| Latest Forum Topics / Others |

|

|

DOW & STI

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

04-Mar-2010 06:19

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

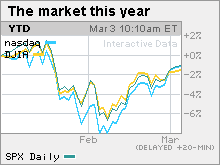

Stocks struggle ahead of jobs reportsNEW YORK (CNNMoney.com) -- Stocks ended mixed Wednesday, giving up the day's gains by the close as reports showing a stronger economy and a slower pace of job cuts failed to reassure investors after the recent run. Also in play: An announcement from Greece about the steps it will take to cut its deficit.  Stocks had posted slim gains through the early afternoon following reports showing some stability in the job market and a pick up in the services sector. But the gains petered out in the afternoon. Investors had a mild reaction to the Fed's periodic "Beige Book" reading on the economy, released around 2:00 p.m. ET. The Beige Book showed that economic activity picked up somewhat in 9 of the Fed's 12 districts. Consumer spending also improved modestly. But the report failed to sway investors, leaving stocks near unchanged. Stocks have drifted higher over the past three sessions, pushing the S&P 500 and the Nasdaq into positive territory for 2010. The Dow briefly moved into positive territory during Wednesday's session, before retreating. After a strong rally in 2009, stocks have been volatile this year as investors look for evidence that an economic recovery is taking hold, above and beyond the considerable government stimulus that has been put into play. Market participants have been reluctant to move much in the aftermath of a big rally. Between the lows of last March and the highs of January, the S&P 500 jumped 70%. Jobs: A pair of economic reports showed that the pace of job cuts is slowing as the labor market slowly begins to stabilize. Payroll services firm ADP said employers in the private sector cut 20,000 jobs from their payrolls in February, meeting the expectations of economists surveyed by Briefing.com. The drop was the smallest decline in two years. In January, employers cut a revised 60,000 jobs. Outplacement firm Challenger, Gray & Christmas said that 42,090 job cuts were announced in February, down from 71,482 in January. It was the smallest number of announced job cuts since July 2006, when 37,178 cuts were announced. Separately, the Senate voted late Tuesday to extend the deadline for unemployed Americans to apply for benefits, after previous attempts to do so failed. President Obama signed the measure shortly thereafter. Over 200,000 people would have stopped receiving unemployment checks this week. Services sector grows: In other economic news, the Institute for Supply Management's services sector index rose to 53 in February from 50.5 in January, hitting the highest point since December 2007, at the start of the recession. Economists surveyed by Briefing.com thought it would rise to 51. Greece: The debt-strapped nation announced a $6.5 billion plan Wednesday to help it cut its ballooning deficit. The plan includes $3.3 billion in new revenues such as taxes and another almost $3.3 billion in spending cuts, including pension freezes and cuts in civil servants' salaries. Worries that Greece might default on its debt have pummeled the euro and unnerved world markets over the last two months, as investors have wondered if the problems are indicative of a bigger euro zone crisis. The European Union said Wednesday that it will more closely regulate the economies of its 27 members so as to avoid a repeat of the Greece crisis. The new system will issue warnings if a country is heading for trouble, something that might have alerted officials to Greece's problems at an earlier date. On the move: Hedge fund Elliott Associates made an unsolicited all-cash offer for Novell (NOVL) that values the business software maker at around $2 billion. Elliott Associates offered to buy the remaining 91.5% of the company it doesn't already own for around $5.75 per share, or $1.83 billion. The price is a 21% premium over Novell's closing stock price from Tuesday. Novell jumped 28% and was the Nasdaq's most-actively traded issue. On the downside, biotech Medivation (MDVN) lost two-thirds of its value after the company said that its experimental Alzheimer drug Dimebon failed to produce desired results in a late-stage clinical study. Dow component Pfizer (PFE, Fortune 500), which co-develops the drug, lost 1%. Among other Dow movers, Caterpillar (CAT, Fortune 500), Home Depot (HD, Fortune 500), General Electric (GE, Fortune 500), Coca-Cola (KO, Fortune 500) and Boeing (BA, Fortune 500) all gained. Market breadth was positive. On the New York Stock Exchange, winners topped losers four to three on volume of 580 million shares. On the Nasdaq, advancers topped decliners seven to six on volume of 1.86 billion shares. World Markets: In overseas trading, European markets rallied, with the London FTSE rising 0.9%, the French CAC 40 gaining 0.8% and the German DAX advancing 0.7%. Most Asian markets ended lower, although the Japanese Nikkei rose 0.3%. The dollar and commodities: The dollar gained versus the euro and fell versus the yen. U.S. light crude oil for April delivery rose $1.19 to settle at $80.87 a barrel on the New York Mercantile Exchange. COMEX gold for May delivery gained $5.90 to settle at $1,143.30 per ounce. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.62% from 3.60% late Tuesday. Treasury prices and yields move in opposite directions. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

03-Mar-2010 08:51

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

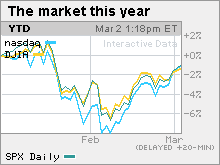

Stocks eke out gainsNEW YORK (CNNMoney.com) -- Stocks ended with modest gains Tuesday, giving up a bigger advance, as investors weighed February auto sales, some upbeat company news and signs that Greece won't default on its debt. The Dow Jones industrial average (INDU) ended just above unchanged. The S&P 500 index (SPX) added 2 points, or 0.2%, and the Nasdaq composite (COMP) rose 7 points, or 0.3%.  Stocks gained in the previous two sessions and in two of the last three weeks. The Nasdaq and S&P 500 ended in positive territory for the year Monday for the first time in six weeks. "I think stocks are benefiting from a little bit of buying in the month-end, new-month period," said Ben Halliburton, chief investment officer at Tradition Capital Management. He said that the gains were surprising considering the recent batch of weaker-than-expected economic news, especially in housing, consumer confidence and consumer spending. Worries about Greece and a broader euro-zone debt crisis caused the more than nine-month-old U.S. stock rally to halt and do an about-face in mid-January. Mixed readings on the U.S. economy have added to the stock market weakness as investors have worried that the recovery won't be as robust as had been hoped. "I think the challenges to the economic recovery are well known, but the question is whether they have been fully discounted by the market," Halliburton said. Investors are gearing up for a busy three days of economic news. The highlight is Friday's government jobs report, expected to show continued weakness in the labor market. Stocks still vulnerable: The mid-January to early February selloff sent the S&P 500 down over 9% and the Dow and Nasdaq down more than 7%. But that selloff is unlikely to be the last big retreat this year, or even in the first half of the year, Halliburton said, considering the size and pace of last year's rally. Between bottoming at a 12-year low in March of last year and hitting a 2010 high on Jan. 19, the Dow gained 64% and the S&P 500 gained 70%. After bottoming out at a six-year low last March, the Nasdaq gained 83% through Jan. 19. Greece: Investors took some comfort Tuesday from signs that Greece's debt situation seems to be under control. Greek Prime Minister George Papandreou said more aggressive action needs to be taken to get the company's ballooning deficit under control. His government is expected to announce further initiatives Wednesday after already announcing plans to raise the retirement age and freeze salaries for civil workers. Autos: Automakers released February vehicle sales numbers on Tuesday in the aftermath of Toyota's massive recall last month. Toyota Motor (TM) said sales fell 9% in February versus a year ago, better than the 10% drop tracker Edmunds.com was forecasting. Ford Motor said February sales jumped 43% from an abysmal month a year ago, the worst month for the industry in 19 years. Sales also outpaced those of General Motors for the first time in 10 years. GM said February sales rose about 12% from a year ago, far short of estimates. GM was expected, along with the other automakers, to benefit more substantially from Toyota's ongoing problems. Earlier GM said it had recalled 1.3 million Chevrolet and Pontiac models in North America due to power steering failures Company news: CF Industries Holdings (CF) relaunched its bid for fellow fertilizer firm Terra Industries (TRA), offering $4.75 billion in cash and stock, after giving up its aggressive takeover attempt in January. CF jumped back into the fray after Terra agreed last month to a $4.1 billion buyout from Norway's Yara. CF shares fell 1%, while Terra shares gained 11%. Qualcomm (QCOM, Fortune 500) said late Monday that it was hiking its dividend by 12% and that it was initiating a new $3 billion stock buyback program. Investors welcomed the news, propelling the stock of the wireless chipmaker up 6.7% Tuesday in active Nasdaq trading. Market breadth was positive. On the New York Stock Exchange, winners beat losers by more than two to one on volume of 835 million shares. On the Nasdaq, advancers topped decliners by less than two to one on volume of 2.52 billion shares. Federal Reserve: Kansas City Fed President Thomas Hoenig said the central bank should raise short-term interest rates sooner rather than later, even with high levels of unemployment. Hoenig said that the extended period of historically low rates raises the risk of speculative behavior. Hoenig, a voting member of the Fed's policy committee, was the only Fed official to vote against the group at the last Fed meeting in January, when the bankers opted to hold interest rates steady at levels near zero. However, rates are not expected to rise for some time, as has been indicated by recent comments from Chairman Ben Bernanke and other voting members of the Fed's policy-setting committee. World Markets: In overseas trading, European markets rallied, with the London FTSE rising 1.5%, the French CAC 40 gaining 1.1% and the German DAX advancing 1.1%. Asian markets ended mostly lower, although the Japanese Nikkei rose 0.5% after the government said the unemployment rate dropped for the second month in a row. Japan also said consumer spending grew. The dollar and commodities: The dollar gained versus the euro and fell versus the yen. U.S. light crude oil for April delivery rose 98 cents to settle at $79.68 a barrel on the New York Mercantile Exchange. COMEX gold for April delivery gained $19.10 to settle at $1,137.40 per ounce. Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.60% from 3.61% late Monday. Treasury prices and yields move in opposite directions. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

02-Mar-2010 08:30

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Nasdaq, S&P turn positive for 2010NEW YORK (CNNMoney.com) -- Stocks jumped Monday, with the Nasdaq and S&P 500 pushing back into positive territory for the year, as investors welcomed AIG's $35 billion asset sale and a pair of mergers in the pharmaceutical sector. Signs that a Greek bailout package is in the works also came into play.  Both the S&P 500 and the Nasdaq ended in positive territory for the year for the first time in over a month. Stocks rallied Monday, the first day of March, as investors dug back in after last week's retreat. Stocks have been choppy and volatile this year in the aftermath of 2009's big rally. Stocks jumped last year after trillions of dollars in fiscal and monetary stimulus were injected into the financial system. But optimism about a 2010 economic recovery also fueled the advance. However, mixed signals about the economy this year have given investors pause as they look for clearer indications that a recovery is not only in place, but can take on a life of its own once the government stimulus fades out. Concerns that Greece's debt crisis could spread to the rest of Europe and that China is seeking to pull back its expansion all dragged on stocks earlier in the year. But stocks have risen in two of the last three weeks. "There are a few positives today, with some of the deal news, but there's still uncertainty about the economy," said Gary Webb, CEO at Webb Financial Group. "It's going to be a lot more volatile this year," he said. "We saw a correction through early February and now we're seeing a rebound. I think we're going to continue to see that seesaw effect throughout this year." February auto and truck sales are due throughout the day Tuesday. Toyota Motor (TM) is expected to take a hit in the aftermath of its recall of millions of vehicles plagued with safety programs. AIG: AIG said Monday that it was selling its Asian life insurance business to Britain's Prudential PLC in a deal worth $35.5 billion. The deal includes $25 billion in cash, $16 billion of which the company has earmarked to pay back the government and taxpayers. Troubled AIG (AIG, Fortune 500) has avoided collapse by borrowing about $132 billion from the government since 2008. On Friday, the company reported a fourth-quarter loss of $8.9 billion, due mostly to costs connected to selling off large stakes in its insurance businesses. Shares gained 4% Monday. Deal news: Japanese drugmaker Astellas Pharma made an unsolicited $3.5 billion bid for OSI Pharmaceuticals (OSIP), maker of the blockbuster Tarceva cancer drug. The deal represents a 40% premium over OSI's Friday closing price. OSI said it would review the offer and that shareholders should make no move as of yet. OSI shares rallied 52% Monday. Over the weekend, German pharmaceutical company Merck KGaA said it would buy U.S.-based Millipore (MIL) for $7.2 billion. Millipore is a life sciences tools maker. Millipore shares gained 11.1% Monday. MSCI (MXB) said it would buy risk advisory firm RiskMetrics Group (RISK) in a $1.55 billion cash-and-stock deal. MSCI shares fell 4% while Risk shares gained 13%. SanDisk (SNDK) jumping 12%, after the flash memory card maker raised its first-quarter sales outlook to between $925 million and $1 billion. Market breadth was positive. On the New York Stock Exchange, winners topped losers three to one on volume of 967 million shares. On the Nasdaq, advancers beat decliners by more than three to one on volume of 2.46 billion shares. Economy: A busy day for economic news included readings on manufacturing, construction and income and spending. The Institute for Supply Management's manufacturing index fell to 56.5 in February from 58.4 in January, surprising economists who thought it would only fall to 57.9. Any reading over 50 signifies expansion in the sector. Construction spending declined 0.6% in January after falling 1.2% in the previous month, the government reported. The drop was in line with estimates. Personal income rose 0.1% in January after gaining 0.3% in December. Economists expected income to climb 0.4%. Personal spending jumped 0.5% after rising 0.3% in the previous month. Economists thought spending would increase 0.4%. Greece: Amid ongoing worries about Greece's ballooning deficit, Olli Rehn, the European Union's financial affairs commissioner, urged the nation to make more budget cuts. Greece has already announced plans to raise the retirement age and freeze wages, but Rehn said such moves are not enough. Greece's finance minister, Giorgos Papaconstantinou, said the government would do "whatever it takes" to cut the deficit. World Markets: In overseas trading, European markets rallied, with the London FTSE rising 1%, the French CAC 40 gaining 1.6% and the German DAX advancing 2%. Asian markets ended higher. The dollar and commodities: The dollar gained versus the euro, the yen and the U.K. pound. U.S. light crude oil for April delivery fell 96 cents to $79.66 a barrel on the New York Mercantile Exchange. COMEX gold for April delivery eased 60 cents to settle at $1,118.30 per ounce. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.61% from 3.59%. Treasury prices and yields move in opposite directions. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

tradersgx

Veteran |

01-Mar-2010 16:07

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Hang Seng Index 21056.93 +448.23 +2.17% Last update: 01-03-2010 16:01 http://www.hsi.com.hk/HSI-Net/HSI-Net |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

tradersgx

Veteran |

01-Mar-2010 11:39

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Hang Seng Index 21010.35 +401.65 +1.95% http://www.hsi.com.hk/HSI-Net/HSI-Net |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

KannaSze

Member |

01-Mar-2010 11:06

Yells: "SMART DOLLAR" |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

position talk as usal...

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

tradersgx

Veteran |

01-Mar-2010 10:17

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Hang Seng Index 20895.16 +286.46 +1.39% http://www.hsi.com.hk/HSI-Net/HSI-Net

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

tradersgx

Veteran |

26-Feb-2010 16:28

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Hang Seng Index 20608.70 +209.13 +1.03% http://www.hsi.com.hk/HSI-Net/HSI-Net |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

yipyip

Master |

26-Feb-2010 13:19

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

UOB, Singapore’s second largest bank, has reported a record operating profit of $3.33 billion for 2009 ! ('o' ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

alexchia01

Elite |

26-Feb-2010 10:55

Yells: "Catch The Stars And Ride With Them" |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Although DOW falls yesterday, but it's still in positive territory. HSI has a strong re-bound today and also in the positive territory. STI is in red and moving very close to SMA (20). This is a mix signal. Trade and invest with caution today. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

tradersgx

Veteran |

26-Feb-2010 10:53

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Hang Seng Index 20633.20 +233.63 +1.15% http://www.hsi.com.hk/HSI-Net/HSI-Net |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

nickyng

Supreme |

26-Feb-2010 06:06

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

aya.....juz SHORT lah! :P

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

26-Feb-2010 06:06

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 1

x 0 Alert Admin |

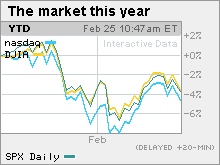

Stocks lose big early, then cut lossesNEW YORK (CNNMoney.com) -- Stocks ended with modest losses Thursday, fighting off a bigger decline that surrounded the latest worries about Greece's debt crisis and weaker-than-expected reports on the economy. The Dow Jones industrial average (INDU) lost 53 points or 0.5%, according to early tallies. The S&P 500 index (SPX) fell 2 points, or 0.2%. The Nasdaq composite (COMP) lost 2 points or 0.1%.  Stocks tumbled out of the gate after both Standard & Poor's and Moody's said they may have to cut Greece's debt rating if the country doesn't implement its so-called austerity measures, meant to rein in its deficit. But after a bigger selloff through the early afternoon, stocks cut losses heading into the final hour of the session. Greece has said it will raise the retirement age and have civil servants take bonus cuts, among other measures. A workers' strike Wednesday added to questions about the nation's ability to cut its debt. Investors are concerned about the broader implications for other euro zone countries, and the euro, should Greece default. "It seems like the market doesn't know how worried it should be about Greece, which is why we're rallying off the lows of the day," said Ryan Atkinson, market analyst at Balestra Capital. While the Greek debt situation is a serious one for the market, it's probably going to come in waves over the next six to nine months, Atkinson said. "Maybe they'll cut a deal initially [with officials], but longer term there are going to be more issues." He said that investors were likely just as concerned about the day's economic news, including worse-than-expected reports on jobless claims and factory orders. Market breadth was negative. On the New York Stock Exchange, losers beat winners eight to seven on volume of 950 million shares. On the Nasdaq, decliners topped advancers eight to five on volume of 2.1 billion shares. Greece: The threat of a Greek default rattled global markets earlier in the month, pushing U.S. stocks to three-month lows and causing the S&P 500 to lose over 9%, just shy of the technical definition of a correction. Investors worried that Greece's problems could reflect a broader euro zone debt crisis that could impact Portugal, Spain, Ireland, Italy and other debt-challenged European nations. But European officials said earlier this month that they were ready to step in and help Greece if need be, and that seemed to calm investors for a few weeks. S&P and Moody's downgrade talk revived the worries. In addition, stocks have been rising for the last two weeks, setting the market up for a little pullback, particularly in the aftermath of last year's big rally. Bernanke: Federal Reserve Chairman Ben Bernanke told Senators Thursday that the central bank is looking into whether Goldman Sachs and other big banks worsened Greece's debt crisis. News reports have said that Goldman and other banks helped arrange deals that may have disguised the extent of Greece's debt problems. In addition, the banks have made bets that Greece will default on loans it took from U.S. financial institutions, according to a New York Times article. Bernanke spoke before the Senate Banking Committee Thursday in his second day of Congressional testimony on the economy. On Wednesday he told a House committee that while the economic recovery is chugging along, the job market remains weak. Against that backdrop, interest rates will stay low for the foreseeable future. That seemed to reassure investors worried about the outlook for the economy and stocks rallied Wednesday. Jobs: The number of Americans filing new claims for unemployment jumped last week to 496,000 from a revised 474,000 the previous week. Economists surveyed by Briefing.com expected 460,000 new claims. Claims have jumped 12% over the past two weeks, due in part to the impact from the severe winter storms on the east coast. Durable goods orders: Orders for big-ticket items meant to last three years or more jumped in January, with aircraft demand fueling the rise. Durable goods orders rose 3% in January, the biggest increase since last summer and better than the 1.5% jump forecast by economists. Orders rose 1.9% in the previous month. Orders excluding transportation fell 0.6% after rising 2% in December. Economists expected a rise of 1%. Coke: Coca-Cola (KO, Fortune 500) said it will buy the North American operations of its biggest bottler, Coca-Cola Enterprises (CCE, Fortune 500) (CCE) in a deal that would cut costs and give it more control of its distribution. The multi-layered deal has Coca-Cola giving up its 34 percent stake in CCE, worth about $3.4 billion, and taking on $8.88 billion in debt. Additionally, the companies agreed that CCE will buy Coke's bottling operations in Norway and Sweden for $822 million and that it has the right to buy Coke's 83% stake in its German bottling operations. The deal comes as rival PepsiCo (PEP, Fortune 500) is about to close a $7.8 billion deal to buy Pepsi Bottling Group and PepsiAmericas, its largest bottlers. Coke shares plunged 4% and CCE shares rallied 32%. Palm: Palm (PALM) said it expects revenue to fall far below current forecasts due to worse-than-expected sales of its new smartphones. Shares plunged 16% on the forecast. Health care: The Obama administration's health care summit was underway Thursday, with Republican and Democratic leaders from both houses of Congress debating ways to reform the system. The president said that both sides agree that costs need to be contained, but they remain bitterly divided over whether to press through with the current bill or start over. World Markets: In overseas trading, major European and Asian markets ended lower. The dollar and commodities: The dollar fell versus the euro, reversing earlier gains. The greenback also fell against the yen. U.S. light crude oil for April delivery fell $1.83 to settle at $78.17 a barrel on the New York Mercantile Exchange. COMEX gold for April delivery rose $11.30 to settle at $1,108.50 per ounce. Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.64% from 3.69% late Wednesday. Treasury prices and yields move in opposite directions. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

tradersgx

Veteran |

26-Feb-2010 03:08

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 1

x 0 Alert Admin |

Worries About Greece is just the trick that BB play down the US stocks for accumulation. Wise move! Dow is slow climb back now..

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

25-Feb-2010 22:30

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

NEW YORK (CNNMoney.com) -- U.S. stocks were set to drop at Thursday's open, as jobless claims surged, worries about the debt crisis in Greece resurfaced and Federal Reserve chief Ben Bernanke prepared for a second day of testimony on Capitol Hill. Dow Jones industrial average, S&P 500 futures and Nasdaq 100 futures were lower, dropping further after an unexpected gain in jobless claims. Futures measure current index values against perceived future performance and offer an indication of how markets may open when trading begins in New York. Wall Street rallied Wednesday after Bernanke again vowed to keep interest rates low for the foreseeable future, reassuring worried investors. The blue-chip Dow gained nearly 100 points. But the positive sentiment didn't last. Bruce McCain, chief investment strategist for Key Private Bank, said the "turmoil in Europe," highlighted by the fact that thousands of Greek workers went on strike on Wednesday, is prompting Wall Street to question its recent advances. "Given the runup that we've had, people are backing up a bit and digesting what they're seeing in the economy and looking for greater clarity as to the direction we take from here," he said. "Sometimes expectations leap ahead of the economic cycle," McCain continued. "People are concerned that markets have moved too fast. There is a general tendency for the markets to move back and adjust the gains, and it looks like we are in one of those periods." Economy: The Labor Department released its weekly jobless claims report before the opening bell on Thursday. Initial jobless claims surged to 496,000 in the week ended Feb. 20. That's much more than the 460,000 claims projected by a consensus of economist opinion from Briefing.com. It's also much larger than the revised tally of 474,000 claims reported for the prior week. Also, the Census Bureau released its monthly report on orders for durable goods, a barometer for manufacturing that rose much more than expected. Orders for durable goods rose 3% in January, the government reported. The orders were expected to have risen 1.5%, according to Briefing.com consensus. Fed: With employment still weak, investors were reassured that the Fed was unlikely to raise short-term interest rates anytime soon. The Fed chief is scheduled to appear before a Senate panel Thursday, basically repeating the testimony he gave to the House panel. Companies: Coca-Cola (KO, Fortune 500) has agreed to buy the North America operations of its biggest bottler, Coca-Cola Enterprises (CCE, Fortune 500), in a deal worth about $12 billion, including nearly $9 billion in assumed debt. World markets: European shares edged lower in morning trading as investors refocused their attention on Greece's woes. Britain's FTSE 100, France's CAC 40 and the DAX in Germany all posted slim losses. Asian markets finished the session in negative territory. The Nikkei in Japan tumbled nearly 1% and the Hang Seng in Hong Kong ended 0.3% lower. Cash and bonds: The dollar rose against the euro and the pound but slipped versus the yen. The price of the 10-year note fell, pushing up the yield to 3.64%. Gold and oil: The price of gold fell $4.50 per ounce to $1,092.70. The price of oil fell $1.42 a barrel to $78.58. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

lookcc

Master |

25-Feb-2010 22:21

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

very sad coming. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

investor005

Member |

25-Feb-2010 22:17

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

sad..................... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

maxcty

Master |

25-Feb-2010 22:10

Yells: "always a learning day for me in trading" |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

ya loh..tonight dj down...tmr sti down more..dj up..sti also down... sti no power to move up liao~~~

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

lookcc

Master |

25-Feb-2010 22:08

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

dj up, sti oso down.......dj down, sti dun no how. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

maxcty

Master |

25-Feb-2010 22:03

Yells: "always a learning day for me in trading" |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

even with DOW positive....STI also no help ma...still negative DOW does not come to a factor now a days.......

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||