|

Latest Posts By dealer0168

- Elite

|

|

| 23-Feb-2010 20:37 |

MAP Tech

/

MAP tech

|

|||||||||

|

|

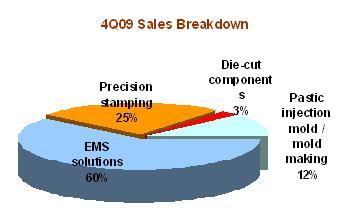

HDD PLAYERS had a tough time in the earlier part of 2009, but the sector has been recovering. My loading, i'm still holding onto it. The coming 1st qtr financial results (this year) from Maptech maybe better. And that makes me hold on to it. That my opinion n i maybe wrong. Anyway judge by yourself. |

|||||||||

| Good Post Bad Post | ||||||||||

| 23-Feb-2010 20:34 |

MAP Tech

/

MAP tech

|

|||||||||

|

|

|

|||||||||

| Good Post Bad Post | ||||||||||

| 23-Feb-2010 15:10 |

Wing Tai

/

Wing Tai

|

|||||||||

|

|

Wow.........hulumas $0.70 lah.....

|

|||||||||

| Good Post Bad Post | ||||||||||

| 22-Feb-2010 22:54 |

Wing Tai

/

Wing Tai

|

|||||||||

|

|

70cents for Wing Tai....emm maybe possible in the next recession that will occurred in other 6 to 8 years time perhaps. Currently, even if there is a drop, the drop won't be that drastic like last year................after so much contributions by the governments of the countries. <<My opinion>>.

|

|||||||||

| Good Post Bad Post | ||||||||||

| 22-Feb-2010 22:18 |

Wing Tai

/

Wing Tai

|

|||||||||

|

|

70cents for Wing Tai....? Not only we should sell house n car to buy. I will also take loan from BANK to buy......haha FearValueGreed is a CUTE fellow...loh Cheers. |

|||||||||

| Good Post Bad Post | ||||||||||

| 22-Feb-2010 14:29 |

Genting Sing

/

GenSp starts to move up again

|

|||||||||

|

|

Seems like Genting going to claim back its $1 status soon. | |||||||||

| Good Post Bad Post | ||||||||||

| 22-Feb-2010 14:27 |

Rotary Engg

/

Rotary

|

|||||||||

|

|

Most likely this week. Rotary seems like does not have the habit of informing their investor earlier on the result announcement from what i see.

|

|||||||||

| Good Post Bad Post | ||||||||||

| 22-Feb-2010 12:26 |

Yanlord Land

/

Yanlord Potential Inverted Head and Shoulders

|

|||||||||

|

|

Tags: Yanlord | Yanlord Land Group

|

|||||||||

| Good Post Bad Post | ||||||||||

| 22-Feb-2010 08:35 |

Yanlord Land

/

Yanlord Dome Collapses

|

|||||||||

|

|

Emm i am still monitoring for the time being. Yet to set a price to start averaging............. But like i say, don't average too frequent......

|

|||||||||

| Good Post Bad Post | ||||||||||

| 21-Feb-2010 22:54 |

Yanlord Land

/

Yanlord Dome Collapses

|

|||||||||

|

|

I do agreed with that. But the property stock will not get drag down by this news for very long. So those who got trap at high value, have to monitor properly n goes in for averaging at correct timing.....

|

|||||||||

| Good Post Bad Post | ||||||||||

| 21-Feb-2010 22:51 |

Yanlord Land

/

Yanlord Dome Collapses

|

|||||||||

|

|

Sorry typo error, should be: "sell on rebound" this statement may makes those

|

|||||||||

| Good Post Bad Post | ||||||||||

| 21-Feb-2010 22:47 |

Yanlord Land

/

Yanlord Dome Collapses

|

|||||||||

|

|

"sell on rebound" this statement may makes those to buy at high price to buy more to average down further more. That may cost ppl more money........if the stock only rebound slightly n goes down more. The best is do yr homework yrself n judge when to buy to average down if u buy too high Up. |

|||||||||

| Good Post Bad Post | ||||||||||

| 21-Feb-2010 22:38 |

Yanlord Land

/

Yanlord Dome Collapses

|

|||||||||

|

|

Sell on rebound , this statement may makes ppl average too frequent. Its good to sell on strength n buy when stock are down. But like i say, timing is very important............ |

|||||||||

| Good Post Bad Post | ||||||||||

| 21-Feb-2010 20:52 |

Yanlord Land

/

Yanlord Dome Collapses

|

|||||||||

|

|

What drop will go back. Now it all depends if u can hold til it goes up. Remember do not average too frequently. Wait for correct timing................ |

|||||||||

| Good Post Bad Post | ||||||||||

| 20-Feb-2010 21:59 |

Genting Sing

/

Playing Cards With the Bears

|

|||||||||

|

|

Genting is a highly speculative stock. Just based on TA, u won't be able to gauge its direction of move. It is a surprise package stock.............. |

|||||||||

| Good Post Bad Post | ||||||||||

| 20-Feb-2010 21:45 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||

|

|

wow....u all so ti-kou. Hahahaha.

|

|||||||||

| Good Post Bad Post | ||||||||||

| 20-Feb-2010 21:32 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||

|

|

This news may pose good path forward for certain stock........ Oil demand and price will rise in H2: Iran officialTEHRAN - Iran sees an increase in oil demand in the second half of 2010 by between 1 and 1.4 million bpd which the major OPEC producer thinks will cause a rise in oil prices, Iranian media said on Saturday. "Based on projections, the global demand for oil in the second half of 2010 will increase on average by 1-1.4 million bpd, and this will push up oil prices," Iran's OPEC governor, Mohammad Ali Khatibi, was quoted as saying in daily paper Mardomsalari. Oil investors are looking for signs of economic recovery and a potential rebound in energy demand. Oil prices have firmed gradually from lows of near $30 a barrel in December 2008 to the current range of between $70 and $85 a barrel. Oil prices rose toward $80 a barrel on Friday as refinery strikes in France and tensions about Iran's nuclear program outweighed fears that U.S. monetary tightening could slow demand growth in the world's largest oil consumer. |

|||||||||

| Good Post Bad Post | ||||||||||

| 20-Feb-2010 18:23 |

Rotary Engg

/

Rotary

|

|||||||||

|

|

That Australian company is the parent company of Rotary customer. The debts things may be resolved soon maybe. Let see how the last qtr results published abt that. Anyway i believe the debts does not impact Rotary at all. Remember: The Group’s balance sheet is strong with assets totalling S$404.0 million, n it has net tangible assets of S$228.8 million and cash and cash equivalents of S$145.6 million.

|

|||||||||

| Good Post Bad Post | ||||||||||

| 20-Feb-2010 12:27 |

Others

/

DOW

|

|||||||||

|

|

ok noted...Susan. Btw Handon, u are free to speak in the forum. Don't always say will nvr post anymore.... Hehe, bc yr posting is interesting sometimes. Cheers.

|

|||||||||

| Good Post Bad Post | ||||||||||

| 20-Feb-2010 11:40 |

Allgreen

/

Allgreen - Can buy ?

|

|||||||||

|

|

depend which property stock u buy........

|

|||||||||

| Good Post Bad Post | ||||||||||

| First < Newer 361-380 of 2601 Older> Last |