| Latest Forum Topics / Others |

|

|

DOW & STI

|

||||||||||||||||||||||||||

|

williamyeo

Senior |

09-Feb-2010 22:35

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Is DJIA back to 10,000 to-nite ?

|

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

williamyeo

Senior |

09-Feb-2010 21:33

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

|

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

|

Blastoff

Elite |

09-Feb-2010 16:38

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

DOW future now green... | |||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

alexchia01

Elite |

09-Feb-2010 11:07

Yells: "Catch The Stars And Ride With Them" |

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Dow Jones drop further last night. Get out of the market while you still can. |

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

tradersgx

Veteran |

09-Feb-2010 09:24

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

European Central Bank President Jean-Claude Trichet said the ECB is “confident” Greece will cut its deficit below the limit of 3 percent of gross domestic product in 2012 from 12.7 percent. bloomberg Europe's Major Indexes shares close higher today. EUROPE EQUITY INDEXES 8 FEB2010 STOXX 50 2664.29 +32.65 +1.24% DJStoxx 600 238.91 +1.45 +0.61% FTSE 100 5,092.33 +31.41 +0.62% DAX 30 5,484.85 +50.51 +0.93% CAC 40 3,607.27 + 43.51 +1.22% FTSE MIB 20,938.24 +122.36 +0.59% |

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

|

Blastoff

Elite |

09-Feb-2010 06:08

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

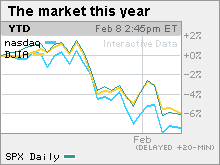

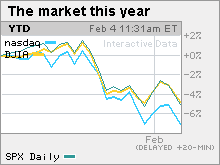

Debt fears drag Dow below 10,000NEW YORK (CNNMoney.com) -- The Dow industrials finished below the 10,000 level Monday for the first time in three months, dragged lower by financial stocks, as investors remained concerned about Europe's debt woes and the U.S. economic recovery. The Dow Jones industrial average (INDU) tumbled 104 points, or 1%, according to early tallies, ending at 9,908. The last time the Dow industrials finished below 10,000 was Nov. 4. The S&P 500 index (SPX) lost 9 points, or 0.9%. The Nasdaq composite (COMP) shed 15 points, or 0.7%.  The major indexes have been on the decline for four weeks in a row as the optimism that propelled a 10-month rally off 12-year lows hit last March has been replaced by cautiousness. Bets that an economic recovery was gaining momentum -- combined with trillions in fiscal and monetary stimulus -- fed the 2009 rally. But so far in 2010, markets have been choppy and weak as investors wait for evidence that the still-germinating recovery is really taking hold, particularly amid the hard-hit labor market and housing industry. "Investors may have priced in a tepid recovery in terms of their strategies, but they haven't priced in sovereign debt issues," said Larry Glazer, managing director at Mayflower Advisors. "That factor, plus companies reporting decent earnings but seeing no response, is having an impact right now." In January, worries about China curbing bank lending and the U.S. White House limiting trading at big banks raised fears about tighter lending standards and the credit markets. But stocks tumbled toward the end of last week on fears that Greece might default on its debt, which could trigger defaults in other European nations, including Portugal, Ireland, Italy and Spain. But some of the selling washed out by late Friday, suggesting the knee-jerk reaction had passed. Helping to take the edge off the selling Monday was a rally in commodity prices and energy and metal stocks as the dollar lost some steam. Last week, debt concerns battered the euro, propelling the dollar and dragging on dollar-traded commodities. A wish to dump riskier assets including U.S. stocks also added to the selling. Commodities and the dollar: The U.S. dollar slipped versus the euro after rising to a more than six-month high versus the European currency last week. The dollar strengthened versus the Japanese yen. Over the weekend, finance ministers from the Group of Seven largest industrialized nations pledged to keep providing liquidity to sustain a recovery. But the issue of Greece's potential default was not specifically addressed. Commodity prices rallied, with COMEX gold for April delivery rising $13.40 to settle at $1,066.20 an ounce. U.S. light crude oil for March delivery rose 70 cents to settle at $71.89 a barrel on the New York Mercantile Exchange. On the move: A number of tech stocks gained, including Hewlett-Packard (HPQ, Fortune 500), Intel (INTC, Fortune 500), Google (GOOG, Fortune 500) and Cisco Systems (CSCO, Fortune 500). Home Depot (HD, Fortune 500) gained after Morgan Stanley reportedly upgraded the Dow component to "overweight" from "equal-weight," saying it will benefit from a recovering housing market. But a variety of financial shares fell, dragging on the market. Bank of America (BAC, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Goldman Sachs (GS, Fortune 500) and Wells Fargo (WFC, Fortune 500) were among the big losers. Market breadth was negative. On the New York Stock Exchange, losers topped winners by a narrow margin on volume of 770 million shares. On the Nasdaq, decliners beat advancers three to two on volume of 1.75 billion shares. Corporate news: Former Merrill Lynch CEO John Thain will run struggling small business lender CIT Group (CIT, Fortune 500), the company said over the weekend. Thain ran Merrill until it was sold to Bank of America in September 2008, at the height of the financial crisis. CIT emerged from bankruptcy in December. Shares gained 2% Monday morning. Toyota Motor (TM), reeling from the recall of more than 8 million vehicles due to brake problems, told its dealers it is close to announcing a solution to the problems with the Prius hybrid Sedan. Quarterly results: A few big corporations are due to report results this week, including Dow components Coca-Cola (KO, Fortune 500) and Walt Disney (DIS, Fortune 500) on Tuesday and Sprint Nextel (S, Fortune 500) on Wednesday. Coke is expected to have earned 66 cents per share up from 64 cents a year ago, according to a consensus of economists surveyed by earnings tracker Thomson Reuters. Disney is expected to have earned 39 cents per share, down from 41 a year ago. Sprint Nextel is expected to have lost 19 cents per share after earning 24 cents per share a year ago. With 320 companies, or 64% of the S&P 500, having reported results, earnings are on track to have risen 207% versus a year ago and revenues to have gained 8%. But the big jump year-over-year is partly due to easy comparisons to a tough fourth-quarter of 2008. Financial companies in particular are driving the gains. Stripping out financials leaves earnings growth at 16% and revenue growth at 3%. Results have largely been positive, with 74% of companies beating earnings forecasts and 70% beating revenue forecasts. World markets: European markets ended higher, with the London FTSE gaining 0.6%. Asian markets ended lower Monday. Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.59% from 3.61% late Friday. Treasury prices and yields move in opposite directions. |

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

kellychang

Master |

08-Feb-2010 11:25

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

u r right.. the next 20 years is going to belong to asia!!! huat ya! china, india, indonesia, malaysia and singapore!!!

|

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

Hulumas

Supreme |

08-Feb-2010 10:58

Yells: "INVEST but not TRADE please!" |

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

I sold all my DOW portfolio and start accumulating SGX and Asian stocks.

|

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

|

alexchia01

Elite |

08-Feb-2010 10:54

Yells: "Catch The Stars And Ride With Them" |

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

It's too early to say that the US market is improving. I would stay out of the market until there is a clear signal for reversal. At the moment, all charts shows a down-trend. |

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

sgxinvestor

Member |

08-Feb-2010 10:37

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

The facts shows that US Market is improving. Perharps, this week is the good oppoturnity to accumulate and leverage the portfolio.

|

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

Blastoff

Elite |

08-Feb-2010 06:52

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Markets: Shaky after the slump

NEW YORK (CNNMoney.com) -- Wall Street avoided a bigger walloping late last week, with sellers finally calling it quits after a nearly 10% plunge in less than three weeks. But the week ahead could be pivotal as investors either jump back in - or retreat even further. The week ahead brings quarterly earnings from consumer companies Walt Disney and Coca-Cola, as well as economic reports on retail sales, inventories, employment and consumer sentiment. Debt fears in focus: Worries that Greece will default on its debt, causing a domino effect in other debt-strapped European nations, pummeled U.S. stocks last week. Investors ditched risk and embraced the U.S. dollar and government debt as they worried that a U.S. economic recovery is too fragile to withstand an upheaval across the Atlantic. But the declines followed weakness in late January, all of which set the S&P 500, Dow and Nasdaq close to 10% below rally highs hit late last month. A 10% selloff is technically a correction, and investors managed to slow and then stop the selling before the market hit such levels late Friday. "You've clearly got some negative sentiment and legitimate concerns," said Phil Orlando, chief equity market strategist at Federated Investors. "But that doesn't mean the market should be down 10% and continue falling. If we are able to traverse the concerns, we can return the focus to fundamentals, which are starting to improve." He pointed to the batch of better-than-expected fourth-quarter earnings and some of the recent reports that show the economy is continuing to stabilize, although the job market remains battered. The challenge is going from an economic recovery that is largely stimulus driven to one that is driven by fundamentals, said Robert Siewert, portfolio manager at Glenmede. "People are questioning the fundamentals." He said that the issue going forward is "how sustainable corporate earnings and GDP are going to be when we haven't yet seen a fundamental improvement and when we still see systemic problems overseas." Quarterly results: As the quarterly reporting period winds down, just a few market-moving names are scheduled for this week. Dow components Coca-Cola (KO, Fortune 500) and Walt Disney (DIS, Fortune 500) are expected Tuesday, while Sprint Nextel (S, Fortune 500) is Wednesday. Coke is expected to have earned 66 cents per share up from 64 cents a year ago. Disney is expected to have earned 39 cents per share, down from 41 a year ago. Sprint Nextel is expected to have lost 19 cents per share after earning 24 cents per share a year ago. With 314 companies, or 63% of the S&P 500, having reported results, earnings are on track to have risen 206% versus a year ago and revenues to have gained 7%, according to the latest results from tracker Thomson Reuters. The year-over-year jump is partly due to an abysmal fourth-quarter 2008, at the height of the financial crisis. Unsurprisingly, financial companies are leading the recovery in quarterly results. Stripping out the financial sector, earnings are expected to have risen 16% versus a year ago, while revenue is expected to have risen 2%. Results have largely been positive, with 74% of companies beating earnings forecasts and 71% beating revenue forecasts. On the docket

Monday: There are no market-moving reports scheduled. Tuesday: The Commerce Department is expected to report in the morning that wholesale business inventories for December fell 0.6% after falling 1.5% in the previous month. Wednesday: The December trade balance from the Commerce Department is due before the market open. The trade gap is expected to have narrowed to $35 billion from $36.4 billion. The January Treasury budget, due out in the afternoon, is expected to have narrowed to $60 billion from $91.9 billion in December. The weekly crude oil inventories report from the government is also due in the morning. The House Financial Services Committee holds a hearing on the unwinding of Federal Reserve liquidity programs that were put in place to help temper the blow of the recession. Fed Chairman Ben Bernanke is due to testify. In the afternoon, the House Oversight Committee holds a hearing on Toyota (TM). The company has recalled more than 8 million vehicles due to safety issues with its gas pedal. Thursday: The January retail sales report is due shortly before the start of trading. Sales are expected to have risen 0.4% after falling 0.3% in December. Sales excluding autos are expected to have risen 0.4% after falling 0.2% in December. The government's business inventories report for December, due out after the start of trading, is expected to have risen 0.4% after rising 0.4% in the previous month. The weekly jobless claims report from the Labor Department is also due in the morning. Friday: The University of Michigan's consumer sentiment index for February is expected to have risen to 74.8 from 74.4, according to forecasts. |

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

daphnecsf

Senior |

07-Feb-2010 18:27

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

I bet on "Green". hehe :) jmv Based on the Dow Components' Quarterly Data (vs previous Q) Better Net Income: 21 companies 70.00% :)

|

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

|

tradersgx

Veteran |

06-Feb-2010 23:55

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

US is recovery? you bet. (",) (",) (",) February 6, 2010 'It's bargain hunting in an oversold market,' said Cleveland Rueckert, market analyst at Birinyi Associates in Stamford, Conneticut. 'At least in the short term, selling was overdone.' Major indexes turned positive heading into the close, as investors scooped up shares in the technology and materials sectors - two of the worst perforomers during the market's latest pullback. -- REUTERS ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ Dow Components USD$'000 ( http://finance.yahoo.com/q/cp?s=%5EDJI ) Quarterly Data (vs previous Q) Alcoa, Inc. (AA) Total Revenue: 30-Sep-09 $4,615,000 30-Jun-09 $4,244,000 31-Mar-09 $4,147,000 31-Dec-08 $4,672,000 Net Income: 30-Sep-09 $129,000 30-Jun-09 ($454,000) 31-Mar-09 ($497,000) 31-Dec-08 ($1,191,000) American Express Company (AXP) Total Revenue: 30-Sep-09 $6,559,000 30-Jun-09 $6,639,000 31-Mar-09 $6,481,000 31-Dec-08 $7,443,000 Net Income: 30-Sep-09 $640,000 30-Jun-09 $337,000 31-Mar-09 $437,000 31-Dec-08 $240,000 Boeing Co. (BA) Total Revenue : 30-Sep-09 $16,688,000 30-Jun-09 $17,154,000 31-Mar-09 $16,502,000 31-Dec-08 $12,664,000 Net Income : 30-Sep-09 ($1,564,000) 30-Jun-09 $998,000 31-Mar-09 $610,000 31-Dec-08 ($86,000) Bank of America Corporation (BAC) Total Revenue: 30-Sep-09 $33,135,000 30-Jun-09 $40,736,000 31-Mar-09 $45,417,000 31-Dec-08 $31,188,000 Net Income: 30-Sep-09 ($1,001,000) 30-Jun-09 $3,224,000 31-Mar-09 $4,247,000 31-Dec-08 ($1,789,000) Caterpillar Inc. (CAT) Total Revenue: 30-Sep-09 $7,298,000 30-Jun-09 $7,975,000 31-Mar-09 $9,225,000 31-Dec-08 $12,923,000 Net Income: 30-Sep-09 $434,000 30-Jun-09 $341,000 31-Mar-09 ($112,000) 31-Dec-08 $661,000 Cisco Systems, Inc. (CSCO) Total Revenue: 24-Oct-09 $9,021,000 25-Jul-09 $8,535,000 25-Apr-09 $8,162,000 24-Jan-09 $9,089,000 Net Income: 24-Oct-09 $1,787,000 25-Jul-09 $1,081,000 25-Apr-09 $1,348,000 24-Jan-09 $1,504,000 Chevron Corp. (CVX) Total Revenue: 30-Sep-09 $46,625,000 30-Jun-09 $40,205,000 31-Mar-09 $36,130,000 31-Dec-08 $45,203,000 Net Income : 30-Sep-09 $3,831,000 30-Jun-09 $1,745,000 31-Mar-09 $1,837,000 31-Dec-08 $4,895,000 EI DuPont de Nemours & Co. (DD) Total Revenue: 30-Sep-09 $6,156,000 30-Jun-09 $7,088,000 31-Mar-09 $7,270,000 31-Dec-08 $6,070,000 Net Income: 30-Sep-09 $409,000 30-Jun-09 $417,000 31-Mar-09 $488,000 31-Dec-08 ($629,000) Walt Disney Co. (DIS) Total Revenue: 3-Oct-09 $9,867,000 27-Jun-09 $8,596,000 28-Mar-09 $8,087,000 27-Dec-08 $9,599,000 Net Income: 3-Oct-09 $895,000 27-Jun-09 $954,000 28-Mar-09 $613,000 27-Dec-08 $845,000 General Electric Co. (GE) Total Revenue: 30-Sep-09 $37,852,000 30-Jun-09 $39,082,000 31-Mar-09 $38,411,000 31-Dec-08 $46,213,000 Net Income : 30-Sep-09 $2,530,000 30-Jun-09 $2,586,000 31-Mar-09 $2,896,000 31-Dec-08 $3,722,000 The Home Depot, Inc. (HD) Total Revenue: 1-Nov-09 $16,361,000 2-Aug-09 $19,071,000 3-May-09 $16,175,000 1-Feb-09 $14,607,000 Net Income: 1-Nov-09 $689,000 2-Aug-09 $1,116,000 3-May-09 $514,000 1-Feb-09 ($54,000) Hewlett-Packard Company (HPQ) Total Revenue: 31-Oct-09 $30,950,000 31-Jul-09 $27,451,000 30-Apr-09 $27,351,000 31-Jan-09 $28,800,000 Net Income : 31-Oct-09 $2,448,000 31-Jul-09 $1,642,000 30-Apr-09 $1,716,000 31-Jan-09 $1,854,000 International Business Machines Corp. (IBM) Total Revenue: 30-Sep-09 $23,566,000 30-Jun-09 $23,251,000 31-Mar-09 $21,711,000 31-Dec-08 $27,007,000 Net Income: 30-Sep-09 $3,214,000 30-Jun-09 $3,103,000 31-Mar-09 $2,295,000 31-Dec-08 $4,427,000 Intel Corporation (INTC) Total Revenue: 26-Sep-09 $9,389,000 27-Jun-09 $8,024,000 28-Mar-09 $7,145,000 27-Dec-08 $8,226,000 Net Income: 26-Sep-09$1,856,000 27-Jun-09($398,000) 28-Mar-09$629,000 27-Dec-08 $234,000 Johnson & Johnson (JNJ) Total Revenue: 27-Sep-09 $15,081,000 28-Jun-09 $15,239,000 29-Mar-09$15,026,000 28-Dec-08 $15,182,000 Net Income : 27-Sep-09 $3,345,000 28-Jun-09 $3,208,000 29-Mar-09$3,507,000 28-Dec-08 $2,714,000 JPMorgan Chase & Co. (JPM) Total Revenue: 30-Sep-09 $18,184,000 30-Jun-09 $29,502,000 31-Mar-09 $29,584,000 31-Dec-08 $32,910,000 Net Income : 30-Sep-09 $3,588,000 30-Jun-09 $2,721,000 31-Mar-09 $2,141,000 31-Dec-08 $702,000 Kraft Foods Inc. (KFT) Total Revenue: 30-Sep-09 $9,803,000 30-Jun-09 $10,162,000 31-Mar-09 $9,396,000 31-Dec-08 $10,767,000 Net Income: 30-Sep-09 $820,000 30-Jun-09 $829,000 31-Mar-09 $662,000 31-Dec-08 $163,000 The Coca-Cola Company (KO) Total Revenue : 2-Oct-09 $8,044,000 3-Jul-09 $8,267,000 3-Apr-09 $7,169,000 31-Dec-08 $7,126,000 Net Income: 2-Oct-09 $1,873,000 3-Jul-09 $2,049,000 3-Apr-09 $1,359,000 31-Dec-08 $995,000 McDonald's Corp. (MCD) Total Revenue: 30-Sep-09 $6,046,700 30-Jun-09 $5,647,200 31-Mar-09 $5,077,400 31-Dec-08 $5,565,000 Net Income: 30-Sep-09 $1,261,000 30-Jun-09 $1,093,700 31-Mar-09 $979,500 31-Dec-08 $985,300 3M Co. (MMM) Total Revenue : 30-Sep-09 $6,193,000 30-Jun-09 $5,719,000 31-Mar-09 $5,089,000 31-Dec-08 $5,509,000 Net Income : 30-Sep-09 $936,000 30-Jun-09 $792,000 31-Mar-09 $530,000 31-Dec-08 $536,000 Merck & Co. Inc. (MRK) Total Revenue: 30-Sep-09 $6,049,700 30-Jun-09 $5,899,900 31-Mar-09 $5,385,200 31-Dec-08 $6,032,400 Net Income: 30-Sep-09 $3,361,500 30-Jun-09 $1,588,300 31-Mar-09 $1,455,800 31-Dec-08 $1,644,800 Microsoft Corporation (MSFT) Total Revenue: 31-Dec-09 $19,022,000 30-Sep-09 $12,920,000 30-Jun-09 $13,099,000 31-Mar-09 $13,648,000 Net Income : 31-Dec-09 $6,662,000 30-Sep-09 $3,574,000 30-Jun-09 $3,045,000 31-Mar-09 $2,977,000 Pfizer Inc. (PFE) Total Revenue: 27-Sep-09 $11,621,000 28-Jun-09 $10,984,000 29-Mar-09 $10,867,000 31-Dec-08 $12,346,000 Net Income : 27-Sep-09 $2,878,000 28-Jun-09 $2,260,000 29-Mar-09 $2,730,000 31-Dec-08 $266,000 Procter & Gamble Co. (PG) Total Revenue: 31-Dec-09 $21,027,000 30-Sep-09 $19,807,000 30-Jun-09 $18,662,000 31-Mar-09 $18,417,000 Net Income : 31-Dec-09 $4,659,000 30-Sep-09 $3,307,000 30-Jun-09 $2,471,000 31-Mar-09 $2,613,000 AT&T, Inc. (T) Total Revenue: 30-Sep-09 $30,855,000 30-Jun-09 $30,734,000 31-Mar-09 $30,571,000 31-Dec-08 $31,076,000 Net Income: 30-Sep-09 $3,192,000 30-Jun-09 $3,123,000 31-Mar-09 $3,201,000 31-Dec-08 $2,404,000 The Travelers Companies, Inc. (TRV) Total Revenue: 30-Sep-09 $6,126,000 30-Jun-09 $6,363,000 31-Mar-09 $5,735,000 31-Dec-08 $5,805,000 Net Income : 30-Sep-09 $935,000 30-Jun-09 $740,000 31-Mar-09 $662,000 31-Dec-08 $801,000 United Technologies Corp. (UTX) Total Revenue: 30-Sep-09 $13,375,000 30-Jun-09 $13,196,000 31-Mar-09 $12,249,000 31-Dec-08 $14,499,000 Net Income : 30-Sep-09 $1,058,000 30-Jun-09 $899,000 31-Mar-09 $799,000 31-Dec-08 $1,145,000 Verizon Communications Inc. (VZ) Total Revenue: 30-Sep-09 $27,265,000 30-Jun-09 $26,861,000 31-Mar-09 $26,591,000 31-Dec-08 $24,645,000 Net Income: 30-Sep-09 $1,176,000 30-Jun-09 ($82,000) 31-Mar-09 $3,210,000 31-Dec-08 $1,235,000 Wal-Mart Stores Inc. (WMT) Total Revenue: 31-Oct-09 $99,411,000 31-Jul-09 $100,910,000 30-Apr-09 $94,242,000 31-Jan-09 $109,116,000 Net Income : 31-Oct-09 $3,015,000 31-Jul-09 $3,666,000 30-Apr-09 $3,022,000 31-Jan-09 $3,792,000 Exxon Mobil Corp. (XOM) Total Revenue: 30-Sep-09 $82,260,000 30-Jun-09 $74,457,000 31-Mar-09 $64,028,000 31-Dec-08 $84,696,000 Net Income : 30-Sep-09 $4,730,000 30-Jun-09 $3,798,000 31-Mar-09 $4,702,000 31-Dec-08 $7,820,000 |

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

trader9988

Senior |

06-Feb-2010 19:59

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

well the sti also break 150sma last fri but managed barely to sit just on top of 150sma..... dun bode well...if this broken as well.. prepare for drop to 200sma..around 2569 as of last fri

|

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

alexchia01

Elite |

06-Feb-2010 19:08

Yells: "Catch The Stars And Ride With Them" |

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Dow Jones 1. Break through SMA C(20), (50), and (100) 2. Sign of 1st Bear non-confirm - 15 Jan 2010 - Fall 0.94% 3. Sign of 2nd Bear red flag - 21 Jan 2010 - Fall 2% 4. Sign of 3rd Bear Confirmation - 4 Feb 2010 - Fall 2.6% STI 1. Break through SMA C(20), (50), and (100) 2. Sign of 1st Bear non-confirm - 13 Jan 2010 - Fall 0.96% 3. Sign of 2nd Bear red flag - 21 Jan 2010 - Fall 1.5% 4. Sign of 3rd Bear Confirmation - 26 Jan 2010 - Fall 2.5%

|

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

trader9988

Senior |

06-Feb-2010 17:24

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

how you define bear market can share...is it more than 10% correction frm previous all time high... thx

|

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

alexchia01

Elite |

06-Feb-2010 17:19

Yells: "Catch The Stars And Ride With Them" |

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

We are officially in the bear market now. Unless you are going short. Or you discover some rare gems that can go against the bear. I suggest you don't jump into the red sea. |

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

alexchia01

Elite |

05-Feb-2010 10:26

Yells: "Catch The Stars And Ride With Them" |

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Dow Jones Going Down. Better stay out of the market. |

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

Blastoff

Elite |

05-Feb-2010 06:17

|

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

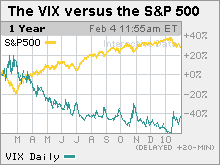

Stocks plunge on job and debt woesNEW YORK (CNNMoney.com) -- Stocks tumbled Thursday, with the Dow and S&P 500 near 3-month lows, amid fears of sovereign debt woes in Europe, and a rise in weekly jobless claims ahead of Friday's big monthly employment report. The Dow Jones industrial average (INDU) tumbled 270 points, or 2.6%, closing at 10,002.26 according to early tallies. The blue-chip average fell as low as 9998.03 right before the close. The last time it fell below 10,000 was in early November.   The S&P 500 index (SPX) sank 34 points, or 3.1%. Both indexes closed at their lowest points since Nov. 4. The Nasdaq composite (COMP) fell 65 points, or 3%, and closed at its lowest point point since Nov. 6. Debt woes propelled the dollar to a more than seven-month high versus the euro, which in turn pummeled dollar-traded commodities such as oil and gold. Treasury prices spiked, lowering yields, in a classic flight-to-safety move. Meanwhile, the VIX (VIX), Wall Street's fear gauge, spiked 18%, suggesting investor nervousness was increasing. "A surprise rise in weekly jobless claims ahead of tomorrow's non-farm payrolls report in combination with the sovereign debt issue has got people a bit spooked today," said Mikel Keifer, vice president at Jurika Mills & Keifer. Keifer said concerns about Greece's debt problems have been in play for a while, but now Spain, Portugal and Ireland are joining the fray. Reports of labor unrest and political problems in the troubled nations are adding to the nervousness. "The worries are coming more to the forefront as market participants wonder if these countries will be able to refinance the debt," Keifer said. The stronger dollar sent oil and gold prices lower, and stocks such as Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500) sliding. With energy one of the biggest sectors in the S&P 500, the selloff in the sector dragged on the broader market. Weaker-than-expected labor market reports on both Wednesday and Thursday also played a role, creating jitters ahead of Friday's January jobs report. "The market is turning its attention to the jobs data and it doesn't like what it's seeing," said Matt King, chief investment officer at Bell Investment Advisors. Rally loses steam: Stocks rallied in the last 9 months of 2009 as investors dug back in after a brutal start to the year. The S&P 500 gained 65% between the 12-year lows hit on March 9 and year-end. That advance continued up until around Jan. 19 of this year. But between that Jan. 19 high and the end of January, the S&P 500 lost just short of 7%. "The market is in a pessimistic mood today, but this is also an extension of the correction we saw in late January," King said. "We saw a 7% decline, but we probably need to see double-digits (in percentage) before the selloff is over." Jobs: The number of Americans filing new claims for unemployment rose to 480,000 last week from a revised 472,000 the previous week, the Labor Department reported. Economists surveyed by Briefing.com expected 455,000 new claims. Continuing claims, the number of Americans receiving benefits for a week or more, rose to 4,602,000 from 4,600,000 the previous week. Economists expected 4,581,000. The report was the lead-in to Friday's big January jobs report from the government. Employers are expected to have added 15,000 jobs to their payrolls last month after cutting 85,000 in the previous month. The unemployment rate, generated by a separate survey, is expected to hold steady at 10%. But the annual revision of U.S. payrolls is expected to show job losses during the recession were a lot more severe than previously thought. The Bureau of Labor Statistics is expected to say that 824,000 more jobs were lost than previously thought during the April 2008 to May 2009 period. Factory orders: December factory orders rose 1% versus forecasts for a rise of 0.5%. Orders rose 1% in the previous month. Quarterly results: After the close of trading Wednesday, tech leader Cisco Systems (CSCO, Fortune 500) reported better-than-expected quarterly sales and earnings. Toyota Motor (TM) reported improved earnings in its most recent quarter and also lifted its estimates for the fiscal year ending in March. But the results did not include the impact of the huge recall of millions of vehicles due to gas pedal problems. Toyota estimates that the global recall could cost it as much as $2 billion. On Thursday, the government announced a formal probe into brake problems in the popular Prius hybrid. (Feds probing Prius brakes) World markets: In overseas trading, Asian markets tumbled and European markets ended lower. Commodities and the dollar: The dollar gained versus the euro on worries about sovereign debt in Greece, Spain and elsewhere in Europe. The dollar fell versus the Japanese yen. The dollar's strength against the euro dragged on oil and gold prices and individual stocks. COMEX gold for April delivery fell $49 to settle at $1,062.40 an ounce. U.S. light crude oil for March delivery fell $3.84 to settle at $73.14 a barrel on the New York Mercantile Exchange. Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.61% from 3.70% late Wednesday. Treasury prices and yields move in opposite directions. Market breadth was negative. On the New York Stock Exchange, losers beat winners by over nine to one on volume of 1.01 billion shares. On the Nasdaq, decliners topped advancers by more than five to one on volume of 2.27 billion shares. |

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||

|

alexchia01

Elite |

04-Feb-2010 23:27

Yells: "Catch The Stars And Ride With Them" |

|||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Actually, we have to look at both. No matter how much STI is de-couple from DJI, DJI will always have an effect over STI. We are too much connected and link with US and the west. SSE is the fastest growing and biggest stock market in Asia. It's too near and big to ignore. SSE definitely Asia, including STI. In reality, STI is affected by both market.

|

|||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||