| Latest Forum Topics / Straits Times Index |

|

|

News Update!

|

|||

|

sk6666

Veteran |

22-Mar-2012 21:18

|

||

|

x 0

x 0 Alert Admin |

Jobless Claims in U.S. Fall to Lowest Level in Four YearsBy Shobhana Chandra - Mar 22, 2012 8:43 PM GMT+0800 http://www.bloomberg.com/news/2012-03-22/jobless-claims-in-u-s-decline-to-lowest-level-in-four-years.html |

||

| Useful To Me Not Useful To Me | |||

|

sk6666

Veteran |

22-Mar-2012 14:39

|

||

|

x 0

x 0 Alert Admin |

FTSE, DAX, CAC Seen Lower as Europe Debt Concerns ReturnPublished: Thursday, 22 Mar 2012 | 2:27 AM ET By: Shai Ahmed CNBC Associate Editor European shares are expected to open lower Thursday as concerns turn to Spain after the country’s bond yields rose sharply Wednesday, prompting fears that the debt crisis plaguing the euro zone could return. http://www.cnbc.com/id/46818187 |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

sk6666

Veteran |

21-Mar-2012 15:07

|

||

|

x 0

x 0 Alert Admin |

FTSE, DAX, CAC Seen Higher Budgets WatchedPublished: Wednesday, 21 Mar 2012 | 2:14 AM ET By: Shai Ahmed CNBC Associate Editor European stocks are called to open higher Wednesday despite Asian shares falling overnight on concerns that China’s economic slowdown could be longer lasting. http://www.cnbc.com/id/46804567 |

||

| Useful To Me Not Useful To Me | |||

|

sk6666

Veteran |

20-Mar-2012 10:58

|

||

|

x 0

x 0 Alert Admin |

Asian Stocks Erase Initial Gains as Hong Kong Shares Declinehttp://www.bloomberg.com/news/2012-03-20/asian-exporters-advance-on-u-s-homebuilder-confidence.html |

||

| Useful To Me Not Useful To Me | |||

|

moneycow

Master |

19-Mar-2012 00:44

|

||

|

x 0

x 0 Alert Admin |

Uncle SAM is smart. It feed soldiers so its natural to make full use of them as professional. Supposedly as world's peace keeper. As peace keeper sometime you have to attack also. :). Sometimes you need to be on offensive to keep peace. Lie what they did to Saddam Hussein. :)

|

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

krisluke

Supreme |

18-Mar-2012 19:17

|

||

|

x 0

x 0 Alert Admin |

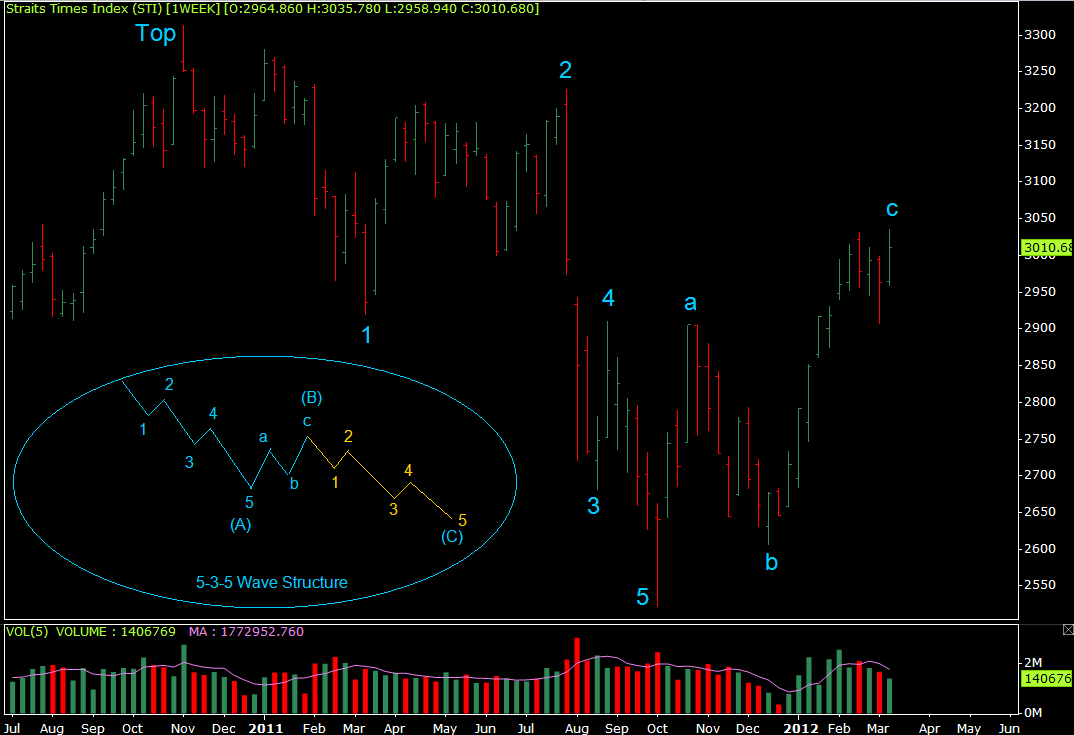

According to Elliott Wave International ( EWI ) March 15's report, the Elliott Wave count for the STI Weekly Chart is labeled in blue as below:

As always, the commentary from EWI is very brief. They did not elaborate much on the wave structure leaving it to the readers to interpret ( which is frustrating ).

Based on my interpretation, if a downtrend has five waves ( 1, 2, 3, 4, 5 ) followed by a three waves ( a, b, c ) counter-trend move. We should be looking at a 5-3-5 correction ( from the " Top" marked in the chart ) where the 1st five wave ( 1, 2, 3, 4, 5 ) is corrective wave " A" of a higher degree, the three wave ( a, b, c ) is corrective wave " B" of a higher degree ( which is where we are now ). From here, we should expect another downtrend of a 2nd five wave ( remember we said 5-3-5? The 5-3 has unfolded. The last 5 in the 5-3-5 is what we are heading for now ).

Please note that the Elliott Wave counts ( in blue ) are not my view, it is the view of EWI. I have merely added my interpretation ( those labels in gold color ).

|

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 19:13

|

||

|

x 0

x 0 Alert Admin |

French Socialist urges Tobin tax, eurobonds for growth

Hollande delivers speech during a political rally with European Socialists in Paris

PARIS (Reuters) - France's Socialist presidential frontrunner said on Saturday he would renegotiate an EU budget treaty to include a financial transactions tax and common European bonds to stimulate growth via investment in energy, education and urban development. Francois Hollande, who has made renegotiating the fiscal pact signed by 25 European leaders this month a central part of his campaign, also said he wanted to change the role of the European Central Bank to give it a broader mandate for stimulating growth, not just controlling inflation. " I solemnly affirm today that I will renegotiate this budgetary treaty for the good not just of France but the whole of Europe," Hollande told a meeting of Socialist politicians from across the continent. While he accepted the need to rebalance government finances, Hollande said the first step must be a return to economic growth which too much austerity threatened to undermine. " This treaty is an illusion and it poses a risk... It creates the conditions for a lasting economic crisis which would only create budgetary imbalances once again," he told the crowd, including Belgian Prime Minister Elio du Rupo and the leader of Germany's opposition SPD party, Sigmar Gabriel. The German-inspired fiscal compact would impose a cap on budget deficits throughout Europe and allow countries to be sued for flouting its rules. But several countries, including the new conservative government in Spain, have voiced concern that imposing austerity too quickly may worsen an economic downturn. Hollande said a broad financial transactions tax - dubbed a Tobin tax after the U.S. Nobel laureate who first proposed it in the 1970s to discourage speculation - should be applied across Europe on all financial instruments, including derivatives, to fund infrastructure and development projects for growth. President Nicolas Sarkozy, who trails Hollande in the polls by a wide margin for the May 6 runoff election, has proposed a narrower tax in France, mainly on trading in equities, saying he hoped this would inspire European partners to follow suit. Hollande has support from Europe's left. Germany's SPD has said it would only back the fiscal compact if the government agrees extra measures like a transaction tax. Because the pact affects sovereignty, Chancellor Angela Merkel's coalition requires a two-thirds majority in both houses of parliament, making her dependent on the opposition. In Hollande, where the government also relies on the left-wing opposition to pass European pacts, two leading Labour MPs have indicated they would block it unless the Netherlands gets more time to lower its deficits. " European Socialists must raise their voices and say ... this treaty is not enough!" said Pier Luigi Bersani, the leader of the leftwing PD party in Italy. " Francois' challenge is shared by all of us." FRANCE MAY START MOVE TO LEFT With elections next year in Germany and Italy, the euro zone's first and third largest economies, Hollande says he hopes his victory could spark a swing to the left in Europe, making France as a battleground for the region's left and right. " If a wave starts in France, it will become irresistible in the whole of Europe," he told the meeting. At present leftist parties govern only in a handful of smaller states like Belgium, Denmark and Austria, often in coalition governments. Hollande said there was still time before the treaty was ratified to seek an amendment. In a further obstacle to its implementation, Irish Prime Minister Edna Kenny's announced last month a surprise referendum on the treaty -- though opinion polls suggest Irish voters may approve it. With only 12 countries required to ratify the treaty before it takes effect, Hollande may have only a small window to act. The Socialist leader said that, as part of the renegotiation, the European Investment Bank (EIB) must be made to step up its lending to fund development projects and credit to businesses. More use should also be made of EU structural funds, much of which was going to waste at present, he said. He called for the firepower of the euro zone's permanent bailout fund, the European Stability Mechanism (ESM), to be boosted by allowing it to access liquidity from the ECB like a bank. Germany has staunchly opposed such a proposal. " The ECB must go further in playing its role of lender of last resort," Hollande said. " I know this idea is not shared by everyone in Europe, but we must extend the mandate of the ECB. Price stability has been accomplished ... Acting in favour of growth should also be part of the ECB's mission." Hollande said that new European funds to stimulate growth needed to be used to regenerate impoverished urban centres across the continent, finance renewable energy, and provide opportunities to a generation of young Europeans whose future would otherwise be blighted by the ongoing financial crisis. " I want to make the youth a great European cause," Hollande told the meeting. " I can't accept that youth unemployment in Europe is around 25 percent and there is despair among a generation which is growing up. Europe must make room for its youth." |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 19:12

|

||

|

x 0

x 0 Alert Admin |

Greek banks may not need all of EU/IMF aid-cenbanker

ATHENS, March 17 (Reuters) - Greek banks hard-hit by the country's debt swap might not need all the aid earmarked by the EU and IMF to help them weather the crisis, central bank chief George Provopoulos was quoted as saying on Saturday.

The European Union and International Monetary Fund have set aside some 50 billion euros to recapitalise and support the lenders, the biggest private holders of Greece's debt. The banks all took part in the largest debt restructuring in history this month that saw bondholders lose as much as 74 percent on their investments. " The recapitalisation of the banks will be completed by September 2012," Provopoulos told To Vima newspaper. " I believe that the available amount will not need to be fully exhausted." Provopoulos said he still hoped there would be mergers in the Greek banking sector after Alpha Bank on Wednesday scrapped plans to tie up with rival Eurobank in what would have been Greece's biggest bank merger in decades. The merger fell through after the debt swap inflicted a bigger hit on their portfolios than expected, with Eurobank particularly affected as its exposure to Greek sovereign bonds was roughly double. " It's possible that we will see mergers. After its recapitalisation the banking sector will be much healthier and stronger," Provopoulos said ahead of the publication on Monday of the central bank's monetary policy report. He warned once again that for Greece to leave the eurozone would be like " opening the gates of hell." " Fortunately the decisions by the Eurogroup and successful completion of PSI (debt swap) are making this scenario distant and give Greece the chance to enter, with hard work, a virtuous circle," he said. (Reporting by Renee Maltezou and Ingrid Melander Editing by Mark Heinrich) |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

krisluke

Supreme |

18-Mar-2012 19:10

|

||

|

x 0

x 0 Alert Admin |

What To Do When A Company Lies About Its Products They say the truth will set you free, but sometimes, not telling the truth can make you lots of money. That’s the assertion made by a California woman suing the maker of a major orange juice brand, claiming that its “100% pure and natural” orange juice is, in fact, not. In a federal lawsuit filed earlier this year, she claims the company, knowing consumers “want and demand natural products,” deceives them in its advertising and packaging for some of its juice. In fact, the juice is extensively processed in a way that changes its essential nature, she adds. This is hardly the first time people have claimed something was wrong with their drink. In my book, “Scammed: How to Save Your Money and Find Better Service in a World of Schemes, Swindles, and Shady Deals” I explore the fascinating case of yet another beverage, which made health claims about its products that some consumers found misleading. The question is, what do you do when you think a company has lied about one of its products? The lawsuit.Based on the previous two examples, you might think a lawsuit is the fastest and easiest way to get a company to start telling the “truth.” It isn’t. Actually, it’s most often the last resort. Lawsuits are expensive and they take a lot of time. Unfortunately, the good guys don’t always win, either. Buy carefully.Did you do all of your research before plunking down your credit card? Often, with just a little research, you can determine if a company’s assertions are correct, or if they’re inflated. As I explain in Scammed, most lies can – and should – be caught at this stage: before you buy. Ask for clarification.If you’ve bought something you believe is fraudulent, try asking the company for clarification. Sometimes, what you think is a fib is actually a misunderstanding, and it can be fixed with a quick conversation. Note: It’s better to phrase this as a question, rather than an accusation (in other words, instead of saying, “This orange juice isn’t 100 percent pure!” try “What does 100 percent pure mean, exactly?” Appeal to the management or executive level.If you’re unhappy with the answer you get from a rank-and-file employee, contact a manager. The best way to get an “official” answer or clarification is to put your request in writing, preferably as an email. I list the names of many managers on my customer-service wiki. Go to a higher authority.Take your case to a government regulatory agency, a media organization or, ahem, a consumer advocate (like me). A third party may be in a better position to gain clarity, and possibly push for clearer language to appear in any labeling or marketing claims. It would also send an unmistakably clear signal to the company that you’re not going away until it does something. Stop buying the product – and tell others to do the same.The boycott should be your last stop before filing a lawsuit. Tell everyone you know that the product is phony, urge them not to buy the product, and only if that fails should you take your case to a court. Companies stretch the truth about their products – or lie – often. But if you follow these steps, you can help put an end to it. Christopher Elliott is a consumer advocate who blogs about getting better customer service at On Your Side. Connect with him on Twitter and Facebook or send him your questions by email. This post originally appeared at Mint. |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 19:08

|

||

|

x 0

x 0 Alert Admin |

LAGARDE: China Has 3 Major Priorities Right Now From the International Monetary Fund website: Opening Ceremony, China Development Forum 2012 Guest Speech by Christine Lagarde, IMF Managing Director Beijing, Sunday, March 18, 2012 As prepared for delivery Good morning. It is an absolute pleasure to be back in Beijing and so soon after my excellent visit last November. My desire to be here reflects just how important China has become for the global economy. It is a great privilege to be among such esteemed company. I would also like to thank Li Wei and his colleagues at the Development Research Center of the State Council for inviting me here today. “China & the World: Macroeconomic Stabilization and Economic Restructuring.” At this juncture, I cannot think of a better theme for this year’s forum. The specific economic challenges that countries face today naturally differ, with positive signs emerging in some corners of the globe and severe stresses still prominent in others. Yet, there are common goals that unite us all—the quest for growth and stability—lasting growth, shared growth, growth that delivers jobs and a better livelihood for all. This event provides an excellent opportunity to reflect on the remarkable role that China is playing, and can continue to play, in pursuing these global goals. I am very much looking forward to hearing Vice Premier Li Keqiang speak, as I’m sure you all are too. So, let me reflect briefly on two things: first, the state of the global economy and second, China’s leading role in securing economic stability and prosperity. Global Economic Challenges The past few years have been extremely difficult for many parts of the world. And, even just a few months ago, the situation was decidedly gloomy. Indicators for the last quarter of 2011—namely for Europe and the United States—did not provide much reassurance. Yet, today, we are seeing signs of stabilization signs that policy actions are paying off. Financial-market conditions are more comfortable and recent economic indicators are beginning to look a little more upbeat, including in the United States. Important decisions and policy actions, particularly by the European Central Bank and some European countries, have helped. I have said for some time that we can avoid the worst if all partners play their part. Moving forward with renewed support for Greece—from both the IMF and European partners—is an important milestone in this regard. The measures are ambitious and it will be important to focus on implementation and monitoring, but we have made an important step forward. On the back of these collective efforts, the world economy has stepped back from the brink and we have cause to be more optimistic. Still, optimism must not lull us into a false sense of security. There are still major economic and financial vulnerabilities we must confront. I’ll mention three.

And we must not forget that there are still too many people, in too many countries, who are enduring the hardship of unemployment. So, the global economy may be on a path to recovery, but there is not a great deal of room for maneuver and no room for policy mistakes. It is often said that a reputation is “gained in inches and lost in miles”. The same could be said of economic progress. All countries must persevere with their policy efforts if the progress of yesterday is to translate into the promise of a brighter tomorrow. So, what are the main challenges?

China’s Leadership This brings me to my second point—China’s global leadership. For many years now, China’s economic successes have captured the world’s attention. We have looked on in awe as, year after year, China has posted spectacular growth and, in the space of three decades, created 370 million jobs and lifted half a billion people out of poverty. When the global crisis hit, China again showed leadership and adept policy skills. Indeed, the global economic situation might have been even more calamitous had it not been for the impetus that China provided to growth and stability. China’s leadership role in global institutions has mirrored these economic successes. As one of the IMF’s largest shareholders and as an influential member of the G-20, China has been instrumental in helping to make the global economic system less prone to damaging crises. Yet, lingering weaknesses in the global outlook reinforce the importance of China continuing to forge ahead—by maintaining a prominent role in global policy discussions and by sustaining its efforts to accelerate the transformation of the Chinese economy. So, as I see it, the priorities for China are now threefold:

I am encouraged that the government has embraced these goals, reflected in the comprehensive policy agenda in the recent 12th Five Year Plan. Conclusion Finally: If I had one piece of advice for policymakers around the world, I might borrow the words of Confucius: “In all things, success depends on previous preparation.” 凡 事 预 则 立 , 不 预 则 废 We have seen China’s previous preparation bear the fruits of today’s success. And we are beginning to see the small successes from recent action in Europe. But today’s risks are still very much global. We are all interconnected and we are all affected by each other’s policy actions. We need to prepare for success together. If we stand together, the whole will be more than the sum of the parts. And, in this, China is a leader of the global economy—leading by example, leading by responsible economic policy, leading by engagement. Thank you. |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 19:06

|

||

|

x 0

x 0 Alert Admin |

UPDATE 2-China home prices fall for fifth straight month

(Fixes typo in paragraph 8)

* China new home prices fall 0.1 pct in Feb on month ago * They remain unchanged last month from a year ago * Home prices to continue falling on government curbs By Langi Chiang and Don Durfee BEIJING, March 9 (Reuters) - Chinese home prices fell in February from January for a fifth consecutive month and are expected to continue heading south in coming months, underlining the success of Beijing's long campaign to cool property market speculation. Average new home prices across China fell 0.1 percent last month, versus a drop of 0.2 percent in January, according to Reuters' weighted home price index based on data announced by the National Bureau of Statistics on Sunday. The NBS said new home prices fell in 45 of the 70 major cities it monitors and remained flat in 22, but rose in the cities of Jinan, Xining and Baotou. In January, they stopped rising in all 70 cities from a month earlier. In year-on-year terms, home price declines spread to 27 cities in February from 14 in January. As a result, they remained unchanged on average last month for the first time since China's property tightening campaign started in late 2009. That compared with an annual rise of 0.5 percent in January. " China's property prices will likely continue their downward trend, likely going into the second half of 2012 and until policies are altered," Mark Budden, China area leader of EC Harris, a global built-asset consultancy, said after the data. ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ China Overseas Land sees tough times ahead Wen: Property mkt risks chaos if controls eased ANALYSIS-Politics push property tax to Beijing TABLE-Feb sales of major Chinese developers China Jan-Feb property sales revenue tumbles ^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ The NBS stopped publishing its nationwide home price index in January 2011, but continues to provide city-specific data. NO RELAXATION Chinese Premier Wen Jiabao on Wednesday told a news conference that he would stick to property tightening measures during his last year in office to deflate asset bubbles that would hurt the broad economy if they burst. " I can now tell everyone very clearly that home prices are still far above the reasonable level. Therefore, we must not relax tightening," he reiterated, dousing hopes of a letup in his government's property tightening stance. His comments dimmed the outlook for Chinese developers - many are suffering sliding sales and an acute funding shortage - and sent the country's property shares down by 5 percent over the following three trading days. Still, Beijing does not want to see the market crash and has started fine tuning its policy. Banks are now increasing mortgage loans for first-time home buyers and offering lower rates. Regulators are also making it easier for developers building normal housing to get bank loans. On the ground, some local governments have tried to loosen curbs, but the central government has so far pushed back such efforts by Shanghai and several other cities. " Premier Wen's statement can also be seen as a signal to local governments who have been trying to ease policies," Tao Wang, an economist with UBS in Hong Kong, said in a note to clients on Friday. China's property sales fell 20.9 percent in the first two months of 2012 from a year earlier, the NBS said on March 9. DEEPENING PRICE CUTS Although transaction data from private real estate consultancies pointed to a slight pickup in recent weeks from a trough during the Lunar New Year, industry observers widely expect it to be short-lived. " Before the easing or eventual removal of the restrictive policies in the property sector, further softening of home prices and reduction in transaction volume of sales will continue," China Overseas Land & Investment, the country's No 1 developer by market value, said in a statement on Thursday. China still has strong pent-up demand for housing, with its rapid urbanisation and rising household income. But tightening measures have blocked access to housing market for some families and kept others waiting for even lower prices. Inventories of unsold homes in China's big cities such as Beijing and Shanghai have hit record highs and developers have slowed the pace of land purchases, underlying slower growth in real estate investment this year. China's real estate investment accounted for 13 percent of GDP last year and affects over 40 other industries. While the private sector real estate market will remain weak this year, economists expect Beijing's affordable housing campaign will boost construction and help prop up the economy. The $316-billion scheme will see China starting construction of 7 million cheap homes this year and finishing 5 million. Last year, the country started 10 million units and completed 4.3 million. " With social housing playing a larger role in overall property construction this year than ever before, the government may afford to keep a tough stance on property policies for longer," said UBS' Wang. She added that affordable homes " will provide an indispensable contribution to overall property construction and help avoid a hard-landing in China." (Editing by Jonathan Thatcher) |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 19:05

|

||

|

x 0

x 0 Alert Admin |

Striking Pictures Of US Troops Serving Around The World The average day at work for U.S. military members is anything but typical.

Men and women from every walk of life combine their energy and expertise doing things in places most of us can't even imagine. Tragedies often make their way into the headlines of the world, while the day-to-day scope of what troops encounter often falls by the wayside. The following pictures were taken by U.S. military photographers assigned to units throughout the world and posted by BlackFive. |

||

| Useful To Me Not Useful To Me | |||

|

|

|||

|

krisluke

Supreme |

18-Mar-2012 18:58

|

||

|

x 0

x 0 Alert Admin |

Christians gather to bid farewell to Egypt's Pope

The body of Pope Shenouda III, the head of Egypt's Coptic Orthodox Church, is displayed for public viewing inside the Abassiya Cathedra in Cairo

CAIRO (Reuters) - Christians gathered on Sunday to pay final respects to Pope Shenouda III, who sought to soothe sectarian tension in his four decades atop Egypt's Orthodox Church but saw increasing flareups in the majority Muslim nation in the last months of his life. Friction has worsened since President Hosni Mubarak, who suppressed Islamists, was ousted last year. Since then Shenouda, who died on Saturday aged 88, often called for harmony and regularly met Muslim and other leaders. Christians, who comprise about a tenth of Egypt's 80 million people, have long complained of discrimination and in the past year stepped up protests, which included calls for new rules that would make it as easy to build a church as a mosque. Shenouda had served as the 117th Pope of Alexandria since November 1971, leading the Orthodox community who make up most of Egypt's Christians. His funeral will be held on Tuesday, Egyptian state media reported. U.S. President Barack Obama offered his condolences and Pope Benedict, leader of the world's Roman Catholics, offered prayers after being informed of his death. Thousands of Christians queued in Cairo's Abbasiya district overnight and on Sunday morning at the cathedral where Shenouda's body was initially laid in a coffin and later seated on a ceremonial throne wearing gold and red embroidered religious vestments, a golden mitre on his head and holding a gold-topped staff. He was popular among many of Egypt's Christians even outside the Orthodox Church, as well as among many Muslims. However, some Christian activists said Shenouda should have pushed the state harder to secure more rights for Christians. In one phrase Shenouda often repeated and which was also cited in newspapers on Sunday, he would say: " Egypt is not a nation we live in, rather it is a nation that lives in us." The burial is expected to take place at the Wadi el Natrun monastery in the desert northwest of Cairo, where the late pope had requested he be buried. Shenouda was banished to Wadi el Natrun monastery in 1981 by then-President Anwar Sadat after he criticised the government's handling of an Islamic insurgency in the 1970s and Egypt's 1979 peace treaty with Israel. Under Mubarak's rule, relations between the government and the Coptic church were generally smooth, with the pope portrayed in state media as a symbol of religious harmony, despite occasional outbreaks of sectarian violence. RELIGIOUS DIALOGUE " We will remember Pope Shenouda III as a man of deep faith, a leader of a great faith, and an advocate for unity and reconciliation," the U.S. president said in a statement issued by the White House. Obama said Shenouda had been committed to national unity and was " a beloved leader of Egypt's Coptic Christians and an advocate for tolerance and religious dialogue." Shenouda publicly supported Mubarak during his last days and before Mubarak's ouster by a popular uprising on February 2011, a move that drew some criticism from some members of his church who joined the protests that ousted the president. Some Muslim leaders also backed Mubarak in his last days. Christians have long complained about rules that put more restrictions on building a church than a mosque and also say they have been discriminated against in the workplace. Christians have accused hardline Islamists of attacking churches and said the authorities have failed to step in to protect them, although experts say some recent incidents have been fuelled by local grudges as well as sectarian tensions. Such violence has for years been sparked by disputes ranging from rows over church building to inter-faith romances. The head of Egypt's ruling military council, Field Marshal Mohamed Hussein Tantawi, granted Christians working in state institutions three days mourning, state media reported. Bishop Bakhomious, head of the church of Bahaira, a district in the Nile Delta north of Cairo, will temporally hold the post of pope for two months until a new leader is elected. Egyptian media described the procedure for choosing a new pope as one based on a system of voting by board members of the church's city councils. The council's vote on three preferred candidates, and the final choice is made when a name is picked out of a box by a young child, the media said. (Editing by Edmund Blair and Mark Heinrich) |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 18:57

|

||

|

x 0

x 0 Alert Admin |

Wall St Week Ahead: Stocks' correction coming? Not that again

* S& P 500 up 9 out of 10 weeks

* Apple shares up 45 pct for the year * Wall Street's " fear gauge" at 5-yr low By Angela Moon NEW YORK, March 16 (Reuters) - Investors are beginning to wonder if this Energizer Bunny of a rally can just keep going without taking a break or a fall. Every Friday for the past couple of months, the question has hung in the back of investors' minds: Is the stock market's rally strong enough to continue without a correction? Even with the S& P 500 above levels unseen since before the financial crisis, the answer remains: Yes. The broad market index broke through 1,400 - a psychologically important level - for the first time in four years this week. On Friday, the S& P 500 closed at 1,404.17, its highest since May 20, 2008. The index is up for nine out of the past 10 weeks. " We are seeing this unbelievable rally in the market and yet the market is unbelievably complacent. We haven't been this bullish for a long time," said Randy Frederick, director of trading and derivatives at the Schwab Center for Financial Research, based in Austin, Texas. Indeed, the CBOE Volatility Index or VIX, Wall Street's fear gauge, plunged to a five-year low despite the S& P 500's stunning gain of 12 percent for the year so far. The VIX measures the expected volatility in the S& P 500 index over the next 30 days and generally moves in the opposite direction of the broad market. Investors often use VIX options and futures as a hedge against a market decline. Frederick said the only concern is the wide spread between second- and third-month VIX futures, suggesting a rise in volatility in the longer term. But the front-month futures that expire next week have come down to levels near the spot VIX. The VIX fell 6.2 percent on Friday to end at 14.47, its lowest close since June 2007. " I would like to see the VIX around 17 just because it tends to have a significant pop when there is bad news at current levels," Frederick said, adding that " frankly" there isn't that much negative news out there. STRENGTH IN MIDCAPS Further evidence of the market's bullish sentiment: The S& P 400 midcap index has popped above the 1,000 mark, an area of strong resistance since last year, according to Ryan Detrick, senior technical strategist with Schaeffer's Investment Research, in Cincinnati. " It's a big area of resistance, but we have moved above this. If we manage to stay here, then the strength in the overall market will advance further," Detrick said. " Historically, April has been a strong month so we can even see the market going up to 1,440, which is the high made in May 2008," he added. TRACKING THE BIG APPLE The direction of Apple shares will also be in focus next week after the stock hit the $600 mark for the first time in history this week, only about a month after it topped $500. Apple currently accounts for about 18 percent of the Nasdaq 100 stock index. Its weighting was cut to 12.3 percent from 20.5 percent last April, but the price surge has pushed the stock's weighting back up, making this index of 100 well-known companies hostage to the performance of a few technology titans like Apple. With Apple's heavy weighting, investors are questioning whether the broad market can continue to rally even with a pullback in Apple shares. " It's a name that a lot of people have exposure to so it definitely has an impact on indexes, but it seems even without Apple, the money gets put to work in other sectors and stocks," Detrick said. While the VIX has been sliding, the expected volatility in Apple has increased, judging by a VIX index that tracks Apple options. Apple, like IBM and other bellwether names, has its own VIX index. The CBOE Apple VIX index, which measures the expected 30-day volatility of the underlying shares of Apple, jumped 35 percent this week, suggesting more gyrations ahead as more investors speculate on short-term moves. (Wall St Week Ahead runs every Friday. Questions or comments on this column can be emailed to: angela.moon(at)thomsonreuters.com) (Reporting By Angela Moon Editing by Jan Paschal) |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 18:24

|

||

|

x 0

x 0 Alert Admin |

At the end of Tuas.. ... |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 18:19

|

||

|

x 0

x 0 Alert Admin |

Artistic drawing on tuas west road... ... Do observe there a train included |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 18:11

|

||

|

x 0

x 0 Alert Admin |

Skyscaper picture of tuas west extension and tuas south extension ... ... |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 18:06

|

||

|

x 0

x 0 Alert Admin |

Building construction by various factory and warehouse... ... An interesting pi |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 18:00

|

||

|

x 0

x 0 Alert Admin |

An interesting figure in the sky from the west ... ... at Tuas |

||

| Useful To Me Not Useful To Me | |||

|

krisluke

Supreme |

18-Mar-2012 17:55

|

||

|

x 0

x 0 Alert Admin |

Bird View on jurong island and tuas view.. ... |

||

| Useful To Me Not Useful To Me | |||