|

Back

x 0 x 0

x 0 x 0

|

Ezra Holdings - Baby steps to recovery

Ezra?s kitchen-sinking efforts in 3Q13 were warranted on hindsight as subsea turned around nicely in 4Q13. However, it is too early to turn bullish with just one good quarter. Maintain Underperform.

4Q13 core profit of US$7.3m was above our US$2m estimate, bringing FY13 core loss to US$39m. This is ahead of our -US$44m forecast and consensus?s -US$33m, thanks to stronger subsea margin in 4Q13. We lift our FY14-15 EPS by 3-43% for stronger subsea margin and introduce FY16 EPS. Our target price rises to S$1.00 after rolling over to CY15, still based on 11x (-1 s.d. of its 5-year mean). Ezra could be catalysed by positive margin surprises.

Subsea profitable again

Subsea delivered a high single-digit net profit in 4Q13 vs. a loss in 3Q13. Utilisation rebounded to 70-80% with the execution of more projects. Gross margins recovered to pre-3Q13 average of mid-teens. We believe that this could be helped by a few fasttracked transportation & installation jobs in Malaysia and Vietnam slotted in 4Q14. Recall that in 3Q13, subsea was affected by the lack of critical mass, delays and cost overruns for some projects. Subsea secured US$1.25bn of orders in FY13 and the order backlog stood at US$1.1bn.

We expect US$1.5bn of orders in 2014, as Ezra tenders for US$5bn-6bn of jobs. 1Q14 earnings should be stable but we are worried about its utilisation rates in 2Q14 (Dec-Feb) which crosses the Monsoon in Asia and winter months in Europe. We now expect FY14 gross margins for subsea to be 14% (12% previously).

Muted offshore showing

Offshore division's utilisation rose to 94-95% in 4Q13 (3Q13: 70-80%) as more vessels returned to work. Gross margin improved to 20% from 17% in 3Q13. The outlook seems stable as activities are picking up in the Gulf of Mexico and West Africa. The average rate for Ezra's fleet is US$1.75-1.80/BHP. We expect FY14 gross margins for offshore to be 21%.

Technical Analysis

|

| Daily Chart |

Too expensive

At 19.7x CY14 P/E, Ezra?s valuation is double that of its Singapore peers (9x) We would wait until its subsea division delivers consecutive profits with no major hiccups. ( Read Report)

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Ya, This is the strongest amongst the 3.

Net profit for the 3 months ended 30.6.13 : $ 2.585m vs Loss of $5.14m same period last year.

NTA per share : 25.50c

starlene ( Date: 29-Oct-2013 11:03) Posted:

| strongest among the trio never drop below 20cts this round..I thougfht Asiason is a fund mger stock..get whack so easily this round.Bluemont is worst becoz of rights shares back..but long term will recover if the CEO take over on Nov 6..I thinnk even if there are investigations the directors /manipulators are charged but cos still on going concern,,,hope the 3 cos have bottomed..ideally no more force selling but now slow uptrend |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Hello 123, any update on GLP ?

hello123 ( Date: 21-Oct-2013 14:24) Posted:

as predicted last fri , GLP this monday morning surge to 313 then react down , now 309.

for more details , see http://sgxswinger.blogspot.sg/

hello123 ( Date: 18-Oct-2013 16:18) Posted:

GLP now 307 , could rally to 313-315 react down then go 330-332 react down then finally 338-40..

for more details , see http://sgxswinger.blogspot.sg/ |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

$50 per 10,000 shares

happyharvest ( Date: 26-Oct-2013 05:27) Posted:

$50 dividend per 1000 shares?

edwinteo ( Date: 25-Oct-2013 23:05) Posted:

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

No durian !..........only peanut......... Lol

ezridax ( Date: 30-Oct-2013 09:41) Posted:

hopefully, they will issue some durians!

roostertan ( Date: 29-Oct-2013 21:48) Posted:

| Not yet. In certain cases, company will have AGM and declare dividends thereafter |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Declared 0.5 cent final dividend.

ezridax ( Date: 29-Oct-2013 21:35) Posted:

| no dividend declared ... rats :P |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

NEWS RELEASE

CapitaMalls Asia achieves 3Q 2013 PATMI of S$64.8 million (HK$400.1 million)

Year-to-date 2013 operating PATMI increases 35.8% to S$185.3 million (HK$1,143.8 million)

Singapore and Hong Kong, 30 October 2013

? CapitaMalls Asia Limited (SGX: JS8 and HKEx: 6813) announced today that it achieved profit after tax and minority interests (PATMI) of S$64.8 million (HK$400.1 million1) for 3Q 2013, an increase of 4.0% over the S$62.4 million (HK$384.8 million) for 3Q 2012. Operating PATMI for 3Q 2013 was S$65.1 million (HK$401.9 million), a 4.4% increase over the S$62.4 million for 3Q 2012.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

UOBKH

|

Restricted Stocks for Online Trading

|

| |

29 October 2013

|

| |

|

| |

Please note that only the following stocks are restricted from online trading: |

| |

|

| |

- AdvSCT (5FH)

- Albedo Group (5IB)

- Amplefield (C60)

- Artivision (5NK)

- AsiaMed (505)

- Asian Micro Holdings Limited (585)

- Asiasons (5ET)

- AUSSINO (A15)

- Blumont (A33)

- Cedar (530)

- CEFC Intl (Y35)

- Chaswood Resources Holdings Ltd (5TW)

- China Great (D50)

- China Oilfield Technology Services Group Ltd (DT2)

- CNMC (5TP)

- Digiland (G77)

- ElektromotiveGrp (5VU)

- ElektromotW150710 (5VWW)

- EMS Energy Ltd (5DE)

- HL Global (L18)

- Infinio (5CS)

- Innopac Holdings Ltd (I26)

- Ipco Intl Ltd (I11)

- IP Comdty.ETN.100US$ (J1QZ)

- ISR Capital Ltd shares (5EC)

- JK Tech (5TS)

- Koyo (5OC)

- Lereno (587)

- Lereno W150430 (5QSW)

- LifeBrandz (L20)

- Lindeteves-Jacoberg Ltd (L15)

- LionGold (A78)

- LionGold Warrants (R5UW)

- Metech Int^ (QG1)

- Mirach Ener (C68)

- NexGenSCom^ (B07)

- OKH GLOBAL LTD (S3N)

- Rowsley Ltd (A50)

- Rowsley W161003 (T5MW)

- Singapore Kitchen Equipment (5WG)

- Singapore Medical Group (5OT)

- Sitra Holdings (International) Ltd (5LE)

- SKY ONE HOLDINGS LIMITED (5MM)

- Stratech Systems Ltd (S73)

- SunMoon Food Company Ltd (F06)

- SurfaceMT^ (Q7Q)

- Transcu (E15)

- TT Int (T09)

- TungLok (540)

- United Fiber System Limited (P30)

- Vallianz (545)

- W Corp (OJ4)

- WE Holdings (5RJ)

- YHM Group Ltd (5QT)

- Zhongmin Baihui Retail Group Ltd (5SR)

- Zhongxin Fruit & Juice Ltd (5EG)

- Covered Warrants

|

| |

|

| |

Please contact your Trading Representatives for trading assistance.

|

| |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

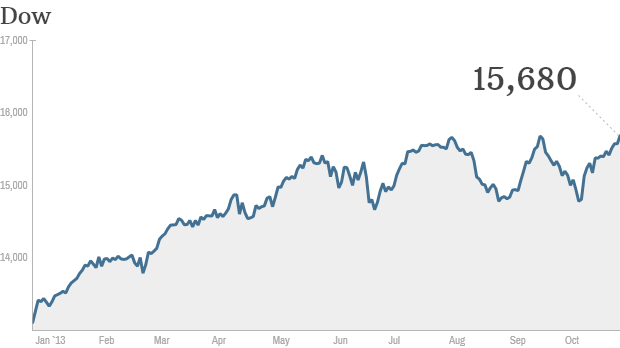

Dow, S& P 500 close at record highs

By Hibah Yousuf @CNNMoneyInvest October 29, 2013: 4:32 PM ET

Click the chart for more stock market data.

The bulls are on a roll. Stocks rose again Tuesday, despite a lackluster report on retail sales and a brief glitch involving the Nasdaq.

The Dow Jones industrial average jumped more than 100 points, to finish at a record closing high. The Dow is still slightly below its all-time intraday high though.

The S& P 500 also gained and closed at a record high for a third straight day, while the Nasdaq finished at its highest level since September 2000.

Retail sales slipped 0.1% in September. The decline was the first since March but was in line with expectations.

A separate report showed that home prices kept rising in August, with prices in 20 big cities climbing at a 12.8% annual rate, according to the S& P/Case-Shiller index.

The Federal Reserve was also be in focus as the central bank kicked off its two-day policy meeting. A statement is due Wednesday afternoon. The Fed is widely expected to keep its stimulus measures in place, but investors will be looking for signs to determine when the Fed may begin scaling back, or tapering, its $85 billion monthly bond buying program.

Nasdaq index prices briefly halted: The Nasdaq Composite index and Nasdaq-100 stopped updating just before noon due to dissemination issues. The indexes resumed updating at 12:45 ET. Options trading was halted, but stocks listed on the Nasdaq were not affected.

Still, this glitch is the latest in a string of malfunctions at the Nasdaq that began with the marred debut of Facebook (FB, Fortune 500) in May 2012.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

North and South American Indexes

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Look like now can only eat Ang Ku Kuek and drink plain water......

Peter_Pan ( Date: 29-Oct-2013 14:49) Posted:

come come..! afternoon tea time..! everyone take one and go make ur own tea..! |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

MACD cross today!!

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

0.006 would be a very strong support!

mb7269 ( Date: 29-Oct-2013 12:23) Posted:

|

So high chance to collect at .002 ? or even .001? |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

PROPOSED NEW SUBSCRIPTION OF 584,375,930 SHARES IN ADVANCE SCT LIMITED

1.1 The Board of Directors of Advance SCT Limited (the ?

(collectively the ?

ordinary shares. In view of the changed market conditions in the last two months, the Subscribers have requested for and the Company has agreed to the termination of the

Subscription Agreements. On 28 October 2013, the Company has entered into separate agreements with each of the Subscribers to terminate the Subscription Agreements.

1.2 In lieu of the Subscription Agreements, the Company has entered into a placement agreement (the ?

placement agent (the ?

capital of the Company (the ?

?

Price on the terms and subject to the conditions of the Placement Agreement. The Placement Agent shall be obliged to subscribe for any Placement Shares for which

subscription by parties other than the Placement Agent cannot be procured. The Company shall pay to the Placement Agent an underwriting commission of 1.50% of the

aggregate Placement Price.

Placement Agreement?) with Lim & Tan Securities Pte Ltd as thePlacement Agent?). Pursuant to the Placement Agreement, the Company has agreed to allot and issue up to 584,375,930 new ordinary shares in thePlacement Shares? and each a ?Placement Share?) at an issue price of S$0.0065 (the ?Placement Price?) for each Placement Share (thePlacement?) and the Placement Agent has agreed, on a fully underwritten basis, to subscribe for and/or procure the subscription for, the Placement Shares at the Placement Company?) refers to its announcement on 26 August 2013 in relation to six conditional subscription agreementsSubscription Agreements?) with six individual investors (collectively the ?Subscribers?) for the subscription of an aggregate number of 584,375,930 new

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

SINGAPORE DAYBOOK: Straits Trading, ARA Asset, Bond Auction

ARA Asset Management (ARA SP) and Straits Trading agreed to jointly invest in property. Straits Trading will acquire a 20.1 percent stake in ARA for S$294.4 million from Li?s Cheung Kong Investment Co. and ARA Chief Executive Officer John Lim in cash and shares, according to

statement.

...

WHAT TO WATCH:

* Straits Trading (STRTR SP) lifts trading halt at 830am in

Singapore

* ARA Asset Management (ARA SP) lifts trading halt at 830am in

Singapore

* Singapore Exchange (SGX SP) introducing Asian foreign

exchange futures for deliverable and non-deliverable Asian

currencies from Nov. 11

* OKP Holdings (OKP SP) 3Q net S$288,000 vs S$2.4m

* King Wan Corp. (kwan SP) wins S$26m worth of new M& E

contracts order book S$168.9m worth M& E contracts

* Boustead Singapore (BOCS SP) unit gets design-build-and-

lease contract

* ST Engineering (STE SP) unit gets line maintenance contract

from Jetstar Asia

* Healthway Medical (HMED SP) 3Q net S$10.1m vs S$1.1m

* Tee International (TEE SP) signing of conditional letter of

intent for S$142m package

MARKETS:

* S& P 500 up 0.1% to 1,762.11

* Stoxx Europe 600 down to 319.49

* MSCI Asia Pacific up 0.9% to 142.62

* Straits Times Index rose 0.1% to 3,207.85

ECONOMY:

* Singapore plans to sell S$4 billion of 364-day bills

Cliff Tan

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

World Markets

North and South American markets finished broadly higher today with shares in Brazil leading the region. The Bovespa is up 1.70% while Mexico's IPC is up 1.11% and U.S.'s S& P 500 is up 0.13%.

North and South American Indexes

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

The Board of Directors (the ?

respond to the queries raised by Singapore Exchange Securities Trading Limited (the ?

on 28 October 2013 regarding trading activity in the Company?s shares as follows: Board?) of Sky One Holdings Limited (the ?Company?) wishes toSGX-ST?)

Question 1: Are you aware of any information not previously announced concerning you

(the issuer), your subsidiaries or associated companies which, if known, might explain the

trading? - If yes, the information must be announced immediately.

Response

To the best of the Company?s and its Directors? knowledge and belief, all known information has

been duly announced in accordance with the listing rules of the SGX-ST and the Company and its

Directors are not aware of any information not previously announced concerning the Company

and its subsidiaries which, if known, might explain the trading on 28 October 2013.

Question 2: Are you aware of any other possible explanation for the trading?

Response

We are not aware of any possible explanation for the trading.

With reference to the Company?s proposed acquisition of Energy Prima Pte Ltd (the ?

Acquisition

the Company?s due diligence work on the Proposed Acquisition is still ongoing.

There has been no material change in the Company?s existing businesses of Express Land

Transport, Airfreight and Coal Logistics since 31 March 2013, being the latest full financial year of

the Company. Proposed?), as announced on 28 September 2012, 10 October 2012 and 25 September 2013,

Question 3: Can you confirm your compliance with the listing rules and, in particular,

listing rule 703?

Response

The Company confirms that it is in compliance with the listing rules of the SGX-ST and, in

particular, listing rule 703 of the Listing Manual regarding disclosure of material information.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Singapore Q3 2013 Corporate Earnings: Reuters

DATE COMPANY NAME RIC PERIOD

Oct 28 Raffles Medical Group Ltd Q3

Oct 29 Great Eastern Holdings Ltd Q3 ...

Oct 30 United Overseas Insurance Ltd Q3

Oct 30 Indofood Agri Resources Ltd Q3

Oct 30 CapitaMalls Asia Ltd Q3

Oct 30 CDL Hospitality Trusts Q3

Oct 30 Singapore Post Ltd Q2

Oct 31 Osim International Ltd Q3

Oct 31 CapitaLand Limited Q3

Nov 1 Oversea-Chinese Banking Corpn Q3

Nov 1 DBS Group Hldgs Ltd Q3

Nov 1 China Aviation Oil (S) Corpn Q3

Nov 4 Genting Singapore PLC Q3

Nov 5 United Overseas Bank Ltd Q3

Nov 5 SembCorp Marine Ltd Q3

Nov 5 COSCO Corporation (S) Ltd Q3

Nov 5 Singapore Airport Terminal Srvs Q2

Nov 6 Jardine Cycle & Carriage Ltd Q3

Nov 6 STATS ChipPAC Ltd Q3

Nov 6 Ezion Holdings Ltd Q3

Nov 7 SIA Engineering Co Ltd Q2

Nov 7 Wilmar International Ltd Q3

Nov 7 StarHub Ltd Q3

Nov 8 Venture Corporation Ltd Q3

Nov 11 SembCorp Industries Q3

Nov 11 Fortune REIT Q3

Nov 12 Singapore Airlines Ltd Q2

Nov 12 Biosensors International Group Q2

Nov 12 City Developments Limited Q3

Nov 12 Noble Group Q3

Nov 13 HTL International Holdings Ltd Q3

Nov 14 Global Logistic Properties Q2

Nov 14 Olam International Ltd Q1

Nov 15 WBL Corporation Ltd Q4

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Singapore's penny stock mystery increases pressure on exchange: Reuters

Singapore Exchange Ltd's role as the city-state's equity market regulator is coming under increasing scrutiny in the fall-out from a penny stock crash earlier this month.

The sudden implosion of Blumont Group Ltd, LionGold Corp, and Asiasons Capital Ltd - after huge run-ups in their share price earlier in the year had turned them briefly into billion dollar companies - left many in the market mystified and raised question marks over whether the exchange missed red flags and was too slow to act.

The Monetary Authority of Singapore (MAS) has now stepped into the fray and confirmed on Thursday that a review into what went on was taking place.

Experts say one thing it should look at is whether the bourse is able to manage conflicts of interest between its role as both market operator and watchdog.

" The exchange has to focus on profit for shareholders, meaning they have less time for regulation," said Jimmy Ho, president of the Society of Remisiers who works for brokerage UOB Kay Hian.

Singapore is sensitive to anything that could tarnish its reputation for strong corporate governance, effective regulation

and low levels of crime and corruption, which have helped it develop into one of Asia's major financial centres.

The saga also poses a threat to the exchange's long-running

push to increase revenue by boosting its trading volumes among retail investors.

" It will basically deter people from investing in this asset class (the penny stocks) for now at least," said Kevin Scully, executive chairman and founder of equity research firm NRA Capital.

" You can compare it to the S-chips where we had a spate of frauds," said Scully referring to the string of blow-ups at locally-listed Chinese stocks in 2008 and 2011, that deterred many retail investors from the market.

Blumont, Asiasons and LionGold have all denied any wrongdoing and there are no allegations of fraud in their cases.

PENNY STOCKS

The most actively traded stocks are often the penny stocks which attract little institutional interest. At the same time, SGX has not seen many major big-ticket listings for a number of years and the growth of Singapore's equity market has lagged the growth of the city-state as a major wealth management, foreign exchange and commodities trading hub.

That has led to concerns that the exchange could face pressure to lower standards in order to boost its bottom line.

MAS said last week that it and SGX would look into wider issues that have surfaced regarding " market structure and practices" . The central bank did not elaborate on what that would involve, but said it would issue a public consultation if it decided to make any changes.

Many countries including Hong Kong, Australia and the United

States have an independent securities regulator overseeing the

stock market, a separation aimed at ensuring potential lost revenue is not a consideration when enforcing rules.

In Singapore, SGX performs the front-line regulatory role and the bourse in turn is regulated by MAS. The exchange has a special committee to deal with conflicts of interest its dual role can pose.

SGX said earlier this year that it believed the current system was best for the local market and its proximity to the market helped it understand its users' compliance issues.

It has responded to some of the criticism facing it, saying that it deployed a series of tools to restore stability to the market when the stocks began to fall and that it uses separate measures to investigate possible wrongdoing.

" SGX devotes significant resources into detecting and investigating market misconduct and works closely with statutory

authorities against offenders of the law," the exchange said in

a statement.

RED FLAGS

Shares in natural resources investment company Blumont, alternative investment firm Asiasons and gold miner LionGold raced higher earlier this year, before crashing in a frenzied 40 minutes of trading on Friday Oct. 4. The shares were suspended,

but tumbled further when trade resumed the next Monday.

The three stocks lost more than S$8 billion ($6.47 billion)in combined market value in less than two days of trade. Before that, Blumont's share price had risen more than 1,000 percent since the start of the year.

Some brokers in Singapore had put trading restrictions on the stocks during September due to concerns that their value was

no longer matched by the fundamentals.

SGX did not put in place trading curbs until after the stocks started to fall, causing complaints that it acted too late.

The exchange was not oblivious to the companies' price rises - it queried Asiasons and Blumont twice and LionGold once in the weeks leading up to the crash, moves that SGX says should act as red flags to investors.

Some corporate governance experts say they are concerned,

though, that the need for such queries is on the rise, and there needs to be closer examination of what companies are doing.

" I have noticed that unexplained price run-ups seem to have become more common place, and queries sometimes result in a

disclosure that a deal is being discussed but not certain," said Mak Yuen Teen, associate professor at the National University of Singapore (NUS) Business School, without commenting on the

stocks involved.

" This raises the issue of possible insider trading by someone with knowledge about the transaction - for example a banker or lawyers, and their tippees" .

Blumont and Asiasons both responded to at least one of the queries put to them that they were in discussions on potential deal opportunities, though nothing was confirmed. Both the companies have denied any wrong-doing.

LionGold said it trusted MAS and SGX to investigate the matter.

" As far as we understand from press articles on the matter, MAS is investigating the trading activities surrounding LionGold's shares and not on the company's operations," it said in a statement on Friday.

The exchange and MAS said they were unable to publicly address whether market manipulation could have been behind the

stocks' wild price swings, as it could hinder any investigations.

That is not removing pressure for them to be more open about

the way such cases are investigated in general.

" I personally would like to see more transparency in relation to enforcement, including capacity, resources, number of queries, number of cases investigated, number of cases dropped, number in progress and so on," said Mak at NUS Business School. " At the moment, everything is too much of a black box."

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Zhen De Mah?...OMG!!

Octavia ( Date: 28-Oct-2013 11:31) Posted:

why such big drop,90% down?

another asia blue lion??

solidbuy ( Date: 28-Oct-2013 11:28) Posted:

| Another Blumont kind of counter. Singapore market is sooooo manipulated |

|

|

|

|

|

Good Post

Bad Post

|

|

|

|