| Latest Forum Topics / Others |

|

|

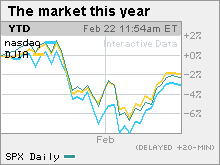

DOW & STI

|

||||||||||||||||||||||||||||||||||||

|

KannaSze

Member |

25-Feb-2010 22:00

Yells: "SMART DOLLAR" |

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

The Bulls and Bears seem to be edging each here.... it's time this be over tonight

|

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

25-Feb-2010 15:43

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

DOW future now -65.... | |||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

25-Feb-2010 06:12

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks surge on renewed optimismNEW YORK (CNNMoney.com) -- Stocks rallied Wednesday after Federal Reserve Chairman Ben Bernanke again pledged to keep interest rates low for the foreseeable future, reassuring investors worried about the outlook for the economy. The Dow Jones industrial average (INDU) gained 91 points, or 0.9%, according to early tallies, while the S&P 500 index (SPX) rose 11 points, or 1%. The Nasdaq composite (COMP) added 22 points, or 1%.  Stocks posted slim gains in the early going, lost some steam after a worse-than-expected new home sales report and then turned higher again after the Fed chief began speaking. The gains continued throughout the session. "Bernanke said they are going to keep the fed funds rate low, the dollar got hit and people started buying stocks," said Dave Rovelli, managing director of U.S. equity trading at Canaccord Adams. The weaker dollar lifted dollar-traded commodities and big corporations that do a lot of business overseas and therefore benefit from a weaker greenback. Financial and technology shares were also on the rise. Investors were digging back in after a two-session decline. That retreat occurred as a lackluster forecast on consumer spending and a plunge in a key measure of consumer confidence amplified concerns about the strength of the recovery. Stocks managed to advance in the previous two weeks as investors focused on the positives in the company and economic news, after a four-week rout. Bernanke: In his first day on Capitol Hill, Bernanke told the House Financial Services Committee that while the economic recovery is moving along, the jobs market remains weak. Against this backdrop, the Fed is unlikely to lift the fed funds rate, the key overnight bank lending rate, anytime soon. Bernanke was testifying before the House Wednesday and was scheduled to appear before the Senate Thursday. "I don't think Bernanke is breaking a lot of new ground here," said Scott Anderson, senior economist at Wells Fargo. "A lot of his testimony is defending the Fed's actions during the crisis, while the economic outlook is similar to the minutes from the last Fed meeting." Investors are looking for more on how and when the central bank plans to unwind emergency programs that were put in place at the height of the financial crisis, particularly after the Fed boosted the discount rate last week. The Fed boosted the discount rate -- the emergency bank lending rate -- by a quarter-percentage point to 0.75%. It was a largely symbolic move in a rate that is rarely used by banks, but it was also the first rise in rates in over a year and the first move in any direction for rates in over two years. The move was another step toward returning monetary policy to a so-called normalized state after the extraordinary measures of the last two years. In his early statements, Bernanke implied that the Fed will at some point need to raise the fed funds rate, the key bank lending rate, but that such a move is not likely to happen soon, considering the still moderate pace of recovery. On the move: Big financial firms JPMorgan Chase (JPM, Fortune 500), Morgan Stanley (MS, Fortune 500) and Bank of America (BAC, Fortune 500) all rallied, along with regional banks such as Keycorp (KEY, Fortune 500), Fifth Third Bancorp (FITB, Fortune 500) and Regions Financial (RF, Fortune 500). In deal news, printing services firm R.R. Donnelley (RRD, Fortune 500) said it is buying Bowne & Co. (BNE), a printer of corporate regulatory filings, in a deal worth $481 million. The $11.50 per share all-cash deal values the stock at more than 60% over Friday's closing prices. Shares of Bowne & Co. rallied 60% in unusually active New York Stock Exchange trading, while RR Donnelley shares gained 3%. Shares of STEC (STEC) plunged 24% in unusually active Nasdaq trading after the company issued a 2010 profit forecast late Tuesday that disappointed investors. The computer data storage firm forecast revenue in a range that is more than 50% below analysts' forecasts and said it would report a quarterly loss, versus current forecasts for a profit. JPMorgan Chase led the list of analysts downgrading or cutting forecasts on the company on Wednesday. Market breadth was positive. On the New York Stock Exchange, winners beat losers by more than five to two on volume of 1 billion shares. On the Nasdaq, advancers beat decliners eight to five on volume of 1.3 million shares. Toyota: The carmaker faced Congressional scrutiny for the second straight day, with company president Akio Toyoda speaking before the House Oversight Committee regarding the recall of millions of vehicles over safety issues. Toyoda, speaking through a translator, apologized for the safety problems that led to deaths, injuries and the eventual recall of more than 8 million vehicles with brake problems. The company said it is creating a system that will make it easier for customer complaints to be addressed and that it is forming a "quality advisory group" to seek input on safety and quality measures. On Tuesday, witnesses argued that the problems with the brakes could be tied to the vehicles' electronic throttle system, but Toyoda disputed that. New home sales: Sales of new homes tumbled to the lowest level on record in January, the government reported Wednesday, surprising economists who expected a rise in sales. Sales fell 11% to a 309,000 annual unit rate from 348,000 in the previous month. Economists expected sales to rise to a 354,000 annual unit rate. "It's a quite disappointing number," said Anderson. "We saw incredible weakness in new home sales following the improvements we saw in the fall." He said the improvements in the fall were largely as a result of the tax rebates for buyers and that, with the impact of those rebates fading, the sales have dropped off. But the existing home sales market is improving, he said, and the overall outlook for housing is getting better. Jobs: The Senate approved a $15 billion jobs creation bill that gives businesses tax breaks for hiring the unemployed and extends tax breaks that encourage companies to buy equipment. World Markets: In overseas trading, major European markets ended with moderate gains. Asian markets ended lower. The dollar and commodities: The dollar tumbled versus the euro and the yen. The dollar's weakness gave a boost to dollar-traded commodities. U.S. light crude oil for April delivery rose 92 cents to $79.78 a barrel on the New York Mercantile Exchange. COMEX gold for April delivery fell $6 to $1,097.20 per ounce. Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.67% from 3.68% late Tuesday. Treasury prices and yields move in opposite directions. |

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

24-Feb-2010 06:20

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks hit as confidence slipsNEW YORK (CNNMoney.com) -- Stocks tumbled Tuesday after a key measure of consumer confidence plunged, reflecting investors' growing pessimism about the strength of the economic recovery. The Dow Jones industrial average (INDU) lost 100 points, or 1%, according to early tallies. The 30-share Dow had lost as much as 115 points earlier.  A mixed market turned negative after the late morning release of a weaker-than-expected reading on consumer confidence. The report reflected investor wariness this year amid some conflicting readings on the economy, debt issues at home and abroad, and lawmaker squabbling in Washington. Stocks have been choppy lately, with the major indexes declining for four weeks, advancing for two weeks and then slipping again Monday -- despite some upbeat earnings and an $11 billion merger in the oil services sector. The Volatility (VIX) index, Wall Street's so-called fear factor, rose 9% Tuesday as nervousness grew about the strength of the recovery. "The bears and the bulls are in a tug of war, and today, the bears have the upper hand," said Bill Stone, chief investment strategist at PNC Financial Services Group. He said that the consumer confidence number is one of the more forward-looking readings and is raising worries that the consumer -- already struggling in a battered labor market -- might pull back even more. "Today it's a combo of a weak number and maybe needing to take a breather after the rally," Stone said. Struggling after the rally: After a huge runup in 2009 based on expectations for a strong recovery in 2010, investors are now looking for proof that such a recovery will take hold. A mixed batch of economic readings has put some doubt in the market this year, while better-than-expected fourth-quarter earnings and revenues have had little impact on investor sentiment. China's decision to temper growth by limiting bank loans and fears of Greece's debt crisis spreading to other European nations have also played a role in the market's seesawing. "In a broad sense, we're in the fourth quarter of a bull rally and a lot of the steam is out of it now," said Tom Hepner, financial adviser at Ruggie Wealth Management. He said investors are looking past the fiscal and monetary stimulus that has propped up the economy over the last year and are looking at the earnings and economic reports. "We're looking at the so-called fundamentals of the market and we're not quite sure it's all there yet," he said. Federal Reserve: Last week, the Federal Reserve surprised investors by boosting the discount rate, the emergency bank lending rate, by a quarter-percentage point, to 0.75%. It was the first change in interest rates in over a year and signaled the very early stages of the Fed returning to a more normal phase of monetary policy. However, the move was largely symbolic, as the discount rate is rarely used. Fed Chairman Ben Bernanke testifies on Capitol Hill Wednesday and Thursday. He is expected to discuss the economy and monetary policy, but investors will be listening to see if he says anything more about the central bank's plans to close out some of the emergency programs put in place during the height of the financial crisis. Housing: The S&P/Case-Shiller Home Price index of the 20 largest metropolitan areas fell 3.1% in December versus a year ago, in line with estimates and an improvement after a drop of 5.3% in the previous month. However, the index rose 0.3% from November's levels, suggesting the housing market is continuing to recover. On a quarterly basis, the index fell 2.5% versus a year earlier, an improvement over the last three years. Jobs: The Senate on Monday agreed to move forward on a $15 billion jobs creation bill that gives businesses a tax break for new hires. The bill would also extend an existing break for spending money on investments like equipment and funds highway and transit programs through the rest of the year. Toyota: Executives from the troubled auto manufacturer are in Washington this week to discuss the company's massive recall and future plans. At the first of three congressional hearings, witnesses argued that the problems with the brakes could be tied to the vehicles' electronic throttle system. James Lentz, the company's U.S. sales chief was testifying Tuesday and Akio Toyoda, the company's president, was due to testify Wednesday. Toyoda is expected to tell U.S. lawmakers that the rush to expand Toyota Motor's business led to the safety issues that resulted in the recall. Quarterly results: A number of retailers reported results Tuesday morning, including Dow component Home Depot (HD, Fortune 500). Home Depot said it returned to a profit in its fiscal fourth quarter after posting a loss a year earlier, with earnings of 18 cents per share, two cents better than expected. Home Depot also boosted its dividend. But the company gave a cautious 2010 outlook amid the still-fragile economic recovery. Target (TGT, Fortune 500) and Sears Holdings (SHLD, Fortune 500) also reported better-than-expected quarterly profit. Sears is the operator of Sears and Kmart. Banks: Over 700 banks are at risk of failing, according to a report from the Federal Deposit Insurance Corp. published Tuesday. The FDIC said that the number of banks on its so-called problem list has climbed to 702, the highest number in 6-1/2 years. The number has increased steadily since the start of the recession in December 2007. However, only a small percentage of banks identified as being in danger end up failing. World Markets: In overseas trading, European markets fell and Asian markets ended mixed. The dollar and commodities: The dollar gained versus the euro and fell against the yen. U.S. light crude oil for April delivery fell $1.45 to settle at $78.85 a barrel on the New York Mercantile Exchange. COMEX gold for April delivery fell $9.90 to settle at $1,103.20 per ounce. Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.70% from 3.79% late Monday. Treasury prices and yields move in opposite directions. Market breadth was negative. On the New York Stock Exchange, losers beat winners seven to three on volume of 1.08 billion shares. On the Nasdaq, decliners beat advancers by over two to one on volume of 1.7 billion shares. |

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

xinus84

Member |

24-Feb-2010 00:08

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

they always seem to go in opposite directions! | |||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||

|

tradersgx

Veteran |

23-Feb-2010 22:36

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Updated: DOW Components' Quarterly Data ; Q on Q Comparison Better Rev: 20 companies 66.67% <----- (", ) (", ) (", ) Lesser Rev: 10 companies 33.33% Total: 30 companies Better Profit: 20 companies + 1 70.0% <---- (", ) (", ) (", ) Lesser Profit: 10 companies -1 30.0% <---- Total: 30 companies +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ ( in USD$ million ) The Home Depot, Inc. (HD) Total Revenue: 1-Feb-10 $14,570.00 VS 1-Feb-09 $14,607.00 -0.3% <----- updated Net Income: -Feb-10 $505.00 VS 1-Feb-09 -$54.00 +Back to Profit (nm) <----- updated http://finance.yahoo.com/news/Home-Depot-profit-beats-rb-1971340505.html?x=0&sec=topStories&pos=4&asset=&ccode= Hewlett-Packard Company (HPQ) Total Revenue: 31-Jan-10 $31,200.00 VS 31-Jan-09 $28,807.00 +8.31% Net Income: 31-Jan-10 $2,300.00 VS 31-Jan-09 $1,856.00 +23.92% Alcoa, Inc. (AA) Total Revenue: 31-Dec-09 $5,433.00 VS 31-Dec-08 $5,688.00 -4.48% Net Income: 31-Dec-09 -$277.00 VS 31-Dec-08 -$1,191.00 Improved (nm) American Express Company (AXP) Total Revenue: 31-Dec-09 $7,051.00 VS 31-Dec-08 $7,303.00 -3.45% Net Income: 31-Dec-09 $716.00 VS 31-Dec-08 $240.00 +198.33% Boeing Co. (BA) Total Revenue: 31-Dec-09 $17,937.00 VS 31-Dec-08 $12,664.00 +41.64% Net Income: 31-Dec-09 $1,268.00 VS 31-Dec-08 -$86.00 +Back to Profit (nm) Bank of America Corporation (BAC) Total Revenue: 31-Dec-09 $17,645.00 VS 31-Dec-08 $21,602.00 -18.32% Net Income: 31-Dec-09 -$194.00 VS 31-Dec-08 -$1,789.00 +Improved (nm) Caterpillar Inc. (CAT) Total Revenue: 31-Dec-09 $7,898.00 VS 31-Dec-08 $12,923.00 -38.88% Net Income: 31-Dec-09 $232.00 VS 31-Dec-08 $661.00 -64.90% Cisco Systems, Inc. (CSCO) Total Revenue: 23-Jan-10 $9,815.00 VS 24-Jan-09 $9,089.00 +7.99% Net Income: 23-Jan-10 $1,853.00 VS 24-Jan-09 $1,504.00 +23.20% Chevron Corp. (CVX) Total Revenue: 31-Dec-09 $48,676.00 VS 31-Dec-08 $45,203.00 +7.68% Net Income: 31-Dec-09 $3,070.00 VS 31-Dec-08 $4,895.00 -37.28% EI DuPont de Nemours & Co. (DD) Total Revenue: 31-Dec-09 $6,814.00 VS 31-Dec-08 $6,070.00 +12.26% Net Income: 31-Dec-09 $441.00 VS 31-Dec-08 -$629.00 +Back to Profit (nm) Walt Disney Co. (DIS) Total Revenue: 2-Jan-10 $9,739.00 VS 27-Dec-08 $9,599.00 +1.46% Net Income: 2-Jan-10 $844.00 VS 27-Dec-08 $845.00 -0.12% General Electric Co. (GE) Total Revenue: 31-Dec-09 $41,438.00 VS 31-Dec-08 $46,213.00 -10.33% Net Income: 31-Dec-09 $3,013.00 VS 31-Dec-08 $3,722.00 -19.05% International Business Machines Corp. (IBM) Total Revenue: 31-Dec-09 $27,231.00 VS 31-Dec-08 $27,006.00 +0.83% Net Income: 31-Dec-09 $4,813.00 VS 31-Dec-08 $4,427.00 +8.72% Intel Corporation (INTC) Total Revenue: 26-Dec-09 $10,569.00 VS 27-Dec-08 $8,226.00 +28.48% Net Income: 26-Dec-09 $2,282.00 VS 27-Dec-08 $234.00 +875.21% Johnson & Johnson (JNJ) Total Revenue: 27-Dec-09 $16,551.00 VS 27-Dec-08 $15,182.00 +9.02% Net Income: 27-Dec-09 $2,206.00 VS 27-Dec-08 $2,714.00 -18.72% JPMorgan Chase & Co. (JPM) Total Revenue: 31-Dec-09 $15,615.00 VS 31-Dec-08 $21,631.00 -27.81% Net Income: 31-Dec-09 $3,278.00 VS 31-Dec-08 $702.00 +366.95% Kraft Foods Inc. (KFT) ( in USD$ million ) Total Revenue: 31-Dec-09 $11,000.00 VS 31-Dec-08 $10,767.00 +2.16% Net Income: 31-Dec-09 $710.00 VS 31-Dec-08 $163.00 +335.6% The Coca-Cola Company (KO) Total Revenue: 31-Dec-09 $7,510.00 VS 31-Dec-08 $7,126.00 +5.39% Net Income: 31-Dec-09 $1,543.00 VS 31-Dec-08 $995.00 +55.08% McDonald's Corp. (MCD) Total Revenue: 31-Dec-09 $5,973.40 VS 31-Dec-08 $5,565.00 +7.34% Net Income: 31-Dec-09 $1,216.80 VS 31-Dec-08 $985.30 +23.50% 3M Co. (MMM) Total Revenue: 31-Dec-09 $6,122.00 VS 31-Dec-08 $5,509.00 +11.13% Net Income: 31-Dec-09 $935.00 VS 31-Dec-08 $536.00 +74.44% Merck & Co. Inc. (MRK) Total Revenue: 31-Dec-09 $10,093.00 VS 31-Dec-08 $6,032.40 +67.31% Net Income: 31-Dec-09 $6,524.80 VS 31-Dec-08 $1,644.80 +296.69% Microsoft Corporation (MSFT) Total Revenue: 31-Dec-09 $19,022.00 VS 31-Dec-08 $16,629.00 +14.39% Net Income: 31-Dec-09 $6,662.00 VS 31-Dec-08 $4,174.00 +59.61% Pfizer Inc. (PFE) Total Revenue: 3Q2009 $11,621.00 VS 3Q2008 $11,973.00 -2.94% Net Income: 3Q2009 $2,878.00 VS 3Q2008 $2,278.00 +26.34% Procter & Gamble Co. (PG) Total Revenue: 31-Dec-09 $21,027.00 VS 31-Dec-08 $19,763.00 +6.40% Net Income: 31-Dec-09 $4,659.00 VS 31-Dec-08 $5,004.00 -6.89% AT&T, Inc. (T) Total Revenue: 31-Dec-09 $30,858.00 VS 31-Dec-08 $31,076.00 -0.70% Net Income: 31-Dec-09 $3,019.00 VS 31-Dec-08 $2,404.00 +25.58% The Travelers Companies, Inc. (TRV) Total Revenue: 31-Dec-09 $6,456.00 VS 31-Dec-08 $5,805.00 +11.21% Net Income: 31-Dec-09 $1,285.00 VS 31-Dec-08 $801.00 +60.42% United Technologies Corp. (UTX) Total Revenue: 31-Dec-09 $14,100.00 VS 31-Dec-08 $14,770.00 -4.54% Net Income: 31-Dec-09 $1,073.00 VS 31-Dec-08 $1,145.00 -6.29% Verizon Communications Inc. (VZ) Total Revenue: 31-Dec-09 $27,091.00 VS 31-Dec-08 $24,645.00 +9.92% Net Income: 31-Dec-09 -$653.00 VS 31-Dec-08 $1,235.00 -Loss (nm) Wal-Mart Stores Inc. (WMT) Total Revenue: 31-Oct-09 $99,411.00 VS 31-Oct-08 $98,345.00 +1.08% Net Income: 31-Oct-09 $3,239.00 VS 31-Oct-08 $3,138.00 +3.22% Exxon Mobil Corp. (XOM) Total Revenue: 31-Dec-09 $89,841.00 VS 31-Dec-08 $84,696.00 +6.07% Net Income: 31-Dec-09 $6,050.00 VS 31-Dec-08 $7,820.00 -22.63% +++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ |

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

smartrader

Elite |

23-Feb-2010 20:52

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Dow will go up.. credit market , esp. investment grade bonds are recovering... |

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

tradersgx

Veteran |

23-Feb-2010 16:19

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Hang Seng Index 20623.00 +245.73 +1.21% Last update: 23-02-2010 16:01 http://www.hsi.com.hk/HSI-Net/HSI-Net |

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||

|

Blastoff

Elite |

23-Feb-2010 06:27

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Stocks end volatile session lowerNEW YORK (CNNMoney.com) -- Stocks ended a choppy session lower Monday as investors weighed earnings news, President Obama's health care proposal and Schlumberger's $11 billion buyout deal for oil services rival Smith International. The Dow Jones industrial average (INDU) lost 19 points or 0.2%, according to early tallies. Last week, the Dow surged 300 points for its biggest one-week gain since November.  "The markets are fairly quiet after a strong week," said Alan Gayle, senior investment strategist at RidgeWorth Investments. "But after a 65% run (on the S&P 500) off the lows and some concerns about the economy in the near term, I'm expecting more choppiness in the weeks ahead." Gayle said investors were eying the deal and earnings news, the direction of the dollar and commodity prices. Investors may have also taken comfort from signs that regulatory changes being proposed in Washington will be milder than feared, he said, including the provisions in President Obama's health care plan, announced Monday. Stocks ended higher last week as investors digested the Federal Reserve's decision to lift the emergency bank lending rate. Stocks also posted gains for the second week in a row after four weeks of declines. But after that advance, stocks are bound to be volatile this week amid ongoing concerns about the outlook for the U.S. economy. Reports are due on housing, jobs and GDP growth. Federal Reserve Chairman Ben Bernanke testifies before Congress Wednesday and Thursday. Lawmakers meet in Washington later this week to discuss the Toyota recall, bank health and fiscal stimulus. Corporate news: Schlumberger (SLB) said it was buying fellow oil driller Smith International (SII, Fortune 500) in an all-stock deal worth $11 billion. The two companies' boards of directors have already approved the deal and shareholders are expected to follow suit. Schlumberger shares fell 3% and Smith shares gained 9%. In other company news, Lowe's (LOW, Fortune 500) reported higher-than-expected quarterly earnings and revenue and said sales would keep rising in the current year. However, shares of the home improvement retailer were little changed. Shares of Dow component Bank of America (BAC, Fortune 500) rose 2% after a judge approved the proposed $150 million settlement between the financial firm and the Securities and Exchange Commission. Credit cards: New credit card rules aimed at protecting consumers went into effect Monday. However, the regulations could result in consumers facing new charges and additional fees as the industry looks to offset the lost revenue. Health care: President Obama presented his outline for health care reform Monday, ahead of the bipartisan health care summit later this week. The 10-year, nearly $1 trillion plan would purportedly cover more than 31 million Americans currently not insured without adding to the budget deficit. The plan also allows the government to shoot down or roll back insurance premium hikes. Economy: A survey from the National Association for Business Economics showed that most leading economists think the recovery will remain on track. World Markets: In overseas trading, most European markets ended lower and Asian markets ended higher. The dollar and commodities: The dollar gained versus the euro, recovering from a morning slide. The greenback was weaker versus the yen. U.S. light crude oil for March delivery rose 35 cents to settle at $80.16 a barrel on the New York Mercantile Exchange. COMEX gold for April delivery fell $8.70 to settle at $1,112.60 per ounce. Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.79% from 3.77% late Friday. Treasury prices and yields move in opposite directions. |

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

smartrader

Elite |

22-Feb-2010 22:02

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Consolidation continues but fundamental data (excluding ... 22-Feb The current correction was started by sovereign risk concerns in Europe for Greece and possibly Portugal, Spain, Ireland and Italy. This caused the VIX index to rise to almost 30 but because the quantum of the Government debt is small about US$35bn....compared to the problems of some US banks, it is clearly solvable and a rescue package is already being put together by other EU members. The VIX index has also eased back to the 20 level over the last few weeks as the risks associated with debt problems in Europe is seen as being quite minor and unlikely to derail the Global economic recovery.

..... Click here to read more |

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

smartrader

Elite |

22-Feb-2010 19:35

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

is this future ? Dow is at 10402 last friday .. | |||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

pharoah88

Supreme |

22-Feb-2010 19:32

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

GOOD NEWS |

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||

|

smartrader

Elite |

22-Feb-2010 19:20

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

||||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

smartrader

Elite |

22-Feb-2010 10:53

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

cheers...Dow will extend gain tonight for 5th straight session.. | |||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

tradersgx

Veteran |

22-Feb-2010 10:47

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Breaking News •Asian Stocks Surge as U.S. Inflation Data Ease Rates Concern; BHP Advances http://www.bloomberg.com/apps/news?pid=20601087&sid=awBAInecfI7I&pos=1 Hang Seng Index 20352.56 +458.54 +2.30% http://www.hsi.com.hk/HSI-Net/HSI-Net |

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

Hulumas

Supreme |

21-Feb-2010 15:26

Yells: "INVEST but not TRADE please!" |

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Market movement is always dynamic and undefined!

|

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

soloman

Master |

19-Feb-2010 19:17

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

NORMALLY STI WILL PAY BACK AT THE NEXT SESSION ,,,,,,,,,,,,,,,,,,, | |||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

Hulumas

Supreme |

19-Feb-2010 19:11

Yells: "INVEST but not TRADE please!" |

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

As I said, global stock market is decoupling!

|

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

pharoah88

Supreme |

19-Feb-2010 16:38

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

Dow jones I & STI are not Linearly coupled.

|

|||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||

|

out-of-the-box

Senior |

19-Feb-2010 16:33

|

|||||||||||||||||||||||||||||||||||

|

x 0

x 0 Alert Admin |

HSI -528 and DJ Future -92 yet STI can move up from -40 to -28.... put up to let go stock?? or up trend?? | |||||||||||||||||||||||||||||||||||

| Useful To Me Not Useful To Me | ||||||||||||||||||||||||||||||||||||