|

Back

x 0 x 0

x 0 x 0

|

and to share this analysis form the same site.

http://understand-s-thrive.blogspot.com/

personnally think bullish, but hurricane Irene is a worry, and then you got earthquake,

this quake is crazy, anytime it can gone bonky.

hope this hurricane pass with less damage...and quake go away.

andreytan ( Date: 27-Aug-2011 04:23) Posted:

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

This site claim 95% accurate,........... just to share.

you go and search it out, and see for yourself.

http://understand-s-thrive.blogspot.com/p/past-calls.html

good luck,

I think september mkt will be bullish ..before the FOMC.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

This Presidential election is making a fool out of us.

The govt want to make us feel good, by having a President to look after our money, and then at the same time , they also have means to overpower him.

This whole thing is in fact a scam of sort,

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Actually, it is not a question of who to vote for really???

But rather do we want to have a President.

Let Singaporean vote to decide whether we really need a President or not???

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

The money belong to us, not the President.

So if the govt want to use it, they should ask Singaporean.

So why not have a referendum to seek Singaporean approval???, afterall, you don't use the reserve every now and then. ..once in a.very long in a recession .

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Do we really need a President?

If present day govt can use constitution to overide him, you look at Ong Teng Cheong, Look what happen to him in the end.??

The govt can change constitution , make the constitution a joke. What is a constitution???You can keep changing a constitiuton to your advantage., what then constitute a constitution?? you tell me.

Elected President is waste of our time and resource and money, We do not need a President.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Taken from understand survive and thrive

Although anyone who had followed Understand, Survive and Thrive's Sell Call would have saved over 10% in less than 2 week, I myself did not anticipate such significant decline. This kind of severe sell-off begs the question whether we are approaching crash territory or are we near a bottom?

Throughout today, I have been seeing a lot of TV personalities saying that this is a great buying opportunity. In my humble trading opinion based on extensive trading experience, bottoms are not formed when everyone knows that it is a buying opportunity. This being said, we have certainly started to see some very good PANIC signs. Therefore, we can say that based on psychological analysis and market understanding we are near a bottom but might not have bottomed yet.

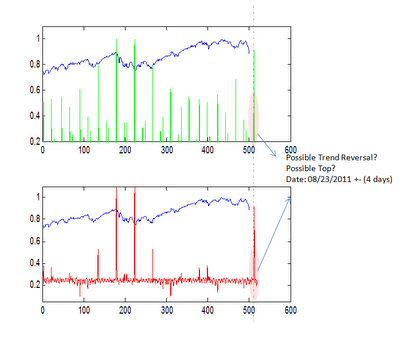

Inflection Point Model In any case, our trades are governed by the Trading Algorithm, not by our opinion. In this regard, we re-ran the proprietary Inflection Point Model, to discern the next possible Stock Market Turn date (Pick the Turn Point). The program output is given below: Analysis According to the two models, the next turn date is scheduled for August 23, 2011 (+/- 4 days). Moreover, both models are showing a potential turn, thus amplifying turn possibility. To our amazement, the amplitude of the turn point is very high. In fact, this amplitude is comparable to the amplitude we saw at the March 2009 bottom. Hence, we might be in for a significant turn point. Interestingly, this time frame also coincides with " Options Expiration Week" and Federal Reserves' Jackson Hole summit, where FED last year announced QE2.

All of these observations, collectively force us to observe that we might witness another significant announcement from the Fed, which might mark the bottom of the current decline. (If the uptrend is intact). Otherwise, if we have entered a bear market, next turn point could mark a top.

The Inflection Point Model is the primary reason why we has not tried to pick the bottom in this market, even when various famous individuals like Lazlo Brinyi and Biggs are recommending to hold the stocks.

Bottom picking is hard, and can result in significant declines. Some people might assume that we will rally based on employment numbers tomorrow, but we believe that any significant rally cannot take place until unless the Trading Algorithm gives a buy signal. Hence, even if the market rallies tomorrow, we will intently and safely wait on the sidelines for the turn window.

Conclusion Now that we have a turn window date, we will concentrate on how to evaluate the market going into the turn window. Risk management is the key to success. In the next post, we will evaluate different market structure scenarios which can take place and how to play them for profitable trade in these tumultuous times. |

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Whatever the reason may be. Stocks were scheduled to fall that is why they fell. Current decline will create enough pessimism among the investors to support a sharp rally few days after Bernanke Speech. UST Inflection Point Model predicted August 22 (+/- 4 days) as the turn window, and the markets bottomed in that time frame.

If the market can hold above August 23 lows then we will soon experience a very sharp rally.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Yes, BOA..Buffet a good man like Bill Gates.

no doubt after giving most of their wealth to charity, they still are much richer than us, but how many of them in this world are like them.

truthly great man, even if some say they are show off.

even if it is, it is a good and great cause show off.

God bless them.

alexchia01 ( Date: 25-Aug-2011 22:45) Posted:

Warren Buffett is a well respected investor in the world.

He has been given away billions to charities in recent years.

If you are following his recent interviews, you'll know that he is Pro-America and optimistic about America Economy.

Obama is looking towards him to support the American Companies.

He has no choice but to Support BAC.

He's 81 years old, I don't think he is doing this for the money.

You may think he's betting, but I think he's fulfilling this obligation as an America Citizen to help his follow countrymen.

If BAC is to fail, it's like our POSB failing.

How many ordinary people in the country will suffer if the national bank fails.

For this, I really respect him. The only true Businessman, Investor and Citizen I know.

xing78 ( Date: 25-Aug-2011 22:24) Posted:

Buffet's previous bets on GS not doing well.

I wouldn't jump in on BAC now at $8.

If it gets back to $3, perhaps I would consider to place a bet on the long side. |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

OMG..mkt down on rumour again...speculation???

http://www.cnbc.com/id/44268228

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

if tomolo, Ben did nothing, then mkt may come down hard for one to two session only, becos by leaving rate close to zero, it

a form of QE, and end year, fund will chase stock, becos they want bonus,

But i dont think Ben will do nothing, becos all data are borderline, one more big shock to stock will see US back to recession,

and all his QE trillion dollar effort gone down the rain.

He got to have some add on to the current plan..to give the economy a boost.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Thanks ,just read your post.

I believe it benefit lot of people here already by your post., not only me.

Zhiwei ( Date: 25-Aug-2011 17:25) Posted:

Audrey,

ya. chartnexus would be adequate for the TA. u can download from web

http://www.chartnexus.com/software/index.php

alexchia01 ( Date: 25-Aug-2011 16:15) Posted:

If you have money, you can attend some of these courses, but like what Hulumas said, DIY is still the best.

I've not attended T3B course before, but I do know that they uses breakout method.

To me, I personally don't like this method because by the time a stock breakout, it's already too late to enter.

I used to think that attending these courses are a waste of money, but they do provide a different prospective to trading.

At the moment, the most complete Technical Analysis course that I know of is ChartNexus course, which I think is more suitable for beginners |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

I still think, one major obstacle is cut loss, or stop loss.

it is always painful.

But imagine if you have cut at the first instance of this crash, today, you dont lose much as compare to those who did not cut.

Those who cut early i estimate lose 10 to 15%, but those who didn't, i think they are some 25 to 30% down,

But if you do it often(stop loss), u came to know that it work, most of the time.

just like, u learn martial art, i practise karate before...u chop tiles the first time, it is very painful , but if you keep at it, then susequently u dont feel less pain ,

and u really can break tiles.

just do it, stop at whatever u can afford to loss, there are no fix % cut loss, no doubt expert say 8%.

say now i m willing to lose $200 on this trade, for a shr px of 1.05....i cut at 1.0 ...so i will only buy 4 lots...if u can afford bigger losses then you can buy more lots.

and when to take profit??? ppl always ask what tg px to take profit in this forum, very common post.

In reality, no one know what px, just base on chart forcast...include me...but if 60 to 70% sure, i make my move.

my method is set trailing stop, if i am happy to lose 3c profit, then if the stock is down 3c, i am out, i lock in the profit., if it go up after that, i will not chase.

but ppl alway say, once i sold the stock go higher, or once i sold the stock go back up, i really loss money.

patient is the word, there are always opportunity in the mkt, wait again for a favourable enter point.

practising mechanical sell and stop, is to unto protection for your profit and capital.

good luck to all....hope a big rally for us to profit in whatever manner.

iPunter ( Date: 25-Aug-2011 18:23) Posted:

The problem is those who do the " mau" ing are not prepared

to lose a lot because they are confident in the first place.

If they are not confident, would they have " mau" ed

in the first place? Thus, the problem lies not with

the market, but with he confidence...... lol...

rotijai ( Date: 25-Aug-2011 18:16) Posted:

mau smaller prepared to loss less

mau bigger prepared to loss more

no mau u dont have to loss $$

dont " sng sng" with stocks ? : |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Thank to all your reply and concern,

I will go down there ,and find out, and come back here to write something abt it.

no worry, i can handle hard sell tactic, i experience many time before.

thank all and God bless.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

I just register for this saturday talk, i am going. anyone interested? we can met and knoweach other better.

I will ask what their system are base on???

but so far, i surf the net, there are not even a single complain abt them, I will search futher and let u guy know?

someone told me they base on trend trading, and all those risk control,,,etc etc..nothing new, then i will walk away.

anyway this saturday election day, dont forget to vote.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

I think u may wait a while first.

it is just borderline bullishness,

andreytan ( Date: 25-Aug-2011 15:42) Posted:

this one just turn bullish stock in my scanner, i think you can bet on it.

but today uptrend is becos of the broad mkt heading up....so u got to be careful

put a stop if u buy.

good luck

seanpent ( Date: 25-Aug-2011 15:39) Posted:

| seems to be rushing towards $3 very soon .... |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

at least u are not looking at the bear, u look to the front

this is dangerous, in a bull mkt, the bear is always appear all of a sudden ,in front of us

you are right, bear can appear any times,,

now , only a 9.0 earthquake will stop the rally and turn bear....i hope not.

it is possible, hope not

Isolator ( Date: 25-Aug-2011 15:41) Posted:

lol... This is what I see from my binocular..... Poor chap.... lol

parimas8 ( Date: 25-Aug-2011 15:36) Posted:

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

this one just turn bullish stock in my scanner, i think you can bet on it.

but today uptrend is becos of the broad mkt heading up....so u got to be careful

put a stop if u buy.

good luck

seanpent ( Date: 25-Aug-2011 15:39) Posted:

| seems to be rushing towards $3 very soon .... |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Hi

anyone here ever attend this course, ??

if attended, how it is??good or bad, please enlighten us,

dont be shy in this no face forum,

thanks.

if good, i may sign up, so it add on to what i learn in the courses conducted by SGX to further enhance my trading skill.

thanks you and God bless.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

This one everybody also know lah...

but what can we do, we keep buying,if not it got to zero,all your reserve go to zero........u want it this way???

China got 3T and Jap and India got 2T...Singapore got investment there...if go to zero, our saving all gone.

so keep buying and keep the music going as long as we can.......

you tell me how to get away without we all incurr heavy losses and consequences..

US is still the 800 lbs gorilla, like they said.

parimas8 ( Date: 25-Aug-2011 15:30) Posted:

Adjust for inflation?

U mean like Zimbabwe's 100 trillion dollah? http://en.wikipedia.org/wiki/File:Zimbabwe_$100_trillion_2009_Obverse.jpg

STI will be 15,000!!!

HAHAHAHAHAHAHAHAAHAHAHAHAHAH!!!!!!!

andreytan ( Date: 25-Aug-2011 14:47) Posted:

i think his 1500 is not adjusted for inflation.

If adjusted for inflation, should be sti 3600.

and mkt are forward looking, so all in sti 4000!!!! |

|

|

|

|

|

Good Post

Bad Post

|

|

|

|