|

Latest Posts By WanSiTong

- Master

|

|

| 08-Nov-2013 05:58 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

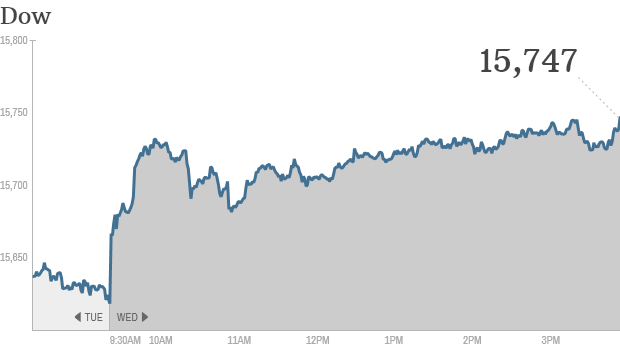

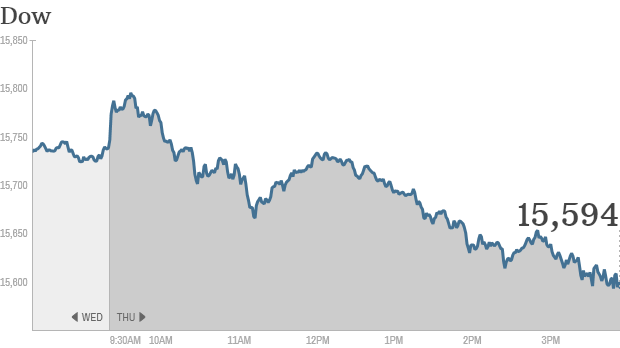

Stocks take a big dive, but Twitter surges

Click the chart for more stock market data. Most stocks finished in the red Thursday, but the one that everyone had their eye on closed firmly in green. Shares of Twitter (TWTR) surged in their debut on the New York Stock Exchange.

But it was a pretty rough day for stocks not named Twitter. The Dow Jones industrial average fell more than 150 points, or 1%, while the S& P 500 dropped 1.3%. The Nasdaq was the biggest laggard of the day, down nearly 2%. Stocks have been trading near all-time highs recently. In fact, the Dow hit a new record early Thursday morning before pulling back. So Thursday's slump might be a sign that investors are growing more worried about how hot the market has been this year. Some analysts feel stocks are getting close to being overvalued. Earnings continue to roll in: The broader market was dragged down by companies with lackluster earnings. Whole Foods (WFM, Fortune 500)was one of the biggest losers in the S& P 500 and Nasdaq as shares sank more than 11%. The sharp drop came after organic grocer cut its earnings and sales forecasts. Related: Fear & Greed Index continues to show greed Upbeat economic data: Investors were initially encouraged by a report that showed the U.S. economy perked up slightly this summer, driven largely by businesses re-stocking their shelves, a rise in consumer spending, and the ongoing housing recovery. Gross domestic product -- the broadest measure of economic activity -- rose at a 2.8% annual rate in the third quarter, according to the Bureau of Economic Analysis. That marked the fastest growth in a year and was stronger than economists had anticipated. A separate report showed initial jobless claims declined for the fourth straight week. But the positive economic data also reignited speculation that the Federal Reserve may begin tapering its bond buying program, said analysts at Wells Fargo Advisors. The Fed's stimulus measures have been a major driver of the bull market over the past several years. Investors will continue to keep close tabs on economic data, particularly readings on the job market. The October jobs report is due early Friday. Economists surveyed by CNNMoney expect 120,000 jobs were added last month. ECB unexpectedly cuts rates: In Europe, it's all about the European Central Bank. The ECB said it cut a key interest rate to 0.25%, a sign of how fragile the European economic recovery is. European stock markets made modest gains in afternoon trading, keeping them near five-year highs. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 08-Nov-2013 05:53 |

Straits Times Index

/

STI to cross 3000 boosted by long-term investors

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

World MarketsNorth and South American markets finished broadly lower today with shares in U.S. leading the region. The S& P 500 is down 1.32% while Brazil's Bovespa is off 1.21% and Mexico's IPC is lower by 0.73%.

North and South American Indexes

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07-Nov-2013 23:01 |

Swiber

/

Swiber

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Swiber's disposal of KreuzWritten By Stock Fanatic on Thursday, November 7, 2013

Proceeds to be used as working capital and fund future investments

Swiber is expected to record a net gain of about US$90.6m from this proposed disposal, and the cash consideration of S$129.2m will be used as working capital to fund the group?s core business as well as to undertake future business expansions and acquisitions as they arise. Do note that as at Jun 2013, Swiber was in a net debt position of US$643m.

Technical Analysis

Loss of future earnings from Kreuz

The proposed disposal is subject to the approval of the shareholders of Swiber at an EGM (to be convened), and should it take place, Swiber will deconsolidate Kreuz from its financials. This will have a significant impact on Swiber?s earnings, as Kreuz is estimated to contribute about half of our FY13F EPS forecast of 11.5 S cents.

Kreuz started its operations in Jul 2008 with the establishment of Kreuz Subsea Pte. Ltd., as the offshore subsea services division of the Swiber Group. It was listed on the Catalist Board in Jul 2010 (IPO price S$0.27/share), and was transferred to the Main Board in Oct 2012.

According to Kreuz?s IPO prospectus, Swiber?s effective cash cost per share in Kreuz was S$0.529.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07-Nov-2013 22:54 |

COSCO SHP SG

/

CoscoCorp

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Not vested ,just for sharing....DYODD Cosco Corporation - The return of the provisionsWritten By Stock Fanatic on Thursday, November 7, 2013After five consecutive quarters of provision writebacks, which offered hope that its operations might stabilise, Cosco once again reminded us that redemption is still a long way off. De-rating catalysts could come from persistent weak execution.

Technical Analysis

Top-short

We recommend investors to sell the stock in view of the negative triggers in 4Q. We believe that the market has already priced in US$2bn of order intake. While the company may ?buy? contracts by lowering profitability, that would not buy it any favours from the market. (Read Report)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07-Nov-2013 22:26 |

Swiber

/

Swiber

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

This chicken end up will be slaughtered becos the master wants the eggs........sad !

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07-Nov-2013 18:01 |

Tiong Woon

/

Tiong Woon

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

May all you dreams come true!... Huat arh....

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07-Nov-2013 17:50 |

Tiong Woon

/

Tiong Woon

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Everyone must have a dream........

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07-Nov-2013 15:50 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Vard Holdings Ltd - Buy ahead of earnings recoveryWritten By Stock Fanatic on Thursday, November 7, 2013While Vard?s 3Q earnings miss of 5% was hardly inspirational, it cannot be argued that the company is in a downward spiral either. We expect a 2-year EPS CAGR of 15% in FY13-15 due to margins recovery. Catalysts could come from stronger earnings and orders.

Intra Day |

|

|

Gadgets powered by Google |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07-Nov-2013 12:01 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Still alive......Lol

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07-Nov-2013 12:00 |

Others

/

What?s Happened to Blumont, Asiasons and LionGold

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07-Nov-2013 11:43 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07-Nov-2013 11:11 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Above the current px......but I hold for medium to long term.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good Post Bad Post | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07-Nov-2013 10:49 |

Vard

/

Vard Holdings

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Yes, Vard should issue a royalty award to be. Hahaha....

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||