| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||

|

Blastoff

Elite |

26-Nov-2009 08:41

|

||

|

x 0

x 0 Alert Admin |

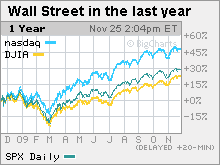

Dow hits new '09 high ahead of holidayBoth the blue-chip average and the S&P 500 end at 13-month peaks after reports show improvement in labor market, new home sales and consumer spending. All financial markets are closed Thursday for the holiday, while Friday brings an abbreviated session for stocks. Some market pros will make a five-day weekend of the period. The Dow Jones industrial average (INDU) rose 31 points, or 0.3%, ending at a fresh 13-month high. The S&P 500 (SPX) rose 5 points, or 0.5%, and also finished at a fresh 13-month high. The Nasdaq composite (COMP) rose 7 points, or 0.3%, closing short of a 13-month high. Because of the holiday, all the week's news was jammed into the first three days, with nothing on the docket Friday. The combination of a three-day onslaught of economic news and some pre-holiday wariness was keeping investors from moving much Wednesday, said John Canally, economist at LPL Financial. "If we had gotten the jobless claims report only, stocks would be up more," said Canally. "But investors are in a data overload this week and it's only going to continue next week." Next week is a doozy, with reports due on manufacturing, auto sales, housing and the labor market. Monday's trading will be heavily influenced by how the holiday shopping period kicks off. Black Friday, the day after Thanksgiving, and Cyber Monday, the first work day after the holiday, are critical barometers for the health of the consumer at the start of the biggest shopping period of the year. Most economists believe the recession is over. Yet rampant joblessness, lower household income and personal wealth, and a still-tight lending environment should temper the benefit of retailers' discounts. Overall spending is expected to hit a range of between 1% lower than a year ago and 1.5% higher. Canally said that it's likely to hit the higher end of that range. Wall Street ended Tuesday's choppy session lower as investors retreated from 13-month highs hit the day before. Jobs: New claims for unemployment posted a surprisingly large tumble last week, falling to 466,000, a 14-month low. Economists surveyed by Briefing.com thought claims would drop to 500,000 from a revised 501,000 the previous week. Continuing claims, a measure of Americans who have been receiving benefits for a week or more, fell to 5,423,000 from a revised 5,613,000 the previous week. Economists expected 5,565,000 claims. New home sales: Sales rose to a 430,000 annual unit rate in October from a 405,000 unit rate in September. Economists expected sales to dip to a 404,000 annual unit rate. Income and spending: Personal income and spending climbed in October, according to a Commerce Department report released in the morning. Income rose 0.2% after rising 0.2% in September. Economists thought it would rise 0.1%, according to Briefing.com estimates. Spending was up 0.7% after falling 0.6% in the previous month. A separate report showed that orders for durable goods fell 0.6% in October, surprising economists who were expecting orders to rise 0.5%. Orders for goods meant to last three years or more gained 2% in September. World markets: Global markets advanced. In Europe, London's FTSE 100, Germany's DAX and France's CAC 40 all gained modestly. Asian markets ended higher. Currency and commodities: The dollar slipped against the euro and gained versus the yen. The weaker dollar boosted dollar-traded gold, which hit a new record. COMEX gold for December delivery rose $21.20 to a record settlement of $1,187 an ounce. Gold hit $1192.80 during the session, moving ever closer to the $1200 mark. U.S. light crude oil for January delivery rose $1.94 to settle at $77.96 a barrel on the New York Mercantile Exchange. Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.26% from 3.30% Tuesday. Treasury prices and yields move in opposite directions. Market breadth was positive and volume was light. On the New York Stock Exchange, winners topped losers two to one on volume of 800 million shares. On the Nasdaq, decliners beat advancers seven to six on volume of 1.42 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

24-Nov-2009 08:29

|

||

|

x 0

x 0 Alert Admin |

Dow spikes to 13-month highA better-than-expected housing market report, a weak dollar and a surge in commodities are pushing the market to new 2009 highs.  The dollar's initial weakness versus the euro helped lift gold to another record, putting the precious metal within $36 of $1,200 an ounce. However, the dollar staged a comeback by the early evening. The Dow Jones industrial average (INDU) gained 133 points, or 1.2%, closing at 10,450.95, its highest point since October 2, 2008. The Dow rose as much as 177 points in the morning, hitting 10,495.61 -- the highest trading level since Oct. 3, 2008. The Nasdaq composite (COMP) climbed 30 points, or 1.4%, closing short of a 13-month high hit last week. The S&P 500 (SPX) jumped 15 points, or 1.4% but ended short of its 13-month high hit last week. Stocks had slipped for the last three sessions, ending last week mixed, as investors pulled back a bit after pushing the Dow to a 13-month high. But Monday's news brought a new wave of buying. "The market is still in the euphoric state, with people coming to the realization that they can't keep much, if anything in money markets or cash," said Matt King, chief investment officer at Bell Investment Advisors. "Investors are trying to pick up riskier assets and get some yield on those assets." He said that after October's slight pullback, November has clearly been another up month for investors, with the S&P 500 climbing around 6%. And, King added, there is little on tap between now and year end to disrupt the flow, although the pace of gains is likely to slow. Since bottoming at a 12-year low on March 9, the Dow has gained 60% as of Monday's close. In that same period, the Nasdaq gained 69% and the S&P 500 gained nearly 64%. Trading was light Monday and is expected to keep getting lighter in the day's leading up is expected to lighten up in each session leading up to Thursday's Thanksgiving holiday. All financial markets will be closed Thursday and stocks will close early on Friday. After the close, Hewlett-Packard (HPQ, Fortune 500) reported higher quarterly earnings of $1.14 per share, in line with its raised forecast that was released last week. The company also reported a drop in revenue. Earnings grew thanks to strength in China and better profit margins, a key measure of profitability. HP also said that it was tripling its share repurchase program to $12 billion. Shares fell after the close after rising during the session. Tuesday brings reports on housing and consumer confidence in the morning, as well as the latest revision of third-quarter GDP growth. The minutes from the last Fed meeting will be released in the afternoon. Housing: Existing home sales in October surged to the highest level since February 2007, according to a National Association of Realtors report released Monday morning. Sales rose 10.1% in October to a seasonally adjusted annual rate of 6.1 million units, verses a revised 5.54 million units in September. Economists expected sales of 5.7 million units, on average. The strong sales were largely driven by buyers trying to tax advantage of the government's first-time homebuyer tax credit, which was initially due to expire at the end of November. The credit has now been extended to the end of April and includes a broader range of buyers. Investors have been looking for the economic news to confirm what many economists say: The recession, which began in December 2007, is over. In particular, a recovery in the housing market is critical as the credit crisis and housing market collapse deepened the economic crisis. On the move: Stock gains were broad based Monday, with 28 of 30 Dow issues rising, led by Boeing (BA, Fortune 500), Caterpillar (CAT, Fortune 500), Chevron (CVX, Fortune 500), IBM (IBM, Fortune 500), 3M (MMM, Fortune 500), Procter & Gamble (PG, Fortune 500) and Exxon Mobil (XOM, Fortune 500). The Dow's financial shares rallied, too, including American Express (AXP, Fortune 500) and JPMorgan Chase (JPM, Fortune 500). Market breadth Monday was positive and trading volume was light. On the New York Stock Exchange, winners beat losers by more than three to one on volume of 980 million shares. On the Nasdaq, advancers beat decliners by more than two to one on volume of 1.86 billion shares. World markets: Strong markets overseas helped boost U.S. markets. In Europe, London's FTSE 100, the German DAX and France's CAC 40 all surged more than 2%. Asian markets rallied as well. Currency and commodities: The dollar gained against the euro, recovering from earlier weakness and also gained against the yen. The dollar's weakness versus the euro had given a boost to dollar-traded oil and gold prices through most of the session, but oil trimmed most of those gains by the close. U.S. light crude oil for January delivery rose 9 cents to settle at $77.56 a barrel on the New York Mercantile Exchange. COMEX gold for December delivery climbed $18 to settle at $1,164.70 an ounce after touching a record high of $1,174 earlier in the session. Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.35% from 3.34% Friday. Treasury prices and yields move in opposite directions. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

23-Nov-2009 22:37

|

||

|

x 0

x 0 Alert Admin |

Wall Street may follow the world higherGains in Europe and Asia could be echoed in the U.S. as investors react to rising commodity pricesNEW YORK (CNNMoney.com) -- Stocks were set for a higher open Monday, joining overseas markets, as the surge in commodity prices -- including another record for gold -- continued.

Dow Jones industrial average, S&P 500 and Nasdaq futures were all higher before the opening bell. Futures measure current index values against the perceived future performance, offering guidance on stock performance, though they're not always an accurate barometer. The U.S. markets are coming off a lackluster week in which the Dow finished up about a half percent, the Nasdaq dropped 1%, and the S&P ended slightly lower. "I think the general bias has been for the market to grind higher," said Mark Luschini, chief investment strategist at Jamey Montgomery Scott. "I think, at the moment, it's the path of least resistance. We haven't seen any news on the economic front that would shift [investors'] belief that things haven't started to improve." Luschini said he expects investors to load up on blue-chip stocks - "those larger, more stable companies" - to shore up their positions heading into the holiday season. He also said volume will probably be light during Thanksgiving week. U.S. markets will be closed Thursday for Thanksgiving and will open for only a half-session on Friday. Gold, oil and money: Gold continued to break records, hitting $1,165.50 an ounce in early Monday trading, up $18.50. Oil also rallied, with the January contract climbing 93 cents to $78.40 a barrel. Commodity prices were driven, in part, by a weaker dollar, which slipped versus all major international currencies expect the yen. World markets: The rally in commodities triggered gains in overseas stocks. In Europe, the leading British, French and German indexes were up more than 1.6% in early trading. Hong Kong's Hang Seng index finished 1.4% higher; Tokyo was closed for a holiday. Companies: After the closing bell, Hewlett-Packard (HPQ, Fortune 500) will formally announce its quarterly financial results. Last week, the tech giant pre-announced those results, saying it earned $1.14 per share, excluding charges, on revenue of $30.8 billion. Economy: The National Association of Realtors reports existing home sales for October at 10 a.m. ET. Sales of homes by homeowners are expected to have increased to an annual rate of 5.65 million last month from 5.57 million in September. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

23-Nov-2009 07:53

|

||

|

x 0

x 0 Alert Admin |

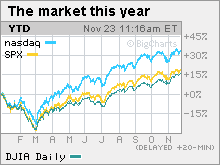

Wall Street buckles in for a bumpy rideStock market stumbles after hitting 13-month highs earlier in the week. Stocks may bounce around with low trading volume next week, but will likely trend higher for the rest of 2009. NEW YORK (CNNMoney.com) -- Stocks hit a bit of a snag over the past few days, and the holiday-shortened week to come won't likely help them bounce back.

"We're going to see the market get pushed around on very little volume, like a tumbleweed on the prairie," said Jack Ablin, chief investment officer at Harris Private Bank. With only three and a half trading days next week, and with many traders away on vacation, volumes are expected to be much lower. Low trading volumes often means stocks become more volatile. That won't be a good thing if next week's economic data is as bad as economists think it will be. Though three housing reports are expected to show very moderate improvement in sales and prices, a revised reading on the nation's gross domestic product will likely show the economy didn't grow nearly as much as the initial estimate. "That GDP number may catch people by surprise," said Art Hogan, chief market strategist at Jefferies & Co. "It's probably going to be revised lower, and it will be very interesting to see how the market reacts to that." The market had been taking sour economic news in stride, even surging to 13-month highs earlier in the week. Investors continued to pour money into stocks as the dollar weakened. Federal Reserve Chairman Ben Bernanke said on Monday that he was concerned about the dollar getting hammered, but he maintained that the Fed will continue to keep interest rates low in an effort to spur economic growth. A lower dollar pushed stocks higher Monday and Tuesday, as the S&P 500 soared above the 1,100 level and the Dow Jones industrial average neared 10,500 points. But the trend reversed on Wednesday, Thursday and Friday, as economic woes sent investors moving back into the dollar and stocks headed lower. The S&P 500 sank below 1,100 and the Dow closed just above 10,300, eking out a meager 0.5% gain for the week. Still, experts think this recent rough patch will be just a temporary glitch, and the steep climb that has continued almost unabated since March will likely continue for the rest of 2009. "The correlation with the dollar has been very tight over the past week," said Hogan. Hogan also said investors have been counting out consumers from the economic recovery, and any positive surprise in the holiday shopping season could be a huge boon for stocks. "The consumer has gotten written off really quickly in this environment," he said. "There have been some very conservative expectations for Black Friday, and there's a real possibility for an upside surprise that will give markets a healthy boost." The week ahead

Monday: The National Association of Realtors reports existing home sales for October at 10:00 a.m. ET. Sales of homes by homeowners are expected to have increased to 5.65 million last month from 5.57 million in September. After the closing bell, Hewlett-Packard (HPQ, Fortune 500) will formally announce its quarterly financial results. Last week, the tech giant pre-announced those results, saying it earned $1.14 per share, excluding charges, on revenue of $30.8 billion. Tuesday: The Commerce Department reports a revised reading of Gross Domestic Product, the broadest view of the nation's economy, at 8:30 a.m. ET. After last month's advanced GDP estimate showed the economy returned to growth at a 3.5% annual rate in the third quarter, economists believe the revised reading will show the economy grew at a rate of 3% last quarter. Also on Tuesday, Case Schiller will report its home price index at 9 a.m ET. Economists expect the report to show prices in the 20-city index to have fallen 9.1% in September after tumbling 11.3% in August. And a reading on the Conference Board's consumer confidence index at 10 a.m. ET is expected to show consumer sentiment slipped slightly this month to a reading of 47.5, down from 47.7 in October. Finally, at 2 p.m. ET, the Federal Reserve will release the minutes from its Nov. 3-4 meeting, in which the central bank opted to keep interest rates steady. The minutes will also include the Fed's economic forecasts for the coming quarters and its long-term projections. Wednesday: The day before Thanksgiving will be jam-packed with economic data reports, beginning with the Commerce Department's report on personal income and spending at 8:30 a.m. ET. Spending is expected to have risen 0.5% in October, compared to a 0.5% decrease in September. Economists predict income rose 0.2% last month after remaining flat in the previous month. Usually announced on Thursday, the government's weekly unemployment insurance claims report will be released on Wednesday at 8:30 a.m. ET next week because of the Thanksgiving holiday. The Census Bureau will release its monthly report on durable goods orders at 8:30 a.m. ET. Economists expect goods orders to tick up 0.5% after growing 1% in September. A report on new home sales will also be released by the Census Bureau at 10 a.m. ET. Like existing home sales, sales of new homes are expected to have risen in October, with 414,000 sales. In September, 402,000 new homes were sold. The government will report on crude oil inventories at 10:30 a.m. ET. Economists believe the nation's oil reserves fell by 887,000 barrels this week. Thursday: The markets are closed on Thursday for Thanksgiving. Friday: The stock market will close early at 1:00 p.m. ET. Economists will be keeping a close eye on retail sales Friday. Known as "Black Friday" the day after Thanksgiving is traditionally the biggest shopping day of the year. -- CNNMoney.com staff writer Benjamin Rooney contributed to this report |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

20-Nov-2009 08:50

|

||

|

x 0

x 0 Alert Admin |

Stocks drop for second straight dayMajor indexes decline as nervousness about the economy puts the brakes on a recent rally. The dollar firms; tech sector hurt by downgrade. The Dow Jones industrial average (INDU) fell 94 points, or 0.9%, to 10,332.4. The S&P 500 (SPX) sank 1.3% to end below the key 1,100 point level. The Nasdaq composite (COMP) lost 36 points, or 1.6%, to close at 2,156.82. Tech shares led decliners after analysts at Bank of America Merrill Lynch downgraded the semiconductor industry. Chip makers Intel (INTC, Fortune 500) and AMD (AMD, Fortune 500) both fell more than 3%. The downgrade came one day after two key software companies issued bearish profit outlooks. After the closing bell, Dell Inc. reported third-quarter results that fell far short of analysts' expectations. "The market is rethinking its outlook for technology growth," said Nick Kalivas, vice president of financial research at MF Global. Meanwhile, the dollar firmed against rival currencies and prices for U.S. Treasurys rose as investors flocked to assets that are considered safe havens. The stronger dollar weighed on the oil market, which undermined shares of energy producers Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500). Gold prices recovered from earlier losses to close at a fresh all-time high. "I think people are playing defense," Kalivas said. "The economic data we've seen recently doesn't encourage people to take on more risk in their portfolios." Analysts said a move lower was not surprising after stocks surged to a 13-month high earlier in the week. "I think a lot of people are concerned that we've come too far, too fast," said Russell Lundeberg Jr., chief investment officer at Barrett Capital Management. Meanwhile, investors continued to focus on the the plight of the dollar, which has shown some signs of strength recently after Federal Reserve officials -- including chairman Ben Bernanke -- indicated that the central bank is monitoring the currency's decline. "The market has definitely been trading off the dollar recently," said Ron Kiddoo, chief investment officer at Kozad Asset Management. "I think the stronger dollar is a bigger factor than the jobless claims." A weekly government report showed the number of Americans filing first-time claims for unemployment benefits was unchanged from the preceding week. Stocks ended lower Wednesday after government data showed a drop in new home construction. The surprisingly weak housing report was the latest in a string of less-than-stellar economic indicators that have put many market participants on edge. Investors are now looking for more concrete evidence of improvement in the job market, retail sales and corporate profits. "Overall, it's not surprising that people are getting nervous," said Lundeberg. "We still have a long way to go in the recovery." Analysts said the volume of shares trading hands recently has been low, suggesting that many big investment funds have moved to the sidelines to protect gains before publishing their year-end reports. Economy: The Labor Department released its weekly report on initial jobless claims, showing that the number of claims was unchanged from the prior week. The government said that jobless claims totaled 505,000 in the week ended Nov. 14. This was very close to the forecast of 504,000 claims, according to a consensus of economist opinion compiled by Briefing.com. A report on leading economic indicators showed an increase of 0.3% in October, below the 0.4% forecast and the 1% rise in September. The Philadelphia Federal Reserve survey, a reading on regional manufacturing, rose slightly. Companies: Dell (DELL, Fortune 500) said net income fell 54% to $337 million, or 17 cents per share, for the quarter ended Oct. 30. Results included charges of 6 cents per share for cost cutting and other one-time expenses. Without the charges, the PC maker said it earned 23 cents per share. Analysts polled by Thomson Reuters had forecasted adjusted earnings of 28 cents per share. Retail apparel maker Gap Inc. (GAP, Fortune 500) reported quarterly results that were in line with analysts' expectations. The company said after the closing bell that net income rose by 25% in the quarter on improved profit margins and strong sales at its discount chain Old Navy. Sears Holdings (SHLD, Fortune 500) posted a narrower-than-expected quarterly loss of $127 million, or $1.09 a share, an improvement from the loss of $146 million, or $1.16 a share, a year earlier. Results were helped by the first increase in same-store sales at its Kmart unit in four years. JPMorgan Chase (JPM, Fortune 500) said Thursday it was buying the half of U.K. broker Cazenove that it does not already own for about $1.67 billion. World markets: Asian shares mostly fell. Japan's Nikkei tumbled 1.3%. Major European indexes were also closed lower, with the CAC-40 in Paris falling 1.8%. The price of oil fell $2.12 to settle at $77.46 a barrel. The price of gold recovered from earlier losses to settle at a record high of $1,141.90 per ounce, up 70 cents from the previous day's closing price. Bonds. Treasury prices rose. The yield on the benchmark 10-year note, which moves inversely to its price, fell to 3.34% from 3.36% late Wednesday. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

19-Nov-2009 20:55

|

||

|

x 0

x 0 Alert Admin |

Stocks set for early slideWorries about the economic recovery put investors on the sidelines.NEW YORK (CNNMoney.com) -- U.S. stocks were poised for a drop Thursday, as concerns about the economic recovery resurfaced, rattling investors.

Dow Jones industrial average, S&P 500 and Nasdaq futures were lower. Futures measure current index values against the perceived future performance, offering guidance on stock performance, though they're not always an accurate barometer. Dave Babbs, head of trading for MF Global Spreads in London, said investors are second-guessing the recent rally, which drove stocks to a 13-month high on Tuesday. "To be honest with you, it shouldn't have been up there where it was," he said. "The Dow has gone up too quickly. I just think it needs to call off a little bit." Wall Street ended Wednesday's session on a slightly negative note after a report showed a drop in new home construction. Economy: The Labor Department will release its weekly report on initial jobless claims at 8:30 a.m. ET. Jobless claims are expected to be practically unchanged for the week ended Nov. 14, notching up slightly to 504,000, according to a consensus of economist opinion compiled by Briefing.com. In the previous week, claims totaled 502,000. A report on leading economic iIndicators is due out at 10 a.m. ET and is expected to show any increase of 0.4% for October, according to a Briefing.com consensus. This would be a slow-down from the prior month, when the leading indicators rose 1%. The Philadelphia Federal Reserve survey, a reading on regional manufacturing, also is slated to be released at 10 a.m. ET. Companies: JPMorgan Chase (JPM, Fortune 500) said Thursday it was buying the half of UK broker Cazenove that it does not already own for about $1.67 billion. Sears Holdings (SHLD, Fortune 500), Dell (DELL, Fortune 500) and Gap (GPS, Fortune 500) are due to post their financial results for the latest quarter. World markets: Asian shares mostly fell. Japan's Nikkei tumbled 1.3%. Major European indexes were lower in midday trading. The price of oil fell 65 cents to $78.93 a barrel in electronic trading. The price of gold fell $7 in electronic trading to $1,134.20 per ounce. On Wednesday, gold for December delivery settled at a record high of $1,141.20 an ounce, up $1.80 from the previous close. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

19-Nov-2009 08:05

|

||

|

x 0

x 0 Alert Admin |

Stocks hit a roadblockMajor indexes retreat from 13-month highs after a surprise drop in new home construction fuels concern about the strength of the economic recovery. NEW YORK (CNNMoney.com) -- Stocks closed slightly lower Wednesday, paring deeper losses, after a drop in new home construction made investors jittery about the economic recovery and wary profit outlooks weighed on the technology sector. The Dow Jones industrial average (INDU) was down 11 points, or 0.1%, to close at 10,426.3. The S&P 500 (SPX) fell less than one point to 1,109.8. The tech-heavy Nasdaq composite fell (COMP) 10 points, or 0.5%, to 2,193.1. Stocks opened lower and struggled for most of the day before moving off session lows in the last 30 minutes of trade. The modest retreat, which came one day after the major indexes closed at their highest levels in 13-months, was sparked by government data that showed initial construction of new single-family homes fell to a six-month low in October. The unexpected drop came despite government efforts to stimulate the battered housing industry, and highlighted fears that stocks may have gotten ahead of economic reality. "A lot of people were betting on a housing recovery," said Abigail Doolittle, a portfolio manager at Johnson Illington Advisors. "The decline in construction starts is probably making some people nervous." Investors were also focused on the outlook for the technology sector after Salesforce.com and Autodesk offered cautious earnings guidance for the fourth quarter. Tech giant Hewlett-Packard (HPQ, Fortune 500) was among leading decliners on the Dow, while Microsoft (MSFT, Fortune 500) bucked the trend. Shares of Bank of America (BAC, Fortune 500) rose 3.68% after hedge-fund guru John Paulson reportedly told investors that he expects the stock price to almost double in the next two years. Meanwhile, the dollar fell broadly against rival currencies, with the euro climbing near $1.50 at one point. The weak dollar helped push gold prices to another all-time high, while oil prices closed above $79 a barrel. Investors have looked to the dollar for direction in recent weeks, with a softer greenback normally reflecting a stronger appetite for risky assets such as commodities and stocks. But with the major indexes up some 30% from the lows of early March, many investors have become reluctant to push the market higher until they see more concrete signs that an economic recovery is underway. "At the margin, the economic data has been stabilizing," said Lawrence Creatura, a portfolio manager with Federated Clover Investment Advisors. "It's been 'less bad' and that has been enough for investors up to now. Whether 'less bad' continues to be enough remains to be seen." Analysts said the volume of shares trading hands recently has been low, suggesting that many big investment funds have moved to the sidelines to avoid jeopardizing gains before publishing year-end results. On the New York Stock Exchange, losers topped winners 3-to-1 on volume of 858 million shares. On the Nasdaq, decliners toped advancers almost 2-to-1 on volume of 1.8 billion shares. Economy: The government reported that housing starts fell more than 10% to an annual rate of 529,000 in October, the lowest level in six months. An annual rate of 600,000 housing starts was expected, according to a forecast from Briefing.com consensus. The revised rate for September was 592,000. The government reported that the annual rate of housing permits fell 4% to 552,000 in October, from the revised September rate of 575,000. This was lower than the 580,000 permits expected for October, according to Briefing.com consensus. . The government also reported its Consumer Price Index, a key measure of inflation, rose 0.3%. The CPI was expected to rise 0.2% in October, according to a consensus of economists surveyed by Briefing.com. The core CPI, which excludes volatile food and energy prices, rose 0.2% in October. That was slightly more than the 0.1% increase expected for October, according to Briefing.com consensus. Companies: Salesforce.com (CRM), which makes Web-based business software, reported third-quarter earnings that were in line with analyst expectations. But the results also showed a slowdown in contracts for new business, which sent shares down more than 3%. Shares of Autodesk (ADSK) plunged 10% after the maker of computer-aided drafting software forecast fourth-quarter earnings that were below Wall Street's consensus view. On Tuesday, Goldman Sachs (GS, Fortune 500) said that it is launching a $500 million initiative aimed at propping up small businesses. Obama administration officials, including Treasury Secretary Tim Geithner, are due to meet Wednesday to address the small business lending drought. World markets: Japan's Nikkei index finished the session 0.6% lower. Major indexes in Europe closed mixed. Currency and commodities: The dollar, which has suffered from recent weakness, was down versus all major currencies. The dollar index (DXY), which measures the U.S. currency's value against a basket of rivals, was down 0.3% to 75.14 The price of oil rose 56 cents to end at $79.58 per barrel after hitting a high of $80.33 earlier in the session. Gold rose $1.80 to settle at another all-time high of $1141.20 an ounce. It also hit a record trading high of $1,149.40 an ounce. Bonds: Treasury prices fell as investors focused on Wednesday's inflation report. The yield on the benchmark 10-year note, which moves opposite its price, rose to 3.36% from 3.32% late Tuesday. |

||

| Useful To Me Not Useful To Me | |||

|

Hulumas

Supreme |

17-Nov-2009 10:21

Yells: "INVEST but not TRADE please!" |

||

|

x 0

x 0 Alert Admin |

For the next decade S&P and STI up by 1 : 3.8 ratio. i.e. STI up 3.8% will lead S&P up by 1%!!!

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

17-Nov-2009 07:41

|

||

|

x 0

x 0 Alert Admin |

S&P 500 shoots above 1,100Wall Street rallies as energy and commodity shares rise on weak dollar; Bernanke says economic recovery will be modest.The Dow Jones industrial average rose (INDU) 136 points, or 1.3%, to close at 10,406.96. That's the highest level for the blue-chip indicator since October 2008. The S&P 500 (SPX) gained 15.8 points, or 1.8%, to close above the psychologically important 1,100 level. The Nasdaq composite (COMP) rose 30 points, or 1.4%, to 2,197.5. Stocks followed overseas markets higher in early trade following strong economic data out of Japan. The market held gains after a closely watched report on retail sales came in mixed. Analysts said the main driver of Monday's rally was the weak U.S. dollar, which helped push gold prices to a record high and fueled a 3% gain in the oil market. The dollar has lost more than 7% this year against rival currencies as investors take advantage of U.S. interest rates near zero percent to fund bets in more risky stock and commodities markets. On Monday, the battered greenback fell 0.3% to touch a 15-month low against a basket of other currencies. Meanwhile, Bernanke said the U.S. central bank expects to keep interest rates "exceptionally low" for an "extended period" as the U.S. economy recovers at a modest pace. Art Hogan, chief market analyst at Jefferies & Co., said the market is focused on the anemic dollar. "As the dollar weakens, commodity prices go up," he said. "It's nothing new, but there's really nothing else driving the market right now." Stocks have soared over the past two weeks as investors have gained confidence in the pace of the economic recovery. The market has also been supported by signs that policy makers around the world will keep economic stimulus efforts in place for a prolonged period of time. Monday's rally reflects the "continuing resiliency of the market," said Richard Sparks, senior equities analyst at Schaeffer's Investment Research. He said stocks could continue higher as the market overcomes key technical levels and more investors are drawn in from the sidelines. With the Dow holding firmly above the psychologically important 10,000 level, investors are now turning their attention to another key high-water mark. Analysts say a sustained push above 1,100 points on the S&P 500 could pave the way for further gains in the weeks ahead. "The big news today was the S&P closing above 1,100," said David Levy, a portfolio manager at Kenjol Capital Management. "From a short-term perspective, that's very bullish for the market." After failing to close above 1,100 on three separate occasions over the last few months, the push above that key level suggests that the market is becoming more convinced that an economic recovery is under way, he said. "We see the market going higher into year end," Levy said. Bernanke. Speaking in New York, Bernanke said financial conditions are significantly better than they were a year ago as markets around the world have stabilized. But he warned that constrained bank lending and the weak job market "likely will prevent the expansion from being as robust as we would hope." Given the challenges facing the economy, interest rates will probably remain "exceptionally low" for "an extended period," he said. Bernanke also noted that the Federal Reserve, which is not responsible for managing currency fluctuations, is watching the decline of the U.S. dollar. "We are attentive to the implications of changes in the value of the dollar and will continue to formulate policy to guard against risks to our dual mandate to foster both maximum employment and price stability. Economy: Retail sales jumped 1.4% in October from the prior month, according to the Census Bureau, exceeding the increase of 0.9% expected by a consensus of economists surveyed by Briefing.com. Excluding automobiles, sales rose 0.2%, falling short of the 0.4% gain forecast by Briefing.com consensus. That's compared to an overall decline of 1.5%, or an increase of 0.5% without auto sales, the prior month. A report from the New York Federal Reserve Bank showed manufacturing activity in New York State slowed in November. The Empire State index fell to 23.51 in early November from 34.57 in October, which was a five-year high. Companies: Home improvement retailer Lowe's (LOW, Fortune 500) reported a 30% drop in quarterly profit, but offered an optimistic outlook for fourth-quarter earnings. General Motors (GM, Fortune 500), releasing its first financial results since emerging from bankruptcy in July, said it lost $1.2 billion in the third quarter. It also said it would begin repaying government loans in December. The U.S. government would receive $1 billion, with nearly $200 million going to the governments of Canada and Ontario. After the markets closed, troubled auto and mortgage lender GMAC shook up its executive suite, naming former Citigroup (C, Fortune 500) executive Michael Carpenter CEO. World markets: Stocks worldwide were lifted amid optimism that governments would keep up stimulus efforts. In Asia, Japan's Nikkei added 0.2% after finance ministers said the country's economy grew 1.2% in the third quarter. European shares also closed higher. Money, oil and gold: The dollar was lower versus major international currencies. The dollar index (DXY), which measures the U.S. currency's value against a basket of rivals, was down 0.3% to 74.94. Commodities continued to benefit from the weaker greenback. Oil for December delivery jumped $2.55 to close at $78.90 a barrel. And gold prices, which have been on a tear this month, surged $22.50 to end at a new record of $1,139.20 a troy ounce. |

||

| Useful To Me Not Useful To Me | |||

|

lookcc

Master |

16-Nov-2009 22:56

|

||

|

x 0

x 0 Alert Admin |

excl autos n gas was 0.2% increase, expectation 0.4%. | ||

| Useful To Me Not Useful To Me | |||

|

singaporegal

Supreme |

16-Nov-2009 22:50

Yells: "Female TA nut" |

||

|

x 0

x 0 Alert Admin |

Retail sales surge in the US. Excellent news for the economic front! | ||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

16-Nov-2009 19:51

|

||

|

x 0

x 0 Alert Admin |

Stocks ready to rollFutures advance ahead of retail sales. GM to release first earnings report since emerging from bankruptcy.LONDON (CNNMoney.com) -- U.S. stocks appeared ready for a strong start Monday, as investors maintained an upbeat view on the economic recovery ahead of a key report on retail sales. At 4:56 a.m. ET, S&P 500, Nasdaq-100 and Dow Jones industrial average futures were higher. Futures measure current index values against their perceived future performance and offer an indication of how markets may open when trading begins. Wall Street has rallied for the past two weeks as investors have gained confidence in the pace of the economic recovery. Economy: A reading on October retail sales is due out at 8:30 a.m. ET. Investors will be watching the report closely to see how consumer spending is faring ahead of the key holiday shopping season. A survey on manufacturing in New York state also comes out at 8:30 a.m. ET. That's followed by a report on September business inventories at 10 a.m. ET. Autos: GM is due to release its first earnings report since emerging from bankruptcy in July. The automaker is expected to announce that it plans to begin repaying a $6.7 billion U.S. government loan before the end of the year, according to published reports. World markets: Stocks worldwide were lifted amid optimism that governments would keep up stimulus efforts. In Asia, Japan's Nikkei added 0.2%. European shares jumped in morning trading. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

Blastoff

Elite |

16-Nov-2009 08:00

|

||

|

x 0

x 0 Alert Admin |

Wall Street: All eyes on the consumerAfter two strong weeks of gains, investors will zero in on further signs that the economy is indeed on the road to recovery. Retail sales will set the tone. NEW YORK (CNNMoney.com) -- Investors will brace for a spate of economic reports this week with their fingers crossed that there is more good news than bad since that will set the tone for the remaining seven weeks of the year. With Black Friday less than two weeks away, retailers are hoping consumers will be willing to open their wallets during the all-important holiday sales period, helping fuel the economic recovery. Kicking off the week will be the government's monthly retail sales report, which investors hope will shed light on how much consumers will be willing to spend. "Next week is all about consumer spending and the holiday," said Burt White, chief investment officer at LPL Financial. Retail sales have shown some improvement recently, suggesting that consumers are suffering from "frugal fatigue" and may be more willing to splurge this holiday season, White said. A rebound in consumer spending, which accounts for the bulk of U.S. economic activity, could help fuel bets that a recovery is firmly underway. The outlook for consumer spending remains murky with the national unemployment rate at a 26-year high of 10.2%. "In this environment, anything associated with jobs is probably the most important thing," said Quincy Krosby, market strategist at Prudential Financial. To that end, investors will likely pay close attention to Thursday's report on the number of Americans filing first-time claims for state unemployment benefits. Investors will also focus on the plight of the U.S. dollar, which wallowed near a 15-month low against the euro for most of last week. The dollar has been taking a beating recently as investors take advantage of rock-bottom interest rates in the United States to bulk up on more risky assets. "For now, it's still sell the dollar and buy risk," White said. "It's a crowded trade, but a good one." Stocks ended the week on a high note, logging the second consecutive week of gains as optimism about the recovery gained momentum. The question on investors' minds this week will be 'can that momentum be sustained?' Eyes on Bernanke

Demand for riskier assets, like equities, could hit a speed bump Monday afternoon with Federal Reserve chairman Ben Bernanke scheduled to deliver an economic outlook speech at the Economic Club of New York. While the central bank is not responsible for managing currency fluctuations, some analysts think Bernanke may strike a more hawkish tone given the severity of the greenback's recent weakness. Others expect Bernanke to echo recent official policy statements that interest rates will remain "exceptionally low" for an "extended period" of time. On the docket

Monday: The week starts with a closely watched report on October retail sales before the opening bell. Economists expect the Commerce Department to report that sales rose 0.9% last month after 1.5% drop, according to consensus estimates gathered by Briefing.com. Also due Monday morning, a report on manufacturing activity in the mid-Atlantic region and business inventory data from September. Federal Reserve chairman Ben Bernanke will speak about the outlook for the U.S. economy in New York at midday. Tuesday: The government's producer price index comes out before the market opens. Analysts think prices at the wholesale level ticked up 0.5% in October. Excluding volatile energy prices, the index is forecast to rise 0.1%. Government figures on capacity utilization and industrial production in October are due out at 9:15 a.m. ET. The market will also digest quarterly financial results from Home Depot (HD, Fortune 500), Target (TGT, Fortune 500) and TJX Companies (TJX, Fortune 500) before the opening bell. Wednesday: The housing market will be in focus with reports on housing starts and building permits released before the market opens. Also before the opening bell, the government's closely-watched inflation gauge is expected to show that consumer prices were flat in October. Excluding food and energy, prices are expected to have risen 0.1% last month after a 0.2% increase the month before. Thursday: The Labor Department reports on the number of Americans filing new claims for unemployment benefits at 8:30 a.m. ET. Jobless claims fell to 502,000 filings last week and analysts say a figure below 500,000 this week could help push the market higher. A report on leading economic indicators comes out after the market opens. Sears Holdings (SHLD, Fortune 500) will report quarterly earnings in the morning, while PC giant HP (HPQ, Fortune 500) and apparel-maker Gap (GAP, Fortune 500) will post earnings after the closing bell. Friday: No economic reports are on the docket. |

||

| Useful To Me Not Useful To Me | |||

|

cyjjerry85

Elite |

11-Nov-2009 23:22

|

||

|

x 0

x 0 Alert Admin |

looking at the charts both STI and DOW are gaining but its the near recent uptrend with decreasing volume that is slightly more of a concern...any opinions to be shared about the charts? cheers` |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

11-Nov-2009 20:35

|

||

|

x 0

x 0 Alert Admin |

Stocks set for early gainsFutures advance after Fed officials signal rates to remain low for some time.LONDON (CNNMoney.com) -- U.S. stocks looked set to open higher Wednesday, as investor optimism rose on the expectation that interest rates would remain low for some time.

At 4:47 a.m. ET, S&P 500, Nasdaq-100 and Dow Jones industrial average futures were higher. Futures measure current index values against their perceived future performance and offer an indication of how markets may open when trading begins. U.S. bond markets are closed for Veteran's Day but stock and commodity markets are open as usual. Wall Street finished Tuesday's session mixed as investors expressed caution following the recent stock rally. Economy: Federal Reserve officials speaking Tuesday night noted that the U.S. economic recovery was likely to be weak. But they also reinforced the view the central bank would keep rates low for the forseeable future. Companies: AIG's (AIG, Fortune 500) Robert Benmosche is considering stepping down as CEO of the bailed out insurer, according to the Wall Street Journal, which cited unidentified people familiar with the matter. World markets: In Japan, the Nikkei finished the session little changed. Hong Kong's Hang Seng added 1.6%. Major European indexes were higher in morning trading. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

11-Nov-2009 08:04

|

||

|

x 0

x 0 Alert Admin |

Stocks lose steamDow pared gains, ending slightly higher with other indexes lower. Trading stayed in a tight range on investor caution after previous day's rally.NEW YORK (CNNMoney.com) -- Stocks ended mixed Tuesday, giving up some gains, as the market faltered after a triple-digit rally in the previous session.

The pullback after a day of choppy trade showed investors were cautious after a Monday jump that pushed the blue-chip Dow to its highest level in 13 months. After reversing several times, the Dow Jones industrial average (INDU) closed up 20 points, or 0.2%, to close at 10,246.97. The S&P 500 (SPX) slipped less than 1 point, or less than 0.1%, to end at 1,093.01, and the Nasdaq composite (COMP) fell 3 points, or 0.1%, to settle at 2,151.08. David Babbs, head of trading at MF Global in London, said the lack of news this week means the market is "going to go sideways and wait for its next cue." The market will likely remain in a tight band until the next Federal Reserve policy-setting meeting Dec. 16, said Don Humphreys, president of Voyager Wealth Management. "After a rally like Monday's, there's always a chance for a pullback, but I think we'll tread water," Humphreys said. "Overall, the trend continues to be higher." Tuesday could not sustain momentum from the rally Monday, which came after the Group of 20 said over the weekend that it would keep economic stimulus in place. "We see that stimulus is still needed," said Peter Cardillo, chief market economist at Avalon Partners. "And as long as money is cheap, people will continue to invest." A falling dollar boosted prices for gold, oil and other commodities, and Cardillo said investors will focus on those markets in absence of major reports -- as well as corporate news including earnings from Applied Materials (AMAT, Fortune 500), Wal-Mart (WMT, Fortune 500) and Walt Disney (DIS, Fortune 500). Long-term focus. The Dow has soared 56% after hitting a 12-year low in March, and the blue-chip index is up 16.5% for all of 2009. The Nasdaq has jumped 36.6% this year. Monday's rally was the Dow's third gain of more than 199 points in the past eight trading days. But despite roaring back from its March nadir the Dow is still 28% below the record high set in October 2007. Analysts and investors alike have struggled to determine whether the recent rally is justified. Voyager Wealth's Humphreys says it depends on the timeline. "Maybe the fundamentals aren't there for a quick kill, but that's a short-term basis," Humphreys said. "I think for longer-term investors, the fundamentals are there -- we are out of the worst of this recession." Barring a change in federal interest rate policy, Humphreys said he expects a "flat to higher trend" in the market for the remainder of 2009 with the Dow ending the year above 10,000. Economy: Most U.S. cities saw gains in the median price of single-family homes sold last quarter, said a report from the National Association of Realtors. The national median home price was $177,900 in the third quarter, up $7,000 from the previous quarter. In other housing news, the Treasury Department said 650,000 troubled borrowers have been put into trial loan modifications under the Obama administration's foreclosure rescue plan. Companies: Sprint Nextel (S, Fortune 500) said Monday that it plans to cut between 2,000 and 2,500 jobs in an attempt to reduce costs. The European Commission has objected to Oracle's (ORCL, Fortune 500) proposed takeover of Sun Microsystems (JAVA, Fortune 500), which could threaten the deal. Other markets: Global markets were mixed. Asian shares finished the session in positive territory, and European stocks ended slightly lower. The dollar rose off 15-month lows, jumping slightly against the euro and the British pound. The greenback inched up on the Japanese yen. The price of U.S. crude oil fell 38 cents to settle at $79.05 a barrel. Treasurys were steady Tuesday, after a record $25 billion offering of 10-year notes attracted strong demand. The 10-year yield fell to 3.47% from 3.48% late Monday. The government is selling $81 billion worth of debt this week in a quarterly refunding. Treasury will auction $16 billion in 30-year bonds later in the week. Market breadth was negative. On the New York Stock Exchange, losers topped winners by three to two on volume of 900 million shares. On the Nasdaq, decliners topped advancers almost nine to four on volume of 1.9 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

10-Nov-2009 07:35

|

||

|

x 0

x 0 Alert Admin |

Dow surges to 13-month highSigns of continued global recovery and talk about deals boost to investor confidence. Dow gains 200 points; Nasdaq and S&P 500 jump 2%.   NEW YORK (CNNMoney.com) -- Stocks rallied Monday, with the Dow industrials surging to a 13-month high, as investor optimism gained momentum.

The Dow Jones industrial average (INDU) soared 204 points, or 2%, to close at 10,226.94 -- its highest level since Oct. 3, 2008. The gains were broad-based, with all but 1 of the 30 components in the blue-chip index closing higher. Financial and commodity-related shares led the advance. The S&P 500 (SPX) gained 24 points, or 2.2%, to settle at 1,093.07 and the Nasdaq composite (COMP) rose 42 points, or 2%, to close at 2,154.06. Stocks rallied right out of the gate Monday after the Group of 20 said over the weekend that it would keep economic stimulus in place. With little news on tap for this week, "psychological factors and technical levels are driving 70%-80% of this market," said Financial Enhancement Group analyst Joe Clark. "The market does create its own psychology," he added. "You would never go to the grocery store and pay a higher price because someone else did, but that's what happens in stocks -- the momentum that's happening today after G-20." Finance ministers of the G-20 met over the weekend and pledged to continue government aid. The dollar fell sharply against the euro and British pound, while commodities and commodity-linked stocks rose. In "a bit of a dead week" in terms of economic reports, investors will take their cues from other news events, Clark said. "People are reading the news and pondering all of it," Clark said. "Some stories might be enough for a quick boost, but as far as overall recovery most people are saying, 'We'll believe it when we see it.'" Oil, gold and the dollar. U.S. oil for December delivery rose $2 to settle at $79.43 a barrel, after sinking almost 3% on Friday's mostly negative labor market report. COMEX gold for December delivery rose to an intraday record of $1,109.90 Monday before it pared gains to settle up $5.70 at $1,101.40 per ounce. "The story's all about gold and the dollar," said Charles Smith, chief investment officer at Fort Pitt Capital Group. With the dollar back at $1.50 against the euro for the first time in a few weeks, "the dollar scare has started again, with people piling into gold," Smith said. "I don't believe inflation is a valid concern, but that's what's moving investors." Stocks had bounced back last week, with the Dow reclaiming the 10,000 mark. So far in 2009, the Dow is up about 15% and the Nasdaq composite has soared 35%. S&P and technical trading. Financial Enhancement analyst Clark said more investors have "moved into the technical trading world." Clark said professional investors had been holding out for the S&P 500 to cross 1,060, viewing the level as a signal it was safe to re-enter the market. Still others are holding out for when the S&P crosses 1,100 and remains steady above that mark, he said. "There are people on the sideline viewing this as an opportunity to get in," Clark said. "Personally, I'll be be happy when I see the S&P holding above 1,100 -- even though it's psychological rather than technical." Eyeing corporate deals. With no significant economic indicators on Monday's docket, investors focused on corporate news, particularly talk about deals -- possible and completed. Kraft (KFT, Fortune 500) launched a $16.3 billion hostile takeover bid Monday for British candymaker Cadbury after the deadline for the initial bid passed without a deal. Cadbury rejected Kraft's initial $16.7 billion offer in early September and again turned it down. Comcast (CMCSA, Fortune 500) and GE (GE, Fortune 500) have reportedly agreed on the worth of NBC Universal. The agreement is a major hurdle cleared for Comcast as it aims to gain control of NBC Universal. Northrop Grumman (NOC, Fortune 500) has sold its consulting arm to two private equity firms. The $1.65 billion deal was announced Sunday. "Most of these deals have been viewed as positive for the market," said Paul Radeke, wealth advisor at KDV Wealth Management. "It's a view of consolidating domestic opportunity, rather than the transfer of American wealth to the international market." World markets and bonds: Asian shares closed higher, with Japan's Nikkei adding a modest 0.2% and the Hang Seng in Hong Kong jumping 1.7%. Major European indexes closed almost 2% higher, with the German DAX leading the way at a 2.4% gain. Bond prices were mostly lower, with the 10-year note holding modest gains, as the government began selling $81 billion worth of debt this week in a quarterly refunding. Treasury auctioned $40 billion in 3-year notes Monday, with $25 billion in 10-year notes and $16 billion in 30-year bonds being offered later in the week. Market breadth was positive. On the New York Stock Exchange, winners topped losers by five to one on volume of 909 million shares. On the Nasdaq, advancers topped decliners almost two to one on volume of 1.2 billion shares. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

09-Nov-2009 21:03

|

||

|

x 0

x 0 Alert Admin |

Deals could buoy Wall StreetInvestors maintain upbeat sentiment, eye developments on potential mergers and declining dollar .NEW YORK (CNNMoney.com) -- U.S. stocks, fresh off a solid week of gains, appeared ready for a strong start to the new week Monday amid talk about some major deals in the works. At 7:15 a.m. ET, S&P 500, Nasdaq-100 and Dow Jones industrial average futures were all solidly higher. Futures measure current index values against their perceived future performance and offer an indication of how markets may open when trading begins. U.S. stocks bounced back last week, with the Dow reclaiming the 10,000 mark. But trading could be choppy this week with little in the way of economic news. Companies: In a day with no significant economic indicators being reported, investors will likely focus on corporate events, particularly talk about deals -- possible and completed. Comcast (CMCSA, Fortune 500) and GE (GE, Fortune 500) have reportedly agreed on the worth of NBC Universal. The agreement is a major hurdle cleared for Comcast as it aims to gain control of NBC Universal. Kraft (KFT, Fortune 500) is expected to launch a hostile takeover bid for British candy company Cadbury's on Monday. Northrop Grumman (NOC, Fortune 500) has sold its consulting arm to two private equity firms. The $1.65 billion deal was announced Sunday. "Mergers and acquisitions are starting to heat up, and that's always positive for the stock market," said Peter Cardillo, chief market economist for Avalon Partners. "There really isn't any major economic news until Friday, so the markets are taking a different focus." World markets: Asian shares advanced, with Japan's Nikkei adding a modest 0.2% and the Hang Seng in Hong Kong jumping 1.7%. Major European indexes were all up more than 1% in morning trading, with the German DAX leading the way with a near-2% gain. Other markets: The dollar fell sharply against the euro and British pound, and held even with the Japanese yen in early trading. The weakness is a result of a G-20 meeting in Scotland held over the weekend that yielded no definitive agreement on trade imbalance solutions. "With the dollar under severe pressure, the perception is that the declining dollar will fuel further speculative money into the stock market," Cardillo said. "That will also continue to fuel the rush into commodities." U.S. oil for December delivery rose 97 cents to $78.40 a barrel after sinking nearly 3% on Friday's mostly negative labor market report. Gold for December delivery rose to a new high Monday morning, gaining $12.50 to $1,108.20 per ounce. Bonds fell as stock futures rose, with the 10-year yield falling back to 3.53%. Treasurys also fell in anticipation of a mammoth week of auctions for the Treasury Department's quarterly refunding. Treasury issues $40 billion in 3-year notes Monday, $25 billion in 10-year notes Tuesday and $16 billion in 30-year bonds Thursday. |

||

| Useful To Me Not Useful To Me | |||

|

Blastoff

Elite |

09-Nov-2009 07:37

|

||

|

x 0

x 0 Alert Admin |

Stocks: Buyers 'swooping back in'Wall Street lost a mere 6% in the fall selloff before bouncing back last week. Can it keep the ball rolling in a challenging week ahead?NEW YORK (CNNMoney.com) -- So was that it? Is the so-called market correction over? Stocks rallied last week, with the Dow reclaiming 10,000, as the major indexes erased most of the losses of the previous two weeks. With the week ahead light on economic and corporate news, market direction will be fueled mostly by momentum and emotion. "For a while, it looked like we were having a buyer's strike, but then the buyers came swooping back in at the end of the week," said Timothy Ghriskey, chief investment officer at Solaris Asset Management. After rallying 63% from its 12-year low hit in March, the S&P 500 shed nearly 6% in the last two weeks of October. Some feared the pullback would extend to 15%. Instead, buyers jumped back in. "The looming issue is whether we've seen enough of a correction to bring out even more buyers or whether we need to see a bigger leg down first," Ghriskey said. A combination of trillions still sitting in money market funds in either cash or low-yielding cash equivalents makes the case for another run up. Slowly improving economic and corporate news should help as well. But as Friday's labor market report made clear, the economic recovering is still in its infancy. Jobs and the consumer: Last week's run was fueled by better-than-expected profit and economic reports, the government's decision to extend unemployment benefits and the homebuyer tax credit -- and news that Warren Buffett's Berkshire Hathaway (BRKA, Fortune 500) bought railroad Burlington Northern Santa Fe (BNI, Fortune 500). But even bad or mixed news on the jobs front got rewarded last week, most notably on Friday, when stocks managed to gain despite a government report showing unemployment hit a 26-year high of 10.2% last month. The knowledge that the labor market is the last area to turn in a recovery and that the unemployment rate would eventually top 10% may have taken the sting out of the report, Ghriskey said. Or there may be the perception that the 10.2% rate was as bad as its going to get. Either way, the willingness of investors to respond to both good and bad news by jumping in and buying suggests the mood has turned more positive again -- whether it should or shouldn't. Wall Street saw its biggest one-day rally in three months after the weekly jobless claims dropped to 512,000, a level not seen since January. Yet, the decline could mean people are running out of benefits, rather than finding jobs. And unemployed or underemployed consumers don't spend aggressively -- problematic for a recovery. "At some point soon we need to start seeing improvement rather than just better-than-expected news," said Mike Stanfield, chief investment officer at VSR Financial Services. "Even if the news continues to improve it's reasonable that stocks will seesaw for the next few months until the economic news starts to show stronger growth," he said. On the docket

Monday: This week brings the quarterly refunding from the Treasury Department. Treasury issues $40 billion in 3-year notes Monday, $25 billion in ten-year notes Tuesday and $16 billion in 30-year bonds Thursday. Tuesday: The Senate Budget Committee holds a hearing on bi-partisan efforts needed to cut the deficit. Bank of America's financial services conference begins in the morning, with outgoing CEO Ken Lewis due to speak. Wednesday: Treasury bond markets, government offices and some banks are closed for Veterans Day, but all other financial markets are open. After the close of trading, Applied Materials (AMAT, Fortune 500) reports quarterly results. The chip gear maker is expected to have earned 11 cents per share versus 55 cents a year ago, according to analysts surveyed by Thomson Reuters. Thursday: Wal-Mart Stores (WMT, Fortune 500) reports results before the start of trading. The Dow component is expected to have earned 81 cents per share versus 77 cents a year ago, according to forecasts. Walt Disney (DIS, Fortune 500) reports quarterly earnings after the close. The media company is expected to have earned 40 cents per share versus 43 cents a year ago. Government readings on weekly jobless claims, weekly crude oil inventories and the October Treasury budget are also due in the morning, but forecasts weren't available in advance. Friday: The September trade balance is due out before start of trading. The trade gap is expected to have widened to $31.9 billion from $30.7 billion in the previous month, according to a consensus of economists surveyed by Briefing.com. The University of Michigan's consumer sentiment index for November is expected to have risen to 71.8 from 70.6 in the previous month. JC Penney (JCP, Fortune 500) is due to report results before the start of trading. The retailer is expected to have earned 11 cents per share versus 55 cents a year ago. Abercrombie & Fitch (ANF) reports results before the start of trading. The retailer is expected to have earned 21 cents per share versus 72 cents a year earlier. Government readings on October import and export prices are also due in the morning, but forecasts were not available in advance. |

||

| Useful To Me Not Useful To Me | |||

|

smartrader

Elite |

06-Nov-2009 23:57

|

||

|

x 0

x 0 Alert Admin |

it has to peak beyond the 10 percent as predicted... watch out when there consecutive months of improvement in reverse trend --- that's where dow will taste 300+pts in a single session.. | ||

| Useful To Me Not Useful To Me | |||