching, but we may not see as much volatility as usual, since most activity already took place this week," said Peter Cardillo, chief market economist with Avalon Partners. "It's going to be a sideways market today with nothing really happening. The market will take a pause with averages slipping in and out of positive territory." Economy: State employment data is due out at 10 a.m. ET. The figures come a day after the U.S. Labor Department reported an unexpected drop in the number of Americans filing new claims for unemployment in the latest week. Several encouraging reports have driven stocks back to levels not seen since the start of the credit crisis in mid-September 2008. But many market analysts believe that stocks won't be able to maintain those sharp gains for much longer. "It's an exciting time in the market, with stocks responding well to economic news, confirming that we're in growth mode now and out of the recession," said Cardillo. "But the market will pull back, with a minor correction of 6% to 8%. We're not quite ready for it just yet, but it will happen at the end of the month or in early October." Companies: Palm (PALM) reported a quarterly loss late Thursday but said its smartphone sales rose 134% to 823,000 units during the latest quarter on the back of the new Pre. World markets: Asian stocks pulled back as investors paused for breath. European indexes were slightly higher after a lower start. Other markets: The dollar rose modestly versus the euro, yen and pound. The rising greenback sent oil prices lower. U.S. light crude oil for October delivery fell 59 cents to $71.88 a barrel. Treasury prices were mixed, with the benchmark 10-year yield rising to 3.39%. |

|||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||