|

Latest Posts By WanSiTong

- Master

|

|

| 05-Nov-2013 16:55 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

FNN and FCL will be traded separately on the SGX mainboard. The listing of FCL is expected in Nov or Dec 2013 |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 16:51 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

FCL is not listed yet. But ..........Fraser and Neave received eligibility-to-list for the listing of FCL from the SGX. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 16:48 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Frasers Centrepoint Limited (FCL) ,estimated market price $2.05 to 2.10 Frasers Centrepoint Trust (FCT) (current px : $1.83) is a Retail Real Estate Investment Trust focused on growing shareholder value for its unitholders through active asset management, sound financial management and strategic investments. |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 16:07 |

Dragon

/

Dragon Group - Rising up

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Cannot find dragon in current world, Dragon fly can?

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 15:51 |

Dragon

/

Dragon Group - Rising up

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 14:22 |

OUE HTrust

/

OUE Hospitality Trust IPO Listing

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

OUE: TP : 3.57 CP: 2.42 PE 2013 F : 2.4 yield : 4.5 |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 14:05 |

Shen Yao

/

ThinkEnv name change to Liongold Corp

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 09:57 |

OUE HTrust

/

OUE Hospitality Trust IPO Listing

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Our Top Large Market Capitalisation Stock Picks (UOBKH) Target Price / price @ 30.10.13 / Monthly Performance / PE2012 / PE 2013F / Yield

Bumitama BUY 1.23/ 0.99/ 0.5/ 16.6 /19 0 FirstRes BUY 2.4 /1.95 2.1 /10.2 /13.9/ 2.1 Ho Bee Land BUY 2.45/ 2.06 N O L BUY 1.3 /1.06 OUE BUY 3.57/ 2.42

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 09:41 |

Others

/

Any Stocks Also Can Discuss Forum

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Singapore Stocks to Watch

* Armarda (AMDA SP): Associate China Mobile Satellite Communications received order for 5,000 Thuraya mobile satellite handsets... * Ascott Residence Trust (ART SP): To raise gross proceeds of S$254m via 1 for 5 rights issue * China Great Land (CGL SP): Gets termination for piling- related services contracts worth ~55.4m yuan * CitySpring (CITY SP): 2Q loss S$754k vs $8.8m profit * Falcon Energy (FALE SP): 1H net $34.4m Sees profitability in current finl yr * Forterra Trust (FORT SP): Names Seah Choo CEO * Genting Singapore (GENS SP): 3Q net S$193m vs S$110.3m * GKE (GKEC SP): Requests trading halt * Hiap Hoe (HIAP SP) 3Q net S$33.3m vs S$13.3m * Hupsteel (HUP SP): 1Q net S$710,000 vs S$327,000 * Keppel REIT (KREIT SP): Unit gets S$100m term loan facility * Sound Global (SGL SP): Unit enters agreement for $110m term loan facility * Swee Hong (SWHL SP): Expects 1Q loss due to lower rev., higher costs * Vallianz (VALZ SP): Names Phoon Kim Sin CFO * Viva Industrial Trust (VIT SP): Gets BB+ rating from Standard & Poor?s * Yongmao (YMAO SP): 2Q rev. 232.1m yuan vs 181.2m * United Overseas Bank (UOB SP), Sembcorp Marine (SMM SP), Cosco Corp. Singapore (COS SP): among cos. reporting earnings today Huat arh....

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 09:22 |

Shen Yao

/

ThinkEnv name change to Liongold Corp

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

三 只 才 夠 力 ! ! Hahaha..........

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 09:09 |

Shen Yao

/

ThinkEnv name change to Liongold Corp

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 09:02 |

Resources Prima

/

Reverse Takeover of Sky One

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Continue chiong !! | |||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 05:46 |

Shen Yao

/

ThinkEnv name change to Liongold Corp

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 05:21 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

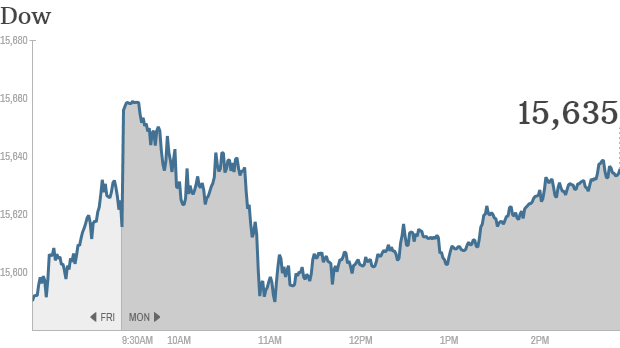

U.S. Stocks Advance as Commodity Shares Rally Before Data

Click the chart for more stock market data. NEW YORK (CNNMoney)

The market has been riding a huge wave of momentum, and investors continued to push stocks higher at the start of the week.The Dow Jones industrial average. S& P 500, and Nasdaq ended Monday with modest gains. U.S. stocks rose, after the Standard & Poor?s 500 Index climbed for four straight weeks, as Exxon Mobil Corp. and U.S. Steel (X) Corp. led a commodity rally while investors awaited data on employment and economic growth. ?The path of least resistance continues to be up,? James Dunigan, who helps oversee $118 billion as chief investment officer in Philadelphia at PNC Wealth Management, said by phone. ?In general, the earnings picture is good. Valuations with the market at these levels are probably in the fair range. As you get into year-end portfolio adjustments, playing on that momentum we?ll likely see the market continue to do well here as opposed to selling off. I think if there are any sort of corrections they?ll be short lived in this environment.? The equity gauge jumped 4.5 percent in October as the Federal Reserve decided to continue $85 billion in monthly bond purchases, and companies beat earnings forecasts. Investors are watching data to gauge the health of the U.S. economy after the Fed last week said it needs to see more evidence of sustained improvement before reducing the pace of its monthly bond purchases. Earnings BeatSeventy-six percent of the 373 S& P 500 companies that have reported earnings so far have beaten analysts? estimates, according to data compiled by Bloomberg. Income for the broad index probably increased 4.1 percent in the third quarter, according to analyst estimates compiled by Bloomberg. The S& P 500 has surged more than 160 percent from a bear market low in 2009 as the central bank introduced unprecedented monetary stimulus to spur growth. The benchmark gauge is up 24 percent this year, poised for the best annual gain since 2003. The rally pushed the index?s price-to-earnings ratio up 18 percent this year to 16.7, near the highest level in more than three years, data compiled by Bloomberg show. The 15-year average multiple is 19.3. The economy probably slowed in the third quarter and employers hired fewer workers in October, economists project reports to show this week. GDP ReportGross domestic product grew at a 2 percent annualized rate after a 2.5 percent pace from April through June, according to the median forecast of 69 economists surveyed by Bloomberg before Commerce Department figures due Thursday. Growth in consumer spending, the biggest part of the economy, was probably the weakest since 2011. Payrolls rose by 125,000 workers last month after a 148,000 gain in September, Labor Department figures may show Friday. Data today showed U.S. factory orders increased 1.7 percent in September after falling 0.1 percent the prior month. Economists estimated a gain of 1.8 percent for September. ?We?ve been in this slow growth environment for some time and we don?t see it breaking out of the trend,? Rex Macey, who helps oversee $20 billion as chief investment officer at Wilmington Trust Investment Advisors in Atlanta, said in a phone interview. ?That?s the thing markets kind of like, where it could be a little warmer, but at least it?s not too hot.? Year-End MomentumThe rally in U.S. equities may accelerate in the final two months of the year and lift the S& P 500 to its biggest annual increase in 16 years, a look at historical data suggests. Since 1928, shares have climbed in November and December 82 percent of the time when the benchmark gauge advanced at least 10 percent through October, data compiled by S& P and Bloomberg show. The mean increase of 6 percent in this period signals that the index could jump to 1,862.79. In another sign that investor appetite for equities is growing, Twitter (TWTR) Inc. raised the price of shares in its initial public offering by as much 25 percent, putting it on track to raise $1.75 billion amid brisk demand. Twitter is likely to price its initial public offering above the increased range, two people with knowledge of the matter said. |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 05:14 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

World MarketsNorth and South American markets finished mixed as of the most recent closing prices. The Bovespa gained 0.78% and the S& P 500 rose 0.36%. The IPC lost 0.17%.

North and South American Indexes

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 04-Nov-2013 22:39 |

SGX

/

SGX

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

LSE Said in Talks With Singapore Exchange on Clearing PlatformBy Nandini Sukumar - Nov 4, 2013 8:03 PM GMT+0800

London Stock Exchange Group Plc (LSE) is in talks with Singapore Exchange Ltd. to provide technology to clear cash equities for Southeast Asia?s biggest bourse operator, three people familiar with the matter said. A deal would see LSE?s MillenniumIT unit implement a securities-processing platform for SGX, according to the people, who asked not to be identified as the talks are private. SGX isn?t planning to use MillenniumIT for derivatives clearing and the companies aren?t discussing a merger or a stake purchase, the people said. An agreement would mark another link between the exchanges after they introduced trading in the largest and most active stocks on each others? markets. LSE, which bought Colombo-based MillenniumIT in 2009, is seeking to increase revenue from technology and clearing to offset declining volumes. An e-mail from LSE?s press office said the London-based exchange wouldn?t comment on speculation. Joan Lew and Carolyn Lim, spokeswomen at SGX, didn?t immediately return calls and an e-mail seeking comment. MillenniumIT already provides clearing technology for the Argentina Central Securities Depositary and trading systems for Norway?s Oslo Bors, according to statements on its website. LSE is the majority owner of LCH.Clearnet Group Ltd., the world?s largest swap clearinghouse. SGX Chief Executive Magnus Bocker is trying to boost equity trading volumes that averaged about S$1.5 billion ($1.2 billion) a day this year, a 37 percent decline from 2007, according to data compiled by Bloomberg. SGX earned S$54.4 million in revenue from securities clearing in the three months ended Sept. 30, a 17 percent increase from the same period a year earlier, according to a regulatory filing. Derivatives revenue climbed 16 percent to S$51.7 million. |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 04-Nov-2013 22:30 |

Resources Prima

/

Reverse Takeover of Sky One

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

NAV : 56.77 HKc ( 57.45 HKc same period last year)

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 04-Nov-2013 22:14 |

Resources Prima

/

Reverse Takeover of Sky One

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Half year Loss reduced to HK$ 1.372m VS Loss of HK$ 3.279m (same period last year) A commentary at the date of the announcement of the competitive conditions of the industry in which the group operates and any known factors or events that may affect the group in the next reporting period and the next 12 months:

The Proposed Acquisition is expected to result in a reverse takeover of the Company. Should the Proposed Acquisition be completed, it is also proposed that the Company disposes of its existing business (excluding PT Energy Indonesia Resources and any shares in it held by Sky One Network (Holding) Ltd) to Dicky Suen Yiu Chung, a controlling shareholder and Chief Executive Officer of the Company (the ?Proposed Disposal?). Please refer to the Company?s announcements on 28 September 2012, 10 October 2012 and 25 September 2013 for more details on the Proposed Acquisition and Proposed Disposal.

The Company will update its shareholders as and when there are material developments to the Proposed Acquisition and the Proposed Disposal.

The Group?s Coal Logistics division carries out the business of mining support activities. Since beginning operations in October 2012 until 30 September 2013, the division has hauled approximately 441,000MT of coal. In view of the high demand for energy and coal resources, the Group is cautiously optimistic about the performance of the Coal Logistics division. It is expected that there be synergies with the Proposed Acquisition, should it succeed.

The Group expects continued weak demand for its Express Land Transport division and Airfreight division in their key markets in Hong Kong and the People?s Republic of China amid the present global economic uncertainties. The lacklustre cargo volume and/or unit price due to weakened demand are expected to lead to insufficient margins to cover the operating costs for these two business divisions.

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 04-Nov-2013 21:07 |

Elite KSB

/

Elite KSB

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Reference Distribution Pte Ltd, Jordon International Food Processing Pte Ltd, Soonly Food Processing Industries Pte Ltd and Safa Gourmet Food Pte Ltd (the ? Company on 31 October 2012. Capitalised terms used herein shall have the definitions ascribed to them in the Circular, unless otherwise stated or the context otherwise requires. Upon and following the completion of the Disposal on 31 October 2012, the Company became a cash company within the meaning of Rule 1018 of the Listing Manual. The SGX-ST had on 5 October 2012 granted its approval for the trading of the Shares to be maintained subject to the Company?s satisfaction of the conditions set out in paragraph 7 of the Circular. Paragraph 7 of the Circular provides (a) the Company shall be required to meet the requirements of a new listing within 12 months from the date of completion of the Disposal (the ? (b) the Company may apply to the SGX-ST for a maximum six (6)-month extension to the Relevant Period subject to the Company providing milestones in finding a new business which investors may evaluate the Company?s progress and (c) in the event the Company is unable to meet its milestones, or find a new business despite the time extension granted, no further extension will be granted and the Company will be required to delist and make a cash exit offer in accordance with Rule 1309 to its Shareholders within six (6) months from the date of expiry of the six (6)?month extension period. The Company had been actively exploring various options and met with many potential target businesses but the Company has not been able to identify a suitable target for investment. Hence, the Company is not able to meet the requirements of a new listing within the Relevant Period. The Company has not been granted any extension of the Relevant Period. Accordingly, in accordance with Rule 1018 of the Listing Manual, the SGX-ST will be entitled to proceed to remove the Company from the Official List. It is the Company?s intention to distribute its cash back to Shareholders and thereafter undertake a voluntary liquidation. The Board has noted that pursuant to paragraph 7 of the Circular, a cash exit offer should be offered to Shareholders in accordance with Rule 1309.

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 04-Nov-2013 20:53 |

Resources Prima

/

Reverse Takeover of Sky One

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Half year results out! http://infopub.sgx.com/FileOpen/SkyOne30Sep2013.ashx?App=Announcement& FileID=262600 |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| First < Newer 281-300 of 1632 Older> Last |