|

Back

x 0 x 0

x 0 x 0

|

RH Petrogas - So No Sona, So What?

RHP took a 20% dive yesterday amid a slew of trading-negative news which had no fundamental bearing. Malaysian media reported that Sona Petroleum is not taking a stake in RHP, which triggered the selloff on top of traders taking profit to cover losses elsewhere.

RHP is again trading at takeover valuations. Maintain BUY, with SGD1.33 TP.

Solid fundamental value

RHP?s large pool of reserves and resources has a solid intrinsic value. News that Sona Petroleum is not taking a stake in RHP proved to be trading-negative (media articles implied rather inaccurately that RHP?s rise was due solely to rumours of Sona?s acquisition). We believe RHP?s intrinsic value stands on its own legs and needs no validation from an outsider purchase.

We were right and wrong simultaneously

Yesterday, we said that traders were selling profitable positions to cover losses in Blumont/ Asiasons/ Liongold. We were right on this, but wrong on the impact. Our sources inform us that, smelling blood in the water, other traders took a short position on the stock, causing the stock price to fall to artificially-depressed levels far below what we thought was a sensible entry point.

Placement shares begin trading today

RHP also announced that new placement shares will begin trading today. We believe the stock?s increased free float will contribute to long-term liquidity and thereby also reduce the price impact of non-fundamental-motivated trading.

Back at takeover levels

With its price collapsing to less than half of our conservatively-estimated TP, RHP is again trading at takeover levels. We firmly believe that the margin of safety at this level is extremely wide and that longer-term investors who can ride out the volatility stand to reap supernormal gains.

Technical Analysis

|

| Daily Chart |

Maintain BUY, with SGD1.33 TP

We reiterate our BUY recommendation with an unchanged SGD1.33 TP, based on parity to our net present value (NPV)-and-risking model.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

By Nick Taborek - Oct 18, 2013 4:48 AM GMT+0800

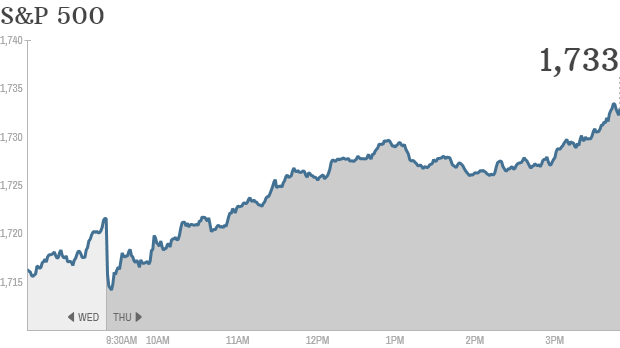

U.S. stocks rose, sending the Standard & Poor?s 500 Index to a record, as speculation grew that the Federal Reserve will maintain the pace of stimulus after Congress ended the budget standoff

Click for more market data.

NEW YORK (CNNMoney)

The S& P 500 hit a new record high Thursday, one day after lawmakers voted to reopen the government and ended a fiscal showdown that put the nation at risk of default. But a batch of lackluster corporate earnings weighed on the Dow.

The S& P 500 rose 0.7% to just above 1,733, surpassing the previous all-time high from last month. The Nasdaq also gained ground, but remains far from its record highs from 2000. The Dow Jones industrial average ended the day flat as weakness in IBM (IBM, Fortune 500), Goldman Sachs (GS, Fortune 500) and UnitedHealth (UNH, Fortune 500) was balanced by strength in American Express (AXP, Fortune 500) and Verizon (VZ, Fortune 500).

IBM and Goldman are the second and third highest weighted components in the Dow, which is weighted by stock price as opposed to market value like the S& P 500. This means moves in these higher-priced stocks have an outsized impact on the Dow.

" IBM takes a huge bite since it's the highest priced Dow stock," said Hank Smith, chief investment officer at Haverford Trust.

Stocks surged more than 1% Wednesday following news that Congress had reached a deal to reopen the federal government and avert a potentially catastrophic default. But investors are still wondering what happens when the government bumps up against the debt ceiling again in February.

" While there's great relief that a deal was inked before the so-called deadline, the reality is that these new deadlines aren't too far away in terms of passing a budget and the next debt ceiling issue in early February," said Smith.

He added that investors should brace for more volatility as lawmakers continue to butt heads over spending. But he said there could be " more upside" for stocks if Congress can pass a budget before the end of the year.

The dollar was weaker against other major world currencies, sinking as much as 1% against the euro and the pound. European stocks were lower while Asian markets finished mixed.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

North and South American Indexes

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Sorry PAT for TW should read 19.3m instead of 16.3m

| |

Tat Hong |

Tiong woon |

|

| |

1Q ended 30.6.13 |

Full yr ended 30.6.13 |

|

| |

|

|

|

| Profit & Loss |

($' M) |

($' M) |

|

| Revenue |

175x4=700 |

200 |

|

| Profit after Tax |

9.2x4=36.8 |

19.3 |

*After the sale of the loss making yard, this year (ending June14) will benefit

|

| depreciation |

21.5x4=86 |

27 |

from the absence of close to $3mln in operating losses attributed to the yard. |

| |

|

|

|

| |

|

|

|

| EPS (cents) |

1.28x4=5.12 |

4.23+0.65=4.88 |

* Adjusted for 3m increase in profit due to the sales of yard |

| |

|

|

|

| NTA (cents) |

98 |

51.22 |

|

| |

|

|

|

| |

|

|

|

| Balance sheet items |

($' M) |

($' M) |

|

| |

|

|

|

| Properties, plant & Equipments |

912.8 |

307.3 |

|

| Inventory |

182.7 |

4.7 |

|

| Trade & receivables |

241.4 |

68.8 |

|

| Cash & Bank |

58.1 |

26.2 |

|

| TOTAL ASSETS |

1521.9 |

426.5 |

|

| |

|

|

|

| Financial Liabilities |

500.4 |

102.3 |

|

| TOTAL Liabilities |

793.9 |

185.9 |

|

| |

|

|

|

| |

|

|

|

| Cash Flow Statement |

($' M) |

($' M) |

|

| |

|

|

|

| Purchase of Plant & equipments |

38.5x4=154 |

14 |

|

| Repayment of borrowing |

34x4=136 |

23.5 |

|

| Financial lease |

25x4= 100 |

15.5 |

|

| Interest paid |

4.8x4=19.2 |

2.7 |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Besides EPS and NTA, Tiong woon 's cash flow & financial position are much better than Tat Hong as shown below.

TW's Capital expenditures and financial liabilities are also much lower .

Closing price today for TW is 34.5c as compared to 93c for TH.

| |

Tat Hong |

Tiong woon |

|

| |

1Q ended 30.6.13 |

Full yr ended 30.6.13 |

|

| |

|

|

|

| Profit & Loss |

($' M) |

($' M) |

|

| Revenue |

175x4=700 |

200 |

|

| Profit after Tax |

9.2x4=36.8 |

16.3 |

| *After the sale of the loss making yard, this year (ending June14) will benefit

from the absence of close to $3mln in operating losses attributed to the yard.

|

|

| depreciation |

21.5x4=86 |

27 |

|

| |

|

|

|

| |

|

|

|

| EPS (cents) |

1.28x4=5.12 |

4.23+0.65=4.88 |

* Adjusted for 3m increase in profit due to the sales of yard |

| |

|

|

|

| NTA (cents) |

98 |

51.22 |

|

| |

|

|

|

| |

|

|

|

| Balance sheet items |

($' M) |

($' M) |

|

| |

|

|

|

| Properties, plant & Equipments |

912.8 |

307.3 |

|

| Inventory |

182.7 |

4.7 |

|

| Trade & receivables |

241.4 |

68.8 |

|

| Cash & Bank |

58.1 |

26.2 |

|

| TOTAL ASSETS |

1521.9 |

426.5 |

|

| |

|

|

|

| Financial Liabilities |

500.4 |

102.3 |

|

| TOTAL Liabilities |

793.9 |

185.9 |

|

| |

|

|

|

| |

|

|

|

| Cash Flow Statement |

($' M) |

($' M) |

|

| |

|

|

|

| Purchase of Plant & equipments |

38.5x4=154 |

14 |

|

| Repayment of borrowing |

34x4=136 |

23.5 |

|

| Financial lease |

25x4= 100 |

15.5 |

|

| Interest paid |

4.8x4=19.2 |

2.7 |

|

StewardLittle ( Date: 17-Oct-2013 19:45) Posted:

| Tiong Woon constantly requires capital expenditures which their operating cash flow cannot support. Just look at Tat Hong and compare. |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

17 October 2013

SGX reports first-quarter net profit of $92 million

?

? Operating profit: $107 million, up 21%

? Net profit: $92 million, up 24%

? Earnings per share: 8.6 cents, up 24%

? Interim dividend per share: 4.0 cents

For the full SGX Financial Statements announcement, please visit www.sgx.com.

Revenue: $184 million, up 15% from a year earlier

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Pocket CR 6.6c earlier than the Co's payment date (30/10). Left 1/3 to try my luck!

Huat arh......

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Another one Tiong Woon

NAV as at 30.6.13 : $ 0.52

WanSiTong ( Date: 09-Oct-2013 20:37) Posted:

Tiong Woon Corp - completed the sale of their loss making shipyard in Bintan yesterday

■ Tiong Woon Corp (TWC) has finally completed the sale of their loss making shipyard in Bintan yesterday.

■ This is a very positive development as the shipyard lost close to $3mln last year and was sold for $18mln, reaping them a one-time gain of $2.7mln.

■ TWC?s cash holdings will be increased by 75% from $24mln to $42mln.

■ Net gearing will improve from 33% to a healthy 25%.

■ This will come in handy to fund the company?s expansion plans as management seeks to expand into the Iskandar region to capitalize on the region?s expected construction boom over the next few years.

■ As well, management is contemplating expanding their Singapore facilities as their current operating space is getting tight based on their current runrate and orders.

■ This is because a key customer of TWC, Rotary Engineering has secured a record order book of just over $1bln, which is expected to be delivered over the next 2 years.

■ Other oil related customers such as Total, Sinopec and Shell are also expanding aggressively in Tuas (Singapore Lube Park).

■ After the sale of the loss making yard, this year (ending June?14) will benefit from the absence of close to $3mln in operating losses attributed to the yard.

■ This will see TWC easily achieving our 25% net profit growth projection for full year ending June?14 of $22.5mln, translating to a forward PE of 7x.

■ This is undemanding relative to its growth prospects of 25% as well as peers such as Tat Hong?s 10x and Hiap Tong?s 9x. ■ TWC?s NTA of 52 cents means its price to book is only 0.65x and we note that its assets have not been re-valued and are kept at historical cost.

■ If TWC can trade up to its peer group average PE of 9.5x, there is potentially an upside of 36% to 46 cents, which would still put it at a discount to its NTA of 52 cents.

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 1 x 1

|

Sorry..... should be OUE

WanSiTong ( Date: 17-Oct-2013 11:59) Posted:

UOE

NAV as at 30.6.13 : $ 3.44

WanSiTong ( Date: 01-Oct-2013 08:14) Posted:

|

Overseas Union Enterprise- Yet another special dividend in sight.

FY13F PE (x): 33.1

FY14F PE (x): 33.8

Commercial REIT in the offing. OUE is exploring the establishment of a commercial REIT with an initial portfolio that is expected to include OUE Bayfront and other commercial assets owned by Lippo China Resources.

Yet another special dividend in sight. OUE Bayfront was last valued at S$1.08b and has a committed occupancy rate of over 95% at an average rent of over S$10.30 psf pm. Lippo China Resources? commercial property assets that could potentially constitute the intial portfolio include Lippo Centre in Hong Kong and the Lippo Plaza in Shanghai. A successful listing could mean yet another similar special dividend as the Hospitality REIT (10-20 S cents/share) and a vehicle to realise value for its other commercial properties in Singapore (6 Shenton Way and Towers One and Two and One Raffles Place).

Maintain BUY with a target price of S$3.57 / share, pegged at 20% discount to our revised RNAV of S$4.46/share. OUE is trading at a deep

42% discount to its RNAV.

Source: UOBKH

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

UOE

NAV as at 30.6.13 : $ 3.44

WanSiTong ( Date: 01-Oct-2013 08:14) Posted:

|

Overseas Union Enterprise- Yet another special dividend in sight.

FY13F PE (x): 33.1

FY14F PE (x): 33.8

Commercial REIT in the offing. OUE is exploring the establishment of a commercial REIT with an initial portfolio that is expected to include OUE Bayfront and other commercial assets owned by Lippo China Resources.

Yet another special dividend in sight. OUE Bayfront was last valued at S$1.08b and has a committed occupancy rate of over 95% at an average rent of over S$10.30 psf pm. Lippo China Resources? commercial property assets that could potentially constitute the intial portfolio include Lippo Centre in Hong Kong and the Lippo Plaza in Shanghai. A successful listing could mean yet another similar special dividend as the Hospitality REIT (10-20 S cents/share) and a vehicle to realise value for its other commercial properties in Singapore (6 Shenton Way and Towers One and Two and One Raffles Place).

Maintain BUY with a target price of S$3.57 / share, pegged at 20% discount to our revised RNAV of S$4.46/share. OUE is trading at a deep

42% discount to its RNAV.

Source: UOBKH

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

|

UOBKH

Restricted Stocks for Online Trading

|

| |

16 October 2013

|

| |

|

| |

Please note that only the following stocks are restricted from online trading: |

| |

|

| |

- Albedo Group (5IB)

- Asiasons (5ET)

- Blumont (A33)

- Cedar (530)

- Chaswood Resources Holdings Ltd (5TW)

- Digiland (G77)

- EMS Energy Ltd (5DE)

- Innopac Holdings Ltd (I26)

- Ipco Intl Ltd (I11)

- IP Comdty.ETN.100US$ (J1QZ)

- ISR Capital Ltd shares (5EC)

- LionGold (A78)

- Metech Int^ (QG1)

- Mirach Ener (C68)

- NexGenSCom^ (B07)

- Rowsley Ltd (A50)

- Rowsley W161003 (T5MW)

- Transcu (E15)

- Vallianz (545)

- WE Holdings (5RJ)

- YHM Group Ltd (5QT)

- Covered Warrants

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Yes ! Hopefully no profit guidance for this quarter. Huat arh........

Scheduled date for release of Financial Results for the Third Quarter ended 30 September 2013

Vard Holdings Limited will be announcing its financial results for the third quarter ended 30 September 2013 on Wednesday, 6 November 2013, before market opens.

The financial statements, presentation and news release will be available for viewing at

www.sgx.com as well as the company?s website www.vard.com.

SFGuyRuleZ ( Date: 16-Oct-2013 19:28) Posted:

| Vard's results will be released on 6th of Nov.. No profit guidance, most likely should be good ba, I hope (fingers crossed). Just added more again today at 0.83. But still have to see how the US drama unfolds. Hopefully my bargain hunt is an early christmas present and not a disaster. Lol.. |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

By Nick Taborek - Oct 17, 2013 4:02 AM GMT+0800

U.S. stocks rallied, sending the Standard & Poor?s 500 Index (SPX) toward a record, as the Senate crafted a deal to end the government shutdown and raise the debt ceiling before tomorrow?s deadline.

The S& P 500 rose 1.4 percent to 1,721.47 at 4 p.m. in New York. The benchmark gauge slid 0.7 percent yesterday after climbing 3.3 percent over the previous four days.

?Investors are relieved that it looks like we?re not going to go over the cliff,? Ben Hart, a research analyst at Radnor, Pennsylvania-based Haverford Trust Co., which oversees about $6 billion, said by phone. ?It takes the worst case scenario off the table.?

The S& P 500 dropped 4.1 percent from its all-time high of 1,725.52 reached Sept. 18 as Congress struggled to reach agreement on a federal budget, forcing the first partial government shutdown in 17 years. The gauge has recovered 4 percent of the decline as optimism grew that a deal would be reached, and is within about four points of its record. The S& P 500 is up 21 percent for the year.

The bipartisan leaders of the Senate reached an agreement to end the fiscal impasse and to increase U.S. borrowing authority. The Senate and House plan to vote on it later today, and the White House press secretary said President Barack Obama supports the deal.

The framework negotiated by Senate Majority Leader Harry Reid and Minority Leader Mitch McConnell would fund the government through Jan. 15, 2014, and suspend the debt limit until Feb. 7, setting up another round of confrontations.

Four-Week Standoff

The agreement concludes a four-week standoff that began with Republicans demanding defunding of Obama?s 2010 health-care law, and objecting to raising the debt limit and funding the government without policy concessions. House Speaker John Boehner said in a statement that Republicans won?t block the Senate compromise.

With no deal, the U.S. would exhaust its borrowing authority tomorrow and the government may start missing payments at some point between Oct. 22 and Oct. 31, according to the Congressional Budget Office. Fitch Ratings put the world?s biggest economy on watch for a possible credit downgrade yesterday, citing lawmakers? inability to agree.

The S& P 500?s advance over the past week has squeezed managers who borrowed and sold shares to bet on declines lawmakers would struggle to reach a deal. U.S. companies with the most short sales have climbed 4.7 percent since Oct. 9, compared with a 3.9 percent advance for the benchmark gauge, data compiled by Bloomberg and Goldman Sachs Group Inc. show.

Hedge funds, whose bearish bets on stocks have held their returns to half the Standard & Poor?s 500 Index in 2013, helped send a gauge of manager bullishness compiled by ISI Group LLC within 0.2 point of its lowest reading in 2013 last week.

Fed Stimulus

Equities have surged in 2013 as the Federal Reserve maintained efforts to stimulate the economy by holding interest rates near zero percent and purchasing $85 billion of bonds each month under a program known as quantitative easing.

The rally in 2013 has been the broadest in at least 23 years, with S& P 500 companies extending the streak of quarters in which they have avoided an earnings contraction to 15 and valuations holding below historic averages. Of S& P 500 members, 443 are up so far in 2013, data compiled by Bloomberg show. The next-closest year was 1997, when 436 companies had advanced and the index was quadrupling.

Profits for companies in the index probably increased 1.4 percent during the third quarter while sales rose 2 percent, according to analysts? estimates compiled by Bloomberg. Some 22 companies in the S& P 500 are due to post results today.

U.S. economic growth remained ?modest to moderate? as consumer spending maintained gains and business investment grew, the Fed said today in its latest Beige Book business survey. Four of the 12 Fed districts reported slower economic growth while eight others said the expansion held steady amid ?uncertainty? stemming from the U.S. fiscal deadlock.

The report provides policy makers anecdotal accounts from the Fed districts two weeks before they meet to set monetary policy.

To contact the reporter on this story: Nick Taborek in New York at ntaborek@bloomberg.net

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

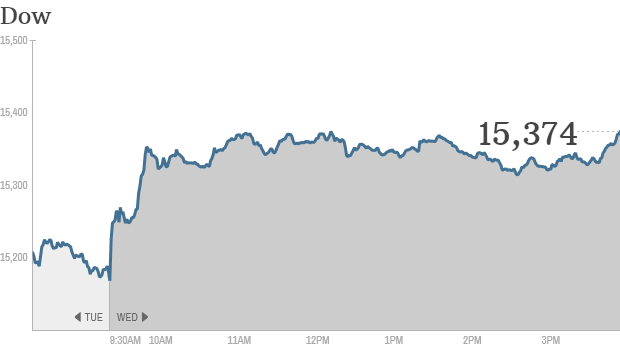

Dow gains 200 points as debt deal emerges

By Ben Rooney @CNNMoneyInvest October 16, 2013: 4:32 PM ET

Click for more market data.

NEW YORK (CNNMoney)

Stocks surged Wednesday as investors cheered news that Senate lawmakers have reached a deal to reopen the government and avoid a possible United States debt default.

The Dow Jones industrial average jumped more than 200 points, or 1.3%. The S& P 500 and Nasdaq both gained more than 1%.

Senate officials announced an agreement Wednesday that would end a 16-day government shutdown and raise the debt ceiling ahead of a midnight deadline. Lawmakers in the House and Senate could vote on the bill as soon as tonight, Congressional aides told CNN.

The Treasury Department has warned that it will no longer be able to borrow the money it needs to pay all the nation's bills and will start burning through its cash reserves starting Thursday. This has raised concerns around the world that America could default on its debts.

If passed, the bill would forestall what most economists say would have been a shock to the global financial system. But some investors say Congress is merely kicking the can down the road. The deal funds the government through January 15 and raises the debt ceiling until February 7.

" You could call it a relief rally, but I don't know that anything has really been resolved," said Brent Schutte, market strategist at BMO Private Bank. " At least the market can stop worrying about it for a while."

Yields on short-term Treasury bills had been rising lately on default concerns. But demand was strong at Wednesday's sale of one-month T-bills and one-year notes.

Fed taper delayed even further? There may be one potential bright spot from the continued dysfunction in Washington. The Federal Reserve is unlikely to cut back on, or taper, its bond-buying program anytime soon.

" With more uncertainty and the potential for the government shutdown to drag on the economy, the last thing the Fed wants to do is begin to taper," said Bernard Kavanagh, vice president of portfolio management at Stifel Nicolaus. " That should give the market a bit of a tailwind."

In its latest snapshot of economic conditions, known as the Beige Book, the Fed said growth continues at a modest pace.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

World Markets

North and South American markets finished broadly higher today with shares in Brazil leading the region. The Bovespa is up 1.80% while U.S.'s S& P 500 is up 1.38% and Mexico's IPC is up 0.34%.

North and South American Indexes

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

OUE Limited (the " Company" ) refers to its announcement dated 25 September 2013 stating the Company was exploring the listing of OUE Commercial Trust, constituted under the laws of the Republic of Singapore, which shall invest mainly in commercial properties (the " Proposed REIT" ), and the units of which are to be listed on the Main Board of Singapore Exchange Securities Trading Limited (the " SGX-ST" ). The Company had also announced on 25 September 2013 that the initial portfolio of the Proposed REIT is expected to include OUE Bayfront, being an 18-storey office building located at 50 Collyer Quay, together with its ancillary properties comprising a conserved tower building used for a food and beverage outlet and a link bridge with retail shops (collectively, the " OUE Bayfront Property" ). Lippo Plaza Property" ). The Lippo Plaza Property is located at No. 222, Huaihai Zhong Road, Huangpu District, Shanghai, the People?s Republic of China. The Proposed REIT has, on 16 October 2013, through a wholly-owned subsidiary, entered into a conditional sale and purchase agreement with Lippo China Resources Limited (" LCR" ), which is listed on The Stock Exchange of Hong Kong Limited (the " HKSE" ), to acquire shares in the company holding the Lippo Plaza Property. The sale and purchase agreement is conditional upon, among other things, the underwriting agreement in relation to the offering of units in the Proposed REIT becoming unconditional.

Further to the above, the Company wishes to announce that it intends to submit a draft circular to the SGX-ST for review, in respect of, among other things, the disposal of the OUE Bayfront Property to the Proposed REIT.

In addition to the OUE Bayfront Property, the initial portfolio of the Proposed REIT will include a 36-storey commercial building known as " Lippo Plaza" , excluding Unit 2 on Basement 1, the 12th, 13th, 15th and 16th Floors, and 4 car parking spaces with a total gross floor area of approximately 58,521.54 square metres (the "

The size, timeframe and terms of any offering to be made in respect of units in the Proposed REIT are currently under review and have not been decided. The listing of the Proposed REIT on the SGX-ST will be subject to, among other things, market conditions, the relevant regulatory, shareholders? and other approvals having been obtained and the execution of all definitive agreements by the relevant parties. Therefore, there is no certainty as to whether the listing of the Proposed REIT will proceed.

An announcement will be issued by the Company in the event that there is any material development in relation to the listing of the Proposed REIT. In the meantime, shareholders are advised to refrain from taking any action in respect of their shares in the Company which may be prejudicial to their interests, and to exercise caution when dealing in the shares of the Company.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Dow +183

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

World Markets

North and South American markets are higher today with shares in U.S. leading the region. The S& P 500 is up 0.88% while Brazil's Bovespa is up 0.20% and Mexico's IPC is up 0.03%.

North and South American Indexes

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

By Alexis Xydias - Oct 16, 2013 9:42 PM GMT+0800

U.S. stocks gained, sending the Standard & Poor?s 500 Index (SPX) higher for the fifth time in six days, as lawmakers rushed to lock up an agreement on raising the debt limit before tomorrow?s deadline.

The S& P 500 rose 0.6 percent to 1,708.93 at 9:39 a.m. in New York. The benchmark gauge slid 0.7 percent yesterday after rallying 3.3 percent over the previous four days. The Dow Jones Industrial Average gained 91.77 points, or 0.6 percent, to 15,259.78 today. Trading in S& P 500 stocks was 21 percent above the 30-day average at this time of day.

?If the market truly believed the U.S. will default on its obligations, we would see a more dramatic reaction from equity and bond markets,? Henk Potts, who helps oversee about $310 billion as a strategist at Barclays Wealth & Investment Management in London, said by phone today. ?The great expectation is the deal will be done. If the deal is not done, however minuscule that chance that may be, it would have a devastating impact on sentiment.?

The S& P 500 has advanced 1 percent this month even as Congress failed to agree on a federal budget, forcing the first partial government shutdown in 17 years.

Debt Limit

A framework being negotiated by Senate Majority Leader Harry Reid and Minority Leader Mitch McConnell would fund the government through Jan. 15, 2014, and suspend the debt limit until Feb. 7. The proposal will probably be presented for a House vote by Speaker John Boehner and may win passage with a majority of Democrats and minority of Republicans, Representative Charles Dent, a Pennsylvania Republican, said in an interview on CNN.

With no deal, the U.S. would exhaust its borrowing authority tomorrow and the government may start missing payments at some point between Oct. 22 and Oct. 31, according to the Congressional Budget Office. Fitch Ratings put the world?s biggest economy on watch for a possible credit downgrade yesterday, citing lawmakers? inability to agree.

?Reaching a broad agreement aside, there are still a few hoops to go through before it can be considered a done deal,? Jim Reid, a strategist at Deutsche Bank AG, wrote in e-mailed comments. ?All eyes clearly will be on this today as we await for further developments from Capitol Hill.?

The Federal Reserve is scheduled to release its Beige Book of current economic conditions today.

Earnings Season

Some 22 companies in the S& P 500 are due to post results today.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

CapitaMalls Asia ST: as long as 1.91 is support look for 2.09

Alternative scenario: below 1.91, expect 1.85 and 1.81.

1.91 is our pivot point. Our preference: as long as 1.91 is support look for 2.09. Alternative scenario: below 1.91, expect 1.85 and 1.81. Comment: the RSI is above 50. The MACD is positive and below its signal line. The stock could retrace in the short term. Moreover, the stock is above its 20 and 50 day MA (respectively at 1.96 and 1.93). Supports and resistances: 2.13 * 2.09 ** 2.06 1.97 last 1.93 1.91 ** 1.85 * Copyright 1999 - 2013 TRADING CENTRAL

|

|

Good Post

Bad Post

|

|

|

|