|

Latest Posts By WanSiTong

- Master

|

|

| 31-Oct-2013 17:19 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

||||||||||

|

|

|

||||||||||

| Good Post Bad Post | |||||||||||

| 31-Oct-2013 17:16 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

||||||||||

|

|

|

||||||||||

| Good Post Bad Post | |||||||||||

| 31-Oct-2013 16:33 |

Shen Yao

/

ThinkEnv name change to Liongold Corp

|

||||||||||

|

|

|

||||||||||

| Good Post Bad Post | |||||||||||

| 31-Oct-2013 16:24 |

Midas

/

Midas

|

||||||||||

|

|

The train moving soon............

Make sure you got the ticket !! |

||||||||||

| Good Post Bad Post | |||||||||||

| 31-Oct-2013 14:13 |

Neptune Orient L Rg

/

NOL

|

||||||||||

|

|

Neptune Orient Lines - No respite from freight rate woes Written By Stock Fanatic on Thursday, October 31, 2013 ? Rate restorations on Asia-Europe in June-July helped container liner division to break even in 3Q13 ? But results still slightly below as Intra-Asia rates plunged owing to capacity cascading from mainlanes ? Current spot rates on Asia-Europe are back at panic levels again , but no major capacity reduction measures seen

Highlights

Muted peak season, as expected. NOL reported headline net profit of US$20m in 3Q13, compared to our expectations of about US$12m, but this includes about US$34m realized forex gains, and hence results are slightly worse than expected. Liner volumes were down 5% y-o-y, and interestingly 5% q-o-q as well, despite it being the traditional peak season.

Intra-Asia volumes were the worst affected (down 12% q-o-q) as were Intra-Asia rates (down 7% q-o-q), possibly due to the cascading of capacity from the mainlanes. Asia-Europe rates recovered on average by 10% q-o-q as a result of the rate restoration programmes in June-July, and combined with NOL?s cost control measures, resulted in better operating performance compared to 2Q. However, profits are likely to be short-lived, as we explain below. Our View

Rates are quickly back to the bottom. We had highlighted earlier that we do not expect the July rate increases to stick beyond 3Q. As it turned out, spot Asia-Europe rates started falling sharply from end-August and at US$661/ TEU now, are down 60% since early August. The rate plunge is largely due to carriers? failure to keep capacity in check, with the introduction of new 13,000-18,000 TEU ships in the last few months.

Though liners have variously announced rate increases ranging from US$600-1,000 per TEU from 1st November, we expect the impact to be short-lived, as no capacity reduction measures for the low season has been announced, unlike last year, when Maersk, G6 and CKYH Alliances had taken off loops.

Technical Analysis

Recommendation

Unfavourable demand-supply dynamics continue to persist. We keep our numbers relatively unchanged and maintain our HOLD call on the stock, with an adjusted TP of S$1.10, pegged to 1.0x FY14P/BV. Despite hopes of a slow economic recovery, we do not think NOL will be able to achieve normalised returns before FY15, given the influx of capacity still scheduled to enter the industry, going forward. (Read Report)

|

||||||||||

| Good Post Bad Post | |||||||||||

| 31-Oct-2013 14:10 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||||||||

|

|

US FOMC ? tapering delayed Written By Stock Fanatic on Thursday, October 31, 2013 The Fed's decision to keep the status quo for the QE programme was in line with our and market expectations. We think there are two reasons that weaken the case for tapering in the near term:

1) the lingering uncertainties about the budget and debt ceiling entering the new year, as the leadership agreed to extend the debt ceiling until 7 Feb and government funding until 15 Jan, and

2) the mixed economic signals amid the uncertainty over the impact of the partial government shutdown on economic activity in 4Q13.

In a nutshell, we only expect the Fed to initiate the tapering of asset purchases once there is stronger economic improvement and the smooth resolution of the political impasse over the budget and debt issues. We think that the QE tapering may be delayed until 2Q-3Q 2014.

" The Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases.? Fed puts tapering plan on hold for now...

As widely expected, the Fed decided to keep its policy rate and QE programme status quo after the conclusion of a two-day meeting. The mixed economic data signals and the impact of the 16-day partial government shutdown were key reasons for the Fed's announcement of no tapering. We think that the odds are low that the Fed will act at its final meeting this year on 17-18 Dec, as another round of budget and debt negotiations is scheduled in mid-Jan and early-Feb, respectively. As such, Ben Bernanke may decide to pass the baton to Janet Yellen as his term ends on 31 Jan 2014.

... amid skewed economic signals

The Fed said that household spending and business fixed investment remain encouraging, but the recovery in the housing sector has slowed. The Fed also pointed to fiscal policy as restraining economic growth. The temporary layoffs in the private sector tied to the government shutdown skewed the recent initial jobless claims sharply higher above trend and private sector employment also slowed. Going into the government shutdown, the manufacturing sector was flat and consumer sentiment turned less upbeat about the job market and long-term prospects.

Playing the waiting game

Given the earlier comments by Fed officials suggesting that the Fed may hold off its tapering for quite some time, we expect the Fed to push back the unwinding of monetary stimulus to 2Q-3Q 2014. In addition, there is lingering uncertainty over the budget and debt issues. The deferment of QE tapering will likely spur risk appetite and thus, support emerging market assets. (Read Report)

|

||||||||||

| Good Post Bad Post | |||||||||||

| 31-Oct-2013 14:06 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||||||||

|

|

Federal Reserve prolongs stimulus

Ben Bernanke's top goal -- substantial improvement in the job market -- is still eluding him. NEW YORK (CNNMoney)

Call it QE-Indefinitely.There's still no end in sight for the Federal Reserve's stimulus program -- known as quantitative easing -- after the central bank met this week and decided to continue buying $85 billion in bonds each month. In a statement released after the conclusion of its policy meeting, the Fed pointed to fiscal policy (a.k.a. government spending cuts, the shutdown and debt ceiling debate) as " restraining economic growth." While the Fed continued to characterize the overall economy as expanding at a " moderate pace" -- the same as at its prior meeting -- it did downgrade its assessment of the housing market slightly. " The housing sector slowed somewhat in recent months," the statement said. Related: This could be the largest Fed stimulus yet The central bank has been buying $85 billion in bonds every month since September 2012, and has said it will continue to do so until the job market improves " substantially." The program is now nearing $1 trillion in total, yet that goal remains elusive. Sure, the unemployment rate, at 7.2% is slightly lower than it was, but so too is the country's labor participation rate. Only 63% of Americans ages 16 and over either have a job or are looking for one -- the lowest level since 1978. Meanwhile, hiring is stuck in slow motion, averaging 185,000 news jobs added in each of the last 12 months. Overall, not much has changed in the job market since last year. What about 'tapering'? Investors had previously thought the Fed would begin slowing its stimulus plan by now, in a gradual wind-down process dubbed " tapering." Fed Chairman Ben Bernanke said as much back in June, when he remarked " We anticipated that it would be appropriate to begin to moderate the monthly pace of purchases later this year." But Bernanke has also said the Fed's decision will depend on the economic data. That's been a problem since the October government shutdown delayed some economic reports and is expected to muddle some of the data in the coming months, and the debt ceiling standoff could still resurface early next year, weighing on the economy once again. Add in the Fed's leadership transition, as Bernanke's term ends in January, and Fed watchers largely think the central bank has to wait until at least its March 2014 meeting, before making any major policy changes. " I don't think Federal Reserve Board members would feel very comfortable about beginning the tapering process until we're closer to 200,000 jobs added each month. We're a long way from there -- in fact we're moving in the wrong direction," said Mark Zandi, chief economist for Moody's Analytics. Why there isn't a bond bubble

Others even predict the job market weakness will persist so long, the Fed might opt to continue bond purchases at full strength, through at least June. If these predictions come true, this round of QE is likely to total more than either of its two predecessors: QE1 totaled $1.5 trillion and the second round of stimulus added up to about $600 billion. What does this mean for interest rates? Before the Great Recession, the Fed's main tool was its short-term interest rate. Lowering the rate made it cheaper to borrow money, which aimed to stimulate the economy. But the central bank has already kept that rate near zero since December 2008, and that's one reason it is resorting to more unconventional policies like quantitative easing. The hope is by buying all these bonds, the Fed will lower long-term interest rates too. Mortgage rates are one noticeable area where consumers may notice the effect. The average rate on a 30-year mortgage fell as low as 3.4% in April, but then started rising during the summer, as investors predicted the Fed would cut back on stimulus. Now that the Fed is standing pat, the rate has been falling again, and as of last week, it was 4.1%. The longer the Fed continues QE, the lower rates could fall. Not everyone is happy... QE remains a controversial policy. At every meeting this year, Kansas City Fed President Esther George has been voicing concerns that the Fed could be overstimulating the economy and even risk inflating a bubble. She voted against the decision, citing " the risks of future economic and financial imbalances." She was the only dissenter among the Fed's 10 voting members. |

||||||||||

| Good Post Bad Post | |||||||||||

| 31-Oct-2013 13:56 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||||||||

|

|

Fed maintains stimulus, says government policy hits growth The US Federal Reserve kept its stimulus programme in place as expected on Wednesday, but said that the government's fiscal policy is a drag on the economy. WASHINGTON: The US Federal Reserve kept its stimulus programme in place as expected on Wednesday, but reiterated the government's fiscal policy is a drag on the economy. In their first meeting since the government shutdown at the beginning of October, Fed policy makers made no reference to the potential impact that laying off hundreds of thousands of workers for 16 days might have had on the economy. Nor did the Federal Open Market Committee hint at the direction of future policy, amid widespread anticipation over when it might rein in the $85 billion a month stimulus. Instead, after a month of mostly dull and inconsistent data - much of it delayed and skewed by the shutdown - the FOMC stressed the need to see more evidence of sustained progress before taking action. After a two-day meeting - the first since Fed Vice Chair Janet Yellen was nominated by the White House to replace Chairman Ben Bernanke on February 1 - the FOMC described economic activity as having " continued to expand at a moderate pace." The panel said that household spending and business investment are still advancing, inflation remains well in check, and the labour market continues to improve. Risks to the economy have " diminished, on net, since last fall," the FOMC said, repeating observations from its last statement on September 18. At the same time, unemployment remains elevated, the policymakers said, underscoring the need for continued support to the economy from its ultra-low interest rates and quantitative-easing (QE) asset-purchase programme. There was no comment on the October 1-16 shutdown, despite numerous independent analysts estimating that it took some $24 billion out of the economy and would cost it up to 0.5 percentage points from growth in the fourth quarter. Preliminary data released in the past week suggests that consumer spending slowed and consumer and business confidence suffered as a consequence. And there was no allusion to worries that the same show of political brinksmanship that forced the shutdown could resume in January if fresh budget talks between Republicans and Democrats again prove fruitless. The temporary budget for the current 2014 fiscal year runs only through January 15. But the Fed policymakers did reiterate a view that Bernanke has been pressing since last year, that tightening government spending is holding back the economy's rebound from the 2008-2009 recession. " Fiscal policy is restraining economic growth," the FOMC said, tersely. US stocks, which hit fresh all-time highs on Tuesday, were lower on Wednesday prior to the meeting, and continued to fall afterward, with the S& P 500 losing 0.49 percent. The dollar was higher, with one euro buying $1.3730, compared with $1.3770 before the announcement. Markets have fixed on the Fed's handling of the QE taper since May when Bernanke said that, if the economic data held up, the Fed would begin slowing the asset purchases late this year and wind them up by mid-2014. That sent bond yields and interest rates surging, and wreaked havoc in the capital and currency markets of emerging economies around the world. Since then, though, the FOMC has held back, amid an apparent slow spot in the economy since August and with policy battles in Washington having dimmed consumer and business confidence. Economist Paul Edelstein of IHS Global Insight called the slightly positive Fed statement " puzzling in light of the recent fiscal turmoil and lingering risks." At the same time, he noted, it gave no signal on reducing the bond-purchase programme. " The Fed's short-term objective is to protect the economic recovery from Washington headwinds," he noted. With another battle looming in January, it means the Fed might hold off on the taper until March, according to Edelstein. Harm Bandholz of UniCredit said that economic data could prove strong enough for the FOMC to cut asset purchases beginning in January. At the same time, he acknowledged, " Financial markets have already pushed back taper expectations to March." - AFP/de

|

||||||||||

| Good Post Bad Post | |||||||||||

| 31-Oct-2013 13:48 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||||||||

|

|

Singapore index down Hutchison Port, CapitaLand fall: Reuters

Singapore shares dipped on Thursday, led by shipping port operator Hutchison Port Holdings Trust and Southeast Asia's biggest property developer CapitaLand Ltd. The benchmark Straits Times Index eased 0.2 percent to 3,225.58 points, while the MSCI's broadest index of Asia-Pacific... shares outside Japan was 0.3 percent lower. Hutchison was the worst performer on the index, with units falling as much as 2.7 percent to an almost eight-week low at $0.73. Some 23.8 million units were traded, more than 1.6 times its average 30-day full-day volume. The port operator reported last week an 8.4 percent drop in net profit for its quarter ended September. CapitaLand shares fell as much as 2.2 percent to a three-week low at S$3.09 after posting an 8.7 percent fall in third-quarter net profit on Thursday due to lower portfolio gains. The company earned S$135.5 million ($109.6 million) in the three months ended Sept. 30, down from S$148.5 million a year ago. |

||||||||||

| Good Post Bad Post | |||||||||||

| 31-Oct-2013 09:52 |

Ezra

/

Ezra

|

||||||||||

|

|

This counter has been climbing from 0.83 since August. The price shoot up so high could be partly due to the warrants (due date : 1 Nov, exercise price : 1.20)! After that do not know whether the price can be sustained !? |

||||||||||

| Good Post Bad Post | |||||||||||

| 31-Oct-2013 09:29 |

Ezra

/

Ezra

|

||||||||||

|

|

Another problem is low margin!

|

||||||||||

| Good Post Bad Post | |||||||||||

| 31-Oct-2013 08:40 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

||||||||||

|

|

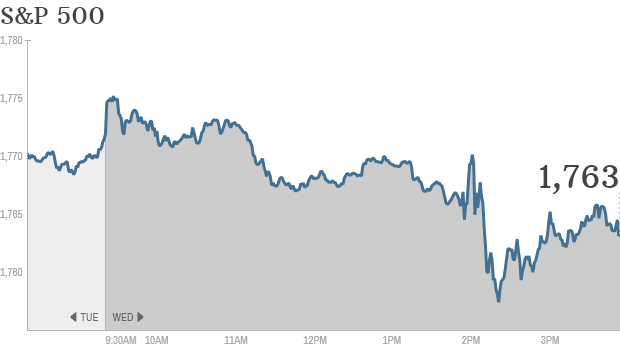

Bull getting tired? Investors shrug off Fed

Click chart fore more markets data. NEW YORK (CNNMoney)

Investors didn't seem to care that the Federal Reserve decided to continue its $85 billion a month bond buying program.Stocks, which are hovering near all-time highs, fell after the Fed announced no major changes to its stimulus program, commonly known on Wall Street as quantitative easing or QE. Investors expect the program to last at least until the end of this year. The Dow Jones industrial average, the S& P 500 and the Nasdaq closed with modest losses after starting the day with small gains. Both the Dow and S& P 500 closed at record highs Tuesday, and both hit new intra-day highs on Wednesday. Related: Fear & Greed Index shows investors are greedy The rally has been a global one. European markets climbed to their highest levels in five years Wednesday, and Asian markets ended with sizable gains. Signs of a market that's too hot to handle? Investors have become increasingly concerned that the market might be overheated. CNNMoney's Fear & Greed Index, which measures market volatility and six other gauges of investor sentiment, has been in Greed territory for the past week. There has been a remarkable shift in the market's mood this month. The index was showing signs of Extreme Fear earlier in October as investors worried about the government shutdown and a potential debt default by the United States. PIMCO's Bill Gross. who runs the largest bond mutual fund, is one of a number of big fund managers who think that stocks have gotten ahead of themselves. Gross wrote on Twitter late Tuesday that " all risk asset prices artificially high." Related: Why the Fed should worry about deflation Allianz Global Investor's U.S. investment strategist Kristina Hooper says that the market is once again focusing on when the Fed will pull back on its bond purchases. " We're back to an environment where bad economic news is good," said Hooper. " Bad news suggests we will be on Fedicare for longer." Weak hiring: Investors got another weak data point on Wednesday. Private sector employers added just 130,000 jobs in October -- their lowest level of job growth since April, according to a report by payroll processor ADP. |

||||||||||

| Good Post Bad Post | |||||||||||

| 30-Oct-2013 22:32 |

CapitaMalls Asia

/

First Day trading open at $2.30

|

||||||||||

|

|

CIMB TP : $ 2.25 Outperform | ||||||||||

| Good Post Bad Post | |||||||||||

| 30-Oct-2013 22:31 |

CapitaMalls Asia

/

First Day trading open at $2.30

|

||||||||||

|

|

CapitaMalls Asia - Gradual growth on trackWritten By Stock Fanatic on Wednesday, October 30, 2013

|

||||||||||

| Intra Day | |

|

|

|

|

Gadgets powered by Google |

Technical Analysis

| Daily Chart |

| Daily Chart |

WanSiTong ( Date: 30-Oct-2013 12:40) Posted:

|

sean123 ( Date: 22-Oct-2013 21:06) Posted:

|

https://brokingrfs.cimb.com/4eIqk3xlcDtqsz1QsgN2wx2n6S2cZQF6Wd9Hf703GG9A0M-MyprADfV52KyZaC6ldfSiXjGSOls1.pdf

CIMB TP : 0.74 Outperform

Accelerating to high speed

China?s aggressive railway expansion plans present a tremendous opportunity for Midas given the company?s 60% market share and strong track record in the industry. We estimatethat Midas can win Rmb2.5bn-3.2bn worth of high-speed rail (HSR) orders by end-2015.

We raise our FY14-15 EPS to 17-19% above consensus the market is likely to follow suit. We believe further HSR contract wins could catalyse the stock. Maintain Outperform, with our target price unchanged at S$0.74, based on 1.29x CY14 P/BV (20% discount to average P/BV during 2010-11).

China?s railway spending

To improve connectivity between provinces and cities across China, the government plans to add 11,200 high-speed train cars (10,400 currently) and extend the high-speed railway to 18,000km by 2015. To achieve this, it has allocated a

Rmb3.3tr budget for railway investments over the current five-year plan period that ends in 2015. In 2011-12, Rmb1.21tr was spent on building railway infrastructure, which leaves a budget of Rmb2.09tr for 2013-15. As the procurement of railway equipment (including train cars) tends to be back-end loaded, there could be an increase in the remaining budget to Rmb2.16tr that the market has yet to factor in. Based on Midas?s 60% market share, we estimate that it could win Rmb2.5bn-3.2bn of HSR orders by end-2015.

Why Midas

Midas has built up several competitive advantages over the years: 1) close relationships with its key customers, CNR Changchun, CNR Tangshan and CSR Bombardier Sifang, 2) having the dies to produce a variety of extrusion profiles, and 3) strong track record of manufacturing quality products. As a result, we believe Midas can maintain its position as a preferred supplier to its key customers, which will help it to retain its leading market share of 60% and win the bulk of the HSR contracts.

Further re-rating likely

Midas is currently trading at 0.9x P/BV (1 s.d. below mean). We believe its discounted valuations are unjustified given the strong order momentum that is likely to come in 4Q13-2015. In the next round of procurement alone, we believe Midas could win Rmb545m of HSR contracts, an upward revision from our previous estimate of Rmb309m. This will provide a further re-rating catalyst for the stock.

https://brokingrfs.cimb.com/4eIqk3xlcDtqsz1QsgN2wx2n6S2cZQF6Wd9Hf703GG9A0M-MyprADfV52KyZaC6ldfSiXjGSOls1.pdf

| First < Newer 341-360 of 1632 Older> Last |