|

Latest Posts By elfinchilde

- Elite

|

|

| 17-Jun-2008 14:45 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

aiyah. actually, it's simple. If you're looking to buy for mid to long term: not yet. most of the blues are actually just beginning their downtrend. while the pennies have never quite recovered from Aug 17 last year. Note that generally, the highs of Mar-May have never matched the Oct highs. While some of the counters have broken below the Aug 17 low. It's a mixed market though, which is why, pick your counters well. |

| Good Post Bad Post | |

| 17-Jun-2008 14:42 |

SGX

/

SGX

|

|

|

appears as tho one foreign fund selling, two local BBs buying for today. mid term trend still declining. |

| Good Post Bad Post | |

| 17-Jun-2008 14:24 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

More precisely, it is how they affect the DJIA, which in turn affects sentiment on STI. So it's not US news -->STI. It's US news-->DJIA--> STI. The in between is important, because there is dilution of influence: ie, we may or may not follow the DJIA, as we're also affected by HSI and SCI. Of the list tonight, the more important ones is Housing Starts and PPI m/m. Housing Starts measures the annualized number of new residential buildings that began construction during the previous month. The previous measurement was 1.03mil, and the forecast is 0.99 mil. So if all are in line with forecasts, the DJIA will not be affected. Where there's shock movement up/down is when the number deviates a lot from the forecast. So if actual starts (check at 830 pm tonight) are much less, say 0.5mil, then you can expect the DJIA to react negatively and go down. (ie, proportional relationship). PPI is the Producer Price Index. Closely related to the CPI--Consumer Price Index. If actual > forecast, DJIA will go up. actual < forecast, DJIA goes down. Note that they are forecasting for a rise of 1% cf to previous released data of 0.2% rise. Given that the released CPI was in line with expectations, i don't think this will deviate by a lot: so the data to watch tonight is the housing starts. For the rest of the week,, global news release (times stated are s'pore times): go to http://www.forexfactory.com/calendar.php ---------------- |

| Good Post Bad Post | |

| 17-Jun-2008 13:29 |

CapitaLand

/

CapitaLand: Too early to bottom fish

|

|

|

careful with this counter, too many large lots selling (100 and above); buying is done only in small quantities. Appears to be controlled distribution. Net movement thus far is about 300 lots sold. Appears as though funds are selling capitaland. |

| Good Post Bad Post | |

| 17-Jun-2008 13:00 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

US data out tonight: red denotes important news. And yea, as cyjerry said. Our market follows the DJIA, SCI and HSI. Note that SCI is on dangerous grounds now; given the amount of china plays here, you'd naturally expect STI to be stuck. So generally, i'd advise to skip the first hour of play, unless you're selling into a rally. Try not to buy in the 1st hour if your trading frame is longer than 5 days. ----------- |

| Good Post Bad Post | |

| 16-Jun-2008 13:40 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

sigh. tried creating charts to post up but can't. So for those interested, try to follow. How to tell the difference between a real rebound and a relief rebound. Using yl as an example, and SJ charts (keejang! free advert! ------------------------------- Note: if you're a very short term player (ie, 5 day trading frame), it should not matter to you if it's a relief rebound or a "real one"---since the only difference between the two is that the real rebound lasts for a longer time. 1) Setup for yanlord: bar chart, MACD, williams at 7 days, vol. (you'll have to toggle the last chart.) 2) Know the ave daily vol and the ave range of your counter. For yl, the daily trading range is at least 12c: this should be your target if you're an ultra short term. 3) Real rebound: Mar 20 to Apr 11. Px 1.67 to 2.6. Called on MACD. Exact entrance and exit is called on williams 7. 4) Technical rebound: May 23 to May 28th. Px 2.16 to max 2.32. (the target is 2.28, which you can get on the 27th or 28th May--definitely exit on 28th because the close is lower than the open. Red overhang on candlesticks). You know it's a relief rebound because MACD is still on longterm downtrend, but wills is 100% oversold. So don't be greedy; target small: the daily range of yl.) 5) You will not take the 2nd apparent 'rebound' on Jun 10th (2.09 px) because the vol is low then. ie, false signal on wills. if you had taken it, you'd not ride it but choose to exit at the high of 2.13, which it touched twice but did not breach, on increased volume. (2nd signal that it is a false rally). ------------- overall, i'd say, pick a few counters, know them well. and trade only them. It helps if you have a feel for your counters. such that almost by instinct, you know their ranges, whether a signal is false or not. Also, pick counters that are suitable for your time frame. If you can't afford to watch every second, don't play the highly volatile ones. liable to get heart attacks. hehe. |

| Good Post Bad Post | |

| 16-Jun-2008 12:41 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

hey baseerahmed, thanks for providing the website info for all of us here. :) novicex, no problem. best time to be learning is all times! hehe. agree with singaporegal actually: from a TA perspective, with volumes so low, charting is not as accurate as before--ie, higher probability of error. Which is also why i've been out of the market for the past month(s). Note for newbies to trading: time frame is very important. You need to decide if your trading frame is 5 days, or 2 weeks, or 1 month, or longer. You then key your indicators accordingly. And stick to it. Remember the old proverb, that a bird in hand is worth two in the bush. Don't get distracted by all the rushing counters, and let go the one in your hand. Eg, if your time frame was five days or less, you'd have entered friday (what i had said about relief rally close to support levels), looking to exit today or tomorrrow for small gains. BUT, if your time frame is 2 weeks to 3 months, you'd not enter friday, because long term indicators are still down. And technical rule is to enter after the turn up. Not before. So it's very important to keep in mind your time frame, and to use the right indicators/parameters for them. cheers. :) |

| Good Post Bad Post | |

| 14-Jun-2008 14:18 |

Entertainment

/

Jemahh Islamiyah leader escapes from Whitley Rd!

|

|

|

http://catherinelim.sg/2008/05/28/letter-to-the-straits-times-on-the-mas-selamat-scandal/ for those of you who follow the straits times. catherine lim had posted a forum letter on the mas selamat escape. The last line of the letter was censored by the Straits Times. What is revealing to me isn't just that censorship. Since a paper has the right to edit what it publishes, and it does not have to apologise for it. But read the comments by a Lawrence Leow, dated May 28th, on the blog. True or not, i do not know. But if it is true, then, it is rather disappointing. |

| Good Post Bad Post | |

| 14-Jun-2008 14:13 |

Entertainment

/

Jemahh Islamiyah leader escapes from Whitley Rd!

|

|

|

the surprise to me isn't that they lost Mas Selamat. The surprise would be if they catch him back, excluding via strokes of luck (ie, by genuine effort and intelligence). Since really, Singaporeans tend to be possessed of a practical, don't-rock-the-boat mentality. "Kiasu, kiasee, kia zheng hu", being a common phrase levied. Especially our civil servants. We're not exactly known for imagination, sterling original intelligence, or derring-do. Just witness the stock replies in the Forum pages to complaints from the public. It's all about following traditional order. Not letting new things happen. While people like Mas Selamat, whether right or wrong, are idealists through and through: they make things happen. In defiance of established order. So the question is simple: How can a realist ever capture an idealist, when they cannot even begin to comprehend the mind of the latter? When all they are concerned about is being safe, being stable, not rocking the boat? Imagination is key, and imagination is lacking, even derided as "useless" or "second rate" to the old ways of doing things. And the catch-22 of the old ways is that when it fails, it falls back to the old ways of sweeping things under the carpet, and "let's move on". The question, again. How can a realist ever capture an idealist? The answer was written in psychology way before already. |

| Good Post Bad Post | |

| 13-Jun-2008 23:39 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

support refers to a critical technical level at which large buyers usually come in to shore up the market. When a key support is broken on increasing volume, that's a bearish sign for the mid/long term. short term technical rebounds tend to occur around the support point, however. most counters are showing short term oversold on a long term downtrend. ie, can expect relief rebounds sometime soon. how many days it can go up is anyone's guess then. All depends on sentiment, which is reflected in volume. If you look at the longer term trading frame of the STI, it moves in ~3 mth cycles. Mar to May = up. If the rebound occurs on sustained volume, it means it has a good chance of going up further, rather than the sell-into-rally scenario. pick counters well, would be my advice. try to avoid the speculative pennies at this stage; yes, you can make a lot more, but the risk may not be worth it if in the next two weeks, some bad news comes out from china or the US. SCI is really not holding up well. personal opinion only. caveat emptor applies.

|

| Good Post Bad Post | |

| 13-Jun-2008 17:26 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

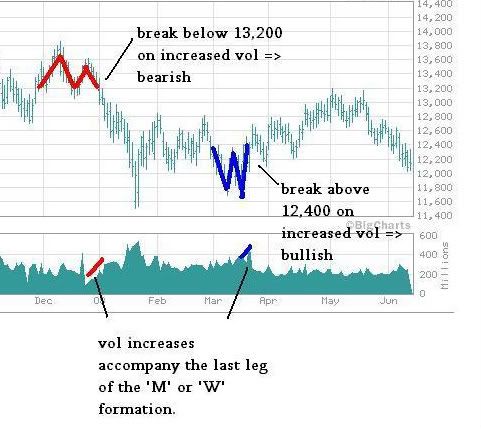

for newbies to charting. just simple technicals to see market trend, no need talk of BB movement etc: how to gauge the likely direction of a stock/index movement. you'd use fibonacci to call the actual support/resistance levels. But otherwise, check for basic formations in your price volume charts. As follows, using the DJIA as an example: ------------------

|

| Good Post Bad Post | |

| 13-Jun-2008 17:19 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

yea, TA. i'm more of a technical person, though i've learn some FA from shplayer, and the rest here. always good to learn more. :) technical-wise: check for a double top formation, otherwise known as an M formation. (see today's Straits Times back page, they gave quite a good call there). A break of the M downward on increased vol is a bearish sign. In contrast, a break of a W upward on increased vol is a bullish sign. hm. STI closing today not good. Just checked the blues: a lot of large buying in the last half hour; more than i expected. But it's still down. doesn't bode well. share buybacks tend to occur as the company tries to send a signal that it believes in its own company, its stock is cheap at those prices. To reassure investors, really. What technically follows is this: index is down, broad market down. Company initiates buy back. stock price goes up for a day or two. Whereupon it usually drops below the company buyback price for a short period. When it starts to turn up, that is when you buy. |

| Good Post Bad Post | |

| 13-Jun-2008 16:54 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

no problem, cathy. :) technical update for the regional indices: HSI closed way below 23,000 at 22,592. dropped 1.87% today. SCI has dropped 3% to 2868. They've both broken key support levels. SCI by technical definition is close to a bear market (a bear market being when the market gives up its entire gains of the previous year(s)): critical level for SCI = 2,840 (bear market), then 2,612. May see a brief rebound to ~3,050 levels. HSI: Support of 23,000 and 22,850 broken in one swoop. Next level to watch is 22,660 (a very thin support), the stronger support is 21,100. The Nikkei is in bear territory already, as 14,000 is its critical level. DJIA bear territory is 11,500. 12,000 is the critical support level. Critical stage for a lot of the global indices. ie, you may expect rebounds at the above levels or thereabouts (remember it's never an exact science): if the rebounds are with strong vol, that's good. if not, it's a sell into rally scenario. What's troubling about the HSI/SCI falls is that they occurred with larger vols than usual. Points to sustained downtrend being a greater probability. |

| Good Post Bad Post | |

| 13-Jun-2008 15:15 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

well, HSI and SCI have broken their critical supports. So STI will likely close slightly +/- its own support. I'd wager 2,990 to 3,020 close. Would expect to see some after-the-bell movement: if more shortists are covering back, the index will go up; if more people throw, it'd be down. close call either way. Vol without the buybacks is actually low. more than half of sembcorp's trade today came from a married deal at 3.55, for instance. |

| Good Post Bad Post | |

| 13-Jun-2008 15:04 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

careful on the broad market. vol is up today because there's a lot of married deals across the board: kep corp, semb corp, sgx, etc. i believe some, if not all, are share buybacks. which means market may have some downside left. |

| Good Post Bad Post | |

| 12-Jun-2008 15:16 |

Others

/

Shares Plunge! People Jump!

|

|

|

it's a serious problem really. especially when you break down the stats by age group: more of the young ones (< 25 years old) and the older ones (senior citizens) are committing suicide. The given stats also do not give the full story. Because most families/people will not like to admit suicide. So some of the 'heart attacks', and accidents, and 'open verdicts', are actually suicide stats, as well. A good preposition, cyjjerry. If you can find someone who's willing to coach, i'd be willing to learn, really. life shouldn't just be about oneself. :) |

| Good Post Bad Post | |

| 12-Jun-2008 12:50 |

Others

/

Forex Trading Broker

|

|

|

heya, you can take a look at FXCM, metatrader or Ig markets. the last offers free 2 week demo; the system is web-based--so you can try it out for yourself without having to download stuff: http://www.igmarkets.com.sg/cfd/demo.html?ct=h the commission that is charged is the pip spread between the buy/sell price, so it entirely depends on which pair you are playing, and what your broker is willing to give. if you're a normal account, then standard commission will be 2-3 pips for the most common pairs: Euro/US, US/JPY, Euro/JPY. etc. If you're trading exotic pairs like the GBP/JPY, the pip spread can be as much as 8-9. cheers and good luck! :) |

| Good Post Bad Post | |

| 12-Jun-2008 12:45 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

eh, eldarchen, i thought i warned you two days ago to stay out of the market for these two weeks..... (-_-")..... a bit too risky to buy STI puts now, i think...wait for bottom to fish. |

| Good Post Bad Post | |

| 12-Jun-2008 12:42 |

Yanlord Land

/

Lord of the China property market

|

|

|

cyjjerry, it usually means more than one BB is fighting for control of the counter (one wants it up, one wants it down. Who has deeper pockets win). That's why the movement will be extremely volatile. If you can track counterparty, you can see what is happening. (alternatively, it is just controlled release/accumulation, so that it doesn't appear 'fishy'). To gauge the direction, you need to count the net movement of the large lots traded. Alternatively, just look at williams 7 days for yl. The spike was 2.16 to 2.32. Thereafter, down. It was a short up on a long down, so to speak. MACD gives pretty accurate long term pic for yl, while williams 7 gives the short-term trend. need to be careful though, because yl has a history of going down even on oversold williams if the MACD is on a long term downtrend. what it does though, is to have a few 'hui2 guan1 fan3 zhao4's before it drops. |

| Good Post Bad Post | |

| 10-Jun-2008 15:02 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|

|

hm. not good. HSI has dropped 1,000 plus points. If it tanks til closing, be prepared for renewed sell down on STI after 4 pm. |

| Good Post Bad Post | |

| First < Newer 681-700 of 2759 Older> Last |