| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||

|

boyikao3

Master |

06-Nov-2009 23:27

Yells: "Money or reputation ?" |

||

|

x 0

x 0 Alert Admin |

Who cares? This is a jobLESS recovery right? That's why Dow is climbing now..!

|

||

| Useful To Me Not Useful To Me | |||

|

teeth53

Supreme |

06-Nov-2009 23:26

Yells: "don't learn through life, learn to grow with life " |

||

|

x 0

x 0 Alert Admin |

http://money.cnn.com/2009/11/06/news/economy/jobs_october/index.htm?postversion=2009110609 Unemployment hits 10.2%The unemployment rate spiked to its highest level since 1983, much worse than expected as employers continue to trim jobs despite other signs of growth. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

smartrader

Elite |

06-Nov-2009 22:52

|

||

|

x 0

x 0 Alert Admin |

above 10k trading band has to be the norm when dusts settled... |

||

| Useful To Me Not Useful To Me | |||

|

bennykusman

Veteran |

06-Nov-2009 22:45

|

||

|

x 0

x 0 Alert Admin |

dow jones positive now..weird right? | ||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

06-Nov-2009 22:29

|

||

|

x 0

x 0 Alert Admin |

Job market report disappoints Wall StreetHigher-than-expected payroll losses for October could set markets lower after rally that pushed Dow back above 10,000.NEW YORK (CNNMoney.com) -- U.S. stocks were set to fall Friday after the government reported higher-than-expected payroll losses for October and an increase in unemployment. S&P 500, Nasdaq-100 and Dow Jones industrial average futures were lower, losing their lukewarm gains immediately after the payroll report. Futures measure current index values against their perceived future performance and offer an indication of how markets may open when trading begins. The blue-chip Dow reclaimed the 10,000 mark Thursday after a batch of positive economic news sparked a rally on Wall Street. Prior to the pre-market release on October payrolls, Philip Isherwood, equities strategist at Evolution Securities in London, said it would be used to gauge consumer spending for the upcoming holiday shopping season. "If you lose your job, you lose your ability and willingness to spend," he said. "The more confident people are in the employment background, the more willing they are to spend. It sets the tone, if you like." Jobs: The U.S. Labor Department reported that payrolls fell by 190,000 jobs in October and the unemployment rate rose to 10.2%. Economists had expected the economy to have lost another 175,000 jobs last month and for the unemployment rate to rise to 9.9%, according to a consensus of economists surveyed by Briefing.com. Earnings: Futures showed little reaction to an earnings report on Friday from American International Group (AIG, Fortune 500), which beat expectations. AIG reported a third-quarter net profit of $455 million, or 68 cents per share. The company reported revenue of $26 billion. The stock slipped in pre-market trading. Starbucks (SBUX, Fortune 500) posted late Thursday quarterly results that topped expectations. The coffee retailer also boosted its outlook. Fannie Mae (FNM, Fortune 500) reported a nearly $19 billion loss on bad loans and said it would have to seek more government funds. World markets: Global shares rose on the back of Wall Street's rally. Asian shares finished the session with gains and major European indexes were higher in midday trading. Money and oil: The dollar was mixed against major international currencies, edging up against the euro and the pound but slipping versus the yen. The price of oil dropped $1.03 to $78.59 a barrel in electronic trading. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

06-Nov-2009 07:48

|

||

|

x 0

x 0 Alert Admin |

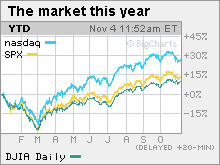

Dow reclaims 10,000Stocks surge after reports on jobless claims and productivity provide reassurance. Cisco's report and outlook helps techs. Big jobs report on tap for Friday.  The Dow Jones industrial average (INDU) gained 205 points, or 2.1%, closing at 10,005.96. The Nasdaq composite (COMP) climbed nearly 50 points, or 2.4%. Both the Dow and Nasdaq saw the biggest one-day percentage gains since July 23. The S&P 500 (SPX) gained 20 points, or 1.9%. "Today's big news was that we saw fewer claims for unemployment benefits," said Mike Stanfield, chief investment officer at VSR Financial Services. "That suggests that the underlying economics are continuing to improve." He said that this was reassuring to investors following several weeks of concerns about the pace of the recovery. It was also encouraging for investors ahead of Friday's monthly employment report. Stocks have been volatile over the past three weeks, with the S&P 500 losing 5% through Wednesday's close on worries that the rally has gotten ahead of the recovery. Between March 9 and the peak on Oct. 19, the S&P 500 gained 63%. Stocks ended mixed on Wednesday after the Federal Reserve held interest rates steady at historic lows near zero -- and said it will keep them low for an extended period. The issue for markets is whether there have been enough positive developments of late to give stocks another leg up, Stanfield said. He said he thinks that the next leg up could be delayed, and that stocks are likely to churn in a range for the next six months or so. After that point, investors will have a better sense of how the economy is doing without the benefit of trillions of dollars in government stimulus, which many credit for the 3.5% rise in GDP in the third quarter. Gains were broad based, with all 30 Dow issues rising, led by Boeing (BA, Fortune 500), Caterpillar (CAT, Fortune 500), Chevron (CVX, Fortune 500), Exxon Mobil (XOM, Fortune 500), IBM (IBM, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Procter & Gamble (PG, Fortune 500), 3M (MMM, Fortune 500), United Technologies (UTX, Fortune 500) and Wal-Mart Stores (WMT, Fortune 500). Market breadth was positive. On the New York Stock Exchange, winners beat losers four to one on volume of 1.3 billion shares. On the Nasdaq, advancers topped decliners by over three to one on volume of 2.25 billion shares. Jobs: The government's weekly jobless claims report and third-quarter productivity report showed that the pace of layoffs is slowing, but also that employers are still not creating jobs. The number of Americans filing new claims for unemployment fell to 512,000 last week from 532,000 the previous week, the lowest level since January. Economists surveyed by Briefing.com expected 522,000 claims, on average. Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 5.749 million from 5.817 million the week before. Economists thought it would fall to 5.750 million. It was the eighth decline in nine weeks. Although the decline could mean people are running out of benefits -- not that they are finding jobs. Separately, the Senate and House both voted Wednesday to extend unemployment benefits by up to 20 weeks -- and extend the homebuyer tax credit. President Obama is expected to sign the bill into law Friday. Another economic report showed that worker productivity is up, a good sign for corporate profits, but also further evidence that companies aren't hiring. Third-quarter productivity rose by 9.5% after rising 6.6% in the previous quarter. Economists thought it would fall to 6.5%. "The productivity and jobless claims show a rapidly improving economy," said Ryan Detrick, senior technical strategist at Schaeffer's Investment Research. But the key report this week is the October unemployment report from the Labor Department, due Friday, Detrick said. Due before the start of trading, employers are expected to have cut 175,000 jobs from their payrolls after eliminating 263,000 in the prior month. The unemployment rate, generated by a separate survey, is expected to rise to 9.9% from 9.8% in September. Retail: Shoppers remained cautious with their spending last month, with discounters and warehouse clubs seeing the best October retail sales. On the upside, Costco (COST, Fortune 500) said sales at stores open a year or more rose 5% during the month, topping forecasts for a rise of 4.7%. Shares gained around 1%. Gap (GPS, Fortune 500) reported sales rose a better-than-expected 4%, sending shares higher in morning trading. Shares gained 3.5%. On the downside, American Eagle Outfitters (AEO) said sales fell 5% versus forecasts for a rise of 1.7%. Shares fell 11.6% in active New York Stock Exchange trading. Company news: After the close Wednesday, Cisco Systems (CSCO, Fortune 500) reported weaker quarterly earnings and revenue that beat estimates. The company's CEO, John Chambers, said current-quarter revenue would top estimates and that business conditions had bottomed at least six months ago. Cisco shares gained 2.8% Thursday. Automaker Toyota (TM) reported a surprise quarterly profit Thursday and cut its annual loss forecast by over 50% Shares of CVS Caremark (CVS, Fortune 500) slumped 21% in active trading after the company warned that 2010 profits at Caremark, its pharmacy benefits management division, are likely to slump by 10% to 12%. The company also said Caremark's CEO is stepping down. Drugstore CVS bought Caremark in March 2007 The news overshadowed the company's bigger-than-expected jump in quarterly profit. World markets: European markets gained, reversing early losses. Asian markets tumbled. Currency and commodities: The dollar fell versus the euro and gained against the yen. U.S. light crude oil for December delivery fell 62 cents to settle at $79.78 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery climbed $2 to settle at $1,089.30 an ounce. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.53% from 3.52% Wednesday. Treasury prices and yields move in opposite directions. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

05-Nov-2009 08:13

|

||

|

x 0

x 0 Alert Admin |

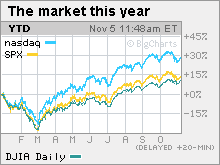

Stocks give up gains after FedWall Street abandons the rally late in the session as investors consider weak banking sector, the central bank's decision to hold rates steady. The Dow Jones industrial average (INDU) gained 30 points, or 0.3%. The Dow had gained as much as 156 points in the afternoon, but couldn't sustain those gains through the close. The S&P 500 (SPX) gained 1 point, or 0.1%, and the Nasdaq composite (COMP) lost 2 points, or 0.1%. Stocks rose through the early afternoon as investors welcomed a pair of labor market reports that signaled the pace of layoffs is slowing. But markets were volatile in the afternoon, cutting gains after the Fed announcement, recharging the advance in the late afternoon, and then abandoning most of the gains by the close. Although the market pretty much got what it wanted from the Fed, trading is typically volatile on Fed days, said Michael Sheldon, chief market strategist at RDM Financial Group. He said that the late-day selloff could be attributed to both a bearish banking call by influential analyst Meredith Whitney -- and the S&P 500's inability to hang on above a key technical level. "I think investors are getting a little nervous, and that's reflected by the fact that the market has pulled back a bit over the last few weeks," Sheldon said. Since hitting a 2009 closing high of 1097.91 on Oct. 19, the S&P 500 has lost just short of 5% as of Wednesday's close. That retreat followed a massive rally that saw the broad index gain 63% after bouncing off a 12-year low. Oil prices spiked past $80 a barrel and gold prices flirted with all-time highs just close to $1,100 an ounce. The dollar slipped versus the euro and strengthened against the yen. Bond prices slipped, boosting the corresponding yields. After the close, Cisco Systems (CSCO, Fortune 500) reported weaker quarterly earnings and revenue that beat estimates. Chief Executive John Chambers said current-quarter revenue would top estimates and that business conditions had bottomed at least six months ago. Cisco shares gained 4% in extended-hours trading. Federal Reserve: The central bank opted to hold interest rates steady at historic lows near zero, as expected, following its two-day policy meeting. In its closely watched statement, the bankers said economic activity is likely to remain weak for some time. As a result, "the Federal Reserve will continue to employ a wide range of tools to promote economic recovery and to preserve price stability." This provided some reassurance to investors who were concerned about how and when the Fed plans to unwind the billions of dollars in stimulus it has pumped into the economy in the wake of the financial crisis. "The statement was unsurprising," said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc. "It was more optimistic, but that was in line with the recent data." He said that at whatever point the Fed does began preparing to raise rates, it will begin preparing the market well in advance. Jobs: Two reports Wednesday morning suggested the pace of job losses is slowing, raising hopes that Friday's big monthly report will continue that trend. Payroll services firm ADP said Wednesday that employers in the private sector cut 203,000 jobs from their payrolls in October after cutting 227,000 in September. A consensus of economists surveyed by Briefing.com expected 198,000 job cuts. A separate report, from outplacement firm Challenger, Gray & Christmas, showed the number of planned layoffs slowed to 55,679 in October, down 16% from September. In other economic news, the Institute for Supply Management's reading on the services sector of the economy fell to 50.6 in October from 50.9 in September. Economists thought it would rise to 51.5. Company news: Time Warner (TWX, Fortune 500), the parent of CNNMoney.com, reported weaker quarterly sales and earnings that topped forecasts. The company also boosted its full-year 2009 forecast and said that its outlook has improved, although it expects to take a $100 million charge in the quarter as it restructures its Time Inc. division. Dow component Kraft Foods (KFT, Fortune 500) reported weaker quarterly earnings that topped estimates on weaker revenue that missed estimates. The company also boosted its 2009 earnings forecast and cut its revenue outlook. Shares fell 3%. Merck (MRK, Fortune 500) rallied after it said it expects annual earnings growth of nearly 10% until 2013. Comcast (CMCSA, Fortune 500) reported higher quarterly earnings that topped forecasts. Election: Investors also digested results from Tuesday's elections, including Republican victories in two highly competitive races for governor in both New Jersey and Virginia. CNN exit polls suggest that worries about the economy and growing joblessness led to the victories. World markets: European and Asian markets ended higher. Bearish news from European banks dragged on markets around the world Tuesday. But Wednesday's new was more upbeat. Société Générale, France's no. 2 bank, said earnings more than doubled from a year ago. Currency and commodities: The dollar fell versus the yen and gained against the euro. U.S. light crude oil for December delivery rose cents 80 cents to settle at $80.40 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery climbed $2.40 to settle at $1,087.30 an ounce and hit an intraday record high of $1,098.50 an ounce in electronic trading. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.49% from 3.47% Tuesday. Treasury prices and yields move in opposite directions. |

||

| Useful To Me Not Useful To Me | |||

|

smartrader

Elite |

02-Nov-2009 09:31

|

||

|

x 0

x 0 Alert Admin |

Broken Rally will be a good news in itself....irony in stock markets.. | ||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

02-Nov-2009 07:31

|

||

|

x 0

x 0 Alert Admin |

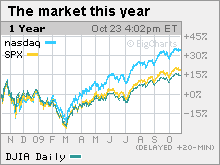

Wall Street's broken rallyA seven-month advance came to a halt in October as investors turned cautious. Can November recharge the run?  NEW YORK (CNNMoney) -- Last week's big selloff did more than just rattle investors: it put an end to a seven-month win streak that had pushed the S&P 500 more than 60% above the March lows.

While the monthly decline was small -- less than 2% -- it emerged after a tumultuous week dictated by a stronger dollar, sliding energy and financial issues, and a variety of quarterly financial reports. A stronger-than-expected rise in third-quarter GDP growth -- the strongest sign yet that the recession is over -- provoked a one-day rally and nothing more. "The underlying fundamentals look good," said David Chalupnik, head of equities at First American Funds. "But there's still a lot of worry in this market, which we saw this week." He said the week ahead should be better, but it may be muted as investors wait for Friday's big jobs report. "Right now the market is all about jobs and the consumer," said Kelli Hill, portfolio manager at Ashfield Capital Partners. "While GDP is growing, the consumer is hurting." Weak consumer confidence, sluggish spending and the still-deteriorating labor market are all creating worries about what a recovery will look like beyond the near term. Government stimulus programs such as Cash for Clunkers and the tax breaks for first-time home buyers have helped, but are short term fixes. Investors are concerned about what a recovery will look like without the help. "There's growth and resilience in productivity, but people are still losing their jobs," she said. Jobs: The state of the labor market moves front and center on Wall Street in the week ahead, with a number of reports on joblessness in October on tap. The government's non-farm payrolls report on Friday is likely the highlight. Employers are expected to have cut 166,000 from their payrolls after cutting 263,000 in September, according to a consensus of economists surveyed by Briefing.com. The unemployment rate is expected to drift ever closer to 10%, hitting 9.9%. On Wednesday, the Senate is expected to vote to extend unemployment benefits. Other economic events to keep an eye on during the week include October auto and truck sales, due Tuesday, and the weekly jobless claims and October chain store sales, both due Thursday. For a more detailed look at this week's economic news, see the chart. Federal Reserve: The central bank meets Tuesday and Wednesday with a decision on interest rates and a statement due out Wednesday afternoon. The Fed is widely expected to hold the fed funds rate, a key overnight bank lending rate, at historic lows near zero, as a means of supporting a still-tentative economic recovery. In its closely watched statement, the Fed could provide hints as to when, later this year or early next, it plans to start removing the trillions in stimulus it put into the system as the financial crisis took hold. The bankers are not expected to lift interest rates until sometime next year. Quarterly results: With roughly 344 companies, or 69% of the S&P 500 having reported results, profits are currently on track to have fallen 17.5% versus a year ago, according to Thomson Reuters. That makes the third quarter the ninth consecutive quarter of declining profits, the longest stretch since Thomson began calculating the information a decade ago. However, the percentage of companies reporting upside surprises is at an all-time high of 80%, with just 6% meeting forecasts and 13% missing forecasts. Revenue is currently on track to have fallen about 10.7% versus a year ago. Next week brings a smaller number of market-moving quarterly results, including Dow components Cisco Systems (CSCO, Fortune 500) and Kraft Foods (KFT, Fortune 500). Ford Motor (F, Fortune 500), due out Monday morning, is expected to have lost 13 cents per share, after losing $1.31 a year ago, according to Thomson Reuters estimates. Kraft Foods, due out after the close Tuesday, is expected to have earned 48 cents per share, versus 44 cents a year ago. Time Warner (TWX, Fortune 500) reports results Wednesday morning. The media company (and parent of CNNMoney.com) is expected to have earned 53 cents a share versus 30 cents a year ago. Cisco Systems, due out after the close Wednesday, is expected to have earned 31 cents per share, down from 42 cents a year ago. CIT: One cloud hanging over the markets to start the week is the bankruptcy filing of CIT Group (CIT, Fortune 500), one of the leading providers of funding for small and medium-sized business. The company said it has already worked out a reorganization plan with bondholders that it expects to speed the Chapter 11 process and reduce CIT's debt by $10 billion. But the filing means that common and preferred shareholders, which include the federal government to the tune of $2.3 billion in Troubled Asset Relief Program funds, will be wiped out. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

30-Oct-2009 07:20

|

||

|

x 0

x 0 Alert Admin |

Dow's best day in 3 monthsA better-than-expected jump in third-quarter economic growth fired up the bulls, putting the blue-chip indicator and the S&P 500 at 3-month highs.  The Dow Jones industrial average (INDU) gained just shy of 200 points, or 2%, closing at 9962.58. It was the Dow's biggest one-day percentage gain since July 15, and came exactly 80 years after Wall Street's darkest day, the Crash of 1929. The S&P 500 (SPX) index added 23 points, or 2.3%, managing its biggest one-day percentage gain since July 23. The Nasdaq composite (COMP) climbed 38 points, or 1.8%, its biggest one-day percentage gain in about a month. "The market sold off Wednesday in expectation of a lower number and today it got a positive surprise," said Karl Mills, president and chief investment officer at Jurika Mills & Keifer. "This shows the economy is continuing to recover and heal," he said. "It's just not clear what that recovery is going to look like." Gains were broad based, with 29 of 30 Dow issues rising, led by Boeing (BA, Fortune 500), Chevron (CVX, Fortune 500), Caterpillar (CAT, Fortune 500), Hewlett-Packard (HPQ, Fortune 500), IBM (IBM, Fortune 500) JPMorgan Chase (JPM, Fortune 500), 3M (MMM, Fortune 500), Travelers (TRV, Fortune 500), Wal-Mart Stores (WMT, Fortune 500) and Procter & Gamble (PG, Fortune 500), which reported a better-than-expected profit. The rally in the financial sector boosted the KBW Bank (BKX) index by 4%. Commodity shares spiked, with the Morgan Stanley Commodity (CSX, Fortune 500) index up 5%. The Dow and S&P ended three of the last four sessions lower, and the Nasdaq declined in all four, as investors turned cautious after a seven-month stock rally. Early enthusiasm about better-than-expected third-quarter profit gave way to questions about the strength of the economy, causing investors to pull back. The S&P 500 lost 5% between the rally peak on Oct. 19 and Wednesday's close. Both the better-than-expected GDP report and the preceding sharp, short selloff gave stocks a boost Thursday. Since bottoming at a 12-year low on March 9, the S&P 500 has gained 57.6% as of Thursday's close. Reports on personal income and spending, consumer sentiment and manufacturing are all due Friday morning. Dow component Chevron (CVX, Fortune 500), Duke Energy (DUK, Fortune 500), Alcatel-Lucent (ALA) and Sony (SNE) are among the corporations reporting quarterly results in the morning. Economy: GDP grew at a 3.5% annualized rate in the third quarter, the government reported Thursday. That was better than the 3.2% rate economists surveyed by Briefing.com had predicted and also marked the first quarter of growth in a year. GDP fell at a 0.7% rate in the second quarter. Some organic factors fueled the advance, including a slowdown in the pace of businesses reducing inventories. But other short-term factors played a role too, including the impact of government stimulus programs such as Cash for Clunkers. Yet some economists are concerned that when those short-term factors are removed, any recovery could be pretty flimsy. "It was a little better than expected, but you have to wonder how much of the growth was pulled from another quarter, with the stimulus driving so much of it," said Drew Kanaly, chairman and CEO at Kanaly Trust. "As you look to quarters down the road, you have to wonder how sustainable this level of GDP is," he said. "Can the government take away all the stimulus and make that handoff to the private sector?" A separate government report showed that the number of Americans filing new claims for unemployment fell to 530,000 last week from 531,000 the previous week. Economists thought it would drop to 525,000. Continuing claims, a measure of Americans receiving benefits for a week or more, fell to 5,797,000 from 5,945,000 the week before. Economists thought claims would fall to 5,905,000. Results: Exxon Mobil (XOM, Fortune 500) said quarterly earnings plunged 68% in the quarter due to lower oil and natural gas prices. The No. 1 U.S. oil company reported weaker quarterly revenue as well. Both earnings and revenue missed estimates. Shares of the Dow component ended little changed. Dow component Procter & Gamble (PG, Fortune 500) reported weaker quarterly earnings and revenue that topped estimates. The consumer products maker also boosted the low end of its fiscal 2010 earnings forecast. Shares gained 4%. With 302 companies, or 60% of the S&P 500 having already reported results, profits are on track to have fallen 17.9% from a year ago, according to the latest results from Thomson Reuters. Currency and commodities: The dollar fell versus the euro, resuming its slide after a few up days and moving closer to a 14-month low hit last week. The greenback gained versus the yen. U.S. light crude oil for December delivery rallied $2.44 to settle at $79.87 a barrel on the New York Mercantile Exchange, a gain of 3%. COMEX gold for December delivery rallied $16.60 to settle at $1,047.10 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation. World markets: Global markets were mixed. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all gained over 1%. Asian markets ended lower, with Japan's Nikkei losing 1.8%. Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.49% from 3.41% Wednesday. Treasury prices and yields move in opposite directions. Market breadth was positive. On the New York Stock Exchange, winners beat losers four to one on volume of 1.45 billion shares. On the Nasdaq, advancers topped decliners nine to four on 2.33 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

29-Oct-2009 07:06

|

||

|

x 0

x 0 Alert Admin |

Stocks slammedA surprise drop in new home sales sends market lower, with the Nasdaq sliding for the fourth straight session, as investors question strength of the economic recovery.   NEW YORK (CNNMoney.com) -- Stocks tumbled Wednesday, led by the tech-fueled Nasdaq, as a weaker-than-expected new home sales report added to questions about the strength of the economic recovery. The Dow Jones industrial average (INDU) lost 119 points, or 1.2%, to close at 9,762.69. The S&P 500 (SPX) index dropped 21 points, or 2%, to close at 1,042.63. The Nasdaq composite (COMP) tumbled 56 points, or 2.7%, to close at 2,059.61. The Dow and S&P have fallen for three of the last four sessions, and the Nasdaq for all three, as investors have turned cautious following a seven-month stock rally. Since bottoming at a 12-year low in March, the S&P 500 gained 63% through its peak on Oct. 19. But since then, it's lost 5%, as of Wednesday's close. Enthusiasm about the largely better-than-expected quarterly earnings reports has been tempered recently by concerns about the still-burgeoning economic recovery. "There's been some nervousness over the last week, and today the worry is that the weaker new home sales report means the consumer is still flat on its back," said Alan Gayle, senior investment strategist at RidgeWorth Investments. Gayle said Wednesday's action shows investors are feeling less willing to take on risk at the moment, a factor made clear by the sector movement. In particular, the weakness in areas such as retail, financial and technology - and strength in defensive sectors like consumer staples and healthcare. GDP: Thursday's reading on gross domestic product growth is the key economic event of the week. GDP is expected to have grown at a 3.2% annualized rate in the third quarter after shrinking at an 0.7% annualized rate in the second quarter. GDP has declined steadily for four straight quarters, as Americans have contended with the worst recession since the Great Depression. But the end of the recession doesn't necessarily mean a return to a period of robust growth, particularly amid rising joblessness and still-sluggish consumer spending. Government stimulus programs have played a big role in the recovery, and there are concerns about the strength of the system once that support winds down. The weekly jobless claims report from the Labor Department is also due in the morning. Housing: New home sales fell to a 402,000 unit annualized rate in September from a revised 417,000 unit annualized rate in August, the Commerce Department reported. Sales were expected to rise to a 440,000 unit annualized rate, according to a consensus of analysts surveyed by Briefing.com. Durable goods: Orders for manufactured goods meant to last three years or more rose 1% in September, after falling 2.6% in the previous month. The rise was in line with estimates. Goods excluding transportation rose 0.9% after falling 0.4% in August. Economists thought they would rise 0.7%. Another report showed that fewer metro areas reported jobless rates above 10% in September than in the previous month. GMAC seeks bailout: GMAC Financial Services is looking for a third bailout from the Treasury Department, according to a Wall Street Journal report. The lender is seeking between $2.8 billion and $5.6 billion, according to the Journal. The U.S. owns a 35% stake in GMAC and has given it $13.4 billion since December 2008. On the move: Financial and technology shares were among the hardest hit stocks Wednesday. Dow financial components American Express (AXP, Fortune 500), Bank of America (BAC, Fortune 500) and JPMorgan Chase (JPM, Fortune 500) all declined. Wells Fargo (WFC, Fortune 500), Goldman Sachs (GS, Fortune 500) and Morgan Stanley (MS, Fortune 500) were among the other big bank shares sliding. The KBW Bank index slid 3.3%. On the tech side, Intel (INTC, Fortune 500), Dell (DELL, Fortune 500), Apple (AAPL, Fortune 500) and Oracle (ORCL, Fortune 500) were among the big losers. Telecom stocks gained, including Qwest Communications (Q, Fortune 500), which posted a higher-than-expected quarterly profit and lifted its full-year earnings forecast. Shares gained 2.6%. Dow stock Verizon Communications (VZ, Fortune 500) rallied 3% after releasing more details about its iPhone challenging Droid smart phone - due for release next week. The phone uses Google's Android operating system, has a mini-keyboard and can run several applications at once. It is expected to retail for $199. Fellow Dow telecom AT&T (T, Fortune 500) also gained, rising just short of 2%. Currency and commodities: The dollar fell versus the euro, resuming its slide after a few up days and moving closer to a 14-month low hit last week. The greenback fell versus the yen. U.S. light crude oil for December delivery fell $2.09 to settle at $77.46 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery fell $4.90 to settle at $1,030.50 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation. World markets: Global markets tumbled. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all lost over 2%. Asian markets ended lower. Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.41% from 3.44% Tuesday. Treasury prices and yields move in opposite directions. Prices held on to gains after the government sold $41 billion in five-year notes. Market breadth was negative. On the New York Stock Exchange, losers beat winners nearly 9 to one on volume of 1.68 billion shares. On the Nasdaq, decliners topped advancers almost six to one on volume of 2.81 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

28-Oct-2009 07:20

|

||

|

x 0

x 0 Alert Admin |

Nasdaq slumps, Dow snaps slideA surprisingly weak reading on consumer confidence and selling in banks, techs and retailers weigh on the composite. Strong energy sector gives the blue-chip indicator a lift.   NEW YORK (CNNMoney.com) -- The Nasdaq slumped and the Dow managed a slim gain Tuesday, as investors weighed a selloff in tech, a rally in energy and a surprise drop in consumer confidence.

A better-than-expected housing market report and a strong response to the government's latest debt auction were also in the mix. The Dow Jones industrial average (INDU) gained 14 points, or 0.1%. The S&P 500 (SPX) index rose 3 points, or 0.3%. But the Nasdaq composite (COMP) lost 26 points, or 1.2%. Since peaking at rally highs a week ago, the Dow has lost 2.3%, the S&P 500 has lost 3.4% and the Nasdaq has lost 3.4% through Tuesday's close. "In the last few days, the market hasn't been looking very friendly, but the overall picture hasn't changed much," said Will Hepburn, president at Hepburn Capital Management. "The upward momentum is still significant." Hepburn said that there's still plenty of fuel to keep the advance going. He cited the improving economic and corporate news, the massive amounts of government stimulus and the trillions sitting in money-market funds in cash or low-yielding bonds. He noted that although the S&P 500 is up 57% from the March bottom, when it hit a 12-year low, the broad average is still down 32% from its all-time high of October 2007. Tuesday's market: Weakness in banks, techs, retailers and transportation stocks dragged down the Nasdaq and limited the rest of the market from moving much. Cisco (CSCO, Fortune 500), Dell (DELL, Fortune 500), Amazon.com (AMZN, Fortune 500) and Yahoo (YHOO, Fortune 500) were among the Nasdaq's biggest decliners. A rally in heavily weighted Dow components Chevron (CVX, Fortune 500), Exxon Mobil (XOM, Fortune 500), DuPont (DD, Fortune 500) and American Express (AXP, Fortune 500) kept the Dow afloat. Stocks tumbled Monday, with the Dow dropping 100 points for the second day in the row. A spiking dollar dragged on commodity shares and other stocks that benefit from a weak U.S. currency. The dollar and commodity prices remained in focus Tuesday. But investors also looked to the economic news ahead of Thursday's highly anticipated GDP (gross domestic product) growth report. Energy: Energy was the strongest sector on the day, as investors reacted to a smattering of financial reports and the impact of the U.S. dollar. European oil behemoth BP (BP) reported weaker quarterly earnings and revenue due to lower oil prices, but the results topped analysts' estimates. BP's U.S.-traded shares rose 4%. Valero Energy (VLO, Fortune 500), the largest U.S. oil refiner, reported a bigger-than-expected quarterly loss Tuesday, with fuel demand suffering amid the sluggish economy. Shares fell 4.3%. Nonetheless, a variety of energy stocks rallied, including Dow components Chevron and Exxon Mobil. Raw commodity prices were higher as well, despite a mixed dollar. Typically a weak dollar boosts dollar-traded commodity prices and a strong dollar pressures prices. Confidence: Consumer sentiment took a plunge in October, according to a Conference Board report released after the start of trading. The Consumer Confidence index fell to 47.7 in October from a revised 53.4 in September, reflecting the impact of rising joblessness and shrinking household wealth. Economists surveyed by Briefing.com thought the index would rise to 53.5. The part of the index that measures how consumers rate the present economic situation fell to 20.7 in October from 23 in September. It was the lowest level since February 1983, when it stood at 17.5. Housing: Home prices rose for the fourth month in a row in August, according to the S&P Case-Shiller Home Price index of the 20 largest metropolitan areas. Prices also showed the smallest year-over-year declines in nearly 2 years. Prices rose 1.2% in August after climbing 1.6% in July. Versus a year ago, prices were down 11.3%, but that was shy of the 11.9% drop economists were expecting. Financial results: With 230 companies, or 46%, of the S&P 500 having already reported results, profits are on track to have fallen 18.1% from a year ago, according to the latest from Thomson Reuters. Results have largely topped forecasts, with 80% of companies beating earnings' estimates, 6% meeting expectations and 13% missing forecasts. Currency and commodities: The dollar gained versus the euro, after falling to a 14-month low last week. But the greenback fell versus the yen. U.S. light crude oil for December delivery rose 87 cents to settle at $79.55 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery fell $7.40 to settle at $1,035.40 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation. World markets: Global markets were mixed. In Europe, London's FTSE 100 added 0.2%, France's CAC 40 was barely changed and Germany's DAX lost 0.1%. Asian markets ended lower. Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.47% from 3.55% late Monday. Treasury prices and yields move in opposite directions. Gains accelerated after the government saw strong demand for its sale of $44 billion in 2-year notes. Market breadth was negative. On the New York Stock Exchange, losers beat winners by almost two to one on volume of 1.39 billion shares. On the Nasdaq, decliners topped advancers by over two to one on volume of 2.42 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

27-Oct-2009 06:58

|

||

|

x 0

x 0 Alert Admin |

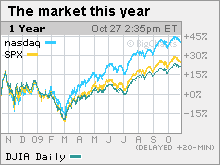

Stocks slump as dollar spikesWall Street tumbles after the Dow briefly hits the 10,000 level, as investors sell into the advance. NEW YORK (CNNMoney.com) -- Stocks tumbled Monday, retreating after the Dow crossed the 10,000 level again, as a stronger dollar battered commodity shares, and the financial sector tumbled.

The Dow Jones industrial average (INDU) lost 104 points, or 1%, after having gained as much as 100 points in the morning. The S&P 500 (SPX) index fell 13 points, or 1.2%. The Nasdaq composite (COMP) fell 13 points, or 0.6%. Stocks had risen in the morning but did an about-face as the greenback firmed up. Financials spearheaded a broad-based selloff, with 27 of 30 issues falling, including Bank of America, JPMorgan Chase (JPM, Fortune 500), Chevron (CVX, Fortune 500), Hewlett-Packard (HPQ, Fortune 500), Caterpillar (CAT, Fortune 500), Boeing (BA, Fortune 500) and United Technologies (UTX, Fortune 500). The dollar turned higher on the back of a stronger-than-expected bond auction, pressuring dollar-traded commodities and big multi-nationals that benefit from the weak dollar, said Richard Campagna, chief investment officer at 300 North Capital. The financial sector was hit by reports over the weekend that Bank of America (BAC, Fortune 500)'s plans to repay federal bailout money may have hit some roadblocks. Regional banks Fifth Third Bancorp and SunTrust were both downgraded to "sell" by Richard X. Bove of Rochdale Securities. But the selloff was also a continuation of last week, Campagna said. "I think people are very nervous short term even though the prospects are positive long term." Stocks ended last week lower, with investors not impressed by the latest spate of better-than-expected quarterly results, including Microsoft and Amazon.com late in the week. After that selloff, stocks managed to gain through most of Monday morning. But the early weakness in the financial sector grew as the session wore on, and the dollar reversed course, dragging on commodities. Since bottoming at a 12-year low on March 9, the S&P 500 has gained nearly 60%, with any modest selloff being met with renewed buying interest. But in the last week that trend has changed a little, with the buyers sitting out. "The market got a little overextended through mid-month and some people are waiting for an opportunity to jump back in," Campagna said. "Meanwhile, the short-term guys want to cash out, so you're seeing some weakness. Tuesday brings quarterly results from BP and Valero Energy and economic reports on durable goods orders, the Case Shiller Home Price index and the October Consumer Confidence index. Quarterly results: Dow component Verizon Communications (VZ, Fortune 500) said profit tumbled 30% as higher costs countered an increase in revenue thanks to its strong wireless business. Nonetheless, earnings topped expectations. The company also reported higher quarterly revenue. But shares slipped, getting dragged down in the bigger selloff. Just shy of 140 components of the S&P 500 are due to report quarterly results this week. With 206 companies, or 41% of the S&P 500 having already reported, profits are currently on track to have fallen 18.3% from a year ago, according to Thomson Reuters. So far, results have been soundly above forecasts, with 81% of companies topping expectations, 7% meeting and 12% missing. Company news: Capmark Financial, one of the country's largest commercial real estate lenders, filed for bankruptcy protection Sunday, reflecting the major problems in the business property sector. Dutch financial services firm ING (ING) said Monday it plans to spin off its insurance business and sell $11.3 billion of stock to pay back some of what it took in bailout money from the government last year. World markets: Global markets were negative. In Europe, London's FTSE 100 lost 0.8%, France's CAC 40 lost 1.2% and Germany's DAX gave up 1.3%. Asian markets ended lower. Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.54% from 3.48% late Friday. Treasury prices and yields move in opposite directions. Yields jumped as the government completed the first few auctions in a record week for debt sales. Treasury sold $30 billion in six-month notes, $29 billion in 3-month notes and $7 billion in five-month Treasury Inflation Protected Securities, or TIPS. All three saw strong demand. Currency and commodities: The dollar gained versus the euro, after falling to a 14-month low last week. The dollar gained versus the yen as well. The stronger dollar pressured dollar-traded commodity prices. U.S. light crude oil for December delivery fell $1.82 to settle at $78.68 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery fell $13.60 to settle at $1,042.80 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation. Market breadth was negative. On the New York Stock Exchange, losers beat winners thee to one on volume of 1.39 billion shares. On the Nasdaq, decliners beat advancers two to one on volume of 2.34 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

26-Oct-2009 07:01

|

||

|

x 0

x 0 Alert Admin |

Stocks: Trying to recharge the rallyBetter-than-expected earnings have reassured investors, but last week, the market stalled. Can this next big batch of results get the engine going again?   NEW YORK (CNNMoney.com) -- The quarterly reporting period has gotten off to a bang-up start, with 81% of companies outshining analysts' forecasts. But with expectations now raised, the latest crop of strong results has had little impact on the broad market.

Stocks ended last week lower, breaking a two-week run that was in itself part of a longer multi-month rally. After falling to 12-year lows in March, the S&P 500 has risen 60% as of Friday's close, thanks to a mix of signs of an improving economy and trillions in fiscal and monetary stimulus. "We've had this massive 60% rise off the March bottom because of all the excess liquidity," said Timothy Holland, co-portfolio manager of the Aston/TAMRO Diversified Equity Fund (ATLVX). "Short term I'm optimistic it can continue, but longer term, I'm wary," he said. He said that assuming third-quarter results continue to impress, the S&P 500 will have registered three straight quarters of better-than-expected earnings, even if it's mostly been driven by cost cutting and no growth in revenues. The improving quarterly results and better economic data should help stocks keep rising, he said. Also helping: ongoing impact of the government stimulus and the eventual point at which some of the trillions sitting in money market funds get put to work. "I think we're likely to build on the gains from here, but it's not going to be at the same rapid pace we've seen," said Gary Webb, CEO at Webb Financial Group. Longer term, stocks could be vulnerable, particularly amid a lack of clarity about the economic outlook a year from now. "Getting into next year, we could have problems as we move past the liquidity and cost cutting and improved sentiment that's been driving the advance," Holland said. "No one is clear on what the economy is going to look like when all that is removed." Last week stocks declined. And while the selloff was minimal, it was a surprise considering that it happened in a week that brought better-than-expected profits from Apple (AAPL, Fortune 500), Microsoft (MSFT, Fortune 500), Amazon.com (AMZN, Fortune 500), 3M (MMM, Fortune 500), AT&T (T, Fortune 500), McDonald's (MCD, Fortune 500) and others. The week ahead: The week ahead is equally busy for quarterly reports and also brings key readings on housing, jobs, income and - most notably - the first reading on whether third-quarter gross domestic product grew. GDP is expected to have risen at a 3.1% annualized rate, after sliding in the previous quarter. On the earnings front, 137 of the S&P 500 are due to report this week. While it's the biggest number yet in terms of sheer volume, it's lighter in terms of the kinds of companies that drive the market. Standouts include Dow components Verizon (VZ, Fortune 500), Procter & Gamble (PG, Fortune 500), Exxon Mobil (XOM, Fortune 500) and Chevron (CVX, Fortune 500). So far, 199 companies, or 40% of the S&P 500, have reported results. Profits are currently on track to have fallen 18.2% versus a year earlier, according to the latest from Thomson Reuters. Revenue is expected to have dropped more than 10% from a year ago. Of the companies that have reported, 81% have beat expectations, 7% have met and 12% have missed. Economy

Here's what else is on tap: Monday: No market-moving economic news is due Monday. Tuesday: Durable goods orders, from the Commerce Department report, are expected to have risen 0.7% in September, after falling 2.4% in the previous month, according to a consensus of economists surveyed by Briefing.com. Durable goods excluding transportation are expected to have risen 0.8% in September, versus no change in August. The Case Shiller Home Price index, which tracks 20 of the largest housing markets, is expected to show prices fell 11.45% in August after falling 13.3% in July. The October Consumer Confidence index, from the Conference Board, is expected to have risen to 54.0 in October from 53.1 in September. Wednesday: Sales of newly constructed homes are expected to have risen to a 440,000 unit annualized rate in September from a 429,000 unit annualized rate in August. The Commerce Department report is due out shortly after the start of trading. The government's weekly crude oil inventories report is also due in the morning. Thursday: The first reading on third-quarter Gross Domestic Product (GDP) growth is the dominant economic report of the week. Due for release in the morning, the government is expected to report that GDP grew 3.1% in the quarter after shrinking 0.7% in the previous quarter, with the economy emerging from a recession that began in December 2007. Also on tap: The weekly jobless claims report from the Department of Labor is due out in the morning. The House Oversight Committee holds a hearing on executive compensation that is likely to be widely watched on Wall Street. White House "pay czar" Kenneth Feinberg is set to testify. Last week, Feinberg called for the seven biggest recipients of federal bailout money to cut in half what they pay their top executives. Also last week, the Federal Reserve proposed a broad overhaul of pay policies at 28 of the largest U.S. banks. Thursday is also the 80-year anniversary of the 1929 market crash. Friday: September personal income and personal spending reports are due in the morning and are likely to draw considerable attention, amid worries about the hard-hit consumer. Income is expected to hold steady after rising 0.2% in the previous month. Spending is expected to have fallen 0.4% after rising 1.3% in August. Also slated: the Employment Cost Index, the revised reading on consumer sentiment from the University of Michigan and the Chicago PMI, a regional reading on manufacturing. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

22-Oct-2009 23:29

|

||

|

x 0

x 0 Alert Admin |

Stocks mixed at openInvestors continue to take a critical look at corporate results. Jobless claims jump unexpectedly. NEW YORK (CNNMoney.com) -- U.S. stocks were mixed at Thursday's open as investors continued to fret about third-quarter corporate results and reacted to a worse-than-expected job market report.

The S&P 500 and Nasdaq composite index were slightly lower and the Dow Jones industrial average was slightly higher. "I think it's positive, considering the way we closed yesterday," said Todd Leone, head trader at Cowen & Co., before the opening bell. "They took the market down hard." Having recently reached the hard-won goal of 10,000, Leone believes the Dow will probably "range around for a little while" without making dramatic moves, one way or another. Wall Street fell from its one-year high Wednesday after a late-stage selloff in banking shares, inspired by influential banking analyst Richard Bove's downgrade of Wells Fargo. The Dow and S&P 500 both fell 0.9%, while the Nasdaq lost about 0.6%. Earnings: Dow Chemical (DOW, Fortune 500) reported third-quarter earnings that beat expectations. Dow said that it earnings were 63 cents per share, or 24 cents excluding certain charges, with revenues of $12 billion. A consensus of analysts had expected revenue of $11.8 billion and earnings of 10 cents per share, according to Thomson Reuters consensus. Travelers (TRV, Fortune 500), a New York-based insurer, reported earnings of $1.65 per diluted share, with net written premiums of $5.3 billion. The company also raised its full-year guidance to a range of $5.30 to $5.50. AT&T (ATT) reported a 1% dip in overall revenue, to $30.9 billion, which included a 10% gain in wireless service revenue, the biggest portion of sales. The company said earnings slipped nearly 2% to 54 cents per share. Companies: Microsoft (MSFT, Fortune 500) launched Windows 7, which is expected to spur many PC users to change their operating system for the first time in about eight years. Economy: The government reported that initial jobless claims jumped by 11,000 to 531,000 in the week ended Oct. 17. This was more than 515,000 claims forecast by Briefing.com consensus. The government said the continuing claims fell by 98,000 to about 5.9 million. A report on Leading Economic Indicators will be released at 10 a.m. ET. Also at that time, the housing price index from the U.S. Federal Housing Finance Agency will come out. World markets: Stocks in Asia finished the session with losses, with Japan's Nikkei losing 0.6%. Major European indexes were in negative territory in midday trading. Money and oil: The dollar rose against major international currencies, including the euro, the yen and the British pound. The price of oil dropped 28 cents to $81.09 a barrel. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

22-Oct-2009 10:31

|

||

|

x 0

x 0 Alert Admin |

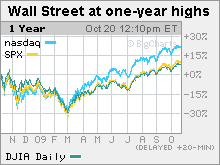

Stocks fall from one-year highsBanking, retail and technology lead a late-session selloff as investors back off after pushing the Dow, Nasdaq and S&P 500 to 2009 highs. NEW YORK (CNNMoney.com) -- Stocks tumbled Wednesday afternoon, after influential analyst Richard X. Bove downgraded his rating on Wells Fargo, sparking a steep selloff in the banking sector. The Dow Jones industrial average (INDU) lost 92 points, or 0.9%. The S&P 500 (SPX) index lost 10 points, or 0.9%. The Nasdaq composite (COMP) lost 13, or 0.6%. Stocks had rallied through the early afternoon as investors welcomed better-than-expected results from Wells Fargo, U.S. Bancorp and Morgan Stanley. But Bove's note knocked the wind out of the banking sector in the late afternoon, and that sent the rest of the market lower. Bove of Rochdale Securities cut Wells Fargo to "sell" from "neutral" following the company's better-than-expected quarterly earnings. While acknowledging the earnings surprise, Bove said essentially that the meat of the report is a lot more mixed, and that losses due to bad loans seem to be accelerating. "That was a blind side," said Joseph Saluzzi, co-head of equity trading at Themis Trading. "The downgrade in the middle of the day to a major bank caused the speculators to jump," he said. Saluzzi said that the abrupt turnaround in direction is reflective of that fact that day-traders and other Wall Streeters with a short-term focus are driving the market right now, Also rattling banks during the day: talk that the Obama administration will require executives at firms that took the most bailout money take big pay cuts. Kenneth Feinberg, the administration's "pay czar," will call for the seven biggest bailout recipients to cut total pay packages for their 25 highest paid employees by an average of 50%, a senior official confirmed to CNN Wednesday. Investors are deep in the thick of the quarterly reporting period, with 135 of the S&P 500 companies reporting results this week. After the close Wednesday, eBay (EBAY, Fortune 500) reported weaker quarterly earnings that topped estimates, but the online marketplace also issued a fourth-quarter earnings forecast at the low end of analysts' expectations. Shares fell 5% in extended-hours trading. Results: Stocks slipped Tuesday, as disappointing results from DuPont (DD, Fortune 500) and Coca-Cola (KO, Fortune 500) and a weaker-than-expected reading on the housing market caused investors to step back. But the rally found some new fuel through most of Wednesday until the 11th hour selloff. So far, 122 companies, or nearly one-fourth of the S&P 500, have reported results. Profits are currently on track to have fallen 20.9% versus a year earlier, according to the latest from Thomson Reuters. Revenue is expected to have dropped 10.4% from a year ago. The Dow 30's results are expected to be weaker, Thomson said, with profits due to slide just short of 30% versus a year ago. Banks: Wells Fargo, U.S. Bancorp and Morgan Stanley were among the companies reporting better-than-expected quarterly results Wednesday, while Boeing missed forecasts.

Wells Fargo (WFC, Fortune 500) reported a profit of $3.2 billion in its latest quarter as strength in its mortgage-lending business and other units tempered the impact of losing billions in bad loans. The bank reported higher quarterly earnings that soundly topped estimates. Shares were up moderately in the morning, but they fell 1% by the end of the day. U.S. Bancorp (USB, Fortune 500) reported weaker quarterly earnings that topped estimates thanks to strong mortgage banking revenue, up 350% from a year ago. Shares rose 6.7%. Morgan Stanley (MS, Fortune 500) reported its first quarterly profit in a year Wednesday thanks to strong fixed-income sales and trading revenue. The bank reported earnings and revenue that fell from a year ago but topped estimates. Shares gained 7%. Other results: Dow component Boeing (BA, Fortune 500) reported an earnings-per-share loss versus a year-ago profit due to expenses connected to its long-delayed 787 Dreamliner program. The aerospace developer also reported higher revenue. Both revenue and earnings results fell short of analysts' estimates. Boeing also cut its 2009 earnings outlook. Shares fell 1%. Other big Dow losers included Caterpillar (CAT, Fortune 500), IBM (IBM, Fortune 500), Merck (MRK, Fortune 500), Home Depot (HD, Fortune 500), Wal-Mart Stores (WMT, Fortune 500), JPMorgan Chase (JPM, Fortune 500), McDonald's (MCD, Fortune 500) and Pfizer (PFE, Fortune 500). After the close Tuesday, Yahoo (YHOO, Fortune 500) reported higher quarterly earnings that beat forecasts on weaker revenue that also beat forecasts. Shares climbed 2% Wednesday. In other company news, Sun Microsystems (JAVA, Fortune 500) said late Tuesday that it was cutting 3,000 jobs related to its purchase by Oracle (ORCL, Fortune 500). Its stock fell 3%. The VIX: The CBOE Volatility index, Wall Street's so-called fear gauge, hit a 14-month low of 20.10 Wednesday morning. While that would seem to be a positive, since it implies investor anxiety is waning, it also suggests that investors could be getting too complacent and that a bigger stock retreat could be in store. The VIX bounced back after the stock selloff, ending at 22.22. Labor market: All 50 states and the District of Columbia reported big jumps in unemployment rates in September versus a year ago, according to state-by-state data released Wednesday. Fifteen states reported jobless rates above 10% in September, with Michigan's unemployment topping the list at 15.3%. Economy: The economy has shown signs of stabilizing or even improving in recent weeks, according to the Fed's "beige book" of economic conditions, released in the afternoon. World markets: Global markets were mixed. In Europe, London's FTSE 100 rose 0.3%, France's CAC 40 was barely changed and Germany's DAX added 0.4%. Asian markets ended lower. Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.41% from 3.34% late Tuesday. Treasury prices and yields move in opposite directions. Currency and commodities: The euro jumped to a 14-month high against the dollar, extending its recent run against the U.S. currency. The dollar inched higher versus the yen. U.S. light crude oil for December delivery rose $2.25 to settle at $81.37 a barrel on the New York Mercantile Exchange, pushing toward a fresh one-year high. Prices rose after the latest weekly supply data from the government showed a smaller-than-expected rise in crude supplies. COMEX gold for December delivery rose $5.90 to settle at $1,064.50 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation. Market breadth was negative. On the New York Stock Exchange, losers beat winners three to two on volume of 1.4 billion shares. On the Nasdaq, decliners topped advancers by more than two to one on volume of 2.60 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

21-Oct-2009 22:19

|

||

|

x 0

x 0 Alert Admin |

Stocks try to rise on bank resultsMarkets manage a slim early advance after Morgan Stanley and Wells Fargo report better-than-expected results.The Dow Jones industrial average (INDU) gained 11 points or 0.1%. The S&P 500 (SPX) index gained 2 points, or 0.2%. The Nasdaq composite (COMP) rose 7 points or 0.2%. Stocks fell Tuesday, dragged lower by mixed quarterly reports, including disappointing results from DuPont (DD, Fortune 500) and Coca-Cola (KO, Fortune 500), and a weak reading on the housing market. But the Dow still managed to hold above the 10,000 level. David Jones, chief market strategist at IG Markets, said that the Dow, having reached 10,000, will probably keep "flipping around" at that level for the immediate future. "I think markets are obviously always a little bit nervous when we've gained as much as we have in the last few months," said Jones. "But so far, the response to the earnings has been very positive, so investors seem to think that the recovery that started in the spring is still sustainable." Earnings: Financial services firms Morgan Stanley and Wells Fargo beat analysts' forecasts with their pre-market reports on third-quarter earnings, but Boeing missed. Morgan Stanley (MS, Fortune 500) announced third-quarter revenue of $8.7 billion and earnings of 38 cents per share. Analysts had forecast revenue of $7 billion and earnings of 27 cents per share, according to a consensus of analysts surveyed by Thomson Reuters. MS stock gained 5% in the morning. Wells Fargo (WFC, Fortune 500) reported third quarter revenue of $22.5 billion and earnings of 56 cents per share. Analysts had expected revenue of $21.6 billion and earnings of 37 cents per share, according to Thomson Reuters. The stock edged up in pre-market trading. Wells stock was little changed in the morning. Boeing (BA, Fortune 500) fell short of expectations. The aircraft manufacturer reported revenue of $16.7 billion, with a loss of $2.23 per share. That's compared to the Thomson Reuters forecast of $17.2 billion in revenue with a loss of $2.12 per share. Boeing said most of the previously announced loss stemmed from research and development costs for the first three 787 flight-test airplanes. Shares fell 1% in early trading. Yahoo (YHOO, Fortune 500) posted higher quarterly earnings late Tuesday that beat forecasts on weaker revenue that also topped estimates. Yahoo's third-quarter profit tripled from last year. Companies: Other stocks to watch include Sun Microsystems (SUN, Fortune 500), which said late Tuesday that it was cutting 3,000 jobs over the next year, because of delays in its pending acquisition by Oracle (ORCL, Fortune 500). Economy: A report on U.S. state unemployment rates comes out at 10 a.m. ET. That's followed by the Fed's Beige Book of economic conditions, which is due out at 2 p.m. ET. World markets: Stocks in Asia were lackluster, with major indexes posting mild losses for the session. The mood was also downbeat in Europe, where shares edged lower in midday trading. Money and oil: The dollar was mixed versus major international currencies, edging up against the euro and the yen but slipping versus the British pound. The price of oil fell $1.16 to $77.96 a barrel, having edged off its peak of $80-plus on Tuesday. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

21-Oct-2009 08:59

|

||

|

x 0

x 0 Alert Admin |

Stocks slide, but Dow holds 10,000Mixed profit reports, a stronger dollar and a weaker housing market report are among the factors dragging on Wall Street.  NEW YORK (CNNMoney.com) -- Stocks dipped Tuesday as a stronger dollar and some disappointment about DuPont and Coca-Cola's results gave investors a reason to retreat from the recent rally. A weaker-than-expected housing market report added to the downward pressure. The Dow Jones industrial average (INDU) lost 50 points, or 0.5%, according to early tallies, after ending the previous session at the highest finish since Oct. 3, 2008. The S&P 500 (SPX) index lost 7 points, or 0.6%, after ending Monday's session at the highest point since Oct. 2, 2008. The Nasdaq composite (COMP) fell 13 points, or 0.6%, after ending the previous session at the highest point since Sept. 26, 2008. After the close, Yahoo (YHOO, Fortune 500) reported higher quarterly earnings that beat forecasts on weaker revenue that also beat forecasts. Also after the close, Sun Microsystems (SUN, Fortune 500) said it was cutting 3,000 jobs related to its purchase by Oracle (ORCL, Fortune 500). Tuesday brought quarterly results from five Dow components: DuPont, Pfizer, Coca-Cola, Caterpillar and United Technologies. Apple and Texas Instruments were among the names who reported after the closing bell Monday. Stocks gained Monday, with the Dow reclaiming 10,000 in response to a weak dollar, higher commodity prices and some earnings optimism. But the path higher over the last week has been choppy as investors have sifted through a mix of profit reports. That choppiness put pressure on stocks Tuesday. "I'm impressed we've managed to stay above 10,000 as I would have expected a bigger pullback after the last few days," said Gary Webb, CEO at Webb Financial Group. Webb said that after better-than-expected quarterly results last week from the likes of Goldman Sachs (GS, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and Intel (INTC, Fortune 500) raised investors' expectations for the reports this week. As such, even companies that have reported strong results this week have seen a mixed stock reaction. "When we see an economy that's going in the right direction at a stronger pace, we'll see a more positive reaction to the profit reports," he said. Since bottoming at a 12-year low on March 9, the S&P 500 has risen more than 62%. But some worry that the Dow's move above 10,000 has been a ruse and that investors should beware. "We've traded up on some optimism about the global recovery and there are technical reasons why the market could keep rallying," said Brian Battle, vice president at Performance Trust Capital Partners. However, he said that a lot of the improvement in the economy and profits is being clouded by the enormous amounts of government stimulus. "Once you remove all the stimulus, the underlying economy is not as strong." Wednesday brings reports on crude inventories, state-by-state unemployment rates and the release of the Fed's "beige book" report on the economy. Fed Governor Daniel Tarullo speaks about the economy in Washington D.C., starting around 1 p.m. ET. Wells Fargo (WFC, Fortune 500) and eBay (EBAY, Fortune 500) are the biggest companies reporting quarterly results Wednesday. Blue-chip results: DuPont (DD, Fortune 500) reported higher third-quarter earnings that topped estimates on weaker revenue that missed forecasts. The chemical maker used cost-cutting to temper the impact of weak sales and surging crude and energy costs. Looking forward, DuPont narrowed its full-year earnings guidance to a per-share range of between $1.95 and $2.05. Shares fell 2.2%. Coca-Cola (KO, Fortune 500) reported modestly higher third-quarter earnings that met estimates on weaker revenue that missed forecasts. The company was hit by weaker sales amid the impact of the recession. Coke was also hurt by the comparatively strong dollar, at least versus a year ago. A stronger dollar hurts companies like Coke because the majority of its profit comes from sales overseas. Those sales then convert back to less U.S. dollars. Coke shares fell 1.3%. Pfizer (PFE, Fortune 500) reported higher third-quarter earnings and weaker revenue, both of which surpassed analysts' estimates. Although the maker of Lipitor, Viagra and other drugs saw a decline in sales due to the recession, that was offset by aggressive cost-cutting. Shares fell 0.3%. Caterpillar (CAT, Fortune 500) reported weaker quarterly earnings that topped estimates on weaker quarterly revenue that missed forecasts, due to lower sales. But the heavy-equipment maker also lifted its full-year earnings forecast to a range of $1.10 to $1.30 per share, versus its previous guidance of 95 cents per share. Caterpillar gained 3%. United Technologies (UTX, Fortune 500) reported weaker quarterly earnings and revenue that missed estimates. Looking forward, the company said it expects earnings of $4.10 per share, in the middle of its previous guidance. UTX runs jet engine maker Pratt & Whitney, Otis elevators and other businesses. Shares were little changed. Tech results: Late Monday, Apple (AAPL, Fortune 500) reported fiscal fourth-quarter revenue and earnings that easily beat analysts' estimates, thanks to strong sales of Macintosh computers and iPhones. Apple also forecast current-quarter revenue in a range of between $11.3 billion and $11.6 billion, versus the $11.4 billion analysts are forecasting. Apple forecast earnings per share of between $1.70 and $1.78 versus the $1.91 analysts' predict. Shares rallied as high as $204 in after-hours trading Monday, an all-time high. On Tuesday, shares gained $8.90 or 4.7% to close at $200.60 per share. Texas Instruments (TXN, Fortune 500) also reported results after the close Monday. The chipmaker reported weaker quarterly earnings and revenue that topped estimates. Shares gained 0.6% Tuesday. Other results: Boston Scientific (BSX, Fortune 500) reported a profit versus a year-ago loss, but results were shy of forecasts. The medical device maker also cut its full-year 2009 earnings forecast due to slower sales of defibrillators and other products. Shares fell 15.7% in very active NYSE trading. Economy: Housing starts rose to a 590,000 unit annual rate in September, versus a revised 587,000 in the previous month. Economists expected starts at a 610,000 unit annual rate. Building permits, a measure of builder confidence, rose to a 573,000 unit annualized rate in September from a revised 580,000 unit annualized rate in August. Economists surveyed by Briefing.com thought starts would rose to 595,000 unit annualized rate. The Producer Price Index (PPI), a measure of wholesale inflation. PPI slipped 0.6% in September versus forecasts for a flat reading. PPI rose 1.7% in the previous month. The core PPI, which strips out volatile food and energy prices, fell 0.1% after rising 0.2% in the previous month. Economists thought it would rise 0.1%. World markets: Global markets were mixed. In Europe, London's FTSE 100 lost 0.7%, France's CAC 40 lost 0.5% and Germany's DAX lost 0.7%. Asian markets ended lower. Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.34% from 3.38% late Monday. Treasury prices and yields move in opposite directions. Currency and commodities: The dollar gained versus the euro and the yen, reversing the direction after its recent slide versus a basket of currencies. U.S. light crude oil for November delivery fell 52 cents to settle at $79.09 a barrel on the New York Mercantile Exchange, after ending the previous session at the highest level in a year. COMEX gold for December delivery rose 50 cents to settle at $1,058.60 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation. Market breadth was negative. On the New York Stock Exchange, losers topped winners two to one on volume of 1.24 billion shares. On the Nasdaq, decliners topped advancers by over two to one on volume of 2.15 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

goondusamy

Veteran |

20-Oct-2009 07:54

Yells: "BonBon is half beast half human " |

||

|

x 0

x 0 Alert Admin |

Eh Blastie, why u post the same thing in 2 different thread? Desperate to gain Supreme status? |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

20-Oct-2009 07:03

|

||

|

x 0

x 0 Alert Admin |

Dow 10,000: Stocks at one-year highsWall Street recharges the rally as investors gear up for a big week for corporate results. Apple delivers strong results after the close. The Dow Jones industrial average (INDU) rose 96 points, or 1%, ending at 10092.19. That was its highest close since Oct. 3, 2008, when it closed at 10,325.38. The S&P 500 (SPX) index gained 10 points, or 0.9%, to close at 1097.90, ending at its highest point since Oct. 2, 2008. The Nasdaq composite (COMP) advanced 19 points, or 0.9%, and closed at its highest point since Sept. 26, 2008. "This is a liquidity driven rally and the market is probably going to keep moving higher over the next few weeks," said Tyler Vernon, chief investment officer at Biltmore Capital. "People are feeling optimistic," he said. "They're getting sick of getting zero percent returns on money market accounts and are wanting to take on more risk." After the close Apple (AAPL, Fortune 500) reported fiscal fourth-quarter revenue and earnings that easily beat Wall Street analysts' estimates, thanks to strong sales of Macintosh computers and iPhones. Shares surged as much as 9% in extended-hours trading, hitting an all-time high of $204 per share, before pulling back to trade at $202.19. Apple's forecast for the current quarter sets revenue in a range between $11.3 billion to $11.6 billion, encompassing the $11.4 billion analysts are predicting. Apple also predicted earnings per share of between $1.70 and $1.78 versus the $1.91 analysts' predict. Texas Instruments (TXN, Fortune 500) also reported results after the close. The chipmaker reported weaker quarterly earnings and revenue that topped estimates. Shares gained 3% in after-hours trading. Stocks have been essentially on the rise for more than seven months. Since closing at a more than 12-year low on March 9, the S&P 500 has gained 62.3% as of Monday's close. Monday's market: Gains were broad-based Monday, with 25 of 30 Dow issues rising, led by 3M (MMM, Fortune 500), American Express (AXP, Fortune 500), Chevron (CVX, Fortune 500), Caterpillar (CAT, Fortune 500), United Technologies (UTX, Fortune 500), Wal-Mart Stores (WMT, Fortune 500), Exxon Mobil (XOM, Fortune 500) and IBM (IBM, Fortune 500). Wall Street advanced last week after Goldman Sachs (GS, Fortune 500), Intel (INTC, Fortune 500), Google (GOOG, Fortune 500) and others reported better-than-expected quarterly results, raising bets that profits are starting to recover along with the economy. That perception helped the Dow push past the 10,000 level, a key psychological point. However, Bank of America (BAC, Fortune 500)'s big quarterly loss and General Electric (GE, Fortune 500)'s weaker revenue, both reported Friday, reminded investors that any profit recovery is going to be choppy. Results: About 135 companies, or 27% of the S&P 500, will report results this week, including 13 Dow components. The standouts are: American Express, 3M, Microsoft (MSFT, Fortune 500), Merck (MRK, Fortune 500), Pfizer (PFE, Fortune 500), and Coca-Cola (KO, Fortune 500). Other big names due to report include: Yahoo (YHOO, Fortune 500), Wells Fargo (WFC, Fortune 500), Amazon.com (AMZN, Fortune 500) and eBay (EBAY, Fortune 500). Earnings have been beating forecasts around 79% of the time, while revenues have been topping expectations around 61% of the time, according to Thomson Reuters. S&P 500 earnings are expected to have fallen around 23% in the third quarter from a year ago, according to the latest from earnings tracker Thomson Reuters. That would make the third quarter the ninth consecutive loser for the S&P 500, the worst streak since Thomson began tracking results a decade ago. World markets: Global markets were mixed. In Europe, London's FTSE 100 rose 1.8%, France's CAC 40 added 1.7% and Germany's DAX gained 1.9%. Asian markets ended mixed, with the Hong Kong Hang Seng lower and the Japanese Nikkei higher. Bonds: Treasury prices gained, lowering the yield on the 10-year note to 3.38% from 3.41% late Friday. Treasury prices and yields move in opposite directions. Prices were volatile after the latest government debt auctions saw strong demand. Treasury sold $30 billion in 3-month bills and $30 billion in 6-month bills. Currency and commodities: The dollar tumbled versus the euro and the yen, resuming its recent slide versus a basket of currencies. U.S. light crude oil for November delivery rose $1.08 to settle at $79.61 a barrel on the New York Mercantile Exchange, after ending the previous session at the highest level in a year. COMEX gold for December delivery rose $6.50 to settle at $1,058.10 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation. Market breadth was positive and trading volume was fairly light. On the New York Stock Exchange, winners beat losers seven to three on volume of 1.08 billion shares. On the Nasdaq, advancers topped decliners eight to five on volume of 1.99 billion shares. |

||

| Useful To Me Not Useful To Me | |||