|

Back

x 0 x 0

x 0 x 0

|

Tat Hong Holdings: No surprises in 2QFY14 results - OCBC Research

Tat Hong?s 2QFY14 results remained weak as expected. Revenue fell 14.2% YoY to S$185.3m while operating profit declined by 33.9% to S$18.6m.

Despite the poorer showing, management declared an interim dividend of 1 S cent vs. 1.5 S cents last year. Entering 2HFY14, we expect Tat Hong?s performance to stay weak. Its Australian operations are unlikely to produce any turnaround until early FY15 (at its earliest) as sentiment remains poor. ...

Nonetheless, some positives from stability in Singapore, Hong Kong and China operations should help to cushion some of the declines. As the street had factored in expectations for a weakened performance, we should not see sustained selling pressure on the counter.

Adjusting our forecasts downwards slightly, our fair value falls to S$0.90 (S$0.96 previously). Maintain HOLD.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Properties should be stated at fair value based on valuations performed by independent professional valuers . The fair value are based on market value.

The valuation should be done on the financial reports cut off date, ie Balance Sheet date. If not, it should close to Balance Sheet date.

Siwomp ( Date: 14-Nov-2013 14:01) Posted:

I am not account trained, my question,

1) mkt value is taken when? 2012? 2013 Jan? or 2013 Oct?

2) from mkt value (date) to record (date) how long can that be, 6 months a yr or longer?

3) How is the mkt value derived? latest transacted price of similar properties in the area? if no property were transacted in the area in the last 2 years then how?

I see ways to present the same sets of numbers to different effect.....imo

WanSiTong ( Date: 14-Nov-2013 13:49) Posted:

| I have no idea when they do the assets valuation. However, based on IAS & GAAP, they suppose to record their assets based on mkt value |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Singapore shares gain after Yellen soothes worries on Fed: Reuters

Singapore shares were poised for their biggest daily gain in nearly two months on Thursday, after Federal Reserve Vice Chair Janet Yellen soothed uncertainties over the Fed's monetary stimulus.

The benchmark Straits Times Index gained 0.9 percent to 3,193.85 points by 0421 GMT. The MSCI's broadest index of Asia-Pacific shares outside Japan was up 1.2 percent. ...

Palm oil firm Golden Agri-Resources Ltd was among the best performers, advancing as much as 3.5 percent to S$0.59, rebounding from a 2-1/2-week low in the previous session hit after the company reported a sharp decline in third-quarter net profit.

Golden Agri shares, which soared 15 percent in October, are down 2.5 percent this month. In a note on Wednesday, OCBC analysts remained downbeat on the outlook, noting that company

management has forecast a decline in full year crude palm oil output even as it is positive on next year's market.

The OCBC analysts, saying the recent price rally " looks overdone" , maintained a " sell" call on the stock and a target price at S$0.465.

Shares of agricultural company Olam International Ltd rose as much as 2.4 percent to S$1.51, its highest in more than one week, after announcing a sale and lease-back of its Australia almond orchards for A$200 million ($185.96 million).

The deal will help monetize about half of Olam's assets linked to its Australia orchard, said Citi Research in a note, adding that orchards are likely to drive the company's edible nuts segment earning and cash generation as it matures. Citi has a " buy" rating and target price of S$2.60 on the stock.

Olam is due to report quarterly results later Thursday.

Singapore Telecommunications Ltd shares rose 0.8 percent to $3.79. Southeast Asia's largest telecommunications operator reported weaker-than-expected net profit for the second quarter as strong Singapore dollar hit overseas earnings.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

I have no idea when they do the assets valuation. However, based on IAS & GAAP, they suppose to record their assets based on mkt value.

Siwomp ( Date: 14-Nov-2013 13:43) Posted:

The report is dated 11 Nov 2013, but the valuation of the properties and other Assets is done when? Especially the properties, huge difference.....

WanSiTong ( Date: 14-Nov-2013 13:20) Posted:

| Based on the 3Q SGX announcement dated 11 Nov |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Just to clarify...... NTA is the money shareholders eventually will get in case the company closed shop.

Touch wood..... I don't think SupperGroup will close shop one day....Lol

WanSiTong ( Date: 14-Nov-2013 13:20) Posted:

Based on the 3Q SGX announcement dated 11 Nov.

Siwomp ( Date: 14-Nov-2013 13:15) Posted:

| Institutional Counter..... generating good cash.....lol.......NAV.....just a measure of the asset value.....wonder when was the NAV derived, is it up todate |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Based on the 3Q SGX announcement dated 11 Nov.

Siwomp ( Date: 14-Nov-2013 13:15) Posted:

Institutional Counter..... generating good cash.....lol.......NAV.....just a measure of the asset value.....wonder when was the NAV derived, is it up todate?

WanSiTong ( Date: 14-Nov-2013 13:11) Posted:

NAV: 79.66c

last done : 3.41

Wow! Current px is 4.3 times of the NAV........How to say....... |

|

|

|

|

|

Good Post

Bad Post

|

x 1 x 1

x 0 x 0

|

NAV: 79.66c

last done : 3.41

Wow! Current px is 4.3 times of the NAV........How to say.......

|

|

Good Post

Bad Post

|

x 1 x 1

x 0 x 0

|

SINGAPORE DAYBOOK :Prepare for US Fed stimulus taper: Tharman Countries should put in place domestic reforms, raise productivity

[SINGAPORE] THE global economy has to accept the fact that the United States Federal Reserve will have to start paring its asset-buying stimulus at some point.

What countries should do ahead of the US central bank's expected tapering of the stimulus programme is to start preparing themselves early, said Singapore Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam.

He made these points after a meeting with visiting US Treasury Secretary Jacob Lew yesterday.

The world's stock markets have taken a hit amid mounting speculation that Washington could begin cutting its US$85 billion a month economic stimulus programme from as early as next month.

Weighing in on the issue of market jitters and speculation about tapering, Mr Tharman said: " At some point, the Fed will have to start tapering. Whether it tapers in December or sometime next year will eventually be (only) a footnote in history.

" At some point, it's going to have to taper - and it's important for all of us to start preparing for this eventuality."

What this means is that all countries must, among other priorities, put in place domestic reforms, raise productivity, and liberalise and remove roadblocks to infrastructure investments.

" The eventual tapering on the Fed's part will, I think, (be) a net positive for emerging Asia - a net positive as long as we respond to this likely outcome, start preparing for it now, have a little more urgency in domestic reforms," said Mr Tharman.

He revealed that Mr Lew had assured that the US was serious about getting a clear resolution of its current budget and debt impasses.

" Resolving this problem is important not just to the United States, but for the global economy and sustaining the global recovery," said Mr Tharman.

The two leaders also discussed the latest state of the Trans-Pacific Partnership (TPP) negotiations, which are now in the final stages after three years of talks and are expected to be concluded soon.

The US-led TPP talks involve 12 Pacific Rim countries, including Singapore. The TPP is billed as the world's largest free-trade agreement and accounts for about a third of world trade and nearly 40 per cent of the global economy.

" We are both committed to achieving a high-standard TPP agreement that will ultimately boost trade, boost investment and boost job creation in all our countries. Our negotiators are working intensively to resolve the outstanding issues," said Mr Tharman.

The aim is still to strike a deal by year-end, and Mr Tharman said that every country involved " should try our best" to reach a consensus.

The negotiators from the 12 countries are set to meet in Salt Lake City in the US next week before Singapore hosts the next TPP Ministerial Meeting in December.

Separately, Mr Lew also met Prime Minister Lee Hsien Loong at the Istana, where they exchanged views on international and regional developments, including the global economic and financial outlook.

Mr Lew's two-day trip to Singapore, which ended yesterday, was the second leg of his five-nation swing through Asia that began earlier this week in Japan and will wrap up in China.

(Source: The Business Times)

MARKET SCOOP

WBL Q4 net profit halves on car cooling measures

CSE Global profit after tax up 5.8%

Tat Hong Q2 net down 53% at S$8.2m

Interra Resources's Q3 earnings soar to US$4.99m

Oxley Holdings Q1 net profit surges to S$250.8m

Olam sells Australian almond orchards for A$200m

ComfortDelGro's Q3 profit up 5.4% at S$76.7m

Banyan Tree narrows net loss in Q3 to S$1.42m

(Source: The Business Times)

DBS VICKERS Securities says ?

CENTURION CORPORATION | BUY | TP: 0.77

Centurion recorded 3Q13 revenues of S$16.8m (-5% y-o-y), gross profit of S$8.9m (+0%) and net profit of S$5.4m (+30%)

Gross margins improved 3ppts to 53% and net margin improved to 32%, on the back of higher contributions from the accommodation business

The group?s 3Q13 accommodation revenue grew 12% y-o-y to c.S$12m, bringing 9M13 accommodation revenue to S$36m, which is 81% of our full year estimate

Revenue from optical disks declined much quicker than expected ? 9M13 revenue fell 32% to S$14m, comprising c.68% of our full year estimate

Excluding the one-off impairment loss for the optical disk business, revaluation gains and the gain from sale of industrial land at Mandai, the group?s core net profit was S$13.3m, slightly lagging our full-year estimate of S$19m

This was largely due to higher than expected cost of sales for the optical disk business

Phase 2 of the Mandai dormitory development, comprising an additional 1,540 beds, was completed in September 2013

As was with the Phase 1 development, we expect the dormitory to achieve full occupancy by end-2013

To date, the group has another 7,864 beds in its Singapore pipeline ? 3,764 beds will be added upon completion of upgrading works at Toh Guan in 1Q14, with another 4,100 beds to be completed at the Woodlands site in 2015

We remain optimistic about Centurion?s expansion in the Singapore dormitory space, as the market still remains vastly undersupplied (c.160k beds vs 740k foreign workers), and will continue to remain so, unless the BCA and JTC release more land for dormitory purposes

We should see sequential improvement in Centurion?s dormitory business in 4Q13, given new contribution from Phase 2 of Mandai dormitory in Singapore, as well as improved occupancy rates in Malaysia

We should also see better performance from the optical disk business as production generally picks up during the holiday season

Maintain BUY, TP unchanged at S$0.77

UOB KAY HIAN says ?

SEMBCORP INDUSTRIES | BUY | TP: S$6.00

Sembcorp Industries (SCI) reported a net profit of S$254.4m, up 40% yoy, for 3Q13

This was due to an exceptional gain of S$117.1m from the IPO of Sembcorp Salalah

Power & Water Company, but this gain was partially offset by an impairment charge of S$48.5m made for the Teeside operation in the UK

Excluding these exceptionals, 3Q13 group net profit would have posted an increase of 3% yoy (adjusted utilities net profit +4% yoy)

The utilities business accounted for S$172m (+73% yoy) or 68% of 3Q13 net profit

while the marine business contributed S$79m (+12% yoy) or 31%

Within the utilities business, Singapore registered a 24% decline in net profit because of a) plant maintenance in 1Q13, b) lower spark spreads, and c) lower gas sales

This was offset by higher contributions from China and the Middle East, while UK was affected by the impairment charge

Sembcorp Marine (SMM) had earlier reported net profit of S$129.7m (+23% yoy) for 3Q13 and S$373.3m (+0.5% yoy) for 9M13

Operating margin deteriorated to 10.1% in 3Q13 from 13.0% (11.8%, excluding disposal gain) in 2Q13 and 13.7% in 1Q13

This is due to conservative profit recognition in the early building stages of its maiden drillship projects

However, 3Q13 operating profit rose 32% yoy because of an 86% yoy increase in turnover

Earnings from associates and JVs fell 67% yoy to S$4.2m in 3Q13 from S$12.7m in

3Q12

This was largely due to COSCO Shipyard Group?s poor earnings

At the turnover level, 3Q13?s rig building revenue more than doubled

This offset lower revenue from offshore and conversion

Revenue from shiprepairs rose 33% yoy

Marine orderbook stands at S$13.5b with project deliveries stretching to 2019

The seven drillships for Sete Brasil make up 47% of the orderbook

SCI provides a better refuge than earnings-cyclical SMM as the latter?s margin is uncertain

SCI?s utilities earnings growth in 2013-15 will be driven by three additional power plant capacities, namely: a) the Salalah IWPP expansion in Oman (started in 2Q12), b) Sembcorp Cogen?s new 400MW power plant (end-13/1Q14) in Singapore, and c) a 49% stake in Thermal Powertech Corp, which is building a 1,320MW power plant commencing in 1H14) in Andhra Pradesh, India

This should mitigate Singapore?s weaker electricity spreads as a result of more competition from an expected planting up of > 3,000MW of new power generation capacity (total of 10,800MW as at end-12) in Singapore in 2013-14

We raise our 2013 net profit forecast to factor in 3Q13?s exceptionals while our 2014 and 2015 net profit forecasts are largely unchanged

Our target price is tweaked from S$5.80 to S$6.00, which is set at a 10% discount to our revised sum-of-the-parts (SOTP) valuation of S$6.67/share

Earnings from new utilities projects is a key share price catalyst

The major risks are Singapore?s weak electricity spreads in 2013-14 and lower-than-expected earnings contributions from SMM

OSK DMG Securities says?

NAM CHEONG | BUY | TP: S$0.39

Nam Cheong released its 3Q13 results this morning, reporting a record quarterly profit that solidly beat our and street forecasts

Revenue was up 140% y-o-y to MYR341.2m on the back of strong shipbuilding

and higher contributions from vessel chartering

Gross margins were the big surprise - shipbuilding margins surged to 22.8% from 17.3% in 2Q13 and q-o-q vessel chartering margins jumped to 67.6% from 55.5%

These flowed down to the bottomline for a PATMI of MYR58.7m, up 86% q-o-q, comfortably surpassing our preview estimate of about MYR50m

The balance sheet position is even stronger today with net gearing falling to 12% from 39% at the start of the year

Cash flows were very strong in 3Q13, with net operating cash flow of MYR149.4m

What struck us was the build-up in inventory to MYR687m from MYR454m at end-FY12

This is a leading indicator for NCL's future performance as its shipbuilding sales are driven by vessels-in-stock, and the build-up hints at strong vessel sales and earnings growth to come

NCL is one of our Top Picks in the sector with strong earnings growth, healthy cash flows, high ROE, but trading at a low 7-8x P/E

We currently recommend BUY with a SGD0.39 TP

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Corporate News

CRT: DPU of 3.26 cents beats forecast by 4.6%. Buoyed by an upturn in consumer sentiment, Croesus Retail Trust's (CRT) DPU of 3.26 cents for the 144 days ended 30 Sep 13 beat its IPO forecast by 4.6%. Income available for distribution beat its forecast by 8.3%, at 1,140m yen (S$14.3m). The upside was largely due to property tax rebates and a decrease in current income tax. This was offset by a difference in hedge rates between actual and forecast for the period. Ggross revenue for the period met expectations, at 1,998m yen. Net property income was 1,269m yen, or 3.1% higher than forecast. Overall, property expenses were 4% below forecast. (Source: Business Times)

CSE Global: Net profit up 5.8% yoy in 3Q13. CSE Global recorded net profit of S$11.4m in 3Q13, up 5.8% yoy. Revenue came in 6.3% lower yoy at S$122m mainly due to lower revenues in the Americas and EMEA (Europe, Middle East and Africa) regions. However, net margins in these regions improved substantially due to the lower level of zero-margin revenue in the Middle East and the higher level of more profitable offshore activity in the Americas. (Source: Business Times)

Olam: Sells Australian almond orchards for A$200m. In its second sale-and-leaseback transaction, Olam International is selling nearly 12,000ha of almond orchards in Victoria, Australia, for A$200m (S$233m) cash. The deal was made with a group of investors led by Zurich-based Adveq Real Assets Harvested Resources, an asset manager that invests in private-equity and real asset funds. Olam will lease the land and related farming and irrigation infrastructure for 18 years, with the option of renewal. It expects to book a post-tax capital gain of A$45m from the deal. (Source: Business Times)

Oxley Holdings: 1QFY14 net profit surges to S$250.8m. Oxley Holdings' net profit for the three months ended September hit a record S$250.8m, compared with S$6.6m a year ago. Revenue soared to S$686m from S$50m a year ago. Oxley declared an interim one-tier tax exempt cash dividend of 3 cents per share. (Source: Business Times)

Petra: Chocolate maker 3Q13 net profit up 3.5% yoy. Petra Foods posted a 3.5% yoy rise in 3Q13 net profit to US$14.8m, helped by higher sales from its branded consumer division. Revenue from the division rose 10.4% yoy to US$126.9m on higher sales from Indonesia, which grew 8% yoy to US$92m other regional markets including the Philippines, Malaysia and Singapore grew 17% yoy to US$35.3m. Indonesia accounts for 72% of revenue. Petra says it has cornered more than half the market for its brands in Indonesia. (Source: Business Times)

Tat Hong: 2QFY14 net profit down 53% yoy at S$8.2m.

From the Regional Morning Notes

Bumitama Agri- 3Q13: Net profit of Rp169b (+9.1% qoq, -5.2% yoy), below expectation, on lower-than-expected FFB production due to dry weather in 2011.

(BAL SP/BUY/S$0.99/Target: S$1.23)

FY13F PE (x): 19.6

FY14F PE (x): 15.9

Results below expectation. Bumitama Agri (BAL) reported 3Q13 net profit of Rp169b, bringing 9M13 net profit to Rp475b. However, excluding the one-off items, ie withholding tax on interim dividend in 9M13 and gain on hedging in 9M13, its adjusted 9M13 net profit would have been Rp490b.

Maintain BUY and target price of S$1.23, based on 14x 2014F PE. We like BAL for its young age profile and best OER to support its 5-year net profit CAGR of 32%.

ComfortDelGro Corporation- 9M13: No surprises, managing tough environment well.

(CD SP/BUY/S$1.895/Target: S$2.35)

FY13F PE (x): 15.5

FY14F PE (x): 14.7

Good solid showing. 9M13 net profit of S$203m (+6.3%) is within our expectations, accounting for 77% of our full-year estimate. The group?s 9M13 operating margin was flat yoy at 12.0%. Despite cost pressures on staff (+9.0% yoy) and maintenance (+8.8% yoy), areas such as fuel and materials & consumables declined 1.5% yoy and 12.1% yoy respectively to help offset the cost pressures. The significant rise in staff cost is attributable to: a) the headcount increase as a result of acquiring Metroline, and b) higher foreign worker levy. Maintain BUY on CD with a DCFbased target price of S$2.35.

First Resources- 3Q13: Net profit of US$51.4m is above expectation on lower effective tax rate. Outstanding results with good CPO price and production growth.

(FR SP/BUY/S$2.06/Target: S$2.40)

FY13F PE (x): 14.6

FY14F PE (x): 13.0

FR reported a net profit of US$51.4m (+36.4% qoq, -20.0% yoy) for 3Q13 and US$152.7m (-6.9% yoy) for 9M13. Its 9M13 results account about 85% of our full-year forecast. Results were above our expectation mainly on lower-thanexpected effective tax rate coming from tax adjustment by subsidiaries. Maintain BUY with a target price of S$2.40, based on 15x 2014F PE. We like FR for its hands-on management team, young age profile and efficiency.

RH Petrogas- 9M13: Weaker revenues registered due to the decrease in average oil price and decline in production.

(RHP SP/BUY/S$0.65/Target: S$1.60)

FY13F PE (x): n.m.

FY14F PE (x): 55.6

Top-line hampered by decline in production. RHP?s 9M13 revenue of

US$57.8m was lower by 4.3% qoq and 4.3% yoy due to the decrease in

average oil price for the period and decline in production due to its field?s

operational issues and oilfield?s natural production decline. Given that oil

prices have been on a short-term downtrend, we believe that RHP?s

revenue in 4Q13 would likely remain weak unless it is able to increase

production.

Maintain BUY with target price of S$1.60 based on NPV and risking model.

Our valuation is based on the NPV of the company?s current

production/near-production fields, plus risked estimates of its 2C resources

and prospective resources, less net debt adjusted for its committed capex

and new funds raised from its recent private placement exercise.

Yangzijiang Shipbuilding- 3Q13: Net income declines 6% yoy due to a

higher tax rate.

(YZJ SP/BUY/S$1.17/Target: S$1.39)

FY13F PE (x): 7.5

FY14F PE (x): 8.3

6% earnings decline mostly due to higher tax rate. Yangzijiang

Shipbuilding?s (YZJ) 3Q13 revenue was Rmb3.67b (+2% yoy), of which

shipbuilding revenue was Rmb3.32b (+0.4% yoy). Overall gross margin

(including investment business) edged up yoy to 29.6% (3Q12: 29.4%) due

primarily to a slightly higher percentage of high-margin investment

business (9.5% of total revenue in 3Q13 vs 8.5% in 3Q12). Shipbuilding

margin was 22% (3Q12: 23% 2Q13: 21%). Pre-tax profit still gained 6%

yoy but net income declined 6% yoy on a significant increase in the

effective tax rate to 29% (3Q12: 22%) due to a higher tax rate in Changbo

(25% vs 15%) and a withholding tax on Chinese subsidiaries' distributable

profit in 3Q13. YZJ remains our only BUY within Chinese shipyard sector.

We lift target price to S$1.39 (from S$1.32), based on 1.3x 2014F P/B.

Singapore Airlines- Key takeaways from analysts? meeting.

(SIA SP/HOLD/S$10.28/Target: S$11.40)

FY14F PE (x): 26.0

FY15F PE (x): 20.8

Expect further yield pressure in 2HFY14. 2H is generally a period of lower

yield and the airline has guided the same for this year. SIA noted that half

the 3.5% decline in 2Q?s pax yields was due to the stronger Singapore

dollar, with the rest of the decline coming from lower local yields.

Essentially SIA has been cutting prices to meet the competitive pressures.

Given the guidance, we lower our FY14 yield forecast by 3.5% to 11.0 S

cents. Maintain HOLD with a lowered target price of S$11.40 (previous

S$11.50).

Crane supplier Tat Hong Holdings announced a net profit of S$8.2m for 2QFY14, down 53% yoy. Revenue was down 14% yoy at S$185.3m. The company said the results were due to a decline in profit contribution from Australian operations as well as S$5.2m of unrealised foreign exchange losses. Excluding foreign exchange effects, net operating profit would have improved 43% qoq. Tat Hong declared an interim dividend of 1 cent a share, down from 1.5 cents a year ago.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Looks like game going to start soon ..........

ahmah00 ( Date: 14-Nov-2013 09:42) Posted:

|

they waiting for miracle. i waiting for this to toh. |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

He or she is 洪 金 宝 ?? Lol.......

Peter_Pan ( Date: 14-Nov-2013 10:05) Posted:

pepperginger ( Date: 14-Nov-2013 10:03) Posted:

Morning sista!

Very swee la, lol!

Merlin sibo? I don't know marlin lei, wait let me go check check okay ^^

My otto can't make it lei, kuay liao si pek sianz, lol!

Everyone huat arrr |

|

|

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Courts Asia (COURTS SP) HOLD (Downgraded)

Share Price S$0.695

Target Price S$0.71

Shares issued (m): 559.1

Weak 2QFY14: Key Takeaways From Results Briefing

Valuation

Downgrade to HOLD and lowered target price to S$0.71 based on a peer average PE of 13.5x applied to our reduced FY14F EPS estimate of 5.2 S cents for Courts Asia (Courts). We think negative sentiment on the stock will remain until the company delivers improved sales and puts forward a sustainable strategy for its credit business. Suggested entry at S$0.60/share.

Key Takeaways

Sluggish product sales excluding bulk sales of digital products same-storesales growth (SSSG) are -1.6% and -12.8% ytd for Singapore and Malaysia respectively. With the lack of new IT product launches in 2QFY14, there was no catalyst to push Singapore?s sales higher. Malaysia was also hit by weaker consumer sentiment as the government began clamping down on household debt and the macro environment turned less optimistic. The country?s central bank (CB) downgraded its GDP forecast to 4.5-5% for 2013 vs 5-6% earlier. Retail spending has been slowing down, based on figures compiled by Retail Group Malaysia.

Tightening the credit belt squeezed out high-margin credit sales. In line with the respective CB?s credit tightening measures, Courts also initiated more risk management controls internally. While this limited the group?s top-line growth (2QFY14: +3.3% yoy) and hurt margins (2QFY14 gross margin of 28% vs 34% in 2QFY13), it helped management maintain decent impairment ratios of 3% and 4.8% ytd for Singapore and Malaysia respectively. To mitigate the lost sales in Malaysia (credit sales declined 16% ytd for existing stores), Courts launched a Credit Recovery Plan, which primarily entices its best credit customers with more benefits and incentives, to increase purchase activity. While management?s prudence and long-term mindset are positives, we think the pressure on margins will weigh on investor sentiment.

Near-term headwinds are dampeners forecasts revised downwards. The challenging retail and credit picture led us to cut our FY14-16F earnings projections by 18-38%. New stores in Malaysia will only provide profit contribution after 2 years of operation. We also see the market adjusting their margin expectations lower as the group?s credit business is reined in to a more conservative state. While operating expenses were well-managed ytd, we could see a slight uptick in the succeeding quarters on pre-operating expenses for its new-store pipeline.

Making room for Indonesia?s 2 ?Big-Box? outlets, 10 stores in the next 5 years. These stores will be located within Jakarta and will allow for economies of scale in the city. Management expects the breakeven period for its Indonesian stores to be 2 years and has secured new borrowing facilities in light of the certain additional working capital requirements. Overall, the group had an available headroom of S$540m as at end-Sep 13. We have also turned cautious on prospects in Indonesia due to slower economic growth, higher political risks (2014 presidential elections), higher operating costs and stiffer competition. We note that Ace Hardware Indonesia has signalled that there will be slower store expansion in 2014 on the back of these concerns.

Price Chart

Source: Bloomberg Financials

Year to 31 Mar (S$m) FY12 FY13 FY14F FY15F FY16F

Net Turnover 724.2 793.8 832.8 875.7 954.2

EBITDA 70.3 78.6 62.0 80.3 88.0

EBIT 62.5 68.8 53.2 69.5 76.4

Net Profit 39.4 41.4 29.3 40.3 45.8

EPS (S cent) 7.9 7.8 5.2 7.2 8.2

PE (x) 8.8 8.9 13.3 9.6 8.5

P/B (x) 1.6 1.3 1.3 1.2 1.1

Dividend Yield (%) 0.0 1.5 2.3 3.1 3.5

Net Margin (%) 5.4 5.2 3.5 4.6 4.8

Net Debt to Equity (%) 65.2 46.7 68.9 65.1 62.5

Interest cover (x) 4.9 4.5 3.7 4.2 4.6

ROE (%) 18.0 14.3 9.4 12.0 12.4

Source: Courts, Bloomberg, UOB Kay Hian

Market cap (S$m): 388.6

Market cap (US$m): 311.0

3-mth avg t'over (US$m): 0.8

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Courts Asia - Trouble in Malaysia

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Biosensors International Group - Soft outlook

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

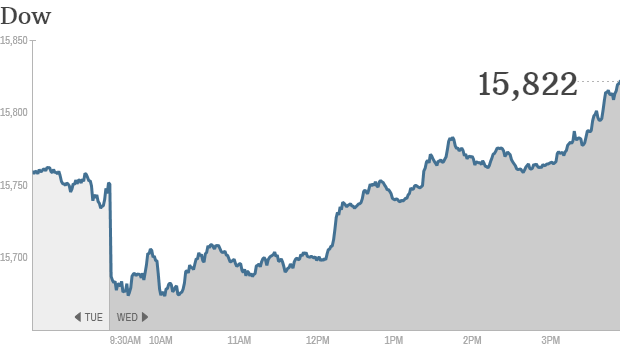

The bull is back! Dow and S& P hit records

Click for more market data.

The Dow and S& P 500 both rose to another record Wednesday, resuming their march higher after taking a breather Tuesday. Investors remain focused on the economy as they attempt to gauge when the Federal Reserve will scale back its monetary stimulus.

The Dow Jones industrial average rose 0.4% and the S& P 500 rose 0.8%. The Nasdaq rose 1% and is inching closer to the psychologically key level of 4,000, a milestone it hasn't topped since the tech bubble burst in 2000.

The gains came amid uncertainty about when the Federal Reserve will finally begin reducing, or tapering, its bond-buying program.

" Commentary by Fed officials continues to confound, with some for more stimulus and some for less, some talking of a December taper and some of later," said Mike van Dulken, head of research at Accendo Markets.

Related: Companies pledge millions to Philippines

Fed vice chair Janet Yellen may shed light on the topic when she appears before the Senate Banking Committee on Thursday for her confirmation hearing. Yellen is President Obama's nominee to replace Ben Bernanke as chairman of the Fed.

The Fed's stimulus policies have been a major driver of the bull market in stocks over the past few years. But recent reports on economic growth and hiring have some experts betting that the central bank will begin its exit strategy sooner rather than later.

Investors were also digesting a Chinese Communist Party communique on economic reform that was heavy on jargon but light on specifics.

That put pressure on Asian markets Wednesday, with the main stock indexes in Hong Kong and Shanghai declining by nearly 2%. European markets also fell. Shares in London sank amid concerns the Bank of England could hike interest rates after the bank raised its inflation expectations and lowered its outlook for unemployment.

Related: Fear & Greed Index remains in greed

What's moving: Macy's (M, Fortune 500) shares rose on better-than-expected quarterly earnings and strong same-store sales.

The retailer's results suggest American consumers could spend big this holiday season, according to some StockTwits traders.

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

World Markets

North and South American markets finished higher today with shares in Brazil leading the region. The Bovespa is up 0.82% while U.S.'s S& P 500 is up 0.81% and Mexico's IPC is up 0.43%.

North and South American Indexes

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

3Q Revenue reduce 51%

9 mths Revenue reduce 74%

WanSiTong ( Date: 13-Nov-2013 22:47) Posted:

3Q Loss : 713k (last yr : Profit : 196k)

9mths Loss : 8.4m (Last yr Loss: 1m) |

|

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

3Q Loss : 713k (last yr : Profit : 196k)

9mths Loss : 8.4m (Last yr Loss: 1m)

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

The following Resolution was duly passed at the Extraordinary General Meeting (the " EGM" ) of Fraser and Neave, Limited held on 13 November 2013:

ORDINARY RESOLUTION

RESOLVED THAT pursuant to Article 142 of the Articles of Association:

(1) Approval of the Proposed FCL Distribution

Subject to the other conditions in paragraph 4.2 of the Letter to Shareholders in the Circular dated 28 October 2013 being satisfied, approval be and is hereby given for the Company to make a distribution (the " FCL Distribution" ) of the entire issued share capital of FCL (" FCL Shares" ) held by the Company by way of a dividend in specie on the basis of two FCL Shares for each ordinary share in the issued share capital of the Company (" Shares" ) held by or on behalf of the shareholders of the Company (" Shareholders" , being registered holders of the Shares, other than the Company, except that where the registered holder is The Central Depository (Pte) Limited (" CDP" ), the term " Shareholders" shall mean Depositors, other than the Company, as defined under the Companies Act, Cap 50 of Singapore) as at a books closure date to be determined by the Directors (" Books Closure Date" ) such that:

(i) the FCL Shares are distributed free of encumbrances and together with all rights attaching thereto on and from the Books Closure Date

(ii) where the directors of the Company (" Directors" ) are of the view that the distribution of the FCL Shares to any Shareholder whose registered address as recorded in the Register of Members of the Company or in the Depository Register maintained by CDP on the Books Closure Date is outside Singapore (the " Overseas Shareholder" ) may infringe any foreign law or may necessitate compliance with conditions or requirements which the Directors, in their absolute discretion, regard as onerous or impracticable by reason of costs, delay or otherwise, such FCL Shares shall not be distributed to such Overseas Shareholder, but shall be dealt with in the manner set out in paragraph (iii) below

(iii) the FCL Shares which would otherwise be distributed to the Overseas Shareholders pursuant to the FCL Distribution be distributed to such person(s) as the Directors may appoint, who shall sell the same and thereafter distribute the aggregate amount of the net proceeds, after deducting all dealings and other expenses in connection therewith, proportionately among such Overseas Shareholders in accordance with their respective entitlements to the FCL Shares as at the Books Closure Date, in full satisfaction of their rights to the FCL Shares, provided that where the net proceeds to which any particular Overseas Shareholder is entitled is less than $10, such net proceeds shall be retained for the benefit of the Company, and no Overseas Shareholder shall have any claim whatsoever against the Company or any other person in connection therewith and

(iv) the Directors and/or any of them be and are hereby authorised to appropriate an amount of up to $2,911,034,349 out of the retained profits of the Company to meet the value of the FCL Shares to be distributed to the Shareholders.

Results of Poll Voting

The vote on the Resolution that was decided at the EGM was conducted by poll. The vote as cast on a poll (including proxies received) at the EGM is set out below: RESOLUTION |

FOR |

AGAINST |

Total No. of Valid Votes Cast |

No. of

Shares |

% |

No. of Shares |

% |

Ordinary Resolution

To approve the proposed FCL Distribution |

1,314,198,062 |

100.0% |

0 |

0.0% |

1,314,198,062 |

|

|

Good Post

Bad Post

|

x 0 x 0

x 0 x 0

|

Thank you cccx123

cccx123 ( Date: 13-Nov-2013 21:48) Posted:

Think need to borrow for minimum 5-6 days and charges are like 6% per anum on the value of shares borrowed plus some other miscellaneous fees. Very troublesome..

WanSiTong ( Date: 13-Nov-2013 21:46) Posted:

| Just for knowledge, when do you have to return the shares to the broker and how do they charge. |

|

|

|

|

|

Good Post

Bad Post

|

|

|

|