| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||||

|

pharoah88

Supreme |

12-Apr-2010 12:21

|

||||

|

x 0

x 0 Alert Admin |

D O W 1 1 1 1 1 |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

12-Apr-2010 06:37

|

||||

|

x 0

x 0 Alert Admin |

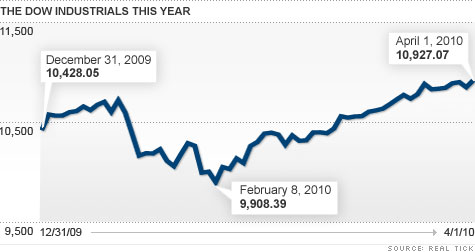

Here come the profit reports

NEW YORK (CNNMoney.com) -- Investors return to work this week with the Dow just short of 11,000, the Nasdaq nearing a two-year high and the first-quarter reporting period set to take off. The blue-chip Dow crossed the 11,000 mark just before the close Friday, but ended short of that to finish at a new 18-month high. The S&P 500 also carved out another 18-month high. Meanwhile, the Nasdaq stands at its highest point since June of 2008. But that leg of the rally occurred in a quiet week when few economic reports were released, Congress was on break and the quarterly reporting period hadn't yet begun. This week ushers in a decidedly busier period. "Dow 11,000 is a nice headline, but the Dow is not the economy," said Brian Battle, vice president at Performance Trust Capital Partners. He said that continued momentum from the recent rally should carry over in the week ahead, with stocks continuing to rise after the Dow, S&P 500 and Nasdaq composite have all climbed in seven of the last eight weeks. "We've had a Rodney Dangerfield stock market rally, where we get no respect because no one believes it can keep going," Battle said. "Earnings season starts next week and that's going to be key." Reports on tap: Quarterly profit reports will start pouring in this week, and results are expected to be very strong. Cost-cutting and easy comparisons to an abysmal first quarter of 2009 are expected to boost results, but investors will also be watching to see if revenues are growing. What companies say about the rest of the year will be critical too, particularly with stock indexes at multi-month highs. "I think the optimism that has lifted markets lately will carry through as the earnings start to come out, but the guidance is going to have to be a lot stronger than in recent quarters," said Peter Tuz, president at Chase Investment Council. He said that between fall 2008 and the end of 2009, companies were very cautious about profits because of the weak economy. But that won't be enough for stock investors anymore. "We've seen good earnings on cost-cutting and tepid revenue for a few quarters now," Tuz said. "But now we're at a point where we need to see profits driven by economic growth." Earnings are currently expected to have risen almost 37% versus the first quarter of 2009, according to Thomson Reuters, while revenues are expected to have risen 10%. Alcoa (AA, Fortune 500) begins the quarterly reporting period, as is traditional, when it reports results after the start of trading Monday. Alcoa is one of five Dow components due to report results this week. The others are Intel (INTC, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Bank of America (BAC, Fortune 500) and General Electric (GE, Fortune 500). Tech leader Google is also due to report. Greece: U.S. investors will also be attuned to developments coming out of Europe, amid speculation that debt-laden Greece could receive a bailout from the European Union and the International Monetary Fund (IMF) shortly.

Quarterly results

Monday: Aluminum producer Alcoa is expected to have earned 11 cents per share, according to a consensus of analysts surveyed by Thomson Reuters. Alcoa reported a loss of 59 cents per share a year ago. Tuesday: Chip leader Intel reports results after the close. The Dow component is expected to have earned 38 cents per share after earning 11 cents per share a year ago. Wednesday: JPMorgan Chase, which reports results before the bell, is expected to have earned 64 cents per share versus 40 cents a year ago. JPMorgan is the first of a slew of banks that are expected to report strong profits this week. Thursday: Tech behemoth Google (GOOG, Fortune 500) reports results after the close. The company is expected to have earned $6.57 per share versus $5.16 per share a year ago.

On the docket

Monday: The March Treasury budget, due in the afternoon, is expected to show a surplus of $67.5 billion, versus a deficit of $191.6 billion in February, according to a consensus of economists surveyed by Briefing.com. Tuesday: The February Trade Balance, due in the morning from the Commerce Department, is expected to have widened to $39 billion from $37.3 billion in January. Import and export prices are also due in the morning. Wednesday: The March retail sales report from the Commerce Department leads a busy day for economic news. Sales are expected to have risen 1.1% after growing 0.3% in February. Sales excluding autos are expected to have risen 0.5% after rising 0.8% in February. The Consumer Price Index (CPI), a measure of consumer inflation, is expected to have risen 0.1% in March versus a flat reading in February. Core CPI, which excludes volatile food and energy prices, is expected to have risen 0.1% after moving up 0.1% in February. The government also releases the weekly crude oil inventories report and February business inventories report in the morning. The Fed's periodic "beige book" reading on the economy is due in the afternoon. Thursday: The weekly jobless claims report from the Department of Labor is the highlight of another busy day for news. Approximately 440,000 Americans are expected to have filed new claims for unemployment last week versus 460,000 in the previous week. Continuing claims, a measure of those who have been receiving benefits for a year or more, are expected to have risen to 4,600,000 from 4,550,000 in the previous week. Friday: Housing starts and building permits are due out in the morning from the Census Bureau and are likely to move markets. Starts are expected to have risen to a 610,000 unit annual rate in March from a 575,000 unit annual rate. Building permits, a measure of builder confidence, are expected to have fallen to an annualized rate of 626,000 units from a 637,000 rate of units in the previous month. The April Consumer Sentiment index from the University of Michigan is due after the start of trading. Sentiment is expected to have improved to a reading of 75.0 from 73.6 in March. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

pharoah88

Supreme |

10-Apr-2010 23:10

|

||||

|

x 0

x 0 Alert Admin |

S T i 3 0 3 3 |

||||

| Useful To Me Not Useful To Me | |||||

|

pharoah88

Supreme |

10-Apr-2010 23:05

|

||||

|

x 0

x 0 Alert Admin |

D O W 1 1 1 1 1 |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

09-Apr-2010 07:03

|

||||

|

x 0

x 0 Alert Admin |

Stocks rise on consumer hopesNEW YORK (CNNMoney.com) -- Stocks gained Thursday as upbeat sales reports from the nation's retailers helped provide optimism about the economic outlook, taking the edge off worries about Greece and other euro zone debt issues. The Dow Jones industrial average (INDU) added 30 points, or 0.3%. The S&P 500 index (SPX) gained 4 points or 0.3%. The Nasdaq composite (COMP) gained 6 points, or 0.2%, and matched Tuesday's 18-month high. Stocks fell in the morning, but managed to erase those losses and edge higher in the afternoon, led by financial shares including American Express (AXP, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and Goldman Sachs (GS, Fortune 500). The KBW Bank (BKX) index added 1.4%. Retail shares gained as well. Stocks slipped Wednesday after General Motors' huge loss, but the market was also vulnerable after finishing at 18-month highs Tuesday.

Retail: A number of chain stores reported strong March sales thanks in part to the early Easter holiday and signs of improvement in the job market.

Among the standouts, women's apparel retailer The Limited (LTD, Fortune 500) said sales rose 15% at stores open a year or more versus forecasts for a rise of 6.8%. Discounter TJX (TJX, Fortune 500) said sales at stores open a year or more rose 12% in the month. As a result, the retailer raised its current quarter profit outlook. But some companies warned that a strong March will chip away at April sales. Kohl's (KSS, Fortune 500) said its strong 22.5% jump in March will be followed by a decline in April. Jobs: The number of Americans filing new claims for unemployment rose to 460,000 last week from a revised 442,000 the previous week, the Labor Department said Thursday morning. Economists surveyed by Briefing.com had expected 435,000 claims, on average.

Airlines: UAL' (UAUA, Fortune 500)s United Airlines and US Airways (LCC, Fortune 500) are reportedly talking about a merger again, according to several published reports. The two companies discussed teaming up previously in the last decade. UAL shares gained 7% and US Airways shares gained 12%. Other airlines rose as well. World markets: In overseas trading, European markets slumped as Greece's borrowing costs hit a record high on worries about the country defaulting. Asian markets ended lower. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.90% from 3.86% late Wednesday. The 10-year had risen as high as 4% Monday, an 18-month high. Treasury prices and yields move in opposite directions.

The dollar and commodities: The dollar fell versus the euro and gained against the yen. COMEX gold for June delivery fell 10 cents to settle at $1,152.90 per ounce. U.S. light crude oil for May delivery fell 46 cents to settle at $85.39 a barrel on the New York Mercantile Exchange. Market breadth was mixed. On the New York Stock Exchange, winners beat losers on volume of 1.05 billion shares. On the Nasdaq, advancers topped decliners on volume of 2.35 billion shares. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

WLBO_BB

Master |

08-Apr-2010 16:08

Yells: "Warren Look Before Others _ Buffett Best " |

||||

|

x 0

x 0 Alert Admin |

short ahhhhh!!! | ||||

| Useful To Me Not Useful To Me | |||||

|

tradersgx

Veteran |

08-Apr-2010 16:07

|

||||

|

x 0

x 0 Alert Admin |

Stocks with Thai exposure may fall Tags: Banyan Tree | Banyan Tree Holdings | Thai Beverage | Thai Beverage Pcl | Thai Beverage Public Co Written by The Edge Thursday, 08 April 2010 08:55 Shares of companies with significant business in Thailand, such has Thai Beverage (Y92.SG), Banyan Tree (B58.SG), may pull back following state of emergency declared by Thai government in Bangkok, surrounding provinces says Dow Jones. But judging from past experience, impact on stocks may be short-lived. 2006 ouster of Thaksin Shinawatra as PM, for instance, triggered early selling in Singapore shares on day of incident but damage limited as investors shortly bought back on dips. Still, political unrest won’t bode well for business, especially for Banyan Tree, which returned to profitability in 4Q09 on tourism rebound after losses in 3Q09, 2Q09. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

08-Apr-2010 08:07

|

||||

|

x 0

x 0 Alert Admin |

Stocks finish with lossesNEW YORK (CNNMoney.com) -- Stocks tumbled Wednesday following a report that consumer borrowing fell and General Motors said it lost billions of dollars during the second half of 2009. The Dow Jones industrial average (INDU) lost 72 points, or about 0.7%, to end at 10,897.52. The S&P 500 index (SPX) fell 7 points, or 0.6% to 1,182.44. The Nasdaq composite (COMP) also fell 6 points, or 0.2% to 2,431.16.  Trading on Wall Street was muted Tuesday, but the Nasdaq and S&P 500 edged higher to finish at 1-1/2 year highs. "With such a strong runup, you're going to hit resistance eventually," said Alan Lancz, president at Alan B. Lancz & Associates. "The market needs a catalyst to get investors to buy at these levels." Lancz said it would be difficult to break barriers at the 11,000 mark on the blue-chip Dow index and 1,200 for the S&P. Companies: Shortly after the start of trade, General Motors posted a $4.3 billion loss for the July-December period of 2009, during which the company emerged from bankruptcy protection. In its annual report released Wednesday, Goldman Sachs (GS, Fortune 500) defended employee bonuses and its multi-billion dollar relationship with AIG (AIG, Fortune 500) while downplaying its short-selling in the mortgage market. The market is in a "wait-and-see" pattern, Lancz said, as investors look ahead to next week and the quarterly corporate results season. Earnings reports have been generally upbeat recently, and the trend is still upward, but Lancz said he worries about upcoming quarters. "Later in 2010, year-over-year comparisons will be difficult," Lancz explained. "We'll also have the headwinds of increased interest rates, and higher commodities costs. I think that's going to slow further progress." Economy: With one hour left in the session, the Federal Reserve reported consumer credit fell at an annual rate of 5.6% in February to $2.448 trillion, after increasing for the first time in a year during the previous month. That was much worse than expected, as analysts expected a drop of only $0.7 billion. The Dow fell more than 122 points immediately following the report's release then pared losses ahead of the market's close. "That is definitely disappointing, as it shows a lack of confidence in buying," Lancz said. "Investors are going to be jumpy on any kind of negative data." Lingering concerns about the debt woes brewing in Europe also weighed on stocks, Lancz said. Greece denied reports Tuesday that it was uncomfortable with accepting assistance from the International Monetary Fund. The Financial Crisis Inquiry Commission began a three-day hearing, focusing on the causes behind the mortgage meltdown. Former Fed Chief Alan Greenspan testified at Wednesday's hearing, saying that while steps can be taken to limit the impact of another shock, regulators can't fully prevent another crisis from happening. Outlook: Dave Hinnenkamp, chief executive of KDV Wealth Management, said mixed economic reports have left investors a bit nervous. "Overall, depending on what you look at, there's good news and bad news," Hinnenkamp said. "But if you look at corporate balance sheets, companies are sitting on a lot of cash as they wait for recovery. That bodes well for down the road." Beyond corporate earnings and the unemployment rate, investors are also looking at the impact of winding down federal purchase programs, Hinnenkamp said. Last week, the Federal Reserve stopped buying securities backed by pools of mortgages. World markets: Britain's FTSE 100, France's CAC 40 and Germany's DAX all ended slightly lower. In Asia, markets ended mixed. the Hang Seng in Hong Kong climbed 1.8%, and Japan's Nikkei posted slight gains. Shares in China, however, slipped 0.3%. Other markets: U.S. Treasurys rose, with the yield on the benchmark 10-year note falling to 3.63%. Bond prices and yields move in opposite directions. Earlier this week, the yield topped 4% for the first time in 18 months amid optimism about the economic recovery. Wednesday's auction of 10-year notes was part of an $82 billion offering this week of U.S. debt. Oil prices dipped, with crude for May delivery settling down 96 cents to $85.88 a barrel. The government's weekly oil inventories report said crude oil supplies rose about 1.1 million barrels last week. COMEX gold for June delivery settled at $1,153 an ounce, up $17 from the previous day. The dollar managed gains against the euro and British pound, but it slipped against the yen. |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

07-Apr-2010 22:30

|

||||

|

x 0

x 0 Alert Admin |

Stocks step back from rallyNEW YORK (CNNMoney.com) -- Stocks fell at the start of trading Wednesday, as investors remained cautious amid the recent stock run and General Motors posted a $4.3 billion loss for the fourth quarter. The Dow Jones industrial average (INDU) lost 22 points, or 0.2%. The S&P 500 index (SPX) fell 2 points, or 0.1%. The Nasdaq composite (COMP) slipped 1 point, or less than 0.1%. Trading on Wall Street was muted Tuesday, but the Nasdaq and S&P 500 edged higher to finish at 1-1/2 year highs.

In its annual report released Wednesday, Goldman Sachs (GS, Fortune 500) defended employee bonuses and its multi-billion dollar relationship with AIG (AIG, Fortune 500) while downplaying its short-selling in the mortgage market.

The Financial Crisis Inquiry Commission begins a three-day hearing, focusing on the causes behind the mortgage meltdown. Former Fed Chief Alan Greenspan testified at Wednesday's hearing, saying that while steps can be taken to limit the impact of another shock, regulators can't fully prevent another crisis from happening.

Earlier this week, the yield topped 4% for the first time in 18 months amid optimism about the economic recovery. Wednesday's auction of 10-year notes is part of an $82 billion weekly offering of U.S. debt. Oil prices dipped, with crude for May delivery drifting down 23 cents to $86.61 a barrel. Gold prices rose $7.60 to $1,143 an ounce.

Meanwhile, in currencies, the dollar managed gains against the euro and British pound, but it slipped against the yen. |

||||

| Useful To Me Not Useful To Me | |||||

|

tradersgx

Veteran |

07-Apr-2010 16:30

|

||||

|

x 0

x 0 Alert Admin |

Hang Seng Index closed 21928.77 +391.77 +1.82% Last update: 07-04-2010 16:01 |

||||

| Useful To Me Not Useful To Me | |||||

|

tradersgx

Veteran |

07-Apr-2010 15:21

|

||||

|

x 0

x 0 Alert Admin |

STI 3000.........today? |

||||

| Useful To Me Not Useful To Me | |||||

|

tradersgx

Veteran |

07-Apr-2010 10:32

|

||||

|

x 0

x 0 Alert Admin |

Hang Seng Index 21772.34 +235.34 +1.09% Last update: 07-04-2010 10:29 |

||||

| Useful To Me Not Useful To Me | |||||

|

|

|||||

|

Blastoff

Elite |

07-Apr-2010 08:24

|

||||

|

x 0

x 0 Alert Admin |

Nasdaq, S&P at new 1-1/2 year highsNEW YORK (CNNMoney.com) -- Financial shares rose in an otherwise tepid session Tuesday that nonetheless saw two of the major indexes -- the Nasdaq and the S&P -- finish at their highest levels in more than a year and a-half. The S&P 500 index (SPX) added 2 points, or 0.2%, closing at its highest point since Sept. 26, 2008, when it topped 1,200. The Nasdaq composite (COMP) rose 7 points, or 0.3%, ending at its highest point since Aug. 15, 2008. The Dow Jones industrial average (INDU) lost a few points, after having risen as high as 10,987.38 earlier. The Dow ended the previous session at 10,973.55, the highest finish since Sept. 26, 2008, when it closed at 11,143.13. Stocks drifted in the morning, but found a little momentum in the afternoon as bank shares bounced and investors digested the minutes from the last Federal Reserve meeting. Credit Suisse First Boston reportedly made some bullish comments on SunTrust Banks (STI, Fortune 500) and Regions Financial (RF, Fortune 500), giving those stocks a lift. But the broader banking sector was also on the rise, with the KBW Bank (BKX) index up 2.4%. Stocks advanced Monday following the three-day Easter weekend, with investors responding favorably to the previous week's jobs report, a strong housing market report and the launch of Apple's iPad device. But there was less on the docket Tuesday and stocks struggled through most of the session. Investors were also keeping an eye on the Treasury market, a day after the 10-year note yield surged to 4%, the highest level in 18 months. Prices have been sliding and yields rising recently as investors have sought riskier assets amid bets on a bigger recovery. Also in focus: Oil prices, which surged to nearly 18-month highs Tuesday. In a quiet week for news, reports are due Wednesday on consumer credit, Thursday on jobless claims and Friday on wholesale inventories. Fed minutes: Information reviewed by central bankers at the March 16 Fed policy-setting meeting showed that the economy continues to improve at a moderate pace and the labor market is stabilizing. Higher energy prices have boosted overall consumer price inflation, but prices excluding food and energy were little moved. On the downside, the recovery could lose momentum amid the still-sluggish housing market and impact from weaker spending at the state and local government level. At the March 16 meeting, central bankers voted to hold a key short-term interest rate at historic lows near zero and said rates will stay exceptionally low for the foreseeable future. Company news: Massey Energy (MEE) shares plunged 11.4% after the company confirmed 25 workers were killed after an explosion at one of its coal mines in West Virginia. Federal regulators are pushing for a $16.4 million fine against Toyota Motor (TM) for deliberately hiding accelerator problems from officials for months. The fine is the maximum allowed under the law and follows the recall of more than eight million vehicles due to gas pedal and sudden acceleration problems. Toyota shares were barely lower. AT&T (T, Fortune 500) said it will invest an additional $1 billion to upgrade its business network and improve services and products for customers. Shares were little changed. Business software maker CA (CA) said full-year profit would hit the low end of its previous forecast and that it would cut about 1,000 jobs. Shares lost 1.9%. Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.97% from 3.99% late Monday. The 10-year had risen as high as 4% Monday, an 18-month high. Treasury prices and yields move in opposite directions. Treasury sold $40 billion of 3-year notes Tuesday in the second of four auctions scheduled for this week geared toward selling $82 billion in debt. The sale received more than 3 times the bids than the amount sold, a signal of solid demand. Monday's sale of $8 billion in 10-year Treasury Inflation Protected Securities (TIPS) also saw a strong response. The dollar and commodities: The dollar gained versus the euro and fell against the yen. COMEX gold for June delivery rose $2.20 to settle at $1,136 per ounce. U.S. light crude oil for May delivery rose 22 cents to settle at $82.86 a barrel on the New York Mercantile Exchange, the highest point for crude since October 2008. World markets: In overseas trading, European markets rallied Tuesday after resuming trading following a long Easter holiday weekend. Asian markets ended mixed, with the Hong Kong Hang Seng rising and the Japanese Nikkei falling. Market breadth was mixed. On the New York Stock Exchange, winners topped losers by eight to seven on volume of 940 million shares. On the Nasdaq, advancers beat decliners seven to six on volume of 2.12 billion shares. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

06-Apr-2010 06:47

|

||||

|

x 0

x 0 Alert Admin |

Dow flirts with 11,000NEW YORK (CNNMoney.com) -- Stocks rallied Monday, with the Dow edging closer to 11,000, as investors returning from a long weekend welcomed last week's jobs report, the morning's strong housing market report and the launch of Apple's iPad device. The market also kept an eye on the 10-year Treasury note yield, which surged to 4% as investors dumped treasuries in favor of riskier assets. Oil prices surged to nearly 18-month highs. The dollar was mixed versus other major currencies. The Dow Jones industrial average (INDU) added 46 points, or 0.4%, to close at 10,973.55. Earlier, the Dow rose to within 11 points of 11,000, a key psychological level. The Dow last closed above 11,000 on Sept. 26, 2008, ending at 11,143.13. The S&P 500 index (SPX) gained 9 points, or 0.8% closing at its highest point since Sept. 26, 2008, when it topped 1200. The Nasdaq composite (COMP) added 27 points, or 1.1%, closing at its highest point since Aug. 15, 2008.

Monday also was the first chance for investors to react to the strong sales for Apple's iPad tablet computer, which launched Saturday amid much enthusiasm.

Jobs: Employers added 162,000 jobs to their payrolls in March, more than in any month in the last three years, the government said Friday. Economists surveyed by Briefing.com were expecting an even bigger gain, of 184,000 jobs. However, the report was not considered disappointing as it showed growth even when accounting for temporary employment and the impact of 48,000 once-in-a-decade census jobs. Employers cut 14,000 jobs in February. The unemployment rate, generated by a separate survey, held steady at 9.7% as expected. Apple: The tech leader said it sold 300,000 of its iPad tablet computers on Saturday and that users downloaded over one million apps from the company's App store and over 250,000 ebooks from its iBookstore. Shares of Apple (AAPL, Fortune 500) gained 1% Monday. Economy: The pending home sales index posted a surprise jump in February, rising 8.2% to 97.6 from a revised 90.2 in January. Economists expected the report from the National Association of Realtors to have declined by 1%, according to Briefing.com forecasts.

Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 4% from 3.86% Friday. Treasury prices and yields move in opposite directions.

The dollar and commodities: The dollar fell versus the euro and yen. COMEX gold for June delivery rose $7.70 to $1,133.80 per ounce. U.S. light crude oil for May delivery rose $1.75 to settle at $86.62 a barrel on the New York Mercantile Exchange, the highest close for crude since October 2008. World markets: In overseas trading, European markets rallied. Asian markets ended higher as well. Market breadth was positive. On the New York Stock Exchange, winners topped losers by three to one on volume of 906 million shares. On the Nasdaq, advancers beat decliners by almost three to one on volume of 2.05 billion shares. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

05-Apr-2010 16:16

|

||||

|

x 0

x 0 Alert Admin |

Jobs report jolt for stocks

NEW YORK (CNNMoney.com) -- Stock investors return from a long weekend ready to embrace an encouraging piece of news: The economy added more jobs in March than in any month in the last three years. With stock markets closed for Good Friday, the Monday after Easter is the first trading day for investors to react to the report. "I think investors will see it as a sign that the economy continues to improve," said Karl Mills, president and CEO at Jurika Mills & Keifer. Employers added 162,000 jobs in March after losing a revised 14,000 jobs in February, the Department of Labor said Friday. Economists had predicted a gain of 184,000 jobs, according to a consensus of economists surveyed by Briefing.com. However, the report was not seen as disappointing, with economists noting that results were encouraging, even when stripping out temp jobs and the jobs created by the Census Bureau for its once-a-decade head count of the U.S. population. "The number wasn't as strong as people had hoped," Mills said. "But it was still a positive and shows that the labor market is moving in the right direction." The unemployment rate, generated by a separate survey, held steady at 9.7% as expected. Mills said that one concerning factor to keep an eye on in the weeks ahead is the spike in treasury bond yields, amid worries about inflation and rising interest rates. Bond markets were opened for a shortened-trading session Friday, with prices tumbling and the corresponding yields rising after the job market report. The benchmark 10-year note rose to 3.94%, the highest level in nearly 10 months. The dumping of bonds in favor of stocks or other riskier investments indicates investors are feeling a bit more optimistic about the economy. But the ten-year note yield is tethered to lots of consumer loans, and a sustained period of higher rates would raise borrowing costs for mortgages and other kinds of debt. Stocks stalling at recent highs: While the reaction on a sentiment level is bound to be positive, the report may not give much of a boost to stock markets after the recent rally. The Dow, Nasdaq and S&P 500 have all risen in six of the last seven weeks and are now standing at or just below their highest levels in 18 months. "I think we have another quarter or two in front of us that could be strong," said Fred Dickson, chief market strategist at D.A. Davidson & Co. "But because we've gone so far, so fast, it wouldn't be surprising to see a pullback of 4% or 5% sometime in the next month or two." Since bottoming at a 12-year low on March 9, 2009, the Dow Jones industrial average has risen 67%, the S&P 500 has risen 74% and the Nasdaq has risen 89%. iPad: Apple (AAPL, Fortune 500)'s new iPad debuted Saturday and the sales results will be scrutinized Monday, both in terms of what it means for the company and for other computer, e-reader and smartphone makers. Early reviews have been varied, with critics praising the resolution, screen quality and lightness of the tablet computer or bemoaning the lack of features normally found on a laptop.

On the docket

Monday: The Pending Home Sales index for February is expected to have fallen 1%, according to a consensus of economists surveyed by Briefing.com. Sales fell 7.6% in the previous month. The Institute for Supply Management's services sector index, due after the start of trading, is expected to have risen to 53.6 in March from 50.0 in February. Tuesday: The minutes from the last Federal Reserve policy-setting meeting are due for release in the afternoon. Wednesday: February consumer credit is expected to have risen $1.6 billion after rising $5 billion in the previous month. The report from the Federal Reserve is due out in the morning. Federal Reserve Chairman Ben Bernanke and Federal Reserve Vice Chairman William Dudley are both expected to speak. Also due to speak: Federal Reserve Governor Thomas Hoenig. The weekly oil inventories report from the government is due in the morning. Thursday: The weekly jobless claims report from the Department of Labor is due in the morning. Claims are expected to have fallen to 433,000 last week from 439,000 in the previous week. Continuing claims, a measure of Americans who have been receiving benefits for a week or more, are expected to have fallen to 4,650,000 from 4,662,000 in the previous week. March sales from the nation's retailers are due throughout the morning. Last month, sales jumped a bigger-than-expected 4%, rising for the sixth month in a row. Investors will be looking to see if consumers can continue the trend for another month. Friday: Wholesale inventories are expected to have risen 0.3% in February after falling 0.1% in the previous month. The Commerce Department report is due in the morning. |

||||

| Useful To Me Not Useful To Me | |||||

|

Blastoff

Elite |

05-Apr-2010 15:54

|

||||

|

x 0

x 0 Alert Admin |

DOW future positive. | ||||

| Useful To Me Not Useful To Me | |||||

|

tradersgx

Veteran |

05-Apr-2010 10:01

|

||||

|

x 0

x 0 Alert Admin |

corr.. HONG KONG - The share market is closed for the Easter holiday on Monday and for the Ching Ming (Tomb Sweeping) Festival on Tuesday. Trading will resume on Wednesday. |

||||

| Useful To Me Not Useful To Me | |||||

|

tradersgx

Veteran |

05-Apr-2010 09:48

|

||||

|

x 0

x 0 Alert Admin |

Bloomberg

|

||||

| Useful To Me Not Useful To Me | |||||

|

sgxinvestor

Member |

05-Apr-2010 07:38

|

||||

|

x 0

x 0 Alert Admin |

Bloomberg; OIL Price trades above $85 now !!! SEMBMARINE CHEOOONG AHHHH !

|

||||

| Useful To Me Not Useful To Me | |||||

|

tradersgx

Veteran |

04-Apr-2010 21:48

|

||||

|

x 1

x 0 Alert Admin |

8 stocks that will push STI to breakout 3000! jmv (',' ) STI Constituent Stocks: As at 1st Apr'10 JMH 400US$ Golden Agri Sembcorp Ind Keppel Corp Semb Marine Starhub SingTel Noble Group SPH ComfortDelgro HK Land US$ OCBC Bk Capitaland Jardine C&C UOB DBS Group SMRT Olam City Devp Wilmar SIA Eng F & N Capitamall Trust ST Engg SGX Cosco Genting Spore NOL SIA

|

||||

| Useful To Me Not Useful To Me | |||||