| Latest Forum Topics / Straits Times Index |

|

|

STI to cross 3000 boosted by long-term investors

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

guoyanyunyan

Elite |

21-Nov-2013 17:00

Yells: "uncertainty always exist" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Singapore upgrades growth outlook for the full year http://www.cnbc.com/id/101215927 |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

guoyanyunyan

Elite |

21-Nov-2013 16:40

Yells: "uncertainty always exist" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 1 Alert Admin |

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

21-Nov-2013 14:33

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Singapore shares fall to 1-week low on Fed stimulus withdrawal fears: Reuters Singapore shares fell for a third consecutive session to a one-week low on Thursday after minutes of the US Federal Reserve's October meeting indicated possible stimulus withdrawal at one of its next few meetings. The benchmark Straits Times Index was down 0.5 percent at 3,168.19 at 0435 GMT. The MSCI's broadest index of Asia-Pacific shares outside Japan fell 1.3 percent.... Palm oil producer Golden Agri-Resources Ltd and casino operator Genting Singapore PLC were among the worst performers on the index. Genting shares fell 2.1 percent to an almost seven-week low of S$1.42 while Golden Agri dropped as much as 4.3 percent to S$0.56. However, shares of Rex International Holding Ltd, advanced for a third consecutive session, rising 4.1 percent to S$0.64. The oil exploration company confirmed on Wednesday it acquired 10 percent stakes in two offshore licenses in Norway from North Energy ASA. On the economic front, Singapore raised its full-year growth forecast for 2013 to between 3.5 and 4.0 percent after third-quarter GDP grew 5.7 percent from a year ago, helped by further signs of a recovery in manufacturing and continued strength in services. |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

21-Nov-2013 14:22

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

SINGAPORE DAYBOOK : Fed's Bullard: December taper 'definitely on the table' [WASHINGTON] Recent US economic data is looking better and a solid jobs report for November would increase the likelihood that the Federal Reserve would start to scale back bond buying at its meeting next month, a senior Fed official said on Wednesday. " It is definitely on the table, but it is going to depend on the data," James Bullard, president of the St. Louis Federal Reserve Bank, told Bloomberg television. " A strong jobs report, I think, would increase the probability some for a December taper." Bullard is a voting member of the Fed's policy-setting committee this year. The central bank at its October policy meeting voted to keep buying bonds at an US$85 billion monthly pace, delaying a decision to start scaling back the program until it saw more evidence of a durable recovery that could sustain job creation. The Fed had stunned markets in September when it opted to keep buying bonds at the same pace, after allowing expectations to harden over the summer that it was getting set to taper. Yields on longer-term bonds, which had risen sharply on expectations of tapering, snapped back when the Fed opted to stick with the US$85 billion pace. Mr Bullard said that when the Fed does eventually decide to start reducing bond purchases, markets would be better prepared. " If we taper because we see a stronger economy, I think the markets will swallow that without a problem," he said. (Source: The Business Times) |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

21-Nov-2013 14:19

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

NEWS HEADLINES - US stocks fell on Wed after Federal Reserve meeting minutes signaled the central bank was on track to slow down its bond-buying programme. - Singapore?s domestic wholesale trade rose 5.1% in 3Q13 compared with a year ago, according to data released by the Department of Statistics Singapore. ... - The Draft Master Plan 2013 has taken a more holistic approach to developing new activity clusters and encouraging green spaces. - Keppel Corporation has secured a contract to build a repeat KFELS Super A Class harsh environment jackup rig from Ensco plc for around US$265m. - CapitaLand has unveiled plans for a quick sale of about a third of its stake in Australand Property Group that could fetch around A$434m (S$507m). - Rex International Holding has received the green light to acquire 10% stakes in two offshore licences in Norway from North Energy ASA. - SIIC Environment Holdings is buying a 50% stake in Shanghai Pucheng Thermal Power Energy for 530m yuan (S$108.2m). - Hafary Holdings is placing a big bet on Singapore's housing outlook with the opening of its new S$21.5m showroom building. |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

Peter_Pan

Supreme |

21-Nov-2013 14:17

Yells: "did you order dunkin' donuts" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

sti tio std u all dont know meh? i have sent doctor to take a look this morning...

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Wisely

Member |

21-Nov-2013 14:02

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Will i see a bloody Christmas or Merry Christmas coming Dec. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

yummygd

Supreme |

21-Nov-2013 10:56

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Sgx is a joke. Their watchdogs all sack. Ridiculous.

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

oldbirdy

Member |

21-Nov-2013 10:03

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Sti champion..... Drop more then other's .... up little |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Shirleyfong88888

Member |

21-Nov-2013 09:40

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Shares Red Red again! :( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Octavia

Elite |

21-Nov-2013 09:16

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

US stocks extended losses into the third day after Fed minutes indicated that the central bank may scale back its monetary stimulus in the coming months as the US economy improves. Ten-year Treasury yields gained 9bps to 2.8%, while gold declined and the dollar strengthened. Policy makers expect economic data to show improvements in the labour market, which will warrant trimming the pace of bond purchases in the near future. This is backed by St Louis Fed President James Bullard suggesting that tapering is on the table in Dec even as most market watchers still believes the Fed will likely delay a decision till Mar 2014. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

21-Nov-2013 07:32

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

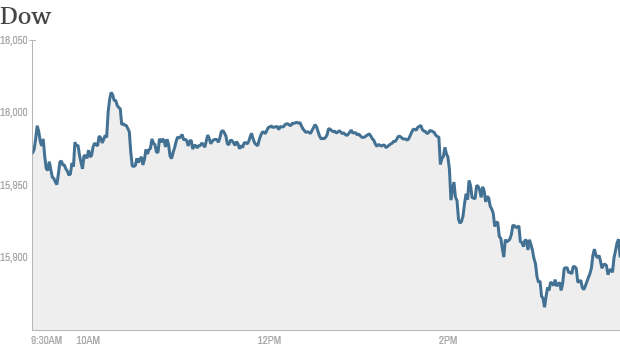

Stocks pull back after Fed minutes  Stocks finished Wednesday lower after minutes from the latest Federal Reserve meeting showed the central bank could cut back on its bond-buying program even if the job market doesn't improve dramatically.The Dow, S& P 500 and the Nasdaq all went from being up slightly to down modestly after the Fed minutes were released. The S& P 500 fell 0.4 percent to 1,781.37 at 4 p.m. in New York. The Dow Jones Industrial Average retreated 0.4 percent to 15,900.82 and has topped 16,000 for three straight days before returning below the threshold. About 5.9 billion shares changed hands on U.S. exchanges, in line with the three-month average. ?We?ve also had a very, very good year, so this may be a decision-making point for those who have enjoyed a very good return in the equity market,? Paul Mangus, head of equity strategy and research for Wells Fargo Private Bank in Charlotte, North Carolina, said in a phone interview. His firm manages $170 billion. ?The minutes were a continuation of what the FOMC has been saying all along.? The S& P 500 has rallied 25 percent in 2013, poised for its best year in a decade, following stimulus from the Fed and better-than-estimated earnings. The gauge traded for about 17 times its companies? reported earnings at its last record on Nov. 15, the highest valuation since May 2010. The Fed has long maintained that it wants to see a healthier labor market before it would pull back, or taper, its stimulus programs. But according to the minutes, the Fed suggested it could taper for reasons other than substantial improvement in the job market. Investors have been hoping that the central bank will continue its stimulus program into 2014, extending the $85 billion a month bond-buying spree that has supported the U.S. economic recovery and helped boost stock markets to record levels. Kate Warne, investment strategist with Edward Jones, said before the minutes were released that she does not expect the Fed to make any significant changes to policy until the job market improves. That said, she believes there will be market volatility between now and the end of the year and throughout the early part of 2014 as investors speculate about the timing of the Fed's next move. Warne even suggested that a full-blown correction, or 10% pullback from recent peaks, is possible given how high stocks have soared this year. On Tuesday evening, chairman Ben Bernanke made a speech that indicated Fed support was likely to continue into 2014. Although that decision won't be Bernanke's to make. His terms end early next year. President Obama has nominated Fed vice chair Janet Yellen to replace Bernanke. She just needs to be confirmed by the Senate, which seems almost certain. Related: Bernanke says the recent jobs reports were " disappointing" On the economic front, retail sales for the month of October rose more than expected. Consumer prices were relatively flat for the month, a sign that inflation remains tame. With inflation currently not a threat, Jim Baird of Plante Moran Financial Advisors said " the Fed isn't likely to feel any urgency to pull in the reins on policy." There was some not so encouraging news about housing though. The National Association of Realtors reported that existing home sales in October fell more than economists were expecting. Tapering DecisionPolicy makers expected that the economic data will show ongoing improvement in the labor market and ?thus warrant trimming the pace of purchases in coming months,? according to the record of the Federal Open Market Committee?s Oct. 29-30 gathering. Stocks pared gains earlier as Fed Bank of St. Louis President James Bullard said a reduction in bond buying is ?on the table? for the next policy meeting in December. As of yesterday, four of five investors expected the Fed to delay a decision to begin reducing its bond buying until March 2014 or later, with just 5 percent looking for a move next month, according to the latest Bloomberg Global Poll. Only one in 20 said the central bank will begin to reduce its purchases at its Dec. 17-18 meeting, according to the poll yesterday of investors, traders and analysts who are Bloomberg subscribers. |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

Peter_Pan

Supreme |

21-Nov-2013 07:26

Yells: "did you order dunkin' donuts" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

shortists huat tua tua again..? | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

WanSiTong

Master |

21-Nov-2013 07:23

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

World MarketsNorth and South American markets finished mixed as of the most recent closing prices. The IPC gained 0.37%, while the Bovespa led the S& P 500 lower. They fell 2.35% and 0.36% respectively. North and South American Indexes

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

tanglinboy

Elite |

21-Nov-2013 07:22

Yells: "hello!" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

STI has been sleeping for 2 months already. I want some action! | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Peter_Pan

Supreme |

21-Nov-2013 07:03

Yells: "did you order dunkin' donuts" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Fed's minutes no pratty? STI loves it! | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

bishan22

Elite |

21-Nov-2013 06:52

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

STI will sleep today. Yawn........... | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Peter_Pan

Supreme |

21-Nov-2013 00:26

Yells: "did you order dunkin' donuts" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Peter_Pan

Supreme |

21-Nov-2013 00:25

Yells: "did you order dunkin' donuts" |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

sti tio std | |||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

aysaibey

Member |

20-Nov-2013 22:38

Yells: "Listen to the Wind. - Kungfu Master." |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

The Chinese are bidding land at HDB flat prices. They can buy up all our flats and rebuilt at current prices. |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||||||||||||||||