|

Latest Posts By WanSiTong

- Master

|

|

| 02-Nov-2013 15:34 |

Others

/

Any Stocks Also Can Discuss Forum

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Nice!!

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 02-Nov-2013 05:13 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 02-Nov-2013 05:05 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

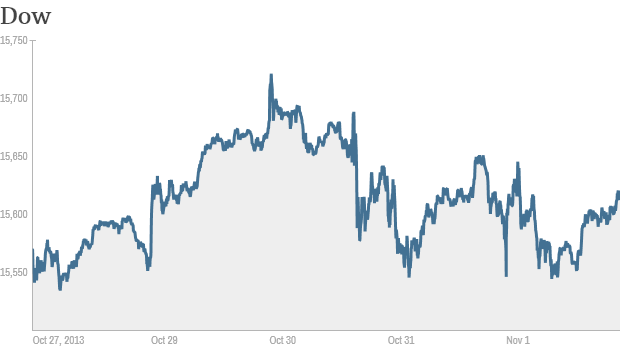

U.S. Stocks Rise Amid Factory Data, Corporate Earnings U.S. stocks rose, halting the first two-day drop in the Standard & Poor?s 500 Index in three weeks, as optimism about corporate earnings offset concern that improving economic data could prompt the Federal Reserve to trim stimulus. The S& P 500 climbed 0.3 percent to 1,761.64 at 4 p.m. in New York, after earlier falling as much as 0.2 percent. The equity gauge advanced 0.1 percent in the past five days, its fourth straight weekly gain. The Dow Jones Industrial Average rose 69.80 points, or 0.5 percent, to 15,615.55 today. About 6.8 billion shares changed hands on U.S. exchanges, 14 percent above the three-month average.

Click for more market data. NEW YORK (CNNMoney)

Stocks finished the week with gains on Friday, and investors are cautiously optimistic that this year's rally still has legs.The Dow Jones industrial average, the S& P 500 and the Nasdaq all rose slightly. For the week, the Dow and the S& P 500 ended up a bit, while the Nasdaq posted a small loss. Stocks are coming off a strong month. The S& P 500 gained 5% in October, a significant jump considering the government was shut down for more than two weeks. The Dow and S& P 500 are both hovering near record highs. If history is any guide, the good times should keep on rolling. The S& P 500 has gained in November more than 60% of the time over the past 30 years, according to Schaeffer's Investment Research. Ryan Detrick, senior technical analyst Schaeffer's, said November and December have been even stronger in years when stocks have rallied during the first quarter. The theory is that investors who missed the early gains try to make up for it in the final months of the year, he said. " We expect to see aggressive buyers into the end of year on any and all pullbacks," said Detrick. Even with the S& P 500 up 23% this year, investors continue to pile into stocks. Investors poured more than $10 billion into equity funds during the six day period ending Oct. 29, according to data from EPFR Global. The Fed's bond buying program has been a major catalyst of the bull market over the past few years. While the central bank is expected to stay on hold into next year, investors have been keeping close tabs on the latest economic data to gauge when the Fed might start to pull back on its stimulus efforts. There was only one major economic report released Friday. But the news was good. The manufacturing sector continued to expand in October. The ISM index rose to 56.4, up from 56.2 in September and topping forecasts. |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 02-Nov-2013 04:58 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

World MarketsNorth and South American markets finished mixed as of the most recent closing prices. The S& P 500 gained 0.29% and the IPC rose 0.10%. The Bovespa lost 0.45%.

North and South American Indexes

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 01-Nov-2013 17:38 |

ESR-REIT

/

Cambridge Ind Trust Results Announcement

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Cambridge Industrial Trust - It?s all about debtWritten By Stock Fanatic on Friday, November 1, 2013

Upgrade to Outperform

Although the acquisition market remains challenging, we believe a strong balance sheet will allow CIT to be well positioned to make any acquisitions/AEIs when opportunity knocks. In addition, the long debt expiry profile, together with c.86% of debt under a fixed rate, will allow it to weather any hikes in interest rates. (Read Report)

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 01-Nov-2013 16:38 |

Shen Yao

/

ThinkEnv name change to Liongold Corp

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 01-Nov-2013 15:55 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Left right.... left right ! Come on, move forward please !! |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 01-Nov-2013 15:50 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

0.90 very strong resistance !

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 01-Nov-2013 15:28 |

COSCO SHP SG

/

CoscoCorp

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Cosco Corporation - Drillship saga's aftermathWritten By Stock Fanatic on Friday, November 1, 2013

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Intra Day | |

|

|

|

|

Gadgets powered by Google |

Technical Analysis

| Daily Chart |

Maintain HOLD TP S$0.83, pegged to 1.4x FY14 P/BV

While we are optimistic that Cosco will emerge as a competitive offshore yard in China in another cycle or two as it gains experience in various offshore products, earnings recovery will take time as it moves up the value chain gradually. We prefer Yangzijiang as a purer play to ride the shipbuilding recovery, and Keppel Corp as the global leader in the offshore space. (Read Report)

Annualised Distribution /Yield (%) : 7.41%

Distribution and Book Closure Date Details

Distribution period : 1 July 2013 to 30 September 2013

Distribution rate " 1.251 cents per unit comprising:

(a) taxable income

(b) capital gains

Books closure date 11 November 2013

Payment date 17 December 2013

Another hen that lays golden eggs !!

To correct:

ki" sound No. 4......起 ........... Huat arh......

WanSiTong ( Date: 01-Nov-2013 06:02) Posted:

|

rabbitfoot ( Date: 31-Oct-2013 18:30) Posted:

|

jamesng ( Date: 31-Oct-2013 22:03) Posted:

|

World Markets

North and South American markets finished mixed as of the most recent closing prices. The Bovespa gained 0.15%, while the S& P 500 led the IPC lower. They fell 0.38% and 0.03% respectively.

North and South American Indexes

| Index | Country | Change | % Change | Level | Last Update | |

|---|---|---|---|---|---|---|

|

Dow Jones Industrial Average | United States | -73.01 | -0.47% | 15,545.75 | 4:32pm ET |

|

S& P 500 Index | United States | -6.77 | -0.38% | 1,756.54 | 4:32pm ET |

|

Brazil Bovespa Stock Index | Brazil | +83.38 | +0.15% | 54,256.20 | 3:29pm ET |

|

Canada S& P/TSX 60 | Canada | -6.57 | -0.85% | 767.47 | 4:20pm ET |

|

Santiago Index IPSA | Chile | +40.97 | +1.06% | 3,321.27 | Oct 30 |

|

IPC | Mexico | -11.44 | -0.03% | 41,038.65 | 4:06pm ET |

U.S. Stocks Fall on Stimulus Speculation Amid Earnings

By Nick Taborek - Nov 1, 2013 5:00 AM GMT+0800

U.S. stocks fell, giving the Standard & Poor?s 500 Index its first two-day slide in three weeks, on speculation the Federal Reserve will scale back stimulus in coming months as investors assessed earnings.

The S& P 500 dropped 0.4 percent to 1,756.54 at 4 p.m. in New York, after fluctuating between gains and losses during the day. The Dow Jones Industrial Average fell 73.01 points, or 0.5 percent, to 15,545.75. About 7.2 billion shares changed hands on U.S. exchanges, 21 percent above the three-month average.

?The market is re-rating expectations to maybe earlier Fed tapering than consensus,? Andres Garcia-Amaya, New York-based global market strategist at JPMorgan Chase & Co.?s mutual funds unit, said in a phone interview today. His firm oversees $400 billion. ?The Fed was a little bit more hawkish than people expected, not a lot, but incrementally more hawkish.?

The S& P 500 (SPX) fell 0.5 percent from a record yesterday, halting four days of gains, as the Fed fueled bets it may begin to cut stimulus in the coming months. The central bank maintained $85 billion in monthly bond purchases, saying that while the economy shows signs of ?underlying strength? it needs to see more evidence of sustainable improvement.

Taper Timing

Economists at Citigroup Inc. and Barclays Plc said yesterday?s Fed policy statement opens the possibility of reduced bond purchases as soon as December. The odds of a taper in January rose to 45 percent, from 25 percent before the decision, according to Citigroup. Economists surveyed by Bloomberg Oct. 17-18 had predicted the Fed would begin paring stimulus in March.

?We don?t expect anything really before the March time frame,? David Roda, the Miami-based regional chief investment officer for Wells Fargo Private Bank, said in a phone interview. His firm manages $170 billion. ?Even though the jobs data is slowly improving, the pace of improvement has slowed and the quality of job growth is certainly not that great.?

Economic Data

Fed stimulus has helped propel the S& P 500 higher by more than 160 percent from a 12-year low in 2009. The gauge surged 4.5 percent in October, for the biggest monthly gain since July, as lawmakers ended a 16-day government shutdown and agreed to extend the U.S. borrowing authority, avoiding a possible debt default.

Stocks slumped earlier today after a report showed business activity in the U.S. expanded in October as orders and production surged. The MNI Chicago Report business barometer jumped to 65.9 from 55.7 in September, the biggest monthly increase in more than three decades. Readings above 50 signal expansion.

Separate data showed fewer Americans filed applications for unemployment benefits last week as a backlog in California?s reporting cleared.

Rosesyrup ( Date: 31-Oct-2013 19:19) Posted:

|

Highlights:

Exploration drilling by LionGold?s 77% owned subsidiary, Signature Metals Limited, successfully identified a 200m extension of gold mineralisation at the Obenemase Deposit in Ghana

Diamond drilling returned excellent results with multiple thick high-grade gold mineralised intersections

Peter_Pan ( Date: 31-Oct-2013 17:58) Posted:

|

| Rosesyrup ( Date: 31-Oct-2013 17:17) Posted: |

| First < Newer 321-340 of 1632 Older> Last |