|

Latest Posts By dealer0168

- Elite

|

|

| 23-Mar-2010 22:32 |

Allgreen

/

Allgreen - Can buy ?

|

|||||||||

|

|

Don't know how to talk to u. People quoting example of good point lah. U want buy cheap stock, 10cent, 20 cents.....go pa-sak-malang.

|

|||||||||

| Good Post Bad Post | ||||||||||

| 21-Mar-2010 10:54 |

Allgreen

/

Allgreen - Can buy ?

|

|||||||||

|

|

A good stock to hold. Dividends of S$ 40/ lot not bad also. Cheers. |

|||||||||

| Good Post Bad Post | ||||||||||

| 21-Mar-2010 10:49 |

Citic Envirotech

/

ALERT: UtdEnvirotech.

|

|||||||||

|

|

Quite truth that its still under-valued. Need to be patience, its time will come. Cheers.

|

|||||||||

| Good Post Bad Post | ||||||||||

| 21-Mar-2010 10:45 |

Keppel Land

/

Kepland

|

|||||||||

|

|

FearValueGreed this name suits u. U speak with greed. Really showing extreme greed within u. Buy only at $1, abit too forceful especially current economy showing quite ok in recovery. But got chance lah.......wait with great patience will pay off. but maybe is 6 to 7 years later for yr $1 dream to come truth pal. Cheers.

|

|||||||||

| Good Post Bad Post | ||||||||||

| 18-Mar-2010 23:10 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||

|

|

hehe.....maybe hui-kuang-fang-zhao.

|

|||||||||

| Good Post Bad Post | ||||||||||

| 18-Mar-2010 22:08 |

Allgreen

/

Allgreen - Can buy ?

|

|||||||||

|

|

$1.23 now, hope Allgreen progress more. Cheers. |

|||||||||

| Good Post Bad Post | ||||||||||

| 18-Mar-2010 22:00 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||

|

|

Haha quite truth that we should not intepret it as going fr water counter. But UtdEnvirotech is a good FA counter besides being a water counter. Thus no harm going for it. Cheers man

|

|||||||||

| Good Post Bad Post | ||||||||||

| 18-Mar-2010 21:45 |

Rotary Engg

/

Rotary

|

|||||||||

|

|

Its time will come soon. Jus have to be patience....... Cheers |

|||||||||

| Good Post Bad Post | ||||||||||

| 18-Mar-2010 21:35 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||

|

|

Go for water relate counter UtdEnvirotech

|

|||||||||

| Good Post Bad Post | ||||||||||

| 13-Mar-2010 21:21 |

Allgreen

/

Allgreen - Can buy ?

|

|||||||||

|

|

Im still holding strong on it. Recent economy result show us that more recovery to Stock to come. N i believe Allgreen may progress more than that. Cheers.

|

|||||||||

| Good Post Bad Post | ||||||||||

| 13-Mar-2010 09:33 |

Others

/

R U with Jack Neo or RU against him?

|

|||||||||

|

|

Haha, but based on newspaper, some say he request for it. Even under 20 years old girl, he also ask. He is too open for this things. A disgrace to TCS. Chop him off lah. Haha Maybe Japan AV show may invite him over to be director to make a show of his own...haha So old already he still can't think. Imagine his children may be laughed by ppl for having such dirty old fellow as father. Personnelly i also don't like his act of using his wife to close the case. It only shows that this guy is very cunning. The mistake made by him is a BIG one loh

|

|||||||||

| Good Post Bad Post | ||||||||||

| 10-Mar-2010 22:34 |

Others

/

R U with Jack Neo or RU against him?

|

|||||||||

|

|

Jack Neo indeed should wake up. His childrens must be badly affected by his news. Now he must feeling like a lousy father. Haha, btw his history in newspaper makes him sound like a "wolf" huh....haha. Hai, quite sad for his childrens. His stupid act caused all this. |

|||||||||

| Good Post Bad Post | ||||||||||

| 09-Mar-2010 23:13 |

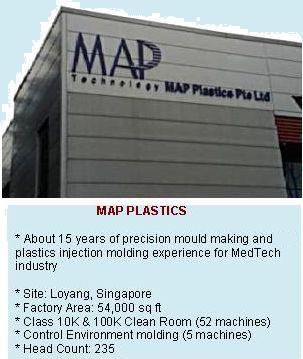

MAP Tech

/

MAP tech

|

|||||||||

|

|

yes, have to be patience on this one. If things turn up well, it maybe a multi-baggers. |

|||||||||

| Good Post Bad Post | ||||||||||

| 08-Mar-2010 20:32 |

Yanlord Land

/

Yanlord Inverted Head and Shoulders Confirmation

|

|||||||||

|

|

This news been on for awhile already. N remedy been carry out in pipe line. Its old news, not much impact at all. For long term, Yanlord looks good.

|

|||||||||

| Good Post Bad Post | ||||||||||

| 07-Mar-2010 11:25 |

MAP Tech

/

MAP tech

|

|||||||||

|

|

|

|||||||||

| Good Post Bad Post | ||||||||||

| 06-Mar-2010 11:58 |

Swiber

/

Swiber

|

|||||||||

|

|

Swiber indeed don't give divi. But is a company with quite good FA . If u want oil counter relate that provide divi, go for Rotary, Keppel, sembmarine. Above few are good in FA. N they give good divi as well. |

|||||||||

| Good Post Bad Post | ||||||||||

| 05-Mar-2010 22:29 |

COSCO SHP SG

/

CoscoCorp

|

|||||||||

|

|

Wait til confirmation that cosco will / will not be out of STI component index first. If it is out, it may drop further more.............. |

|||||||||

| Good Post Bad Post | ||||||||||

| 05-Mar-2010 22:02 |

Oceanus

/

Oceanus

|

|||||||||

|

|

Oceanus

| Underperform

Daiwa downgrades from "Outperform" and cuts the price target to 31.5 cents from 37.5 cents, as it lowers FY10-12 earnings estimates by 31.7, 17.9 and 9.6 per cent respectively. It says investors have yet to fully appreciate the extent of the company's problems, including high abalone mortality rate, sale of small abalones and higher-than-expected financing costs. |

|||||||||

| Good Post Bad Post | ||||||||||

| 03-Mar-2010 21:36 |

CapitaMalls Asia

/

Fibonacci Retracements and Channels

|

|||||||||

|

|

Below news is the reason for its progress UPWARDS? 02/03/2010 09:52 - 0151 GMT [Dow Jones] Cosco (F83.SG) may be dropped from STI while CapitaMalls Asia (JS8.SG) may be added in index's next semi-annual review in March; "this is the opposite of the review one year ago, where two real estate stocks were deleted and two consumer services added." Notes no changes in last review in September. Expects CapitaMalls Asia to be assigned weight of 0.65% on STI; Cosco's current weighting at 0.45%. STI made up of 30 companies with largest market cap on Singapore Exchange. FTSE ST Advisory Committee expected to unveil results of review around March 11, with any changes taking effect after market close on March 19. (FKH) |

|||||||||

| Good Post Bad Post | ||||||||||

| 03-Mar-2010 21:31 |

Allgreen

/

Allgreen - Can buy ?

|

|||||||||

|

|

Allgreen

$1.15 | Outperform

Credit Suisse maintains its rating and raises the price target to $1.60 from $1.40 on the back of earnings upgrades following developer's "stellar" FY09 results. The house raises FY10 and FY11 earnings forecasts by 15 and 36 per cent, respectively, to factor in better-than-expected selling prices and take-up rates. |

|||||||||

| Good Post Bad Post | ||||||||||

| First < Newer 321-340 of 2601 Older> Last |