|

Latest Posts By WanSiTong

- Master

|

|

| 06-Nov-2013 18:20 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

What I understand is F& N would return S$3.28 in cash for each Share held by the Shareholders of the Co. as at the Books Closure Date. Nothing mentioned about whether he must be the 5 or 7 years bond holders. Pls refer to F& N announcement No.209 dated 10 May 2013

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 06-Nov-2013 15:47 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

What happen to 3 of you ? Bo cou Kan ah ??

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 06-Nov-2013 14:53 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Singapore - Earnings Revision SummaryWritten By Stock Fanatic on Tuesday, November 5, 2013 |

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 06-Nov-2013 13:12 |

SPH

/

SPH

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Final dividend : 15c Ex date : 6 Dec

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 06-Nov-2013 12:13 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 06-Nov-2013 11:53 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Nvm ! fight him back (I meant for a better tomorrow!) ! Huat arh...... � � � Record order intake of NOK 7.95 billion in 3Q 2013 � � � New shipyard in Brazil, Vard Promar, ramping up production first blocks completed � � � Positive outlook for new order wins for the remainder of 2013 and going into 2014, notwithstanding a highly competitive market � � � The financial results for the current quarter and year to date show an improvement compared to the previous quarter, and demonstrate overall profitable operations for the Group

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 06-Nov-2013 11:42 |

Ezra

/

Ezra

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Ezra Holdings (EZRA SP, 5DN) ? Could be making new 52-week highs?S ource: NextviewEzra Holdings (EZRA) Last price: S$1.335 Technically, as long as the stock could be well supported above S$1.26, watch to see if EZRA could break above S$1.35 to test S$1.52. On 30 Oct 13, EZRA announced its Subsea Services (EMAS AMC) and Offshore Support Services (EMAS Marine) divisions have been awarded projects worth US$110m in the Gulf of Mexico and the Asia-Pacific region. In our institutional research report dated 5 Aug 13, we maintain HOLD and raise our target price from S$1.07 to S$1.25 as our 2014F P/B yardstick is increased from 0.75x to 1.0x. We estimate the long term (since 2004) 1-year forward P/B mean of the offshore/subsea contractors is 1.7x. An uncertain earnings outlook keeps EZRA's valuations at well below the sector?s long-term P/B mean valuation.

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 06-Nov-2013 11:36 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

all buck kar oredi (黑 眼 圈 )... Lol!!

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 06-Nov-2013 09:45 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

The financial results for the current quarter and year to date show an improvement compared to the previous quarter, and demonstrate overall profitable operations for the Group.

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 06-Nov-2013 08:50 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

RECORD ORDER INTAKE IN 3Q 2013 POSITIVE OUTLOOK FOR NEW ORDER WINS FOR THE

� � � � � � � � � �

Operations at the Group?s European shipyards are stable, with work load at the Romanian yards gradually reverting to a normal situation. The Norwegian yards saw successful delivery of four vessels during the quarter. The load situation at the Vietnam yard has improved as a result of a new project secured during the quarter.

Key shipyard infrastructure for the Group?s second yard in Brazil, Vard Promar, was completed in the third quarter. The ramp-up of production capacity at the new yard is underway, and the first blocks have been produced.

The financial results for the current quarter and year to date show an improvement compared to the previous quarter, and demonstrate overall profitable operations for the Group.

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 06-Nov-2013 05:39 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

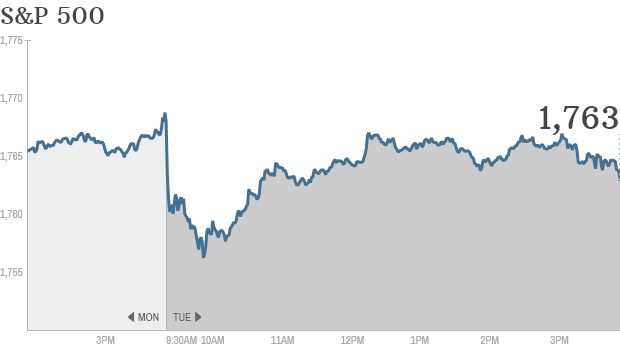

Stocks flounder as investors watch and wait

Click chart for more markets data. Stocks are still hovering near all-time highs. But investors had no reason to do much other than watch and wait Tuesday.The Nasdaq and the Dow closed near breakeven, while the S& P 500 index dipped 0.3%. Stocks in the U.S. and around the world have been buoyed by the Federal Reserve's $85 billion a month stimulus program this year. The Fed is likely to pull back on its bond buying sometime in 2014. But investors are largely watching economic reports and waiting for more hints about when the Fed may finally make a move. Related: Fear & Greed Index still shows greed |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 06-Nov-2013 05:35 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

World MarketsNorth and South American markets finished broadly lower today with shares in Mexico leading the region. The IPC is down 1.89% while Brazil's Bovespa is off 1.11% and U.S.'s S& P 500 is lower by 0.28%.

North and South American Indexes

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 21:37 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Some postings from the SJ forumers:

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 21:35 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

FAQ - Frasers Commercial Trust CPPUFrasers Commercial Trust (FCOT) is offering its unitholders the opportunity to subscribe to a Convertible Perpetual Preferred Unit (CPPU) for every 20 FCOT units they hold. Should you take up the offer? What are Convertible Perpetual Preferred Units? The Convertible Perpetual Preferred Unit (CPPU) is a kind of a hybrid security with elements of equity (the convertibility feature) and debt (the preferred feature). In the case of Frasers Commercial Trust (FCOT)?s CPPU, it can be converted into units of the FCOT Reit. FCOT's CPPUs are ?senior? in that they rank higher than ordinary FCOT Reit units when dividends are distributed at the end of each financial period. CPPUs however do not carry voting rights. They are thus similar in this aspect to preference shares or regular bonds. How does the FCOT CPPU work? Each CPPU, priced at $1, can be converted to units of FCOT, from 26 Aug 2012 onwards. The conversion price has been fixed at $0.2369. Therefore, each CPPU can be converted into 4.22 FCOT units. Why would anyone want to pay $1 for a CPPU and then $0.2369 to pay for a FCOT unit which costs only $0.15 now? CPPU holders would in theory be able to convert to FCOT units at $0.2369 (the strike price) even if an underlying FCOT unit rises to $0.30 (market price) in the future. In this scenario, CPPU unit holder?s profit is thus the difference between the strike price and the future market price. At conversion, CPPU holders need not pay more to convert their CPPU to FCOT units. If the future market price remains below $0.2369, CPPU holders are not obliged to convert their CPPUs, but can continue to enjoy the 5.5% annual yield. Why did FCOT issue CPPUs in the first place? FCOT was highly leveraged, when the financial recession of 2008/08 hit. In lieu of cash, CPPUs were issued by FCOT to Orrick Investments, a subsidiary of Frasers Centrepoint Limited (FCL), as payment for the acquisition of Alexandra Technopark by FCOT in July 2009. Now FCL is divesting part of its CPPUs to other unitholders of FCOT. FCOT is managed by Frasers Centrepoint Asset Management (Commercial) Ltd (the ?Manager?), which like Orrick Investments, is also a subsidiary of FCL. Why is FCL selling the CPPUs? As with most divestment decisions, FCL probably have other investment opportunities that are more attractive than the 5.5% yield from the CPPU. Offering the CPPUs to other FCOT unitholders is part of the exit strategy by FCL. Do unitholders have the option to redeem the CPPUs? No. As a ?perpetual? instrument, the CPPU do not have an expiry date and only the Manager have the option to redeem CPPU at the option price of $1 at a time of its choice. What choices do CPPU holders have? Until the Manager decides to redeem the units, CPPU holders may either:

Is the CPPU suitable for my investment profile? The CPPU has elements of debt and equity. Its complexity is lower than that of warrants and higher than that of shares. It is probably not suitable for the typical Reit investors who may not be sophisticated enough to understand the mechanisms of convertibility and options. What are some of the possible risks? Being backed by the Frasers Centrepoint that is part of the Frasers and Neave (F& N) conglomerate, the CPPU probably carries low risks, some of which are as follows:

Is the FCOT CPPU worth investing in? Yes, if you are an existing FCOT Reit unitholder who foresees a sharp decline in distribution income to FCOT units. Otherwise, it may be more worthwhile to invest in the ordinary FCOT Reit units. This is because at the current FCOT market price of $0.15 per unit, the annualized yield is the 6.33% based on the latest quarterly available results. This compares favorably to the CPPU?s yield of 5.5% at the issue price of $1. Moreover, although the CPPU offers a possibility of a call option on FCOT Reit units, the prospect of a profit is low as the rules behind the CPPU is tilted in favour of the Manager. Should FCOT?s unit price rises above the conversion price of $0.2369, the Manager would have the incentive to redeem the CPPU and thus deprive the CPPU holders from taking advantage of the call option. Disclaimer This FAQ is only intended to provide a simplified explanation of the FCOT CPPU to retail investors. Please refer to the SingWealth general Terms of Use. |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 18:13 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Better to follow Ezra.... from 0.85 to 1.335..........huat arh........... |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 17:57 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Lol......Look like I am the marketing agent of F& N.... | |||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 17:46 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 17:38 |

F & N

/

F&N

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

FCL expected to be one of the largest listed property companies on the SGX-ST by market capitalization

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 17:26 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Very likely tomorrow will release another good news, turn around from Loss to Profit! Double happiness.......双 喜 臨 门 Huat arh.... |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 05-Nov-2013 17:20 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

VARD SECURES NEW CONTRACT FOR A SURVEY VESSEL FOR CIRCLE MARITIME INVEST JSC

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||

| First < Newer 261-280 of 1632 Older> Last |