| Latest Forum Topics / Others |

|

|

DOW & STI

|

||||||||||||||||||||||||

|

bishan22

Elite |

17-Mar-2011 21:47

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Hope it will close higher, tomorrow all will be green green.

|

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

Blastoff

Elite |

17-Mar-2011 16:30

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Even DOW future up +76 points now. | |||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Blastoff

Elite |

17-Mar-2011 16:21

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Will STI show some form of recovery towards the closing????

|

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

bishan22

Elite |

17-Mar-2011 16:11

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Europe showing recovery.

|

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

Isolator

Supreme |

17-Mar-2011 16:01

Yells: "STI is hard landing to below 2000..." |

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Dow should rebound tonight... and if can stay above around 11650 (should be easily achieved)... there will be more upside... | |||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Blastoff

Elite |

17-Mar-2011 13:21

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Mar 17, 2011STI 1.07% lower at middaySINGAPORE shares were lower at midday on Thursday, with the benchmark Straits Times Index at 2,939.27, down 1.07 per cent, or 31.73 points. About 650 million shares exchanged hands. Losers beat gainers 369 to 56. |

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

Blastoff

Elite |

17-Mar-2011 08:15

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Rough day for stocks: S& P 500, Nasdaq erase year's gains The S& P 500 lost nearly 25 points, or 2%, Wednesday. That steep drop put the benchmark index down 0.1% for the year. The S& P 500 lost nearly 25 points, or 2%, Wednesday. That steep drop put the benchmark index down 0.1% for the year.NEW YORK (CNNMoney) -- A sell-off in U.S. stocks accelerated Wednesday, with all three major indexes ending at their lowest levels of 2011. The S& P 500 and Nasdaq composite erased their gains for the year, while the Dow is barely hanging on, up only 0.3% in 2011. Trading was extremely choppy as investors tried to sort out disappointing U.S. housing data against the backdrop of developments in Japan. It didn't help that European Union energy commissioner GŁnther Oettinger sounded a warning bell about increased risks related to Japan's crippled nuclear reactors at a meeting in Brussels. Moreover, the U.S. Embassy in Tokyo cautioned American citizens who live within 50 miles of the damaged Fukushima Daiichi nuclear plant to evacuate or take shelter indoors. " Today's not a good news day, and the market is reacting emotionally," said Fred Dickson, chief market strategist at D.A. Davidson & Co. The Dow Jones industrial average (INDU) tumbled 242 points, or 2%, with all 30 components of the blue chip index in the red. IBM (IBM, Fortune 500), General Electric (GE, Fortune 500) and American Express (AXP, Fortune 500) led the decline. The index was down almost 300 points at its low for the day. The S& P 500 (SPX) slipped 25 points, or 2%, to end at 1,256.88. The broad index closed 2010 at 1,257.64. The Nasdaq (COMP) lost 51 points, or 1.9%, to finish at 2,616.82. The tech-heavy index closed at 2,652.87 last year. Global concerns also pushed the dollar below •80 briefly, hitting •79.75, matching the record low hit in April 1995 (More on currencies). Wall Street's most widely cited measure of volatility, the VIX (VIX), surged more than 20% to 29.40. Earlier, it climbed above 30 for the first time since July. Dickson is advising his clients to get to the sidelines until the picture of the nuclear threat in Japan becomes clearer. Wednesday's declines came on the heels of a sharp sell-off in the previous session, which was dominated by worries about Japan. Japan in crisis: In a televised speech Wednesday, Japan's emperor told citizens not to give up hope as the country grapples with an epic earthquake. " It's quite rare of the emperor to appear on television, and that has made investors a little nervous," said David Jones, chief market strategist with IG Markets in London. Prior to the speech, Tokyo's Nikkei index rose 5.7%, rebounding from two days of losses that had drained more than 16% from the index. The increasingly desperate situation at Japan's nuclear plants is keeping investors on edge. Stunned by the devastation in Japan, they have been reducing their exposure to risky assets and flocking to investments that are considered safe, including U.S. Treasuries. Investors continued to buy up U.S. government debt Wednesday, sending the 10-year yield down to 3.23% from 3.32% late Tuesday. Aside from Japan, Moody's Investors Service cut Egypt's rating by one notch, further into non-investment grade quality. And late Tuesday, Moody's downgraded Portugal's credit rating from A1 to A3 -- a lower investment grade status. And Fitch downgraded Bahrain's debt to below investment grade, following a government clash with protesters. Asian markets ended higher, with the Shanghai Composite index rising 1.2% and Hong Kong's Hang Seng index edging up 0.1%. European markets closed sharply lower. The FTSE 100 dropped 0.8%, and France's CAC 40 and DAX in Germany tumbled more than 1%. (World markets) Economy: The government said new home construction fell 22.5% in February, more than economists were expecting, while the number of permits for future housing construction fell 8.2% to all all-time low. Separately, the government's Producer Price Index showed that prices at the wholesale level jumped 1.6% in February, which was much more than expected. Commodities: Oil prices -- which fell nearly 4% on Tuesday -- were higher Wednesday, as concerns about the ongoing turmoil in North Africa and the Middle East were revived. Oil for April delivery gained 80 cents, or 0.8%, to settle at $97.98 a barrel. Gold futures for April delivery climbed $3.30 to settle at $1,396.10 an ounce. |

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

Blastoff

Elite |

16-Mar-2011 17:24

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Current DOW future +26 points. | |||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Blastoff

Elite |

16-Mar-2011 17:22

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks headed higher at the openNEW YORK (CNNMoney) -- U.S. stocks were set to open slightly higher Wednesday, after Japanese stocks rebounded from a two-day skid in the aftermath of last week's earthquake. Dow Jones industrial average (INDU), S& P 500 (SPX) and Nasdaq (COMP) futures were higher ahead of the opening bell. Futures measure current index values against perceived future performance. Tokyo's Nikkei index rose 5.7% Wednesday, a bounceback from two days of losses that had drained more than 16% from the index. The partial recovery came despite more gloomy news from the crippled Fukushima Daiichi nuclear power plant, where workers trying to end the crisis were evacuated for a time because of elevated radiation levels. (CNN.com's coverage)

Other Asian markets ended higher, with the Shanghai Composite index rising 1.2% and Hong Kong's Hang Seng index edging up 0.1%. Stocks in London, Frankfurt and Paris were higher in early trading.(World markets) U.S. stocks fell sharply Tuesday as investors looked past a somewhat positive statement from the Federal Reserve to focus on the deteriorating situation at Japan's Fukushima Daiichi nuclear power plant. Investors, stunned by the devastation in Japan, had been reducing their exposure to risky assets and flocking to investments that are considered safe, including U.S. Treasuries. But the Wednesday rebound in Japanese stocks sent Treasuries lower. Economy: In the United States, investors will take in reports on the nation's housing market and inflation at the wholesale level.

Currencies and commodities: The dollar gained against the euro and the Japanese yen, but eased against the British pound. Oil prices, which fell nearly 4% on Tuesday, were higher early Wednesday as concerns the ongoing turmoil in North Africa and the Middle East were revived. Oil for April delivery gained $1.31 to $98.49 a barrel.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.33% from 3.3% late Tuesday. |

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

Blastoff

Elite |

16-Mar-2011 14:35

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Mar 16, 2011STI higher at middaySINGAPORE shares were higher at midday on Wed, with the benchmark Straits Times Index at 2,952.25, up 0.21 per cent, or 6.17points. About 712.2 million shares exchanged hands. Gainers beat losers 224 to 161. |

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

Blastoff

Elite |

16-Mar-2011 10:03

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Mar 16, 2011STI opens higherSINGAPORE shares opened higher on Wednesday, with the benchmark Straits Times Index at 2,973.77 in early trade, up 0.96 per cent, or 27.91 points. Around 111.3 million shares exchanged hands. Gainers beat losers 178 to 45. |

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

GuavaXF30

Master |

16-Mar-2011 09:17

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Sorry, I stand corrected. IT is up more than 500 pts. Hope it holds. Hope that situation for the Japanese people improves too.

|

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

GuavaXF30

Master |

16-Mar-2011 08:29

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Where dod you get 500 pts from ? I only see them up 159 pts. At the high, it was up about 171 pts. Anyway, should have some recovery but not much. Fear is still there. What is more important for the world market is DOW. Last night was down almost 300 pts but ended down just 137. At one point about half an hour before close, it was almost even, down just a few points but close lower towards the close probably due to day traders profit-taking. YES, evem in this kind of market, there are people profiteering. I just hope that they will be conscientious enough to donate their profit from yesterday to the victims in Japan....

|

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

bladez87

Master |

16-Mar-2011 08:29

Yells: "I AM PAPER TRADING AFTER LOSING 5k!" |

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

wow! strong rebound... but dropping le | |||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

zhixuen

Veteran |

16-Mar-2011 08:22

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Japan rebound 500 points this morning session.

|

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

ivanignatius

Member |

16-Mar-2011 08:18

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Surely the point here is that no-one has any idea what happens next. If the reactor blows, it'll take Japan into a serious downturn, and Japan is still 7% of world GDP so that is a disaster. In that case, load up on anything with a yield as we're heading for a deflationary world. Suggest buying perpetual bonds, Cambridge REIT. On the other hand, if Japan gets on top of this quickly, the focus will go back to all the problems in Bahrain and Libya and the spiralling oil price, and China property overheating, and inflation will be the main threat. In that case, gold is probably the best bet, as well as Japan equities. What to do? |

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

bishan22

Elite |

16-Mar-2011 07:44

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Beware, the dead cat may bounce back to trap more. Good luck.

|

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

Blastoff

Elite |

16-Mar-2011 07:43

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks claw back from steep sell-off

NEW YORK (CNNMoney) -- Stocks regained some lost ground in the last hour of trading Tuesday, but Japan's devastating earthquake and nuclear crisis still have investors on edge. All three of the major U.S. stock indexes closed down about 1.2%, after plunging much deeper earlier in the day. The Dow Jones industrial average (INDU) posted a 138-point loss, after falling 297 points earlier. All but one of the 30 Dow components were in the red. The S& P 500 (SPX) fell 15 points and the Nasdaq (COMP) dropped 34 points. A somewhat positive statement from the Federal Reserve, which would typically garner attention, failed to sway investors significantly in the afternoon.

The earthquake also damaged Japan's Fukushima Daiichi nuclear power plant, and subsequent explosions and fires there have only escalated fears about a nuclear crisis in Japan. Japan's Nikkei index (NKY) dropped 10.6% on Tuesday alone, and over the last two days, it shed 16.1% -- its worst two-day loss since 1987.

The Japanese nuclear plant that exploded Saturday is equipped with reactors designed by Dow component General Electric (GE, Fortune 500). GE shares fell 1.6% Tuesday. Insurance companies in the S& P 500 also sank, led by Aflac (AFL, Fortune 500) which tumbled 5.6%. Aflac generated about 75% of its revenue in Japan last year. Hartford Financial Services Group (HIG, Fortune 500) fell 4.6%, Prudential (PRU, Fortune 500) dropped 2% and MetLife (MET, Fortune 500) fell 3%. Netflix (NFLX) was one of the few stocks to buck the downward trend, rising 7.9% after Goldman Sachs (GS, Fortune 500) upgraded the stock earlier in the day. Meanwhile, oil prices fell nearly 4% as investors pulled back after its recent run, and gold prices fell 2.3%. The dollar rose versus the euro and the British pound, but fell slightly against the yen. Like the U.S. dollar, the yen is considered a safe-haven asset in times of economic uncertainty. The price on the benchmark 10-year U.S. Treasury rose as investors sought the safety of government debt, pushing the yield down to 3.32% from 3.35% late Monday. The Japanese government has taken steps to shore up the nation's financial system. But investors remain nervous about the short-term outlook for the world's third-largest economy.

Wall Street's most widely cited measure of volatility, the VIX (VIX) surged 14.8%. |

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

vonntan

Senior |

12-Mar-2011 22:05

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Dow Jones pulled back but rebounded from it's psychological support at 12000 points. this short term rebound could possibly bring about a small rally to STI. http://sgsharemarket.com/home/2011/03/dow-jones-profit-taking/ |

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||

|

Blastoff

Elite |

09-Mar-2011 07:59

|

|||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

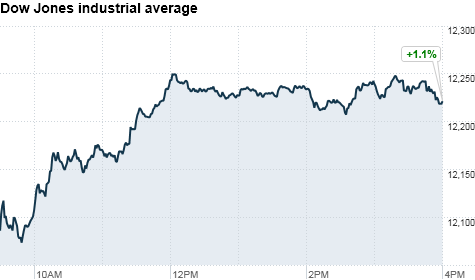

Stocks surge as banks lead gains, oil drops

NEW YORK (CNNMoney) -- U.S. stocks closed broadly higher Tuesday, led by a strong performance in the financial sector. Easing oil prices lent further support. Crude prices retreated following reports that Libyan leader Moammar Gadhafi is working to step down and exit the country safely. The Dow Jones industrial average (INDU) advanced 124 points, or 1%, to close at 12,214 the S& P 500 (SPX) added 11.7 points, or 0.9%, to 1,321.80 and the Nasdaq Composite (COMP) gained 20 points, or 0.7%, to 2,766. Bank of America (BAC, Fortune 500) sparked a rally in financial shares after CEO Brian Moynihan issued a rosy multi-year outlook at the bank's first shareholder meeting in four years. Moynihan also said the banking giant plans to increase its buyback program and may raise its dividend. Shares of Bank of America jumped 5% American Express (AXP, Fortune 500) rose 3.5% and JPMorgan Chase & Co. (JPM, Fortune 500) rose 2.7%. The jump in BofA shares is a change of pace for the Charlotte N.C.-based bank, which has seen its stock price fall 12% from a year ago despite the S& P 500 being up 16%. Shares of other retail banks were also higher, with SunTrust (STI, Fortune 500), USBancorp (USB, Fortune 500) and Hutchington Bancshares (HBAN) each rising 3% or more.

Oil prices: Investors continue to monitor developments in Libya and the civil war's effect on energy prices. Oil futures lost 53 cents or 0.5%, to $104.91 a barrel Tuesday. The retreat came a day after prices spiked to almost $107. Shares of major oil drilling and refining names also fell with Chesapeake Energy (CHK, Fortune 500) falling 2%, ConocoPhilips (COP, Fortune 500) dropping 1% andTesoro (TSO, Fortune 500) shares falling 4%. Gold also eased from the prior session's highs, with prices closing down $7.30 to $1,427.20 an ounce. Gold settled at a record high of $1,434.50 an ounce Monday, as investors sought perceived safety in the precious metal.

Over the long term, however, analysts surveyed by CNNMoney agree that the oil and gold volatility will fade as the crisis in Libya abates.

Companies: Urban Outfitters (URBN) shares plunged 17% after the retailer reported a profit late Monday that widely missed forecasts, saying its margins were hit by increased markdowns. Shares of Sprint Nextel (S, Fortune 500) jumped 5%, on reports that the company was in early negotiations with Germany's Deutsche Telekom to sell Deutsche's T-Mobile business to Sprint. Starbucks (SBUX, Fortune 500) began rolling out its new logo Tuesday, as the coffee company celebrates its 40th anniversary this week. Shares rose 1.2%. Morgan Stanley (MS, Fortune 500) is considering dropping the Smith Barney name from its brokerage business, according to sources cited in the Wall Street Journal. Shares gained 1.7%. Economy: There were no major reports on Tuesday's calendar. World markets: European stocks closed mostly flat. Britain's FTSE 100 rose less than 0.1%, and the DAX in Germany ticked up 0.1%, while France's CAC 40 added 0.6%.

Currencies: The dollar gained against the euro, the Japanese yen and the British pound. Bonds: The price on the benchmark 10-year U.S. Treasury fell, with the yield rising to 3.55%. |

|||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||