|

Latest Posts By WanSiTong

- Master

|

|

| 21-Oct-2013 17:23 |

SGX

/

SGX

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 21-Oct-2013 17:06 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

A Cat is transformed into a Lion!

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 21-Oct-2013 13:27 |

Global Logistic

/

GLP

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

GLP has been climbing from $2.65 since 28/8 ........... | ||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 21-Oct-2013 13:13 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

Singapore shares crawl higher as small, mid-caps stocks top trading: Reuters

Singapore shares edged up on Monday, buoyed by the market regulator's decision to lift trading restrictions in three small and mid-cap stocks. Shares of Asiasons Capital Ltd more than doubled in value, while Blumont Group Ltd and LionGold Corp Ltd jumped about 90 percent in heavy trading, after SGX lifted trading restrictions on these stocks and restored their full access to the equity market. ... The benchmark Straits Times Index inched up 0.2 percent to 3,197.50, in line with a 0.2 percent gain in MSCI's broadest index of Asia-Pacific shares outside Japan. The FT ST Small Cap Index has risen more than 3 percent so far this year, while the FT ST Fledgling Index, which covers companies with smaller market capitalisations, jumped nearly 20 percent. Both outran the benchmark index's 0.9 percent rise year-to-date. " We believe that small mid caps will continue to attract investors interest with its superior growth," DBS said in a research report. DBS's picks include Nam Cheong Ltd, Goodpack Ltd, Centurion Corp Ltd and Yoma Strategic Holdings. DBS also recommended Ezion Holdings Ltd, Kreuz Holdings Ltd and Rex International Holding Ltd in the oil and gas space, as well as palm oil stocks Bumitama Agri Ltd and Indofood Agri Resources Ltd |

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 21-Oct-2013 12:57 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

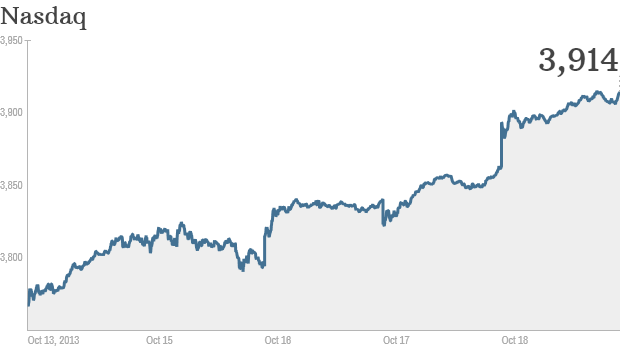

Market Recap

US equities ended the week with gains as better-than-expected corporate earnings from Google and Morgan Stanley boosted investor sentiment. 19 of the Dow components finished with gains with GE (+3.5%) the best performer. For the week, the Dow gained 1.1%. The S& P 500 saw all ten industry groups advance and it gained 2.4% for the week. Rounding off the major indices, the tech-heavy NASDAQ Composite fared the best with a 3.2% gain for the week. NYSE Composite volume came in at 3.7b.... WTI Crude for Nov added 14 cents, or 0.1%, to end at US$100.81/barrel while Dec Brent gained 83 cents, or 0.8%, to settle at US$109.94/barrel. For the week, both WTI and Brent fell 1.2% and 0.5% respectively. Gold for Dec delivery lost US$8.40, or 0.6%, to end at US$1,314.60/ounce. Dec Silver shed 3 cents, or 0.2%, to end at US$21.91/ounce. Nonetheless, for the week, gold and silver gained 3.7% and 3.1% respectively. Implications for Singapore The optimistic display by the US indices last Friday night and the still-positive US index futures (up 0.2% now) could provide some inspiration to the local bourse this morning. As a recap, the STI managed a 0.2% gain in the last session, although investors were still hesitant about pushing it beyond the 3200 psychological obstacle. But with today?s tone likely to remain more upside biased, we could potentially see the index initiating another attempt to overcome this hurdle today. Should the 3200 level be taken out, the index will likely head to the 3260 level (key peaks) next. On the downside, 3155 minor trough is still the immediate base, with the next support lying at the 3125 key trough. |

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 21-Oct-2013 10:47 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

Important Notice - ?Designated Securities?

QUESTIONS AND ANSWERS

1. For stocks bought during the period of designation, will investors be allowed to

sell the stocks before the purchases are settled on T+3? Yes. Following the ending of the designation, stocks bought during the period of

designation can be sold prior to the settlement of the trades on T+3. 2. Do sellers of the stocks still have to show satisfactory evidence that they own

sufficient quantities before brokers can execute a sell order? No. There is no longer a requirement for sellers to show proof of ownership of stocks

before brokers can execute a sell order. 3. For purchases of the stocks, do investors still need to make cash payment

upfront before brokers can execute a buy order? No. Upfront cash payment is no longer required by SGX before brokers can execute a

buy order. This is subject to trading restrictions that brokers may impose as part of their

credit risk management policy. 4. Is short selling now allowed? Yes. Short selling will now be allowed. 5. Is contra trading now allowed? Yes. Contra trading will now be allowed. 6. Is trading on margin financing now allowed? Yes. Trading on margin financing will now be allowed, subject to individual broker?s risk

management policy. 7. Is internet trading now allowed? Poems internet trading will be available from 22 Oct 2013 (Tue). 8. How will SGX treat breaches of trading restrictions imposed on the designated

stocks? Trades done during the period of designation are subject to trading restrictions. Any

breach of such restrictions will be reviewed by the SGX to determine the appropriate

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 21-Oct-2013 10:10 |

Vard

/

Vard Holdings

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

No news is Good news............ Huat arhhhhhhh

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 21-Oct-2013 09:41 |

Others

/

Any Stocks Also Can Discuss Forum

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

Haha....... total 52 counters

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 21-Oct-2013 09:18 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

For those who did not pay cash topick up these 3 counters, script should be changed to : " 裙 子 " 換 成 " 股 票 " ................haha........ |

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 20-Oct-2013 23:07 |

COSCO SHP SG

/

CoscoCorp

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

Cosco Corporation - One step forward, two steps backWritten By Stock Fanatic on Sunday, October 20, 2013 |We doubt the simultaneous string of order wins announced by Cosco, amounting to US$400m, will mask the negative impact of the termination of a contract worth more than US$500m.

What You Should Do

There is no reason to own the stock for now. (Read Report)

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 20-Oct-2013 20:38 |

Global Logistic

/

GLP

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

Compared to CapitaLand or even CMA, GLP is overvalued:

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 19-Oct-2013 10:47 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trade with care!! |

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 19-Oct-2013 10:41 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

For UOBKH

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 19-Oct-2013 10:36 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 19-Oct-2013 10:35 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

UOBKH 17.10.13

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 19-Oct-2013 10:29 |

Others

/

Thought of the Moment

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

贊 ! 兄 弟 姊 妹 别 忘 记 , 扬 眉 吐 气 星 期 一 。

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 19-Oct-2013 07:30 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

S& P 500 Extends Record Amid Stimulus Bets as Google Jumps

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 19-Oct-2013 07:21 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

World MarketsNorth and South American markets finished higher today with shares in U.S. leading the region. The S& P 500 is up 0.65% while Mexico's IPC is up 0.53% and Brazil's Bovespa is up 0.04%.

North and South American Indexes

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 18-Oct-2013 22:40 |

SGX

/

SGX

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

To be more exact....... should be listing fees instead of maintenance fees. Huat arh.....

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| 18-Oct-2013 22:03 |

SGX

/

SGX

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

CIMB TP : 8.69 Outperform

|

||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | |||||||||||||||||||||||||||||||||||||||||||||||

| Intra Day | |

|

|

|

|

Gadgets powered by Google |

Technical Analysis

| First < Newer 441-460 of 1632 Older> Last |